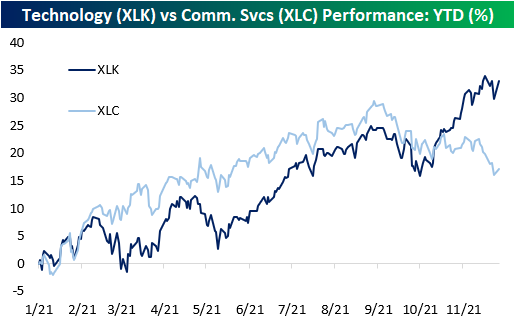

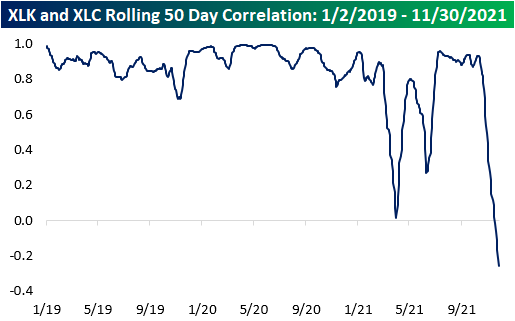

Technology and Communication Services Diverge

Typically, the Technology and Communication Services sectors tend to have high levels of correlation. However, beginning in mid-October, that relationship started to change course. While there have been other performance divergences between the two sectors this year, the current disparity is particularly noteworthy. Since mid-October, the Technology Select Sector SPDR Fund (XLK) and the Communications Services Select Sector SPDR (XLC) have been moving in opposite directions causing the YTD performance spread between the two sectors to widen out to the most extreme level of the year with Technology outperforming by 15.9 percentage points.

Since the start of 2019, just after Standard and Poors switched major stocks like Facebook (FB) and Alphabet (GOOGL) out of the Technology sector and into Communication Services the two ETFs tracking these sectors have had a median 50-day rolling correlation coefficient of +0.89, which implies a strong relationship between the two. For the years 2019 and 2020, the minimum correlation coefficient was +0.68, which still signifies a strong relationship. In 2021, though, the relationship has reversed and actually inverted this month, meaning that over the last 50 days, the two sectors are moving in opposite directions.Click here to view Bespoke’s premium membership options.

Natural Gas Tanks

Since Friday’s close, US natural gas future prices have declined 16.4% as of 11:00 AM on Tuesday, but there have been price discrepancies across the globe. We discussed these differences between natural gas prices in the US versus Europe in today’s Morning Lineup. In the US, natural gas prices have not seen a two-day decline in excess of 15% since 12/31/18 and going back to 2000, two-day pullbacks of this magnitude have only occurred 12 other times, four of which occurred within a month and a half time period (12/13/2000 – 1/30/2001). Heading into the current decline, the speculator net position was in a normal range, so dramatically offsides positioning from futures traders is likely not the driving factor behind this move. For more information on that positioning data, check out Monday’s Closer.

Looking ahead, forward returns of natural gas after a two-day pullback of more than 15% (without another occurrence in the prior three months) tend to be negative (which can be seen as a positive for consumers as it translates to lower energy costs). The day after the six prior periods shown, the average next-day performance for natural gas was a decline of 0.7% (median: -2.9%). Over the next week, the average decline was just 0.4% but the median decline was much greater at 6.1%. Looking out over the next one and three months, performance continued to weaken with average declines of 8.8% (median: 9.2%) and 4.9% (median: -8.7%), respectively. Downside momentum in natural gas was also pretty consistent across as natural gas was only positive across all the time windows shown one-third of the time. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/30/21

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“History doesn’t repeat itself, but it often rhymes.” – ???

On this day in 1835, Samuel Clemens aka Mark Twain, considered by many to be one of the greatest American writers, was born. While the quote above has often been attributed to Twain, there is no documented evidence that he ever said the last part of the quote. One variation he has written was “History never repeats itself, but the Kaleidoscopic combinations of the pictured present often seem to be constructed out of the broken fragments of antique legends.” Not quite as succinct but along the same lines.

