B.I.G. Tips – Look Familiar?

Sentiment Slumps Ahead of CPI

In spite of the S&P 500’s attempts at moving above its 50-DMA in the past week, bullish sentiment took a hit with only a quarter of responses to the AAII survey reporting as optimistic. That compares to 30.6% last week. Today, equities are roaring higher in reaction to the cooler than expected CPI print. Given the timing of the release and market reaction, the latest readings on investor sentiment can already be considered out of date as collection periods would have missed today’s news. Looking forward, holding constant any other catalysts and price action that may affect sentiment in the week to come, the CPI number and subsequent positive market reaction are likely to support a much more positive reading on sentiment next week.

In the two weeks leading up to now, bearish sentiment had been in free fall, going from 56.2% during the week of October 20th all the way down to 32.9% last week. A little more than half of that decline was recovered this week as bearish sentiment rose all the way back up to 47%.

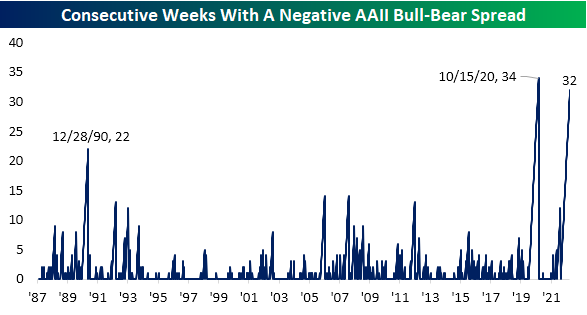

As a result of those recent moves, the bull bear spread moved much deeper into negative territory. After hitting the highest level of the current near record stretch of negative readings, the spread has fallen back down to -21.9. Click here to learn more about Bespoke’s premium stock market research service.

Fourth Week Higher For Continuing Claims

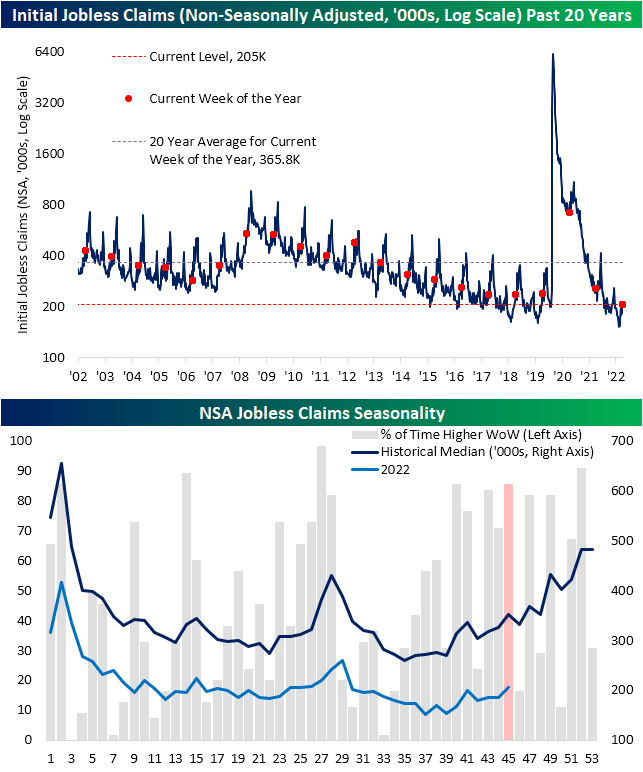

While today’s CPI print took the spotlight of positively received economic data, jobless claims have continued to rise a bit. Seasonally adjusted initial claims rose to 225K from last week’s 1K upwardly revised level of 217K. That is 1K below the early October high for the weakest level of claims since the end of the summer. Given recent readings, claims have been trending slightly higher but remain at historically strong levels.

On a non-seasonally adjusted basis, claims are swinging higher as is normal for this point of the year. In fact, the current week of the year has historically seen claims rise week over week 85% of the time. That ranks fourth as the week of the year most consistently to see claims rise. In spite of that expected increase, at 205K claims are much lower than the comparable week of years past.

