Opposite Day For Retail Triple Plays

There were two earnings Triple Plays in the past 24 hours, with both coming out of the retail industry. A triple play is when a company reports better than expected earnings and revenues and also raises guidance. On Tuesday after the close, Nordstrom (JWN) reported EPS 19 cents above estimates and revenues of $3.657 billion compared to estimates of $3.329 billion. In spite of those strong results, the stock is not only down but it has also erased all of the gains of the past week dropping 16.5% as of this writing in today’s session. The leaves the stock right around its lows from the end of last month which are also at a similar level to the consolidation that took place at the end of last year.

Meanwhile, another retailer, Dick’s Sporting Goods (DKS), is seeing the opposite reaction. The stock is up 15% today after reporting EPS of $5.08 ($2.82 expected) and sales that were $440 million above forecasts. While both companies reported triple plays, those inverse reactions are also resemblant of the longer-term trends in the stocks heading into the reports. Since the start of the year, JWN has been making a series of lower lows and lower highs while DKS has been in a steady uptrend.

As for where the reactions stand relative to each stock’s respective history, JWN is on pace for its worst one-day reaction to any quarter since at least 2001 surpassing the 15% drop from its report in November 2015.

The stock price reaction for DKS is not at a record, but it is historic in its own right. The move today is similar to that of last August when it surged 15.68% on earnings, although that quarter didn’t qualify as a triple play since the company didn’t raise guidance. As such, the stock is on pace for its sixth (or fifth if it closes more than 15.68% higher) largest earnings move on record.

Adding to the irony of today’s reactions, historically Q2 has actually been the strongest quarter for stock price reactions to earnings for Nordstrom. On average, the stock has historically risen 2.26% the day after reporting Q2 results with a positive return 68.4% of the time.

Turning to the retail sector more broadly, the SPDR S&P Retail ETF (XRT) is higher by 15 bps today as the ETF hovers at the high end of the past several month’s range. Given it is an equal-weight ETF, the inverse and volatile moves in JWN and DKS are essentially canceling one another out. Click here to view Bespoke’s premium membership options.

Richmond Adds to Regional Manufacturing Pain

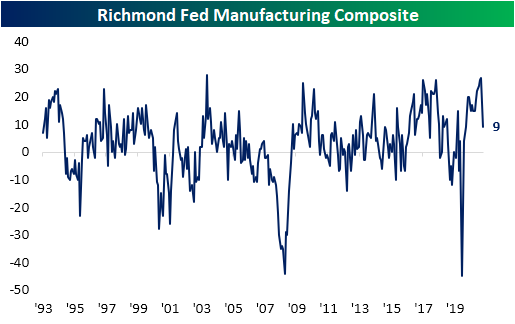

Last week’s releases of the Philly and New York Fed manufacturing surveys showed broad slowdowns in activity, and today’s release of the Richmond Fed’s reading only reaffirmed those findings. The headline number went from a near-record high of 27 in July down 18 points to 9 in August. That is the lowest reading since last July. While that still indicates the region’s manufacturing economy is continuing to grow at a historically healthy clip, the massive decline month over month points to a historic slowdown. In fact, the 18 point decline was the third largest one-month drop on record behind 22 and 49 point declines in February and April of last year, respectively.

