Bespoke’s Morning Lineup – 7/9/21 – Friday Already!

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Know what you own and know why you own it.” – Peter Lynch

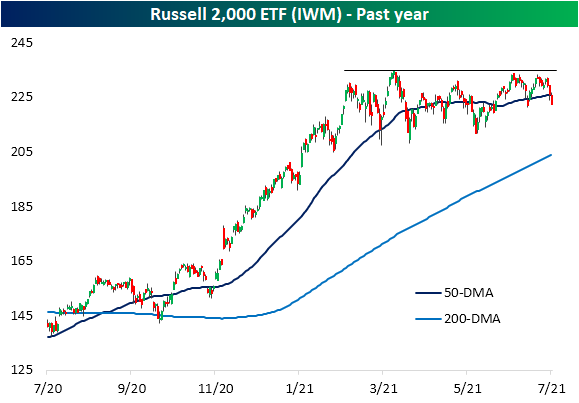

Futures continue to rebound off Thursday’s lows as they look to erase most of yesterday’s losses at the open. Based on where they stand now, all of the major averages are set to finish the shortened week modestly in the red and bucking the positive seasonal trend in the process. Small caps are leading the charge this morning with Russell 2000 futures trading up by just over 1%. A positive showing today would snap what has been a four-day streak of 0.90%+ declines. The last time the Russell 2000 experienced a streak that long was in late February 2020 during the COVID crash. Granted, the magnitude of the losses was much larger back then, but it just helps to put the recent negative sentiment towards small caps into perspective.

10-Year US Treasuries are also trading lower this morning and that sets the stage for an end to the eight-day streak of falling 10-year yields. As we noted in the Closer report last night, over the last 20 years, there have been a number of streaks as long as the current one, but none have been longer.

On the regulatory front, the Biden administration just confirmed a number of executive orders aimed at competition in the agricultural, banking, health care, rail, technology, and transportation sectors, but futures are actually higher now than they were leading up to the releases.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, a discussion of economic data and policy actions in China, the latest US and international COVID trends including our vaccination trackers, and much more.

As the Technology sector has outperformed in recent weeks and US Treasury yields have declined, it almost seems as though the cyclical trade has been written off for dead, but a look at sector performance on a YTD basis provides some good perspective. Even after the recent outperformance, the Technology sector is still underperforming the S&P 500 on a YTD basis (14.8% vs 15.0%). At the same time, most of the cyclical sectors that surged in late 2020 and earlier this year are still handily outperforming the S&P 500 this year. The YTD gain in the Energy sector still dwarfs the S&P 500 and every other sector. Likewise, Financials still have a six percentage point lead on the Technology sector. Pullbacks in the Industrials and Materials sectors have moved them into the laggard camp on a YTD basis, but their gains are still solid. Like the period of consolidation that the technology/growth areas of the market experienced from September through earlier this year, one could just as easily take the view that these sectors are simply consolidating their monster gains of the prior months.

Bulls and Bears Retreat

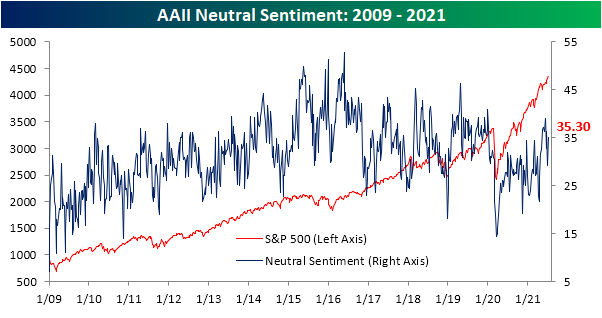

Leading up to the over 1% reversal lower today, the past week has seen the S&P 500 and NASDAQ make a number of new all-time highs. In spite of this, the weekly sentiment survey from AAII showed bullish sentiment give up all of its gains from the prior week as it came in at 40.2%. That is back down to the same level as of June 10th and the 8.4 percentage point decline was the largest since the 10 point drop at the end of April.

