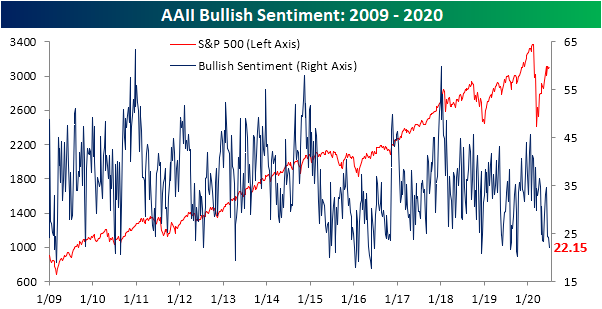

Bullish Sentiment Below 25% for 3 Weeks

Despite generally positive price action over the past week, bullish sentiment has continued to take a hit. AAII’s sentiment survey saw just 22.15% of respondents report as optimistic for equities over the next six months. That is down for a fourth consecutive week and the third week in a row with less than a quarter of respondents reporting as bullish. That leaves bullish sentiment at its lowest level since October of last year when it fell to 20.31% and in the bottom 5% of all readings since the beginning of the survey in 1987.

As previously mentioned, less than a quarter of respondents have reported as bullish for three consecutive weeks now. As shown in the table below, there have not been many other occurrences of this since the start of the survey. In fact, there have only been 13 other times that bullish sentiment has been below 25% for three weeks or more without another occurrence in the prior 3 months. The last occurrence was in the spring of last year. Most of these streaks have ended at three weeks long, but there are some that have gone on for longer with the longest such streak being in 1990 when bullish sentiment remained below 25% for 9 straight weeks. Although this may indicate that investors hold a pessimistic outlook on the market, historically it has led to strong returns for equities. In prior periods where bullish sentiment has been below 25% for three weeks in a row the S&P 500 has tended to outperform over the following weeks, months, and years. Not only is there outperformance, but over the following 3, 6, and 12 months, the S&P 500 has not been lower even once.

Given that, it should not come as a surprise that many of those low bullish sentiment readings have come around market lows as shown in the charts below.

While bullish sentiment has continued to fall, not every investor has been outright bearish. Neutral sentiment rose to 31.96% this week, up 5 percentage points WoW. That was the largest one week jump in neutral sentiment since May of last year when it rose by over 8 percentage points.

Meanwhile, bearish sentiment was actually lower falling to 45.9% from 48.9% last week. Although lower, bearish sentiment is still fairly elevated in the 93rd percentile of all readings in the survey’s history. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Weekly Sector Snapshot — 7/2/20

The Bespoke Report – 7/2/20 – 100 Down, How Many to Go?

This week’s Bespoke Report newsletter is now available for members.

It looked like the market was going to finish out the week on a positive note, but a late-day sell-off erased much of the day’s earlier gains. Even after the decline, markets finished the day and the week in positive territory. While it was a short week, we have a lot to discuss in this week’s Bespoke Report.

Topics discussed include the strongest 100-day rally since 1933, a discussion of long and short-term performance trends in various asset classes, international equity market performance, still elevated levels of volatility, economic trends, sentiment, seasonal trends, and a lot more.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

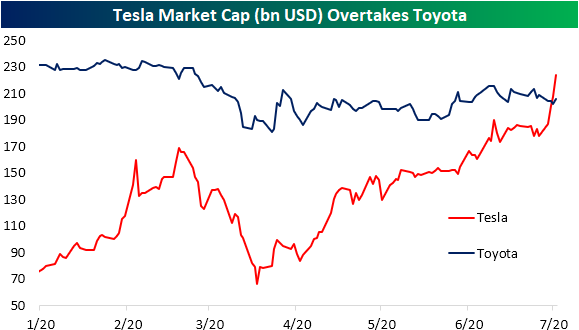

Tesla Tops Toyota

On Tuesday, Tesla (TSLA) reached the milestone of attaining a market cap of over $200 billion. Just one day later it tacked on another $7.5 billion in market cap surpassing Toyota for the highest valued global automobile manufacturer. With another boost today after the company reported a big beat on second-quarter deliveries (90.65K vs estimates of 72K), the stock is up at all-time highs crossing $1,200/share making for a market cap of $237 billion. Meanwhile, Toyota is valued at $205 billion in dollar adjusted terms. That makes TSLA the eleventh largest market cap in the Nasdaq 100.

