China Charges Higher

We’ve highlighted the run in Chinese equities quite a lot in the last several days, but it keeps getting more and more extreme. With a gain of over 1% overnight, China’s CSI 300 not only turned in its eighth straight day of gains but also its eighth straight day of rallying more than 0.5%. In the history of the CSI 300 dating back to 2002, there has only been one other time where the CSI 300 saw eight or more straight daily gains of 0.5%. That was back in April 2007.

If you don’t remember what was going on with Chinese equities back in April 2007, take a look at the chart below. The last time the CSI 300 had a streak of 8+ days of 0.5% daily gains, the CSI had already doubled in the prior six months. From there, though, it went on to nearly double again in the next six months. Eventually the bubble burst, and it wasn’t much more than a year later that the CSI 300 was back below where it was in April 2007. Like what you see? Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup 7/9/20 – Europe Still Lags and China Charges Ahead

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

It’s been a quiet session overnight, and futures are currently indicating a flat open in the S&P 500 and a positive open in the Nasdaq (what else is new?). The big story overnight has definitely been the rally in Chinese equities. While the CSI 300 opened down slightly at the open, it immediately rallied into positive territory and finished up over 1%. Today’s gain not only marks the 8th straight day of gains but also the 8th straight day where the index has rallied more than 0.5%. In the history of the CSI 300 (since 2002) the only other time the index saw that many consecutive gains of more than 0.5% was back in April 2007, right in the middle of that massive bubble.

Shifting focus back to the US, the key indicator to watch today is Jobless Claims at 8:30. Consensus expectations are for 1.375 million which would be down from last week’s reading of 1.427 million. That would extend the record streak of w/w declines up to 14. Despite that record run of w/w declines, in the last ten weeks, Jobless Claims have been higher than expected nine times. Talk about threading a needle!

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, auto sales in China, global and national trends related to the COVID-19 outbreak, and much more.

As you’ve seen each day in the Morning Lineup, case counts and hospitalizations in the US have only been trending higher over the last few weeks. While conditions haven’t improved in the US, you’ve no doubt seen the trends in Europe, which have been improving. Given the diverging paths of the outbreak on each side of the Atlantic, we’ve seen parts of the US rollback re-opening while Europe continues to move forward.

Against this backdrop, you would think the European economy and equity markets would be doing better than the US, but at this point that hasn’t been the case. The chart below shows the performance (in dollar-adjusted terms) of the S&P 500 and Europe’s STOXX 600 since both indices bottomed on 3/23. In the three and a half months since the low, Europe’s STOXX 600 is up an impressive 37.8%. Over that same span, though, the S&P 500 is up over 41%! Now, when we’re talking such large numbers, a difference of less than four percentage points doesn’t seem like much, but it seems a bit surprising that US equities are even outperforming at all. Unless the market has it wrong, the message it’s sending is that looking out six to nine months, the US will find itself in a better place than Europe.

B.I.G. Tips — Emerging Markets and China Outperform

Daily Sector Snapshot — 7/8/20

Stocks for the COVID Economy — 7/8/20

Gold Cup

The gold ETF (GLD) has gone through a nine-year drought from new all-time highs, but as it gets closer to its prior highs from September 2011, there are three possible upcoming technical set-ups. The first would be a massive multi-year “cup and handle” pattern. You can see the “cup” that has been forming over the last nine years. For the “handle” to form, GLD would need to go into a sideways consolidation phase from here for a bit. Once that consolidation phase occurs, the pattern would suggest a significant leg higher over potentially years (rather than months).

The second — and more negative — setup would be a bearish “double top.” This would happen if GLD gets right up to its highs from September 2011 and fails to break through that resistance

Finally, the third setup would simply be a breakout higher from here. GLD could simply continue moving higher and break right through resistance at its 2011 high.

Regardless of what happens, the “cup” that has been forming for nearly a decade now is something you don’t see often. It will be interesting to watch this pattern from a technical perspective over the next few months. Keep an eye on it! Click here to view Bespoke’s premium membership options for our best research available.

China Stock Market Surge — You Ain’t Seen Nothin’ Yet

Today marked the 7th straight day of gains for China’s Shanghai Composite, and as shown below, the index has now exploded above prior highs over the past year.

Over the last 20 trading days, China’s Shanghai Composite is up 15.9%. While that may seem like a lot, it hardly registers as one of the bigger 20-day moves for Chinese stocks over the past 25 years. China’s Shanghai Composite Index has had prior 20 trading day moves of more than 30% multiple times. For Chinese investors, the recent move has been nice, but they may still be thinking “you ain’t seen nothin’ yet.” Click here to view Bespoke’s premium membership options for our best research available.

Record Low Mortgage Rates; Highest Purchases Since 2009

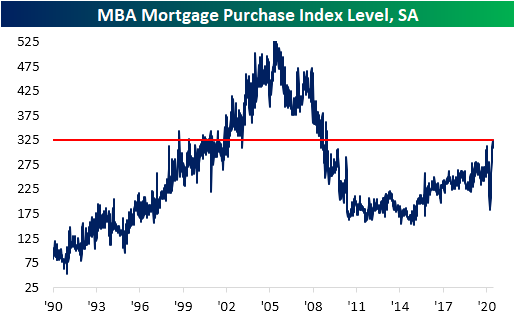

Over the course of the past couple of years, the national average for a 30 year fixed rate mortgage has been on the decline with the only significant spike higher being a temporary one in March of this year. By April, the national average had fallen back to levels prior to the spike, and beginning in June mortgage rates began accelerating to the downside. Just yesterday, the national average was 3.21% which is the lowest level since at least 1998.

