Amazon (AMZN) Primed and Popped

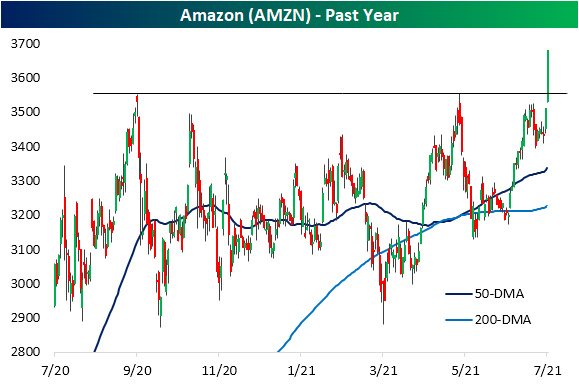

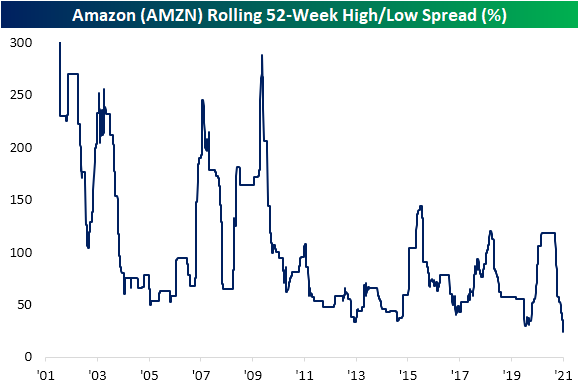

One returning trend that we have made note of recently has been the outperformance of mega-cap stocks on what has generally been moderate broader market breadth. Online retail giant Amazon.com (AMZN) is a good example of this today. Even though the S&P 500 is down 0.35% on 3:1 negative breadth as of this writing, AMZN is providing a boost as the index’s top performer up 4.55%. That puts the stock on pace for its best day since November 4th when it gained 6.32%. While today’s move is notable in its own right as that stands in the 93rd percentile of all daily moves since the stock began trading in 1997, even more impressive is that it marks a breakout to the upside of the past year’s range. As shown below, since last summer the stock has been rangebound between its lows around $2,870 set in late July—which were then retested in September and March—and the highs around $3,550 first reached in September which was then unsuccessfully tested earlier this spring.

While that range is finally broken, we would note just how tight it had gotten. With the lower readings from last spring having rolled off, the 52-week intraday high/low spread as of last Friday hit a record low of 23.79%. The breakout to new highs today has lifted that reading up to 28.14% which still does not have another period that can be compared to. While not as low as today, the only other times that the spread has come close to current levels was early 2020 right before the COVID crash, February 2015, and June 2013. Click here to view Bespoke’s premium membership options.

Chinese Equities Falling Behind

2021 saw Chinese equities get off to a strong start with the CSI 300 leading the way higher versus the US (S&P 500) and Europe (STOXX 600). By the time of the Chinese New Year on February 12th, the CSI 300 had already rallied 11.44% YTD, but the new (Chinese) year has seen a plague of regulatory risk resulting in a complete reversal in that earlier strength. From mid-February to March the index fell sharply and it has not done much since then. Chinese equities have now erased the entirety of the double-digit move from the first several weeks of the year as the CSI 300 is currently down 2.5% YTD. Meanwhile, the S&P 500 and STOXX 600 have both trended higher and are currently up 15.58% and 14.58% YTD, respectively. Given the weakness of the CSI 300, the relative strength lines of the S&P 500 and STOXX 600 versus the CSI 300 have taken off in recent months.

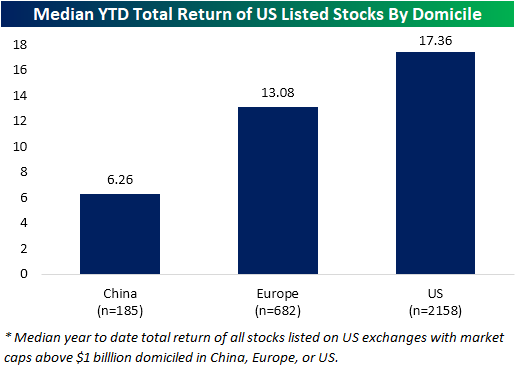

Taking another look at the underperformance of Chinese equities, in the chart below we show the median year-to-date total return of stocks listed on US exchanges with market caps greater than $1 billion grouped by the country, or region in the case of Europe, that they are domiciled in. As shown, US-domiciled stocks have the largest median return this year at 17.36%. European companies whose shares are traded in the US are not far behind in performance having posted 13% gains this year. While still having posted a positive total return, Chinese names are up by far less at only 6.26%. Click here to view Bespoke’s premium membership options for our best research available.

