High Levels of Volatility

It’s been a volatile start to 2022 so far. With an average intraday trading range of two percentage points, the S&P 500’s average intraday range in the first 41 trading days of the year has been the widest since 2009, and the only other year besides 2009 where the average range was wider was 2008.

High levels of intraday volatility tend to coincide with periods of elevated uncertainty among investors and typically occur during periods when the market is lower. When the average daily range of the S&P 500 has been more than 1.5 percentage points during the first 41 trading days of the year, the average YTD performance of the S&P 500 was a decline of 5.7% (median: -4.3%). This significantly trails the average gain of 1.3% (median: 2.0%) of all years since 1983. So far this year, the S&P 500 has had the second-worst start since 1983 trailing just 2009, when the S&P 500 tanked 25.3% in the first 41 trading days.

Regarding forward returns after these volatile starts, returns vary. Although performance over the following one and three months tended to be better than average and more consistent to the upside, over the following six months and for the rest of the year, performance was more mixed. Click here to view Bespoke’s premium membership options.

Unusual Seasonal Strength From Claims

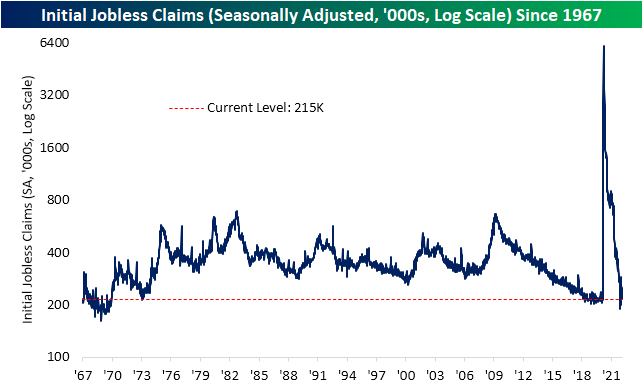

Jobless claims were expected to fall to 225K this week, but the decline was even larger as first-time claims fell to 215K. That marked an 18K decline from last week’s slight upwardly revised number of 233K and is the lowest level of claims since the final week of 2021.

On a non-seasonally adjusted basis, it was a very impressive week. Claims dropped to 194.7K, and after revisions, it is the first sub 200K print since March 2020. That also makes for the lowest level of the current week of the year on record. The 21.3K improvement from last week is also seasonally unusual. The current period of the year has historically marked a temporary low in the average reading on claims (second chart below). Additionally, the current week of the year has infrequently seen claims fall as they did this week. Throughout history, the ninth week of the year has been one of the most consistent periods in the first half of the year to experience week over week increases in claims. In fact, historically the current week of the year has seen claims rise WoW over 70% of the time and prior to this year, the last time the current week of the year saw a lower reading on claims was 2011.

Continuing claims were less impressive this week. While last week’s reading was revised down by 2K to 1474K, this week’s number was slightly higher at 1476K. That compares to estimates of further declines down to 1420K. Even though the most recent reading disappointed, the current level of claims is still well below the range of readings from the past several decades. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 3/3/22 – Is This Thing On?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“He who knows when he can fight and when he cannot will be victorious.” – Sun Tzu

After a seemingly endless run of days where the futures indicated big moves at the opening bell, this morning, futures on all of the major averages are very little changed fluctuating on either side of unchanged. Even bitcoin is flat on the day! It’s not like there is a lack of potential catalysts, though. We have weekly jobless claims at 8:30, and then at 10, we’ll get the latest reads on Services PMI, Factory Orders, and Durables Goods. Also, don’t forget about Powell’s testimony at 10 AM, and continued developments out of Ukraine..

Jobless claims were just released, and while initial claims were expected to come in at a level of about 230K, the actual reading came in at 215K. Continuing claims were forecast to drop to around 1.44 million, and that reading came in higher than expected rising to 1.476 million which was unchanged from last week.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

With little change in the futures this morning, we thought this would be a good time to take a look at the technical picture for the major US indices. While yesterday’s bounce was welcome, it did little to improve the downtrends in the major averages.

