Bespoke’s Morning Lineup – 11/11/21 – Tentative Rebound

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“He died unquestioning, uncomplaining, with faith in his heart and hope on his lips, that his country should triumph and its civilization survive.” – Warren G Harding

In observance of Veterans Day, the Federal government and banks are closed today. That means that for today at least, stocks will not be able to fall because of rising yields. Equity futures are modestly higher this morning with the Nasdaq leading the gains. There’s no economic data on the calendar due to the holiday, and even the earnings calendar is relatively quiet.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Yesterday was one of those relatively uncommon days where it didn’t matter if you were in stocks or bonds- they both had a rough day. While the S&P 500 was down around 0.80%, long-term treasuries dropped more than twice as much as the iShares 20+ Year US Treasury ETF (TLT) fell 1.83%. Over the last ten years, there have been just 34 other days where SPY and TLT both finished the day down more than 0.75%, and in the charts below we summarize the performance of both ETFs in the day, week, and month following each prior occurrence.

Starting with SPY, the day after the 34 prior occurrences its median gain has been 0.17% with gains 57% of the time which is better than the average one-day performance for all one-day periods over the last ten years. However, as you move out over the next week and month, median performance following these days where both SPY and TLT were down 0.75% or more, returns have actually been negative and well below the long-term average. In fact, both one week and one month later, SPY was higher less than half of the time.

Although SPY has tended to show weaker than average performance over the following week and month, TLT’s median one-week and one-month performance has been better than average. In fact, one month following the 34 prior occurrences, TLT only fell five times.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Triple Plays Back to Performing Well

We’ve been tracking earnings “triple plays” for the last 15+ years. A company registers an earnings triple play when it reports results that 1) beat consensus EPS estimates, 2) beat consensus revenue estimates, and 3) raise forward guidance. You can read more about the term over at Investopedia where they’ve given Bespoke credit.

Historically about 5-10% of earnings reports have been triple plays, and below is a chart showing the rolling 3-month percentage of all earnings reports that have been triple plays. You’ll notice that coming out of the COVID recession in the spring of 2020, the percentage of companies reporting triple plays began to spike, and the number kept on rising all the way through the spring/summer of 2021. It’s now apparent that analysts were way too conservative with estimates in the 12-18 months after the initial COVID crash, which resulted in an extremely high percentage of companies beating both EPS and revenue estimates. At the same time, companies themselves were getting more and more positive on the future of their businesses, and the result was a spike in the percentage of companies raising guidance. At its peak earlier this year, nearly 20% of all earnings reports were triple plays over the prior three-month period, which was 50% higher than the prior highs around 12% seen in the mid-2000s. That kind of rate was clearly unsustainable, and as you can see in the chart, the percentage of companies reporting triple plays is currently falling back down to more normal levels.

Using our Earnings Explorer tool, we can track how stocks that report triple plays have historically reacted to the news. As shown in the snapshot below, over the last ten years, there have been just over 5,600 earnings triple plays, and these stocks have averaged a one-day gain of 5% on the first full trading day following the earnings release. That one-day gain of 5% shows how positively investors typically view earnings triple plays.

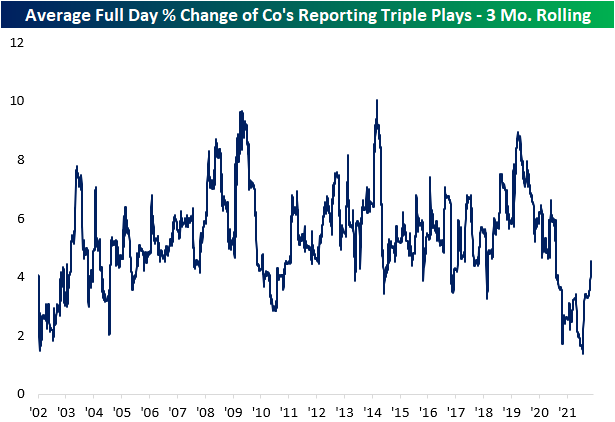

Taking a closer look at one-day price reactions to triple plays, below we show the average one-day price change for stocks reporting triple plays on a rolling three-month basis.

As you can see, the average one-day gain for triple plays fell sharply after the Covid recession at the same time that the percentage of companies reporting triple plays was spiking. This intuitively makes sense — the more common triple plays are, the less investors will reward the stocks that are reporting them.

