Stocks Only Going Up In The First Half

One of the most remarkable aspects of the past six months has been the lack of a significant pullback. The S&P 500 has not seen a 5% pullback since October, and since the start of the year, the most it had fallen from a high was 4.23% from mid-February to March 4th. Besides that and another smaller 4% pullback in May, it has been a one-way trip higher. Looking back through the history of the S&P 500, there are not many other years in which the index went the entire first half without at least a 5% pullback. Below we show the chart of the S&P 500 for each of the 14 years that, like this year, did not experience a pullback of at least 5% in the first half. . As shown, six of these (highlighted in green)—1954, 1958, 1964, 1993, 1995, and most recently 2017—actually did not see a 5% or larger pullback in the second half of the year either.

As for the other years, the S&P 500 did generally tend to move higher for at least part of the second half, but there have been a range of declines. The year with the largest decline in the second half was 1986 when the index fell 9.42% in September. And that was after a 7.53% decline shortly after the midpoint of the year in the first two weeks of July. The 1959 occurrence similarly saw a 9.17% decline from August through September. While it did not necessarily all happen within the second half of the year, the declines in the final days of the 1961 occurrence actually marked the beginning of a bear market that ultimately would see the S&P 500 fall 23.6% from its late 1961 peak. Click here to view Bespoke’s all of Bespoke’s premium membership options and to sign up for trial.

Bespoke Consumer Pulse Report – July 2021

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Intraday Performance on the Last Day of the Half

Today marks the last day of what was a strong quarter and first half for the S&P 500. The index is on pace to notch a 14.33% gain in the first half of 2021 which, behind the 17.35% rally in 2019, marks the second-best first half of a year since 1998. So does a strong first half mean that investors will take some money off the table on this final day? In the charts below, we show the average percentage change from the prior close for the S&P 500 on the final day of the quarter/half going back to 1983. Generally, across the last day of a quarter or a half (last day of Q2 or Q4), the S&P 500 tends to move higher for most of the session, but the final hour of trading typically sees that move get erased bringing the index down to the flatline on the day. Taking a more specific look at the last day of Q2 or the first half, the S&P 500 is usually pretty flat in the morning before taking a leg higher in the mid-afternoon. Granted, as with other quarter ends, the index tends to reverse lower at the end of the day although it finishes more solidly in the green.

With such a big move higher so far this year, we also wanted to take a look at just the years in which the S&P 500 was up double digits through the first half of the year. As shown in the second chart below, the standard performance in those years is a bit different with a decline in the morning but a rebound in the early afternoon. We would note though, the occurrence from 1999 weighs heavy on the average. On that day, the Federal Reserve hiked rates a quarter-point but took a dovish stance with respect to rate increases on the horizon. That led the S&P 500 to go from a nearly 1% decline at the day’s lows to an over 1.5% gain by the end of the day. As such, excluding that one occurrence in 1999 shows an intraday pattern that is more similar to the norm for all quarter ends with a drift lower in the final couple hours of trading. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 6/30/21 – One of the Biggest Surprises of the Quarter

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“There’s not many things less important than the score at halftime.” – Bill Self

After a weak open in Europe, US futures sold off earlier but have been clawing their way back ever since. The weakness in Europe has mainly been on concerns of the spread of the Delta COVID variant as well as weak manufacturing data out of China. As shown in our economic indicator charts in today’s Morning Lineup, many global manufacturing gauges have clearly shown signs of peaking out in terms of their growth rates. That’s not a surprising trend as base effects start to wear off, but it has helped to keep a bid under the treasury market. What is one of the more surprising aspects of the current quarter, though, has to be the fact that with the long-term US Treasury ETF (TLT) rallying 6.1% this quarter, it is actually outperforming the Dow, and underperforming the S&P 500 by less than two percentage points.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, a look at the explosive move in Tin, notable economic data from Asia, Europe, and North America, the latest US and international COVID trends including our vaccination trackers, and much more.

