Historic Small Cap Volatility

It’s no secret that growth stocks have underperformed value stocks over the last twelve months. The trailing-twelve-month performance spread (percentage points) between the small-cap growth and large-cap value indices, two opposite ends of the equity market, is currently at -20.5 percentage points. Although this is far above the recent low of -33.9 ppts, the current reading is in the bottom 6% of all days since the mid-1994 (when both the MSCI USA Small Cap Growth and MSCI USA Large Cap Value Index were active). Interestingly, this year’s trailing twelve-month performance spread was the lowest since 2001 (unwind of the dot-com bubble). Funny enough, the spread had hit the highest level since early 2000 in 2021, as excessive performance from small-cap growth stocks has tended to reverse course after reaching extreme levels.

Small-cap growth stocks tend to trade at significantly higher valuation multiples than large-cap value stocks, which is part of the reason that small-cap growth equities have sold off at a higher rate than their counterparts. These stocks also have higher betas, so market moves have a disproportionate effect. These factors have caused the average daily percent change spread between the two indices to reach an extremely elevated level, the highest since 2000 – 2001. This measure of volatility is also yet to roll over, indicating no end to the volatility regime that has been in place. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day: Doubled Rates Dampen Demand

Apple on iPhone Announcement Days

Building upon yesterday’s Chart of the Day, we took a look into Apple’s (AAPL) intraday performance on iPhone announcement days. Today is one of those days, and although we couldn’t locate the exact announcement time for each day going back to 2008, the ones that we did find occurred at 1 PM Eastern, which is highlighted in red below.

As you can see, the stock has tended to sell off during the first hour of the day before slowly trudging higher until 1 PM Eastern. However, once the event begins, the stock has tended to decline in a sell-the-news reaction. That weakness has tended to last most of the afternoon until the final 40 minutes of trading when the stock has tended to bounce back a bit. For the entire day. AAPL’s stock has, on average, declined 78 basis points on the day of prior iPhone announcements since 2008. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke Morning Lineup – 9/7/22 – Eight in a Row?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There’s nothing fair about it, it’s going to create economic hardship,” – Ryan Lance

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The above quote from the ConocoPhillips (COP) CEO from earlier this year was referring to the energy policy of the United States, but it could just as equally have been used as a response to this morning’s WSJ article that the FOMC is planning on a 75 bps rate hike at its September meeting. Whatever your views are regarding the path of inflation and whether a 75 bps hike is actually needed, the impacts will create some level of hardship on what is already a weakening economy. Chair Powell has admitted as much in numerous comments saying that the FOMC’s fight to reverse the post-COVID inflation surge will be ‘painful’.

Futures were modestly higher before the WSJ article was published but have since reversed into negative territory with the S&P 500 indicated to open down by 0.30% with the Nasdaq indicated lower by a similar amount. The Nasdaq is already down seven straight days, which is the longest losing streak since November 2016, and that streak ultimately went on for nine days before ending. Crude oil prices are modestly lower and treasury yields are lower as well.

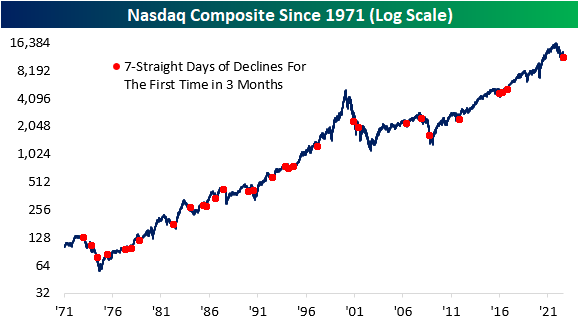

Maybe we were just overdue for a losing streak like the Nasdaq is currently in the midst of now. Before this one, the last losing streak of seven trading days was right before the 2016 election, and the gap of 1,466 trading days between these two streaks was the longest in the Nasdaq’s history. Prior to the current period, the longest gap between 7-day streaks was from late 2001 until 2006, and the only other gap of over 1,000 trading days ended in January 2016.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Nasdaq Declines For 7th Straight Day

Following Tuesday’s drop, the Nasdaq Composite has closed lower for seven consecutive days, a streak that has not occurred since November 2016. During this stretch, the index has declined roughly 9%, which is the largest decline over seven trading days for the index since mid-June of 2022. Even during the COVID crash and the continued sell-off during the first half of this year, the Nasdaq never declined for seven straight days. As apparent from the chart below, the frequency of these occurrences has declined substantially since the first 20 years of the index’s history. Click here to learn more about Bespoke’s premium stock market research service.

As shown in the table below, the median performance following these occurrences does not differ greatly from all periods. Average performance is lower over the following month, three months, and six months, but the positivity rate six months out is identical to that of all periods. The median performance does not differ too greatly compared to all periods across each time frame we looked at. Although investors are likely feeling the pain of this sell-off, there is no evidence suggesting that the forward performance will diverge from the norm.

The chart below provides an alternative way to visualize the consistency of positive returns following seven straight declines for the Nasdaq. Apart from three months forward, the positivity rate for the index was within three percentage points of the norm for every time period we looked at.

