Homebuilder Sentiment Improves as Homebuilder Stocks Breakout

The NAHB released its November reading on homebuilder sentiment this morning. For the third month in a row, sentiment has improved with the index now at a six-month high of 83.

It has now been a full year since the index last hit a record high of 90. While off the peak, the current reading is still extremely strong from a historical perspective in the top 2% of readings. The same goes for the sub-indices. Present sales and traffic were both higher again this month while Future Sales went unchanged. That index has been notably flat over the past few months, stuck at 81 from July through September and now 84 in October and November.

Based on geography, most of the country saw an improvement this month. The only region where sentiment declined was the Northeast (-4). The Northeast is also the only region that is not in the top decile of its historical range after giving up most of the prior month’s gain. The South currently has the strongest reading in the top 1% of readings.

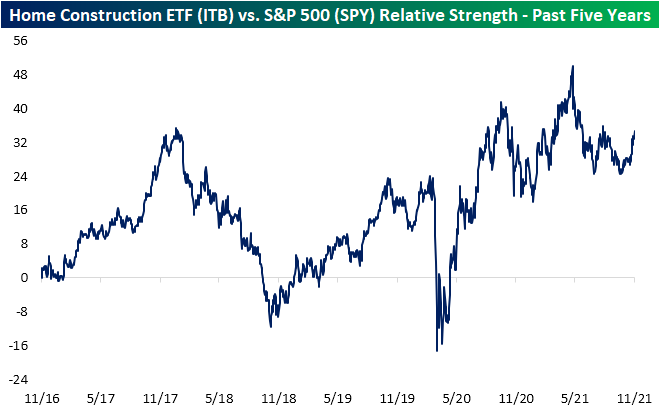

As for homebuilder stocks, the iShares US Home Construction ETF (ITB) is attempting to break out from a six-month period of consolidation. As shown below, ITB is rallying 1.74% today bringing it above the May 10th high closing high but still below the intraday high While near all-time highs, the group is extremely overbought trading 2.5 standard deviations above its 50-DMA following the 18% rally off the early October low when ITB briefly traded below its 200-DMA. With a strong run so far this quarter, only two of the ETF’s 50 holdings are in the red this quarter: Leggett & Platt (LEG) and Lumber Liquidators (LL). The former is down not even one percentage point though.

ITB has also bottomed out and been making a sharp move higher on a relative basis versus the S&P 500 (SPY). After several months of declines, in early October, the relative strength line held up around the same levels as the July lows. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/16/21 – Retail Detail

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If everybody is doing it one way, there’s a good chance you can find your niche by going exactly in the opposite direction.” – Sam Walton

Home Depot (HD) and Walmart (WMT) are on the tape this morning as earnings season winds down. Both companies reported better than expected results on both the top and bottom lines. WMT even raised guidance citing strong results in its eCommerce unit. In reaction to the reports, both stocks are modestly higher with gains of between 1.0% and 1.5%.

Retailers are dominating the earnings headlines this morning and Retail Sales will dominate the economic data as well. There are a number of other reports on the calendar for today (Import Prices, Capacity Utilization, Industrial Production, Business Inventories, and Homebuilder Sentiment), but Retail Sales will kick the day off and likely be the most important release for investors.

Ahead of all the data, US equity futures are flat to modestly higher on the morning, treasury yields are modestly lower, and crude oil is back above $81. The real action this morning has been in the crypto space as most major currencies are down at least 5%. Bitcoin briefly dropped below $59K and tested its 50-day moving average but has rebounded back above $60K since. Factors being cited for the move include the stronger dollar and another round of regulatory crackdowns in China as the government refers to crypto mining as ‘extremely harmful’.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

We reached the mid-point of Q4 yesterday, and it’s hard to find much to complain about if you are a bull. Besides the fact that SPY is already up nearly 9%, four sectors have rallied by double-digit percentages. Looking at these four sectors, though, they aren’t necessarily ones you would look at as typically rallying in unison with each other.

With inflation being the number one concern of investors these days, the fact that Materials and Energy are near the top of the list in terms of performance shouldn’t come as much of a surprise, but the fact that they are accompanied by Consumer Discretionary and Technology is a bit surprising. Consumer Discretionary is a sector that typically underperforms during inflationary periods, but it’s actually the top-performing sector so far this quarter. Similarly, Technology, which is usually associated with growth stocks that should come under pressure when inflation is a concern as future earnings are discounted at a higher rate, has rallied nearly 12%.

