An Impressive 2021 So Far, But Flows Are Slowing

Yesterday the Investment Company Institute updated weekly fund flow numbers for the US mutual fund and ETF industry. As shown in the chart below, total mutual fund flows were positive this year but compared to the performance of ETFs, the inflows have been only modest at best. ETFs have logged more than $700bn in inflows, and while mutual funds avoided a fourth straight net outflow, their $66bn in inflows wasn’t that impressive. Across mutual funds and ETFs, bonds have been the massive winner this year, with more than $500bn in inflows. Equity funds record outflows over time as a mechanical result of equity retirements, but this year inflows have been the largest since 2014 with more than $210bn in buying across mutual funds and ETFs. About a quarter of total equity fund inflows so far this year have been dedicated to funds buying the domestic stock market. That’s the best year for domestic equity fund flows since 2014, and breaks a string of five consecutive years of outflows, though net flows have been stable for months now.

This analysis was first published last night in The Closer, Bespoke’s end-of-day macro note. To receive The Closer and all of Bespoke’s other reports covering sentiment and positioning, sign up for a two-week trial today if you’re not yet a member.

Philly Fed Fails

Last Friday the first regional Fed manufacturing report for the month of October rolled in with a larger than anticipated decline in the Empire Fed index. The Philly Fed’s index released this morning saw a similar result. The General Business Conditions index fell from 30.7 to 23.8 versus an expected decline to 25. That reading indicates the region’s manufacturing economy is still growing at a historically solid rate, but there was a significant deceleration in the month of October.

Taking a look under the hood of the report, overall the results were not as bad as the headline reading might imply. Most categories of the report were higher and General Business Conditions was the only index that was not in the top 10% of readings going back to the beginning of the survey in 1968. Inventories, Prices Received, and Average Workweek were the only current condition indices to fall month over month. Indices for future expectations are generally more pessimistic with only a small handful in the top decile.

The index to see the largest month over month increase in October was for New Orders as the index nearly doubled to 30.8. That is the strongest reading since May and it remains one of the strongest readings throughout the history of the survey. Shipments and Unfilled Orders rose less dramatically but likewise came in at historically strong levels. Inventories are also rising at a historically solid clip in spite of pulling back slightly this month. Of these indices, the most notable move was in future expectations for Unfilled Orders. After hitting a high of 19.2 back in June, the index has been in absolute free fall, shedding another 8.1 points this month. That is the weakest reading since 1998. In other words, even though backlogs are continuing to build on continued strong demand, businesses expect to rapidly work those off in the near future. Ironically, firms also reported that they expect shipments to decelerate down the road as well.

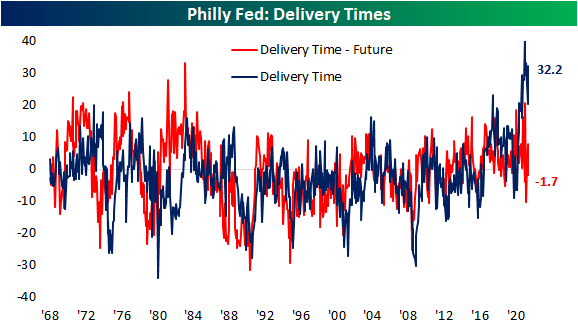

As for the reading on supply chains, delivery times remain historically high and deteriorating in October with the index rising 11.8 points to 32.2. That is the third-highest reading on record behind this past May (41.5) and June (33.3). But firms also do not appear to think things can get much worse. Expectations for Delivery Times fell into negative territory this month for the first time since July. That negative reading indicates reporting firms expect delivery times to be lower rather than higher in the future. Click here to view Bespoke’s premium membership options.

Sentiment Surge

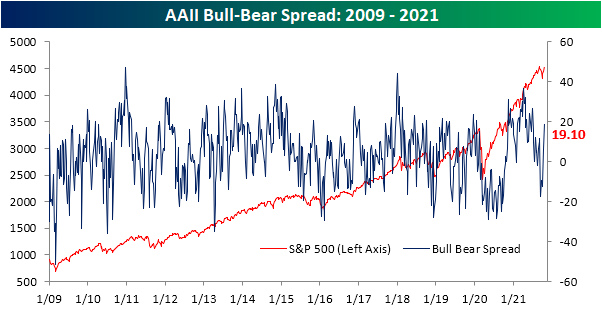

Over the past couple of weeks, the S&P 500 has reversed higher, and the index is now only a few basis points away from the September 2nd closing high. With the rally, sentiment has taken a sharp turn towards optimism. The AAII reading on bullish sentiment rose for a second week in a row, climbing 9 percentage points to 46.9%. That is the highest reading on bullish sentiment since the week of July 1.

