Chart of the Day: Positive Returns by Holding Period

Bespoke’s Morning Lineup – 3/29/22 – Apple’s (AAPL) “X”-Day Winning Streak

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Price is rarely the most important thing.” – Tim Cook

When our alarms went off this morning, futures were indicating a mixed to positive open, but that tone has moved firmly to the side of gains following reports of progress being made in the Russia-Ukraine ceasefire talks. The Ukrainian side believes that enough progress has been made to warrant a meeting between Putin and Zelenskyy, while the Russian side has said that talks have become constructive. We’ve seen positive headlines like this in the past only to get walked back in the hours following, but given the heavy losses Russian troops have sustained, there is a stronger feeling that Russia has become increasingly eager for a way out of the war. However things ultimately play out, the market has responded with equities moving higher, and both gold and oil dropping.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Price may rarely be the most important thing, but shares of Apple (AAPL) are in the middle of an impressive winning streak with ten straight days of gains. Since the launch of the iPod in late 2001, the current streak ranks as just the fourth time that AAPL’s stock has rallied for ten or more days, and it’s the first such streak since July 2010. Of the three prior double-digit winning streaks, the only one that lasted more than ten days was back in 2003.

The chart below shows the performance of AAPL since the start of 2002, and we have included red dots to show each prior time that AAPL was up for ten or more days. Looking at where the prior streaks occurred relative to AAPL’s price trend, one occurred early in an uptrend, one was followed by a short-term pullback, and the other was right in the middle of an uptrend. So, while the winning streak for AAPL is great for shareholders, it appears to say little about the future performance of AAPL’s stock. One item we found interesting, though, is that even after the current ten-day run of gains, the current streak is the first of the four that AAPL’s trailing three-month performance was negative (-2.1%). On the 10th straight day of gains in the prior streaks, AAPL’s trailing three-month returns were 29.3% (2003), 48.8% (2004), and 27.3% (2010).

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Not All Yield Curve Inversions Are Created Equally

While the Fed has pivoted from a period of quantitative easing to tightening, there has been near devastation in the bond markets as yields rocket higher. Interestingly, short-term rates have risen at a faster pace than long-term rates, which has caused fears of an inversion to resurface. Overnight, for the first time since February 2006, the 5 year yield was higher than the 30 year, which implies that investors have a higher required rate of return for near-term debt instruments (likely due to inflation and real yields). Inversions of yield curves are commonly cited as a leading recession indicator, so investors are carefully watching the movements in yield spreads.

As shown in the chart below, overnight Sunday into Monday morning, there was a brief inversion between the yields of the 5 and 30-year US Treasuries. By late in the afternoon Monday, though, the spread was back to a just barely positive and still narrow 1.3 basis points (bps). Since the start of 1980, the average spread has been 87.4 bps, and since 2000, the average has been even steeper at 126.5 bps.

Below is a long-term chart of the yield spread between 30 year and 5 year US notes. As you can see, the narrowing of the spread has been constant since mid-2021, which is when CPI prints began to come in way ahead of estimates, implying that the Fed would have to take tightening action to slow down economic growth. The last time these yields came close to inverting was in mid-2018, but a pullback in rates caused the spread to widen before an inversion occurred. Looking back historically, while a recession has usually followed an inversion of the 5s30s yield curve going back to 1980, it has not been the most reliable predictor of recessions compared to other parts of the curve. As shown in the chart, there were two different points in the 1980s where the curve inversion was a false alarm, and then again in the mid-1990s, this part of the curve briefly inverted but no recession was forthcoming. Click here to try out Bespoke’s premium research service.

Chart of the Day – 2s10s Yield Curve Inversions. Just a Matter of Time?

