Bespoke’s Morning Lineup – 6/14/21 – Bitcoin Back in Business

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.” – Friedrich August von Hayek

In terms of the economy, there’s a lot on the calendar this week, but it starts out slow as there are no reports to kick off the week today. A number of indices in Asia were closed overnight, but Japan was open and managed to rally 0.7% as Industrial Production surprised to the upside. European indices are trading higher to kick off the week as Industrial Production in the region also doubled expectations (0.8% vs 0.4%). In US markets, futures are mixed with the Dow lower, the S&P 500 flat, and the Nasdaq higher.

With not much going on in financial markets, the real action has been in bitcoin which is trading at its highest levels since late May following comments on Sunday from Elon Musk that Tesla may start accepting bitcoin as payment again in the future provided there’s confirmation of ‘reasonable (~50%) clean energy usage by miners with a positive future trend’. These days, that’s enough to move a $700 billion asset by over 5%.

Read today’s Morning Lineup for a recap of all the major market news and events, the latest economic news from around the world overnight, including Industrial Production in Europe, and the latest US and international COVID trends including our vaccination trackers, and much more.

It was a pretty positive week for US equities last week. In the “US Index” screen of our Trend Analyzer, every index ETF we track with the exception of the Dow (DIA) finished the week higher. DIA’s weakness primarily stemmed from a nearly 10% drop in shares of Caterpillar (CAT). With the rally last week, all of the ETFs listed head into the new week at overbought levels with a neutral timing score. You can’t get much more uniform than that.

While the ‘wide-angle’ view of US indices shows a good deal of uniformity, at the sector level there has been a lot more dispersion. Six sectors finished last week higher, and five traded lower. The biggest winners of the week were Health Care, Real Estate, and Technology, while cyclical sectors like Financials, Materials, and Industrials all fell more than 1%. In many respects, last week was a bit of a reversion to the mean trade where the biggest winners traded lower while the biggest underperformers had their day in the sun. To illustrate, the six sectors that were up on the week are now up an average of 12.95% while the five sectors that were down are still up an average of 23.6% YTD.

Bespoke Brunch Reads: 6/13/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Labor Markets

Employed in a SNAP? The Impact of Work Requirements on Program Participation and Labor Supply by Colin Gray, Adam Leive, Elena Prager, Kelsey B. Pukelis & Mary Zaki (NBER Working Papers)

Work requirements do little to increase employment among recipients, while pushing out beneficiaries who are entitled to benefits; the authors estimate that simply eliminating work requirements would be a more effective step than new programs to target low-income adults. [Link; soft paywall]

How Does the Dramatic Rise of CPS Non-Response Impact Labor Market Indicators? by Robert Bernhardt, David Munro, and Erin Wolcott (FRB Chicago/Middlebury College Working Paper)

Declining response rates for the Census Current Population Survey explain a significant share of the decline in labor force participation rates reported over the last couple of decades. [Link; 26 page PDF]

Teens

Summer Job Market for Teens Is Sweet by Patrick Thomas (WSJ)

With labor markets tight, employers are reaching down the age ladder to fill low prerequisite positions and have driven teen labor force participation to the highest levels since 2008. [Link; paywall]

Sixteen Years Old, $1.7 Million in Revenue: Max Hits It Big as a Pandemic Reseller by Sarah E. Needleman (WSJ)

Huge disruptions in supply chains and massive consumer demand have sent goods markets into a wild frenzy benefitting re-sellers and middlemen that can move quickly to arbitrage prices. [Link; paywall]

Big Shifts

On the Crisis and Inflation, Barron’s Shows How the Past Can Be Prologue by Matthew C. Klein (Barron’s)

A look at a pre-COVID analogue to the pent-up demand and tight supply chains which have sent prices of some goods soaring in recent months, using both data and the words of contemporaries in media reporting. [Link; paywall]

Farewell, Millennial Lifestyle Subsidy by Kevin Roose (NYT)

The combination of high demand, tight labor markets, and wind-downs of investor subsidies are turning the various on-demand apps which fueled a labor-intensive luxury lifestyle for young adults over the past decade into pricey options. [Link; soft paywall]

