One Year’s Loss Is Not the Next Year’s Gain

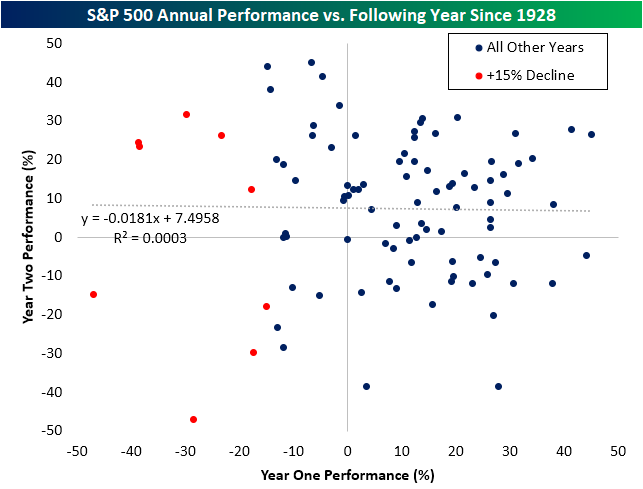

It’s finally the last trading day of what has been a tough year for most asset classes, especially equities. As of this writing, the S&P 500 is on pace to finish the year with a 19.83% loss. Over the course of the index’s history, there have only been nine other years in which the S&P 500 has fallen at least 15% for the full year. Of course, turning the page of the calendar does not mean all the issues dragging stocks lower magically go away, and a big decline one year does not in and of itself mean we’re due for a big gain the next year.

In the chart below we plot the annual percentage change of the S&P 500 versus its move the following year. Taking a linear regression shows that performance one year is not a good explainer for next-year performance with a miniscule R squared of 0.0003. Looking just at those years where the S&P fell 15%+, five times the index posted gains the next year, while four times the index posted further declines. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 12/30/22 – One Last Gut Punch

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Hope smiles from the threshold of the year to come, whispering ‘it will be happier’…” – Alfred Lord Tennyson

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

In case you missed it last Friday, we emailed out our annual Bespoke Report which covers everything you need to know about the setup for financial markets and the economy heading into 2023. You can read it here.

At least we hope next year will be happier! That’s not the case this morning, though, as markets are giving the pulls one last dagger to close out the year. Nasdaq futures are currently down over 1% while the S&P 500 is indicated to open down roughly half of one percent. Besides the fact that the calendar still says 2022, there’s little in the way of catalysts driving the weakness. US Treasury yields are modestly higher on the day while crude oil trades lower. The only economic report on the calendar today is the Chicago PMI which is expected to rebound following last month’s surprise plunge. That index could use a lift as it’s currently in the midst of its largest y/y decline since 1980! From a market perspective, can today’s closing bell come soon enough?

For all the volatility we’ve seen this month, it was surprising to see that the nine 1% days in the S&P 500 (up or down) this month only ranks tied for 10th going back to 1952 when the five-day trading week in its current form started on the NYSE. In fact, even last year just as the S&P 500 was about to peak, the month of December had more 1% daily moves. The other years with more 1% days in December all stand out in market history as some of the most volatile years in market history, including 2008 when there were 15 (more than two-thirds of all trading days in the month) 1% daily moves.

There’s still one trading day left in the year, and if the S&P 500 has another 1% day today it will move 2022 into a tie for 5th place with 1974, 1998, 2000, and 2018 in terms of 1% daily moves in December.

Where December 2022 stands out more, however, is in the number of 1% down days. With six 1%+ declines this December, it already ranks as tied for the third most 1% declines during the last month of the year since 1952. The only years with more were 2008 and 2018 while 1973, 1974, 2000, and 2002 are tied with this year. The only thing positive we can say is that it’s almost over, and hopefully, the new year will be ‘happier’.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Bespoke 50 Growth Stocks — 12/29/22

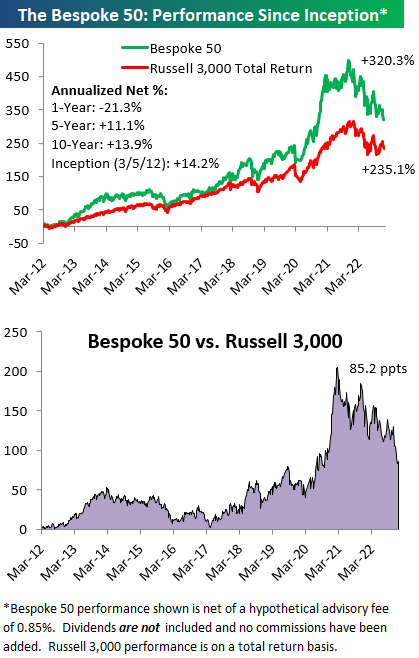

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Bulls Come Home for the Holidays