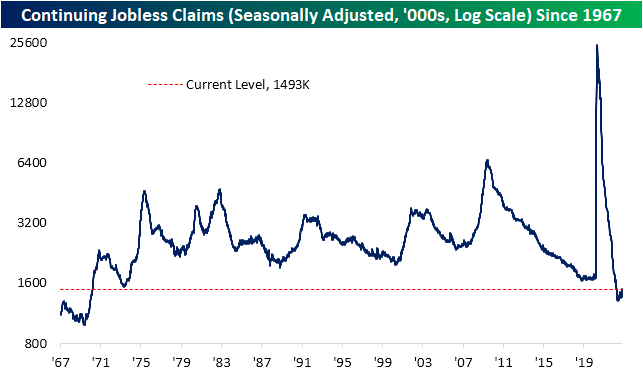

Without doubt, initial jobless claims paint a picture of solid health in the labor markets without much in the way of significant deterioration or improvement lately. Continuing claims are similar in sitting well below pre-pandemic levels that are some of the strongest of the past several decades. Unlike initial claims, though, continuing claims have been more consistently climbing in recent weeks. Now at 1.493 million, claims have risen in each of the past four weeks, bringing the reading to the highest level since the end of March. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day: Markets Rejoice On Peak Inflation

Bespoke’s Morning Lineup – 11/10/22 – No Comeback This Year

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“This is the most disappointing loss I have ever been associated with.” – Jimmy Johnson, 11/10/1984

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

You can take the positive futures with a grain of salt this morning as everything is likely to and will change following the 8:30 Eastern release of October CPI. Economists are currently forecasting the headline reading to increase by 0.6% m/m while the core reading is expected to be slightly more subdued at 0.5%. That report will be the main course, but don’t forget about jobless claims. Initial Jobless claims are expected to remain right around last week’s level of 217K. Not much is expected to change with regard to continuing claims either, but if the consensus reading of 1.487 million comes in, it would be the highest reading since April.

The words above could really be attributed to anyone who invested in financial assets of any type this year, but when Jimmy Johnson uttered them on this day in 1984, he was referring to his Miami Hurricanes and their role in one of the biggest blown leads in college football history. Playing Maryland, the Hurricanes took a 31-0 blowout into halftime in what was looking like a laugher. The Hurricanes of the 1980s were brash and known for their attitude, and they were also a team that most people outside of Miami eagerly rooted against.

That trash-talking Miami attitude was on full display back in 1984. As Maryland’s Jess Atkinson described it, “No question about it. Those guys were the biggest cheap-shot, trash-talking, classless outfit of football players I’ve ever seen in my life…You can almost take getting beat if a team is kicking your butts and they’re doing it cleanly. And there was no question that they were kicking our butts in the first half. But that team made us mad, and it gave us a little extra incentive.” Well, the Terps came out determined in the second half and led by QB Frank Reich coming off the bench and throwing six touchdowns, they were able to somehow complete one of the most unfathomable comebacks in college football history.

It’s amazing enough to lead a team to one of the greatest comebacks in college football history, but Reich also managed to find himself on the winning side of one of the greatest comebacks in NFL playoff history nine years later on a freezing January Buffalo afternoon. After trailing the Oilers 35-3 early in the second half, more than a few Bills fans left the cold and damp Rich stadium stands thinking about what could have been and looking ahead to next season. The Bills didn’t give up, though. One of his teammates reminded Reich that he had already been part of the greatest comeback college win, so perhaps he could do it again. Reich then went on to tell the team that they had to take the rest of the second half one play at a time. Using that play-by-play approach, the Bills staged a miraculous comeback as a wave of fans came back from the parking lots and filled the stands again to witness the 41-38 “Comeback” win.

As good a run of luck that Reich had in his football-playing career, his coaching career hasn’t been as lucky. While he had a big turnaround in his first season when the Colts made the playoffs after starting off the season at 1-5, the years since then have been somewhat uneventful. After starting this season with a record of 3-5-1, including a blowout loss to the Patriots last Sunday, Reich was unceremoniously fired by Colts owner Jim Isray.

Like the lucky streaks often seen in sports among teams or individual athletes, they all eventually end. 2022 has been a year where the market’s luck looks to have run out, and a Frank Reich comeback isn’t in the cards. Judging by various measures of sentiment, the only question now seems to be how much worse things will get. Even though we’re in what has historically been the best time of year for equities, individual investor sentiment, as measured by the American Association of Individual Investors, has shown a higher percentage of bears than bulls every week this year except one! As shown in the chart below, sentiment this year has been especially negative as there has only been one week where bullish sentiment exceeded bearish sentiment. Prior to 2022, there was no other year since 1987 where fewer than 25% of all weeks had more bulls than bears.

It’s been a terrible year. Everything that has happened, though, is in the past. Rather than looking back on the year and thinking about what could have been, investors always need to be looking forward and thinking of what could be.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 11/9/22

Haves and Have Nots

As evident in our Sector Snapshots over the past several days and as we discussed yesterday on Twitter, sector performance has lately been a tale of the haves and have-nots. The areas of the market that possess some of the most heavily weighted stocks, namely Communication Services, Consumer Discretionary, and Technology, have drastically underperformed other cyclical sectors like Financials, Industrials, and Materials. As a result, relative strength lines have blown out. Shown another way, in the charts below, we show the ratios of each of these sectors relative to the S&P 500. A rising line would indicate the sector is outperforming the broader market and vice versa.

