May Manufacturing Starting Off Strong

The first manufacturing data for May came out this morning with the release of the New York Fed’s Empire State Manufacturing Survey. General business conditions remain at historically strong levels although there was some slowing in May as was expected. After hitting the highest level since October 2017 last month, it was expected to fall to 23.9 in May. The index did in fact decline, but only to 24.3. While lower, that is still around some of the strongest levels (excluding last month) in three years as more businesses continue to report improvements in business conditions than weakness.

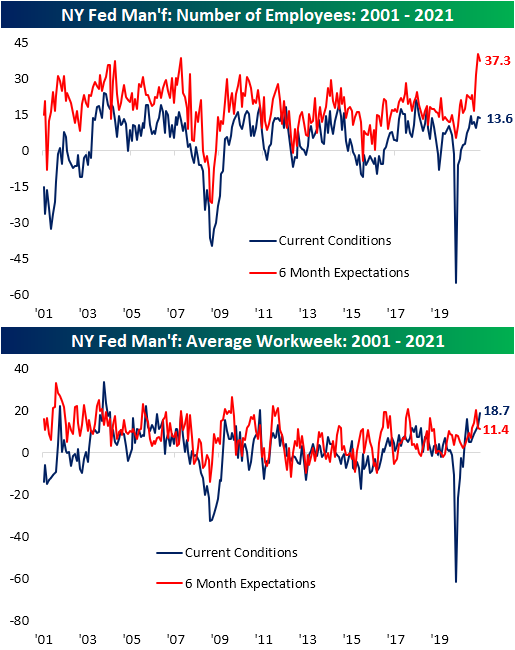

Breadth in this month’s report was pretty mixed; namely with regards to current conditions versus expectations. Every index is still showing an expansionary reading with particular strength out of the indices for the present situation. In fact, most of those indices still sit in the top decile of their historical range with a few like those for unfilled orders, delivery times, and prices even at or just off of record highs. But there were a handful that moved lower: delivery times, inventories, and number of employees.

Regarding expectations, it was much harder to find an increase. Delivery times and technology spending were the only two of these indices to rise month over month. While many indices for expectations still sit at historically strong levels, there are more that are middling within their respective historical ranges. Overall, the report showed that New York area firms have seen a peak in optimism even as they continue to report strong conditions.

Demand certainly appears to be one area without much in the way of weakness. New orders rose 2 points month over month to 28.9. That is the highest level in just over 15 years and the only other readings as high occurred throughout late 2003 to mid-2004. Those orders are making their way out the door at an increased rate too as shipments climbed to 29.7. That index has been making a vertical climb since the winter as it reached its highest level since August 2007.

Despite this, NY area firms are not fulfilling orders fast enough. Last month saw the Unfilled Orders index rise by one of the largest amounts in a single month on record, and it continued to climb albeit by a much smaller 0.2 points in May. The only month on record with a higher reading in unfilled orders was September 2001. Inventories were one of the few current condition indices to fall in May, although the reading still indicated growth. In other words, those unfilled orders are not necessarily drawing down on inventory levels.

Supply chains are one of the main areas that are likely holding things back. Higher readings in the delivery times index mean that businesses are reporting that it takes longer for products to reach their destination. Even after falling 4.5 points in May off of the April record, the current level sits well above the prior record high of 16.2 from March 2018.

In addition to taking longer for products to get to where they are going, the price point is on the rise. Both indices for prices paid and received rose to record highs in May. In fact, over the past two months, there has not been a single respondent to have reported a decrease in prices paid. That is the first time that has occurred since February and March 2012.