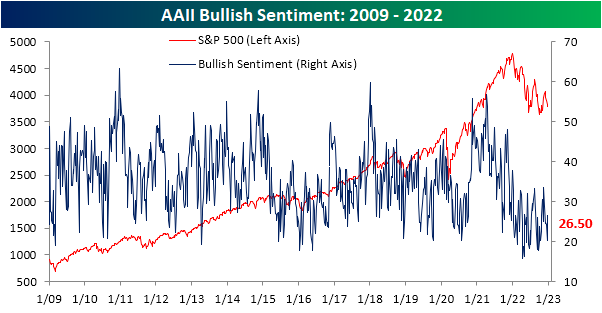

The last week of the year also brings in the last reading on investor sentiment for 2022. Perhaps a bout of new year’s optimism has overridden the negative impact of the market’s continued decline, but bullish sentiment actually rebounded up to 26.5% after spending four straight weeks below 25%. That leaves the reading right in the middle of the past year’s range.

Bearish sentiment, on the other hand, fell from a recent high of 52.3% down to 47.6%. Unlike bullish sentiment, that level remains a bit more elevated. Outside of last week’s 50%+ reading, it would have been the highest reading since October 20th.

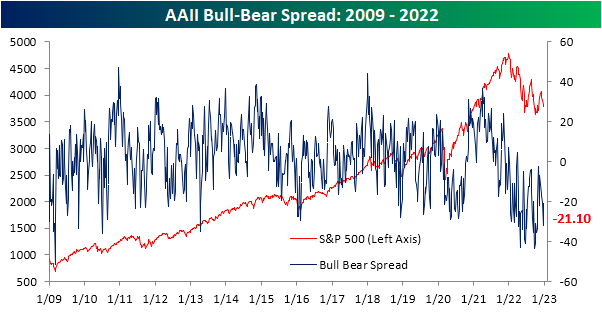

In spite of a slightly more bullish tilt, this week’s data continues to show sentiment is dominated by bears. The bull-bear spread favors bears by 21.1 percentage points; the third week in a row with a sub -20 reading.

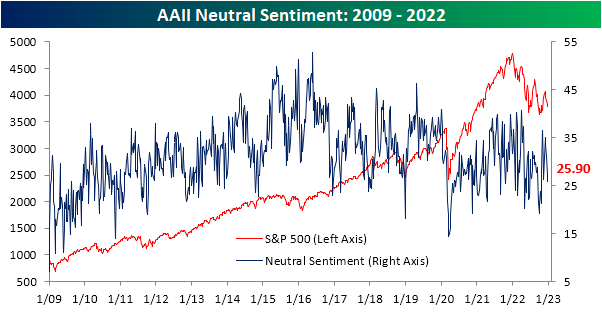

Not all of the gains to the bullish camp came from the bears. The share of respondents reporting neutral sentiment was also lower this week falling for the fourth week in a row. This week’s 1.5 percentage point drop was the smallest of that four-week span but brings the indicator to the lowest level since October 20th. Click here to learn more about Bespoke’s premium stock market research service.

2022 Solidified as the Worst Year for Sentiment

As we noted in an earlier post, today’s release of the AAII survey gives us the final reading of the year on sentiment, solidifying a number of points as to just how dour the investor outlook has been.

For starters, the bull-bear spread heavily favors bears, and that has been the case for some time now. As shown below, the spread has been negative (meaning a higher share of respondents are reporting as bearish than bullish) for a record 39 weeks in a row- over a month longer than the previous record which occurred recently in 2020.

Across all weeks in 2022, bullish sentiment averaged a reading of merely 24.73%. Since the survey began in 1987, that is a record low. In fact, the previous lowest readings were a few percentage points higher at 27.29% and 27.08% in 1988 and 1990, respectively. Meanwhile, the average reading on bearish sentiment was historically elevated at a record of 46.2%, surpassing the prior record set in 2008 by one percentage point. Prior to 2008/2009, only 1990 saw a very high average reading for bearish sentiment.

As we highlighted in an earlier tweet, given the low readings on bullish sentiment, there was not even a single week this year in which bullish sentiment came in above its historical average of 37.63%. Of course with a low share of survey respondents reporting as bullish, a larger share would be reporting as bearish. To match the impressive reading with no weeks seeing above-average bullish sentiment, nearly every week this year (51) has seen bearish sentiment come in above its historical average of 31%, tying the record high set in 2009.

