Gas Prices High Following The Seasonal Pattern Into Labor Day

If you’re planning to drive anywhere this weekend, you may need a wheelbarrow to carry the cash you’re going to need to fill up. According to AAA, based on the national average, a gallon of gas will set you back $3.184. Around the country, though, prices vary widely. In California, where prices are the highest (even higher than Hawaii), the average price of a gallon of gas is $4.40 ($4.71) if you fill up with premium). Mississippi wins the title of lowest average price at just $2.79 per gallon and is one of just 15 states where you can still get a gallon of gas for less than $3. While prices may be high heading into Labor Day weekend, the fact that it still costs less than 13 cents to drive a mile isn’t all that bad (based on the average fuel efficiency of 24.9 miles per gallon), and it’s much cheaper than most other areas of the world.

That being said, prices at the pump are still high whether you look at things from an absolute or relative basis. For the current day of the year, the national average of $3.18 is higher than at this point in any other year since 2014, and forty cents above the median level for this time of year. On a YTD basis, going back to 2005, this year’s increase is the third largest of any other years besides 2009 and 2005. At 41.3%, prices are up by more than double their average YTD increase through 9/3.

On a y/y basis, average gas prices are also up over 40%. For just about any other time that rate of increase would be extreme, but given the y/y increase just hit a record high of 63.98% in May it doesn’t seem that bad.

Now that we’ve established that gas prices are high, it is worth pointing out that despite the high levels, prices have loosely followed the seasonal trend. The chart below compares gas prices this year to a composite of the average YTD increase for every day of the year going back to 2005. Through the end of May, prices were already up 35% YTD, and in the three months since then, prices have still increased, but at a much slower pace. Historically, prices tend to rise through Memorial Day and then level off through Labor Day before steadily declining to close out the year. Like the annual composite, prices dipped into the end of August this year and have spiked into Labor Day weekend. With respect to this year, increases have been exaggerated due to Hurricane Ida, but if history is any guide, drivers should start to see some relief in the final four months of the year. Click here to view Bespoke’s premium membership options.

And Then There Was One…Chicago

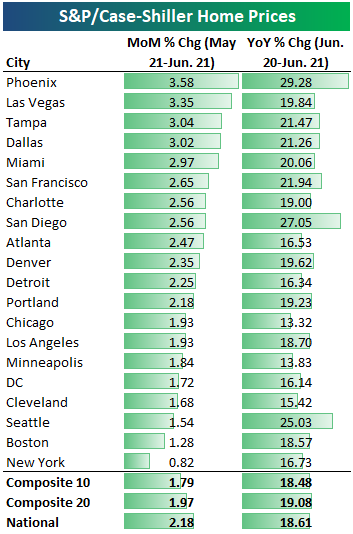

The monthly S&P/Case-Shiller home price numbers for June were published earlier this week and showed a continued surge in home prices. As shown below, 12 of 20 cities tracked saw month-over-month gains of more than 2%, while Phoenix, Las Vegas, Tampa, and Dallas saw MoM gains of 3%+. New York was the only city that failed to see a MoM gain of more than 1%.

On an annual basis, the composite indices were up ~19%, while Phoenix was up the most at +29.3%. San Diego ranked 2nd at +27.05% followed by Seattle in third at +25.03%.

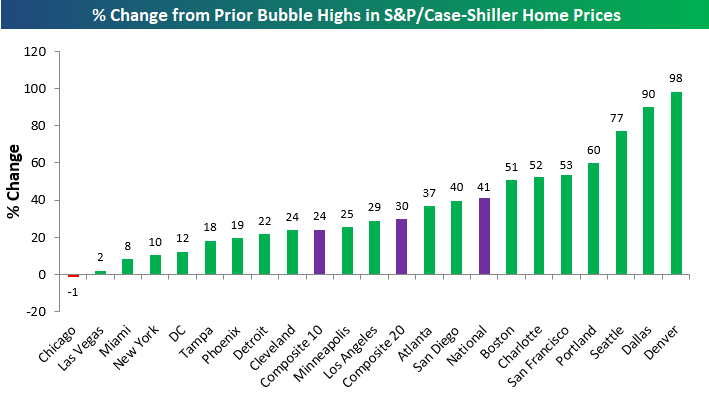

We’ve been waiting to see how long it would take for all of the cities tracked by S&P/Case-Shiller to eclipse the highs in home prices that were made during the housing bubble of the mid-2000s. While many cities like Denver and Dallas passed their prior all-time highs as long ago as 2013, some cities like New York, Miami, Las Vegas, and DC didn’t make new all-time highs until recently after the pandemic hit.