Whoever said it, the fact that history doesn’t repeat itself, but it often rhymes is often on display in financial markets. While there’s no historical parallel to the current period of COVID and the unprecedented amount of stimulus that has been put into the system, human emotions are always a driving factor in market movements, and when faced with increased uncertainty, many investors choose to sell first and ask questions later- even if the headlines driving the market lower today (vaccines and COVID treatments potentially being less effective against the Omicron variant) were also in the market yesterday as well.

Equity futures are indicating a sizable decline at the open with the Dow leading things lower. The moves in the Energy and Treasury market have been even more notable with WTI trading under $68 a barrel, nat gas down over 6% after a 10% decline yesterday, and the yield on the 10-year down below 1.44% to its lowest level since late September.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

There’s been quite a bit of bifurcation in sector performance over the last several trading days. While four sectors are up over the last five trading days, they’re all among the smallest sectors in the market. At the bottom of the list, two sectors (Communication Services and Industrials) are down over 2% while another two are down more than 1.5% (Consumer Discretionary and Materials). Technology, the S&P 500’s largest sector is also down but by a more modest 0.68%.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

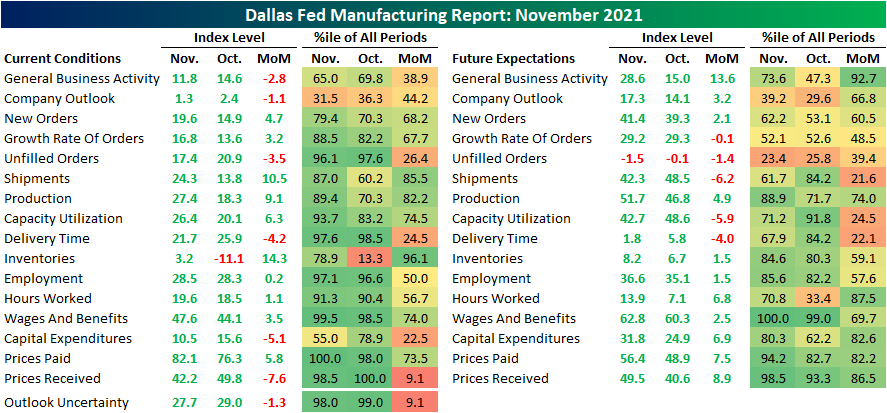

Another Deceleration Out of Dallas

November regional Fed manufacturing surveys have been pretty mixed but generally have shown activity decelerating. The fifth and final report out of the Dallas Fed released this morning reiterated that slowdown in manufacturing activity. The Dallas Fed’s headline reading was expected to show a modest increase from 14.6 to 15.0. Instead, as with other regional Fed surveys, activity decelerated with Business Activity falling to 11.8. While current conditions did not improve as rapidly as expected, expectations were relatively optimistic and have risen sharply over the past two months recovering most of the decline since June’s high.

While General Business Activity was lower, under the hood the report was pretty good with more categories moving higher than lower. Additionally, the bulk of these categories remain at historically strong levels. In fact, Company Outlook is the only one in the lower half of its historical range. General Business Activity and Captial Expenditures are the only others that are not in the upper quartile of readings.

Demand has continued to rebound with New Orders rising from 14.9 in October to 19.6 this month. Given the higher Order Growth Rate, Unfilled Orders also continue to rise at a historically elevated rate, though, that reading did fall in November as Shipments have picked up.

That increase in Shipments also likely had to do with alleviation for supply chains as the index for Delivery Times fell by 4.2 points. Other regional Fed surveys echoed those results this month with declines in Delivery Times of their own. That being said, the index remains historically elevated, and the commentary of the report points to a slew of supply chain-related issues holding back business. Given Delivery Times were not as long and production has risen, Inventories rose back into positive territory.

While there is evidence of improving supply chains, prices for raw materials are still rising. The index for Prices Paid has resumed its move higher and set the first record high since June. Conversely, Prices Received experienced a sharp reversal lower from a record high set last month.

