Small Businesses Problems

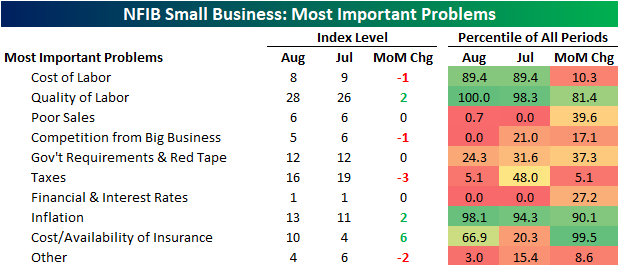

In addition to the various indices regarding small business conditions, the NFIB also surveys firms on what they see as their most pressing issue. In August, by far the most common issue among respondents was labor-related. A record 28% reported quality of labor as the biggest issue; up 2 percentage points versus July. Another 8% reported cost of labor as their biggest issue which was slightly lower than July. On a combined basis, the 36% reporting either cost or quality of labor as their biggest issue was the joint highest reading on record; tying August and November 2019.

Especially over the past several election cycles, the results of the NFIB survey have tended to be impacted by politics. For example, over the past few presidencies, when a Republican is in office there has been a lower percentage of respondents reporting either taxes or government red tap as their biggest issue and vice versa when a Democrat is in office. That combined reading has now completely reversed the uptick following the election of President Biden as labor concerns have increasingly come into focus.

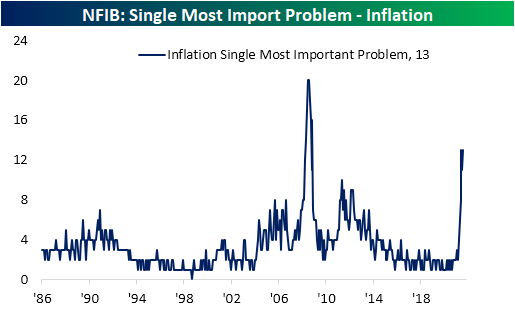

While government-related problems are still the second biggest concern(s) on a combined basis, there have been some other notable moves this month. The percentage of respondents reporting inflation as their biggest issue rose back up to the pandemic high of 13% this month. The Great Recession was the only other period that has seen as elevated a share of respondents seeing price increases as their biggest issue. Additionally, that excludes those reporting cost of labor as an issue.

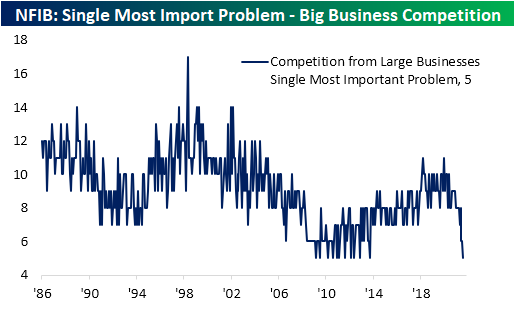

As for what the rise in Inflation as a problem may have borrowed from, one of the most notable has been competition from big business. The reading has seen a gradual decline since the end of 2019, and now at only 5%, it is tied with several months between September 2009 and September 2013 for the lowest reading on record. Click here to view Bespoke’s premium membership options.

Leveraged ETFs in 2021

Rather than mirror the performance of an index or specific asset, leveraged ETFs seek to provide a multiple of that performance through the use of derivatives and debt; usually double or triple that of the underlying asset. These ETFs are meant to track a multiple of daily performance, meaning long-term performance tends to not equal two or three times that of the unleveraged instrument. The companies offering these leveraged ETF products do explain that they track daily performance only, but even still, many investors overlook that fact and choose to own them longer term.

As for other cons working against the potential for higher returns is that these ETFs could create larger losses, they carry higher fees and expenses, and there is the possibility for those 3x or 2x returns to be downgraded as was the case last year. In other words, with the potential for higher returns, there are plenty of other risks, and these ETFs should be addressed with caution. As always, this is in no way to be taken as a buy or sell recommendation for any leveraged ETF product.

In the charts below, we show the hypothetical performance of $100 invested in a handful of leveraged ETFs as well as a more vanilla unleveraged alternative at the start of the year through Monday’s close. We would also note it is purely price returns before any payouts and/or expenses.