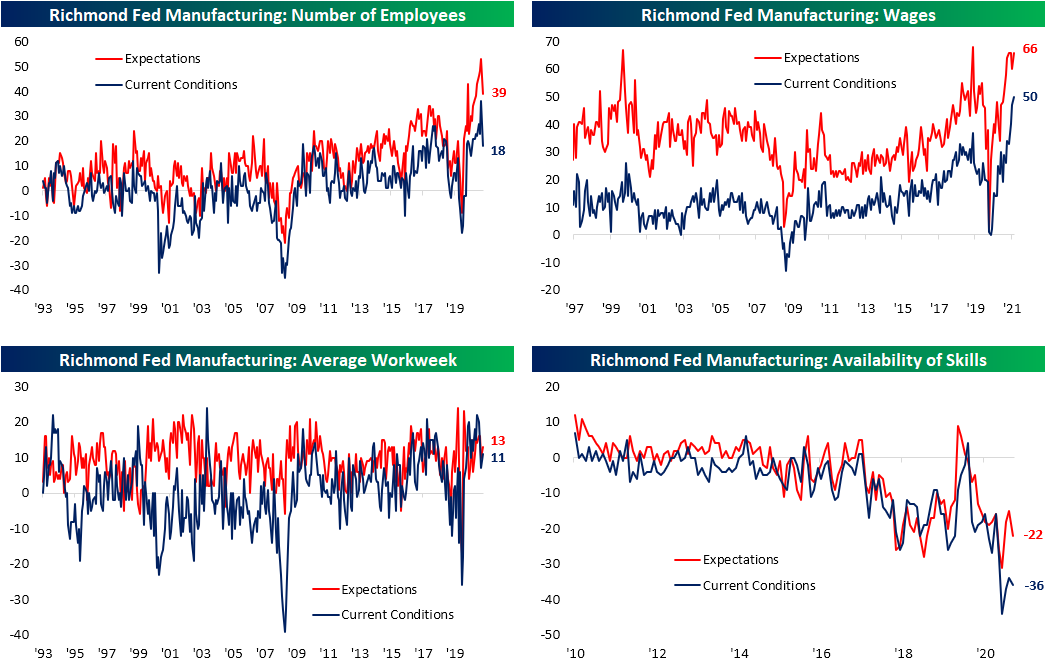

Given the headline number dropped by such a large degree, many of the sub-indices of the report similarly saw declines that rank in the bottom few percentiles of each one’s respective history of month over month changes. Just like the composite reading, if there is a silver lining to be had, most indices are again coming off of near-record levels meaning those large declines only leave them in the middle of their historical ranges at worst as is the case for New Orders and Shipments. Additionally, current readings mostly remain positive indicating that there is still growth across components, but at a more modest pace. The only negative indices are Local Business Conditions, the two indices covering inventories, and Availability of Skills. While some good can be reasoned with negative readings in inventories and availability of skills—for instance, those negative readings can mean firms will need to increase production with strong demand and there is a tight labor market—the drop in local business conditions is more concerning and likely a result of rising COVID cases.

As previously noted, the indices for New Orders and Shipments remain at solid levels consistent with growth in spite of the massive declines month over month. As such, Order Backlogs remain fairly elevated in the 88th percentile. While the growth of backlogs slowed dramatically alongside new orders, supply chains continue to look abnormal. Even though the index for Vendor Lead Times has fallen four points from the record high set back in May, the current reading remains well above any historical precedent.

Given lead times are long and backlogs are still elevated, inventories are also historically low. That is the case for both raw and finished goods. Each of these indices remains negative in the bottom 1% of all readings, but they did see sizable bounces in August. In other words, the region’s firms continue to report that they are drawing upon inventories at a historic rate while vendor lead times are likely not allowing those inventories to be replenished at a more desirable rate.

Prices paid finally got some relief, albeit it was not much. Prices paid rose at a 11.05% annualized pace versus a record high of 11.16% in July. Conversely, Prices Received continue to make parabolic moves rising 9.25% annualized.

Not only are prices paid and received near/at record highs, but wages also set the record bar even high. While wages are rising, actual hiring saw a substantial pullback from a record high as more firms reported a lack of workers with necessary skills. Click here to view Bespoke’s premium membership options.

Nasdaq Crosses Another 1,000 Point Threshold

It won’t be official until the close, but with the Nasdaq crossing 15,000 for the first time today, it’s on pace to cross its third 1,000 point threshold this year and the sixth since the pandemic began in early 2020. The table below lists each 1,000 point threshold that the Nasdaq has crossed over time along with the first day that it crossed that threshold, the number of days since the prior cross, what percentage that 1,000 point consists of relative to the prior threshold, and then how many upside and downside crosses the Nasdaq has had around that level on a closing basis.

Of all the 1,000 point thresholds the Nasdaq has crossed over time, the only one that it never traded back below after crossing it was 6,000 back in April 2017. Besides 1,000, that was also the 1,000 point threshold that took the longest to cross above. After first crossing 5,000 back in March 2000, it took 6,256 days for the Nasdaq to top 6,000. Since then, though, the Nasdaq has been making quick work of 1,000 point thresholds. With the exception of the 486-day gap between 8K and 9K, every other 1,000-point threshold since 6,000 has taken less than a year to cross. Even in the midst of a global pandemic, it took the Nasdaq less than six months to get from 9,000 to 10,000.

The long-term chart of the Nasdaq below includes red dots to show each time the Nasdaq first crossed a 1,000 point threshold along with the number of days for each one.

