Bespoke’s Morning Lineup – 12/13/22 – Most Important Two Days of Month

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s a proprietary strategy. I can’t go into it in great detail.” – Bernie Madoff

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

One day short of 14 years after Bernie Madoff surrendered to authorities for his Ponzi scheme, Bahamian authorities arrested Sam Bankman-Fried yesterday in connection with his massive fraud in the cryptocurrency markets. Now that he’s behind bars, we can only hope that the nonstop media tour he has been on will come to an end.

We’ve got two very important days ahead for the markets with today’s November CPI and tomorrow’s FOMC rate decision. Futures are sharply higher heading into this morning’s release after a strong day yesterday, but hopefully, the markets haven’t set the bar too high.

While there is optimism among investors that the worst of inflation is behind us, the sentiment from two sectors that stand to benefit the most from inflation – Energy and Materials – has been mixed. The charts below show the relative strength of the S&P 500 Energy (XLE) and Materials (XLB) sectors versus the S&P 500 over the last ten years (top chart) and just the last year (bottom two charts).

Starting with the long-term picture, after years of underperformance, both Energy and Materials made a trough relative to the S&P 500 in 2020. While they have both stopped the bleeding, the rebound in Energy has been much stronger than the improvement in Materials (which never underperformed as much in the first place).

Over the last year, both sectors have significantly outperformed the market. Starting with Materials, its outperformance peaked in the spring and then came crashing back down to earth in the summer. The sector started outperforming again this fall, but in recent weeks it has started to run out of steam again.

The Energy sector has seen a much steadier trend out of outperformance this year, and its relative strength actually peaked in early November. While the sector has been under pressure relative to the market for the last month now, its relative strength uptrend has remained intact.

In the case of both sectors, their relative strength in recent weeks hasn’t been nearly as strong and steady as it was in the first half of 2022, but they are also far from collapsing reflecting the fact that while inflation pressures have not been as intense as they were earlier in the year, they still haven’t gone away.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Morning Lineup – 12/12/22 – Small Problems

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The best is yet to come.” – Frank Sinatra

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures are in the green to start the week, but with less than 15 trading days left in 2022, any hopes for anything but a bad year in the stock market can be put to bed. The bulls have pretty much run out of time. This week is starting out on a quiet note with little in the way of economic or earnings-related news, but it’s a major week for global central banks, including the FOMC, and the tone of these meetings will also likely be dictated at least in part by Tuesday’s CPI report for the month of November.

We’ve never fully adhered to the idea that small caps lead the broader market. When an entire index like that Russell 2000 is only 22% larger than the largest single company in the S&P 500 (Apple – AAPL), it’s hard to say that it leads the entire economy. Whether they are a leading indicator or not, though, small-cap stocks are widely followed, and recent trading in the space hasn’t been particularly bullish.

Starting with the Russell 2000, the IWM ETF has been range bound now since early November, but in Friday’s decline it barely closed out the week above its 50-DMA after closing below the 200-DMA earlier in the week.

Trading in micro-cap stocks has been even weaker. Not only did the Micro-Cap ETF (IWC) never trade above its 200-DMA in the last several weeks, but on Friday, it opened and closed below its 50-DMA as well.

Looking at all US index ETFs in our Trend Analyzer, the indices that track the largest market cap companies are generally the farthest above their 50-DMAs, and then as you go down the market cap scale, the closer they get to their respective 50-days with the micro-cap ETF (IWC), the only one actually trading below that level.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 12/11/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

Foreign Affairs

Tiny Lithuania Could Change How The World Handles China by Akbar Shahid Ahmed (Huffpost)

Chinese diplomats have made pulling tiny Lithuania to heel a major policy priority, but the tiny Baltic state, used to domination from its large neighbor, is having none of it. [Link]

TSMC founder Morris Chang says globalization ‘almost dead’ by Cheng Ting-Fang (Nikkei Asia)

At an event in Phoenix, Arizona marking the first equipment installation at a $40bn advanced chip fab that represents years of effort to onshore critical industries to the US, the Taiwanese industrialist blamed geopolitics for shifts away from free trade. [Link; soft paywall]

Selling

Surging retail theft could force Walmart to close stores and raise prices, CEO Doug McMillon warns by Thomas Barrabi (NYPost)

A vague gesture towards closing stores is part of a retail industry effort to highlight dollar increases in “shrinkage” or inventory lost to thieves. National data suggests shrinkage has not risen as a percentage of revenue in recent years. [Link; auto-playing video]