Starting with a look at long-term Treasuries, $100 invested at the start of the year into the iShares 20+ Year Bond ETF (TLT) would be slightly in the red headed into the final quarter of the year. Meanwhile, someone betting on the Direxion Daily 20+ Year Treasury 3x Bull ETF (TMF) would see their $100 fall to $83.24 today. At the low on March 18th, that $100 would have fallen as low as $60. That’s right, a 40% decile for something tracking what is supposed to be a relatively risk-free asset!

As for some other assets, the Energy sector (XLE) and Financial sector (XLF) have been two of the best performing sectors this year. As such, $100 invested into XLE and XLF would have grown to $129.79 and $128.69, respectively. For Energy, the 2x bullish ETF (ERX) would have seen that same $100 turn into $160.78 and the opposite side of that trade (ERY) would see the $100 more than cut in half. The same goes for the 3x bet for Financials. The Direxion Daily Financial Bull 3x Shares ETF (FAS) has nearly doubled YTD in 2021 whereas the inverse bearish ETF (FAZ) would have turned a buck into less than cents.

As briefly mentioned earlier, one other con to leveraged ETFs is higher expenses. For example, taking a look at the S&P 500, $100 invested into the SPDR S&P 500 ETF (SPY) would have become $119.19 year to date before any dividends or expenses. In the case of SPY, expenses are not much of a burden at only 0.09%. While the Direxion S&P 500 3x Bull ETF (SPXL) would have seen that $100 appreciate to an even more impressive $164.82, returns would have been even better if it were not for a nearly 1% expense ratio. As for the bears, if the $100 nearly being cut in half isn’t bad enough, adding insult to injury, the expense ratio is above 1%. For comparison, the median expense ratio of a screen of 1,728 ETFs excluding leveraged ones is only 0.49%. Click here to view Bespoke’s premium membership options.

SPY Snoozing

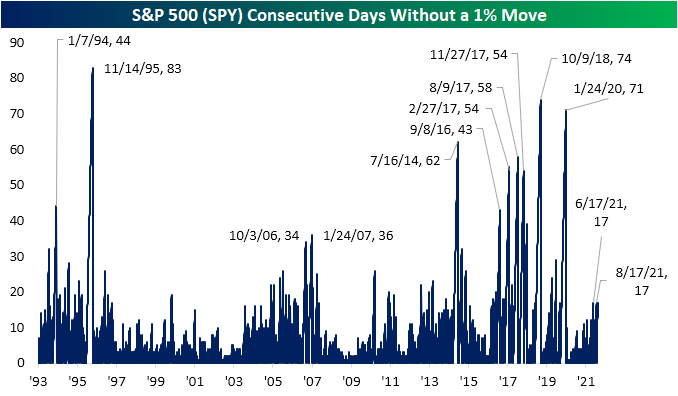

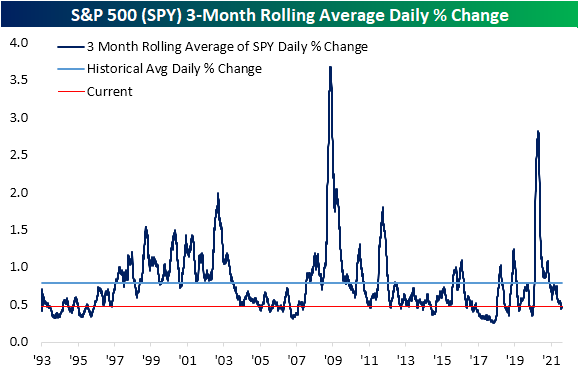

As of this writing, the S&P 500 (SPY) is currently up 0.24% today and is looking to snap a five-day losing streak. While the move has its own degree of excitement, overall the S&P 500 has been on a pretty boring stretch of late. August 18th was the last time that the S&P 500 rose or fell more than 1% in a single session. Not only does that make the current streak including today 17 trading days long, but that move on August 18th had also brought to an end another 17-day long streak without a move of at least 1%. With only a single day between the past two 17-day long streaks, there was also another streak identical in length ending in June. These three stretches tie for the longest run without a 1% move of the post-pandemic period with the prior streak ending in late January 2020. As shown below, going through the history of SPY this year’s non-volatile stretches stand out but are far from the longest streaks on record. For example, the second half of 2016 through 2018 saw multiple streaks without a 1% move that were between 43 and 74 trading days. To find the longest stretch without a 1% one-day move, you have to go back to 1995 when SPY went 83 trading days without a daily move of 1%.

