Tenth District Manufacturing Flying

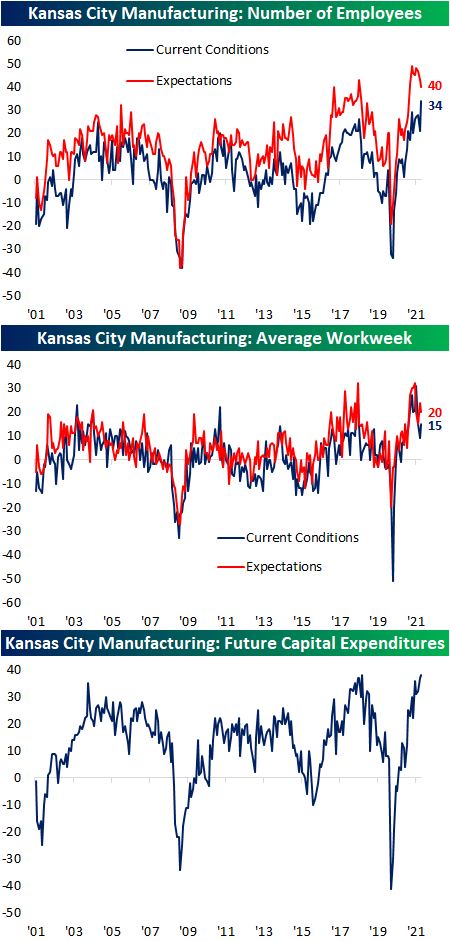

The fifth and final regional Fed manufacturing survey results came in this morning from the tenth district, and like the Richmond and Dallas Fed results, the region’s manufacturing activity saw a significant acceleration in October. The Kansas City Fed’s Composite Index tied the April record high at 31 after rising 9 points month over month. That was the largest one-month uptick since August 2020. While expectations were slightly lower, the past several months’ readings have been less volatile hovering around record highs.

Feeding into the very strong composite index were historically high readings across almost every other category. All but two indices came in the 90th percentile or better and there were three indices—Number of Employees, Prices Paid, and Supplier Delivery Times—that hit record highs. For some of those categories, this month’s upper decile readings also mark a significant improvement from the prior month. For example, Production, Shipments, and New Orders were coming from readings in the 40th percentile range. Additionally, breadth was very strong this month with only two indices falling month over month: Backlog of Orders and Material Inventories. Expectations on the other hand saw weaker breadth in terms of month over month moves and less elevated readings relative to their historical ranges.

As previously mentioned, the most improved area of the report was concerning demand. New Orders, Production, and Shipments all surged MoM with each one seeing double-digit gains. Whereas last month these three indices were somewhere in the 40th percentile range, this month there were in the upper decile of their historical range. Each of those indices experienced big declines last month, so the huge gains in October bring them back to levels last seen in July or August. While those are positives, expectations for Production and Shipments saw large declines ranking in the bottom 3.3% and 1.2% of month-over-month moves. Given current conditions for production and shipments moved significantly higher, firms were able to work off backlogs as that index fell 7 points to 23 which is the lowest reading since January.

That is not to say supply chains improved though. Delivery times surged yet again to set another record high for both current conditions and expectations. The MoM increase in expectations we would also note was the largest to date.

Additionally, Prices Paid continued to rise also hitting records for both current and future indices. While Prices Received were also higher, the indices for that category are off their peak from earlier this year.

The other record high reached this month was for Number of Employees. The index rose 13 points to 34, but potentially because positions are being met, expectations for hiring were weaker. That index continued to roll over falling to 40 in October. While lower, the current reading is still at historically strong levels. Although expectations for increasing hiring have been pulling back, Capital Expenditure expectations have continued to rise with that index tying the record high of 38 set back in September 2018. Click here to view Bespoke’s premium membership options.