Cash Management

Banks to Companies: No More Deposits, Please by Nina Trentmann and David Benoit (WJS)

QE purchases have left the banking system flush with cash, and the liability on the other side of that asset is an ocean of deposits which have jammed bank balance sheets. [Link; paywall]

Cryptocurrency Comes to Retirement Plans as Coinbase Teams Up With 401(k) Provider by Anne Tergesen (WSJ)

A small 401(k) provider is partnering with Coinbase to allow workers to allocate up to 5% of their retirement savings to crypto assets. [Link; paywall]

Don’t Forget To Flush

This man spent last year flushing hundreds of toilets. The new fear as the pandemic wanes: Legionnaires’ disease by Elizabeth Weise (USA Today)

A side effect of emptied out buildings during the pandemic: stagnant water. Maintenance staff has spent untold hours simply running faucets and flushing toilets to prevent standing water from becoming a breeding ground for pathogens even deadlier than COVID. [Link]

Renewables

Plug In or Gas Up? Why Driving on Electricity is Better than Gasoline by David Reichmuth (The Equation)

As the US grid shifts to renewables, the emissions advantages of electric vehicles are extending their lead over gasoline-powered cars even accounting for the CO2 intensity of electrical generation. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Record Household Equity Exposure As Stock Markets Surge

Yesterday, the Federal Reserve updated its quarterly look at the balance sheets of macroeconomic sectors of the United States. One of the metrics we can use the data for is the aggregate exposure to the equity market of the household sector. In the charts below, we show the percentage of total assets and financial assets that households have put in the equity market, either via direct holdings of stocks or exposure to stocks via mutual fund ownership.

In the first chart, we show these data for the combined household and nonprofit sector. Data specific to the household sector only doesn’t go back as far, but the two different flavors of household equity exposure tell the same tale: households are highly exposed to stocks, with a record share of their financial assets and total assets sitting in the equity market at current market values. Click here to view Bespoke’s premium membership options.

June 11th Memory Lane

As the S&P 500 continues to trade in a relatively sideways range with a slow drift higher, we thought it would be interesting to look at years where the market saw its largest single-day gains and losses on this date in history.

Starting off with the bad, you don’t have to go back too far to find the worst June 11th for the S&P 500 as it was only last year. After a nearly three-month rally off the March 2020 COVID lows, stocks were already starting to tread water, but on 6/11, the sellers won out as investors were forced to face reality. The sell-off came one day after Federal Reserve Chairman Jerome Powell highlighted the difficulties facing the American economy, saying that “the pace of recovery remains extraordinarily uncertain.” These cautious comments as well as an escalation in coronavirus infections in the southern part of the United States brought into focus the precariousness of the situation of the time and that the reopening process would not be as smooth as investors once thought. In addition, a number of political polls showed then President Donald Trump falling further behind in polls.

By the time the bell closed last year on June 11th, the VIX surged nearly 50% and closed above 40 as the S&P 500 fell 5.89%. Reopening stocks in the travel/leisure, financial, energy, and industrials sectors fell the most, but no area of the market avoided the selling stampede, as Kroger (KR) was the only stock in the S&P 500 to finish the day higher. Last June 11th no doubt caused a lot of stress for investors at the time, but looking at the move from a longer-term perspective, it was little more than a speed bump on the road to recovery.

In contrast to last year’s June 11th plunge, the best June 11th for US stocks was more than 80 years ago in 1940. Europe was already embroiled in war and things escalated when Italy joined the war effort of the Germans by declaring war on the French and attacking a British naval base in Malta. Despite the escalation of conflict, the market confidently rallied anyway. The reason? For starters, it was coming off a major plunge in May following the German attack of France and other areas of Western Europe. Besides being extremely oversold, another catalyst for the rally was an address by President Roosevelt at the University of Virginia commencement which has come to be known as the “Knife in the Back” speech. In that speech, FDR ditched his prepared comments and instead called for an end to the United States’ isolationism in response to Italy’s actions. He commented that “On this tenth day of June, 1940, the hand that held the dagger has struck it into the back of its neighbor.”