Below is a look at where home prices currently stand relative to their prior housing bubble highs. Every single city except one — Chicago — has now eclipsed its mid-2000s highs. Las Vegas was the most recent to make a new all-time high in June. Prices in Vegas are now 2% above where they were at their peaks in late 2006. And in 2006, prices had gotten pretty ridiculous in Vegas!

While Chicago is the only city tracked by S&P/Case-Shiller where prices are still in the red versus prior highs, they’re now only 1% away from a new high, and we’ll probably see that new high when the next Case-Shiller report is released later this month.

Below are S&P/Case-Shiller home price index charts for all of the cities tracked along with the three composite indices. Chicago is the only city not currently trading at an all-time high.

Finally, the chart below shows how much home prices have risen since COVID hit. Most cities have seen home prices rise between 19-23%, but Phoenix, San Diego, and Seattle have been standouts with gains of more than 30%. On the lower end of the spectrum, New York and Chicago have seen the smallest gains at 17%. Click here to view Bespoke’s premium membership options.

S&P/Case-Shiller sources: FRED website or here at S&P Global.

Netflix (NFLX) Unbuffers

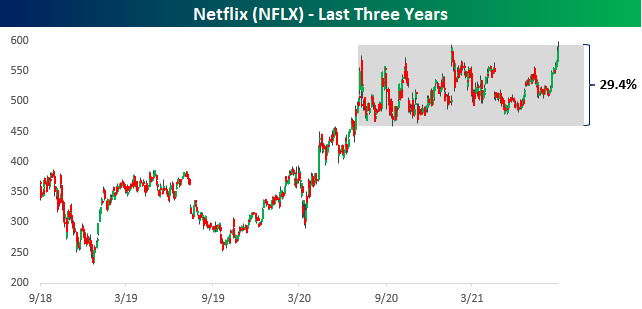

Is there anything more annoying than when you sit down to watch a show or movie on Netflix (NFLX) and you get the dreaded buffering symbol where the show pauses until the connection is strong enough to load? A lot of people around the country from the coast of Louisianna right up north through the coast of Maine are likely experiencing that buffering a bit more frequently as Hurricane Ida disrupted power and internet connections. Investors in Netflix (NFLX) stock have been no strangers to the buffering phenomenon recently as the stock has been stuck in a trading range seemingly as long as the movie “The Never Ending Story.” From July of last year through Wednesday, NFLX traded in a range within a high of $593.29 to a low of $458.60 for a spread of 29.4%. Yesterday, though, NFLX finally broke out of that range trading as high as $598.76.

29.4% may not sound like too small of a range, especially for a stock with a market cap of over $250 billion. For a stock like NFLX, though, 29.4% was the narrowest one-year range the stock had ever traded within. The chart below shows the historical one-year trading range for NFLX since its IPO in 2002. Prior to this year, NFLX had never traded within a range of 50% or less over a rolling one-year period, but as of this week, the range had narrowed to nearly half that. Just like with the movies, though, usually when it buffers once, it runs through a number of fits and starts before it starts running smoothly again. Similarly, even though NFLX started to move yesterday, today it has drifted right back into the range it was trading in all this time. Click here to view Bespoke’s premium membership options.

Gun Background Checks Return to More Normal Range

In a sign that overall levels of anxiety across the United States may be receding, the pace of background checks for the purchase of firearms has come crashing down from record-high levels. From a peak of 4.69 million in March, background checks fell to 2.72 million in August. That level is still the second-highest total for the month of August on record, but after a steady surge with the onset of COVID and the riots across the country last summer, there has been a sharp decline in total checks over the last few months.

On a y/y basis, background checks have really swung from one extreme to the other. From last July to this June, total background checks experienced a 100 percentage point peak to trough swing falling from 79.2% down to a decline of 22.3%. Over the last two months, the rate of decline has gotten less bad, but it is still at negative 12.8%.

