Bespoke’s Morning Lineup – 9/12/22 – Starting Off On a Positive Note

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“See things in the present, even if they are in the future. ” – Larry Ellison

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It looked earlier like futures were going to pick right up where they left off last week, but the positive tone in the pre-market has been weakening ahead of the opening bell. There wasn’t much to drive the positive tone earlier, and there has been no apparent catalyst for the weakness in the last half hour. It’s a quiet day for data today as there are no economic reports on the calendar, and the only earnings report of note is Oracle (ORCL) after the close. The big report of the week comes tomorrow, though, when August CPI will be released at 8:30 AM. Economists are currently forecasting the headline reading to show a decline of 0.1%, although, given the trajectory of gas prices and other secondary indicators, so-called whisper numbers are even more negative.

The holiday-shortened week started off poorly last week but finished on a strong note with three straight gains including two days where the S&P 500 surged 1%+ on solid (+400) breadth. The rally also helped to bring the S&P 500 back above its 50-DMA. It’s been a roller-coaster summer for US stocks as the monster rally in the S&P 500 tracking ETF (SPY) off the June lows failed right at the 200-DMA and downtrend line from the January highs. The sell-off was arrested last week right at the uptrend from the June lows, and with three weeks of trading left in the third quarter, the S&P 500 finds itself in a bit of no man’s land.

All eleven sectors have turned in positive returns over the last five trading days (which includes the Friday before Labor Day). Materials and Consumer Discretionary have led the stampede with gains of just under 5% while Financials aren’t far behind rallying by 3.65%. Consumer Staples is the only sector up less than 1% and one of just three sectors still below its 50-DMA. The only two other sectors below that level are Communications Services and Technology. They are also both the only sectors down over 20% YTD. Given its size in the market, Technology is usually the sector that leads the ship, but it is nice to see that the broader market can rally even if that sector underperforms.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 9/11/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Tech Dystopia

The Rise of Mobile Gambling Is Leaving People Ruined and Unable to Quit by Maxwell Strachan (Vice)

Problem gamblers used to have to drive to a casino or at least a gas station. Now, smartphones deliver a near-constant barrage of prompts and opportunities to gamble, creating disastrous consequences for personalities who are attracted to risk. [Link]

‘It’s a slippery slope’: Most consumers underestimate monthly subscription costs by at least $100, study says by Sarah O’Brien (CNBC)

Low monthly prices, automatic payments, and easy sign-ups mean that consumers are paying over $100/month in forgotten subscriptions. [Link]

China

China’s COVID-19 Stagnation Has No End in Sight by James Palmer (Foreign Policy)

Political leadership remains anchored to its zero COVID policy. [Link]

China’s Economic Slump Bodes Ill for Birth Numbers by Liyan Qi (WSJ)

Low birth rates mean Chinese deaths are set to outnumber births as soon as this year; models suggest the total population is set to fall from just over 1.4bn to below 800mm by the end of this century. [Link; soft paywall]

Ukraine

‘We have already lost’: far-right Russian bloggers slam military failures by Pjotr Sauer (The Guardian)

Far right military bloggers in China are starting to lose hope that the country’s invasion may eventually succeed as Russian lines collapsed in the country’s east and south this week. [Link]

Russia Is Buying North Korean Artillery, According to U.S. Intelligence by Julian E. Barnes (NYT)

Facing shortages of key inputs for construction of even the most basic military equipment, Russia is turning to minor allies to source warfighting material. [Link; soft paywall]

Loosening Markets

Housing Market Update: Mortgage Rate Spike Further Cools Homebuying and Selling by Tim Ellis (Redfin)

Some markets are starting to see outright price declines as new listings plunge, price cuts abound, and the combination of soaring mortgage rates and sky-high prices destroy demand. [Link]

Ocean Shipping Rates Have Plunged 60% This Year by Costas Paris (WSJ)

After a desperate scramble to book freight capacity amidst an avalanche of demand for goods, retailers are faced with inventory overhangs and the freight market is falling apart with shipping rates collapsing in 2022. [Link; paywall]

Retail Activity

Robinhood Unveils Index to Track Customers’ Favored Stocks by Alexander Osipovich (WSJ)

A new index constructed by free-to-trade brokerage Robinhood weights stocks by their customers’ “conviction” or relative frequency shares are held in customers’ accounts. [Link; paywall]

EXCLUSIVE Deal partner for Trump’s Truth Social fails to get backing for SPAC extension -sources by Svea Herbst-Bayliss (Reuters)

As a deadline to approve the proposed blank check takeover of Trump’s nascent social media company loomed, the transaction looked like it might be in doubt. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — 9/9/22