Sentiment Steps Back

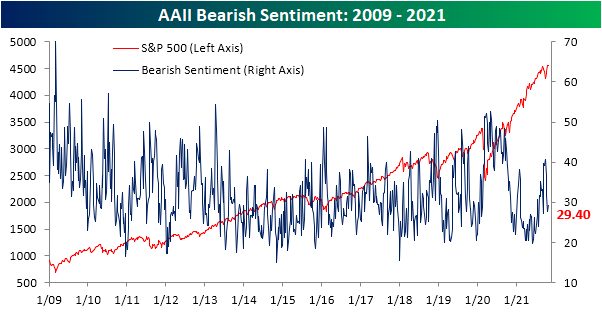

The weekly sentiment survey from AAII saw a surge in optimism in recent weeks, but it took a step back this week even with the S&P 500 at new highs. Bullish sentiment fell from a recent high of 46.9% down to 39.8% this week. Outside of last week, that is still the highest level since the first week of September.

While bullish sentiment saw a significant 7.1 percentage point drop, a relatively small share of those losses turned to the bearish camp. Bearish sentiment only rose 1.6 percentage points to 29.4%. That is still below levels from two weeks ago and is in line with the average from throughout the summer.

The corresponding moves in bullish and bearish sentiment resulted in the bull-bear spread to fall but bulls continue to outweigh bears by 10.4 percentage points.

As previously mentioned, the largest share of losses to bulls did not go to bears, but instead were picked up by those reporting neutral sentiment. That reading moved back above 30% this week gaining 5.3 percentage points. Again, that does not mark any sort of new high or low but instead brings sentiment back to similar levels seen only a month or two ago. Click here to view Bespoke’s premium membership options.

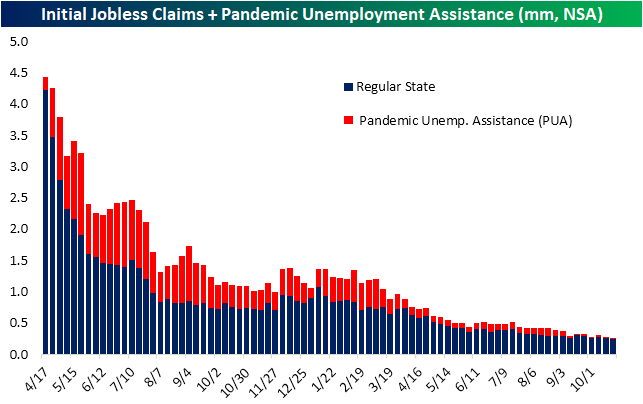

NSA Claims Back Below March 2020 Levels

Both initial and continuing jobless claims once again came in below expectations and at new pandemic lows this week. Seasonally adjusted initial claims fell to 281K this week, exceeding expectations by 7K and a 10K drop from last week’s 1K upwardly revised reading. Claims are now only 25K above the level from the week of March 13, 2020; the last week before claims began to print in the millions.

From a seasonal perspective, the fourth quarter and the current week of the year typically see jobless claims move higher having done so 85% of the time historically since 1967. This week went against those seasonal trends as the unadjusted number fell from 257.2K to 245.5K. While the seasonally adjusted reading is still above, that is actually below the March 13, 2020 reading. In other words, claims are essentially back to where they were just before the pandemic. That is also the case considering PUA claims are basically negligible around 2.5K for a second week in a row as support for the program has ended.

Continuing claims also set a pandemic low coming in at 2.243 million versus expectations of a decline to 2.42 million. That 237K decline week over week was the largest since the week of July 23rd and the fifth week in a row in which continuing claims were lower.

Including all programs delays the data through the week of October 8th for the most recent reading. Total claims across all programs fell to 2.84 million that week as the unwind of pandemic era programs continue alongside the declines in regular state programs. PUA and PEUC programs once again were the biggest decliners falling by almost 250K and 87K, respectively. In total since the official end of these programs in early September, these two programs have seen claims fall by 8.78 million. Through the week of October 8th, PUA, PEUC, and Extended Benefits programs only accounted for 632K claims combined which are likely to continue to decline in the near future. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 10/28/21 – Deal or No Deal?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Don’t find fault, find a remedy; anybody can complain.” – Henry Ford

While just about every company reporting earnings has lamented about the semiconductor shortage impacting their business, in Ford’s (F) earnings report last night, the company took a more constructive tone noting that “revenue, net income, adjusted earnings before interest and taxes, cash flow from operations, and adjusted free cash flow were all sharply higher from the second to the third quarter of 2021, driven by significant increases in semiconductor availability and wholesale vehicle shipments from Q2.” The company didn’t say that the shortage is behind us, but it was nice to hear some positive news for a change.