As shown in the chart below, since Tesla IPOd just over a decade ago, it has consistently been taking up a greater share of the total market cap of global automobile makers. And in the past year, TSLA’s share has skyrocketed. TSLA now accounts for more than a quarter of the total market cap of the 19 largest automakers in the world. The only other automaker that has been able to boast that at any point since TSLA IPO’ed has been Toyota.

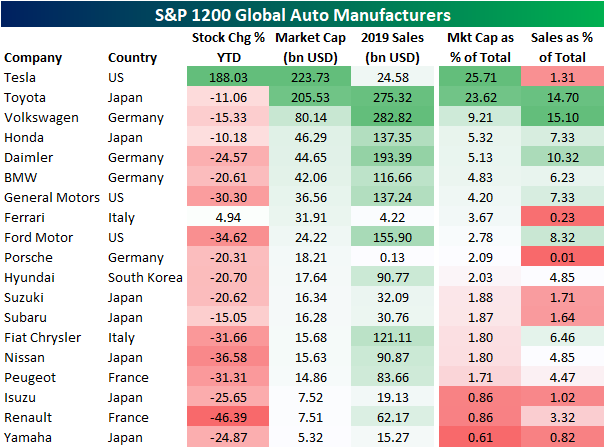

In the table below, we show all 18 stocks in the S&P 1200 Global Automobiles index in addition to Tesla and their YTD change, market caps, and 2019 sales as well as the latter two as a percentage of the total for the group. As shown, other than Tesla only Italy’s Ferrari is up on a YTD basis. But the two stocks’ performances are hardly comparable as TSLA has risen 188% and Ferrari has not even gained 5%. Even though both stocks are sitting in the green in 2020, they account for an extremely small share of global automobile revenues. The two companies combined still account for roughly 1.5% of total revenues of these companies. By comparison, Toyota who has the most similar market cap to Tesla accounts for 14.7% of all sales. Click here to view Bespoke’s premium membership options for our best research available.

China’s Shanghai Composite Approaching 52-Week Highs

Chinese equities surged to close out the trading week today with the Shanghai Composite gaining 2.1%. At current levels, the Shanghai Composite is just 0.80% from taking out its pre-COVID peak made in early January.

Below is a 20-year chart of the Shanghai with a 5-year and 1-year chart included as well. While the index is still well off its highs made during bubble runs in 2007 and 2015, its recent run higher over the last few weeks has pushed it above the top of its 5-year downtrend channel (see second chart below). Click here to view Bespoke’s premium membership options for our best research available.

More of the Same From Jobless Claims

The Nonfarm Payrolls report for the month of June cast a shadow on other labor data, but we did also get weekly jobless claims this morning. While the NFP numbers saw a massive improvement from last month and beat relative to expectations, today’s weekly jobless claims were not as strong. This morning’s release saw more of the same with claims in fact lower, but by a lesser degree than prior weeks since the peak. Seasonally adjusted claims came in at 1.427 million which was lower than last week’s upwardly revised (by 2k) 1.482 million claims but above expectations of 1.3 million. That marked a thirteenth consecutive week in which claims have fallen, the longest streak on record, and the third week in a row higher than expectations. Additionally, as we have been highlighting the past several weeks, although claims have been declining for a record amount of time, the rate of improvement has slowed considerably. Over the past three weeks claims have fallen 46.3K/week on average. That compares to a much larger average decline of 530K/week over the first ten weeks of the current streak. Granted, the level of claims has also dropped sharply, but even as a percentage the pace of decline has slowed.

As for the nonseasonally adjusted data, the same can also be said. By this measure claims have dropped for twelve straight weeks now, coming in at 1.445 million this week. Just like the seasonally adjusted data, there has been a slowed rate of improvement as non-adjusted claims have only seen single to double-digit declines (in ‘000s) in recent weeks compared to much stronger triple-digit declines in the first weeks of the declines off of the peak in claims in April.