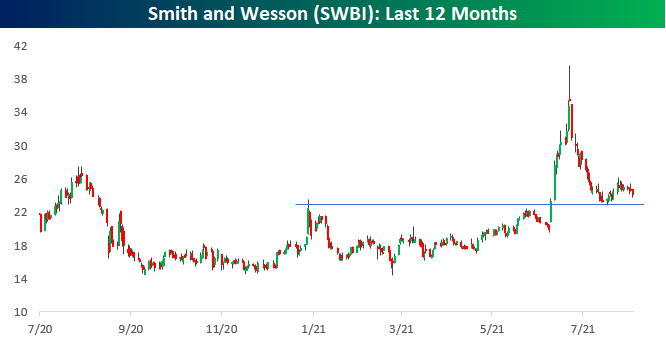

You might surmise that such a large decline in background checks wouldn’t be good for the stocks of gun manufacturers, and you’d be partly right. Below we show one-year charts of Sturm Ruger (RGR) and Smith and Wesson (SWBI). While both stocks are down significantly from their 52-week highs, they’re also far from 52-week lows. In the case of RGR, stock has pulled back from its 52-week high back in July, but for the time being it has generally held above the top end of its prior trading range from earlier this year. In the case of SWBI, the stock really surged back in late June following a strong earnings report but has been quick to give back all of its gains. Despite the large drop, though, it is still trading at higher levels now than it was in the first quarter of the year when levels of background checks were at record highs. Click here to view Bespoke’s premium membership options.

Bullish Sentiment Finally Rises in Back to Back Weeks

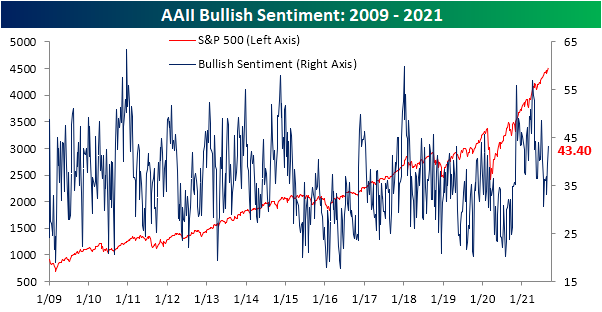

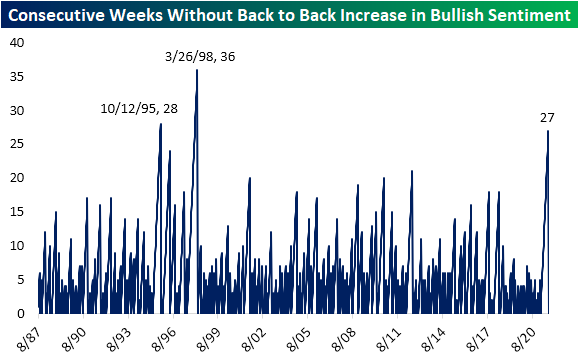

The S&P 500 has continued to press higher resulting in a coincident rise in sentiment. The AAII‘s weekly reading on bullish sentiment rose back above 40% for the first time since the week of July 8th. While 43.4% is not a particularly elevated reading on sentiment (72nd percentile of all periods), the move higher is particularly notable in that it was the first time bullish sentiment has risen in back-to-back weeks since February. That is especially surprising given the fact that bullish sentiment was very elevated at points between now and then, such as back in the spring when it eclipsed 50%. That is also a historically long stretch of time without back-to-back increases in bullish sentiment. As shown in the second chart below, at just over half of a year-long, the only two similar streaks on record were in 1995 and from 1997 to 1998.

Negative sentiment has broadly picked up over the past couple of months. In the AAII survey, bearish sentiment was slightly higher at 33.3% versus 33% last week. While below the peak from only a couple of weeks ago, that is still elevated versus readings from earlier this year.