Last week saw a blockbuster job openings report and the Empire Fed survey is showing a similar willingness to take on more workers. The current conditions index for the number of employees continues to show that businesses are on net increasing their workforce, though at a slowed pace from April. Additionally, the index is at a much less elevated part of its range (the 81st percentile) relative to other indices within the report, but the much more elevated reading in expectations (98th percentile) would indicate the businesses would like to take on far more workers. That is, there appears to be a bit of a disconnect between the actual number of new hires and businesses’ expectations to take on more workers. Potentially as a result of an inability to hire enough workers, the average workweek has continued to climb. At 18.7, the index is at its highest level in a decade. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 5/17/21 – Mind the Gap

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Sometimes buying early on the way down looks like being wrong, but it isn’t.” – Seth Klarman

It’s been a weak morning for equities as futures trade near their lows of the morning. Economic data out of China generally missed expectations, and that has set the negative tone heading into the new workweek as speculative assets like crypto and lumber futures are under pressure.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of overnight economic data, as well as the latest US and international COVID trends including our vaccination trackers, and much more.

It’s been quite a run for value stocks. Over the last six months, the S&P 500 Value index has rallied more than 22% while its growth counterpart has only rallied half of that amount (11.7%) during that same span. With a performance gap between the two of 11 percentage points, the spread is near historically high levels, and it was even wider earlier last week.

The chart below shows the rolling six-month performance gap between the S&P 500 Value and Growth indices going back to the mid-1990s. At last week’s high of 17.5 percentage points, the spread between the two indices is the widest in just under 20 years (June 2001). It got close to current levels in the months coming out of the financial crisis but peaked just shy of last week’s high. While the spread is currently extreme now, keep in mind that it was at record extremes in the other direction last September, so value stocks are basically just catching up to growth.

Bespoke Brunch Reads: 5/16/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Papers

The 15-Hour Week: Keynes’s Prediction Revisited by Nicholas Crafts (Warwick Economics Research Papers)

Longer life expectancy in retirement and longer retirement periods mean that non-work hours have risen 60% over the last 90 years or so, meaning Keynes was right about his prediction for less work but wrong about the distribution of when that time would be enjoyed. [Link; 17 page PDF]

School Reopenings, Mobility, and COVID-19 Spread: Evidence from Texas by Charles J. Courtemanche, Anh H. Le, Aaron Yelowitz & Ron Zimmer (NBER)

A new paper argues that reopenings of Texas schools drove 43,000 new COVID-19 cases and 800 deaths in the first two months of reopening for districts, with changes in adult behavior that school reopenings allowed playing significant contributing role in the overall increase. [Link]

Defense Contracts

Luxury jet makers battle over lucrative spy plane niche by Allison Lampert and Tim Hepher (Reuters)

Lower operating costs make Gulfstreams popular platforms for militaries operating intelligence-gathering platforms that sniff around foreign radar and communications networks looking for signals intelligence. [Link]

The Pentagon Inches Toward Letting AI Control Weapons by Will Knight (Wired)

US military leadership is currently considering if they should allow machines to decide whether weapons are used and what they’re aimed at. [Link; soft paywall]

Post Pandemic

Many Vaccinated Americans Are Still Uncomfortable Returning to Public Activities. The U.S. Economy Needs Them by Alex Silverman (Morning Consult)

People who have received a vaccine are at lower risk than their peers, but are still less likely to eat in a restaurant, travel abroad, or go to the gym as concerns that lead them to seek vaccination aren’t totally solved by the dose. [Link]

The people who want to keep masking: ‘It’s like an invisibility cloak’ by Julia Carrie Wong (The Guardian)

Masking has been a necessary step to preventing the spread of COVID, but has also served to keep people anonymous and discrete, which for some holds an appeal that will last long past the pandemic. [Link]

Risk Appetite

New Amazon bond rivals yield on US Treasuries in record-breaking sale by Joe Rennison, Dave Lee and Camilla Hodgson (FT)

Amazon borrowed at a record low spread to Treasuries this week, part of a staggering decline in the risk premiums offered to investors in the US corporate bond market. [Link; paywall]

What Happens to Stocks and Cryptocurrencies When the Fed Stops Raining Money? by Greg Ip (WSJ)