Taking a look at the four-week moving average is another way of showing this. Currently sitting at 1.5 million, the four-week moving average fell 117.5K this week which was the smallest improvement week over week since the pandemic began. Additionally, although claims by this measure have fallen for 10 straight weeks, each of those weeks has seen smaller and smaller improvements even as jobless claims continue to come in in the millions.

There was one other con to this week’s data: continuing claims ticked higher to 19.29 million. That was only the second time that continuing claims have risen week over week since the peak on May 8th. The other week that claims rose was May 22nd. This week’s increase is not a glaring negative as the increase was very small at just 59K but is worth highlighting nonetheless. That is actually the smallest weekly move in continuing claims (either positive or negative) since a 3K increase in the first week of March. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 7/2/20 – Fireworks Starting Early

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

There may not be as many fireworks as usual this weekend due to restrictions on social gatherings during the COVID pandemic, but on Wall Street, the fireworks are coming early. Futures are firmly in the green on what has historically been a strong period for equities, and things are likely to only get more explosive later this morning with the release of the June Non-Farm Payrolls report and Initial Jobless Claims. What color the fireworks end up will likely be determined by how these reports come in relative to expectations.

Given the observance of the July 4th Holiday tomorrow, US markets will be closed, so there will be no Morning Lineup tomorrow. Happy 4th!

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, global and national trends related to the COVID-19 outbreak, and much more.

Across the universe of S&P 500 sectors, we’re seeing quite a wide disparity between performance coming into the third quarter. Leading the way to the upside, Technology still reigns supreme as the sector is more than 8% above its 50-day moving average (DMA), followed by Consumer Discretionary (6.0%) and Real Estate (5.4%). At the other end of the spectrum, Energy (-3.35%) is the only sector that is below its 50-DMA.

In addition to the three leading sectors highlighted above, the only other sector that is currently overbought is Communication Services, while every other sector is in neutral territory.

Daily Sector Snapshot — 7/1/20

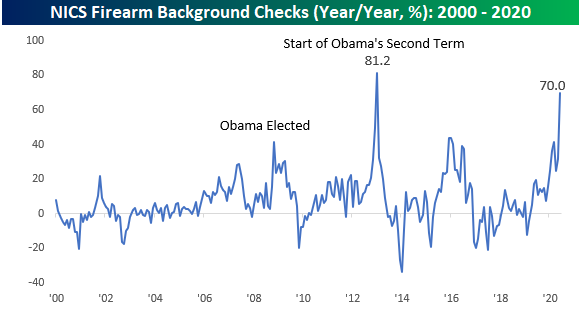

Gun Stocks Blazing

At first glance, the chart below looks a bit like a tally of COVID case counts, but what it really shows is the number of NICS background checks taking place for the purchase of firearms. In the month of June alone, there were 3.93 million background checks which represents slightly more than 1% of the entire US population. Historically, the pattern of background checks follows a saw-tooth pattern hitting their annual highs towards the end of the year, but after hitting a new record high back in March, background checks hit another record high in June. It’s not often that you see that. They say that gun sales increase during periods of uncertainty, and whatever your views are towards the shutdowns or the protests that have erupted all over the country, we can all agree that they have generated enormous amounts of uncertainty.

Besides the instability that has blanketed the country, the decline in President Trump’s poll numbers may also be fueling a rush to buy guns. If Biden were to win in November and the Democrats take control of the Senate, the odds of legislation curbing at least some types of gun sales would only increase. Historically, there is a precedent for this. Back in 2008, when President Obama was elected, the y/y pace of background checks surged at what was a record y/y pace to record highs. When Obama was re-elected, the pace of background checks surged again, increasing at a y/y pace of over 80% at the start of his second term.