Equity futures are higher this morning with the Nasdaq leading the way, but the gains aren’t even enough to bring us back to levels the major averages were trading at in the final hour of trading yesterday. The S&P 500 is marginally higher on the week, but which side of unchanged it finishes the week will likely hinge on earnings reports from Apple (AAPL) and Amazon.com (AMZN) after the close today.

As if all the earnings news wasn’t enough, there’s also a ton of economic data to contend with both today (Jobless Claims, GDP, Pending Home Sales, and KC Fed) and tomorrow (Employment Cost Index, Personal Income and Spending, Chicago PMI, and Michigan Sentiment). The ECB just announced no major changes to policy in its latest statement noting that its pandemic program will remain in place until at least March, but there will likely be more details to come in the press conference at 8:30 AM. Back here at Home, President Biden is expected to announce details for a framework of a $1.75 trillion social-spending and climate package. Whether Congress can pass it is a whole other story.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

There were some really disparate moves in the US Treasury market yesterday as investors sold the short end of the curve on fears of more aggressive policy tightening down the line. At the same time, they were buying the long end betting that more aggressive tightening will cause a slowdown in growth. You can really see the dynamic playing out in the snapshot from our Trend Analyzer below. The ETFs listed below are sorted by where they closed Wednesday within their respective trading ranges, but they are also perfectly sorted by the maturities of the treasuries they track from the short-end of the curve (most oversold) to the long-end (closest to or above their 50-day moving averages).

The charts below show the performance of the 1-3 Year US Treasury ETF (SHY) and the 20+ Year Treasury ETF (TLT). While the magnitudes of the moves are much smaller for SHY, its price chart looks like a steep cliff, while TLT has seen a nice bounce over the last few days.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Microsoft (MSFT) Closes in on Apple (AAPL) as World’s Largest

With a gain of more than 4% today in reaction to earnings, Microsoft (MSFT) is suddenly challenging Apple (AAPL) for the title of world’s largest company. Coming into today, Apple had a market cap of $2.468 trillion versus Microsoft’s market cap of $2.328 trillion. That spread of $140 billion has shrunk all the way down to just $27 billion after Microsoft’s gain of $117 billion in market cap today alone.

As shown below, Microsoft (MSFT) had a market cap of $615 billion versus Apple’s (AAPL) market cap of just $15.9 billion back in late December 1999 near the peak of the Dot Com Bubble. From there, Apple began to gain ground with its iPod and iPhone releases in the early and mid-aughts. On May 26th, 2010, Apple’s market cap finally crossed above that of Microsoft and didn’t look back for quite some time. Remember, before shifting focus on the cloud, Microsoft’s business was struggling mightily. The company’s market cap essentially went sideways for 15 years before exploding higher again in the second half of the 2010s as Office 365 took hold.

While MSFT was actually bigger than AAPL at various points between 2018 and 2020, Apple’s widest market cap margin versus Microsoft actually came in January of this year when Apple was at $2.4 trillion versus MSFT at $1.74 trillion. Since that peak on January 25th, though, MSFT has been rapidly gaining ground. It will only take another small move higher on a relative basis for MSFT to eclipse AAPL’s market cap at this point. AAPL reports earnings on Thursday, so how the stock responds to that report will have a big impact on how this relationship stands heading into the month of November. Click here to view Bespoke’s premium membership options.

Tesla (TSLA) Not Enough To Lift ARK Innovation (ARKK)

It has been awhile since we checked in on Cathie Wood’s ARK ETFs, so below is an updated look at their relative strength versus the S&P 500 SPY ETF. After absolutely surging versus SPY in 2020 and early 2021, the ARK funds have generally been underperforming for the past six months. That being said, they’re still well ahead of SPY since the start of 2020 given that all the relative strength lines are solidly in positive territory. As shown, the ARK Next Generation Internet ETF (ARKW) is doing the best versus SPY over the time period shown. Notably, the ARK Autonomous Tech (ARKQ), Genomic Revolution (ARKG), and Fintech Innovation (ARKF) ETFs have all performed roughly the same versus SPY since the start of 2020 even though they cover different industries and groups.