Memory Lane: Some of The Best and Worst Days of This Week Through History

“Aggressive accounting does not mean illegal accounting” – Kenneth Lay, Enron CEO

“It was greed, pure and simple.” – Dennis Kozlowski, Tyco CEO

“I don’t know accounting.” – Bernard Ebbers, WorldCom CEO

With the July 4th holiday, the first week of July has historically been a rather quiet one for the US equity market, but the equity market don’t always follow the seasonal playbook, and a perfect case in point was the first week of July 2002 when the S&P 500 saw one of its best and worst days in history for that particular week of the year.

Friday, July 5th, 2002 (+3.67%)

With Americans still on edge following the September 11th attacks, the S&P 500 surged on the first trading day after the peaceful and uneventful July 4th holiday. Even a weaker-than-expected jobs report couldn’t dampen the sense of relief. The peaceful weekend coupled with two solid days of gains in European bourses and panic short-covering on a light volume holiday-shortened Summer Friday helped to exaggerate the upside. Relative to prior weeks, it was a rare positive day for the S&P 500. Breadth was positive as gainers outnumbered losers by a margin of more than 4 to 1, and semis surged more than 9%! With terrorism fears momentarily allayed, bulls pushed the S&P 500 to its largest one-day gain since May 8th. Would the post-July 4th rally serve as the catalyst to break the downtrend in US stocks?

Stock market declines in the first half of 2002 were driven by economic weakness as a result of 9/11 and numerous accounting scandals that surfaced in companies like Enron, Tyco, and WorldCom. July 5th provided some irony on that front, though, as The Great Atlantic and Pacific Tea Company (aka A&P grocery chain) disclosed its own accounting error. Only this one was in its favor as an audit showed that the grocer had improperly booked manufacturer discounts and promotions, and the restatement turned what was originally a loss to a gain.

The rally on July 5th also came just two trading days after the S&P 500 first closed below its 9/11 lows, and the bounce instilled some hope that perhaps this would mark the beginning of the elusive bottoming process. Unfortunately, there was no such luck. The following Monday, the S&P 500 dropped 1.22%, and that was followed the next Tuesday by a decline of 2.47%, erasing all of the prior Friday’s gain. The sellers still weren’t done yet, though. Over the next two weeks, the S&P 500 dropped an additional 16%+.

Wednesday, July 10th, 2002 (-3.40%)

After a strong rally on a holiday-shortened Friday (discussed above), stocks opened the following week with declines that reached a crescendo on Wednesday, July 10th when the S&P 500 fell 3.40% to levels not seen in nearly five years (November 1997). As mentioned above, accounting scandals, fears of terrorism, and the weak economy all merged to create one of the worst bear markets in decades, with stocks having their worst half-year performance since 1970.

The first two trading days of this week in July 2002 completely erased the big gains from the prior Friday, and then on Wednesday (7/10/02) equities immediately opened down and ground lower throughout the entire day, closing near the lows of the day. While the news items of the day certainly did not generate any positive sentiment (Qwest under federal investigation, President Bush delivering a speech on corporate responsibility that did not have any concrete steps to prevent future scandals), the market action seemed driven more by despondency than any specific catalyst. A report that investors pulled $11.8 billion out of stock mutual funds in June, the largest move since the prior September after the 9/11 attacks, provided concrete evidence of that sentiment. With so much pessimism and large outflows from mutual funds, a contrarian bet might be to take the other side, but it would be a few more weeks before stocks were able to show any signs of stabilization. Over the nine trading days to the eventual bottom of the July swoon, the S&P 500 fell seven times for an additional decline of 13.3%. Click here to view Bespoke’s premium membership options.

Bespoke Market Calendar — July 2021

Please click the image below to view our July 2021 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.

Bespoke’s Morning Lineup – 7/6/21 – Leaders Lag

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The best time to plant a tree was 20 years ago. The second best time is now.” – Chinese Proverb

Happy Tuesday! If you were off yesterday, we hope you had a good long holiday weekend. There’s not much in the way of fireworks going on in the US equity markets this morning as futures are little changed. The only major item of note is the plunge in shares of the Chinese ride-hailing company, DIDI, after Chinese authorities ordered the removal of its app from various platforms in China. The only economic data of note for today is the ISM Services report at 10 AM. Anything could happen, but based on the current setup, we could be in for a quiet week.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, a discussion of the latest services sector PMI data, other economic data from around the world, the latest US and international COVID trends including our vaccination trackers, and much more.