Stocks reporting triple plays were barely posting gains of more than 1% on their earnings reaction days this past summer, but lately we’ve seen investors treat triple plays more positively. As shown in the chart, the average one-day gain for stocks reporting triple plays has been rising sharply in recent months and is now back above 4%. This comes as we’re seeing less companies report triple plays.

Over the last week, the 82 stocks that have reported earnings triple plays have averaged a one-day gain of 5.67%, and more than a quarter of them have gained more than 10%.

We love tracking the list of individual companies reporting earnings triple plays because it’s a great starting point for further research. Companies reporting triple plays typically have fundamental momentum.

Bespoke subscribers can track both earnings trends more broadly and also see a continuously updated list of recent earnings triple plays. If you’d like to see the list of this earnings season’s triple plays, simply click here to start a two-week trial to Bespoke Premium today.

Jobless Claims Closing in on Pre-Pandemic Lows

With the Veteran’s Day holiday tomorrow, the weekly release of jobless claims was pushed up to today. Initial claims missed expectations falling to only 267K rather than the anticipated drop to 260K. Last week’s number was also revised higher by 2K to 271K. The decline this week marked the sixth week in a row of declines as claims are once again at the lowest levels since March 2020. In fact, this week’s level is only 11K above the March 14, 2020, pre-COVID surge level.

On a non-seasonally adjusted basis, claims were actually higher as could be expected given the seasonal headwinds of this time of year. For the current week of the year, initial claims have historically risen 85% of the time week over week; one of the highest readings of any week. PUA claims meanwhile fell below 2K as the program continues its unwind.

Continuing claims ticked higher this week rising from 2.10 million to 2.16 million on a seasonally adjusted basis. That is the first increase in six weeks but it is a modest one, especially relative to the past few weeks’ declines. Even after the increase, continuing claims are still 79K below levels from two weeks ago.

Delayed an extra week, the inclusion of all other programs showed yet another drop in continuing claims on an unadjusted basis. Total claims across all programs fell to 2.57 million, down roughly 100K from the previous week. Essentially that entire decline was on account of regular state claims with the moves in PUA and PEUC claims basically netting out. There continue to be some residual claims from pandemic era programs, but they now account for a significantly smaller share of claims than was the case only a few months ago, and generally, those claim counts have declined.