Bearish sentiment did not exactly pick up those losses as the reading only rose 2.3 percentage points to 24.5%. That was not a particularly large increase as it only brought bearish sentiment to the highest level in three weeks. While higher sequentially, bearish sentiment remains at the low end of the past several years’ range.

With bulls not becoming bears, neutral sentiment moved higher gaining 6.1 percentage points. At 35.3%, it is still below levels from two weeks ago and is even further below the recent highs that neared 40%. Click here to view Bespoke’s premium membership options.

Chart source: American Association of Individual Investors

Jobless Claims Back to Seasonal Norms

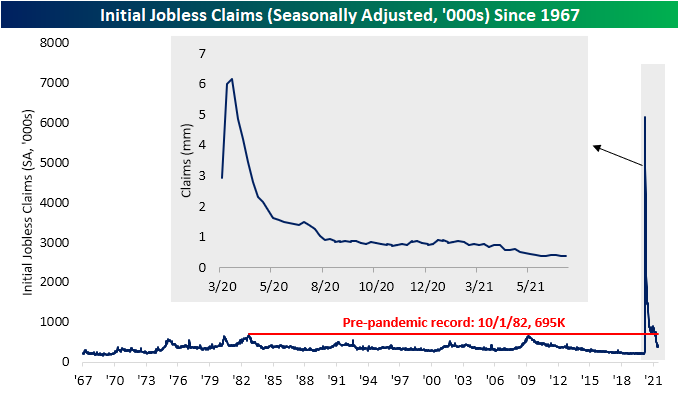

Initial jobless claims disappointed this week rising to 373K versus expectations of a reading 23K lower. Not only was this week’s print higher than expected, but last week’s number was revised up from 364K to 371K. Even though last week’s data was not as strong as it originally appeared to be and this week marked a slight worsening, taking a step back, claims are still at some of the lowest levels of the pandemic and only around 160K above pre-pandemic levels.

On a non-seasonally adjusted basis, claims were again slightly higher rising from 366.5K to 369.7K. While higher, given seasonality trends, this was a notable move. Since 1967, the current week of the year (27th) has only seen UI claims fall week over week once. That decline came last year when claims were coming off of historically elevated levels. While initial claims returned to the usual seasonal pattern this year, it wasn’t by much. Outside of last year, for the 27th week of the year, this past week saw the smallest increase on record.

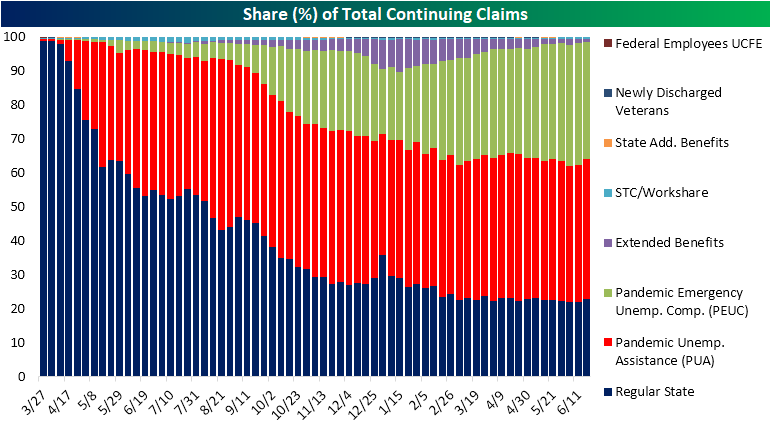

Turning to the impact of Pandemic Unemployment Assistance (PUA), claims fell back below 100K this week as a handful of more states withdrew from the program. Total claims between the two programs summed to 468.7K this week, dropping week over week but still above the low of 435.8K from the first week of June.

While initial claims disappointed, continuing claims fell week over week and came in below the forecasted reading of 3.35 million. Claims this week totaled 3.339 million, setting a new low for the pandemic which is around twice as high as pre-pandemic levels.

