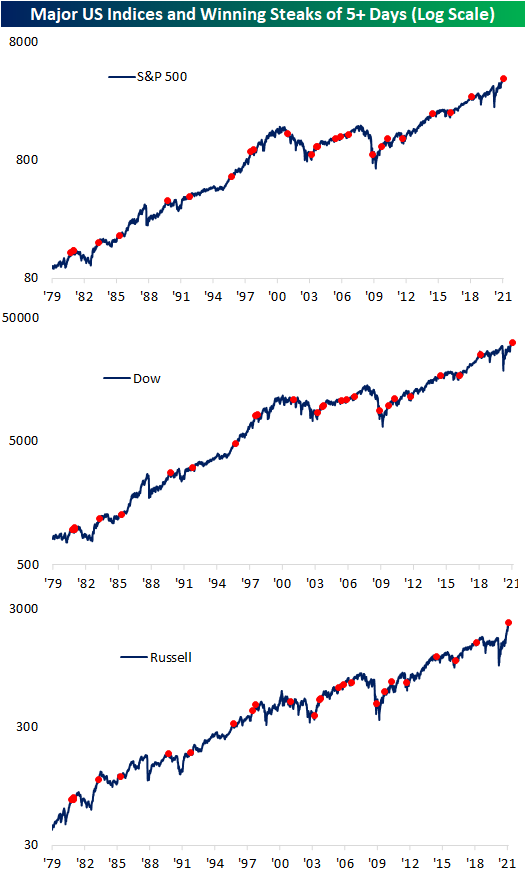

Winning Streaks Coming to an End

With lower closes for both the DJIA and S&P 500 (Russell 2000 was up), both indices ended six-day winning streaks. The last time that the S&P 500, Dow, and Russell 2000 all simultaneously ended winning streaks of 5 trading days or more was nearly three years ago in February of 2018. Just like now, each of the indices were going on six days of consecutive gains. June 2014 and April 2010 also saw identical six-day winning streaks for these three indices.

In the table below, we show the past 24 times since the start of 1979 when the Russell 2000 first began that the S&P 500, Dow, and Russell 2000 saw simultaneous winning streaks of at least five days come to an end. From the close of the first down day that snapped these past streaks, performance has generally leaned positive over the following year. The next week has averaged gains for each of these indices, though we would note, median returns are weaker as big gains following the 2008 occurrence have a heavy impact on the average. In fact, median performance one week after the end of these streaks is actually weaker than the norm for the one-week performance of all periods for each index. For the Dow, in particular, there is a median decline over the next week with positive returns only half the time. One month later has also only seen the index higher half the time while the S&P 500 and Russell are more frequently higher. The performance further out is generally more positive although there is some underperformance relative to the norm. Although the indices are consistently higher three, six, and twelve months later, only the six month period has tended to outperform the norm across each index. Specifically for the Russell 2000, performance is notably strong with positive returns 91.67% of the time. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 2/9/21 – Blink and You May Miss it

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The desire to perform all the time is usually a barrier to performing over time.” – Robert Olstein

After six straight days of gains, US equity futures are poised to open lower this morning. If the S&P 500 finishes the day lower, it will be the first down day since 1/29 when the S&P 500 closed below its 50-day moving average. The data calendar is on the light side this morning. NFIB Small Business sentiment was released earlier this morning and came in lower than expected (95.0 vs 97.0) falling to its lowest level since May. Later on, we’ll get the release of the JOLTS report for December.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, recent moves in the dollar, a preliminary analysis of Japanese Machine Tool Orders, an update on the latest national and international COVID trends, and much more.

One of the hallmarks of a bull market is that corrections are swift and shallow, and windows of opportunity for investors on the sidelines is usually narrow. The pullback we saw in late January provides an excellent example. On January 20th, the S&P 500 closed at ‘extreme’ overbought levels which we classify as more than two standard deviations above its 50-day moving average (DMA). Seven trading days later on 1/29, the S&P 500 was down 3.7% from its high and below its 50-DMA for the first time since early November. Faster than the S&P 500 sold off from ‘extreme’ overbought levels to below its 50-DMA, though, it rebounded back to ‘extreme’ overbought levels again. Yes, just six trading days after closing below its 50-DMA for the first time since November, yesterday the S&P 500 finished the session back above its 50-DMA by more than two standard deviations.

Daily Sector Snapshot — 2/8/21

50 Days Below the 50-Day

While the yield on the 30-year Treasury bond briefly rose above 2% overnight for the first time in a year, in general, long-dated government yields are lower today. As such, the iShares 20+ Year Treasury Bond ETF (TLT) is bouncing from extreme oversold territory today rising over 0.6%. Even after today’s rally, though, TLT continues to trade well below its 50-DMA as it has for 51 consecutive trading days.