Given some of the enormous market caps of some of the largest stocks in the S&P 500, some of the sector performance figures are skewed a bit. Consumer Discretionary is a perfect example. With Tesla’s (TSLA) market cap topping a trillion dollars recently, the stock’s weight in the sector is above 15%, so the fact that it has rallied more than 30% already this quarter (even after dropping 18% in less than two weeks) is a big reason for the sector’s outperformance. Within the technology sector as well, some of the largest stocks in the index have much more reasonable valuations than many other smaller names within the sector and given their dominant positions, they also have attractive earnings profiles.

On the downside, there is none so far this quarter, but the only two sectors that are up less than 5% so far on the quarter are Communication Services (XLC) and Health Care (XLV).

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

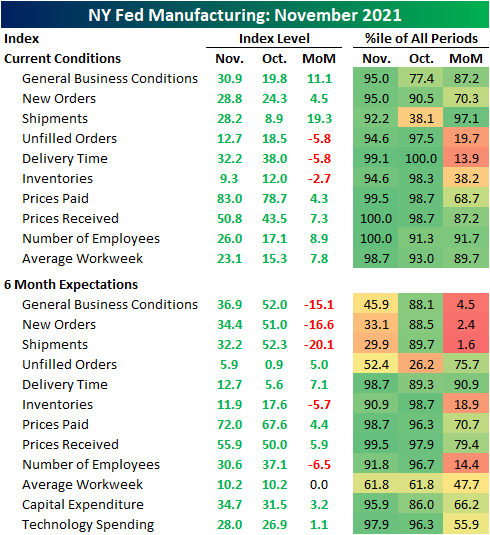

NY Fed Current Conditions and Expectations Split

The New York Fed put out the first regional reading on manufacturing this morning with a big upside surprise. The Empire State Manufacturing Survey jumped from 19.8 to 30.9 in November versus a much smaller expected increase to only 22. As shown below, November’s level is indicative of a historically healthy growth rate for Northeast manufacturing and acceleration relative to October. While growth picked up in November, it remains in the middle of the range of readings from the past several months.

Although it was generally a strong report, one striking element was massive declines in optimism, specifically regarding the six-month expectation indices of General Business Conditions (red line above), New Orders, and Shipments. The month-over-month drop in each of those indices ranks in the bottom 5% of all monthly moves. While that may sound scary, the readings were pretty much outliers relative to the rest of the report. Current condition indices and most other expectations indices remain strong with the vast majority sitting in the upper decile of their historical range; a couple (Prices Received and Number of Employees) even hit record highs.

Current conditions for demand were historically strong and improving in November with New Orders rising 4.5 points to 28.8 while Shipments saw a huge 19.3 point leap to 28.2. That move brought the index from the 38th percentile all the way up to the 92nd. In spite of those improvements, responding firms took a sharply negative turn with regard to outlook. Like the headline index, expectations for new orders, and shipments took sharp turns lower in spite of the improvements in current conditions. The last time that all three of those indices experienced as large of declines simultaneously was back in March 2018. Back then, the catalyst for the big hit to sentiment was a rollercoaster of headlines regarding the trade war with China.

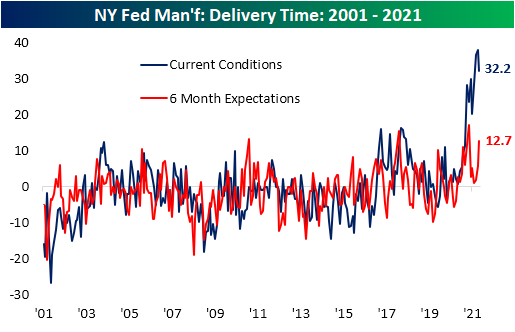

Supply chains remain strained as evident from the extremely elevated reading on Delivery Times. That being said, the index did pivot lower off of a record high in November. That improvement was likely a factor in the big increase in current conditions for shipments. Again though, the outlook is less optimistic with Delivery Time expectations surging back up to one of the highest readings on record. As with current conditions, that could be a part of the reason expectations for shipments coincidentally plummeted.