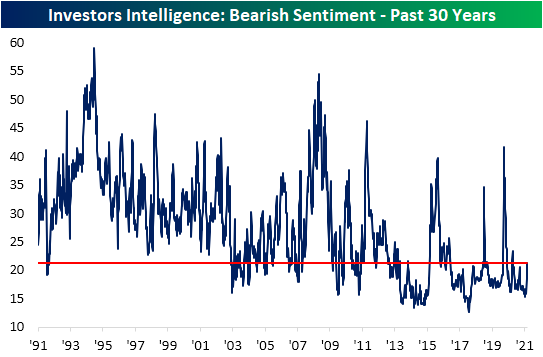

Similarly, the Investors Intelligence survey of newsletter writers has also seen bearish sentiment on the rise throughout the summer. This week, it topped 20% for the first time since March 10th. At 21.3%, bearish sentiment in this survey is at the highest level since last October. With that said, the current reading is also well below the 20 year average of 24.19%.

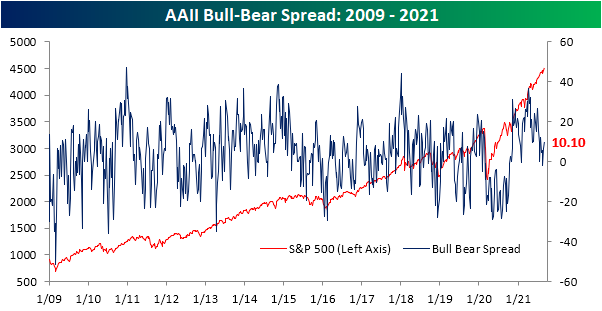

As a result of the larger gains to bullish versus bearish sentiment, optimism remains the favored response in the AAII survey. The bull-bear spread rose back into positive double digits this week for the first time since the last week of July.

Given both bullish and bearish sentiments were higher, neutral sentiment has continued to unwind. That reading fell 4.3 percentage points this week to a new low of 23.2%. That was the fourth decline in the past five weeks as neutral sentiment came in at the lowest level since mid-April. Click here to view Bespoke’s premium membership options.

End of Pandemic Programs Loom

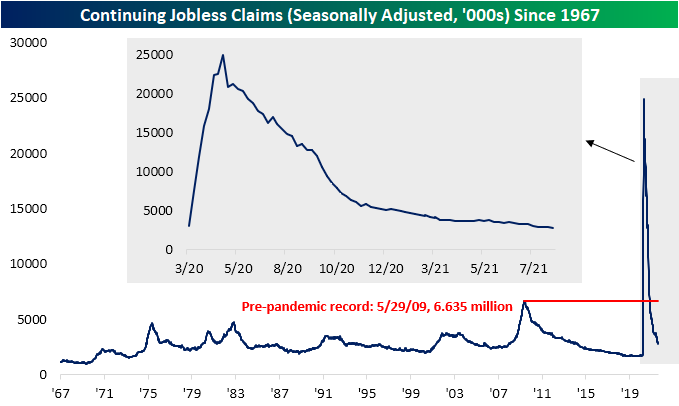

Ahead of tomorrow’s nonfarm payrolls report, this week’s initial jobless claims release came in at 340K; 5K below expectations. That was a 14K decrease from last week’s level which was revised higher by 1K. Additionally, this week’s decline entirely erased the move higher last week. With yet another drop in jobless claims, the indicator has made another pandemic low and is within 84K of the last sub-1 million print (256K on March 13, 2020) prior to the parabolic spike last spring.

As for on an unadjusted basis, claims fell further below 300K to 287.8K this week. This time of year typically sees seasonal tailwinds for claims, but this week did mark the sixth consecutive decline. That made for another pandemic low as claims by this measure are just 35.9K away from the March 2020 levels. Granted, the seasonal strength from the past few weeks is likely to wane until the end of the year. As shown in the second chart below, September (approximately week numbers 37 through 40) historically marks the time of year that week over week increases in the unadjusted number become more frequent, and as a result, claims begin to consistently tick higher. While seasonal headwinds are on the way for regular state claims, overall claim counts will begin to see drops due to the expiration of pandemic era programs. This includes the additional $300 per week payments and programs like PUA and PEUC. In the most recent week, PUA claims came in above 100K for a fourth week in a row.

As for continuing claims, the headline number for regular state programs remains strong with claims hitting another pandemic low of 2.748 million, down from 2.908 million last week. That 160K decline was the largest since a 316K decline in the second to last week of July.

