Neutral Sentiment Surge Continues

The AAII’s weekly sentiment survey saw an equal percentage (30.6%) of respondents report as bullish and bearish last week. This week saw a much more optimistic pivot as 36.2% of respondents reported bullish sentiment. While higher, bullish sentiment is still at one of the lowest levels since last fall. At 36.2%, bullish sentiment is also now just below the historical average of 38%. While the AAII reading on bullish sentiment was higher but still muted, the Investors Intelligence survey of newsletter writers showed bullish sentiment fall 8.1 percentage points to 53.1%. While that is not a particularly low reading (the lowest since only the end of May), it was the largest one week decline since October 2019. In other words, bullish sentiment is not necessarily collapsing, but it has lost some footing.

With more bulls in the AAII survey, fewer respondents reported bearish sentiment. In fact, less than a quarter of investors reported bearish sentiment this week. That is down 6.5 percentage points from the prior week; the largest one-week decline since a 6.6 percentage point decline in the first week of June.

The inverse moves in bullish and bearish sentiment resulted in the bull-bear spread to rise 12.1 points. While off the lows, it is still not as strong of a reading as has been seen for most of this year. In fact, the current reading is 5.5 points below the average since the start of the year.

The most impressive sentiment reading this week was neutral sentiment. Over the past four weeks, neutral sentiment has risen 10.5 percentage points without a single decline in that time. That is the biggest four-week rise since mid-May when it had risen 14.9 percentage points. Now as the predominant sentiment with just below 40% of respondents reporting as such, neutral sentiment is at the highest level since the first week of 2020 when this reading was 1.2 percentage points higher. Click here to view Bespoke’s premium membership options.

State Oddities and Claims

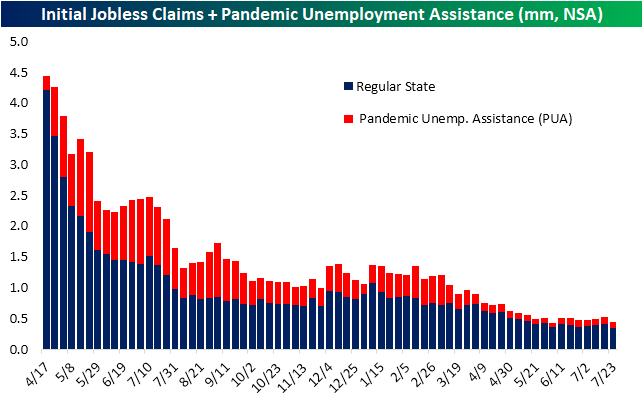

While last week’s jobless claims number was already disappointing on account of increases in layoffs in the manufacturing and automobile industries in Michigan, Texas, Missouri, Illinois, and Ohio, and this week that reading was revised higher by 5K to 424K. Fortunately, the most recent print saw an improvement with claims falling to 400K. That compares to expectations of a drop back below 400K to 385K.

While the seasonally adjusted number did not improve by as much as expected, the non-seasonally adjusted number was much stronger at 344.7K. That leaves initial claims within 100K of the last sub-one million claims print from March 13th of last year. Given that disconnect between the seasonally adjusted and unadjusted numbers, it goes without saying that drops in the NSA number are due to seasonality and typical for this time of year. In fact, as shown in the second chart below, since 1967 when the data begins, claims have risen only 11% of the time during the current week (30th) of the year. That ranks sixth as the week of the year in which claims have most often fallen week over week.

Since mid-June, PUA claims have been fluctuating around 100K. Last week saw a rise up to 109.9K thanks to a big jump in Indiana following a judge’s order for the program to be restarted. Indiana claims started to normalize this week and saw the largest drop of any state, national PUA claims came in back below 100K at 95.17K. That is the lowest level since the first week of June when PUA claims put in a low of 71.23K.