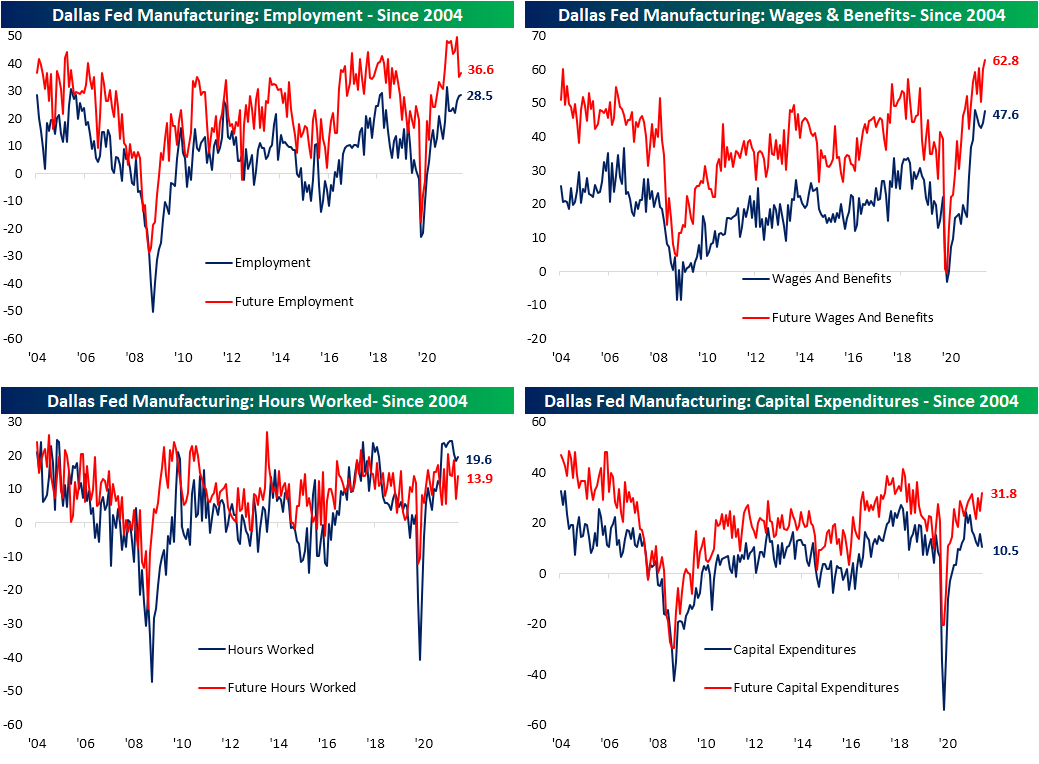

The price of labor is also continuing to rise. The index for Wages and Benefits came in only a half-point below the June record high. Even though current conditions narrowly missed a new high, expectations did set a new record. Not only did firms report that they expect to pay more for labor, but the same goes for Capital Expenditures. That category’s expectations index hit the highest level since March 2019 in November even while the current conditions index came in at the lowest level since the end of 2020. Pivoting back to labor, the index for Employment and Hours Worked were both moderately higher in November. Expectations for these two categories also rebounded after steep drops in October. Click here to view Bespoke’s premium membership options.