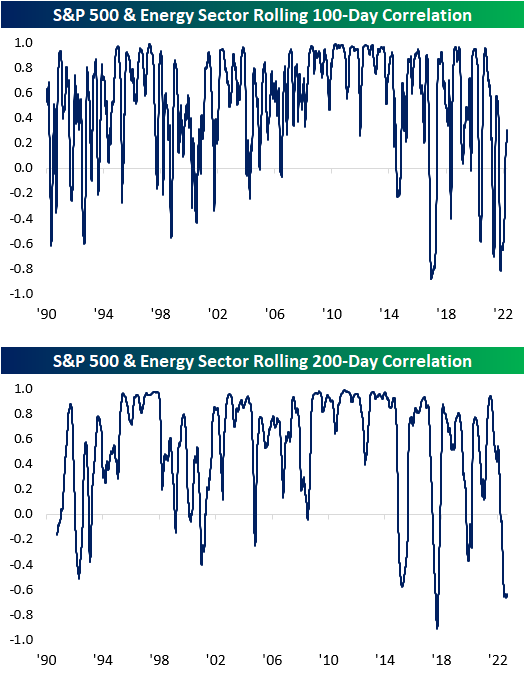

S&P 500 and Energy Correlation Reverses

Early in 2022, extremely high oil and gas prices provided a headwind to the broader economy and significantly contributed to inflation, forcing the Fed to embark on its current aggressive policy of rate hikes. Rising energy prices and higher interest rates led to a divergence in the performance of the Energy sector, which rallied on higher energy prices, and the S&P 500, which came under pressure due to higher rates. As a result, on both a 100 and 200-trading day basis, the correlation coefficients between each index’s closing prices hit the second most negative levels since 1990.

Since 7/15, though, the extreme negative correlation between the Energy sector and the S&P 500 has started to reverse, In fact, the 100-day correlation has even just recently moved back to positive levels, meaning that the S&P 500 and the Energy sector have begun moving more in the same than opposite directions. Although the 200-day correlation coefficient is still near extremely inverse levels, it too has stopped going down and is starting to move towards a more positive relationship. Click here to learn more about Bespoke’s premium stock market research service.

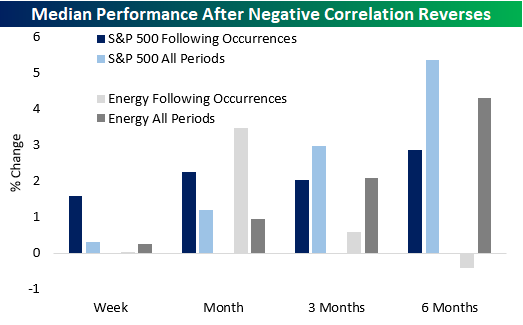

As mentioned above, on 7/15, the 100-Day correlation turned positive while the 200-day remained negative, which has only occurred seven other times since 1990 (with no other occurrences in the prior three months). The table below summarizes the performance of both the S&P 500 and the Energy sector following these occurrences. As you can see, with regard to the S&P 500, there is no clear trend in performance going forward as returns have generally been in line with the historical average for all other periods. As for the Energy sector, performance six months out was quite weak, as the sector was positive less than half of the time with a median decline of 0.4%. The last 25 years have been especially weak as the sector was lower six months later four times in a row. Click here to learn more about Bespoke’s premium stock market research service.

The chart below provides a visualization of the collective returns following each of the occurrences in the table above. When it comes to the S&P 500, its median return was better than ‘normal’; over the following week and month but weaker over the following three and six months. Similarly, the Energy sector also posited weaker than normal returns over the following three and six months.

Chart of the Day: New iPhone Coming – What That Means for Apple (AAPL)

Dollar Index Inflating

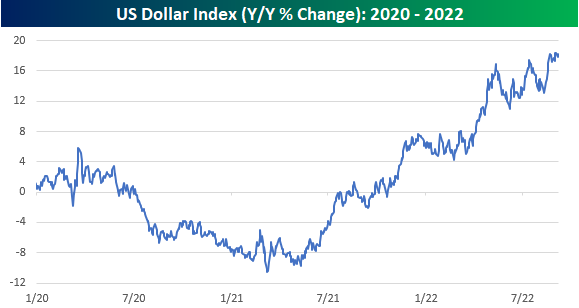

It’s a bit ironic that just as inflation is raging at the highest levels in decades, the value of the US dollar (at least relative to other currencies) has been surging. Imagine where we’d be if the dollar was falling in value. Just last week, the y/y change in the US Dollar Index topped 18.4% which is a rate of change not seen since the summer of 2015 when China was devaluing the yuan. Throughout the history of the US Dollar Index, there have only been a handful of other times that it has rallied this much over a year. Even rarer have been times when the y/y change exceeded 20%. Click here to learn more about Bespoke’s premium stock market research service.