The latest in a long line of opinion columns asking the question “is the Fed entirely responsible for elevated asset prices across financial markets”. [Link; paywall]

From Dutch Tulips to Internet Stocks, How to Spot a Financial Bubble by Jon Hilsenrath (WSJ)

The soaring prices of extremely speculative assets in 2020 and 2021 bear much in common with similarly speculative manias of the past. [Link; paywall]

Malfeasance

Colonial Hacker Group Seeks to Shift Blame for Ransomware by Alyza Sebenius and Ryan Gallagher (Bloomberg)

The hack which has left much of the US Southeast without gasoline may have been conducted by an affiliate group of the hackers whose software was used to execute the attack. [Link; soft paywall]

Crypto Fraudsters Made a Big Bet on Dogecoin, New York Claims by Olga Kharif (Bloomberg)

An NYAG suit alleges a crypto trading platform misused funds by betting the house on Dogecoin, a crypto that started as a joke and has since exploded higher. [Link; soft paywall]

Semiconductors

Your Car, Toaster, Even Washing Machine, Can’t Work Without Them. And There’s a Global Shortage. by Alex T. Williams (NYT)

A detailed look at the global semiconductors shortage and some policy proscriptions for how it might be fixed longer-term. [Link; soft paywall]

Middle East

The War That Shouldn’t Have Been by Neri Zilber (Newlines)

An insightful look at the roots of the most recent flare-up of violence in Israel and Palestine: internal political realignments within both Gazan and Israeli politics have seeded and exacerbated the conflict. [Link]

Education

Catholic Schools Are Losing Students at Record Rates, and Hundreds Are Closing by Ian Lovett (WSJ)

The United States had almost 6,000 Catholic schools before the pandemic, but hundreds have closed and enrollment is falling, with urban dioceses especially pressured by a declining prevalence of Catholicism nationally and difficulties among parents meeting the cost of an education within the faith. [Link; paywall]

Natural World

Groundbreaking effort launched to decode whale language by Craig Welch (National Geographic)

Whales have a language, but knowing it exists and translating it into something that humans can understand (let alone speak back) is a massive challenge for scientists. [Link; soft paywall]

Are These Two Men Going After the Holy Grail of Himalayan Climbing? (Climbing)

There’s speculation brewing that two of the most accomplished climbers in the world are considering a double-ascent of Everest and nearby peak Lhotse in one climb. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

High Flyers At Much Lower Altitudes

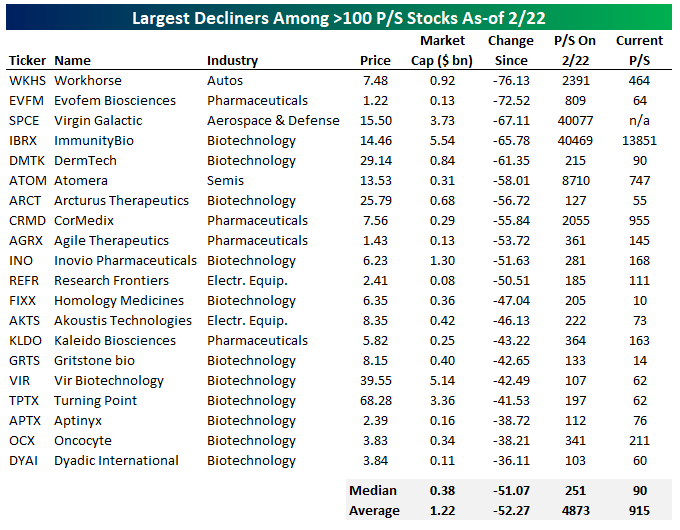

Stocks with extreme valuations have taken a serious haircut since the space peaked on February 22nd. On that date, 59 stocks in the Russell 3000 had a price-to-sales multiple north of 100x. That group had a median price-to-sales multiple of more than 311x on that date. Today, those 59 stocks have a price-to-sales multiple that’s 53.6% lower than it was February 22nd. That compares with a median price decline of 25.4% among the 59 stocks, or -22.5% weighted by market cap. In other words, while prices in this group have been hit very hard, their valuation has compressed substantially more.