Texas Tea Double Digit Dip

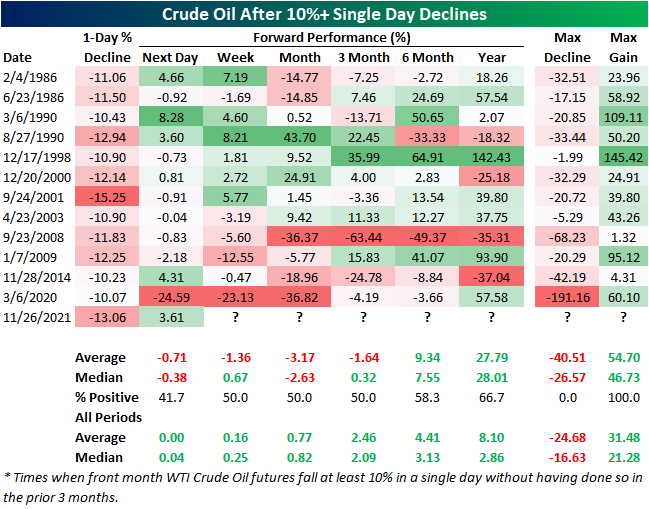

Crude oil prices are back on the rise this week after a sharp decline last Friday. As for how severe of a drop it was, front-month WTI futures fell 13.06% which was the worst single-day decline since April of last year; the same month that saw crude prices dive into negative territory. Looking back to 1983, including last Friday, there have only been 32 days in which crude has fallen double-digit percentage points in a single session. Outside of the series of volatile moves in March and April 2020, November 28, 2014 was the last time that there was as sharp of a decline of at least 10 percentage points.

Crude prices are rebounding today and are currently back above $70, although they’ve been pulling back all morning. In the table below, we show the other dozen times prior to Friday in which crude oil fell at least 10% in one day without having done so in the prior 3 months. As shown, today’s rebound is actually pretty abnormal with WTI typically declining the day after a 10% drop.

As for longer-term forward performance, crude has continued to average declines out over the next three months with positive returns only half the time. On the other hand, six months to one year out has tended to see stronger than normal returns for the commodity. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/29/21 – Back to Work

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The ability to concentrate and to use time well is everything.” – Lee Iacocca

Markets are looking to recover a chunk of Friday’s losses in early trading this morning. Equity futures are up across the board, but the Nasdaq is leading the way higher erasing about 40% of Friday’s losses. Crude oil is also bouncing back above $70 with a gain of over 5%, copper is up 1.5%, and the yield on the 10-year US Treasury is up 6 basis points (bps) to 1.54%. In crypto, bitcoin is trading just below $57K gaining nearly 4% while Ethereum is trading just above $4,300.

Investors are trying to make sense of the latest Omicron Covid strain, but at this point more seems to be unknown than known. Clouding things even more, we’re unlikely to have definitive answers in the immediate future. Early reports have suggested that symptoms from this latest strain have been mild and that vaccines are still likely to provide good protection from severe illness, but that it is also more transmissible. While demographics may be a factor behind the mild symptoms (younger population in South Africa), if that did turn out to be the case overall, it would certainly be a positive. Even if the best-case scenario does play out and Friday’s panic proves to be a massive over-reaction by markets and governments around the world, the short-term impact of restrictions on activity and international travel around the world will have some economic impact. Just last night, Japan announced that it will ban the entry of foreign travelers joining Israel, which made the same announcement last week.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Whether you’re looking at small caps or large-cap equities, it’s a tale of two markets this week. In the small-cap space, the Russell 2000’s break out earlier this month looks increasingly like a fakeout, and rather than a new leg higher, the question for small-caps is whether they can hold support at the uptrend line from the summer lows and not break down. For large caps, the S&P 500 still remains well above its breakout level from the summer high before September’s sell-off. Support for the S&P 500 doesn’t come into play until the 50-day moving average which is just above the 4,500 on the index and $450 for SPY.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