As a result of those affordable rates, purchases have continued to surge. Despite the back to back weekly declines over the past two weeks—snapping a record streak of increases in purchase applications at nine consecutive weeks long and the first back to back declines since April—MBA’s purchase index came roaring back this week rising 5.34% WoW. That brings the index to its highest level since the first week of January 2009. This week’s increase was also the largest WoW gain since the week of May 22nd.

On a non-seasonally adjusted basis, purchase applications were actually lower on the week, but that does not mean that they were not strong. As shown in the chart below, on a non-seasonally adjusted basis, as could be expected due to seasonal trends, purchases remain below their peak from the second week of June of this year but are also still well above any readings for the current week of the year over the past decade.

Taking the Fourth of July holiday into account, this week’s reading was perhaps even more impressive. Purchases typically experience a sharp drop during the week of July 4th. In the past decade, the index has declined an average of 37 points during the Fourth of July holiday week, but this year, the decline was just half of that with the NSA index only falling 18 points. In other words, seasonal trends around the holiday appeared to have been softer than normal this year.

With this week’s strength, there is another positive that comes from this morning’s release. Over the past several weeks’ we have noted that despite strength in purchases later than seasonally normal, damage from earlier in the year had left purchases down on a year to date basis versus last year. That changed this week. With a stronger than normal July 4th week, average purchase apps YTD through the first 27 weeks of the year are now actually the highest of the past decade. Click here to view Bespoke’s premium membership options for our best research available.

Seriously Delinquent Mortgages Surge

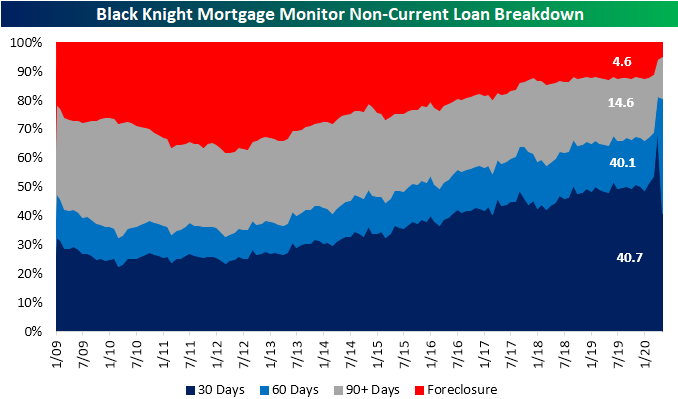

In an earlier post, we highlighted the continued strength of MBA’s weekly reading on mortgage purchases. But another indicator released earlier this week, Black Knight’s Mortgage Monitor, is painting a weaker picture of the US housing market as 4.3 million of all loans are late or in foreclosure. In their release of May data on Monday, the company reported 7.76% of all mortgage loans are now delinquent. That is up from 6.45% in April and the second-largest monthly increase on record behind the 3.1 percentage point increase from March to April of this year. The delinquency rate is now at its highest level since December of 2011.

Of the 4.3 million loans that are delinquent, 200K have moved into foreclosure. As shown below, that leaves both the foreclosure rate and the number of new foreclosures at record lows. While that would normally be a sign of strength, as we have highlighted in the past, foreclosures are low because there has been a moratorium on them. That trend is likely to continue at least for the next couple of months as the FHFA recently extended foreclosure and eviction moratoriums through the end of August from the end of June.

Breaking down non-current loans based on the severity of their delinquency offers some interesting insights. In May, 40.7% (1.75 million) of all non-current loans were delinquent by 30 days. That was down significantly from 69.5% (2.5 million) of all non-current loans the prior month. But the share of non-current loans that are more seriously delinquent (by 60 or 90+ days) rose meaning many delinquent loans remain late on a payment. The number of loans delinquent by 60+ days roughly quadrupled from 427K in April to 1.734 million in May. In total, more than 40% of non-current loans are delinquent by at least 60 days. Loans even more seriously delinquent (90 days) also rose in May to 631K, which works out to 14.6% of all non-current loans and up from 12.8% in April.

Overall, while the number of non-current loans is up, newly delinquent loans as a percentage of total delinquencies declined due to the fact that many borrowers who had previously failed to make payments continued to be delinquent on their loans. Additionally, although there was not a major uptick in new delinquencies in May, that could change in the next few months as forbearances come to an end. In the report, Black Knight noted the schedule for forbearances, and holding constant any extensions, nearly half of all forbearances were set to expire in June with another quarter ending in July. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke CNBC Appearance (7/8)

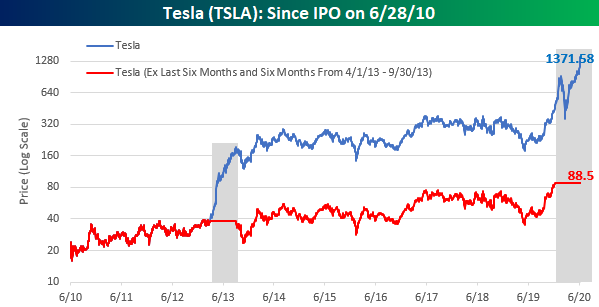

Bespoke co-founder Paul Hickey appeared on CNBC’s Closing Bell on Tuesday to discuss a number of topics including the massive run in Tesla (TSLA). To view the segment, please click on the image below.

The chart below was highlighted in the segment, and it shows Tesla’s performance since its IPO in June 2010. In the chart, each label on the y-axis indicates a doubling of Tesla’s share price. What’s pretty amazing about the ten years that Tesla has been public is that the vast majority of its gains have been confined to two separate six-month windows – the six-month period from April through September 2013 and the last six months. In fact, keeping all things equal, if you were to back out out TSLA’s performance in these two periods, instead of trading just under $1,400 per share right now, Tesla would be under $90 per share. Talk about a lot happening in a little bit of time! Like what you see? Click here to start a two-week free trial for full access to all of our research and market commentary.