The dollar has already seen a big gain, but could this rally match the rarified air of prior 20%+ y/y rallies? Anything is possible, but to get there, it’s going to have to do some heavy lifting. Just looking at a chart of the y/y change since the start of 2020, the momentum of the rally, while still trending higher, has slowed to more of a rangebound area than the blistering momentum experienced in late 2021 and early 2022.

A price chart of the Dollar Index illustrates why. For much of 2022, the comps for the y/y change have been relatively easy as the dollar sold off from its initial COVID surge and traded down to its lowest levels since 2018 and before that levels not seen since 2015. The Dollar Index then made a double-bottom last summer and started to rally in the fall. Therefore, now that the rally is starting to ‘lap’ its early stages, the comps are increasingly tougher. From 9/6/21 to 10/6/21, the US Dollar Index rallied 2.4%, which means that just for the y/y change to remain at current levels, it would need to rally at least that much and then more on top of that to push the gain up to 20%.

Bespoke’s Morning Lineup – 9/6/22 – Positive Futures…For Now

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There are things done today in electrical science which would have been deemed unholy by the very man who discovered electricity” – Bram Stoker

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Maybe we needed the weekend to pause and regroup. At least that’s the hope for the bulls. Futures are higher this morning after a news-packed Labor Day which saw volatility in Europe following news that Russia would cut off natural gas supplies to that region of the world until sanctions were lifted. Also, yesterday, OPEC+ announced that it would cut supplies by 100,000 barrels per day reversing the token increase from September after President Biden visited Saudi Arabia in the Summer.

Despite the positive pre-market tone, concerns still loom as the economy remains on a shaky footing and traders have become all to used to the market trading higher and giving up those gains throughout the trading day. The upcoming weeks are busy with investor conferences so be on the lookout for any negative commentary emanating from those get-togethers. In terms of economic data, the only report on the calendar today is the ISM Services for August. Economists are forecasting the headline index to slow modestly from 56.7 in July to a still expansionary reading of 55.0.

It’s hard to believe after the last week few weeks of selling that the S&P 500 still isn’t even at oversold levels. As shown in the graphic from page two of the Morning Lineup, just three sectors – Consumer Staples, Health Care, and Communication Services – are currently oversold while Energy is the lone sector at overbought levels. While the S&P 500 isn’t oversold, it did close out last week below its 50-day moving average (DMA) along with every other sector except Energy and Utilities.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

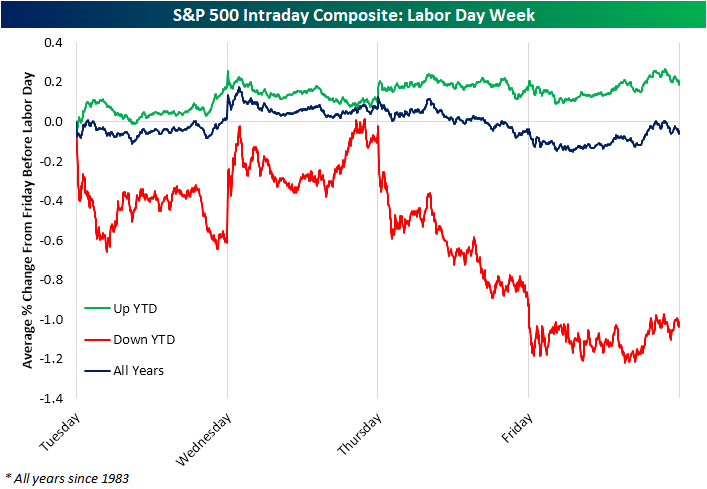

Labor Day Holiday Hangover

It’s the unofficial end of summer with Labor Day now here. While that may mean summer vacation for many traders is over, historically, the holiday-shortened week has averaged uninspired performance. Over the course of the entire week (from the close of the Friday before the holiday to the close of the following Friday), the S&P 500 averaged a modest decline of 0.13% with positive performance only half the time during the post-WWII period. However, breaking down the years by whether or not the S&P 500 was higher or lower on a year to date basis shows a more nuanced story.

Years in which the index was up year to date heading into the holiday have tended to see modest further gains that week. Tuesday has typically been the best day of the week with a 15 bps move higher. On the other hand, years when the S&P 500 was lower YTD have been far worse. The Tuesday after Labor Day has nearly averaged a full 1% decline with positive performance just 40% of the time. That average is somewhat skewed by a 9.9% drop the lady after Labor Day in 1946, but even still, the median decline has been 0.50%. Thursday and Friday have similarly averaged declines albeit much smaller in size.

Looking at the intraday pattern going back to the start of our data in 1983, the bulk of the decline came from midweek on. As shown in the intraday composite below, the S&P 500 has on average almost turned positive by Wednesday’s close, but on Thursday and Friday it has tended to face heavy selling pressures. The series for the years when the S&P 500 was down YTD looks a lot more extreme than the one for years when it was up YTD, but that’s because of the relatively small sample size (just eight years since 1983). In those eight years, though, the S&P 500 was only up the day after Labor Day twice (1990 and 2015). Buckle up! Click here to learn more about Bespoke’s premium stock market research service.