With Americans in a rush to buy guns, the two publicly traded gun manufacturers have been on fire. The charts below show the performance of Sturm Ruger (RGR) and Smith and Wesson (SWBI) over the last year. In the case of both stocks, they have doubled off the lows. While financial markets hate uncertainty, these two stocks can’t get enough of it. Click here to view Bespoke’s premium membership options for our best research available.

First Half and Q2 2020 Asset Class Performance

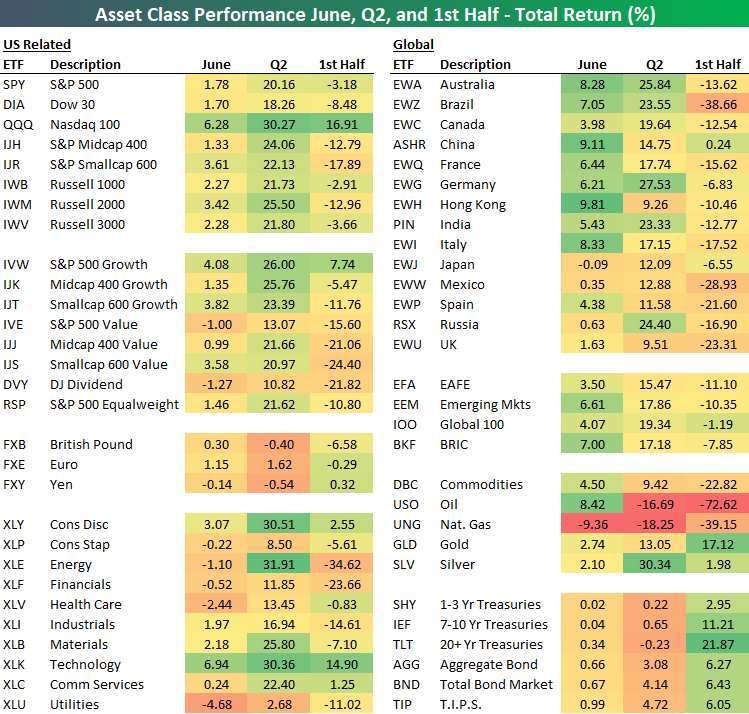

Global pandemics, bear markets, bull markets, countless records in economic data, and widespread protests made for an eventful first half of 2020, to say the least. In the table below we show the total return of various asset classes using key ETFs in June, Q2, and the first half of 2020. As shown, overall the best performing assets in June could be found outside the US as international stocks surged. Hong Kong (EWH) in particular was the best performing asset in June. Oil (USO) similarly saw solid returns of 8.42% during the month but remained the second-worst performing asset in Q2 behind Natural Gas (UNG) which was also the worst-performing asset in June. Additionally, oil was the worst-performing asset in the first half of the year. Meanwhile, although their returns were more muted in Q2 and June, Treasuries (namely at the long end of the curve) were some of the top performers in the first half. Precious metals similarly were strong performers in the first half with particular strength from silver (SLV) in Q2. Silver actually saw returns in line with cyclical equities in Q2.

In terms of the US equities space, the Tech heavy Nasdaq 100 (QQQ) drastically outperformed closing out June with a 16.91% gain in the first half. In Q2 and June, it was also the best performing major index by a wide margin. On a sector basis, Technology (XLK), Energy (XLE), and Consumer Discretionary (XLY) all rose over 30% in Q2 just like the Nasdaq did, though their first half and June returns were more modest with the exception of the Tech sector whose returns were more in line with that of the Nasdaq.

Investing based on market cap saw some interesting dynamics as well. Even though small caps are some of the major US indices down the most on the year—S&P 600 Small Caps (IJR) are down 17.89% and the Russell 2000 (IWM) is down 12.96% YTD—there was some catch up in June as these indices were some of the best performers. That applies to both growth and value names though small cap value (IJS) is still one of the most beaten-down groups in the US equities space. On the other hand, large-cap growth (IVW) offered the strongest returns in June, Q2, and the first half when compared to the various other style ETFs.

Outside of the US, even with big gains in June, countries like Brazil (EWZ), France (EWQ), Italy (EWI), and Spain (EWP) remain down big on the year. Click here to view Bespoke’s premium membership options for our best research available.