Auto Dealers Gird for Softening Demand Amid Higher Rates, Uncertain Outlook by Nora Eckert and Mike Colias (WSJ)

After a two year boom fueled by low rates and soaring demand, auto dealers are facing a big shift that has dealers preparing for the worst: higher payments, too much inventory, and a weak economy are all potential problems. [Link; paywall]

Congress

Sinema leaves Democratic Party, registers as independent by Daniela Altimari and Herb Jackson (Roll Call)

In a desperate bid to save her seat, Arizona Democrat Sinema has retreated from the Democratic Party (though she will keep her committee assignments). She has a lower approval rating with her own party than the rest of the Arizona electorate. [Link]

How Kevin McCarthy Could Lose The Election For Speaker Of The House by Nathanial Rakich (538)

An unusually tight House majority and an unruly caucus could keep frontrunner Kevin McCarthy out of the Speakership and cast the body into chaos at the start of the year. [Link]

Building Permits

A Sense of Where You Are by Devin Bunten (Unplanned Ideas)

The current makeup of American cities and suburbs is a direct function of policy choices made 70 years ago today, themselves driven by the need to meet a massive shortfall in housing construction, a desire for racial segregation, and a new technology in the form of the automobile. [Link]

Climate Hawks Should Have Given Joe Manchin His Pipeline by Eric Levitz (NYer)

Progressive politicians and lobbyists likely made the wrong choice (even based on their own policy goals) when they declined to trade allowing more fossil fuel infrastructure for a failed effort to make decarbonized infrastructure easier to build. [Link]

Food

Is Chicken Birria Authentic? by Javier Cabral (L.A. Taco)

By far the most famous form of birria is the Jalisco-derived braised goat recipe that taco eaters adore. But more unusual – and no less authentic – forms of birria can be found all over Mexico. [Link]

Social Media

Twitter’s Rivals Try to Capitalize on Musk-Induced Chaos by Kalley Huang (NYT)

Social media sites ranging from upstart Post to open source Mastodon are trying to move into the real estate put at risk by antics of Twitter’s new CEO Elon Musk. [Link; soft paywall]

Kids Don’t Want Cash Anymore–They Want ‘Robux’ by Sarah E. Needleman and Sarah Donaldson (WSJ)

Wildly popular online gaming platform Roblox is a key destination for pocket money these days as children prefer buying digital goods to heading down to the store. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Bespoke’s Morning Lineup – 12/9/22 – PPI on Deck

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I’m lazy. But it’s the lazy people who invented the wheel and the bicycle because they didn’t like walking or carrying things. ” – Lech Walesa

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

With an important PPI report about to be released plus Michigan Confidence at 10 AM, futures have still managed to post gains heading into the opening bell. Weaker inflation data out of China could be setting the tone for the positive start as CPI rose just 1.6% y/y which was down from 2.1% in October. All of this will become irrelevant, once the US data is released, though. Stay tuned.

Russia’s invasion of Ukraine caused massive disruption in the global economy, but nowhere was it more pronounced than in Europe. Commodity prices soared resulting in massive inflationary pressures in both food and energy. The negative impacts were also felt in the performance of European stocks. From the time of Russia’s invasion in February through late September, the SPDR Euro Stoxx 50 ETF (FEZ) was down over 25% and nearly double the decline in SPY over that same span. Making matters worse, summer was barely over. Heading into the winter heating season things were only going to get worse.

Well, that’s not exactly what happened. Over the last several weeks, stocks in both the US and Europe have rallied, but with the dollar also declining, European stocks have seen much stronger returns on a dollar-adjusted basis. In fact, through Thursday’s close, FEZ is now outperforming SPY since Russia invaded Ukraine in February. Ten months after Russia’s invasion of Ukraine, crude oil is down, and European stocks are outperforming the US. Now, all we need is natural gas to continue falling.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Bespoke 50 Growth Stocks — 12/8/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were twelve changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Sentiment Staves Off Lower Readings

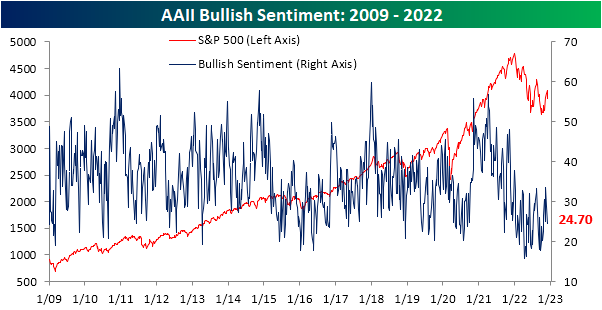

Sentiment tipped over before the S&P 500’s rough start to December. Without the market giving investors any more reason to take a bullish stance, the latest sentiment data from the AAII showed that once again less than a quarter of respondents reported as bullish. This week’s reading was actually slightly higher rising 0.2 percentage points to 24.7%, a reading in the middle of this year’s range.