We’ve talked a lot about the equity market’s impressive ability over the last several months to rotate between sectors and styles without causing too much in the way of a ripple in the overall market. The snapshot of major index ETFs below shows a great example of this rotation as last week’s leaders were the YTD laggards and the laggards were the YTD leaders. Two cases in point? With a decline of 2.43% last week, the Russell Micro-Cap ETF (IWC) remains the top-performing index ETF YTD even as it was the worst-performing ETF of the week. Conversely, even after its 2.63% gain last week, the Nasdaq 100 ETF (QQQ) is still up less than any of the other ETFs in the screen.

The scatter chart below shows the rotation in another way. Starting out at the top left, we have QQQ as the worst-performing index ETF YTD but the best performer last week. From there, as you move to the right, YTD performance increases while performance over the last week gets progressively worse.

Bespoke Brunch Reads: 7/4/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

COVID

7 Ways Covid Has Changed Our World by Aaron Back (WSJ)

A series of articles detailing the 7 ways that COVID has changed the world: exurban growth, shopping habits, vaccine hesitancy, remote learning, the big business potential of vaccines, bigger government spending, and life insurance are the big ideas. [Link; paywall]

The Case Against the Covid-19 Lab Leak Theory by Lindsay Beyerstein (The New Republic)

A detailed takedown of the loose punditry which has surrounded the so-called lab leak hypothesis, which posits COVID originated in a Chinese lab rather than a vector from the natural world as other coronaviruses have. [Link]

Pfizer and Moderna Vaccines Likely to Produce Lasting Immunity, Study Finds by Apoorva Mandavilli (NYT)

While we will only know with the passage of time, initial studies assessing how long mRNA-based COVID vaccines protect recipients are very positive and indicate the shots could generate a lifetime of functional immunity. [Link; soft paywall]

Big Spending

Southwest Offers Workers Double Pay to Avoid July Travel Snags by Alison Sider (WSJ)

The airline is ramping up pay to make sure it has sufficient staff on hand to process the huge swell of customers which are drowning airports and flights with post-COVID demand for travel. [Link]

Tesla is well on its way to smashing last year’s sales record by Tim Levin (Business Insider)

Tesla delivered 201,250 vehicles to customers during Q2, by far its best quarter and putting it on track to easily hurdle its record 2020 sales pace of over 500,000 cars. [Link]

Global App Spending Approached $65 Billion in the First Half of 2021, Up More Than 24% Year-Over-Year by Stephanie Chan (Sensor Tower)

With consumer spending booming, mobile apps are increasingly grabbing share with a huge increase in the number of dollars spent on purchases of apps, in-app purchases, and subscriptions. Apple’s App Store is about twice as large as Google Play. [Link]

China

The deep roots of China’s financial conservatism (Andrew Batson)

High inflation during China’s civil war and the success of the communist government in taming it after defeating the nationalist opposition has deeply colored the fiscal and monetary perspectives of Chinese policymakers. [Link]

Investing

Inner Game with Steven Cohen (Stray Reflections)

A recorded Zoom seminar with Steve Cohen of Point72 Asset Management, focused on his process and the inner approach which has led to his success. [Link]

Retirement

What Peter Thiel’s Roth IRA Means for Yours by Laura Saunders (WSJ)

The revelation that billionaire Peter Thiel has managed to generate a Roth IRA balance of about $5bn is a catalyst for tax reform that cuts off the popular tax minimization strategy. [Link; paywall]

Older Americans Stockpiled a Record $35 Trillion. The Time Has Come to Give It Away. by Ben Eisen and Anne Tergesen (WSJ)

Wealth concentrated in the hands of aging Baby Boomers that will transfer to younger generations over coming years numbers in the tens of trillions of dollars, but the real big inheritances won’t kick off until the 2030s. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Bespoke’s Morning Lineup – 7/2/21 – Happy Birthday!

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“My dream is of a place and a time where America will once again be seen as the last best hope of earth.” – Abraham Lincoln

On a Friday before a holiday weekend, you would expect things to be quiet, and that’s exactly the way things are now ahead of the June jobs report. The release of that report will likely cause some ripples, but don’t expect much in the way of movement after the first couple of hours of trading as traders head for the exits to start the holiday weekend early. Have a Happy July 4th!