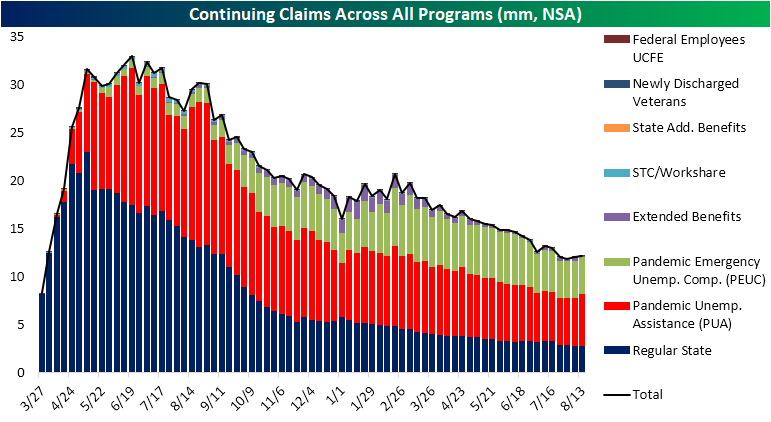

Factoring in all programs adds an additional lag to the data meaning the most recent reading is through the week of August 13th. In that week, total claims rose to 12.2 million from 12.02 million in the prior week. In spite of only having a couple of weeks until the end of the programs, that increase was driven by PUA claims which rose by over 400K and marked the largest one-week increase for the program since April 23rd (420.6K). That brings the total count of pandemic era programs (PUA and PEUC claims) a couple of weeks before their expiration to 9.2 million.

As for the other programs, regular state claims and PEUC claims were little changed at 1.6K higher and 6.04K higher, respectively. Meanwhile, the extended benefits programs saw a significant decline of 237.07K down to 114.4K, although, that program has been particularly volatile over the past several weeks, so we would caution again reading too deep into that move. Click here to view Bespoke’s premium membership options.

India (INDA) Ignites

Looking across the various ETFs tracking the stock markets of the 23 countries tracked in our Global Macro Dashboard, by far the best performer in the month of August was India (INDA) which rallied 8.75%. A large portion of those gains occurred in the final days of the month as well. As shown in the matrix below, over the past five days alone INDA has gained 4.74% which brings it almost 3 standard deviations above its 50-DMA. INDA is also currently at a 52-week high alongside the US (SPY) and Russia (RSX).

INDA is not alone in having become deeply overbought after big moves in recent days. Japan (EWJ), Russia (RSX), Malaysia (EWM), and Mexico (EWW) are also trading over 2 standard deviations above their 50-DMAs. The latter two were also the runners-up in terms of strongest performers in August. In the case of the former two, just last week they were actually in neutral territory as is the case with a number of other country ETFs. No country has seen as dramatic of a move within its trading range than South Africa (EZA), though. One week ago, it was oversold. After rallying 5.79% in the past five days, it has not only taken out its 50-DMA but is now 1.6 standard deviations above it. Looking across the aforementioned countries, and as we mentioned yesterday, one common theme in August was the outperformance of emerging market countries. Tose countries gained an average of 2.21% last month versus a 0.85% gain for developed markets.

Looking at G7 countries, the US has stood out as a notably solid performer. As shown below, the US (SPY) has been in a consistent uptrend over the past year whereas other G7 members have been sideways at best since the spring. With that said, there have been improvements more recently for some countries. The most concrete example is Japan. EWJ has been consolidating over the past few months, but it broke out of its 2021 downtrend this week. Gaining 1.74% today alone, EWJ is at the highest level since early June. France (EWQ) is also having a big day with a 2.2% gain, bringing it right up to the highs from mid-August and early June.

Like France, there are a handful of emerging market countries that have also broken out recently or are nearing a breakout. Mexico (EWW) and Russia (RSX) both took out their highs from the spring and earlier this summer in the past couple of sessions. While it has not put in a new 52-week high just yet, Taiwan (EWT) is likewise attempting to take out prior highs. Meanwhile, we also wanted to highlight the chart of INDA. As previously mentioned, INDA posted big gains over the past month, and as such, the chart is looking quite elevated. Click here to view Bespoke’s premium membership options.

Bespoke’s Consumer Pulse Report – September 2021

Bespoke Market Calendar — September 2021

Please click the image below to view our September 2021 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.