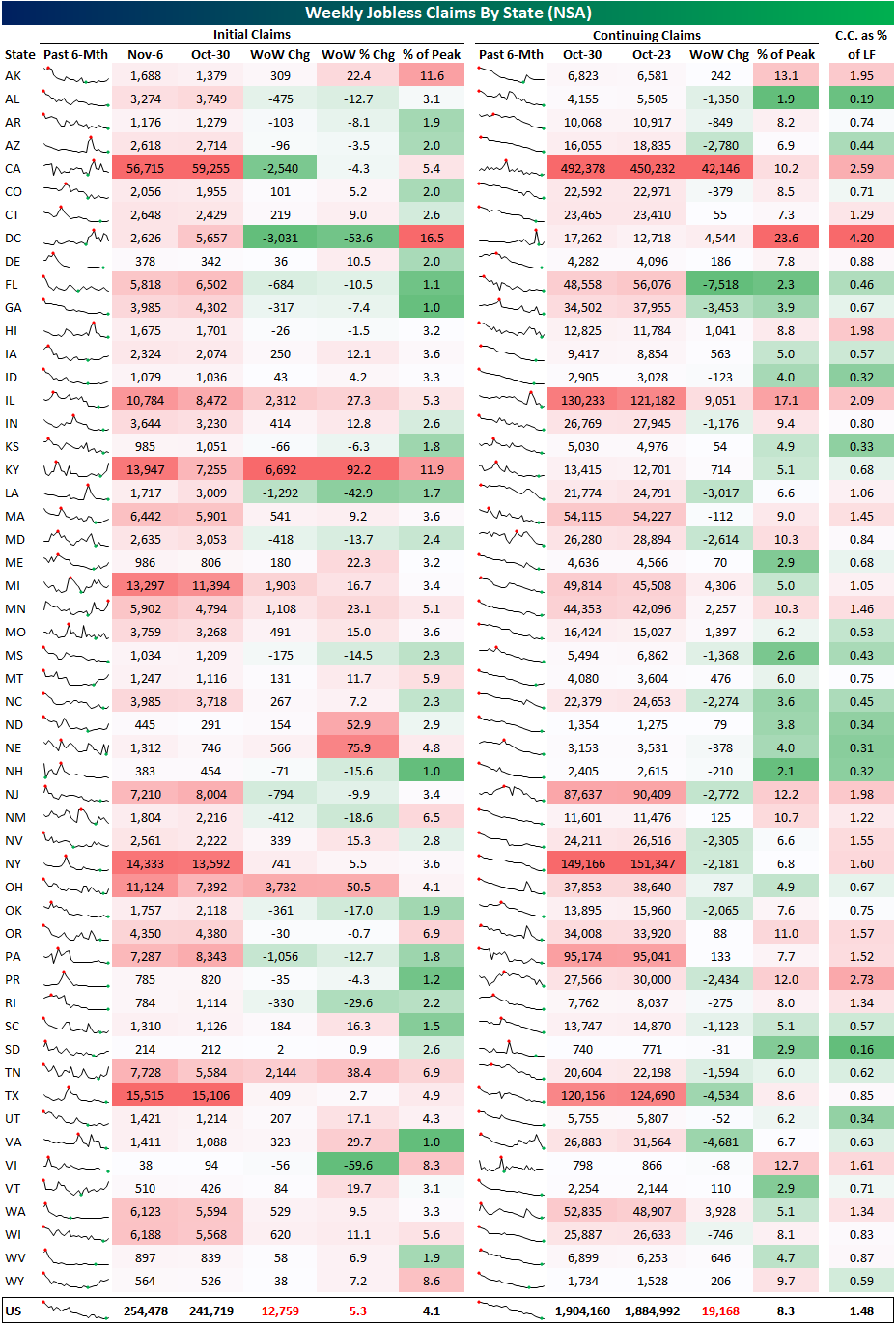

In the matrix below, we show a state-level breakdown of jobless claims. For the most part, states currently have claims counts around new lows, but there are a handful of states that are trending higher like Iowa, Kentucky, Minnesota, Tennessee, and Vermont. As mentioned previously, those reversals in trend are likely a result of seasonal headwinds. Click here to view Bespoke’s premium membership options.

Relative Strength Breakdown for Industrial Metals

Precious metals and industrial metals have been headed in opposite directions lately. Throughout 2021, industrial metals have been in a steady uptrend with Bloomberg’s Industrial Metal Index up as much as 38% at its highs in mid-October. Since then, the group of commodities has been pulling back and are now at the bottom of the past year’s uptrend. Currently, industrial metals are now down to a 22.4% gain on the year. Meanwhile, precious metals have been an underperformer all year, spending the vast majority of 2021 in the red year to date. Since September 29th, though, precious metals put in a low and have rallied 7.7% whereas industrial metals are essentially flat in the same span of time.

Given the inverse moves in industrial and precious metals, the relative strength line between the two has seen its trend falter. As shown below, since late summer 2020, industrial metals continuously outperformed precious metals as seen through the uptrend in the relative strength line. Last month, the line even broke out above the prior high set in June 2018. The sharp decline since then has resulted in a break of the aforementioned uptrend. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/10/21 – CPI on Fire

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Success or failure in business is caused more by the mental attitude even than by mental capacities.” – Walter Scott

After days where it seemed as though stocks could only go up and yields could go down, major US indices are poised for their second straight day of losses while the yield on the 10-year is up from its lowest levels since late September. Coming into today’s CPI report for October, there was some upside risk based on certain aspects of yesterday’s PPI report, and that definitely showed through in the numbers as headline CPI rose 0.9% versus forecasts for an increase of 0.6%. Core CPI rose 0.6% which was also significantly higher than the 0.4% forecasts. On a y/y basis, headline CPI rose 6.2%. Outside of October 1990 when y/y CPI rose 6.3%, this reading hasn’t been higher since the early 1980s.