Below we show the 20 stocks out of the 59 that have seen the largest drops in price since February 22nd. Among this worse-performing subset, the median stock has plunged 51%, in-line with the median 58% drop in price-to-sales since February 22nd. Despite the huge drops in prices over the last few months, these names are still very aggressively valued at a median price-to-sales multiple of 90x. Virgin Galactic (SPCE) has actually seen an infinite price-to-sales multiple after reporting zero revenue in its most recent quarter. From a valuation perspective, it’s still hard to call any of these stocks attractive. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 5/14/21 – Retail Sales Reset

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“End? No, the journey doesn’t end here.” – J.R.R. Tolkien

If you thought that with this week’s inflation data now behind us that we could coast into the weekend, think again. There’s a ton of data on the calendar this morning, including Retail Sales, Industrial Production, and Michigan Confidence. Futures are building on yesterday’s gains after quiet sessions in Asia and Europe, but that could change following the data releases.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of overnight earnings reports and economic data, as well as the latest US and international COVID trends including our vaccination trackers, and much more.

It’s been a rocky week for the market, but the overall trend has been lower this week. Over the last five trading days, all eleven S&P 500 sectors are in the red with Consumer Discretionary (-4.66%), Technology (-3.48%), and Communication Services (-2.69%) all trading down at least 2.5%. Sectors that have held up the best include Consumer Staples (-0.06%), Materials (-0.16%), Health Care (-0.32%), and Utilities (-0.38%) which are all down less than half of one percent. Despite the broad-based declines over the last week, not a single sector is oversold, only two are below their 50-DMA, and five are still overbought.

Bullish Sentiment Down Big

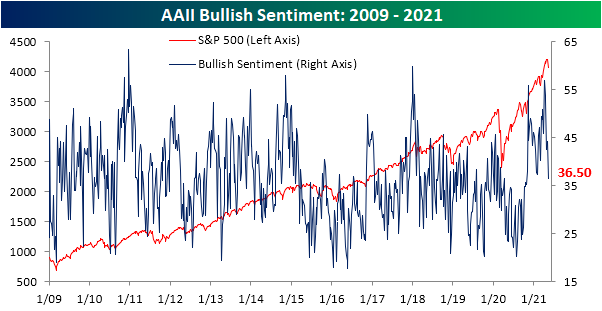

The past week has been one of the worst short term runs for the major indices of the past several months, and sentiment this week is reflecting that negative price action. Bullish sentiment as measured by the AAII weekly sentiment survey took a spill, dropping 7.8 percentage points to 36.5%. Whereas just over a month ago bullish sentiment hit a multi-year high at 56.9%, this week’s reading was the lowest since the last week of October.