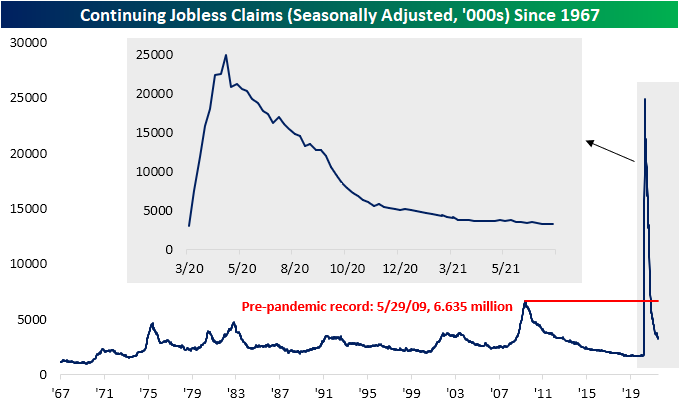

Lagged an additional week to initial claims, continuing claims snapped a streak of three weeks of improvement. Continuing claims rose to 3.269 million from 3.262 million in the prior week. That is only the highest level since the end of June.

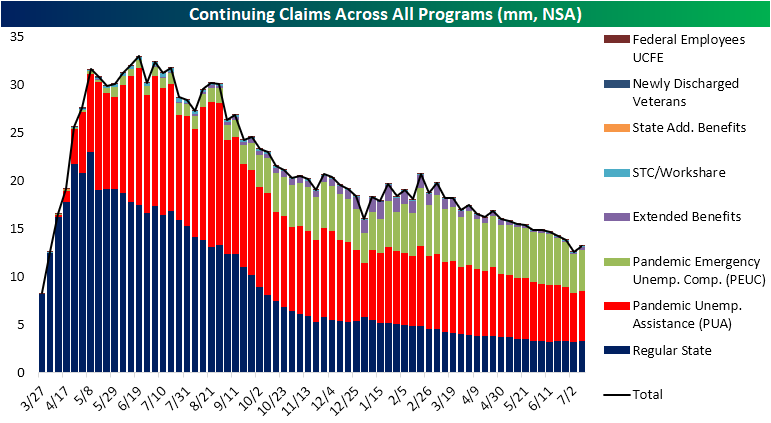

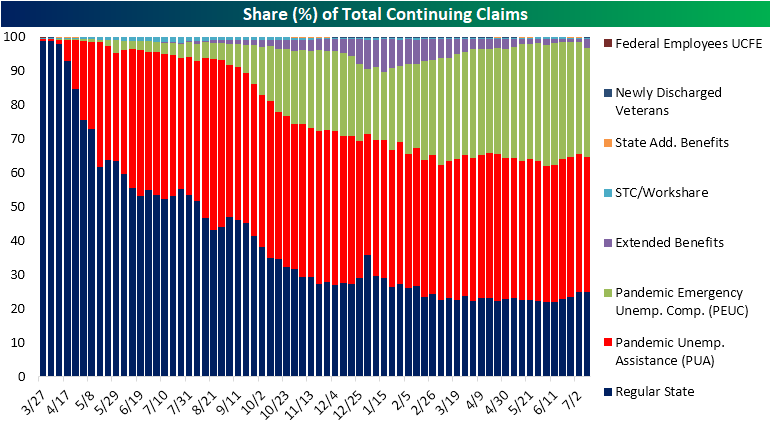

Factoring in all other programs creates an additional week of lag making the most recent reading through July 9th. Continuing claims broadly saw a move higher across programs that week bringing total claims to 13.17 million from 12.59 million. That brought to an end a streak of ten consecutive weeks of declines. As for which programs, in particular, accounted for that uptick in claims, the biggest contributor was the Extended Benefits program. This program saw claims go from under 100K all the way up to 343.5K. While we cannot point to any particular reason for each state’s increase, that large move higher was particularly thanks to two of the most populous states: Texas and California which saw weekly claims rise 180K and 67.1K, respectively. Throughout recent claims reports, there have been a handful of state-level idiosyncracies which impact aggregate claims counts, but overall the trend of improving claims on a national level remains in place. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 7/29/21 – GDP on Deck

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s all about the journey, not the outcome.” – Carl Lewis

Twenty-five years ago today, Olympian Carl Lewis completed one of the most impressive streaks in US track and field history when, at the age of 35, he won the gold medal in the long jump. That victory marked the fourth straight Olympics in which Lewis stood at the top of the podium for the long jump and the ninth time overall. In winning the long jump for the fourth time, Lewis became the first American since Al Oerter to win back to back to back to back golds in the same event.