Due to the Veterans Day holiday tomorrow, jobless claims were released a day early this week, and the results were also not what the market wanted to see as both initial and continuing claims came in higher than expected. In reaction to both reports, equity futures have dropped modestly and yields are higher but not to a large degree either way.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

The decline in the 10-year yield over the last several days (before today) caught a number of investors off guard. After rebounding off its summer lows right around 1.25%, the yield ran up to just above 1.7% in late October. Just as the taper started to show up on the horizon, though, the upside momentum in yields stalled out and quickly started to reverse even as inflation data continues to run hot.

Since the 10-year yield peaked on 10/21 just above 1.7%, it has seen a rapid decline falling to 1.44% yesterday. While it’s a bit of an arbitrary time window, the current 13-trading day decline of 27 basis points (bps) in the 10-year yield is the second largest over the last 12 months behind only the 28 bps decline seen in mid-July. That decline actually came right around the low point in yields for the summer. How markets react to today’s much higher than expected October CPI report will likely give us clues as to whether or not the same reversal in yields plays out this time around too.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Big Business No Longer A Problem For Small Business

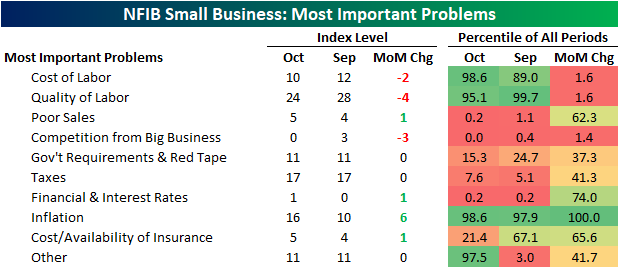

As we noted in an earlier post, the NFIB’s monthly survey of small businesses showed overall strong labor market conditions with some signs of improving labor market tightness in October. As shown below, a combined 34% of respondents reported either costs or quality of labor as their biggest issue. That was down 6 percentage points from the record high last month.

In the table below, we show the full range of problems that the NFIB surveys small businesses on. While both labor-related problems fell, there was a bigger decline in quality of labor which is now back below a quarter of all respondents.

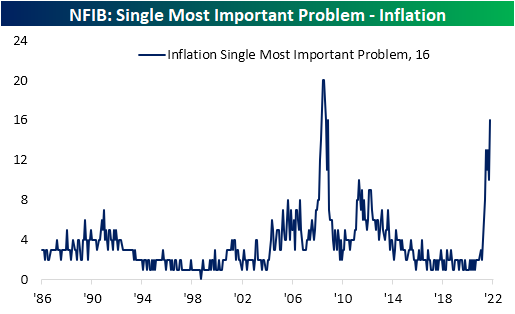

Concerns appear to have moved away from labor and toward inflation. The percentage of businesses seeing inflation as their biggest problem has been elevated at levels unseen since the Financial Crisis over the past several months, but there was an improvement in September. In October, it gained back all that decline and then some as 16% of businesses reported inflation as their biggest issue. That leaves it at the same level as November 2008.

Perhaps one of the most interesting findings of the October report concerned the battle of small vs big business. In fact, there no longer appears to be any battle. For the first time on record, zero percent of respondents reported competition from big business as their biggest problem.

On a combined basis, the percentage of respondents reporting government requirements or taxes as their biggest problems remains the most pressing issue behind labor concerns. Businesses did report improved uncertainty regarding economic policy. As shown below, that index fell sharply to 67 in October, which is now the lowest reading since the start of 2016. Click here to view Bespoke’s premium membership options.

Small Business Economic Outlook Dour

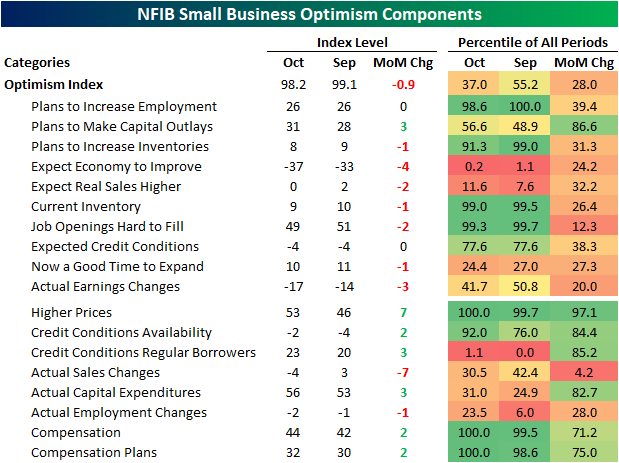

This morning the NFIB released the results of their October survey of small business sentiment. The report saw small business sentiment fall for the second month in a row. At 98.2, the index is now back to the same level it was at this past March.