FDR went on to stress that the US couldn’t’ continue its isolationist policy:

“Some indeed still hold to the now somewhat obvious delusion that we of the United States can safely permit the United States to become a lone island, a lone island in a world dominated by the philosophy of force.”

In reaction to FDR’s speech, the feeling on Wall Street was that the US would take on a more active role in the war effort which caused a surge in industrial, defense, and material companies that would benefit from the Allied war effort. The impact of FDR’s speech was so strong that not only did US equities surge nearly 5% on that day in 1940, but the record June 12th gain was also the following day. Again, though, the gains on 6/11 and 6/12, 1940 came following a 25%+ plunge in less than two weeks, a decline rivaling the COVID plunge in terms of both duration and magnitude. Like the rally off the COVID lows, the equity market rallied sharply in the following weeks regaining more than three-quarters of its May decline over the following six months, but unlike the current period, the gains were fleeting as uncertainty over the war continued to act as a headwind.

Lastly, with inflation such a hot topic these days, we thought it would be fun to highlight some prices of goods in a number of ads we came across from the New York Times on that day in 1940. Read them and weep. Manhattan cocktails for a quarter ($4.81 in today’s dollars), dress shirts for under 2 bucks ($36 in today’s dollars), a new fridge for under $115 ($2,200 in today’s dollars), and a funeral for $150 ($2,885 in today’s dollars)? A dignified funeral no less! While prices are a lot higher now than they were then, so is the stock market. Back in June 1940, the S&P was under 10. Today, it’s 42,000% higher. Click here to view all of Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 6/11/21 – Going Out on a High Note

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Americans are getting stronger. Twenty years ago, it took two people to carry ten dollars’ worth of groceries. Today, a five-year-old can do it.” – Henny Youngman

Equities are looking to close out the week on a positive note today as futures have been steadily drifting higher all morning. The economic calendar is light today with Michigan Confidence the only report on the calendar. One aspect of that report that investors will be watching is inflation expectations. Any material increase in those readings could pose a threat to the positive early tone. The latest readings on inflation expectations in this report were 4.6% for the next year and 3.0% over the next 5-10 years.

Read today’s Morning Lineup for a recap of all the major market news and events, the latest economic news from around the world overnight, and the latest US and international COVID trends including our vaccination trackers, and much more.

The market certainly took yesterday’s high CPI reading in stride. On the one hand, looking back at the last 35+ years, there have been a number of other periods where headline CPI temporarily eclipsed 0.5%. Unique about the current period, however, is that May’s report was the third straight month that prices increased 0.5%+ on a month over month basis. We don’t see that happen too often.

Since 1985, there have been just three other periods where headline CPI jumped 0.5% three months in a row, and in none of those prior periods did the streak extend to a fourth month. In the chart below, we show the 10-year US Treasury yield going back to 1985 and have marked each of the three-month streaks where CPI topped 0.5% in red. In two of the three periods (1990 and 2008), that surge in inflation marked the peak of the 10-year yield for at least the next year. In the third (2005), yields kept rising over the following year increasing from a level of about 4.3% up to 5.3% nine months later.

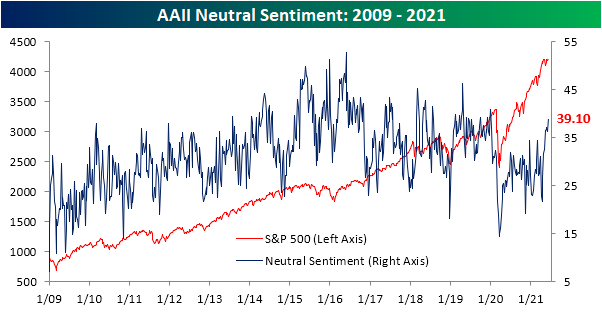

Neutral Sentiment Still On The Rise

After a sharp 7.7 percentage point rise last week, bullish sentiment as measured by the American Association of Individual Investors (AAII) weekly survey pulled back this week falling to 40.2%. While lower, that is still a few percentage points above the levels observed throughout most of May and is roughly 2 percentage points above the historical average of 38.03%. From a contrarian perspective, the more modest readings on sentiment recently are a welcome change from the elevated readings seen earlier this spring and in the winter.