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, a discussion of the latest round of OPEC talks, economic data from around the world, the latest US and international COVID trends including our vaccination trackers, and much more.

July 4th is typically a good time of year for the equity market, and the chart below showing the performance of the S&P 500 from the Friday before to the Friday after July 4th illustrates that point. Since 1945, the S&P 500’s median gain during the four trading day stretch has been a gain of 0.88% with positive returns 71% of the time. Last year was an especially strong July 4th week for the market as the S&P 500 surged 4.02%, ranking as the second-best July 4th week since 1945 (2010 was the best at 5.42%).

We have also highlighted years where the S&P 500 was up over 10% heading into the July 4th week in red. When equities were already up double-digits heading into July 4th, performance was even better with a median gain of 1.06% and positive returns 86% of the time (19 out of 22 times).

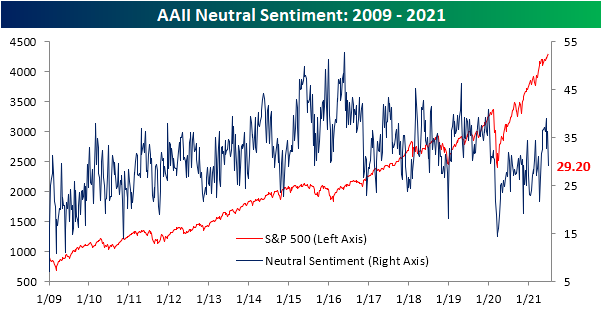

Sentiment Has Perked Up

Sentiment has taken a big step up in the past week. The AAII weekly sentiment survey saw 48.6% of respondents report as bullish this week, up 8.2 percentage points from last week for the highest reading since the week of April 22nd when over half of respondents reported as optimists. Not only is this week’s reading ten percentage points above the historical average, but the one-week increase was the largest since an 11.1 percentage point jump during the week of April 8th. Similarly, the Investors Intelligence survey of newsletter writers saw bullish sentiment jump from 56.5% last week to an eight-week high of 59.6%.

Considering bearish sentiment was already muted, that big increase in bullish sentiment was only met with a 1.1 percentage point decline in bearish sentiment. Only 22.2% of respondents reported as bearish this week, the lowest reading since June 10th.

While bearish sentiment did not experience a particularly large decline, it was an inverse move to bullish sentiment which resulted in the bull-bear spread climbing 9.3 points to the highest level since April 22nd. That means sentiment continues to largely favor the bulls. Prior to the past year, late 2017 and early 2018 was the only other period in recent years that the bull-bear spread was at similar levels to now.

Given the jump in bullish sentiment did not borrow from bearish sentiment, neutral sentiment took a significant hit this week falling 7.4 percentage points. That was both the biggest one-week decline and marks the lower level in neutral sentiment since April. Click here to view all of Bespoke’s premium membership options and to sign up for a trial.

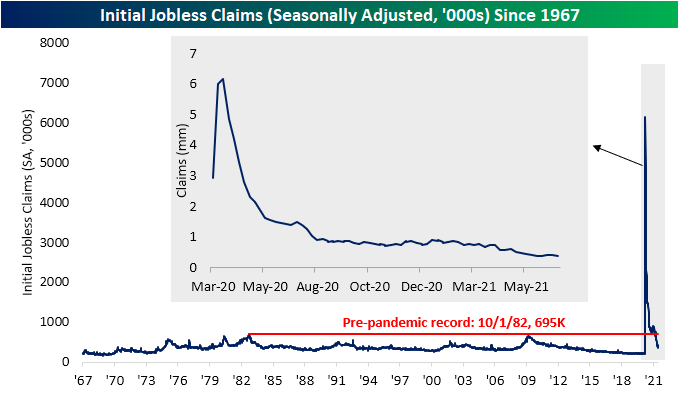

Jobless Claims Back to Pandemic Lows

Initial jobless claims fell to 364K this week from last week’s upwardly revised level of 415K (originally 411K). That 51k decline was the biggest one-week drop since a 156K decline between the first and second week of April. Additionally, this week’s print leaves claims 10K below the previous low of the pandemic.