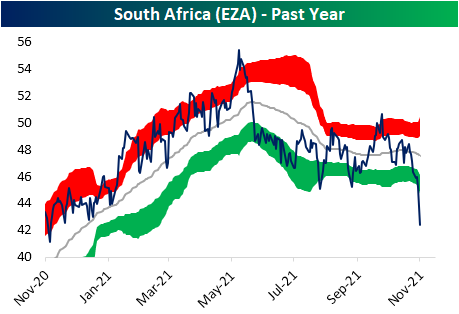

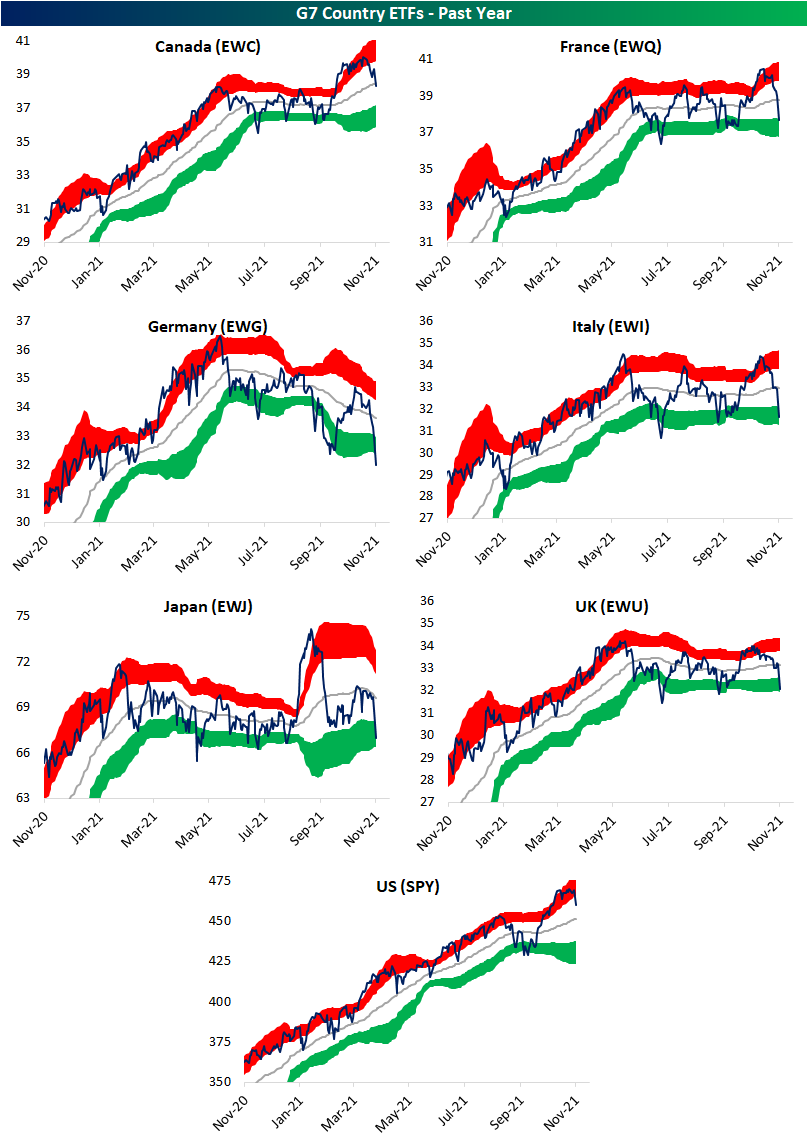

Shortened Day Bloodbath

It may have been a shortened session in the US, but equities took a big hit around the globe today. In the matrix below, we show the ETFs of the 23 countries in our Global Macro Dashboard. As shown, there was only one ETF that was down less than one percent today: Switzerland (EWL). After that decline, it is now one of only two other countries that are currently above their 50-DMAs: the S&P 500 (SPY) in the US and Taiwan (EWT). With that said, both of those countries have pulled back dramatically. Alongside Brazil (EWZ), those two countries are also the only ETFs of this screen that are still in the green for the month of November. As could be expected, the title of the worst performer with a 6% decline today belongs to ground zero of this new strain of COVID: South Africa (EZA). As a result, it is now at ‘off the chart’ oversold levels trading 3.62 standard deviations below its 50-DMA. Although they are not as oversold as South Africa, Spain (EWP) and India (INDA) are also more than 3 standard deviations below their 50-DMAs. Meanwhile, Mexico (EWW) is the most oversold country ETF trading almost 4 standard deviations below its 50-DMA.

The drop in South Africa equities has been dramatic, but that is also in the context of what has already been a downtrend over the past few months. Tacking on today’s declines, EZA is now almost flat over the past year.