In a post yesterday, we noted the breakout to new highs in the semiconductor sector after a four-month period of consolidation. On a relative strength basis, the sector has also picked up the pace over the last six weeks. The chart below shows the relative strength of the Semiconductor ETF (SMH) versus SPY over the last year. SMH’s peak on a relative basis began in mid-February just when the sector’s trading range peaked. For the next three months, the sector significantly underperformed the S&P 500, and it wasn’t until May 13th – the day after the April CPI report – that the sector’s underperformance troughed. Since then, semis have bounced back in a big way, and over the last two trading days have finally broken the downtrend that has been in place since that mid-February peak. New highs and a broken downtrend? It’s been a big week for semis.

June’s Best and Worst Performing Russell 1,000 Stocks

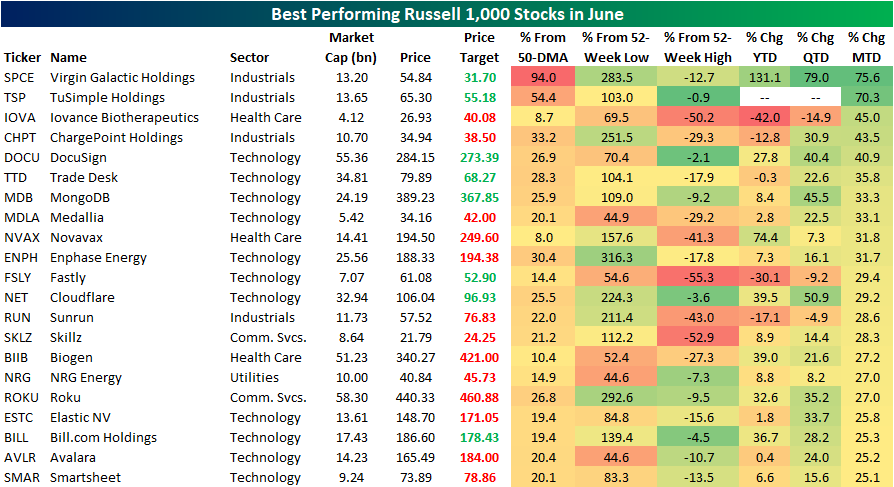

The month of June, the second quarter, and the first half of 2021 are almost in the bag. In the table below, we take a look at the best and worst performers in the Russell 1,000 month to date. For the best performers, we look at the 21 names that are up at least 25% MTD. As for the other side of the performance spectrum, we show the 20 worst performers.

Topping the list with a 75.6% MTD rally through yesterday’s close has been Virgin Galactic (SPCE). A large portion of that has come in the past few sessions alone with a 38.87% gain last Friday which has been partially erased early this week. Given that huge one-day jump, SPCE is over 90% above its 50-DMA and as such, it is the stock that is currently the most extended above its 50-DMA in percentage terms of the whole Russell 1,000. The next best performer in the index has been a recent IPO (debuted on April 15th), TuSimple Holdings (TSP). The stock was also up over 70% in June through yesterday’s close leaving it just off its high from June 14th. After TSP and SPCE, there is a big drop in the percent change this month as Iovance Biotherapeutics (IOVA) is next up with a gain of 45%. That move has reversed some of the declines earlier in the year, although the price is still half of its 52-week high. It is a similar story for Fastly (FSLY) and Skillz (SKLZ) which are also more than 50% below their respective 52-week highs. Additionally, IOVA, FSLY and Sunrun (RUN) are the few names that are still down on the quarter even after being some of the top performers in June.