With two days left in the month, the S&P 500 is also in the middle of its own streak with six straight monthly gains. That’s far from a record but still pretty impressive nonetheless. Futures are higher this morning as equities look to add to their gains for July, as optimism over a bipartisan infrastructure deal boosts sentiment along with positive words from China regarding its crackdown on tech companies in the country.

There is also a good deal of economic data today with the first read on GDP kicking things off with a big miss (+6.5% vs +8.4%) and both initial and continuing jobless claims coming in higher than expected. At 10 AM, we’ll get Pending Home Sales. During the day, we’ll also have the Robinhood (HOOD) IPO which priced at the low end of the expected range, and then after the close, the headline earnings report will be from Amazon.com (AMZN), which will round out the reports of the ‘big five’ mega-caps. So far, the markets have gotten through these reports relatively well, so just one more day to go.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, the latest US and international COVID trends including our vaccination trackers, and much more.

So far this earnings season, it hasn’t been just the mega-caps that have reported strong results. As shown in the snapshot below, of the 339 companies that have reported since the start of July (through Tuesday), 84% have topped EPS forecasts, 80% have exceeded sales estimates, and a net of 17% have raised guidance. Despite those strong results, companies reporting earnings have gapping down an average of 0.10% at the open on their earnings reaction day. During the trading day, though, buyers have stepped in pushing shares higher by 0.15% for a full day gain of 0.05%. That’s hardly a strong reaction, but at least it’s positive-something we haven’t been able to say consistently over the last couple of earnings seasons.