Looking at the chart above may give you a feeling of lightheadedness given the seemingly parabolic nature of the last few years. An important thing to keep in mind, though, is that as a percentage of the index’s price level, every 1,000 point threshold represents a smaller move in percentage terms. While the move from 9K to 10K represented a move of over 11%, the move from 14K to 15K represents only a little more than 7%. Looking at this chart on a log scale where each label on the y-axis represents a doubling of the index shows how modest the recent 1,000 point thresholds have been relative to earlier ones. Think about it this way, in the less than two years between when the Nasdaq first crossed 2K to when it crossed 5K for the first time (four different 1,000 point thresholds), it rallied 150%. Over the last four years, though, the Nasdaq has crossed 10 different 1,000-point thresholds, but the gain has also only been 150%. Click here to view Bespoke’s premium membership options.

Moving Averages By Sector and Market Cap

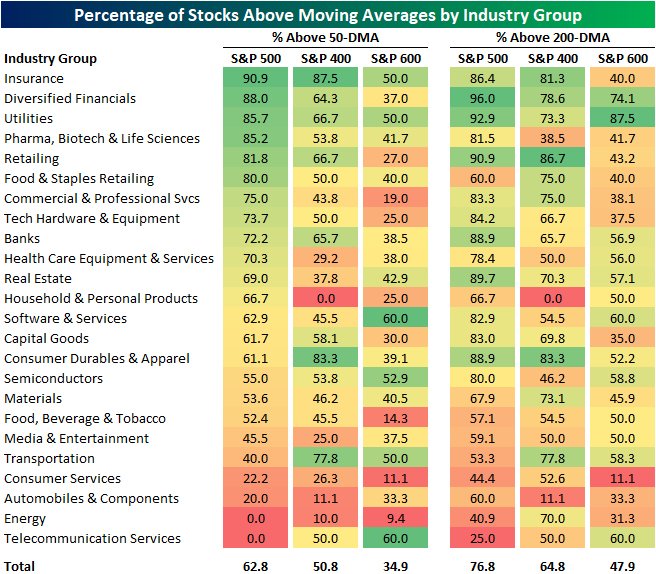

On Friday, we highlighted how a growing number of stocks were falling below their 200 and 50-DMAs recently, but there was a noticeable difference between those readings within large, mid, and small caps. Taking a more granular look, in the table below we show the percentage of stocks currently above their moving averages for each market cap bracket—large- (S&P 500), mid- (S&P 400), and small-caps (S&P 600)—by industry group.

For the most part, each industry group shows the same dynamic in which large caps generally have a stronger reading in the share of stocks trading above their moving averages, but there are a few industries where that is not necessarily the case. For example, mid-caps actually have the strongest readings for industries like Consumer Services and Energy, and Telecommunication Services has the strongest readings for small caps.

As for which industry groups currently have the healthiest readings in the number of stocks above their moving averages, Insurance tops the chart with around 90% of S&P 500 and 400 stocks in the industry above their 50-days. Of course, for small caps, there is a steep drop off though. On the other hand, Diversified Financials and Utilities also have some of the strongest readings in the number of stocks above their moving averages, and that is especially the case with regards to their longer-term 200-DMAs. Click here to view Bespoke’s premium membership options.

Ditching the Friendly Skies

From the start of the year through August 1st, air passenger traffic in the US experienced a massive rebound with the seven-day average passenger throughput in the US more than doubling from just over a million to 2.082 million. What was notable about that August 1st level was that it was pretty close to average throughput levels seen in late Summer/early Fall of 2019 before the pandemic ground things to a halt in early 2020.

August has been unfriendly to the skies, though, and ever since that peak reading on 8/1, passenger traffic has been drifting lower. The Delta variant and the accompanying surge in cases has no doubt had an impact on air passenger traffic, but seasonality has likely been a contributing factor as well. While we don’t have passenger traffic levels prior to August 2019, it only makes sense that as schools start to go back into session and the Summer vacation season comes to a close, Americans are going to be travelling less for vacation.

What’s been interesting about the recent fall-off in air passenger traffic levels has been how steady but modest the declines have been. Starting with the steady aspect, the chart below shows the number of consecutive days that air passenger traffic has declined on a week/week basis. Sunday marked the 21st straight day that passenger traffic declined on a w/w basis, making it the longest streak of the pandemic behind the 18 trading day streak ending right around the election last year.