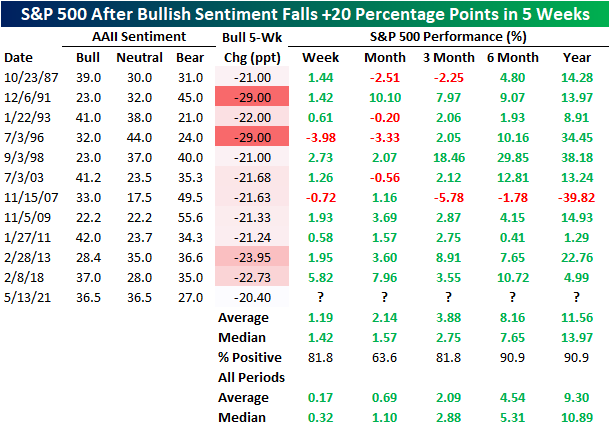

The over 20 percentage point decline in that time was the biggest drop in a span of five weeks since a 22.73 percentage point decline in the five weeks ending February 8th, 2018. In the table below, we show the past 11 periods in which bullish sentiment fell by at least 20 percentage points in five weeks without another occurrence in at least a year. Overall, they have consistently preceded solid runs for the S&P 500 with frequent moves higher that are on average larger than the norm. One and three months later have both seen the S&P 500 trade higher 81.8% of the time and a half year to a full-year out has seen the index lower only one time (in 2007). Additionally, each of the prior instances since 2009 has been marked by the S&P 500 trading higher across all time frames.

With bullish sentiment lower, bearish sentiment gained 3.9 percentage points. At 27%, it is at the highest level since early February though still a few percentage points above the historical average of around 30%.

That has resulted in the bull-bear spread dropping 11.7 points to 9.5. That is the first single-digit reading in the spread since the first week of February, but it still indicates that overall sentiment remains biased towards the bulls.

While bearish sentiment has only risen modestly, neutral sentiment is flying. After gaining another 4 percentage points this week, neutral sentiment hit the highest level since the second week of 2020. Similar to bullish sentiment, the move higher in neutral sentiment over the past few weeks has been one of the largest in roughly three years. Click here to view Bespoke’s premium membership options for our best research available.

Impressive Initial Claims; Anticlimactic Continuing Claims

Last week’s initial jobless claims number had been the first break below 500K since the pandemic began. Although that no longer applies this week after a 9K revision higher to 507K, initial claims continue to impress as the most recent print saw a more considerable break below 500K. Claims this week fell 34K to another new low of 473K. In total over the past two weeks, initial jobless claims have now fallen 117K.

On a non-seasonally adjusted basis, regular state claims combined with claims from the Pandemic Unemployment Assistance (PUA) program totaled 590.97K this week; another pandemic low. The lion’s share of these claims are of the regular state programs as only 103.57K are PUA claims. That reading was ever so slightly higher this week (up 1.76K) and remains just off the lowest level of the pandemic.

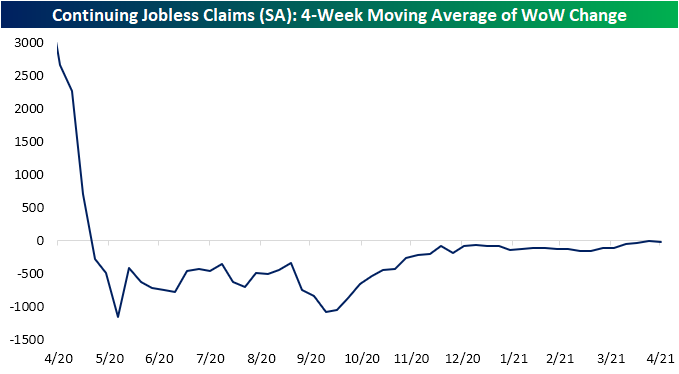

While initial claims have seen great progress over the past several weeks, continuing claims continue to be a bit more disappointing. For the first time since the week of April 9th, seasonally adjusted continuing claims did finally fall, dropping 45K to 3.655 million, but that was 5K less than the decline that had been penciled in by economists. Overall, the general trend remains the same. Whereas there were massive improvements throughout much of 2020, the pace of those improvements slowed last fall. From the end of 2020 through the end of March, claims had averaged around a 100K decline per week. Since the start of April, it has slowed even further with claims averaging only a 14K decline over the past four weeks as shown in the second chart below.