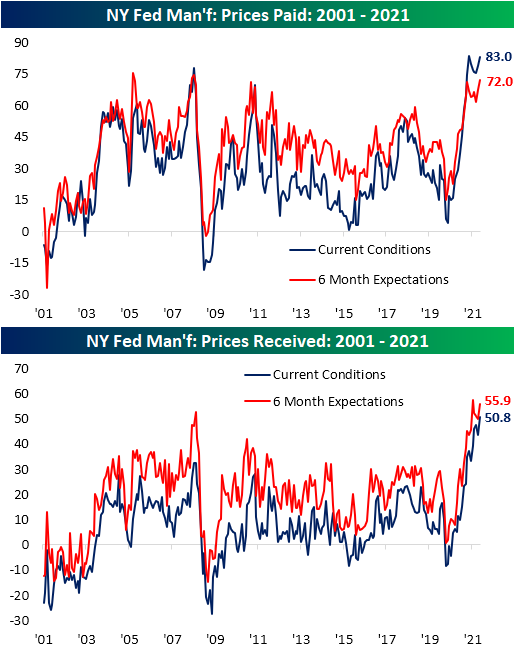

Given longer lead times, prices resumed their rise this month. Prices Paid came in only a half point below May’s record high while expectations rose to the fourth highest reading on record; the highest since July 2008. Prices Received, meanwhile, set a new record high for current conditions and expectations came in at the second-highest level on record behind July’s level.

Another part of the survey that saw big opposing moves in current conditions and expectations concerned employment. Six-month expectations for Number of Employees fell to a new short-term low of 30.6 as the current conditions index set a new record high. Average Workweek also increased and is now slightly below the September high.

While expectations for hiring people may have been on the decline, companies appear to be offsetting that with an increase to other spending. As shown below, both CapEx and Tech Spending were higher this month with the former notching the strongest reading since January 2018. Before that, it was over a decade ago that Capital Expenditures was as elevated as it was this month. Click here to view Bespoke’s premium membership options.

Small and Mid Caps Gain Ground

Equities broadly have been in rally mode so far this quarter, but in the month of November smaller market caps have generally outperformed. Month to date, the small-cap S&P 600 ETF (IJR) has gained 5.88% as of this morning while the mid-cap S&P 400 ETF (IJH) has risen 4.21%. Large caps as proxied by the S&P 500 (SPY), meanwhile, are up less than 2% MTD. While there is plenty of time left in the month for things to change, the spread between the month-to-date performance of small and mid-caps versus large caps is on pace to be on the wider side of all months of the past twenty years. As shown in the charts below, IJR is currently outperforming SPY MTD by 4.05 percentage points, and that reading is 2.37 percentage points for IJH versus SPY. Those rank in the 91st and 86th percentiles, respectively, of all months of the past twenty years. That also marks the first month with significant outperformance of smaller market caps relative to large caps since the stretch of large-cap underperformance that ran from the fall of last year through this past February. Prior to that, you would have to go back to March 2018 to find the last time that small and mid-caps both outperformed large caps by as much as they are this month. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/15/21 – Earnings Season: The Final Stretch

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The challenge of the retail business is the human condition.” – Howard Schultz

We’re heading into the final days of earnings season this week, and so far the results have been very positive. Whether earnings season ends on a positive note or not will depend on how the market reacts to a slew of high profile earnings reports from the retail sector – most notably Walmart (WMT) and Home Depot (HD) on Tuesday, Lowe’s (LOW) and Target (TGT) on Wednesday, and then Kohl’s (KSS) and Macy’s (M) on Thursday. Consumers still appear to be in a strong financial position but as last week’s sentiment report from the University of Michigan showed, they aren’t feeling particularly optimistic. And as the quote above implies, consumer sentiment is the key to retail sales.

Futures are higher to kick off the week, and it’s a slow day for economic data with Empire Manufacturing the only report on the calendar, and it came in better than expected. The 10-year yield is modestly lower this morning and WTI is down over $1 and back below $80 per barrel.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Speaking of oil, the recent pattern for WTI has been interesting. With the commodity having basically doubled over the last year, it’s hard to say anything negative about its performance, but we would note that the most recent peak in late October coincided right with its trendline of higher highs since the beginning of the year. Since that peak, though, the recent pullback has seen WTI break its short-term uptrend line from the most recent low in August. As it attempted to bounce back in mid-November, the rally stalled out right at that former uptrend line. The key level to watch going forward will be right around $78.50 which would represent a lower low. As long as that level holds in the short-term energy bulls probably don’t have a lot to worry about, but it’s a level that should be kept on the radar.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 11/14/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

The Future of Labor

Trapped in the Metaverse: Here’s What 24 Hours Feels Like by Joanna Stern (WSJ)

This video gives you an idea of what the world of working inside the offering of Meta (nee Facebook) might be like. [Link; paywall]

Six questions that could shape the future of the U.S. labor market by Jonnelle Marte (Reuters)