A Year of Friday Action

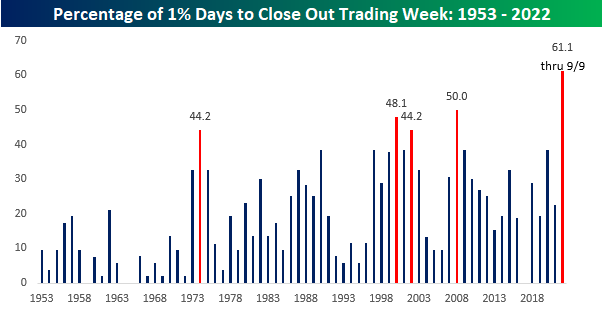

There’s still time left in the trading day which means that anything can happen, but the equity market is on pace to close out the week with a Friday gain or loss of 1%+ for the 22nd time this year. Going back to 1953 when the five-trading day week started on the NYSE, there have only been four other years where the S&P 500 rallied or declined at least 1% on the final trading day of the week (there have been another six where there were 20). The only years where there were more 1% moves to close out the week were 1974 (23), 2000 (25), 2002 (23), and 2008 (26). Keep in mind, though, that while this year is just four off the record-high pace, there are still 16 weeks left in the year! The year is only two-thirds complete, but already Fridays have seen a lot of action.

To make more of an apples-to-apples comparison, on a percentage basis, 61% of all weeks this year have closed out with a one-day move of at least 1%. Granted, it’s not a full year of prices yet, but in prior years since 1953, there was never a year where the S&P 500 closed out the trading week with a gain or loss of at least 1% more than half of the time. In 2008, half of all weeks ended with moves of that magnitude while the percentage in 2000 was 48.1%, and 1974 and 2002 each closed out the week with 1%+ moves 44% of the time. These levels of volatility are a far cry from a year like 2017 when there wasn’t a single Friday that the S&P 500 rallied or declined 1%. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 9/9/22 – Closing on a Positive Note

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I believe that, young or old, we have as much to look forward to with confidence and hope as we have to look back on with pride.” – Queen Elizabeth II

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After its longest losing streak in years ended earlier this week, the Nasdaq is now on pace for a third straight day of gains and a positive week for stocks. The last time the Nasdaq was up three days in a row was to close out July. The catalyst for this morning’s rally appears to be weaker-than-expected inflation data out of China and some weakness in the dollar. Treasury yields are flat to lower even as crude oil is up over 1%.

While she was queen 15 different prime ministers served under Queen Elizabeth II. That’s a lot! Another statistic we found interesting was that during her reign there were also 13 separate bear markets in the US (20%+ declines from a high on a closing basis with no rallies of 20%+ in between), including one where the S&P 500 declined over 50% and another where it dropped over 48%. Besides those, there were five other bear markets where the S&P 500 lost more than one-third of its value. In economic terms, there have been eleven confirmed recessions in the US since the Queen was coronated in 1953, and we could be on the verge of a twelfth now.

During each of these economic and market downturns, it probably felt like the end of the world, and you couldn’t have faulted someone for panicking at the moment, but with the benefit of hindsight, each of those periods ended up being nothing more than a bump in the road (some more than others). During the Queen’s reign, the S&P 500 rallied more than 16,000% or more than 7.6% annualized before even taking dividends into account. With dividends, the annualized rate of return is over 10%. US Real GDP per capita over that same period increased by three and a half times rising from $17,093 to $59,288. With the benefit of all that experience, if you had told the Queen that the economy was contracting or that stocks were on the verge of a bear market, rather than pull her hair out and freak out, instead, in her normally calm demeanor, she would have likely responded with something along the lines of “been there, done that”.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day: 2022 and the End of “Buy the Dip”

Bulls Back Below 20%

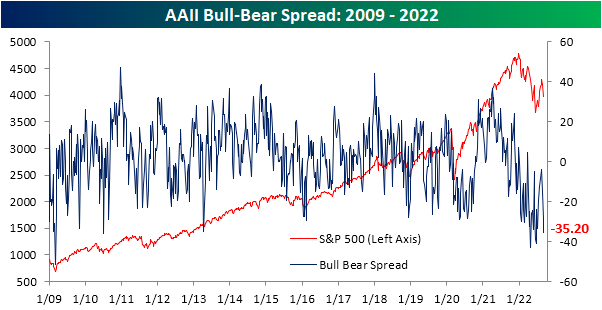

Although the S&P 500 managed to bounce yesterday and today (as of this writing), further declines in the days prior have meant sentiment continued to take a header. In the latest update, only 18.1% of responses to the weekly AAII sentiment survey reported as bullish. That marked the third consecutive decline in bulls resulting in the weakest reading since the end of April.