Steep declines have also resulted in technical breakdowns of multiple other countries like Germany (EGW) and Japan (EWJ). Other European countries like France (EWQ), Italy (EWI), and the UK (EWU) may not have broken below support, but they are at the low end of their recent ranges. As for Canada (EWC) and the United States (SPY), the pullbacks are notable but not as much of a negative following strong gains this fall. Click here to view Bespoke’s premium membership options.

Bitcoin Drawdown Nears 20%

Like just about all other risk assets this week, it’s been a rough one for bitcoin. As of Friday morning, the world’s largest cryptocurrency was trading down over 7% to the low $54K range. After taking out its spring highs in late October and then making a higher high in November, bitcoin has seen a sharp and swift pullback in the last few weeks falling nearly 20%. Even after the current pullback, the uptrend from the summer lows for bitcoin remains intact as a break of that trendline wouldn’t come into play until around the $50K level.

As anyone even paying some attention already knows, volatility is no stranger to bitcoin. While the current pullback is nearing the 20% threshold, in the last year alone, bitcoin has seen a number of pullbacks from record highs of similar or even greater magnitude. As shown in the chart below, if the current pullback reaches the 20% threshold, it would be the fourth pullback of that magnitude or more from a record high in the last twelve months. Of those three prior pullbacks, the first two bottomed out at declines of less than 25%, but the most recent was much deeper as bitcoin was more than cut in half from its April closing high to its July closing low. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/26/21 – So Much for a Sleepy Friday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Anytime anybody tells me the trend is such and such, I go the opposite direction. I hate the idea of trends.” – Clint Eastwood

Prices are being slashed across the investment spectrum this black Friday morning as concerns over the new COVID variant detected in South Africa has investors reigning in risk. It’s important to stress that very little is known at this point about this latest strain, including whether it can evade vaccines or how severe it is relative to other mutations. Therefore, it’s hard to make any informed investment decisions at this point. Historically speaking, chasing a rally or selling into a sharp decline (especially on a very illiquid trading day) rarely ends up being profitable, but that isn’t stopping a lot of people this morning.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

While inflation concerns have shown no signs of abating in November, crude oil prices have been weak and broken some key support levels. Today’s decline of over 5% puts WTI on pace for its worst day since July, and in the process, it has traded below its summer high, which was a level that acted as support earlier this week. This latest break of support follows the break of the trend line that was broken earlier this month, where the subsequent bounce failed right as WTI traded back towards its trend line.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Pandemic and Multi-Decade Low for Claims

Out of the massive slug of economic data this morning, one major bright spot was jobless claims. It has now been 88 weeks since the March 13, 2020 release; the last one before claims began to print in the millions. In that time, claims have fallen to not only take out pre-pandemic levels and the low prior to that of 203K set in April 2019 but today saw the first sub-200K reading since November 20, 1969. That compares to estimates of a reading of 260K and last week’s 2K upward revised number of 270K. On a side note, in 2019 there were three weeks where the initial release of initial claims came in below 200K (1/24, 4/11, and 4/18), but they have been since revised higher.

While that is a significant low in claims, the drop appears to a large degree to be thanks to seasonal adjustment. On a non-seasonally adjusted basis, claims rose to 258.6K which was the highest level in six weeks. It is seasonally normal for claims to head higher during the current week of the year with it having happened over 80% of the time historically. Additionally, that is a bit of catch-up considering claims have been bucking seasonal trends in recent weeks.

Continuing claims were also lower this week falling from 2.109 million to 2.049 million. As with initial jobless claims, that sets a new low for the pandemic that is 265K above the level from March 13, 2020.

Factoring in all other programs creates an additional week of lag to the data meaning the most recent print is through the first week of November. The final week of October’s unusual uptick on account of peculiar growth in claims for expired programs has unwound in the most recent week’s data. PUA claims were more than cut in half as PEUC claims also fell by 121K. Combined that resulted in a new low of 2.44 million claims. Click here to view Bespoke’s premium membership options.