The picture is slightly better when including all programs (although this data is lagged by an extra week). Through the week of April 23rd, total continuing claims across all programs rose 697K to 16.884 million. While lower than most of the pandemic, that had erased the prior two weeks moves lower and was the largest one-week uptick since the first week of March. That uptick was driven almost entirely by PUA claims and Pandemic Emergency Unemployment Compensation. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 5/13/21 – Inflation: Part II

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Learn to take losses. The most important thing in making money is not letting your losses get out of hand.” – Marty Schwartz

After yesterday’s shockingly high headline readings in CPI, it was a tentative picture in markets ahead of the April PPI. While consensus expectations called for a m/m increase of 0.3% at the headline level and an increase of 0.4% on a core basis, the actual numbers once again came in higher than expected although not to the same degree as Wednesday’s CPI (0.6% headline, 0.7% core). Like the movies, the sequel is never as exciting as the original. PPI wasn’t the only report on the calendar this morning, though. Jobless claims came in a bit lower than expected on an initial basis and a bit higher on a continuing basis.

Futures were indicated flat to higher into the report with the Nasdaq leading the way, but they are also off overnight highs as well. Commodities are trading heavy this morning, while bitcoin is plunging following a tweet by Elon Musk that Tesla would no longer accept payment in bitcoin until it was mined in more environmentally friendly ways.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of overnight earnings reports and economic data, a look at some key commodities, as well as the latest US and international COVID trends including our vaccination trackers, and much more.

Over the last three trading days, the Nasdaq is down over 5%, and while that is a steep decline for such a short period of time, it’s hardly unprecedented in the Nasdaq’s history. What is unique about the current decline is just how steep the losses have been in the US Treasury market. While higher rates are bad for growth stocks, normally, when you see a decline so large in the equity market, bonds provide a cushion. Along with the 5%+ decline in the Nasdaq, long-term US Treasuries are also down over 2%. Going back to 1987, there have only been eight other three-day periods where the Nasdaq was down over 5% and long-term US Treasuries dropped more than 2% (highlighted in the chart below).

Gas Prices Put Into Perspective

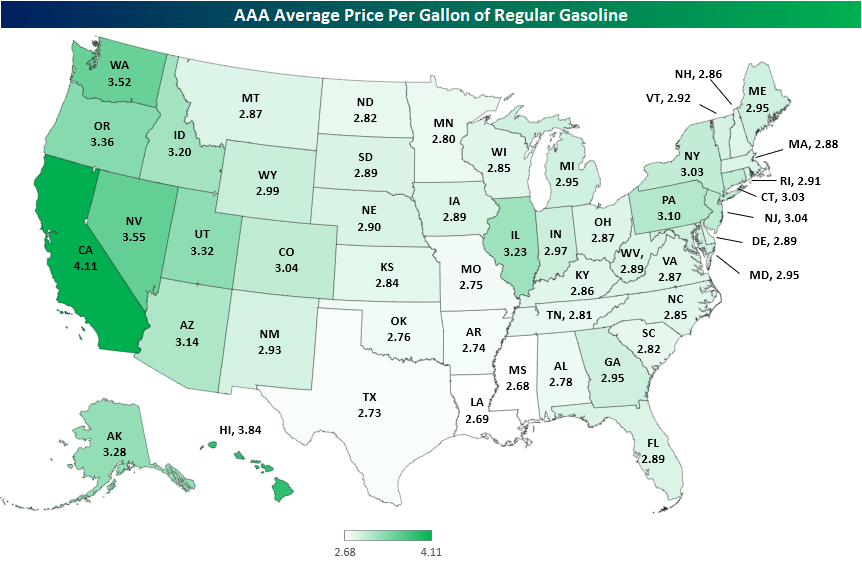

The Colonial Pipeline ransomware attack resulted in a shutdown of a major artery on the East Coast. While the pipeline is partially back online and anticipated to once again be fully operational later this week, the temporary supply outage has resulted in headlines of long lines and some gas stations even totally running out of product to sell, and that has only started to feed on itself causing more hoarding. As a result, the national average for a gallon of gasoline according to AAA crossed back above $3 this week for the first time since October 2014.