Although bullish sentiment was higher, bearish sentiment rose by more with the reading going from 40.4% to 41.8%. That is the highest level since November 10th. While bearish sentiment has remained in a relatively tight range just above 40% for the past four weeks, current readings are more muted than what had been observed throughout most of the past year when there have been plenty of readings above 50%.

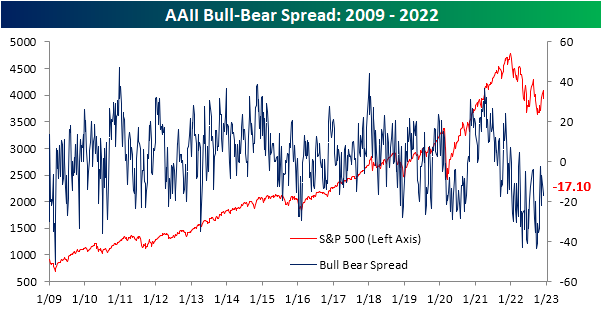

Overall, sentiment continues to heavily favor bears with a 17.1 percentage point spread between bulls and bears. That extends the record streak of negative readings to 36 weeks.

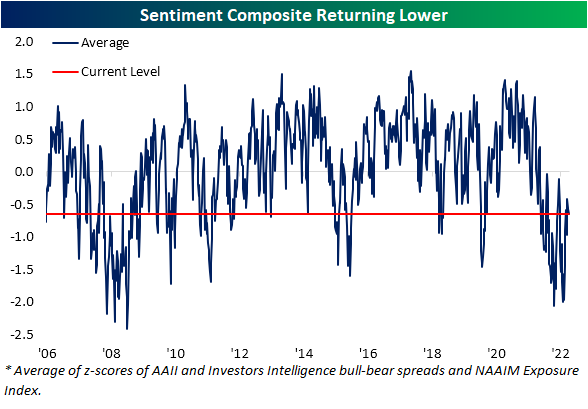

While the AAII survey was overall little changed, other sentiment readings were a bit mixed. The NAAIM Exposure index dropped to the lowest reading in a month. Conversely, the Investors Intelligence survey saw bulls surge to the highest level since late August combined with the lowest reading in the percentage of respondents expecting a correction since June. Aggregating all of these readings points to sentiment taking a bit more pessimistic of a stance this week than what has been observed over the past month. Click here to learn more about Bespoke’s premium stock market research service.

Muddled Continuing Claims Seasonality

At first glance, recent data on jobless claims have not painted a pretty picture of the labor market. For seasonally adjusted initial claims, things have not soured too dramatically although recent readings remain well off the lows from earlier this year. In the latest week’s data, claims rose another 4K to 230K compared to last week’s upward revision of 226K. Given the moves in claims have been somewhat choppy over the past couple of months, the four week moving average has also risen to 230K, the highest reading since the first week of September. In other words, claims are still below summer highs but modestly trending back up to those levels.

On a non-seasonally adjusted basis, the move in the latest week’s reading is right in line with what could have been expected given seasonality. Jobless claims have historically risen over 80% of the time for the current week of the year with an average increase of 85K week over week. The 87K increase this week was right in line with that average and brings the indicator up to similar levels as the comparable weeks of 2017 through 2021 (excluding 2020).

Continuing claims have been the much more worrisome side of jobless claims recently. The seasonally adjusted reading has rocketed higher over the past several weeks, rising to a new high of 1.671 million this week. That is the most elevated reading since the first week of February. Whereas continuing claims had spent a long time below the pre-pandemic range, this latest reading is right back into that range. As we have noted in the past couple of weeks as well (see here and here), the rapid uptick in seasonally-adjusted claims has been consistent with the rise in claims during past recessions, meaning that even if claims are well below where they have been in the past, the speed and direction they have headed are worth keeping an eye on.