Bearish sentiment in turn has rocketed higher, climbing back above 50% last week and rising further to 53.3% this week. That is the highest level of bearish sentiment since the week of June 23rd and ranks in the top 2.5% of all weeks on record.

Given the large inverse moves in bulls and bears, the spread of the two has fallen deeper into negative territory after almost turning positive only a few weeks prior. We would also note that the over 30-point drop in the past month is the largest since a 47.4-point decline at the end of April and ranks as the 29th largest decline in a four-week span on record. With 23 weeks of negative readings in a row, the current stretch is now the second-longest streak of negative readings in the bull-bear spread on record.

Investors appear to be increasingly polarized between bullish and bearish sentiment as well. As optimism and pessimism have experienced wild swings, neutral sentiment has been relatively stable. Neutral sentiment only rose one percentage point this week, rising to 28.7%. That is right in the middle of its recent range. Click here to learn more about Bespoke’s premium stock market research service.

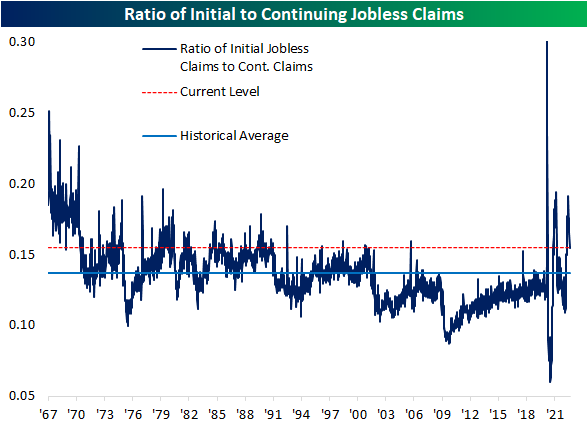

Continuing Claims Catching Up With Initial Claims

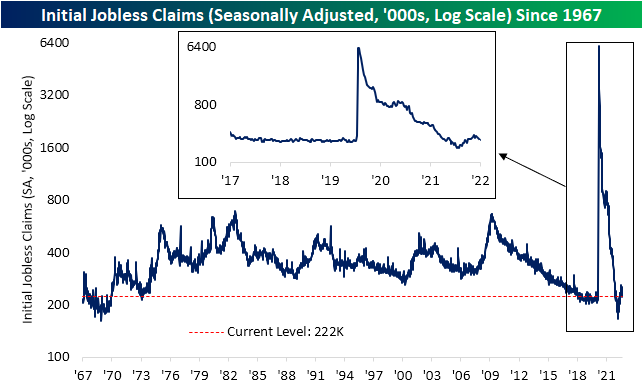

Although this year has seen seasonally adjusted jobless claims drift higher, the indicator is on a four-week-long streak of sequential declines. The latest reading released this morning fell by 6K to 222K from the downwardly revised number of 228K last week. In total, claims have now fallen by 30K during that streak of declines and are another 9K below the high of 261K from mid-July.

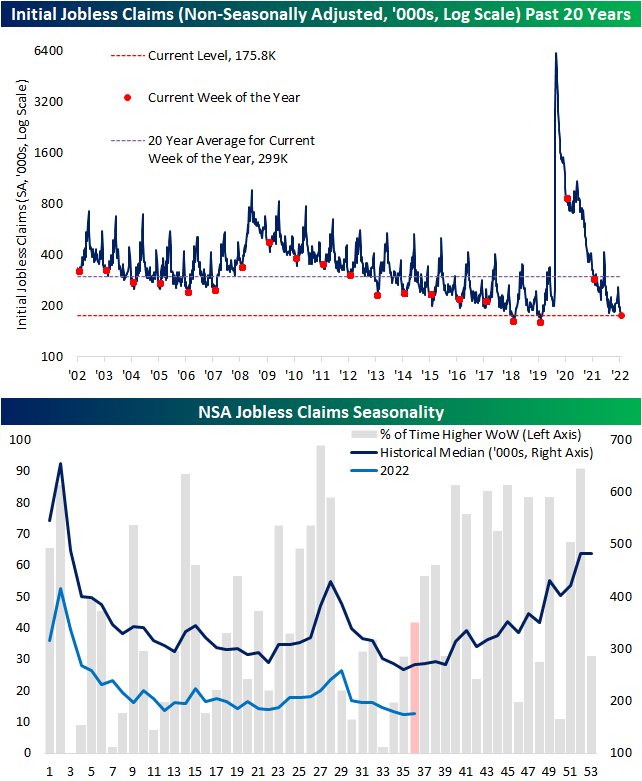

On a non-seasonally adjusted basis, claims were up slightly from 173.9K to 175.8K. Modest increases are the standard for this point of the year as claims have likely put in place their seasonal low before turning higher into year-end. As shown in the first chart below, this week’s reading is historically strong but came up short of the lows for the comparable weeks of 2018 and 2019.