According to AAA, just in the past day, the average price of a gallon of regular unleaded gasoline has risen 2.3 cents and over the past week, it is up 8.1 cents. At an annualized pace, the price of a gallon of regular gasoline is up 281.24% in the past day and 143.9% over the past week. Higher grades of gasoline and diesel have risen by a lesser amount but have likewise seen significant appreciation.

At face value, those readings may look alarming, but from a historical standpoint, we’ve seen far larger. Looking again at the annualized weekly change for regular gasoline in the chart below, the current reading actually comes up just shy of the top decile of all readings since 2004, and there were even higher readings as recently as this past February and March. Even accounting for seasonality (gray shaded regions in the chart highlight every month of May), prices tend to move higher this time of year, and there have been multiple times in the past that gasoline prices have risen at as fast of a clip as now in the month of May. For example, last year was one instance in addition to 2015 and 2016. So, from a national perspective, this week’s uptick in prices at the pump is not necessarily extreme.

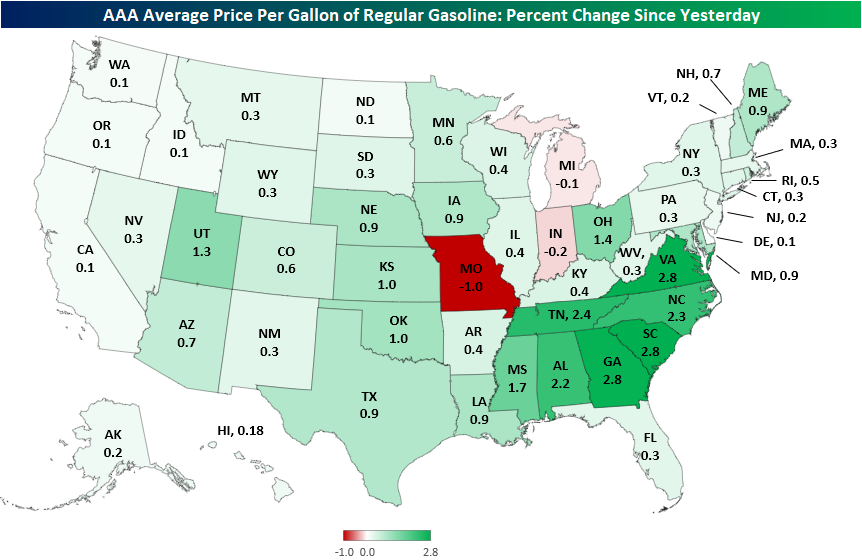

As previously mentioned, the Colonial Pipeline is a major piece of energy infrastructure on the East Coast. In other words, while the national average of gas has risen sharply as a result of the event, the largest increases have been concentrated to a specific region of the country: the Southeast. In the heatmap below, states colored with deeper shades of green indicate those where the average price of a gallon of gas have risen the most in the past week.

Places like Georgia, Alabama, and the Carolinas (all of which the Colonial Pipeline pass through) have seen their states’ average gas prices rise in the mid-to-high single-digit percentage range over the past week; the highest increases in the country. Moving further north along the Eastern Seaboard, the increases in gas prices become less steep but still notable. The vast majority of states in the Midwest, New England, and Mid Atlantic have seen prices rise only in the 2 to 3% range. The same applies to the states in the heartland. But moving further out West, price appreciation has been even smaller. Most Western states have seen the average gas price rise in the 1% range, which is exactly what you would expect to see at this time of year.

Looking at price changes in the past day alone, it is largely the same story. Much of the South has seen prices rise the most rapidly while prices further North have not risen by nearly as much. In fact, states like Missouri, Indiana, and Michigan actually saw prices move slightly lower. Again, the West also has seen prices modestly higher.

Without diminishing any of the effects that the shock of a sharp uptick in prices could have, we would also note that even after the significant appreciation, gas prices in the South remain some of the cheapest in the country. California and other West coast states still have the highest prices per gallon in the country while places like Louisiana and Mississippi have the cheapest. Click here to view Bespoke’s premium membership options for our best research available.