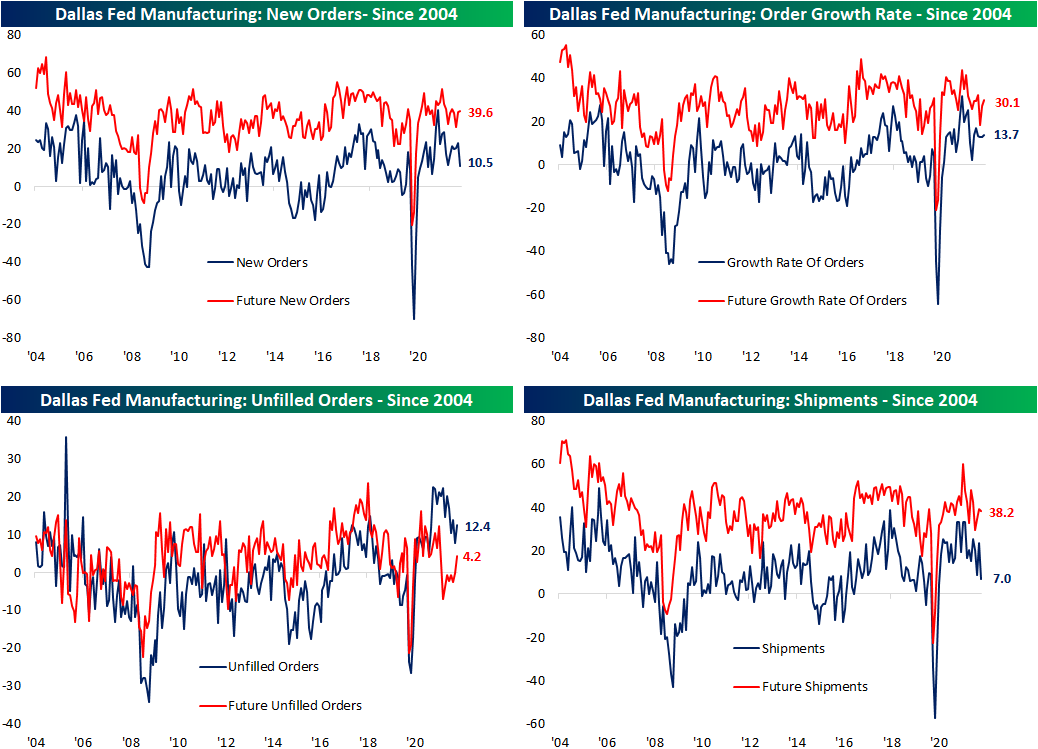

Dipping Dallas

The fifth and final regional manufacturing release came out of the Dallas Fed this morning, capping off the month on a disappointing note. The index fell by more than expected, dropping 5.3 points to 8.7. While lower, that is still several points above December and January levels. The Expectations reading was also lower, setting a 21-month low.

The month over month decline in general business activity came up just shy of the bottom quartile of all readings since the data begins in 2004. In spite of that decline at the headline level, overall breadth was actually largely positive with the number of categories rising month over month doubling the number of categories that fell. With that said, company outlook, shipments, and new orders each saw significant declines. Expectations, on the other hand, had a larger share of categories decline as most of these indices sit lower within their respective historic ranges.

As mentioned above, new orders and shipments experienced two of the most notable declines this month, falling 12.6 and 16.5 points, respectively. New orders is now down to the weakest level since January 2021 while shipments has erased any gain since June 2020. While those were big declines, the positive readings still indicate that the region continues to see growing demand albeit at a slower rate.

Employment metrics were a healthier area of the report showing the region’s firms increased hiring in March at an accelerated rate. Additionally, wages and benefits also rose at a historic rate. The current conditions index for that category set a new record high this month while expectations reversed off of a record. Not only are the region’s firms paying workers more, but they are also increasing capital expenditure. That took out the December high for the strongest reading since last May. That increased spend is also expected to continue as the expectations index hit the highest level in three years. Click here to view Bespoke’s premium membership options.

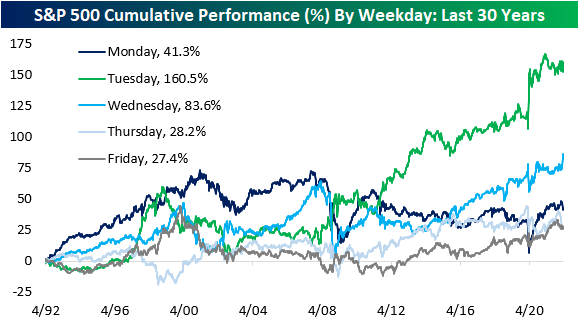

Asset Class Performance by Weekday

As Vladimir Lenin once wrote “There are decades where nothing happens; and there are weeks where decades happen.” For investors, each passing day of late has felt like a month, as Powell’s Pivot, the Ukrainian conflict, rampant inflation, supply chain constraints, and COVID have caused rapid shifts in investor sentiment, leading to heightened volatility. With each day feeling like an eternity, we decided to look into the average performance by weekday to provide you with insights into trading patterns based on the day of the week.