Including all programs into continuing claims counts creates an additional week’s lag in the data meaning the most recent reading is through the week of June 18th. On a combined basis, continuing claims have continued to improve putting in another low at 14.23 million. While they remain the two largest programs accounting for the highest share of total claims, significant declines in PUA and PEUC programs drove that overall decline, offsetting a 53.1K increase in regular state claims. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 7/8/21 – Buckle Up

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“People don’t pay attention until they have to.” – Meredith Whitney

In yesterday’s email, we noted that “Lower interest rates are good for equity prices, but when the pace of the downside move picks up steam, equity investors take pause.” This morning, we are seeing that trend play out in real-time. As treasury yields continue to plunge, equity investors are reading the rally in the bond market as a sign of weakness ahead and taking profits now. The S&P 500 is currently indicated to open down about 1.25%, and in a sign of just how uniform the decline has been, both the Dow and Nasdaq futures are also in the red by about the exact same amount.

Naturally, all sorts of catalysts are being blamed for the decline ranging from the growing threat of the Delta variant, a weaker than expected economic recovery, or lack of an infrastructure deal. Sometimes, though, the market doesn’t need an excuse to sell off and it just needs to let off some steam.

In economic news, the only major data point of the day is initial jobless claims which came in 23K above forecasts (373K vs 350k). Continuing claims, however, managed to fall more than expected falling to a post COVID low of 3.339 million.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, a discussion of growth in the Delta variant, economic data from around the world, the latest US and international COVID trends including our vaccination trackers, and much more.

There was a time not long ago when a number of sentiment indicators showed a healthy degree of skepticism on the part of investors. That time is no longer. One indicator we don’t highlight on a regular basis is the TD Ameritrade Investor Movement Index (IMX). Calculated by TD Ameritrade, the IMX is designed to measure individual investor sentiment based on what investors are actually doing in their brokerage accounts.

Back near the 2020 lows, the IMX index dropped to its lowest level since early 2012 and while it bounced with the overall market when the S&P 500 was back at all-time highs last September, it was much slower to recover and well below its record highs from late 2017. Since the start of this year, though, investor sentiment has really started to surge, rising from 5.49 last November to a record 9.08 in June. In the eleven years that TD Ameritrade has been publishing this index, it has never seen as sharp of a surge as it has over the last several months.

Mega Cap Stocks Relatively Strong

Mega cap stocks are an important area to watch and have been an area of our focus recently as the relatively small number of names hold a large weight within the S&P 500. Their recent strength has propelled the broad market to a series of new highs in spite of what has been weaker breadth outside of this space.

In the chart below, we take a closer look at the relative performance of the four largest stocks versus the S&P 500 over the past year. Alphabet (GOOGL) has performed the best versus the S&P 500 of the four names shown and is at one-year highs. Apple (AAPL) outperformed the S&P significantly in 2020 but gave it all back from late January through May. Since June, however, Apple has been on a tear versus the market. Microsoft (MSFT) and Amazon (AMZN) are both still underperforming the S&P over the last twelve months, but they have made solid moves higher since June. Click here to view all of Bespoke’s premium membership options and to sign up for a trial.

Russell 2,000 (IWM) No Longer in Favor

The final quarter of 2020 and the first quarter of this year saw small caps come back into favor as the Russell 2,000 consistently outperformed the S&P 500 during that stretch. From the late September test of its 200-DMA to the mid-March highs, the Russell 2,000 rose rallied around 65% versus the S&P 500’s gain which was less than half of that. As such, the ratio of the two indices shown below, and highlighted in last night’s Closer, ripped higher. That outperformance has been absent over the past quarter though. In the second half of March, the ratio peaked then made a sharp reversal lower. Throughout Q2 and continuing into Q3, the ratio has continued to trend lower as the Russell 2,000 has trended sideways, hovering around its 50-DMA. Click here to view all of Bespoke’s premium membership options and to sign up for a trial.