The COVID pandemic has driven a big shift in how the US labor market works. Here are some indicators and concepts to keep an eye on as the economy continues to evolve away from the pandemic recession. [Link]

DIY

How To Make A CPU – A Simple Picture Based Explanation (Robert Elder)

Ever curious where the chips which are fowling up so much of the global economy with their shortages come from? Here’s a step-by-step walk-through of how to make them from rock to final installation. Best of luck actually doing this yourself! [Link]

I Have Achieved a Glorious Victory Against the Music Industry and Twitter by Mark Joseph Stern (Slate)

While DMCA takedowns create all sorts of nuisance for social media users, there is a way to fight back; the author demonstrates the successful way to prove a point about fair use and copywrite laws. [Link]

Petty Crime

Scammer Convinced Instagram That Its Top Executive Was Dead by Joseph Cox (Vice)

In an illustration of how absurd the current management of social media networks has gotten, a scammer successfully managed to convince Instagram that their boss had died using a fake obituary. [Link]

‘It’s a great big mess’: Catalytic converter thefts rampant in the Bay Area by Michelle Roberson (SFGate)

An insurer reports thousands of catalytic converters (which prevent smog) are being stolen from California automobiles, with thefts more than doubling over the past year. [Link]

Conspicuous Consumption

The Mystery of the $2,000 Ikea Shopping Bag by Silvia Bellezza and Jonah Berger (Harvard Business Review)

Luxury brand Balenciaga offers a $2000 version of the ubiquitous reusable bags offered by Ikea, offering a fascinating insight into the psychology and branding of super high-priced goods. [Link]

The open secret to looking like a superhero by Alex Abad-Santos (Vox)

An investigation into the rampant use of steroids by men in Hollywood, which has become part of the cost of starring in shows or movies; the increase in steroid use also speaks to broader trends in mounting social pressures on men to conform to a specific body image. [Link]

Supply Chains

Bottlenecks: causes and macroeconomic implications by Daniel Rees and Phurichai Rungcharoenkitkul (BIS)

A helpful analysis about the macroeconomic effects of the pandemic and resulting bottlenecks in supply chains. [Link; 9 page PDF]

Thanksgiving Dinner Staples Are Low in Stock Thanks to Supply-Chain Issues by Stephanie Stamm (WSJ)

Turkeys, pies, and other Thanksgiving staples are hard to find on grocery store shelves this year as supply chain disruptions ripple through the economy. [Link; paywall]

Ancient Cooking

Culinary Detectives Try to Recover the Formula for a Deliciously Fishy Roman Condiment by Taras Grescoe (Smithsonian)

Romans were obsessed with a condiment called “garum”, which is similar to modern Asian fish sauces but involves a slightly different process. The umami-rich additive has finally been reproduced after falling out of favor over a thousand years ago. [Link]

Unintended Consequences

Investors Pushed Mining Giants to Quit Coal. Now It’s Backfiring by Thomas Biesheuvel (Bloomberg)

As larger, publicly-traded companies abandon coal under pressure from investors, smaller private companies willing to mine the carbon-heavy energy resource are stepping in to the fray. [Link; soft paywall]

YOLO

Rich Millennials to Financial Advisers: Thanks for the Golf Invite, but You Can’t Invest My Money by Rachel Louise Ensign and Peter Rudegeair (WSJ)

Aggressive, liquid young investors are forgoing traditional money managers in favor of running their investments themselves. As the old aphorism goes: everyone’s a genius in a bull market. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

BIG Charts of the Week – 11/12/21

You’ve likely seen Bespoke’s premium research before, but we continue to publish unique and timely analysis in reports like our Morning Lineup, BIG Tips, Sector Snapshot, Bespoke Baskets, Closer, and more.

Additionally, we’ve just published this week’s Bespoke Report newsletter — a detailed PDF that is easily digestible but super informative. You can see Bespoke’s current thoughts on global markets and the economy in this report.

Gain access by simply starting a two-week trial to any of the three Bespoke membership levels listed below. You can revisit our membership options here.

Join Bespoke Newsletter (Weekly Bespoke Report + COTD; Lowest price)

Join Bespoke Premium (Newsletter research + Morning Lineup, BIG Tips, and more)

Join Bespoke Institutional (Access to everything!)

The S&P 500 fell slightly this week as we move towards the unofficial end of earnings season in mid-November.