The last twelve months have seen a divergence in performance from the norms of the last 30 years. On a trailing 12-month basis, the S&P 500 has performed poorly on Mondays and Tuesdays before gaining steam from Wednesday through Friday. This diverges from the patterns seen over the last thirty years, in which Thursday and Friday struggled relative to the performance over the first three trading days of the week. This year, oil has averaged gains on every day of the week, but the strongest performance has occurred early in the week, which is interesting as Monday and Tuesday have tended to be the worst days of the week for oil over the last 30 years. Bonds have performed poorly in the beginning of the week over the last twelve months but have partially recovered in the last two trading days. Over the long run, the safe asset has traded narrowly with only Wednesdays averaging a loss. Tuesdays and Thursdays have been strong days for the US Dollar over the last twelve months, but these days tend to result in flat to negative performance when looked at over the last 30 years.

Below we summarize the cumulative performance by weekday for the S&P 500 over the last 30 years. As you can see, Tuesday has been the best performing day by far, booking performance gains of 160.5%. Wednesday has posted a cumulative gain of 83.6%, which lands the day in second place. Friday and Thursday have been the weakest days, booking a cumulative gain of just 27.4% and 28.2%, respectively. Monday lands in the middle, recording a cumulative gain of 41.3%. As outlined above, the recent shift in weekday performance deviates from the norms of the last 30 years as investors have come out of the weekend with fears but concluded the week with optimism. Click here to try out Bespoke’s premium research service.

Bespoke’s Morning Lineup – 3/28/22 – New Week

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The way to crush the bourgeoisie is to grind them between the millstones of taxation and inflation.” – Vladimir Lenin

What was looking like a positive start to the week has taken a turn for the worse as US equity futures have given up much of their earlier gains in the last few minutes. It’s been a quiet morning so far in terms of economic data, and the only real fireworks are taking place at the short end of the Treasury curve and in the crypto space as bitcoin trades above $47K to its highest levels of the year. On the war front, Russia’s stalled advance has that country now narrowing its focus to the ‘liberation of Donbas’ so there is some optimism that talks this week could lead to some sort of peace breakthrough. It’s the last several days of what has been a very volatile quarter, so don’t be surprised to see more of it as we close out the quarter.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

US stocks are still well off their highs from late 2021 and early 2022, but in the short-run, most are either close to or at short-term overbought readings. The S&P 500 moved into overbought territory last week for the first time since January 4th, and at current levels is just shy of taking out its early February highs – a level it stalled out twice at in the first ten days of February.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 3/27/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Ukraine

Why Russia is Losing: Gen. David Petraeus on the War in Ukraine by Jonathan Tepperman (The Octavian Report)

Former US CENTCOM and coalitions forces chief in Afghanistan (as well as CIA director during the Obama Administration) David Petraeus discusses the most important of myriad Russian military failings in its invasion of Ukraine. [Link]

Russia says new ‘phase’ of Ukraine offensive to focus on Donbas by Polina Ivanova, Henry Foy, and Roman Olearchyk (FT)

With Kyiv defended, Odessa out of reach, Kherson under assault from Ukrainian forces, Mariupol still unconquered, and little movement in Russian lines elsewhere, the Russian Ministry of Defense announced Friday that it was pivoting to focus on “liberating” the entirety of Donbas Obkast, a near-explicit admission of defeat. [Link; soft paywall]

Energy

Russia‘s Energy Shock by Nick Birman-Trickett (OGs and OFZs)

A long read on the history of Russia’s economy and energy sector and its role in the broader economy of the country. Chock full of interesting tidbits and details on just how painful the transition away from integration in the global economy is. [Link]

U.S. to Boost Gas Deliveries to Europe Amid Scramble for New Supplies by Matthew Dalton and Giovanni Legorano (WSJ)

US liquid natural gas shipments will help fill some of the gap of disrupted supply from Russia, with the Biden Administration planning to ship at least 50bn cubic meters (more than double last year’s numbers) across the Atlantic through at least 2030. [Link; paywall]

ExxonMobil Running Pilot Project to Supply Flared Gas for Bitcoin Mining: Report by Aoyon Ashraf (CoinDesk)