Value (VLUE) Giving Way To Quality (QUAL)

In last night’s Closer, we noted how until February the Momentum factor (MTUM) was keeping up with Value (VLUE), but it has since given up ground as VLUE, even after stumbling of late, remains the clear top performer of the four factor-based ETFs from MSCI. On a total return basis, VLUE has gained 45.42% over the past year which is roughly 7 percentage points more than the next best performer: the Quality ETF (QUAL). Granted, that return was even stronger at 51.49% at the high on June 4th. With VLUE’s outperformance having wavered over the past month, QUAL has been gaining ground. Additionally, although QUAL has underperformed, alongside Minimum Volatility (USVM) there has been a much less ‘exciting’ and steady grind higher than VLUE or Momentum (MTUM). Click here to view Bespoke’s all of Bespoke’s premium membership options and to sign up for a trial.

Big Banks

Below is a quick look at six-month price charts for the six big US banks and brokers. Notably, Goldman Sachs (GS) and Morgan Stanley (MS) are the two that have thus far managed to hold above their 50-day moving averages, while Bank of America (BAC), Citigroup (C), JP Morgan (JPM) and Wells Fargo (WFC) have all moved below their 50-DMAs. These stocks have generally tracked the direction of longer duration interest rates in 2021. When Treasury yields were rising earlier in the year, the banks were flying high. As Treasury yields have fallen, so have the stock prices of banks. In the next couple of weeks, we’ll get Q2 2021 earnings results from all of these firms, which (for better or worse) could at least briefly take attention away from the interest rate story. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 7/7/21 – Yield Plunge Continues

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Truly brilliant marketing happens when you take something most people think of as a weakness and reposition it so people think of it as a strength.” – Reed Hastings

While still higher versus yesterday’s close, US futures have given up some of those gains as the continued decline in long-term treasury yields picks up the pace. The yield on the 10-year US Treasury currently trades below 1.31% which is now lower than at any other point since 2/19. Lower interest rates are good for equity prices, but when the pace of the downside move picks up steam, equity investors take pause.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, a discussion of growth in the Delta variant, economic data from around the world, the latest US and international COVID trends including our vaccination trackers, and much more.

With the Russell 2000 down more than 1% over each of the last two trading days, small caps have really been lagging their large-cap peers. That underperformance continues a trend we have seen over the last several weeks where the S&P 500 has been increasingly outperforming the Russell 2000 on a daily basis. Over the last 50 trading days, the S&P 500 has outperformed the Russell 2000 56% of the time. That matches a number of other periods as the highest frequency of outperformance over a 50-trading day period since late March 2020. What makes the current period different, though, is that if the S&P 500 outperforms the Russell 2000 on any of the next three trading days, the current period will move into the lead as the highest consistency of large-cap outperformance since the end of March 2020. Just as large-cap tech was in the penalty box from early March through the end of Q1, now it appears as though small caps have found themselves in their own timeout.

Amazon (AMZN) Primed and Popped

One returning trend that we have made note of recently has been the outperformance of mega-cap stocks on what has generally been moderate broader market breadth. Online retail giant Amazon.com (AMZN) is a good example of this today. Even though the S&P 500 is down 0.35% on 3:1 negative breadth as of this writing, AMZN is providing a boost as the index’s top performer up 4.55%. That puts the stock on pace for its best day since November 4th when it gained 6.32%. While today’s move is notable in its own right as that stands in the 93rd percentile of all daily moves since the stock began trading in 1997, even more impressive is that it marks a breakout to the upside of the past year’s range. As shown below, since last summer the stock has been rangebound between its lows around $2,870 set in late July—which were then retested in September and March—and the highs around $3,550 first reached in September which was then unsuccessfully tested earlier this spring.

While that range is finally broken, we would note just how tight it had gotten. With the lower readings from last spring having rolled off, the 52-week intraday high/low spread as of last Friday hit a record low of 23.79%. The breakout to new highs today has lifted that reading up to 28.14% which still does not have another period that can be compared to. While not as low as today, the only other times that the spread has come close to current levels was early 2020 right before the COVID crash, February 2015, and June 2013. Click here to view Bespoke’s premium membership options.