Below is a look at a handful of charts published this week that we thought were interesting or noteworthy. Additionally, we included a few quotes from Corporate America that we heard on earnings calls this week that have implications for the broader economy. Receive charts and analysis like this in your inbox daily by signing up for a two-week trial to Bespoke Premium.

The prospects of continued inflation have made headlines over the last few months, and the issue is yet to abate. In October’s reading, the trimmed-mean CPI was up a record 8.9% annualized, while the median CPI was up 7.1% annualized. Based on October’s CPI, inflation has outpaced compensation growth over the last year, resulting in less buying power for consumers.

In addition to inflation concerns, the cost and quality of labor is also a significant factor impeding business outlooks. The percentage of businesses in the monthly NFIB survey reporting that the cost or quality of labor was their single most important problem pulled back in October from highs reached in September by about 6 percentage points, but 34% of respondents still indicated that the quality and cost of labor was their largest concern.

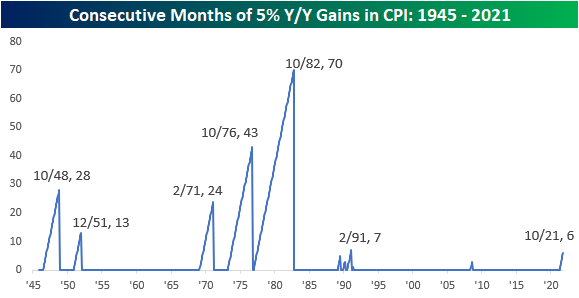

After October’s inflation data, the streak of consecutive months where y/y CPI increased 5% or more reached six, which is the highest level since early 1991 (7). In the post-WWII era, there have only been six other periods where CPI increased by 5%+ for six consecutive months. When these streaks have occurred, most extended over a significant period of time while just two others proved to be transitory.

After the close on Monday of this week, every major US index ETF was in ‘extreme overbought’ territory. Our Trend Analyzer (available with Bespoke Premium or Bespoke Institutional) classifies ‘extreme overbought’ as any time price rises more than two standard deviations above its 50-day moving average.

As shown below, earnings and revenue beat rates have begun to normalize (lower) after spiking in the quarters following the initial COVID shock that caused Wall Street analysts to lower (unnecessarily in hindsight) their estimates.

As the market has been in a consistent bull run since the pandemic low, it is only natural for investors to think about downside potential. For some perspective, the chart below shows that a 20% bear market drop from here would only take the S&P back down to levels seen earlier this year. A very steep drop of 27% would only take us down to the pre-COVID high seen for the stock market in mid-February 2020.

In addition to this week’s charts, we wanted to highlight that throughout this earnings season, we have been reporting on and summarizing select conference calls for our Bespoke Institutional subscribers. Here are some of the notable quotes from this week’s calls with implications for the broader economy:

Flower Foods (FLO) CEO Ryals McMullian commented, “The labor market remains challenging. Unemployment claims are declining, and job openings are at record levels.”

In regards to cruise bookings, Disney CEO Bob Chapek stated, “booked occupancy… is already ahead of historical ranges at significantly higher pricing.”

Chapek added, “we don’t expect to see a substantial recovery in international attendance at our domestic parks until toward the end of fiscal 2022.” This implies that international travel volumes will remain suppressed into the first half of 2022.

TripAdvisor CFO Ernst Teunissen commented, “we’re not out of the woods yet with COVID still impacting us and although we are cautious about Q4, we remain very optimistic that the recovery is taking root and are bullish about travel in our business in 2022.”

PayPal CEO Dan Schulman stated, “We are seeing the impact of global supply chain shortages in our merchant base. Consumer confidence has weakened with the absence of stimulus payments.”

To see the summaries of the earnings reports we covered, you can start a two-week Bespoke Institutional trial, or click here if you are already a subscriber.

In addition to this earnings coverage, Bespoke Institutional subscribers also have access to our recently debuted Little Known Stocks (LIKS) report. On Wednesday, we published our third LIKS report.

In these reports, we provide an in-depth breakdown of a stock that likely remains under the radar of most investors. In this week’s report, we analyzed a ‘pick-and-shovels’ play to a ‘pick-and-shovels’ industry. Over the last three years, this company has grown its revenues at a compounded annual growth rate of 33.2% and is currently trading at a discount relative to its competitors. Over the last year, this stock has outperformed both the Russell 2000 and its broader industry. Again, you can start a two-week trial to Bespoke Institutional to see this LIKS report and others.

Receive charts and analysis like the ones above in your inbox daily by signing up for a two-week trial. Sign up now to read this week’s Bespoke Report!