The S&P 500 tracking ETF (SPY) hit a two-week high yesterday, which is less common this year than hitting record highs was last year. Despite the gains, though, the index has yet to even test its downtrend or 200-DMA which doesn’t come into play until around 4,450 on the index and about 445 for the ETF.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Gun Background Checks Continue to Fall

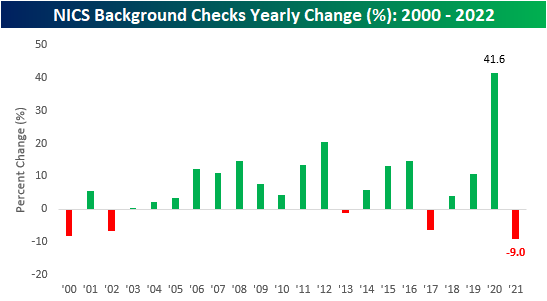

As COVID becomes endemic, levels of anxiety across the country have been declining. At the beginning of the pandemic, uncertainty in the political climate caused by riots and pandemic-related restrictions pushed Americans to rush to their local sporting stores to purchase firearms, resulting in a y/y percent increase in background checks that was second only to the spike seen after Obama’s second term began. In July 2020, FBI background checks spiked by 79.2% y/y, just two percentage points less than the increase seen in January of 2013. However, the absolute number of checks in July of 2020 was 1.14 million higher than the figure from January 2013 (3.64 million vs 2.50 million). In March 2021, background checks topped out at 4.69 million, the highest monthly figure on record. The number of background checks has somewhat normalized since then, resulting in just 2.55 million checks being run in February, albeit a slightly shorter month. Click here to view Bespoke’s premium membership options.

On a full-year basis, 2021 saw total background checks decline by 9.0% to 31.1 million. However, this came off of a record year in 2021, in which checks increased by a whopping 41.6% to 34.2 million. In the first two months of 2022, total background checks have declined by 358,669 YTD or 6.5%.

As you may have assumed, the pullback in background checks does not bode well for the gun manufacturing stocks. Below are the charts of Sturm Ruger (RGR) and Smith and Wesson (SWBI) over the last 12 months. RGR is currently 19.9% off of its high but has rebounded since Russia’s invasion of Ukraine. As the international geopolitical situation becomes increasingly uncertain, firearm sales will likely increase, which has been represented in RGR’s 13.7% upside move in the last week. SWBI is performing far worse, down 54.6% from its 52-week highs. The stock has moved 12.4% higher in the last week but remains deep in the hole. In addition, both of these stocks have been impacted by the legal ruling that could hold gun manufacturers liable for incidents involving their firearms. Previously, these companies were entirely immune from litigation.

As expected, there is a high correlation between the performance of RGR and the number of background checks run over the last twelve months. Since 2000, the correlation coefficient between these two data sets is 0.90, which signifies a strong positive relationship. Should the Ukrainian conflict boost background checks, look for continued strong performance from the gun manufacturers.

Daily Sector Snapshot — 3/2/22

Chart of the Day – Crude Oil and US Dollar Index Surge

Banks (KRE) Swing Wildly

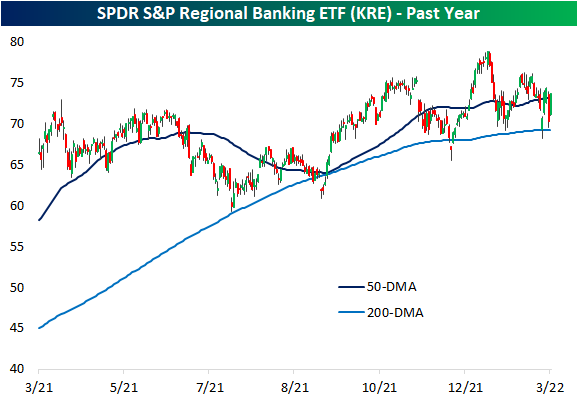

While Financials are the best performing sector so far in today’s session, leading into today it was the worst-performing sector over the past week thanks in large part to a 3.7% decline on Tuesday; the sector’s worst single day since June 2020. Looking more specifically at bank stocks, using the SPDR S&P Regional Banking ETF (KRE) as a proxy, yesterday saw an even more dramatic decline of 5.47% marking the largest decline since November 2020. That drop also ranks in the bottom 1% of all daily changes on record since the ETF began trading in 2006. The over 3.5% rebound today, meanwhile, ranks in the top 5% of all days on record as yesterday’s decline was not quite enough to drop the industry below its 200-DMA; a support level that has now held multiple times in the past year.

As previously mentioned, it is rare for KRE to fall over 5% in a single day. Excluding yesterday, there were 68 other times this happened but only a dozen of those occurred with at least 3 months between the prior instance. In the table below, we show the performance of KRE after each of those periods.