Taking a look at the largest of the ARKK funds, the ARK Innovation ETF (ARKK) has basically been range bound between $100 and $125 over the last six months. As shown below, ARKK recently managed to re-take its 50-day moving average, but it had trouble getting above resistance at its 200-day moving average. That is even with the massive rally we’ve seen in Tesla (TSLA) lately, which is ARKK’s largest holding at 10%.

As previously mentioned, TSLA is by far the largest holding of ARKK, especially after having rallied 17.8% in the past week alone. Skillz (SKLZ) has actually posted an even larger 20.9% rally in the same span, but its weighting is far smaller at only 0.69%, meaning its gains have been much less impactful on ARKK’s performance. As for the rest of the holdings, not even half are in the green over the past five days and only 38% are in the green year to date. Three holdings—Proto Labs (PRLB), Materialise (MTLS), and Berkeley Lights (BLI)—have seen their price more than cut in half since the start of the year. As shown in the snapshot of our Trend Analyzer below, the bulk of these stocks are also in sideways trends.

Now in the throes of earnings season, most of the ARKK holdings have yet to report results but they are scheduled to do so in the coming weeks. Of those left to report, Roku (ROKU) has averaged the strongest one-day gain in reaction to earnings historically with strong beat rates for sales, EPS, and guidance. Speaking of beat rates, DocuSign (DOCU) is notable in having almost exclusively reported Triple Plays throughout its three-year earnings history. Click here to view Bespoke’s premium membership options.

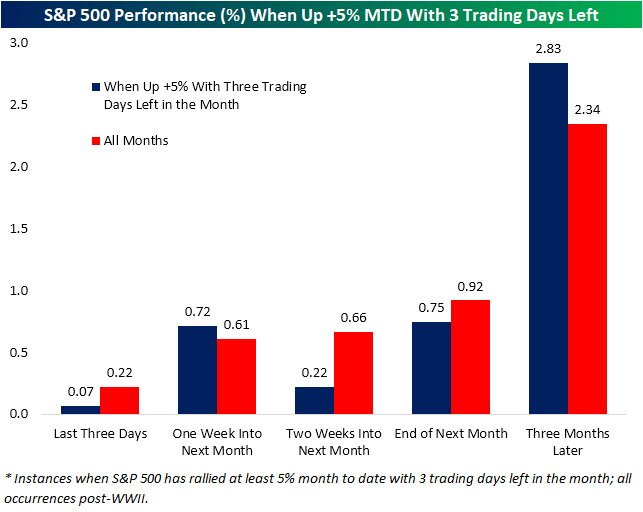

S&P 500 Up +5% With Three Days to Go

There are only three sessions left in the month of October, and the S&P 500 enters them up 6.2% month to date. That marks the best performance through the final three trading days of any month since last November when the S&P 500 was up 11.2% MTD. In the post-WWII period, there have been 95 occurrences where the S&P 500 was up 5% MTD heading into the final three trading days of the month. In those prior months, the S&P 500 has averaged a gain of 7 bps in the final three trading days which is below the average gain of 22 bps in the final three days for all months during that same period. While there is that short-term underperformance, the last three trading days of the given month through the first week of the next month has averaged better than average performance (0.72% vs 0.61%). As for where the S&P 500 goes from there, performance is mixed relative to the norm. Through the end of the following month, returns tend to again be worse than normal, but three months later the S&P 500 has averaged a nearly half percentage point larger gain than the norm. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 10/27/21 – Halfway

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Are you green and growing or ripe and rotting?” – Ray Kroc

With the second and third largest companies in the U.S. reporting earnings after the close yesterday along with dozens and dozens of others, you would have expected to see a larger move in the futures market this morning, but as things stand now, prices are little changed with a slight bias to the upside. Treasury yields are lower with the 10-year back below 1.60% again. The real action in the markets this morning is in the crypto-space, and it’s to the downside as both bitcoin and ether are down over 5% with other smaller assets in the space down even more.