Given there has only been a single day in the last 35 in which the S&P 500 (SPY) has gained or lost more than 1%, taking a look at the 3 month rolling average for the daily move in SPY shows daily volatility has certainly been at the low end of the historical range. Historically, SPY has averaged an absolute daily change of 78 bps. Over the past 90 days, though, SPY’s average daily move has been just 47 bps, ranking in the bottom quintile of readings. Investors expect ‘dull’ trading during the summer months, but now that the calendar says September, a lack of volatility would be out of the norm. Click here to view Bespoke’s premium membership options.

Bespoke Brunch Reads: 9/12/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Power Plants

This wildly reinvented wind turbine generates five times more energy than its competitors by Elissaveta M. Brandon (Fast Company)

A Norwegian start-up is experimenting with a modular design for wind turbines that would replace a single very large blade system with a large grid of much smaller units. [Link]

New Orleans Built a Power Plant to Prepare for Storms. It Sat Dark for 2 Days. by Sophie Kasakove and Nicholas Bogel-Burroughs (NYT)

One knock on renewables is that decarbonized forms of power can sometimes be less reliable than coal or natural gas plants. But in the wake of Ida, a backup power plant New Orleans built to insure reliability wasn’t able to help the power-starved city. [Link; soft paywall]

College

College-Town Economy Hopes for a Boost, if Delta Variant Can Be Held at Bay by Amara Omeokwe (WSJ)

Small towns across the country that rely on students arriving for school every fall are geared back up for a more normal school year, but Delta variant cases may dash the hopes of small and large businesses that cater to undergrads across the country. [Link; paywall]

A Generation of American Men Give Up on College: ‘I Just Feel Lost’ by Douglas Belkin (WSJ)

Women now outnumber men in college 3:2, with the decline in students over the last several years mostly driven by fewer men taking classes. Given the persistence of the college wage premium and the historically higher attendance rates for men, this major shift is likely underappreciated as shift in the social fabric of the country. [Link; paywall]

Vaccines

BioNTech reports promising data on mRNA cocktail in mouse models of colon cancer and melanoma by Arlene Weintraub (Fierce Biotech)

Pfizer’s partner for its mRNA COVID vaccine has partnered with Sanofi to deliver mRNA therapies which stimulate carcinogenic factors that are already produced by the human body using an identical delivery package to the one that tricks cells into manufacturing spike proteins and getting a leg up on the coronavirus. [Link]

Job Postings Requiring Vaccination Soar by Ann Elizabeth Konkel (Indeed)

While the number of job postings on Indeed that require vaccination against COVID remains relatively low overall, they’re growing very quickly and have accelerated since full FDA approval of the vaccine. [Link]

Windshield Wipers

Tesla obtains patent on its wild idea to use lasers as windshield wipers by Fred Lambert (electrek)

Patents are of course a long way away from a production feature (even at feature first, perfection later Tesla) but there’s at least some possibility that the most popular electric car company will start using lasers to clean off windshields. [Link]

Platforms

How TikTok Servers Up Sex and Drug Videos to Minors by Rob Barry, Georgia Wells, John West, Joanna Stern and Jason French (WSJ)

Using bot accounts, the WSJ team explored how accounts representing themselves as minors are exposed to adult content by the powerful algorithms which use past interests to dictate what future content gets displayed. [Link; paywall]

Epic v. Apple ruling: Judge finds Apple has to let developers offer third-party payments by Alexis Keenan and Daniel Howley (Yahoo!)

A California judge sided with Fortnite developer Epic Games in a Friday ruling that leveled an injunction against App Store policies which prevent software developers from collecting payments through their apps without giving Apple a cut. [Link; auto-playing video]

Leverage

Bitcoin to Bucks: Crypto Fans Borrow to Buy Homes, Cars—and More Crypto by Rachel Louise Ensign (WSJ)

With more than $2trn in total crypto market cap, holders are starting to use their currencies as collateral for loans of US dollars, which are being used to buy houses, homes, and all manner of other things that are easy to trade for dollars but not so easy to get with crypto. [Link; paywall]

Sports

Fans Don’t See Much of a Difference Among NFL’s Broadcast Partners, Top Talent by Alex Silverman (Morning Consult)