With the decline in the headline reading, breadth was terrible with only one index that is an input to the optimism index—Plans to Make Capital Outlays—moving higher month over month. The various indices are now all over the place with regards to their own historical ranges. For example, Higher Prices, Compensation, and Compensation Plans all hit a record high while Expectations for the Economy to Improve and Credit Conditions for Regular Borrowers are just off of record lows.

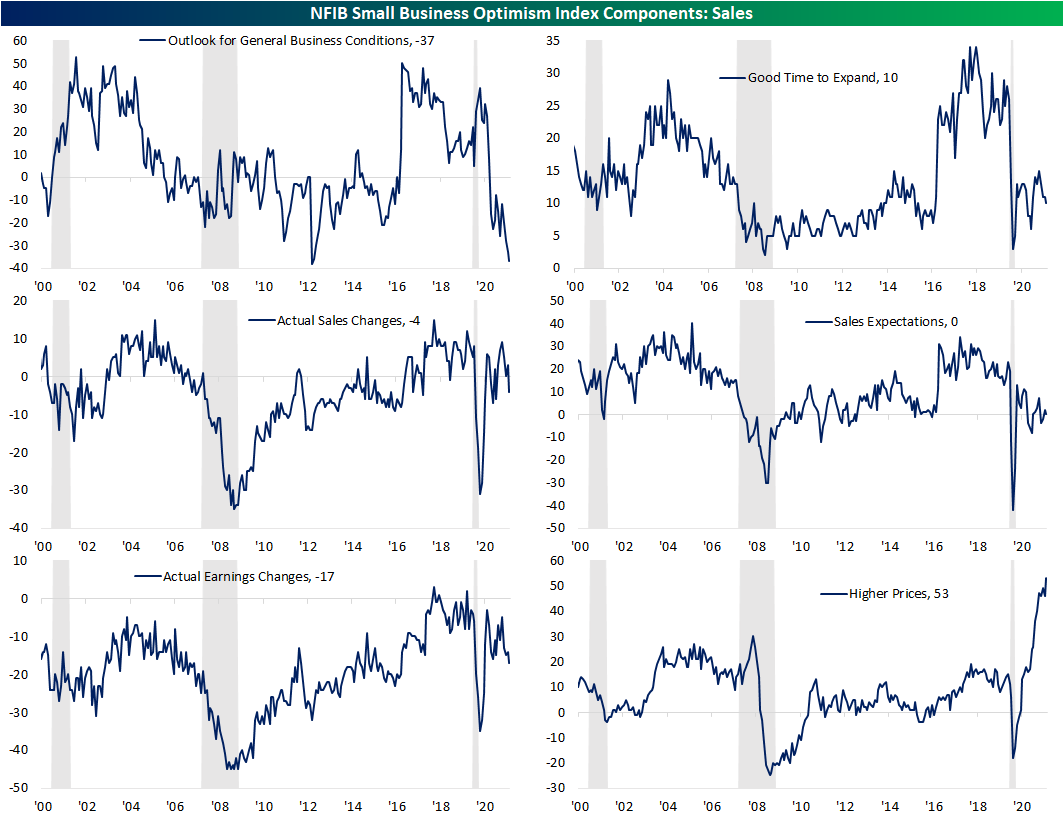

Sales and earnings-related topics weighed on optimism in October. A net negative percentage of responding firms reported weaker actual and earnings changes. Meanwhile, the weakest percentage of respondents reported now as a good time to expand since February. Alongside that weaker reading, Outlook for General Business Conditions continues to collapse and is now at the second-lowest level on record; only slightly above the low from nine years ago. One potential factor playing into that weak sentiment is higher prices as that index hit another record.

While the headline Small Business Optimism index has declined, it has held up considerably well relative to the massive drop in the Outlook for General Business Conditions. As shown below, the spread between the two is now at a record high dating back to 1986.