The economic calendar is light today with Wholesale Inventories and Durable Goods hitting the wires at 8:30 and DoE energy inventory data coming out at 10:30.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

With all the earnings reports this week, especially the ones from the largest companies out there, investors were worried about the potential for volatility, but so far, the bulls have won out as the major indices are higher on the week so far (although we do have three full sessions of trading left in the week). Of the ‘big five’ companies reporting this week, Facebook (FB)’s report was met with a disappointing reaction, and last night after the close we heard from Alphabet (GOOGL) and Microsoft (MSFT). In pre-market trading, GOOGL is trading down less than 1% while MSFT trades higher by just over 1.5%. That leaves Amazon.com (AMZN) and Apple (AAPL) for after the close on Thursday, but so far two of the three that have reported have experienced negative reactions to earnings.

As far as the major US averages are concerned, they’re all higher on the week but to varying degrees. The Russell 2000 has been the weakest of the three indices shown below as it was also the only one to trade lower yesterday. The Nasdaq 100 (QQQ) has been the top performer on the week with a gain of over 1%, but it still has yet to take out its record high from early September. Last but not least, the S&P 500 finished off its intraday highs yesterday, but still managed to close at its second record high of the week.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

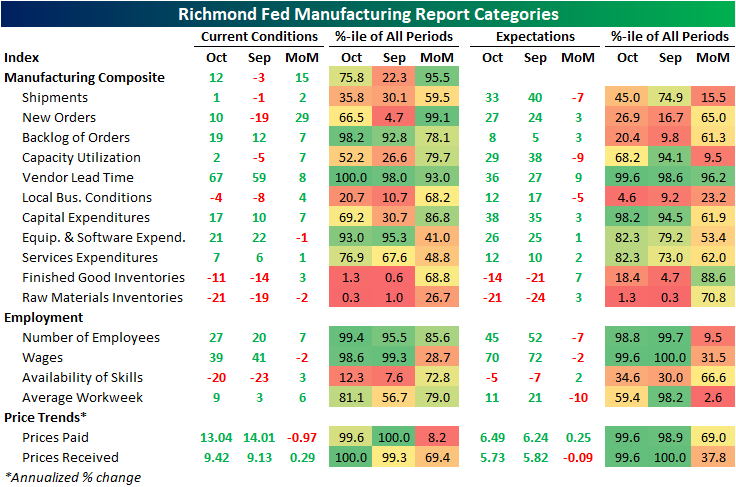

Richmond Fed Back to Positive

Like yesterday’s Dallas Fed reading, the Richmond Fed’s Survey of Manufacturing Activity experienced a larger than expected bounce this month as the headline reading rose from -3 to 12. That compares to expectations of a modest increase to only 5. October’s bounce has helped to recover a decent chunk of the steep drops from August and September.

The rise in the composite reading was thanks to broad increases across the report. The only indices that declined month over month were those of Equipment and Software Expenditure, Raw Materials Inventories, Wages, and Prices Paid. Whereas there were several indices in contraction last month, most moved back into expansionary territory.

By far the most impressive increase this month was in New Orders. Last month, the index plummeted into the bottom 5% of readings, but after a 29 point increase (which ranks as the fourth-largest monthly gain on record), it is back in positive territory. That was met with a solid uptick in Order Backlogs, but the Shipments component remains much more muted and barely positive. That is likely due to supply chain delays as the index for Vendor Lead Times set a new record high.