That’s it for this week. Have a great weekend and we’ll be back at it on Monday!

Best and Worst S&P 500 Stocks Since September 30th

The past month has seen the S&P 500 pivot and rally higher after declines throughout the month of September. Since the end of Q3, the S&P has now gained 8.6%, which is slightly off the highs from earlier this month. Earnings season has been in full swing over the past few weeks meaning there have been plenty of stocks with catalysts for big moves since the end of September. Below we show the stocks that have risen and fallen the most since September 30th.

Topping the list is Enphase Energy (ENPH) having rallied 67.77% in the past month and a half. The bulk of that gain came after earnings as the stock leaped 24.65% the day after reporting and plenty of follow-through in the days after. Arista Networks (ANET) is also up over 50%. Like ENPH, a large portion of ANET’s move came from an over 20% gain on earnings in response to a triple play. There are 18 other stocks in the S&P 500 that have risen by more than 25% since the end of September. The largest of those are NVIDIA (NVDA) and Tesla (TSLA).

Only 18% of the S&P 500 has traded lower since September 30th, and by far the biggest decliner has been Moderna (MRNA). Although it has fallen a dramatic 41% in a short span, that eats into what have been very strong gains this year. Even after its decline so far in Q4, MRNA has still more than doubled year to date. The only other biggest decliners since September that are still up year to date are Garmin (GRMN), Allstate (ALL), Carnival (CCL), and Dish Network (DISH). Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/12/21 – Splits-ville

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Life’s tragedy is that we get old too soon and wise too late.” – Ben Franklin

First, it was General Electric (GE) and now it’s Johnson & Johnson (JNJ) which has announced that it will split up and separate its consumer business from its pharma and medical device unit. The stock is trading up 3% on the news but is still well off its recent highs from August.

The rally in JNJ has provided a lift to Dow futures along with the S&P 500 and Nasdaq, but unless equities can meaningfully build on these early gains during the trading day, all three major averages will finish the week in the red ending a five-week streak of gains.

On the economic calendar today, the only two reports are JOLTS and Michigan Confidence. The JOLTS reading is expected to show a modest decline from last month’s reading, which you may recall came in significantly weaker than expected. Michigan Confidence is expected to show a small bounce, but the key in that report will be where inflation expectations stand.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

While the S&P 500 is lower over the last five trading days heading into today, the majority of sectors have actually experienced gains during that five-day stretch. Leading the way higher, Materials (XLB) has rallied more than 2.5%, followed by Industrials (XLI), Consumer Staples (XLP), and Energy (XLE). On the downside, Consumer Discretionary (XLY) has dropped more than 3% while Communication Services (XLC) is down more than 1%. The only two other sectors that have declined are Health Care (XLV) and Technology (XLK).

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Sentiment Steadily Moving Higher

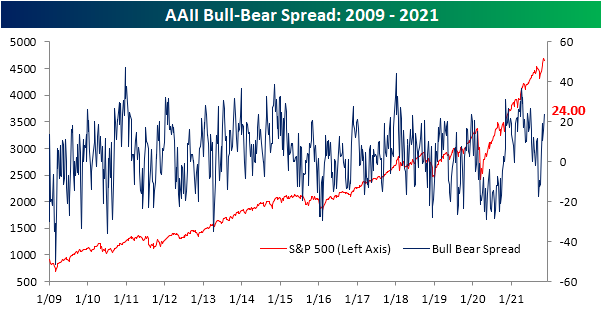

The S&P 500 has encountered some selling pressure this week, but that hasn’t stopped sentiment from continuing its grind higher. The weekly AAII sentiment survey saw 48.0% of respondents report as bullish this week up from 41.5% last week. That puts bullish sentiment at the highest level since the first week of July when it was 0.6 percentage points higher than it is now.

The increase in bullish sentiment borrowed from bears as less than a quarter of respondents reported having negative sentiment for the first time since the last week of July. Similar to bullish sentiment, bearish sentiment is now at the lowest level since the first week of July when it came in at 22.2%.

Overall, sentiment continues to favor bulls to a wide margin. As a result of the inverse moves in sentiment, the bull-bear spread rose to 24 from 15.5 last week. Again, that is levels not seen since early July.

Neutral sentiment also declined this week falling by 4.5 percentage points to 28%. Unlike bullish and bearish sentiment, that reading is basically in the middle of the past several months’ range as the reading has generally hovered around the 30% level. Click here to view Bespoke’s premium membership options.