While this week’s increase was large, it comes on top of a double-digit rise last week. In total, bullish sentiment has climbed 21.4 percentage points in the past two weeks alone. That is the first time since November of last year that bullish sentiment has risen by at least 20 percentage points in two weeks. Going through the history of the survey, there have only been 17 other periods in which there were similar moves without another occurrence in at least six months. Overall, these instances have consistently seen the S&P 500 move higher in the following weeks and months with larger than normal average and median gains. That is except for one year out in which performance has been slightly worse than the norm.

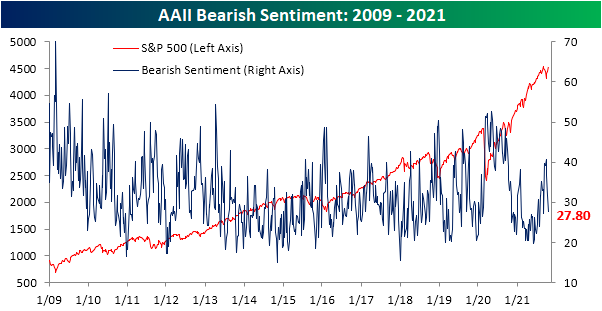

With the big jump in bullish sentiment recently, bearish sentiment has pulled back to 27.8%. That is the lowest reading since September 9th and the third week in a row in which bearish sentiment has moved lower.

With inverse moves to bullish and bearish sentiment, the bull-bear spread stayed in positive territory for the second week in a row as bulls outnumber bears by the widest margin since the first week of July.

Big gains to bulls also borrowed heavily from neutral sentiment as that reading fell from 30.3% to 25.4%. Similar to bearish sentiment, that is the lowest reading since early last month.

As for some other readings on sentiment, the NAAIM Exposure index measuring investment managers’ exposure to US equities has also made a significant move higher this week. Readings in this index range from -200 to 200 where (-)200 would indicate responding managers are leveraged long (short), (-)100 would be fully invested long (short), and a reading of zero would be market neutral. At the end of last month, the reading fell to a low of 55 which was the weakest level since May. While the past two weeks only saw modest improvements, this week there was a surge all the way up to 98. The 33.6 point increase ranks as the fifth-largest week over week moves on record in the index dating back to 2006. Click here to view Bespoke’s premium membership options.

PUA Claims Negligible

Initial jobless claims made another move lower this week with the seasonally adjusted number falling by more than expected to 290K from an upwardly revised reading of 296K last week. That sets another record low for the pandemic era with claims now 34K above levels from March 14th of last year (the last reading before claims began to print in the millions).

On a non-seasonally adjusted basis, claims were again lower as is normal for the current week of the year. Historically, this point of the year is when claims tend to rise into year’s end, but the current week of the year provides a brief period of respite. Since 1967, the current week of the year has only seen claims rise week over week under a quarter of the time. While this week saw some seasonal tailwinds, PUA claims are increasingly a negligible factor as any backlogs are essentially worked off. Initial PUA claims came in at just 2K this week.