On a non-seasonally adjusted basis, claims were likewise lower falling from 397.4K to 359.1K. It is somewhat unusual for the current week of the year to experience a decline as historically it has seen claims rise three-quarters of the time. While regular state claims were lower, PUA claims rose for a third week in a row. Rising to 115.27K, PUA claims are at the highest level since the week of April 23rd. In spite of the two programs having moved in opposite directions, the drop in regular state claims was larger as total combined claims fell back below 500K and are roughly 40K above the low of 435.8K from three weeks ago.

Continuing claims were once again not as strong as the reading continues to flip back and forth between increases and decreases week to week. This week saw a small 56K uptick which left seasonally adjusted claims at 3.469 million. While higher and 56K off last week’s low, claims remain at a healthier level than the rest of the pandemic.

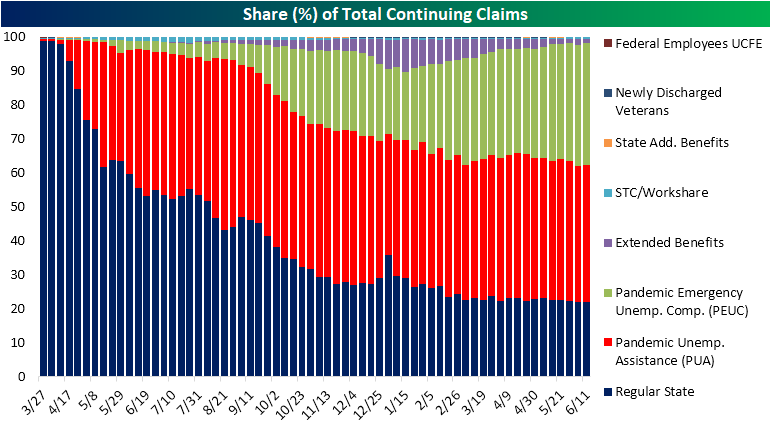

On a non-seasonally adjusted basis and including all other programs through the week of June 11th, claims fell from 14.87 million down to 14.68 million. That marked the seventh week in a row that total claims across all programs fell week over week. The Extended Benefits program was the biggest contributor to that decline as the program saw 86.82K fewer claims than the previous week. Regular state programs were the next biggest contributor to the overall decline with claims dropping 64.7K. With the consistent declines in regular state programs, pandemic era programs (PUA and PEUC) now account for 76.3% of all continuing claims. That share is likely to drop in the coming weeks though as there will be an acceleration in states withdrawing from those programs which will begin to be reflected in this data. Click here to view Bespoke’s premium membership options for our best research available.

Energy and Ethereum Lead The Way Higher in First Half

The first half of 2021 is now in the books. Below is a look at our Asset Class Performance Matrix highlighting total returns in June, Q2, and the first half of 2021 using key ETFs that we monitor on a regular basis.

Across asset classes, energy was the winning theme with commodities like oil (USO) and natural gas (UNG) boasting some of the strongest first-half returns alongside Energy sector stocks (XLE). USO was the top performer of these with its 51.11% total return since the start of the year. Alongside XLE and UNG’s over 40% gains, the Ethereum Trust (ETHE) also rallied 44.32%, albeit there has been a significant pullback in the past month. Although ETHE posted big gains, Bitcoin (GBTC) took a loss with a 6.84% decline in the first half. That is not to say it was not up significantly at one point during the first half as Q2 alone saw a 40.43% loss that brought it into the red for the half. The only other assets to have fallen by more than Bitcoin in the first half were the Japanese Yen (FXY), Gold (GLD), and long bonds (TLT). TLT saw the weakest returns of all of these over the course of the past six months but more recently it has experienced better performance relative to other assets. In fact, its 4.42% rally in June was almost double that of the S&P 500.

In the equities space, again Energy was the top performer while small caps and value outperformed as well in the first half. That was not necessarily the case in June though as there was evidence of rotation out of value and into growth. The NASDAQ 100 (QQQ) and S&P 500 Growth (IVEW) were two of the top-performing ETFs in June and Q2 while value stocks actually fell in June.

As for international equities, Canada (EWC) and Russia (RXS) were the strongest country ETFs in the first half. While it was not enough to lift its first-half gain to the high end of the range of countries shown, Brazil (EWZ) did see a large degree of outperformance in Q2 with a 23.05% gain. That is nearly double the next best performer, Russia. Additionally, these were the only two countries up significantly in June as most countries saw a loss. Year-to-date, China (ASHR) and Japan (EWJ) have been the weakest of the country ETFs. Click here to view Bespoke’s premium membership options.