While the declines in passenger traffic have been steady, the magnitude has been modest. The chart below shows the w/w change in passenger traffic over the last two years, and the declines of the last three weeks have been notably modest. During the current three-week decline, the maximum w/w decline has never reached double-digit percentages. In fact, the last time air passenger traffic was down over 10% on a w/w basis was seven weeks ago on July 4th. One has to think that if Delta variant concerns were really having a major impact on air travel, the drop-off in air traffic would have been more abrupt, similar to what occurred in the early stages of the pandemic. Click here to view Bespoke’s premium membership options.

Bespoke’s Brunch Reads: 8/22/21

US Dollar Breaks Out

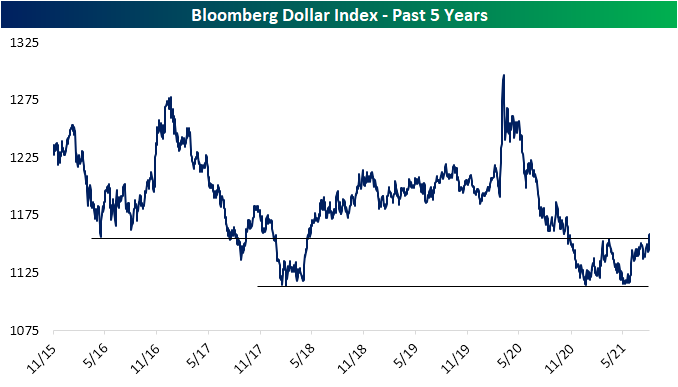

After roughly two months of declines, at the end of May the US dollar (proxied by Bloomberg’s dollar index) found support around the lows from the first week of the year. Since then, the dollar has rallied 4.13%, moving back above its moving averages in the process which have also acted as support ever since. This week alone the dollar has gained 1.4%, and that upward move brings the dollar to the highest levels since early November and the early spring highs when the index stopped short of its 200-DMA.

Taking a step back to look at the past five years, those lows that were reached earlier this spring and at the start of the year can actually be traced all the way back to early 2018 lows. Similarly, the recent highs that were taken out this week are around the same levels as the early 2016 lows. With the dollar now having broken out, it is no longer at the low end of that five-year range. Click here to view Bespoke’s premium membership options.

Fewer Stocks Above Moving Averages

At the moment, of the S&P indices based on market cap, only the S&P 500 is currently above its 50-DMA. Meanwhile, the S&P Mid-Cap 400 is trying to move back above and the small-cap S&P 600 is around 3.5% below its 50-day and moving lower. As for the individual stocks of these indices, it is more or less the same story. The S&P 500 has the strongest percentage of stocks above their 50-DMAs at 56.44%. That is down though from a high of 68.91% at the end of last week. Mid and small caps are even weaker with only 36.5% of the S&P 400 above and less than 30% of the S&P 600 above. While this week saw legs lower in the percentage of stocks above their 50-DMAs for each of these indices, we would also note that recent readings are also well below very strong levels that had been observed from late last year through this past spring.

The same goes for the percentage of stocks above their 200-DMAs. For each of these market cap indices, readings around 90% were commonplace for most of the past year, that is, until the past few months and more specifically the past week. Roughly three-quarters of S&P 500 stocks closed above their 200-DMAs yesterday which is the lowest level since early November. Again, that also applies to mid and small caps which have even smaller shares of stocks above their 200-day moving averages at 65.99% and 60.17%, respectively. Click here to view Bespoke’s premium membership options.

One of the Best Weeks of the Year for Claims

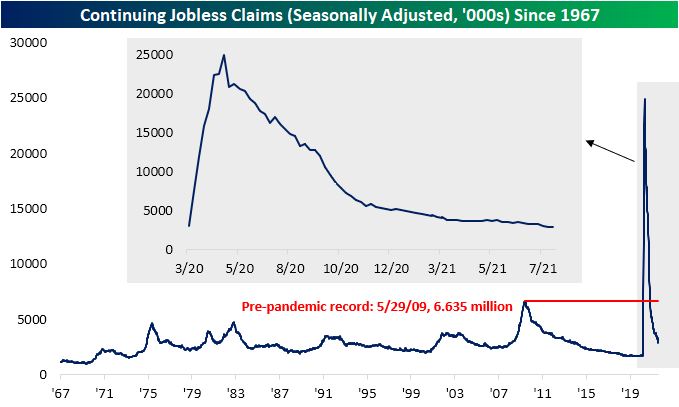

Initial jobless claims hit another pandemic low this week dropping to 348K from last week’s 2K upwardly revised reading of 377K. That was also 16K below expectations and the first better than expected print in six weeks. While recent releases have disappointed relative to forecasts, this week did mark the fourth week in a row that claims have dropped. That is the longest stretch of consecutive declines since a six-week streak ending on June 4th.