Pivoting over to the worst performers, there are 38 stocks in the Russell 1000 that are down double digits month to date. By far the worst of these has been CureVac (CVAC). Similar to how a significant portion of SPCE’s gains came from a single day, most of CVAC’s losses are a result of a 38.99% decline on June 17th. The catalyst for that decline was the announcement that the company’s COVID-19 vaccine was only 47% effective. The next worst performers are two more Health Care stocks that plummeted on disappointing trials data: Exelixis (EXEL) and Sage Therapeutics (SAGE). Of the 20 worst performing Russell 1,000 stocks, EXEL is the closest to a 52-week low. One of the next worst performers is the polar opposite. Upstart (UPST) is up massively off the past year’s lows, and even after the 16.41% decline MTD, the stock is still up over 200% on the year. While many Health Care names are at the bottom of the list of month-to-date performance, one other notable theme is reopening plays. Cruise liner Carnival (CCL) as well as multiple airlines like America (AAL) and Southwest (LUV) also found their way onto the list. Additionally, with metals like gold and copper broadly falling off their highs after significant runs over the past year, Reliance Steel & Aluminum (RS), Newmont (NEM), and Freeport-McMoRan (FCS) are also a few of the worst performers this month. Click here to view Bespoke’s premium membership options for our best research available.

These SOX Aren’t Quitters

After a sideways period of consolidation that lasted more than four months, semiconductors enjoyed a nice rally to kick off the week as the VanEck Semiconductor ETF (SMH) rallied nearly 2.5% to a record high yesterday.

Below we highlight the performance of each individual component of SMH from our Trend Analyzer. While some stocks have clearly done the heavy lifting in the breakout to new highs, it’s pretty impressive to see that all 25 stocks in the ETF had positive returns over the trailing five days. Leading the way higher, both NVIDIA (NVDA) and Micron (MU) have rallied more than 8%, but another nine stocks in the ETF have gained more than 5% over the last week.

Despite the more than four month sideways range for the semiconductor sector, it’s been a very good year for most of the ETFs held in SMH. Just four of the holdings (QCOM, AMD, XLNX, and OLED) are in the red YTD, while the average gain of all 25 stocks is more than 17%. Leading the way higher, Applied Materials (AMAT) and NVIDIA are both up over 50% while four other stocks have tacked on 25% YTD. As a result of the big gains in the last week, the majority of stocks in the SMH ETF headed into today at overbought or extreme overbought levels, and all 25 stocks are above their 50-DMA. Click here to view all of Bespoke’s premium membership options and for a trial to any of our tiers of service.

Bespoke’s Morning Lineup – 6/29/21 – Modest Reversal of Monday Moves

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.” – Carl Icahn

Futures have been mixed for most of the morning, and while they were closer to the flatline earlier, we’ve seen some strengthening in the Dow futures and weakening in the Nasdaq as some of yesterday’s moves are reversing a bit. Today’s notable economic data point will be Consumer Confidence, and the only Fed speaker on the calendar is Richmond Fed President Thomas Barkin at 9 AM. Also just released, CPI in Germany declined to 2.1% y/y which was in line with forecasts. Lastly, in the financial sector, we’ve seen a number of dividend hikes and buyback announcements following stress test results yesterday. The results were largely expected, but two of the more notable dividend moves were Morgan Stanley (MS), which doubled its payment, and Citigroup (C) which left its payout unchanged.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, an update on the Delta variant, notable economic data from Asia and Europe, the latest US and international COVID trends including our vaccination trackers, and much more.

The S&P 500 and the Nasdaq have regularly been making new all-time highs in recent days, but that hasn’t been the case for many of the other major averages. Below we highlight the six-month price charts of a number of major US index ETFs. Outside of SPY (S&P 500) and QQQ (Nasdaq 100), none of the other four have hit new highs in at least a month. To be fair, the four indices that haven’t hit new highs are trading very close to new highs, so it’s not as though they are all breaking down, but as the third quarter kicks off, traders will look for some additional participation from the small and mid-cap areas of the equity market.

Time to Watch the Paint Dry

July 4th is less than a week away and as Americans look to celebrate Independence Day, they will be taking significantly less time out of their day looking at the stock market. At least that’s the takeaway that comes with looking at average volumes during this time of year. The matrix below shows the median daily volume of the S&P 500 ETF (SPY) as a percentage of its 200-DMA for each day of the year going back to 1993.