As previously mentioned, bullish sentiment averaged a reading below 25% this year. Given that reading, it should come as no surprise that 2022 also saw a record number of weeks (30) with bulls below 25%. Prior to this year, 1988 (one year after the survey began) was the prior record at 23 weeks. In other words, this year there were nearly two months more in which less than a quarter of investors reported as bullish than the previous record. Additionally, there had been 17 weeks in which over half of the responses were bearish. Similar to the number of weeks in which bearish sentiment was above average, that ties 2008 for the record high. Click here to learn more about Bespoke’s premium stock market research service.

Continuing Claims Top 1.7 Million

Initial jobless claims have not been of particular interest recently as the weekly indicator has seen choppy week-to-week moves that have yet to set any major new high or low. In the latest release, seasonally adjusted claims rose to 225K, matching expectations for the highest reading since the first week of the month. Looking at the four-week moving average to smooth out some of the choppiness, the number has fallen to 221K. This week was the third sequential decline in a row for the lowest reading since early November.

On a non-seasonally adjusted basis, claims tend to drift higher at the end of the year and into the new year. For example, the current week of the year has historically seen unadjusted claims rise week over week 90% of the time since the data begins in 1967. That seasonal drift has appeared this year but to a lesser degree as the past couple of weeks’ increase in claims has been slightly less strong than normal. Given this, claims are well below comparable readings from the years prior to the pandemic and up only slightly versus this point last year.

Continuing claims remain the more worrisome portion of the weekly jobless claims report. The reading has continued to rise rapidly as this week’s reading eclipsed 1.7 million for the first time since February.

There are plenty of ways of measuring how fast continuing claims have risen, but looking at the 3-month rate of change, claims are up over 25%. As shown below, this large of an increase has never occurred outside of a recession. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 12/29/22 – Almost There

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There is no greater sorrow than to recall in misery the time when we were happy.” – Dante Alighieri

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

In case you missed it last Friday, we emailed out our annual Bespoke Report which covers everything you need to know about the setup for financial markets and the economy heading into 2023. You can read it here.

There are just thirteen hours left of trading to go and then we can finally bid farewell to 2022. Futures are positive this morning, but if this year has taught us anything, it is that what happens in the futures market doesn’t often follow through to regular trading. The only economic data on the calendar this morning is jobless claims at 8:30 eastern. Initial claims were right in line with forecasts at 225K while continuing claims increased to 1.71 million, which is the highest reading since February.

Individual investor bullish sentiment increased more than five percentage points but still remains depressed at less than 26%. This week’s results also officially confirm that 2022 will be the first year in the history of the survey (since 1987) that bullish sentiment was below its historical average every week of the year.

Can it get any worse than 2022 has been for the Nasdaq? With the index making a new closing low for the year yesterday, it is very close to going wire to wire on the year with the closing high coming on the first trading day and the closing low occurring right near the last trading day.

The two charts below show when the Nasdaq has made its annual closing highs and lows for every year since 1972. Starting at the top, on average, the YTD high occurs on the 176th trading day, which works out to mid-September. In terms of individual years, the YTD high occurs in Q4 nearly 60% of the time and in Q1 just 18% of the time. Furthermore, there have only been five other years where the YTD high occurred in the first two weeks, and 2008 was the only other year that the YTD high was on the first trading day of the year.

Shifting focus to the YTD low, on average, it occurs on the 90th trading day of the year. Even more notable, though, is the fact that there have only been four other years where the Nasdaq’s YTD low occurred in the final two weeks of the year (2022, 2018, 2000, and 1973). Those are also the only four years in the Nasdaq’s history where it made its YTD closing low in December. In other words, 2022 has been rare in terms of both the timing of the YTD high and YTD low.

Looking at the charts, you’ll also notice that the only other year with a similar setup where the Nasdaq made its YTD high in the opening two weeks of the year and its YTD low in the final two weeks was in 1973. In 1973, the YTD closing low occurred 239 trading days after the YTD closing high, but this year it will be at least 248 trading days separating the two.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Country ETFs in 2022

Earlier today we published our Global Macro Dashboard which provides an overview of the main economic and market data of 22 major global economies. In the table below, we show the recent performance of the ETFs tracking those same countries.

With 2022 drawing to a close, there are only two countries that are currently in the green for the year: Brazil (EWZ) and Mexico (EWW). Neither are up much, but up is up, especially in a year like this one.

In terms of month-to-date change, Hong Kong (EWH) has risen the most with a 5.62% gain, while China (MCHI) is up a modest 0.46%. On the other end of the spectrum, Taiwan (EWT) has fallen sharply with an over 20% decline, but most of that drop is actually due to a $5.18/share long-term capital gain that the fund paid out earlier this month. Click here to learn more about Bespoke’s premium stock market research service.