While it is far from the case today, typically, the next day has often seen KRE fall further after a 5% drop. Instead, today it is seeing the second-best next-day performance of these instances. As for where things go from here though, returns have been weaker than the norm one week and one month following these past occurrences. KRE has then tended to outperform all other periods three, six, and twelve months out. Click here to view Bespoke’s premium membership options.

Q4 Earnings Season Conference Call Recaps

Bespoke’s Conference Call recaps provide helpful summaries of corporate conference calls throughout earnings season. We go through the conference calls of some of the most important companies in the market and summarize key topics covered by management. These recaps include information regarding each company’s financial results, growth by segment, as well as some aspects of the business that management expects to impact future results. We also identify trends emerging for the broader economy in these recaps.

Bespoke’s Conference Call recaps are available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call recaps. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

Below is a list of the Conference Call recaps published during the Q4 2021 earnings reporting period.

Latest Recaps:

Q4 Previously Published Recaps

Moderna Q4 Conference Call — 2/24/22

Home Depot Q4 Conference Call — 2/22/22

Deere Q1 Conference Call — 2/18/22

Walmart Q4 Conference Call — 2/17/22

NVIDIA Q4 Conference Call — 2/16/22

Airbnb Q4 Conference Call — 2/15/22

Marriott Q4 Conference Call — 2/15/22

Advance Auto Parts Q4 Conference Call — 2/14/22

Uber Q4 Conference Call — 2/9/22

Disney Q1 Conference Call — 2/9/22

Chipotle Q4 Conference Call — 2/8/22

Simon Property Q1 Conference Call — 2/7/22

Tyson Foods Q1 Conference Call — 2/7/22

Snap Q4 Conference Call — 2/3/22

Amazon Q4 Conference Call — 2/3/22

Estée Lauder Q2 Conference Call — 2/3/22

Meta Q4 Conference Call — 2/2/22

Ferrari Q4 Conference Call — 2/2/22

Match Group Q4 Conference Call — 2/2/22

Advanced Micro Devices Q4 Conference Call — 2/1/22

PayPal Q4 Conference Call — 2/1/22

Starbucks Q1 Conference Call — 2/1/22

Alphabet Q4 Conference Call — 2/1/22

United Parcel Service Q4 Conference Call — 2/1/22

Visa Q1 Conference Call — 1/27/22

Apple Q1 Conference Call — 1/27/22

McDonald’s Q4 Conference Call — 1/27/22

Intel Q4 Conference Call — 1/26/22

Tesla Q4 Conference Call — 1/26/22

Boeing Q4 Conference Call — 1/26/22

Automatic Data Process Q4 Conference Call — 1/26/22

Microsoft Q2 Conference Call — 1/26/22

Johnson & Johnson Q4 Conference Cal — 1/25/22

3M Q4 Conference Call — 1/25/22

Lockheed Martin Q4 Conference Call — 1/25/22

American Express Q4 Conference Call — 1/25/22

Netflix Q4 Conference Call — 1/20/22

Intuitive Surgical Q4 Conference Call — 1/20/22

Union Pacific Q4 Conference Call — 1/20/22

Baker Hughes Q4 Conference Call — 1/20/22

UnitedHealth Q4 Conference Call — 1/19/21

Fastenal Q4 Conference Call — 1/19/22

Procter & Gamble Q2 Conference Call — 1/19/22

Silvergate Capital Q4 Conference Call — 1/18/22

Charles Schwab Q4 Conference Call — 1/18/22

BlackRock Q4 Conference Call — 1/14/22

JP Morgan Q4 Conference Call — 1/14/22

KB Home Q4 Conference Call — 1/12/22

Delta Airlines Q4 Conference Call — 1/13/22

Constellation Brands Q3 Conference Call — 1/6/22

Nike Q2 Conference Call — 12/20/22

Recaps published during Q3 are available with a Bespoke Institutional subscription:

Zoom Q3 Conference Call — 11/23/2021

NVIDIA Q3 Conference Call — 11/17/2021

Target Q3 Conference Call — 11/17/2021

Home Depot Q3 Conference Call — 11/16/2021

Walmart Q3 Conference Call — 11/16/2021

Tyson Foods Q4 Conference Call — 11/15/2021

Flowers Foods Q3 Conference Call — 11/12/2021

Disney Q4 Conference Call — 11/10/2021

Coinbase Q3 Conference Call — 11/9/2021

TripAdvisor Q3 Conference Call — 11/9/2021

PayPal Q3 Conference Call — 11/8/2021

Johnson Controls Q4 Conference Call — 11/5/2021

Cloudflare Q3 Conference Call — 11/4/2021

AmerisourceBergen Q4 Conference Call — 11/4/2021

Lumen Technologies Q3 Conference Call — 11/3/2021

Diamondback Energy Q3 Conference Call — 11/2/2021

Sprout Social Q3 Conference Call — 11/2/2021

SolarEdge Technologies Q3 Conference Call — 11/2/2021

Simon Property Q3 Conference Call — 11/1/2021

Clorox Q4 Conference Call — 11/1/2021

Intercontinental Exchange Q3 Conference Call — 10/28/2021

Apple Q4 Conference Call — 10/28/2021

Amazon Q3 Conference Call — 10/28/2021

Merck Q3 Conference Call — 10/28/2021

United Rentals Q3 Conference Call — 10/28/2021

Ford Q3 Conference Call — 10/27/2021

Automatic Data Processing Q1 Conference Call — 10/27/2021

Boeing Q3 Conference Call — 10/27/2021

Evercore Q3 Conference Call — 10/27/2021

McDonald’s Q3 Conference Call — 10/27/2021

Alphabet Q3 Conference Call — 11/26/2021

Microsoft Q1 Conference Call — 11/26/2021

Digital Realty Q3 Conference Call — Q3 2021

3M Q3 Conference Call — 10/26/2021

Facebook Q3 Conference Call — 10/25/2021

Olin Q3 Conference Call — 10/21/21

Tesla Q3 Conference Call – 10/21/21

Equifax Q3 Conference Call – 10/21/21

Baker Hughes Q3 Conference Call – 10/21/21

Netflix Q3 Conference Call – 10/21/21

Intuitive Surgical Q3 Conference Call – 10/21/21

Johnson & Johnson Q3 Conference Call – 10/21/21

NextEra Energy Q3 Conference Call – 10/21/21

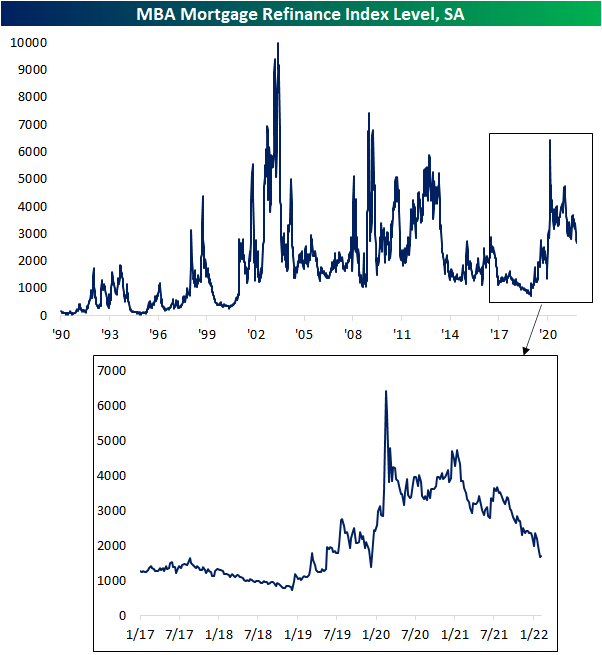

Mortgage Rates Move the Other Way of Treasury Yields

While the past week has seen Treasury yields fall sharply, mortgage rates have continued to rise as has been the case consistently over the past few months with the FOMC slated to begin raising rates. At current levels, various measures on the national average for a 30-year fixed-rate mortgage like the longer-dated weekly series from Freddie Mac or the higher frequency series from Bankrate.com have now reached the highest levels since 2019. For the rate from Freddie Mac, as of the most recent update last Thursday, the national average for a 30-year fixed-rate mortgage stood at 3.89%. For the more recent and higher frequency reading from Bankrate.com, each day of the past week has seen readings at or above 4.25%.