Natural gas flaring off ExxonMobil oil wells in North Dakota is going to be used to power bitcoin mining rigs, turning waste gas in to an income-producing asset. [Link]

Short Sellers

A Top Prosecutor, a Short Seller’s Confession, and a Columbia Professor Offer Clues to the DOJ Probe of Short Sellers by Michelle Celarier (II)

Evolving securities laws are making for some confusing designations in cases of market manipulation, which raise even more existential questions than usual when it comes to the thorny territory of what kind of speech is legal when it comes to markets. [Link]

An Alleged Fraud Uncovered by a Short Seller Ends in Gunfire by Ben Foldy (WSJ)

When the FBI showed up to investigate a potential Ponzi scheme in Las Vegas, the suspect shot at agents and was wounded multiple times; eventually a SWAT team was able to take him in to custody. [Link]

Demographics

Signet Jewelers Says Weddings Will Hit a 40-Year High This Year by Jeannette Neumann (Bloomberg Quint)

Jeweler giant Signet (which owns Kay and Zales) is forecasting the largest number of weddings in four decades as a backlog of nuptials from the pandemic is cleared out. [Link]

Deaths outpace births in most counties as U.S. growth slowed in 2020 by Fredrick Kunkle (WaPo)

While births continued to outpace deaths nationally, falling fertility rates and surging deaths thanks to the pandemic led to three-quarters of the country’s counties reporting more deaths than births in the past year. [Link; soft paywall]

Mystery driver of red truck driving through Texas tornado is a teenager by Amanda Ruiz (Fox 7 Austin)

A red Chevy that was spun dramatically by a tornado in Elgin, TX was driven by a 16 year old Whataburger job applicant on his way home. [Link]

Aerospace

Chinese Boeing jet crashes in mountains with 132 on board, no sign of survivors by Martin Quin Pollard (Reuters)

Earlier this week a Boeing 737-800 NG operated by China Eastern Airlines fell from an altitude of more than 30,000 feet to a brutal crash in southern China. [Link; soft paywall]

Everything to know about Switchblades, the attack drones the US is giving Ukraine by Kelsey D. Atherton (Popular Science)

Everything you didn’t realize you needed to know about the infantry-portable “Switchblade” drones that are part of the lethal aide package that the United States has sent to Ukraine. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 3/25/22 – Wake Up & Smell The Tightening

This week’s Bespoke Report newsletter is now available for members.

Stocks have stopped paying attention to the interest rate markets, but that hasn’t stopped bonds from continuing to plunge. Surging interest rates and a Fed willing to crush the economy to tamp inflation are being ignored by the furious rally in a stock market that believes in the admittedly very strong US economic expansion. In addition, we dive into the investing returns of different generations, with a surprising winner when it comes to long-term investing results as well as key analysis on the driver of long-term investing returns. With the supply side of the economy struggling to keep up, we look at two industries and how supply constraints are benefiting one while holding another back. We also introduce a new basket of stocks designed to find big growth opportunities in EM, review the performance of stocks over the last two years and big winners since the COVID bottom, record low jobless claims, the distribution of assets and liquid savings across the income distribution, economic hits in Europe, and more in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