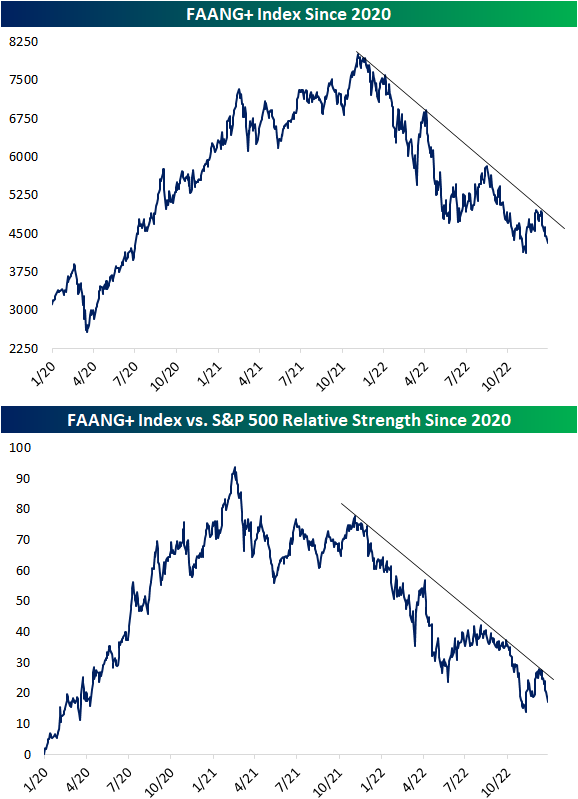

Falling FAANG+

Yesterday Amazon (AMZN) became the third of the mega-cap FAANG+ stocks (along with META and NFLX) to close below its closing low made during the COVID Crash in March 2020. Not only have all of AMZN’s post-pandemic gains been erased, but it’s now trading below its lowest close made during the COVID Crash!

NYSE’s FAANG+ index is described as an index of “10 of today’s highly-traded tech giants.” Given that most of the FAANG+ stocks account for a massive portion of the market cap weighted S&P 500, they are an impactful group. As shown below, the FAANG+ index peaked in early November last year and has dropped 46% since then. The drop more recently follows a failed breakout above the top of its downtrend channel as the index is now back to within 5% of this past November’s low. On a relative basis, the group has been underperforming the broader market for even longer with a high in February of last year.

Below is a look at the ten FAANG+ stocks. As shown, they came into the year with a combined market cap of $12.3 trillion, and they’re ending the year with a combined market cap of just over $7 trillion. While Apple (AAPL) has fallen the least YTD in terms of share price change, it has lost the most in market cap at $844 billion. Amazon (AMZN) has seen its market cap fall the second-most at $843 billion, essentially getting cut in half. Tesla (TSLA), along with AMZN, is one of two names that lost their “$1 trillion market cap” club status this year. TSLA is now down 69% on the year, and its market cap has fallen from $1.06 trillion down to just $344 billion. The other FAANG+ stocks that are down 50%+ on the year include Meta (META), NVIDIA (NVDA), Netflix (NFLX), AMD, and Snowflake (SNOW).

With markets continuing to drop in these final trading days of December, on an absolute basis, 2022 is going to go down as the biggest year of wealth destruction ever for the US equity market. In 2008, the Russell 3,000 saw its market cap fall by $6.7 trillion. As of today, the Russell 3,000’s market cap has fallen about $11.2 trillion so far in 2022. $5.2 trillion of that $11.2 trillion decline has come from just the ten FAANG+ stocks shown below. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 12/28/22 – No News is Good News

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I have no views as to where it will be, but the one thing I can tell you is it won’t do anything between now and then except look at you.” – Warren Buffett (discussing gold)

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

In case you missed it last Friday while you were out holiday shopping or stuck in an airport. We also emailed out our annual Bespoke Report which covers everything you need to know about the setup for financial markets and the economy heading into 2023. You can read it here.

In a year when all the news tended to push stocks lower, it’s nice to see a day with little in the way of news. Equity futures are higher, bond yields are lower, and WTI crude oil is trading just below $80 per barrel after failing to get back above its 50-day moving average yesterday. The only economic data on the calendar today is Pending Home Sales and the Richmond Fed report, and both of those releases are at 10 AM. A lot of people take the last week of the year off, and one group we’re more than happy to see take a break are Fed officials.

Just like any other investment ‘rule’ there are always exceptions, and when it comes to Warren Buffett’s thoughts on gold, most of the time, he would be exactly right. Who would want to own an asset that has little industrial utility and provides no upside in terms if capital appreciation or income? If you want something that just sits there, get a dog.

Every once in a while though, something that just sits there doing nothing may be the best option, and that’s been the case in 2022. With just three trading days left in 2022, the S&P 500 is down close to 20% on the year and long-term US Treasuries are also down by close to a third. Gold hasn’t escaped 2022 unscathed, but with a decline of just over 1%, it’s been the least of all evils in what has been a nasty year for asset classes of all types.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.