As previously mentioned, the recent changes in US Treasuries have been the opposite of mortgage rates. Quantifying this, in the ten days since the February 15th high in the 30-year US Treasury, the yield has fallen 25.26 bps through yesterday’s close. Meanwhile, the 30-year fixed-rate mortgage from Bankrate.com has risen 6 bps. For mortgages, that is far from the largest 10-day change as that reading recently was above 40 bps in mid-February, but regardless, relative to the decline in the 30-year yield, yesterday saw a 31 basis point spread between the two rates’ 10-day changes. As shown in the chart below, that stands in the 98.8th percentage of all periods going back to the start of the mortgage rate data in 1998. June of last year and the COVID crash were the most recent periods to see such a divergence in the moves in 30 year Treasury and mortgage rates.

Given it continues to get more expensive to finance a home, purchase applications from the MBA fell again this week (albeit the 1.76% WoW decline was far less severe compared to the previous week’s 10.14% decline) as the index is now at the lowest level since May 2020.

Refinance applications were actually slightly higher this week, but in spite of that small respite, the index still hovers around some of the lowest levels of the past two years. Click here to view Bespoke’s premium membership options.

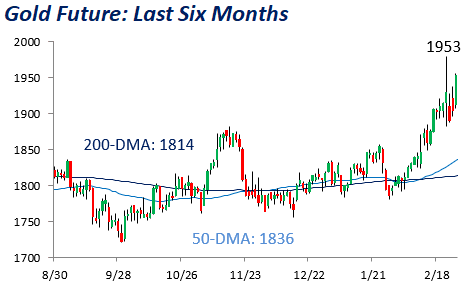

Commodity Driven Stocks Underperforming Commodities

Both oil and gold futures hit 52-week highs in the last week, largely due to Russia’s invasion of Ukraine. Gold is viewed as the classic store of value, which explains the commodity’s recent uptick. Investors are increasingly pursuing hard assets, which spikes the demand for gold while supply remains relatively consistent. Oil futures have sky-rocketed due to a few factors. First, demand for the commodity has increased as the economy has fully reopened and travel has begun to recover. At the same time, we are in a supply-restricted environment as sanctions on Russia have hurt supplies given its status as the world’s second-largest producer.

Although the price of these commodities has risen substantially, equities with direct exposure to these prices have reacted differently relative to the underlying commodity. Starting with oil, the energy sector benefits from increased oil prices as margins expand, thus propping up EPS and allowing for more cash to be returned to shareholders. However, while oil has risen by 15.3% in the last month as of yesterday’s close, the energy sector has only gained 2.7%. This has resulted in a lower ratio between energy stocks and the price of oil, which is pictured below. Since 1990, the performance of the S&P 500 Energy sector and WTI crude oil has been highly correlated, with a correlation coefficient of 0.88 between their closing prices. However, over the last month, the coefficient is just 0.52 and is slightly below the average trailing month correlation coefficient since 1990, which is 0.59. Currently, the ratio of the price of the Energy sector to oil is 5.3, which is well below the median ratio of 6.4 (since 1990). The last time oil topped $100 per barrel was between 2011 and 2014, and we saw the ratio of energy stocks to oil remain at roughly our current level throughout this time period. Once oil definitely broke through the $100 level, the ratio increased.

When looking at the ratio of the price of gold vs gold mining stocks, we are seeing the opposite pattern play out. While the price of an ounce of gold has increased 8.4% since the start of February (as of yesterday’s close), the price of the VanEck Gold Miners ETF (GNX) has appreciated by 17.5%. Since we emerged from the global financial crisis in 2008, this ratio has remained elevated, as the performance of the gold miners has not been as strong as the performance of the underlying commodity. It is worth noting that GNX was launched in mid-2006, so for the chart below we used a contiguous index, using pricing data from Newmont Corp. (NEM) for the period from 1990 through mid-2006. Since 1990, the performance correlation of the two assets has been relatively minimal, holding a correlation coefficient of 0.42. However, over the last month, this reading has ticked higher to 0.97. The rolling one-month correlation coefficient between gold and the miner stocks has had an average 0.72 (median: 0.81), meaning that the miner stocks are more correlated to the movements of gold than they typically have been since 1990. The current price ratio of 15.2 is much higher than the median since 1990 (5.2) but is essentially in line with the ratio since the start of 2014 (15.6).

To summarize, while a number of factors will impact the price of energy and gold related stocks besides just the price of the underlying commodities they deal in, energy stocks have been less correlated in recent history than they have in the past, but we see the opposite in gold miners relative to the price of gold. Additionally, energy stocks have underperformed oil over the last month, and the inverse is true for gold mining stocks relative to gold. Click here to view Bespoke’s premium membership options.