Fans are generally pretty happy with the NFL broadcast teams offered by the major networks, with NBC, CBS, and Fox all about equally popular; ESPN is slightly behind but still viewed favorably by 65% of NFL fans. [Link]

Accents

With Drawl by Laura Relyea (Bitter Southerner)

While often viewed with derision by linguistic philistines, Southern twangs and drawls are accent heaven for those who study how language twists and bends (or holds firm) with the passage of time. NC State professor Walt Wolfram is leading the charge to keep Southern accents alive. [Link]

Taxes

Senior Democrats propose 2% US tax on stock buybacks by James Politi (FT)

Eager to bring on board members of the caucus that are concerned about deficit implications of the Democrats’ $3.5trn proposed budget, Senate Democrats are considering levying a 2% fee on corporate share buybacks as a way to generate revenue. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

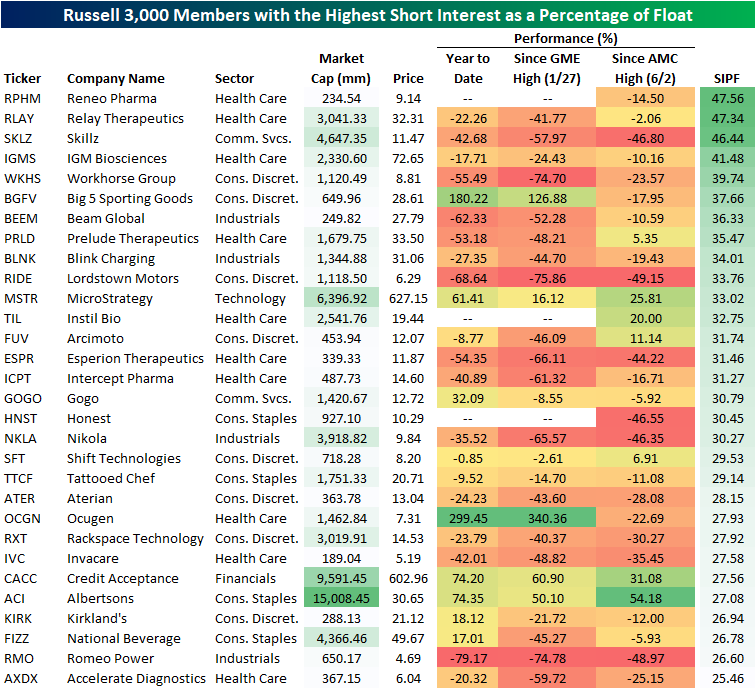

Most Heavily Shorted Stocks

Over the course of 2021, we have seen some aggressive short squeezes, resulting in turmoil for certain financial institutions and millions in profits for some retail traders. The “reddit army” has gone after multiple stocks, most notably Game Stop (GME) and AMC (AMC). Let’s dive into the 25 companies in the Russell 3,000 currently with the highest short interest as a percentage of float. Of these 25 companies, only 8 have experienced positive returns in 2021, and 6 have seen their share price half. Since GameStop peaked in late January, 20 of the companies on this list have lost value, and 9 have seen their equity trade down by 50%. Since AMC’s peak in early June, 7 companies have seen price appreciation, and zero have seen their value decrease by 50%.

The average short interest as a percentage of float for the entirety of the Russell 3,000 is 3.46%, but certain sectors have much higher proportional short interest than others. Consumer Discretionary, Health Care, and Real Estate have the highest, while Utilities, Financials, and Consumer Staples have the lowest. High levels of short interest is a sign of negative investor sentiment, but certain sectors will consistently have higher figures due to the riskiness of their business models.

To dive deeper, let’s look at the average short interest in each industry. Retail, Pharma & Biotech, and Consumer Services have the highest levels, while Banks, Tech Hardware, and Utilities have the lowest levels. The average short interest in the retailing industry is more than three times higher than that of banks for companies in the Russell 3,000.