The end of June typically has above average volumes which is not unheard of for not only month-end but also the end of the quarter. But once the calendar flips over into July, volumes typically dry up. July marks the second-worst first day of a month for volume in SPY; the worst is May with median volumes 2.78% below the 200-DMA. Leading up to the July 4th holiday, volumes plummet. In fact, the median volume on July 3rd has been less than half the 200-day average. The one caveat here is that when the stock market is open on July 3rd, it is usually a shortened session. The only other day of the year where median volume in SPY is further below its 200-DMA is December 24th, another half session. Turning back to July, volumes tend to remain below average throughout the rest of the month and through August as well with only a handful of above-average volume days. In fact, with just four days in the month where median volume is above its 200-DMA, July tends to have fewer above-average volume days than any other month. Click here to view all of Bespoke’s premium membership options and for a trial to any of our tiers of service.

Bespoke’s Morning Lineup – 6/28/21 – Starting the Sprint to the Finish

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“In spite of the cost of living, it’s still popular.” – Kathleen Norris

Good Morning Subscriber,

It’s a quiet start to the new week with US futures mixed, treasury yields modestly lower, and crypto assets rallying. The economic calendar is also pretty quiet today with Dallas Fed Manufacturing the only release on the calendar. We will get some commentary throughout the day from Fed speakers, though, so those have the potential to cause some ripples in the market as they hit the wires. Overnight in Asia, the Chinese central bank said that the economy continues to improve and show signs of stability. In Europe, the trend has been modestly lower with Travel and Leisure stocks experiencing the largest declines while defensive catch a bid.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, an update on bitcoin and crypto technicals, the latest US and international COVID trends including our vaccination trackers, and much more.

Today brings the start of a new trading week but also marks the beginning of the sprint to the finish of Q2. With just three trading days left in the second quarter of 2021, the S&P 500 has already rallied 7.75% in what has been another impressive quarter. With stocks up strongly heading into quarter-end, there’s always a concern that the quarter will close off on a weaker note as portfolio managers look to rotate out of equities in order to get their weightings more in line with their target allocations. While rebalancing like this invariably does occur, long-term performance numbers do not suggest that it has a significant impact on market returns in the final days of the quarter- at least not when the gains are in the high single-digit percentage range and above.

The scatter chart below compares the S&P 500’s QTD returns up until the last three trading days of the quarter (x-axis) and compares that to the S&P 500’s performance in the last three trading days of the quarter. If there was an inverse relationship between QTD performance and returns in the last three trading days, you would expect to see dots higher up towards the left side of the chart and trending lower as you move right. As shown, that type of pattern is minimal at best.

On the right side of the chart, the shaded area represents all quarters where the S&P 500 was up over 5% heading into the last three trading days of the quarter, and we have enlarged that area in the lower chart. While the strongest quarter (Q1 1987) saw the S&P 500 decline 3% in the last three trading days of the quarter, other than that, the dots are scattered all over the place in no meaningful pattern. Of the 305 prior quarters since 1945, the S&P 500’s performance in the final three days of the quarter was a gain of 0.12% with positive returns 58% of the time. In the 113 quarters where the S&P 500 was up at least 5% heading into the final three trading days, though, the S&P 500’s average change to close out the quarter was a gain of 0.005% with positive returns 50.4% of the time. So there is some negative drag, but it’s minimal.

Memory Lane: The Best and Worst Days of This Week Through History

The week before July 4th is often a quiet one for stocks as traders look to make it a vacation and tack on some days before or after the holiday. That doesn’t mean it’s always quiet, though. Throughout the S&P 500’s history, there have been a number of big up and down days during the current week of the year. Below we highlight one of the worst and best; one from 1933 and the other more recently back in 2009.