Bearish sentiment tipped back above 20% this week, though, that is still a muted reading in the bottom 5% of the past decade’s range. In fact, the current level of bearish sentiment is around 10 percentage points lower than the historical average of 30.5%. Looking at another sentiment reading, the Investor’s Intelligence survey of newsletter writers saw bearish sentiment fall to 16.2% which is the lowest level since September.

That means sentiment continues to largely favor the bulls, but the drop in bullish sentiment was not matched by an equivalent rise in bearish sentiment. Instead, the bulk of those losses went into the neutral camp. The percentage of investors reporting as neutral has continued to climb reaching 39.1% this week. As has been the case consistently over the past month, that is the highest level in neutral sentiment since the first few weeks of January 2020 when over 40% of respondents reported as such. Click here to view all of Bespoke’s premium membership options.

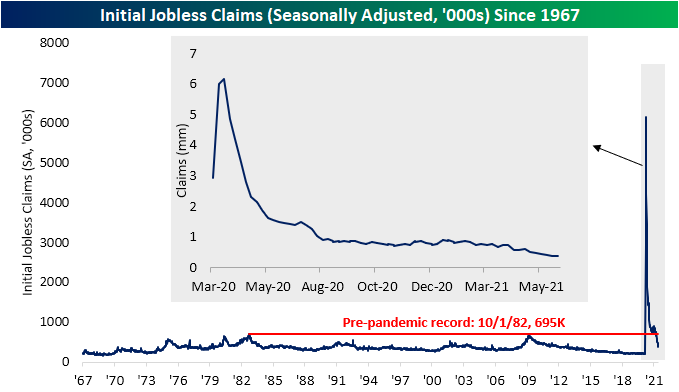

Continuing Claims Finally Improve

Initial jobless claims were expected to fall another 15K this week as forecasts were calling for a reading of 370K. While claims did not live up to those expectations, they did make another move lower falling 9K to 376K. That is now just 120K above the levels from last March, right before claims began to print in the millions.

WIth another sequential decline, seasonally adjusted claims have now fallen for six weeks in a row. That is about half of the record streak of 13 weeks long that ended in early July of last year. Outside of that streak, there have only been six other streaks as long as the current one and only two of those, one in 1980 and the other in 2013, went on for seven weeks.

Those improvements in initial claims were shared on a non-seasonally adjusted basis. Claims from regular state programs fell below 400K for the first time since last year reaching 367.1K. Pandemic Unemployment Assistance (PUA) also set a new low with claims totaling just 71.29K; down only about 2K from the prior week. Although that was a minuscule improvement, the PUA program has massively been unwound over the past few months as we close in on the end dates for the program in half of US states. In fact, this week will mark the exit of the program for Alaska, Iowa, Mississippi, and Missouri. In the most recent week’s data, these four states accounted for 1.7K initial PUA claims and 72.3K continuing PUA claims, or 2.5% and 1.14%, respectively, of PUA claims nationally.

Since the start of the year, the improvements in continuing claims had been decelerating, coming to a head over the past couple of months with multiple upticks. This week offered a sigh of relief as claims fell 258K to 3.499 million. That was not only the biggest one-week drop since March 12th’s 282K decline, but it also brings claims to the lowest level since the week of March 20th last year.

On a non-seasonally adjusted basis and factoring in all other programs (which creates another week’s lag), the picture has been generally more positive. The most recent week’s data through May 21st showed total claims across all programs fell from 15.473 million to 15.376 million, the lowest level of the pandemic. A small uptick in claims from regular state programs was offset by sizable drops in PUA, PEUC, and Extended Benefit claims. Click here to view all of Bespoke’s premium membership options.

Energy Stocks Have a Long Way to Go

The S&P 500 Energy sector is by far the best performing sector year-to-date with a gain of 45.2% through yesterday. As shown below, Energy is outperforming the S&P 500 by roughly 33 percentage points so far in 2021.

Given its huge outperformance so far this year, it’s pretty remarkable that Energy is still lagging the S&P 500 over the last 12 months. As shown below, Energy is only up 22.8% year-over-year versus the S&P 500’s gain of 31.6%.