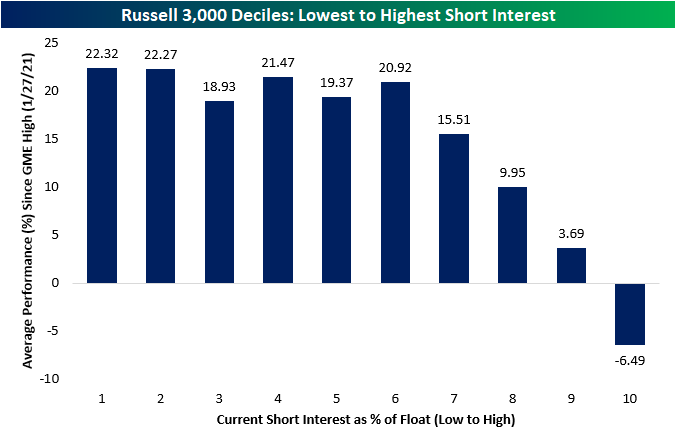

Although there are many exceptions to the rule, in 2021 equities with higher short interest have generally underperformed the remainder of the Russell 3,000. The average return for equities with short interest between zero and ten percent were higher than that of equities with 33%+ short interest.

To support this, let’s undergo a decile analysis. The stocks in the top 20% in terms of short interest have significantly underperformed the rest of the Russell 3,000 since GME hit its highs. While the equities in the bottom 20% of short interest have averaged a 22.23% return since January 27th (GameStop’s top), the top 20% of most heavily shorted stocks have declined by 1.40% on average.

Largest 25 Stocks in the S&P 500, Now vs 20 Years Ago

Yesterday, we took a look at the makeup of the S&P 500’s largest 25 companies in 2021 and compared it to that of 10 years ago. Today, we will be extending the study to 2001, twenty years ago right before the 9/11 attacks. On the day before 9/11, the sectors with the largest number of components in the top 25 in terms of market cap were Consumer Staples, Health Care, Technology, Financials, and Communication Services. While all of these sectors still hold a spot in the current top 25 list, the makeup has shifted substantially. Energy and Industrials, which each accounted for 8% of the top 25 companies in 2001, now have zero representation in today’s list. Consumer Staples also reduced its count from five to two.

Only seven companies that made up the list of top 25 names in September 2001 remain on the list today. Those seven companies are Microsoft (MSFT), J&J (JNJ), Walmart (WMT), Home Depot (HD), Procter & Gamble (PG), Bank of America (BAC) and Pfizer (PFE). The average increase in market cap of these seven equities, excluding dividends, is 241.88% with a median of 263.84%. While the turnover of this list has been high over the last 20 years, every member of this list is still in operation today, but two have been undergone mergers (Time Warner & Royal Dutch Petroleum). Interestingly enough, the members of this list have approximately the same proportionate makeup of the S&P 500, with only a 1.89% increase in the weightings of the top 25 stocks now relative to September 2001.

The US economy today is far different than it was in 2001. As it has changed, some companies have adapted and experienced massive growth, while others have been left in the dust. Apart from the two companies that are no longer independently publicly traded, the average return of the 25 largest companies from 2001 is 92.94% with a median return of 49.08%. Over that same period, the S&P 500 has returned 310.61%.

The Bespoke Report Newsletter — 9/10/21

This week’s Bespoke Report newsletter is now available for members.

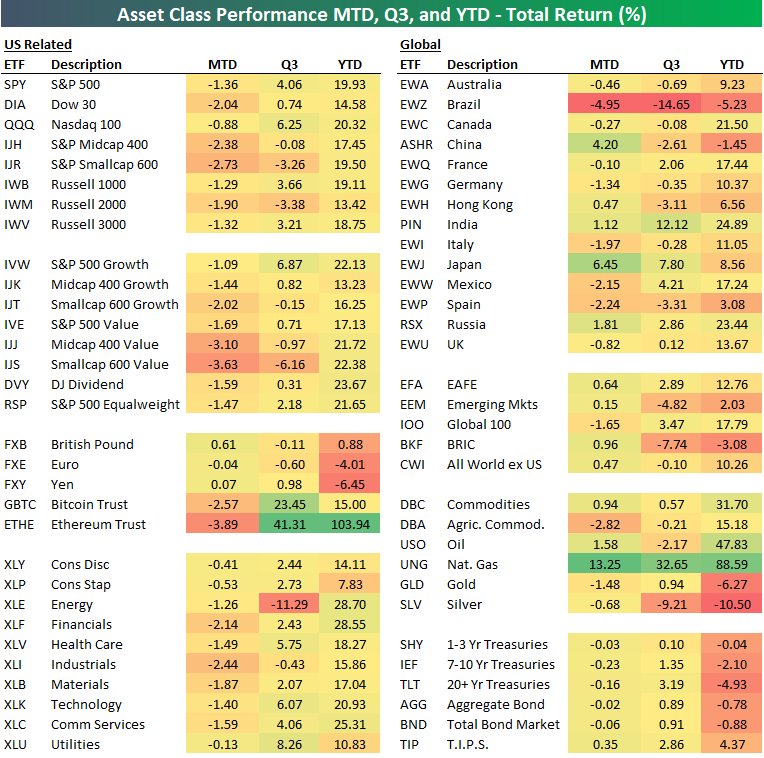

Below we highlight recent performance across a wide range of ETFs representing various asset classes, national equity markets, and US sectors or indices.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