Large Cap Growth Leaves Small Cap Growth in the Dust

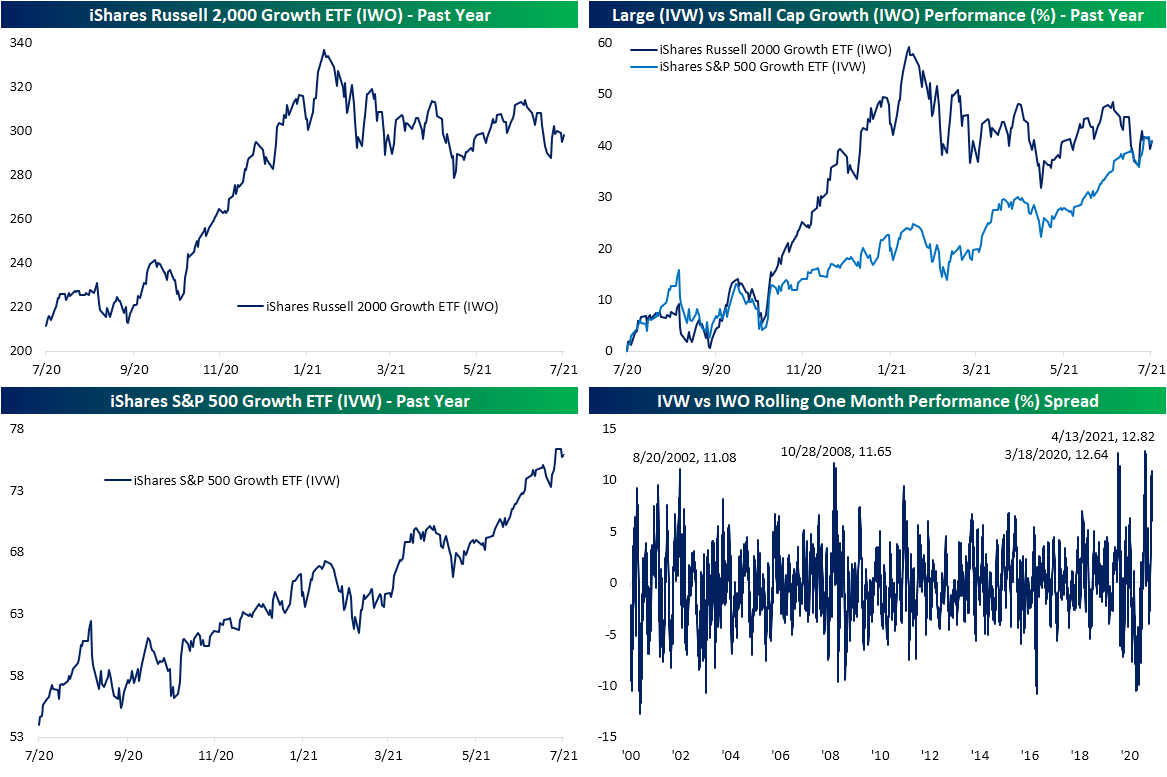

Looking at the styles screen of our Trend Analyzer, growth stocks have been clear winners of late, but that does not necessarily include all growth stocks. Whereas the Growth ETF (VUG) or S&P 500 Growth ETF (IVW) are up over 2% over the past five days through yesterday’s close and are sitting on year to date percentage gains in the high teens, the small-cap focused Russell 2000 Growth ETF (IWO) is actually down over the past week and is barely up on the year.

Taking a closer look at the dynamic between small and large-cap growth, as shown below IWO has been trending lower for basically all of 2021 after a strong run higher at the end of last year. Meanwhile, IVW has been trending in a steady, largely uninterrupted, uptrend. Given that strong run at the end of last year, IWO had been outperforming IVW by a large degree for most of the past year. But small-cap weakness and large-cap strength has meant the two are now up by roughly the same amount (~40%) versus one year ago.

A massive degree of that outperformance has come in the past month alone. In the bottom right-hand chart below, we show the rolling one-month performance spread of the two ETFs. While it has come back down slightly today, at yesterday’s close, there was a 10.9 percentage point spread between the one-month performance of IVW and IWO. That is the widest dispersion between the one-month performance of the two ETFs since April’s record level when the spread reached 12.82 percentage points. Since the Russell 2000 Growth ETF began trading exactly 21 years ago, there have only been a handful of other periods in which small-cap growth underperformed by such a wide degree. The other most recent period was March of last year, October 2008, and then late summer of 2002. Click here to view Bespoke’s premium membership options.

Advanced Micro Surges into a Record Narrow One Year Range

After three straight quarters where the stock has declined in reaction to earnings, shares of Advanced Micro (AMD) are surging over 6% today bring the share price within striking distance of the $100 level. Despite the stock’s strong reaction to earnings today, what’s perhaps even more notable regarding AMD share’s price is that remains stuck in the range it has traded in for a full year now since spiking higher on earnings last July. With an intraday peak of $99.23 in January and an intraday low of $72.5 back in May, AMD has traded in a one-year range of 36.9%.

For most stocks, a one-year range of over 35% wouldn’t raise eyebrows. For a stock like AMD, however, 36.9% is not only narrow but it’s the most narrow in the history of the stock. Since 1991, the average spread between AMD’s 52-week high and 52-week low has been over 200%, and there are multiple periods where the spread topped 500%. On the downside, though, prior to the current period, there was never another period where the one-year range was even less than 50% as in 1995, the spread only dropped down as low as 52%. A one-year range of 36.9% may not exactly be like watching paint dry, but for AMD stockholders, it has been a snoozefest. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 7/28/21 – Three Down…

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Companies that get confused, that think their goal is revenue or stock price or something. You have to focus on the things that lead to those.” – Tim Cook

With three of the big five reporting earnings after the close yesterday, investors got through the night of earnings relatively unscathed. As we approach the opening bell, Alphabet (GOOGL) and Microsoft (MSFT) are both indicated higher while Apple (AAPL) is just modestly lower. The fact that all three of these stocks rallied sharply into earnings and none are down significantly post-earnings is a pretty encouraging outcome.

There’s not a lot of economic news to contend with this morning, but we will get an FOMC decision on interest rates at 2 PM eastern and a press conference from Chairman Powell at 2:30. Earnings data is still coming in hot and heavy, though, and will be that way right up through Friday morning. So far the results remain extremely strong, but stock price reactions, in aggregate, have been less impressive.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, the latest US and international COVID trends including our vaccination trackers, and much more.