While continuing claims are flashing recessionary warning signs after seasonal adjustment, with the latest week’s data (the last week of November) covering a holiday, there are always some difficulties with the seasonal adjustment. On a non-seasonally adjusted basis, claims are still lower than comparable weeks of the year over the past 20 years (top chart below) as claims experience their typical swing higher for this point of the year. As shown in the second chart below, the current week of the year has historically experienced a large uptick. In fact, the average w/w increase for the current week has been 328K, roughly in line with the 300.9K rise in the latest data. Similarly, the total increase off the early October low (+363.5K) has likewise been smaller than the historical median of 538K.

In spite of the tendency of the large swing higher week over week historically, seasonal factoring was not quite as pronounced. As shown below, the seasonal factor was much weaker for the latest week’s data than say the prior few weeks. That is not to say the seasonal adjustment is necessarily wrong or worries of recession as a result of recent moves in the adjusted number are not without merit, rather it is worth noting that the seasonally adjusted number could be sending the message of a more elevated reading on claims than in actuality. In other words, it is not perfectly clear how much of the increase in continuing claims has been the result of seasonality or the beginnings of recession. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke Charts of the Week — 12/8/22

Not yet a member? Subscribe to one of Bespoke’s three membership levels below to receive more in-depth market research and analysis from Bespoke on a daily basis!

Bespoke believes all information contained in this report to be accurate, but we do not guarantee its accuracy. Bespoke’s Charts of the Week is for educational purposes only. None of the information in this report or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. As always, past performance is no guarantee of future results.

Bespoke’s Morning Lineup – 12/8/22 – Imagine…An Up Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Happiness is just how you feel when you don’t feel miserable.” – John Lennon

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures have been steadily improving as we head into the opening bell as the S&P 500 looks to end a streak of five straight declines. European equities have been basically flat trading in a range, while treasury yields and crude oil are higher. One notable asset class that hasn’t been moving at all is bitcoin. In the span of the last 24 hours, the world’s largest cryptocurrency has traded in a range of less than 1%. Looking ahead, the only economic reports on the calendar today are initial and continuing jobless claims. After that, all eyes will shift to Friday’s PPI…and then CPI and the Fed next week.

Happiness is not a feeling the bulls have after the first week of December. The Nasdaq just completed its worst first week to December since 1975. Think about that. Chances are you had no idea what the stock market even was the last time the Nasdaq started off December this bad. Weakness hasn’t just been isolated to the Nasdaq and growth stocks either. While some sectors have done worse than others, they’re all down over the last week as Powell’s speech last week at the Brookings Institution fades into the rearview mirror.

Leading the way lower, Energy has plunged over 6.5% as weaker oil and natural gas prices finally catch up to the sector. There’s no need to feel bad for Energy, though, as it’s still up over 58% YTD and is more than 57% percentage points ahead of the next closest sector (Utilities). Other sectors that have been under pressure since December started were Consumer Discretionary, Financials, Technology, and Communication Services. At the other end of the performance spectrum, Health Care and Utilities get the participation trophies as they’re both down less than 1% MTD.

As bad as December has been to start, one potential bright spot is that every sector except for Energy and Consumer Discretionary remains above its 50-day moving average, so if you want to take the optimistic approach, the last week can still be considered a digestion of the rally off the October lows.

One last side note. This year has been unique for a lot of reasons, but how often is it that you see Energy and Consumer Discretionary simultaneously leading the market to the downside?

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Losses Chase the JPMorgan Chase (JPM) Moving Average Crossover

Banking stocks had been outperforming the broader market throughout most of the fall, but that reversed in a big way in November and even more so this month. The largest stock in the S&P 500 Banking Industry, JPMorgan Chase (JPM), however has been a notable outperformer. As shown below, relative to other S&P 500 banks, JPM has seen its relative strength rip higher.

Although it has reverted lower more recently after trading well above its 50-DMA, the stock has experienced a notable moving average crossover as its 50-DMA has risen above the 200-DMA. That is the first time the 50-day has been higher than the 200-day since the start of the year. From a technical perspective, these types of patterns are considered positive, especially when both are rising (golden cross).

In spite of that bullish reputation, the actual performance following past moving average crossovers where the 50-DMA trades above the 200-DMA is not particularly noteworthy nor should it generate a massive amount of optimism. As shown below, on an average basis, JPM has fallen one week and one month after past occurrences that have happened without another instance in the prior three months. That compares to gains of 0.25% and 1.05%, respectively, for all other periods. Looking further out, average performance has only been notably better than normal three months later albeit that is paired with less consistency to the upside. In other words, moving average crossovers to the upside are not necessarily the positive technical pattern many chart watchers consider them to be. As always, past performance is no guarantee of future results. Click here to learn more about Bespoke’s premium stock market research service.