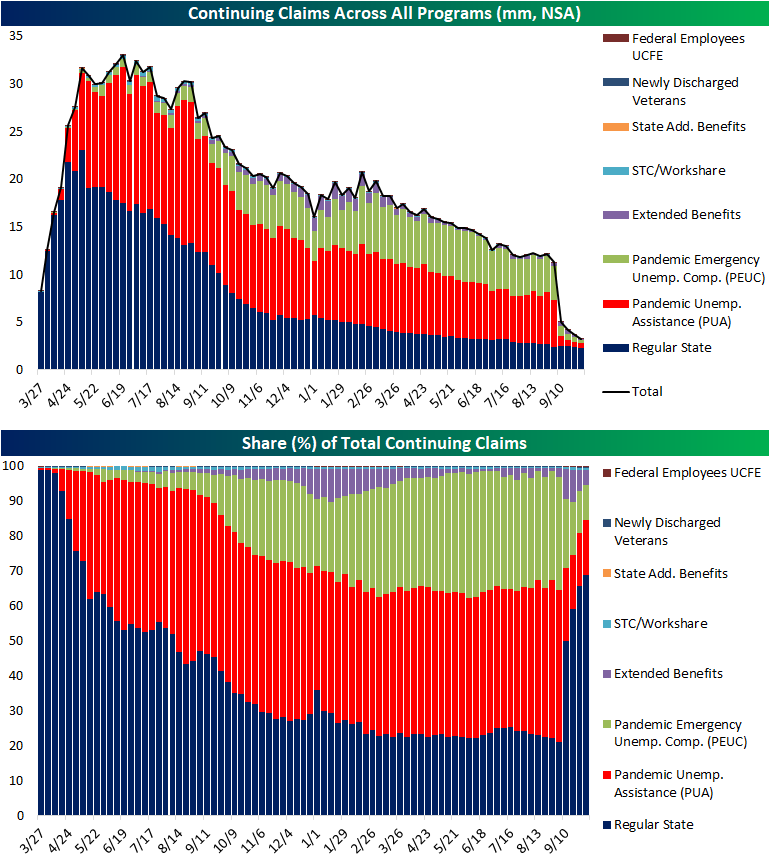

Continuing claims also set another pandemic low falling below 2.5 million.

The most recent data including all programs is through the week of October 1, and again there has been a substantial drop off in total claims thanks to the end of pandemic era programs. Total unadjusted continuing claims fell to 3.29 million down from 3.66 million the prior week. As could be expected, PUA, PEUC, and Extended Benefits programs were the main contributors to those declines leading regular state claims to once again account for a dominant share of total claims. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 10/21/21 – Claims on Deck

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The problem is that a lot of big companies, process becomes a substitute for thinking. You’re encouraged to behave like a little gear in a complex machine. Frankly, it allows you to keep people who aren’t that smart, who aren’t that creative.” – Elon Musk

After a six-day rally of over 4%, the S&P 500 is indicated to open lower this morning along with the other major averages. The big drag on sentiment this morning is the 10-year yield which has spiked by about 4 bps in the last two hours taking yields to the highest level since May. Along with a busy slate of earnings, there are a number of economic indicators on the calendar that have the potential to swing things in the hours ahead. Jobless claims and the Philly Fed will be released at 8:30 AM while Leading Indicators and Existing Home Sales will hit the tape at 10 AM.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

With bitcoin hitting a new high this week, we wanted to update the comparison between ‘digital gold’ (bitcoin) and physical gold over the last year. Like bitcoin’s actual price, the ratio of bitcoin to gold also hit a new high this week topping the prior record high of 36.2 from April and finishing off yesterday at 37 ounces of gold to one bitcoin. That represents more than a six-fold increase in just the last year!

While bitcoin has been on a tear relative to gold, priced in terms of ether, it has underperformed over the last year. Last October, one bitcoin was worth more than 30 ether, but over the next six months that ratio rapidly compressed falling to as low as 12.3 this May. Ever since then, bitcoin and ether have been moving closer in tandem with each other as the ratio has been contained to a range between 12 and 18.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Road and Rail Soar Above Air Freight

One major economic trend of the past several months has been supply chain constraints including logistics issues. Now in the throes of earnings season, earnings of companies related to supply chains and logistics (whether that be people or parcels) are beginning to roll in with four such names reporting in the past day alone: Kansas City Southern (KSU), United Airlines (UAL), Marten Transport (MRTN), and Knight-Swift Transportation (KNX). In the table below, we show all the S&P 1500 Transportation Industry stocks that have reported since late September. Most of these stocks have beaten estimates on the top and bottom line with a few exceptions. While it is the one furthest in the rearview now, FedEx (FDX) was perhaps the worst of these missing EPS estimates and lowering guidance. KNX, on the other hand, reported a triple play this morning; one of the first companies to do so thus far in earnings season.