Although initial claims have been improving and came in lower than expectations, the opposite is true for continuing claims. Lagged an additional week to initial claims, seasonally adjusted continuing claims rose to 1.473 million (expectations of 1.438 million) which is the highest level since the start of April. Unlike initial claims, in spite of recent increases, continuing claims have ample headroom until they reach their pre-COVID range as current levels remain consistent with some of the strongest in over 50 years. In other words, even though initial claims have found respite and have reversed lower, the opposite is true for continuing claims which is evident through the ratio of the two having taken a sharp turn lower in recent weeks. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 9/8/22 – Listless Trading

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“A government big enough to give you everything you want is a government big enough to take from you everything you have.” – Gerald Ford

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures have been trading rangebound around the unchanged line this morning as the ECB rate decision (hiked rates by 75 bps pretty much as expected) and lower-than-expected initial jobless claims have caused a pickup in trading activity generally in a lower direction. The only other indicator on the calendar in the US is Consumer Credit at 3 PM Eastern. Besides the data, there are plenty of investor conferences and even some Fedspeak on the calendar, so be on the lookout for tape bombs throughout the day.

New UK PM Liz Truss has announced a number of initiatives to help alleviate stress from surging energy prices. In a more long-term measure, she announced a lift of the ban on fracking and plans to approve more drilling for oil. In a more short-term-based measure, the new PM also announced a price cap on energy prices for consumers to take effect for the next two years. That should provide short-term relief, but the quote from Gerald Ford above should serve as a reminder – while prices may be capped, consumers will have to pay for it in some way (either through higher taxes or restrictions on the amount of energy one can use).

Investors have been able to buy and sell long-term US Treasuries via ETFs through the iShares 20+ Year US Treasury ETF (TLT) for just about 20 years now. In the first few years of the TLT’s existence, volatility in the ETF was what you would expect for a US Treasury – low. From 2003 through early 2007, the average daily move of TLT over a trailing 200-day period ranged between 0.30% and 0.70%.

Once the housing market crashed and the Financial Crisis set in, volatility in TLT surged with the average daily move breaching 1% on its way to 1.10%. As markets stabilized in 2009, volatility pulled back but never quite back down to its pre-Financial Crisis range. Then in 2011, volatility surged again as the US had its long-term credit rating downgraded in August 2011. Average daily volatility peaked in that period several months later in April 2012 and then began a multi-year decline to a range of around 0.50% per day.

Like everything else in the economy, COVID wreaked havoc on the Treasury market pushing the average daily move in TLT back up above 1%, but the exaggerated volatility was short-lived, and the market quickly returned to more stable levels by June 2021. The period of calm was just as short-lived, though. As the Fed found religion regarding inflation in late 2021 pushing long-term rates higher, volatility has once again surged. Just yesterday, the 200-day average daily move in TLT once again topped 1% for the first time since June 2020. How long this period of heightened volatility lasts remains to be seen, but if rhetoric on the part of Fed officials is to be believed, a return to calm seems a long way off.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Historic Small Cap Volatility

It’s no secret that growth stocks have underperformed value stocks over the last twelve months. The trailing-twelve-month performance spread (percentage points) between the small-cap growth and large-cap value indices, two opposite ends of the equity market, is currently at -20.5 percentage points. Although this is far above the recent low of -33.9 ppts, the current reading is in the bottom 6% of all days since the mid-1994 (when both the MSCI USA Small Cap Growth and MSCI USA Large Cap Value Index were active). Interestingly, this year’s trailing twelve-month performance spread was the lowest since 2001 (unwind of the dot-com bubble). Funny enough, the spread had hit the highest level since early 2000 in 2021, as excessive performance from small-cap growth stocks has tended to reverse course after reaching extreme levels.

Small-cap growth stocks tend to trade at significantly higher valuation multiples than large-cap value stocks, which is part of the reason that small-cap growth equities have sold off at a higher rate than their counterparts. These stocks also have higher betas, so market moves have a disproportionate effect. These factors have caused the average daily percent change spread between the two indices to reach an extremely elevated level, the highest since 2000 – 2001. This measure of volatility is also yet to roll over, indicating no end to the volatility regime that has been in place. Click here to learn more about Bespoke’s premium stock market research service.