As mentioned above, AAPL is trading 1% lower in reaction to last night’s earnings report. Some may look at that weakness as a sign that the best of times are behind the stock, but we always caution against reading too much into one day’s action. Including last night, AAPL has handily topped EPS and revenue forecasts in each of its last five earnings reports, yet the stock is now on pace to have a negative one-day reaction to earnings for the fourth straight quarter. Last July, AAPL surged 10.5% on the day after its earnings report, but following the last three reports, the stock declined 5.6%, 3.5%, and -0.1%, respectively. Despite this current streak of negative reactions to earnings, though, the stock has rallied 57% over that same time span. Nobody knows what the future holds, but one day does not always make a trend.

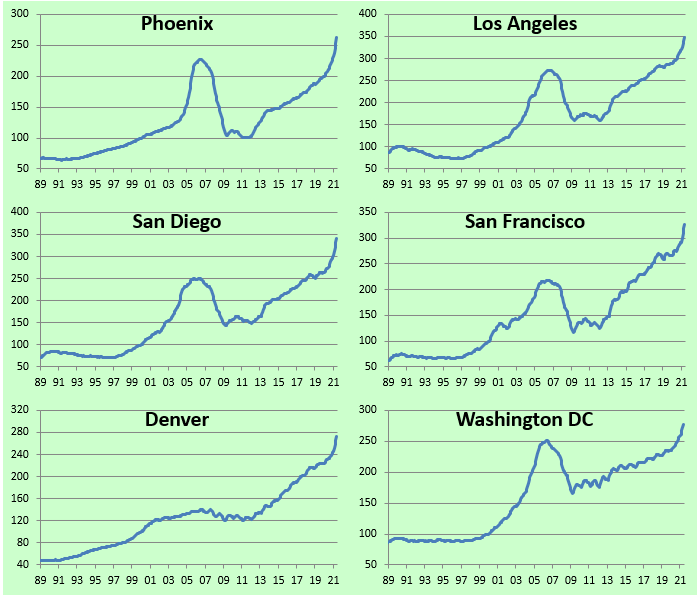

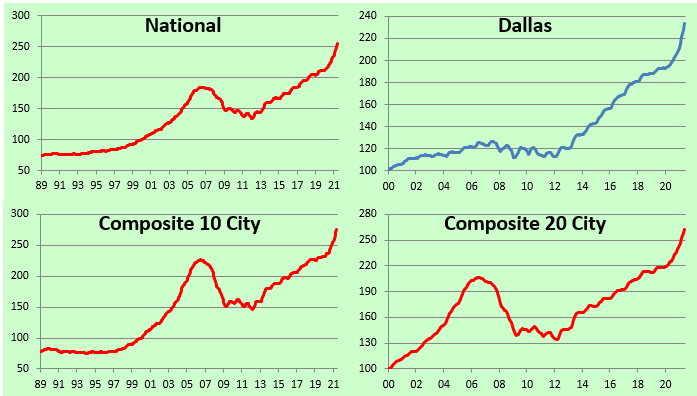

Home Prices Soar to New Heights

May 2021 S&P CoreLogic Case-Shiller home price numbers were released today, and they showed a continued surge in home prices all around the country. The month-over-month gains of 2-3% are similar to what we used to see on a year-over-year basis prior to COVID, but now the year-over-year gains all stand in the teens and twenties. At the top of the list is Phoenix which saw home prices rise 3.75% from April to May and 25.86% from May 2020 to May 2021. Below is a table showing MoM and YoY gains for the twenty cities and the composite indices tracked by S&P CoreLogic Case-Shiller.

Home prices have surged nearly uniformly across the country since COVID first hit. As shown below, since February 2020, the composite indices are up 18-19%, while most cities are up between 14% and 21%. Chicago and New York have seen a slightly smaller jump in prices than the rest of the country. Miami, LA, Portland, Charlotte, Dallas, Tampa, Denver, San Francisco, and Boston are all up between 19-21% since COVID. Three cities stand out for even bigger price jumps. As shown, Phoenix, Seattle, and San Diego are up quite a bit more than the rest of the group with gains between 28-30%.