Starting off with one of the worst days back on July 2nd, 2009, with the market closed on Friday, July 3 rd in observance of the July 4th holiday, the release of the June Employment report was moved up to Thursday, but after the number was released, investors probably wished the report had been canceled altogether. Economists expected total job losses of 365K in June, but the actual decline came in significantly higher at 467K compared to May’s loss of 322K, thus breaking a 4-month streak of lower job losses. The employment report had a raft of other record figures included within it as the unemployment rate climbed up to 9.5% – a level not seen since 1983. The average length of unemployment increased to 24.5 weeks- the highest level since the government began tracking that statistic 1948- and the average workweek for rank-and-file employees in the private sector (80% of the workforce) slipped to 33 hours- the lowest level since the government began tracking that number in 1964.

June’s losses brought the total number of jobs lost since the beginning of the recession to 6.5 million, erasing the total number of jobs gained in the previous nine-year expansion. The only other time that happened was back during the Great Depression. The weak employment numbers raised fears that the deepest and longest recession since the 1930s still had some time to go before a recovery would be underway, and investors looked at the data and questioned whether they had been too optimistic in bigging up stocks from the March 9th lows.

The S&P 500 opened lower and continued to sell off into the close as investors took profits ahead of the upcoming earnings season. Economically sensitive areas of the market got hit the hardest with the Dow Transports dropping 3.7%. After rallying 40% from its March low to its June high, the S&P 500 was down about 2.5% heading into the report, so the 7/2 decline brought the total decline to over 5%. While a 3% decline is always painful, relative to the level of market volatility during that period, it wasn’t particularly extreme, and by July 13th, the S&P 500 was already back above its pre 7/2 highs, and it continued higher throughout the rest of the summer. Click here to view Bespoke’s premium membership options.

Chart watchers were greeted with a puzzling move on Monday, July 3rd, when the market opened with large blocks of rails and industrial issues trading substantially higher than Saturday’s close (yes, there was a time when the stock market was open on Saturdays). Fundamental investors focusing on macroeconomic factors had a range of positive economic news to choose from, including reports of sharp increases in railway car loadings, copper inventories for 1933 being depleted at double the rate as 1932, as well as the moderate rise in prices not having affected the reports of Chain Stores. Volume was frantic at the open as the tape ran as much as ten minutes behind the floor’s transactions in the first hour.

A statement from President Roosevelt on the federal government’s position regarding the international currency measure proposals from the World Economic Conference in London released by Secretary of State Hull was interpreted as both nationalist and inflationist. “The sound internal economic system of a nation is a greater factor in its well-being than the price of its currency in changing terms of the currencies of other nations.” President Roosevelt continued by calling upon the World Economic Conference to direct its efforts to remove trade barriers and stressed the importance of a sound internal economic system in order to reach ultimate stability.

Roosevelt’s statement was met by both praise from supply-side economists like John Maynard Keynes and Irving Fisher and dismay from the gold-standard countries. The reaction of stock prices was far-reaching, with pivotal issues that had been sluggish, breaking out of their range to the upside. Numerous rails and specialties rallied on large volumes while more defensive-oriented Utility stocks experienced more modest gains. Volume on the NYSE at the close was placed at 6,720,000 shares with 266 stocks hitting new highs for the year and zero new lows.

Many observers argued that inflation was behind the move in share prices as the President subordinated all efforts to his campaign for higher domestic price levels (including taking the dollar off the gold standard in April and introducing an amendment to the Agriculture Adjustment Act which drastically expanded the government’s power over monetary policy in May). However, indications that the inflation movement was not the sole inspiration for the advance could be seen in the action of the bond market where prices rose sharply and yields declined. The rally from 7/3/33 didn’t last long, though, as the day’s gains were erased by 7/19/1933, and the S&P 500 didn’t trade meaningfully above those levels at any point in the next year. While the S&P 500 stalled out around its July 1933 levels, keep in mind that in the months leading up to that date, the S&P essentially doubled. Click here to view Bespoke’s premium membership options.