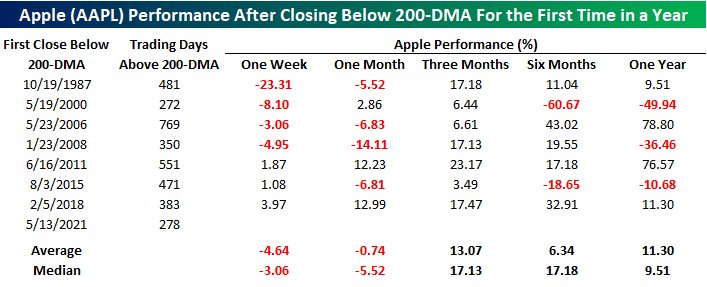

Chart of the Day – Apple (AAPL) Falls From the Tree

COTD Bullet Points:

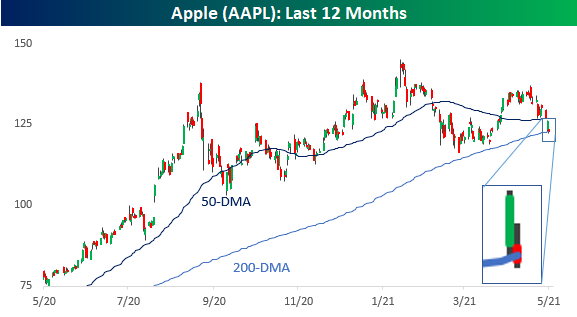

- Apple (AAPL) is on pace to close below its 200-DMA for the first time in more than a year.

- Going back to the early 1980s, there have been seven other streaks that lasted a year or more.

- Following the end of prior streaks of closing above its 200-DMA, AAPL tended to see additional short-term weakness but was higher three months later every single time.

Chart of the Day:

It’s been a rough several days for a lot of stocks, including the S&P 500’s largest stock – Apple (AAPL). Yesterday, the stock saw a successful test of its 200-DMA, but the bounce didn’t last long, and while some time remains in the trading day, the stock is on pace to close below that level for the first time in more than a year. Warren Buffett commented earlier this month that selling some of his holdings in AAPL was ‘probably a mistake,’ but as the stock sells off, the trade is looking better and better. Let’s just hope that for the broader market’s sake (it is the largest stock in the S&P 500) that Buffett’s ‘mistake’ doesn’t end up being that he didn’t sell his entire stake. After all, AAPL’s average closing price in Q4 2020 (the quarter that Buffett sold shares) was $120.28, and as of this afternoon, the stock is barely hanging on to $120.00.

As mentioned above, AAPL has closed above its 200-DMA every day for more than a year. That’s not the longest streak in the stock’s history, but it is one of the longest. The last time there was a streak that lasted longer was in the 383 trading days ending in February 2018 after the volatility crash. In the post-financial crisis period, the current streak is the fourth such streak of more than a year, and going back to the early 1980s, there have been seven other streaks that lasted a year or more.

Now that AAPL is on the verge of ending this streak, what now? The table and chart below show AAPL’s performance following the end of prior streaks where the stock went a year or longer without closing below its 200-DMA. For each period, we show the stock’s performance from the close on the first day that the stock closed below the 200-DMA. AAPL’s performance over the following week and month has been mixed with a downward bias as the stock’s median performance was a decline of 3.06% and 5.52%, respectively. Three months later, the stock tended to turn around posting a median gain of 17.1% with gains all seven times. Moving out over the next six and twelve months, though, returns turned more mixed. While the stock still saw positive returns on both an average and median basis, the magnitude of the gain wasn’t any larger than the three-month average and median returns. More often than not, in fact, the stock’s six-month performance was lower than the three-month performance. In other words, while the stock bounced in the short to intermediate-term, it started to run out of gas from there.