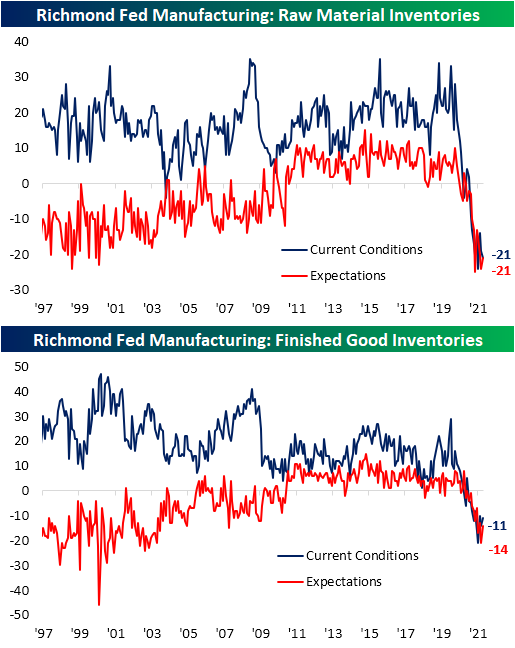

Another issue tied into low shipment growth and delays is rapidly declining inventory levels for both inputs and finished goods. While the former saw a modest bump this month, both indices are only slightly above record lows.

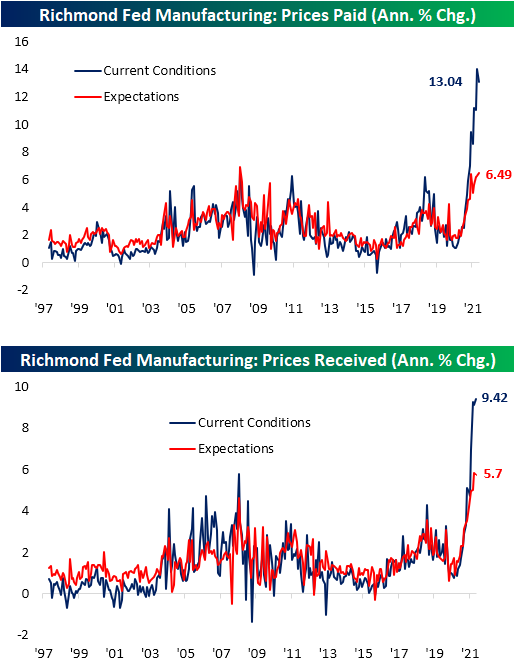

Price indices remain at historic levels and like the indices for inventories, the index for input prices moved lower in October while Prices Received set a new record high at 9.42% annualized. The expectations indices for these two categories saw the opposite results with a new high in Prices Paid and a small decline in Prices Received.

Employment indices were generally stronger in October with upticks in the Number of Employees, Average Workweek, and Availability of Skills. For the Number of Employees, although the current reading is off the peak, it is still above anything observed prior to the pandemic. The same can be said for Wages while the Availability of Skills is back within the range that was in place in the few years leading up to the pandemic. Click here to view Bespoke’s premium membership options.

Short Term Breadth Takes Off

One of the points noted about the recent moves for the S&P 500 over the past few days have been on the outsized impacts of big gains or losses in names like Tesla (TSLA) or Facebook (FB). In spite of the impacts of those single names, the S&P 500’s return to record highs has happened on very strong breadth across sectors. Below, we show 10-day advance-decline line charts from our Sector Snapshot.

The 10-day advance/decline line measures the average daily number of advancers minus decliners in an index or sector over the last ten trading days. It’s a short-term breadth measure that traders use to measure how extended the market is at the moment. Very high readings suggest that the market might be overbought in the near term, and downside mean reversion can be expected. Very low readings suggest the opposite — that the market might be oversold in the near term, and upside mean reversion can be expected.

For the broad S&P 500, the 10-day AD line has hit the highest level since February 12th. Going back to 1990, the current reading stands in the 97th percentile. Looking at each sector, most lines are also in the upper decile of readings since 1990 and only two are not currently overbought: Communication Services and Consumer Staples. Meanwhile, some like Technology and Real Estate are a full two standard deviations above the historical norm. In fact, the Tech sector’s line is the most elevated relative to its respective history of any sector with the current reading in the 98th percentile of all periods. The last time that the line was as elevated as now was in November of last year. No other sector has as long of a gap in time in which it has seen levels similar to the current reading. Most other sectors have seen higher readings as recently as August or September, though current levels are nonetheless elevated. The market has had quite the run over the last two weeks, and we’d expect some sort of cool-off period soon. Click here to view Bespoke’s premium membership options.