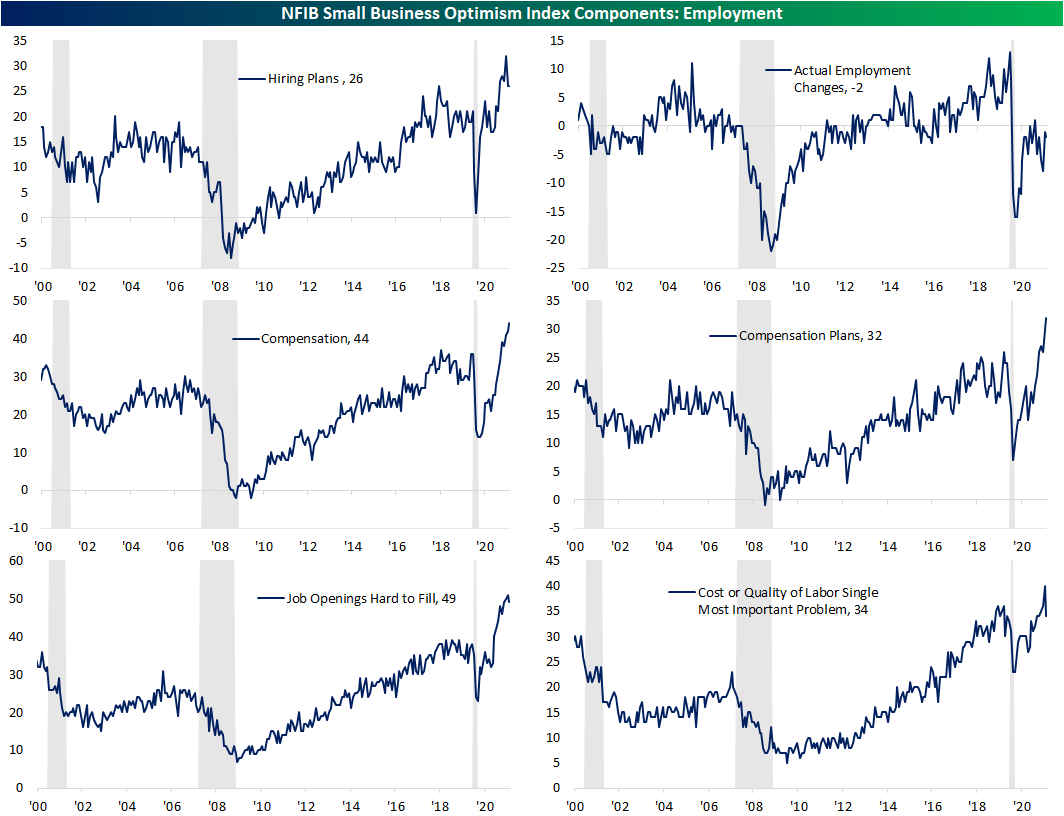

While there were some signs of cooling in October, overall the employment metrics in the report continue to be historically strong. Hiring Plans were unchanged at 26 which is off the late summer peak but still above any pre-pandemic level. While firms do not plan to take on as many workers as they had planned a few months ago, they are at least paying them better. Both Compensation and Compensation Plans continue to surge to new record highs. That has appeared to have some effect as the number of firms reporting Job Openings as Hard to Fill fell modestly. Additionally, as we noted in today’s Morning Lineup, fewer businesses are reporting labor problems as their biggest concern. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/9/21 – Do We Have Twelve?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s such a fine line between stupid, and uh…” – David St. Hubbins, Spinal Tap

It’s a mixed morning in the equity markets as the S&P 500 and Dow are indicated to open modestly lower while the Nasdaq is indicated higher. In the case of the Nasdaq, it’s looking to extend its “Spinal Tap” streak of eleven straight days of gains to a full dozen. The rally in crypto has continued again this morning with both bitcoin and ether trading at record highs. In the treasury sector, 10-year yields are back down to 1.46%.

In economic data, PPI came in right in line with expectations at the headline level (0.6%) and slightly weaker than expected at the core level (0.4% vs 0.5%).