Two more transportation names, CSX (CSX) and Landstar System (LSTR), are also set to report earnings after the closing bell today, and over a dozen other names will follow up in the next week alone. These names could potentially be interesting areas to look for anecdotes regarding broader supply chain issues pressuring the economy, but turning to the stock price reactions, Saia (SAIA) has averaged the largest single-day gain on earnings averaging a 2.5% move across its 60 past earnings reports. Old Dominion (ODFL), Echo Global Logistics (ECHO), Hub Group (HUBG), and XPO Logistics (XPO) are the only others that have averaged greater than 1% gains in reaction to earnings. C.H. Robinson (CHRW) and Avis Budget (CAR), on the other hand, have historically averaged the worst reactions to earnings of this industry.

While there are still plenty of companies within the industry left to report providing plenty of catalysts for moves, since the closing low on September 30th, the transports have seen solid performance with an 8.79% gain through today. That move has not only lifted the industry above its 50 and 200-DMAs but it has also broken the downtrend that has been in place since the spring. Currently, the group is still down 6.1% from its 52-week high. Click here to view Bespoke’s premium membership options.

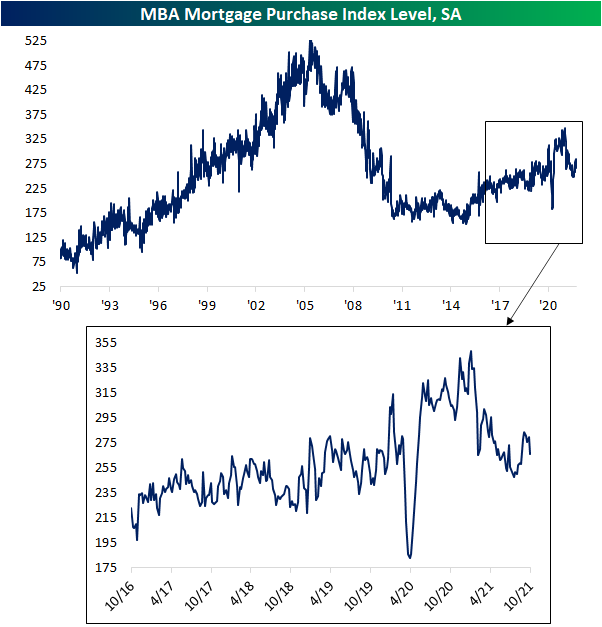

Mortgage Activity Rollover

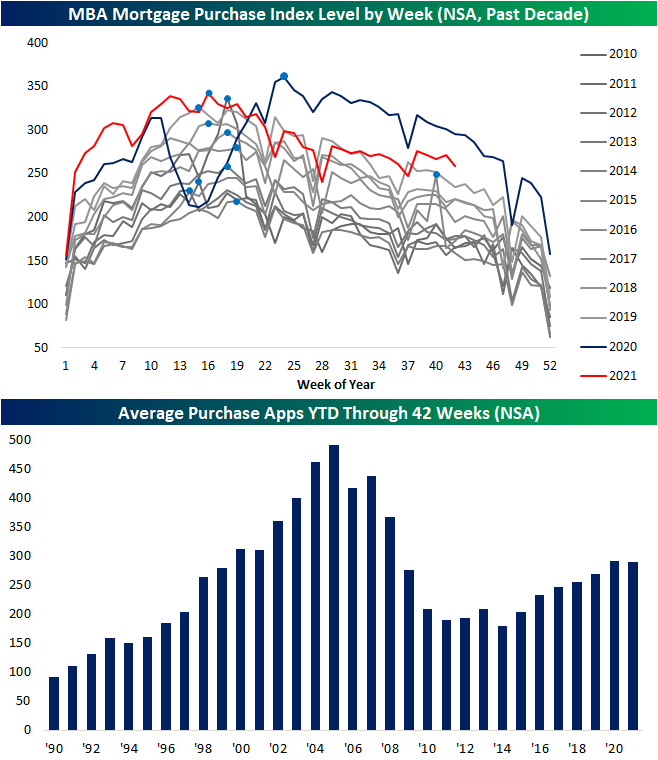

This morning the Mortgage Bankers Association (MBA) released their weekly read on mortgage activity. Whereas most of the past year has seen purchase applications trending lower, the reading bottomed out in late July indicating positive signs for other economic releases like new and existing home sales. Over the past month, though, as interest rates have been rising, the index has been erasing the late summer gains with this week’s 4.86% decline the largest for a single week since July 16th. With that said, the current level of purchase applications remains solid at the high end of the pre-COVID range.

