See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Inflation hasn’t ruined everything. A dime can still be used as a screwdriver.” – H. Jackson Brown, Jr.

It’s inflation day in the US, as the May CPI is on tap for release or, depending on when you’re reading this, has already been released. The only other major report on the calendar is Jobless Claims at 8:30. Futures are mixed heading into the releases, treasury yields are modestly higher, and bitcoin is up over 4%.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of the ECB meeting, the latest economic news from around the world overnight, and the latest US and international COVID trends including our vaccination trackers, and much more.

If you were up earlier this morning and in the Northeast US or parts of Eastern Canada, hopefully, you got a chance to view the eclipse. One ‘eclipse’ investors continue to impatiently wait for is the S&P 500 and its prior record high from early May. As we noted on the blog yesterday, the S&P 500 has made multiple attempts since the start of June to top the prior record, but after getting extremely close each time, either the buyers took a break or the sellers came in.

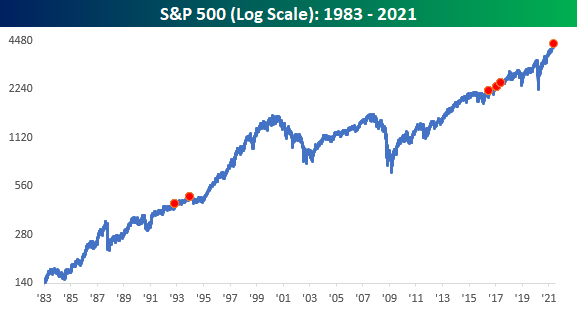

Wednesday marked the fourth straight day that the S&P 500 traded to within 0.15% of its record high but came up short each time. Since intraday data for the S&P 500 begins in the early 1980s, only five other periods have experienced either as long or longer of a stretch of days where the S&P 500 traded within 25 bps of a record high but never got there. The first of these periods occurred in the first half of the 1990s, while the last three all occurred in the year spanning the second half of 2016 and the first half of 2017.

So, does running out of steam just below record highs imply a market running out of gas or recharging ahead of a new leg higher. As shown in the chart below, the results were mixed, but more often than not, investors looked back at these occurrences from higher levels.