And longer-term, Energy’s performance on an absolute basis and relative to the S&P 500 remains horrible. Over the last 5 years, the Energy sector is down 18.7% versus the S&P 500’s gain of 99.5%.

Over the last 10 years, Energy is down 24.9% versus the S&P 500’s gain of 227.4%!

It’s not until we go back 20 years that Energy gets back into the green. Since June 2001, Energy is up 69.4% while the S&P 500 is up 233.6%.

Energy has finally experienced some outperformance versus the broad market in 2021, but its 45% gain year-to-date hardly makes up any ground when looking at the sector’s performance in the 2010s. The sector still has a LOT of catching up to do. Click here to view Bespoke’s premium membership options and sign up for a trial.

Bespoke’s Morning Lineup – 6/10/21 – Inflation Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Inflation hasn’t ruined everything. A dime can still be used as a screwdriver.” – H. Jackson Brown, Jr.

It’s inflation day in the US, as the May CPI is on tap for release or, depending on when you’re reading this, has already been released. The only other major report on the calendar is Jobless Claims at 8:30. Futures are mixed heading into the releases, treasury yields are modestly higher, and bitcoin is up over 4%.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of the ECB meeting, the latest economic news from around the world overnight, and the latest US and international COVID trends including our vaccination trackers, and much more.

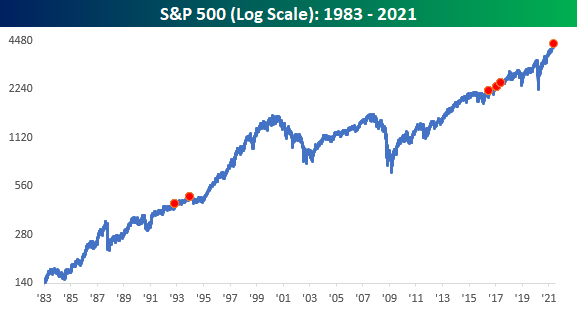

If you were up earlier this morning and in the Northeast US or parts of Eastern Canada, hopefully, you got a chance to view the eclipse. One ‘eclipse’ investors continue to impatiently wait for is the S&P 500 and its prior record high from early May. As we noted on the blog yesterday, the S&P 500 has made multiple attempts since the start of June to top the prior record, but after getting extremely close each time, either the buyers took a break or the sellers came in.

Wednesday marked the fourth straight day that the S&P 500 traded to within 0.15% of its record high but came up short each time. Since intraday data for the S&P 500 begins in the early 1980s, only five other periods have experienced either as long or longer of a stretch of days where the S&P 500 traded within 25 bps of a record high but never got there. The first of these periods occurred in the first half of the 1990s, while the last three all occurred in the year spanning the second half of 2016 and the first half of 2017.

So, does running out of steam just below record highs imply a market running out of gas or recharging ahead of a new leg higher. As shown in the chart below, the results were mixed, but more often than not, investors looked back at these occurrences from higher levels.

Close, But No Cigar

It’s been quite a rangebound period for the S&P 500 over the last few days. Over the last 12 trading days, the spread between the S&P 500’s intraday high and low has been just 1.65% which ranks as narrower than any other period since July 2019. More recently, the upside has been especially capped. Ever since the start of June, the S&P 500 has made multiple attempts to take out its 5/7 record high, but each time it has failed. In just the last four trading days, if the S&P 500 doesn’t take out its record high today, the S&P 500 will have traded within 0.15% (0.11%, 0.14%, 0.03%, and 0.02%) of its all-time high from early May, but each time failed to take it out.

Coming up so close so often but falling short each time has to be disheartening for bulls, and it doesn’t happen particularly often either. The chart below shows streaks where the S&P 500’s intraday high came within 0.25% of an all-time but didn’t quite make it. Since intraday data for the S&P 500 begins in 1983, there have only been four other streaks of similar or longer duration. The first two were in the early 1990s, and then it wasn’t until 2016 that we saw a streak of six days. After that 2016 occurrence, there were two occurrences in the first half of 2017. Click here to view Bespoke’s premium membership options and sign up for a trial.