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

With a gain to kick off the week yesterday, the Nasdaq extended its streak of positive days to eleven. There hasn’t been a streak longer than this since July 2009, and the only one that was as long was back in December 2019. Going back to 1980, the current streak is just the 15th that has lasted at least eleven trading days. Of those, the majority (8) of them were in the 1980s, including the longest which stretched out to 17 trading days in early 1985. Since 1990, there have only been six other streaks of eleven or more trading days, and only two of those have occurred since 2000.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

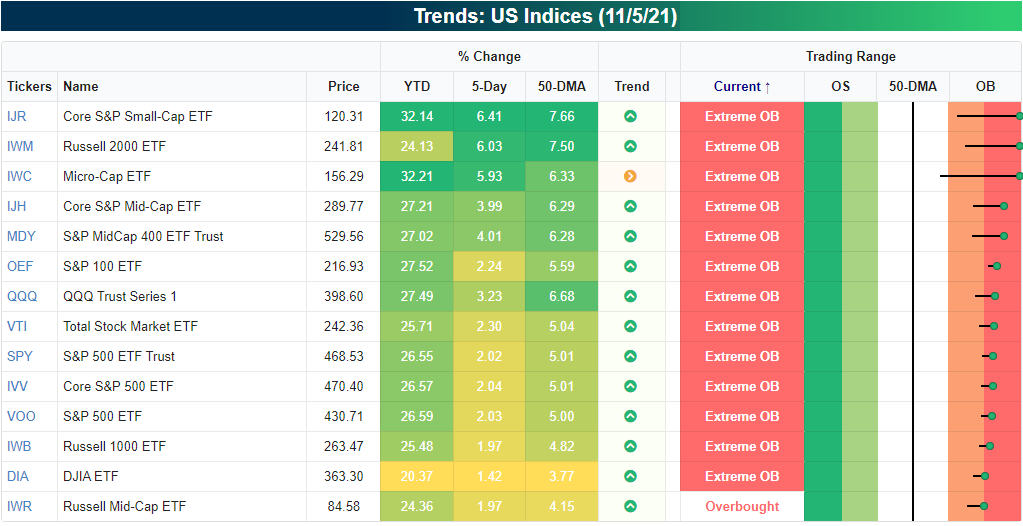

Extremes in Everything

Across major US equity indices, regardless of market cap, the picture is the same: extreme overbought. As shown in the snapshot of our Trend Analyzer below, the Russell Mid-Cap ETF (IWR) was the only major index ETF that did not finish last Friday at least two standard deviations above its 50-DMA. With that said, IWR still finished the week at very overbought levels and only slightly below extreme overbought levels. For the most part, other mid-cap ETFs were some of the most overbought last week like the Core S&P Mid-Cap ETF (IJH) and S&P MidCap 400 ETF (MDY). Small-caps are even more extended with the Core S&P Small-Cap ETF (IJR), Russell 2,000 ETF (IWM), and Micro-Cap ETF (IWC) all off the chart overbought.

Again, looking across the four major US indices, each one is at ‘extreme’ overbought levels with a z-score reading at the high end of the past decade’s range. In the charts below, we show charts of how far the S&P 500, NASDAQ Composite, Dow Jones Industrial Average, and Russell 2,000 are trading from their 50-DMAs as measured in standard deviations. For large caps and the NASDAQ, the current readings are some of the highest since the summer. For the Russell 2,000, no point in the past decade has seen a more elevated reading. In fact, Friday’s close saw the Russell 2,000 finish 3.23 standard deviations above its 50-DMA; the most elevated reading since February 1991. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/8/21 – More New Highs

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you wish to increase your success rate, double your failure rate.” – Thomas Watson

There’s a modestly positive bias to the equity market following a week where new highs were seen across just about every major US average. This morning, the big moves have been seen in the crypto markets where ether is at record highs, and bitcoin is testing its highs from late October.

There haven’t been any major earnings reports yet to speak of today, but that pace will pick up again after the close with PayPal (PYPL) leading the charge. Economic data is also getting off on a slow start to the week, but Tuesday’s PPI and Wednesday’s CPI will be the most important reports of the week to watch.

In terms of Fedspeak today, a number of officials (including Powell) are scheduled to speak throughout the day.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

As mentioned above, it was a banner week for the US equity market as just about every major index touched and closed out the week right at record highs. In terms of the Russell 2000, Nasdaq, and S&P 500, last week was the first time since early February that all three of these indices had record closing highs on the same day. For all three indices, the recent moves are all starting to look extremely steep, and while they’re great for anyone who is long the market, they won’t last forever.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.