Purchase applications are generally following the normal seasonal pattern as well this year. Last year (dark blue line in the chart below) as the pandemic came about, purchase applications took a huge hit during what is normally the strongest point of the year for activity. That resulted in a later than normal seasonal peak (light blue dots). This year’s peak occurred in the spring as has been the norm over the past decade. While purchases have seen their usual seasonal decline since the spring, that does not mean purchases have been weak. Albeit not as strong as 2020 levels, purchase apps have been running at a clip similar to, if not stronger than, 2019 levels.

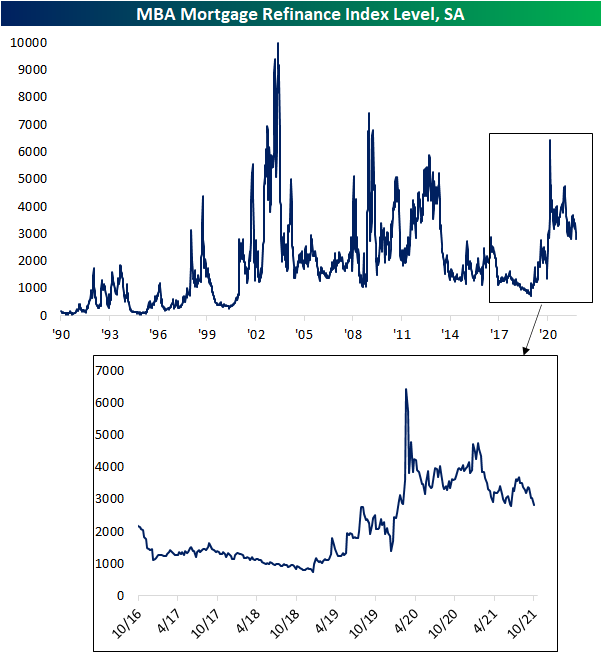

Refinance activity has also rolled over after moving higher in the summer. In fact, this week marked the fourth week in a row with a decline. In that span, this week and two weeks ago marked the largest declines of 7.12% and 9.58%, respectively. Those now leave the index just off recent post-pandemic lows set in early July.

Mortgage rates are certainly one factor contributing to the recent rollover in mortgage activity. As shown below, the national average for a 30-year fixed-rate mortgage is still at historic lows but is now off the lows. This rate bottomed in early August, and the end of last month saw a particularly significant leap higher. Currently, the rate stands at 3.18% versus 3.00% one month ago. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 10/20/21 – Futures Little Changed

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Stone Age. Bronze Age. Iron Age. We define entire epics of humanity by the technology they use.” – Reed Hastings

There’s little movement in international equity markets and US equity futures currently, and the 10-year yield is flat at 1.63%. There’s no economic data to speak of today, but the Beige Book will be released at 2PM eastern. The S&P 500 has been up for five straight days now (its longest winning streak since late August) so a rest wouldn’t be too bad of a thing.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

While it initially rallied after the report was released, shares of Netflix (NFLX) quickly reversed in after-hours trading and are now looking at a loss of about 2% in the pre-market. While subscriber growth numbers came in better than expected, growth in North America looked a little more sluggish raising questions (again) that the streaming service has reached the saturation point in the United States.

Similar to the illustrations we provided of the large banks last week, the chart below shows the performance of NFLX since the start of 2020 with red dots indicating the closing price on the company’s earnings reaction day. What’s looking like a decline of around 2% for NFLX today would mark the seventh time in the last eight quarters where NFLX declined in reaction to earnings, and in each case, it has been a similar story; either sub growth was weaker than expected or investors anticipated that North American sub growth going forward would slow. Despite the short-term pessimism around each quarter’s report, since the start of 2020, NFLX has risen about 97% which is more than double the 44% gain of the S&P 500.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