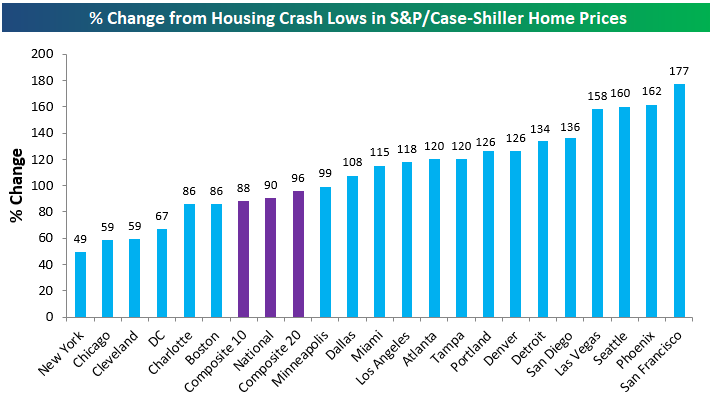

Below we show where home price levels are now versus their low-points after the mid-2000s housing bubble burst. Most lows for home prices were seen sometime between 2010 and 2012. As shown, the composite indices are now up 88-96% from their lows, while 13 of 20 cities are up more than 100% off of their lows. San Francisco is up the most at +177%, followed by Phoenix, Seattle, and Las Vegas (all up 150%+). At the other end of the spectrum, New York is up the least off its lows at +49%.

Notably, the post-COVID surge in home prices has left all but two cities above their prior all-time highs made during the mid-2000s housing bubble. Las Vegas and Chicago are the only two cities that have yet to eclipse their prior highs, but they’re now very close at just -1% and -3%, respectively. Miami, New York, and Washington DC are the three cities that have most recently made new highs.

Below are charts showing historical levels of home prices across the S&P CoreLogic Case-Shiller indices. These really show how much prices have spiked post-COVID. Prices were already trending higher coming into the pandemic, but over the past 17 months, they look more like a rocket does at take-off than a passenger jet! Click here to view Bespoke’s premium membership options.

Fifth District Manufacturing Flying

As we noted in our update of our Five Fed Manufacturing Composite featured in last night’s Closer, July regional Fed manufacturing indices have been showing broadly strong readings. The fifth and final Fed bank’s index released today out of, coincidentally enough, the fifth district added some fuel to the fire. The Richmond Fed’s composite reading was anticipating a 2 point decline from 22 last month. Instead, last month’s reading was revised higher by 4 points, and July saw another uptick to 27. That is the second-highest reading on record behind March 2008 when the composite came in a single point higher.

While the composite index as well as multiple other sub-indices like those for employment, prices, and inventories were at or just off of records, breadth in terms of the month-over-month changes was more mixed. Of the 17 sub-indices, 9 were higher, 1 was unchanged, and 6 were lower.

The area of the report to have seen the most significant deterioration in July was New Orders. The index fell 11 points to 25. Granted, that is coming off of a record high, and the July reading remained in the top 5% of all months. Order Backlogs also fell m/m although the decline was much smaller at only a single point. One interesting dynamic of the readings on Backlog of Orders is the difference between current conditions and expectations. Whereas the current conditions index is in the top 2% of all readings, the expectations component saw an 8 point decline and is now in the bottom decile of readings. Overall, while order growth decelerated, it is still running at a very strong clip.

As such, shipments were higher with that index rising 6 points to 21; the highest level since March. While shipments rose, there still appear to be significant disruptions to supply chains. Vendor Lead Times were unchanged in July just off of the record high from two months ago. While that reading has yet to see much improvement, the region’s businesses do seem optimistic that the lead times will improve but not necessarily return to normal down the road as expectations plummeted 12 points.

Given those supply chain disruptions, inventories continue to decline at record rates. The indices for both raw materials and finished goods fell to fresh record lows.