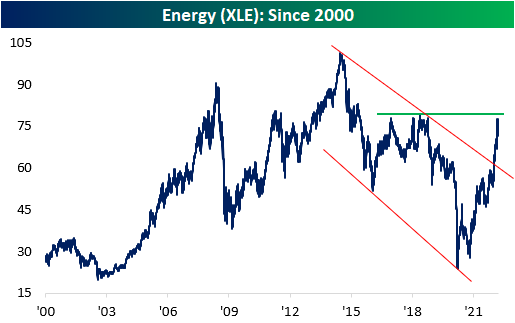

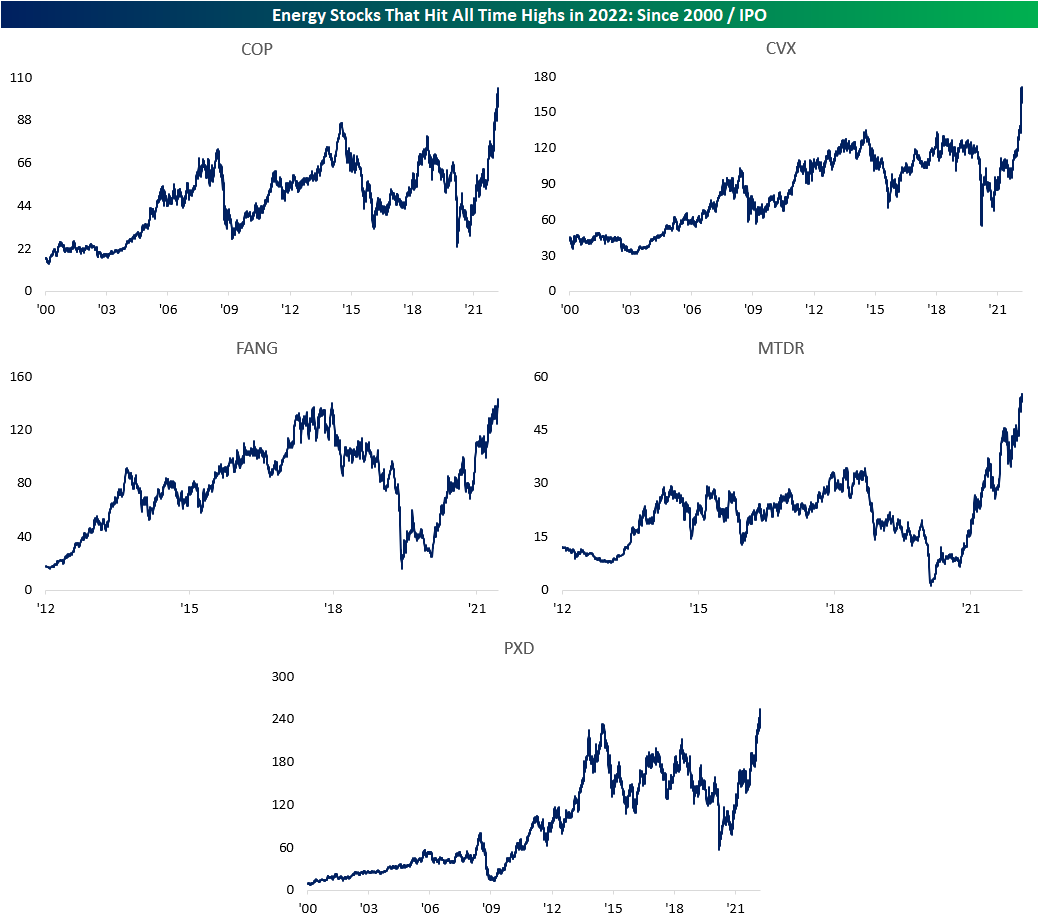

5 Energy Stocks Reached ATHs

Energy stocks have roared higher since the beginning of 2022, gaining a whopping 38.8% in less than three months (as of yesterday’s close). This comes on the back of sharp moves higher in crude, thus implying higher margins and increased bottom line earnings per share. During the pandemic, energy stocks were among the most hurt, as a reduction in travel and economic activity led to a crash in oil markets. Although the YTD gain is certainly substantial, investors that have held energy stocks since mid-2008 are still in the red. The energy sector ETF (XLE) is still 23.0% off of its high price since the turn of the century, which occurred in June of 2014. As you can see from the chart below, XLE has broken its long-term downtrend and is nearing a breakout above 2018 levels. To retest the high of the century, XLE would need to gain another 29.8%.

On March 11th of this year, the relative strength reading of XLE vs the S&P 500 (SPY) since 2000 turned positive for the first time since COVID was declared a pandemic by the World Health Organization (WHO). The ratio has since turned negative, and the reading is currently -5.0 percentage points. The relative strength had moved continuously lower from its high in 2008 through early 2021, but the recent reversal higher is substantial.

Although Energy has been strong as of late, only five of the 63 Energy sector stocks in the S&P 1500 have hit all time highs in 2022 (to be considered, the stock must have been trading for at least five years). The five stocks are ConocoPhillips (COP), Chevron (CVX), Diamondback Energy (FANG), Matador Resources (MTDR) and Pioneer Natural Resources (PXD). Below are the charts of these stocks since the turn of the century. The average stock on this list is up 41.3% on the year as of yesterday’s close, which is only slightly greater than the performance of XLE. Click here to try out Bespoke’s premium research service.