Communication Services has been in a brutal downtrend in relative strength terms for more than a year now and the recent drop has been steep. While the ratio of Consumer Discretionary to the S&P 500 has been more range bound in recent years, there have been a few wild swings in the past year. The most recent swing lower is leaving it close to the lowest levels since early 2015. Tech’s decline has not been nearly as sharp, but the ratio here has nonetheless rolled over to some of the lowest levels of the past few years. Conversely, Financials, Industrials, and Materials have all seen their ratios rip higher to the upper end of the past few years’ range.

In measuring just how sharp of moves these ratios have experienced, they have been outright historic. As for the most pronounced moves, the drops in the lines of Communication Services and Consumer Discretionary rank in the bottom percentile of all 10-day moves since 1990 when our sector data begins. The only periods in which the ratios fell by similar degrees, if not by more, were during the Dot Com bubble. While Tech’s ratio is at new multi-yea rlows, its decline was large (ranking in the 17th percentile) but not nearly as sharp, standing out much less than the aforementioned sectors.

Like Tech, the moves in Financials and Materials have also been quite large and rank in the top decile of all 10-day moves, but those are far from records. The outperformance of Industrials on the other hand, has been remarkable. As of yesterday’s close, the ratio versus the S&P 500 rose 7.24% over the past two weeks. Only three other days—May 19 through May 21, 2020—since 1990 have seen higher readings. Click here to learn more about Bespoke’s premium stock market research service.

Gold Breaks Out Ahead of Election and CPI

High inflation and the aggressively hawkish monetary policy that has come in response, an election, and battered risk assets lend plenty of reason for investors to have sought out safe havens for their money this year. However one such asset, gold, has gotten crushed all the same. The yellow metal is down 18.5% from its 52-week high set in the early spring but on the bright side, it has begun to break out of its downtrend. As shown below, gold has tested support at roughly around $1,620 at multiple points this fall. After the last successful test only about a week ago, front-month futures have surged over 5%. The result has been an upside break of the longer-term downtrend as well as the 50-DMA. This is the first time since the spring gold has traded considerably above that moving average.

While that positive technical development is in the books, it is not necessarily out of the woods yet. There has not been a higher high yet meaning a move above last month’s unsuccessful test of its 50-DMA (around $1,730) would be the next hopeful sign for gold bugs.

Additionally, the current run has occurred at an interesting point in time. Historically considered a prime safe haven asset, gold’s run over the past few days has coincided with a couple of catalysts for uncertainty in the headlines: the midterm election and tomorrow’s CPI print. Based on where gold is trading as of this writing, the metal is up nearly 5.5% over the past four days. As shown below, in the four days leading up to every other CPI release since at least June 1998, that ranks as the fourth-best pre-CPI rally and only the fifth time it has rallied more than 5%. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day – Eyes on CPI

Bespoke’s Morning Lineup – 11/9/22 – Time to Focus on CPI

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Once you replace negative thoughts with positive ones, you’ll start having positive results.” – Willie Nelson

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

If you thought the midterm elections were behind us, think again. Polls have been closed for nearly 12 hours in most jurisdictions, but the results of many contests are still up in the air. Markets hate uncertainty, so as you might expect, equity futures are lower heading into the opening bell, but the losses at this point, have been relatively contained. The economic calendar is quiet today, but tomorrow’s CPI looms on the horizon, and we’re still getting a heavy dose of earnings reports. The recent trend has not been nearly as strong as it was earlier in the reporting period as instances of lowered guidance have become increasingly common.

No matter what the results of the midterm elections were, people were going to wake up in a bad mood this morning. In some ways, the fact that there has been so little change in either direction only makes things worse since no one will be happy. Relative to expectations, Democrats clearly outperformed most expectations, though. Whatever your mood this morning, though, get over it. Like oil and water, politics and investing don’t mix, and you should never let your political ideology cloud your investment decisions. Relative to yesterday, very little has changed. The Fed is still aggressively hiking rates, the economy is weakening, and the stock and bond markets are at the tail end of one of their worst years in history.

As far as last night’s results go, nothing is final, but based on current estimates, the House looks like the razor-thin majority is going to shift from the Democrats to the Republicans, while Democrats are expected to maintain control of the Senate. Going back to WWII, it hasn’t been unprecedented to see smaller changes in the makeup of Congress during a midterm election, but this year’s results will likely end up near the more muted extreme at a time when no side had a decisive majority. Obviously, this is all subject to change, but what really stands out to us is how evenly divided the country is right now. The current rivalry between Republicans and Democrats stacks right up there with some of the biggest sports rivalries in history. Every two years the two sides completely go at it, taking things right down to the wire, and even many times ending up in overtime or a runoff somewhere to see which party comes out on top.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.