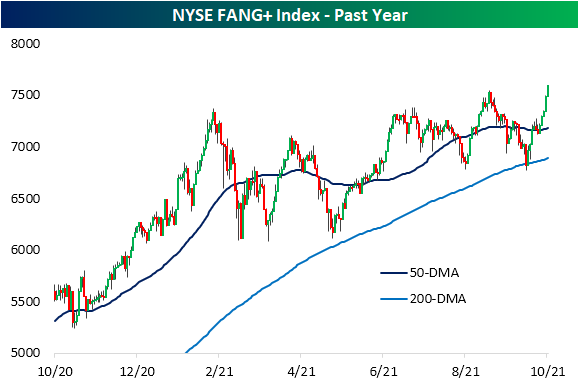

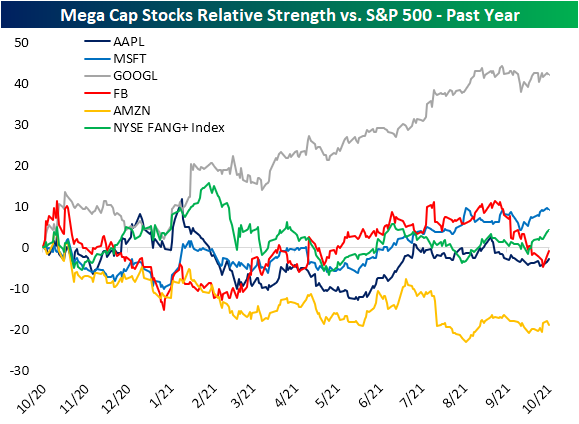

FANG+ Hits a New High With Mixed Relative Strength

One week ago, mega-cap Tech as measured by the NYSE FAANG+ index was trading right around its 50-DMA after successfully testing its 200-DMA not long before. After rallying 6.44% in the past five days, the index of FANG+ stocks is now back at a 52-week high.

In the chart below we show the relative strength lines of the five largest S&P 500 stocks as well as the FANG+ index versus the S&P 500. Microsoft (MSFT), Facebook (FB), and Apple (AAPL) have generally performed in line with the broader market over the past year. More recently, FB has given up any outperformance it had versus the S&P 500 as the stock has come under pressure over the past few weeks. Meanwhile, the broader FAANG+ space has seen its relative strength line turn higher. Two standout stocks on opposite ends of the spectrum for relative strength have been Alphabet (GOOGL) and Amazon (AMZN). Both have seen fairly flat moves in their relative strength lines since the late summer, but from their performance earlier in the year, GOOGL has distanced itself to the upside whereas AMZN has lagged behind other mega-caps.