On a non-seasonally adjusted basis, initial claims fell to 308.57K which is again the lowest level since the start of the pandemic. Meanwhile, pandemic unemployment assistance claims ticked up to 109.38K from 103.85K the previous week. The main state driving that increase was Ohio which saw claims more than double. Maryland, Oregon, and California were the other states to have seen the biggest increase in PUA claims. Those increases also come even as the program is slated to end in just two weeks on September 4th.

As for the decline in claims for unadjusted regular state programs, we would caution against reading too deep into the number on account of strong seasonal tailwinds. As shown below, the current week of the year (33rd) is tied at second for the week of the year that most often sees claims decline. As shown in the second chart below, there has only been one year, last year, in which claims were higher week over week in the 33rd week of the year.

Seasonally adjusted continuing claims missed expectations by 20K this week, but at 2.82 million, this week’s reading still marked a third consecutive decline. As such, claims are still at the lowest level of the pandemic and are closing in on coming within one million from the March 2020 levels.

While the most recent reading on continuing claims was lower, purely looking at regular state claims does not show the full picture. Including all other programs creates some additional lag meaning the most recent data is through the last week of July. Through that week, total claims fell below 12 million for the first time of the pandemic, totaling 11.76 million. Driving that decline were 79.9K and 66.08K declines in regular state and PEUC programs. The biggest decline came from the extended benefits program, though. That program saw claims get more than cut in half after a significant uptick the previous week. Throughout the month of July, claim counts for the extended benefits program were particularly volatile. They started off the month with a sub-100K reading of 98.4K, then rose all the way up to 343.5K, dropped to 239.6K, then rose again to 398.8K before falling back down to 177.9K in the week of July 30th. Click here to view Bespoke’s premium membership options.

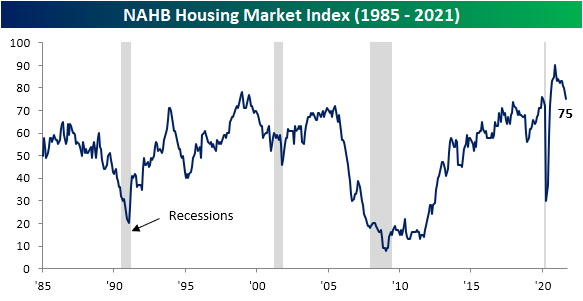

Homebuilder Sentiment: The Next Big Miss

Prior to the pandemic, the NAHB’s record monthly reading on homebuilder sentiment was back in December 1998 when the index hit 78. Last November, the sentiment bar was set even higher when the index reached 90. Since then, though, two-thirds of the releases have declined month over month. The most recent release saw the index drop five more points to 75, marking the first time in a year that homebuilder sentiment came in below the pre-pandemic record high. Additionally, August’s 5-point drop is the largest one-month decline since last April when the index collapsed by a record 42 points at the onset of the pandemic. It is also tied with a dozen other months for the seventh-largest month-over-month decline in the history of the index going back to 1985.

While the release indicates worsening, but still historically strong, sentiment among homebuilders, it can be added to the growing list of economic indicators that have been coming in well below expectations. As we noted in last week’s Bespoke Report, Citi Surprise indices measuring how economic data comes in relative to estimates tipped into negative territory last week. That was as the University of Michigan’s Consumer Sentiment survey saw the biggest miss relative to expectations on record. Today’s reading on homebuilders was not far off those results. The five-point miss relative to expectations was the largest since last April and is tied with 4 other months (April and May 2006, November 2008, and October 2014) for the six largest miss going back to at least 2003.

Driving the decline in the headline reading were five-point drops in present sales and traffic. Even though there has been deterioration in those readings on current conditions, future sales have held up better going unchanged at 81.

Looking across regions, the ones that have seen COVID cases rising the most of late, namely in the South and Midwest, generally saw sharp drops in homebuilder sentiment in August although those are in the context of longer-term declines. The Northeast and the West, on the other hand, are off of their peaks but each region did show an uptick in sentiment for August. Click here to view Bespoke’s premium membership options.