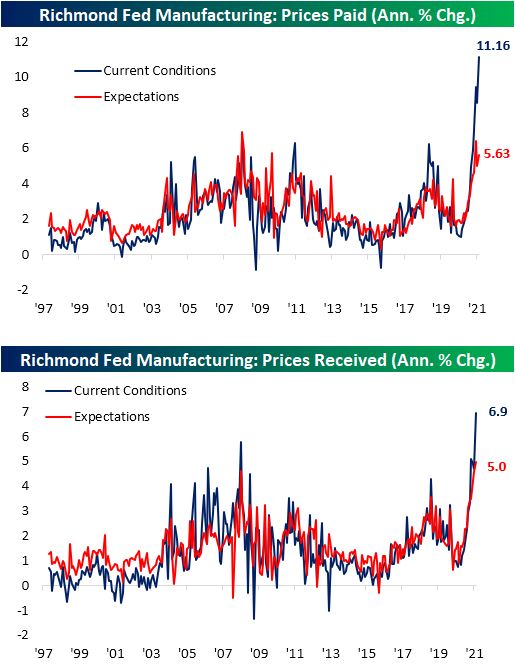

Meanwhile, unlike other regional Fed reports, prices paid have gotten little relief accelerating to an 11.16% annualized rate. Prices Received also rose to a record high of 6.9%.

In addition to input and final good prices, wages also came in at a record high alongside the index for Number of Employees. Forward-looking indicators point to continued strong labor demand going forward too as expectations for the Number of Employees also set a new record. Granted, that did not coincide with a record in the reading on wage expectations. In other words, higher pay has appeared to have enticed more workers but we are potentially hitting a limit on firms’ willingness (or ability) to pay higher wages. Additionally, alongside the higher wages and an increase in employment, there was an improvement in the Availability of Skills index which has been around record lows of late (meaning there has been a lack of candidates with necessary skills). Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 7/27/21 – Now the Fun Starts

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Learn everyday, but especially from the experiences of others. It’s cheaper!” – John Bogle

Futures are indicated lower this morning as Chinese equities sink on continued fears of government crackdowns on that country’s tech sector. We’ve seen a bit of a bounce off the lows, though, as we get closer to the opening bell in the US. If that sounds familiar, it should since it was the exact same setup we had yesterday. While the issues in China are troubling for investments based in China, it should make US assets more attractive as capital flees that area of the world and looks for a safer home.

The week may have started off quietly yesterday, but the real fun begins today as there are not only a number of economic reports but some of the largest companies in the world will start releasing results. In the case of economic data, Durable Goods came in weaker than expected, but last month’s release was revised higher which somewhat netted this month’s weakness out. Later on today, we’ll get releases on Home Prices, Consumer Confidence, and the Richmond Fed Manufacturing sector.

On the earnings front, after the close, we’ll get reports from Alphabet (GOOGL), Apple (AAPL), and Microsoft (MSFT). On a combined basis, these three companies alone are expected to report combined revenues of about $175 billion! As if these three companies weren’t enough, we’ll also hear from Advanced Micro (AMD), Chubb (CB), Mondelez (MDLZ), Starbucks (SBUX), and Visa (V).

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, the latest US and international COVID trends including our vaccination trackers, and much more.

Yesterday was a big day for the crypto-currency markets, but Amazon’s denial that it would accept bitcoin payments by year-end has resulted in a giveback of some of those gains. Bitcoin’s rally yesterday also coincidentally (or not) stalled out right at the same levels it stalled out at in mid-June, so for people to feel more comfortable going forward, they’ll likely want to see prices trade and stay above $40,000.

In the case of ethereum it’s a similar story as the rally in ether stalled out right near $2,400 which is right where it stalled out earlier this month. The only difference between now and then is that while the last rally also failed at the 50-DMA, this time around, ether has still been able to hold above that level.