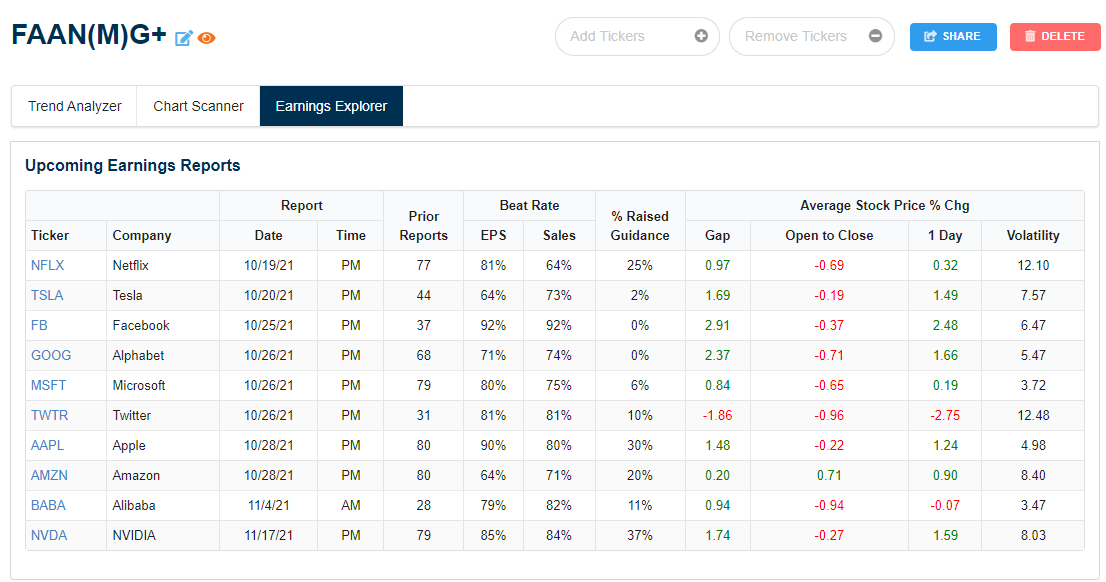

We would also note that a large portion of FAANG—or FAAN(M)G when including Microsoft—is scheduled to report earnings in the coming week. Of these, Twitter (TWTR) and Netflix (NFLX)—which reports tonight—have historically been the most volatile stocks on earnings with each one averaging a move of more than 12% (up or down). TWTR is also one of the only ones in the group to average a full-day decline on its earnings reaction days as shown in the snapshot of our Earnings Explorer below. Click here to view Bespoke’s premium membership options.

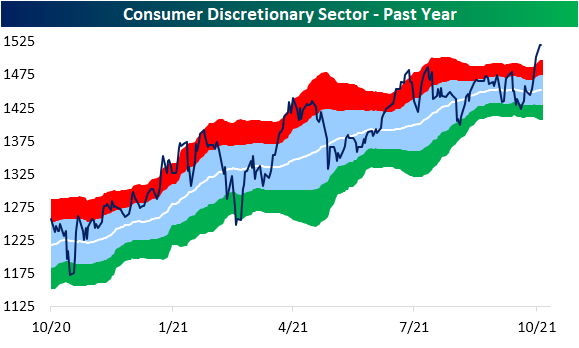

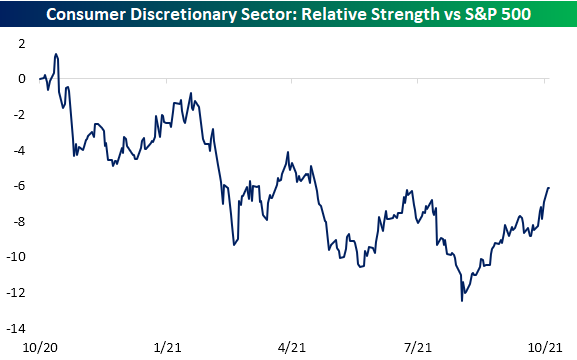

Consumer Discretionary Ripping

As we noted in last night’s Closer, some of the biggest members of the Consumer Discretionary sector by market cap like Amazon.com (AMZN) and Tesla (TSLA) have been pulling more than their fair share for the S&P 500’s gains recently. That also means the sector itself has been on a stellar run having risen over 5% in the past five days; the best five-day run since a 7.18% gain this past March. While currently elevated, this week’s move has marked a dramatic break out above the summer high. Additionally, its relative strength line versus the broader index has also made a significant breakout from the past year’s downtrend.

With that also comes a historic overbought reading. In the chart below, we show the distance in standard deviations that the Consumer Discretionary sector has traded from its 50-DMA. Finishing just shy of 3 standard deviations above its 50-DMA yesterday, the sector hit its most overbought level since the day after Christmas 2019. Going back to the start of our data in 1990, there have only been 20 times including that 2019 occurrence that the Consumer Discretionary sector was as overbought as it was yesterday.

Looking closer at some of the stocks that have driven the sector shows some interesting themes. As previously mentioned, online retail giant Amazon.com (AMZN) has been a key contributor to the S&P 500’s gains, and while the index has clearly broken out of its recent downtrend, AMZN is fighting to do the same. Meanwhile, Target (TGT) has posted double-digit gains in the past week bringing it quickly from oversold to overbought territory. Like AMZN, that move has smashed through a downtrend line.

Home improvement stores have also seen notable breakouts with Home Depot (HD) and Lowe’s (LOW) both breaking above their prior highs. Tractor Supply (TSCO), on the other hand, has maintained its uptrend but has yet to break out.

As consumers have likely had to put off car purchases due to constrained supply and instead repair the car they have, auto parts retailers have also been solid performers with notable breakouts of their own. Stocks like Advance Auto Parts (AAP), O’Reilly (ORLY), LKQ (LKQ), and AutoZone (AZO) have all made new highs in recent days. There are a couple of holdouts, though. Aptiv (APTV) continues to sit just short of a new high while Genuine Parts (GPC) has exited its downtrend but is much further below prior highs than its peers. Click here to view Bespoke’s premium membership options.