Emerging Markets Leave China Behind

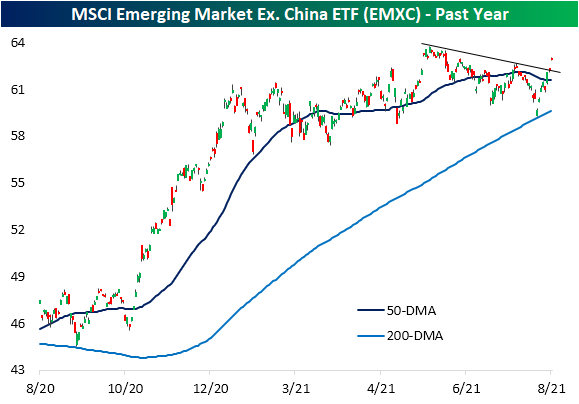

In last night’s Closer, we noted the record underperformance of Chinese equities relative to the US over the past six months. As a result of the weakness in Chinese equities, the MSCI Emerging Market ETF (EEM)—which has roughly a 37% weight in Hong Kong and Chinese stocks—is well off of its highs and has been trending lower over the past several months. Today, EEM is up a healthy 1.37%, but that brings it just short of its 50-DMA which recently fell below its 200-DMA. That is also at similar levels to the lower high from the start of this month.

When factoring out China, emerging markets look much better. Again, the MSCI Emerging Market ETF that excludes China (EMXC) is currently 1.13% below its 52-week high, but the downtrend that has been in place since the early June highs has been on the ropes over the past couple of sessions. Yesterday saw the ETF trade and close right at that downtrend line, but the 1.15% gain today has smashed through it. That leaves EMXC at the highest level since June 15th. The ETF is also at some of the most overbought levels (1.8 standard deviations from its 50-DMA) since then.

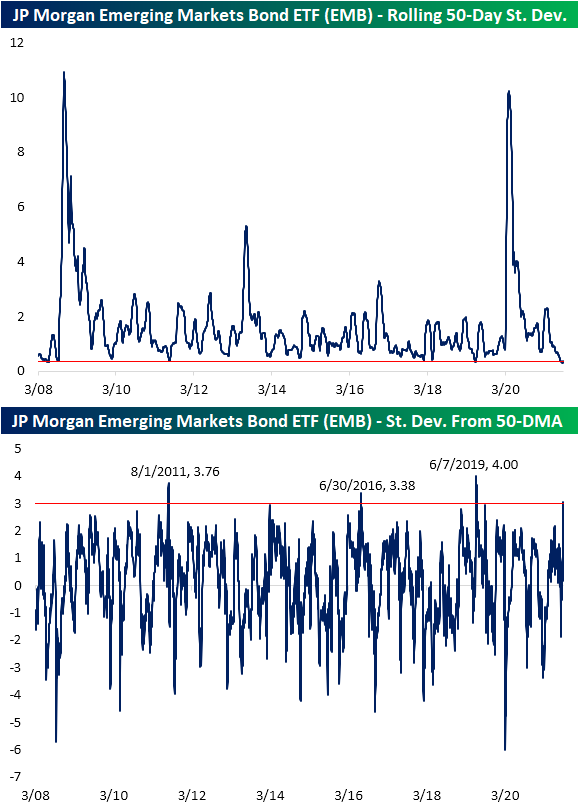

Pivoting over to bonds, looking at the Fixed Income screen of our Trend Analyzer, the best performer over the past five days is also in the EM space. The USD Emerging Markets Bond ETF (EMB) had been mostly flat throughout the summer trending right alongside its sideways 50- and 200-DMAs. Significant gains last Friday and yesterday led EMB to break out of that range as it reaches some of the highest levels since February today.

As previously mentioned, EMB has not ventured far from its 50-DMA recently. In fact, the rolling 50-day standard deviation has been right around some of the lowest levels on record since EMB began trading in 2008. Given that lack of volatility, the rip higher this week has resulted in the ETF moving well beyond the upper end of its narrow trading range. In fact, yesterday the ETF closed over 3 standard deviations above its 50-DMA. That joins only 14 other days where the ETF closed at least 3 standard deviations above its 50-DMA with the most recent of those back in June 2019 when it reached as high as 4 standard deviations above its moving average. Click here to view Bespoke’s premium membership options.