Dallas Manufacturing Slows With Some Silver Linings

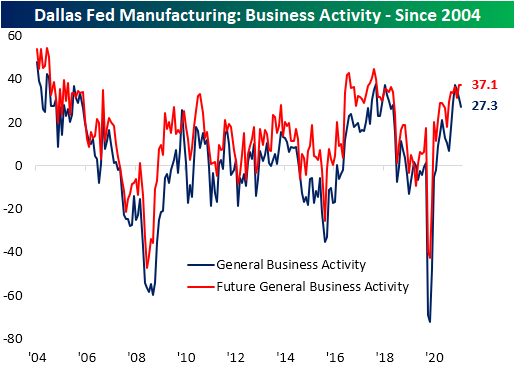

Manufacturing activity in the Dallas Fed’s region continued to expand at a strong clip in July albeit with some slowing. The index for General Business Activity came in at 27.3 rather than the expected increase from 31.1 to 31.6. That decline marked the third month in a row that the index has fallen since the multi-year high of 37.3 in April. While current conditions deteriorated, expectations have held up better with a modest decline of 0.2 points this month.

Most of the individual areas of the report saw a decline month over month in July with 12 of the 16 indices falling. Although most were lower, current levels remain broadly healthy with many in the top decile of their historic ranges. Expectations saw more broad declines with the only index to move higher month over month being Delivery Times. There were some particularly large double-digit declines in expectations for Shipments, Capacity Utilization, Inventories, and Prices Received.

One of the few areas of the report to see a move higher in July concerned new orders. The indices for New Orders and New Order Growth rate rose 0.1 and 2.4 points, respectively. Granted, those upticks still left both indices below their highs from earlier in the sping and expectations saw significant turns lower. While that could imply some slowing in demand, historic backlogs still exist. As shown in the bottom left chart below, outside of the spike in September 2005 and the past few months, the index for Unfilled Orders has never been higher even taking into account the declines over the past few months. Shipments also saw a small turn lower in July while the bigger move was in regards to expectations. Last month, expectations for shipments surged to the highest level since February 2006. This month, that reading reversed by 12.4 points; a month-over-month decline that ranks in the bottom 3% of all monthly moves.

Ironically, even though the reading on shipments worsened, supply chains appeared to have improved to some degree. Higher readings in the Delivery Time index indicate that products are facing longer lead times. Earlier this year the index surged to unprecedented levels, and while it still has a ways to go until it is back to normal, it did fall 7.2 points in July following a 3.2 point decline in June.

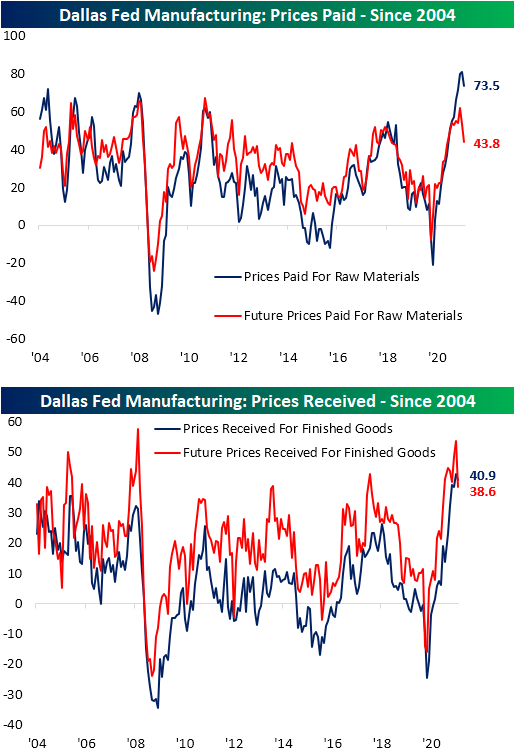

As with Delivery Times, prices have also found some respite after flying higher over the past several months. Prices Paid fell from a record high to 73.5 which is still the third-highest level of any month to date. Expectations also saw a sharp pivot lower falling 9.8 points to 43.8. That is at a similar level to three years ago. Prices Received are a similar picture pulling back from a record high to 40.9. Again even though this reading shows some slowing in price increases, there is no historical precedent for as high of a reading in the index. Additionally, expectations saw an even more dramatic decline as the index fell 15 points. Click here to view Bespoke’s premium membership options.