US Continues to Gain World Market Cap

The S&P 500 has risen around 20% year to date in 2021, and with that rally in US equities more broadly, the United States has gained 1.83 percentage points of total world market cap. The US has consistently dominated in world market cap over the years, and the gains this year mean that the US currently holds a 43.13% share of total world market cap. Since the S&P 500 pre-COVID peak 2/19/20, right before COVID sent the index into a bear market, the US has added 2.27 percentage points to its share of world market cap. The only other country to have also added a significant share of at least one percentage point during that period is China. In early 2020, Chinese equities accounted for only 8.74%, and that share is now sitting at double digits. Those gains have borrowed heavily from countries like Japan, Hong Kong, and the UK which have all seen their share fall by more than half of one percentage point. For Japan and Hong Kong, those losses have primarily come in 2021 whereas the UK has only shed 0.1 percentage points this year. China similarly has seen its share of world market cap pullback this year as government crackdowns have pushed equities lower. Meanwhile, India has seen a decent gain of 0.38 percentage points. Behind the US, India has gained the most this year. Click here to view Bespoke’s premium membership options.

Beige Book Decelerates As Delta Impact Widens

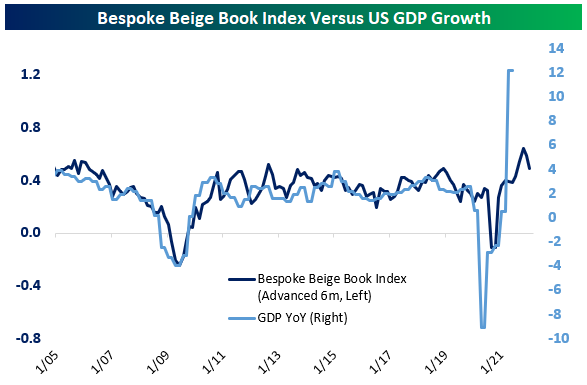

Earlier this week, the Federal Reserve updated its twice-quarterly qualitative assessment of the economy based on conversations with business contacts across the twelve regional districts. For each Beige Book release, we apply a natural language processing algorithm to assess the relative frequency of positive versus negative words, giving us a quantitative comparison of Beige Books over time. As shown in the chart below, our index of Beige Book activity has fallen from record levels recorded back in June to elevated but much more modest levels in September. That’s consistent with the Fed’s description of “moderate” growth thanks to the impact of the Delta variant. Click here to view Bespoke’s premium membership options.

In the second chart below, we show the relationship between GDP growth and our Beige Book Index from above. As shown, the current reading of our index equates to GDP growth of a bit less than 4% YoY. But keep in mind that extreme base effects are still driving wild YoY GDP readings. With that in mind, the Beige Book Index appears to be showing above-trend but decelerating growth, when accounting for base effects of the extremely low GDP reading from Q2 of 2020.

Google Searches Going Against Claims Data

Thursday’s release of initial jobless claims saw a new low for the pandemic with unadjusted claims coming in below 300K for a third week in a row. While that data has set new pandemic lows, Google Trends data on searches for “unemployment” are telling another story. The two series have had a tendency to track one another relatively well, and whereas claims are at new lows, the Google Trends score for “unemployment” has surged in the most recent week’s data. The index has risen seven points to 26 which is the highest level since early June, erasing all of the gains from the late spring and summer. As for the disconnect between the two, there are a couple of potential reasons. The first of which is seasonality. As we noted last week, claims typically tend to rise in the early fall through the end of the year. Another potential explanation for the uptick in search interest for unemployment is Hurricane Ida. While searches for the term in Louisiana haven’t seen a large uptick, searches in the state of New York started to surge last Saturday just after the flooding rains hit the region. If that’s the case, look for an uptick in weekly claims next week. Click here to view Bespoke’s premium membership options.