The current streak of consecutive closes below the 50-DMA for TLT has now joined a list of 13 prior streaks of at least 50 trading days long. The two longest of these went on for 93 consecutive trading days ending in February of 2011 and September of 2013. While the current streak has plenty of time to go to even tie those records, the last streak was very recent ending on November 19th of last year at 63 trading days long. In fact, between the end of that streak and the start of the current streak, there were only two days. In other words, since August 24th, there have only been two days in which TLT did not close below its 50-DMA. Not only that but with TLT currently trading more than 4% below its 50-DMA, the streak isn’t likely to end any time soon.

In the table below, we show each of the past TLT streaks when they first reached 50 trading days long. For each streak, we also show how TLT and SPY performed going forward. On average TLT has continued to drift lower over the following month, but three months to one year out, performance is generally much more positive. Returns have been positive better than two-thirds of the time three and six months out with average gains of 1.81% and 5.75%, respectively. One year later, TLT has traded higher all but once (in November of 2005 when it only fell 8 bps). As for equities, the S&P 500 (SPY) is similarly weak one week after these streaks averaging a decline of 0.46% with positive performance less than a quarter of the time. Again, returns further out are generally more positive with SPY higher 83% of the time 6 months later and 75% one year later. Click here to view Bespoke’s premium membership options for our best research available.

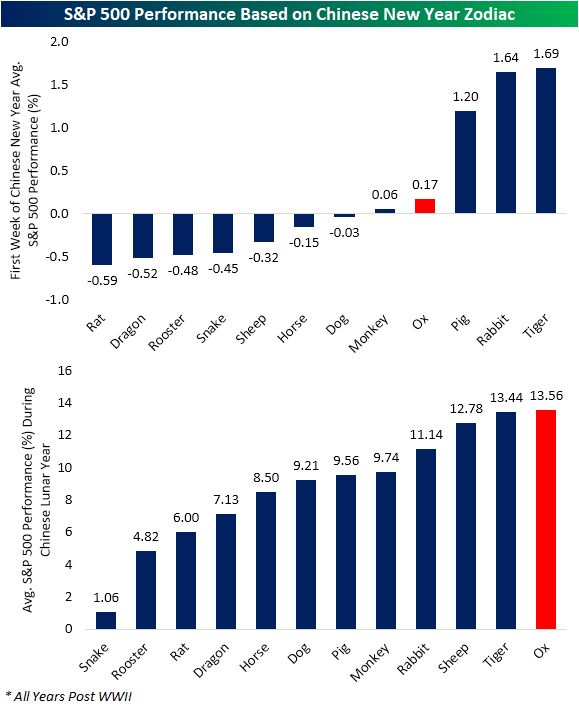

Bullish Returns During the Year Of the Ox

Friday starts off the Chinese Lunar New Year. Celebrations will last for about two weeks though the official legal holiday is seven days long. As such, Chinese markets will be closed from Thursday (New Year’s Eve) through next Wednesday. The Chinese lunar calendar is also associated with a cycle of 12 animal zodiac signs, and 2021 will be the year of the ox. While we would be the first to caution against investing based on zodiac signs, ironically, the year of the ox has historically been met with some of the most bullish market performance in the US. As shown below, in the first week of Chinese New Years that have been marked by the Ox, the S&P 500 has seen an average gain of 0.17%. Only the years of the pig, rabbit, and tiger have seen a stronger performance in the first week of the Chinese lunar year for the S&P 500.

But as for annual performance, from the start of the Chinese lunar year until the end, years of the ox has been marked by the best performance for the S&P 500 with a 13.56% average gain. The past few years that were the year of the ox were 2009, 1997, and 1985. The year of the tiger, which the last one was in 2010, comes in with the second-best performance.

As for the performance of the S&P 500 in the shorter term—particularly around the time when the Chinese markets are closed—in the chart below we show the average intraday performance for the first five trading days of the Chinese New Year for all years since 1990. Despite market closures abroad, the US tends to move steadily higher- and that’s no bull! Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day – Rallies to New Highs

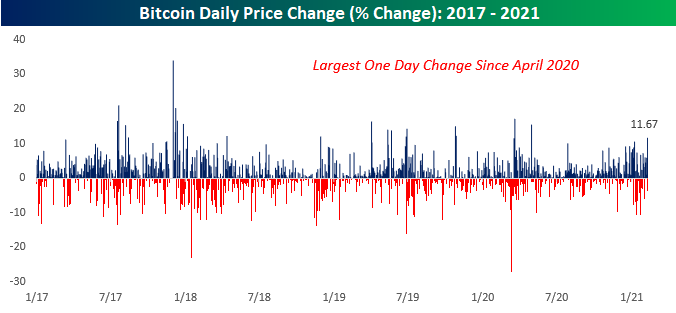

Bitcoin’s Big Day

When it was MicroStrategy (MSTR), it was dismissed as a gimmick, but now that Tesla (TSLA) has used a big chunk of the cash on its balance sheet to buy bitcoin, more people are going to take notice. TSLA hasn’t historically been a company to shy away from publicity, so some will write off today’s announcement as a marketing stunt, but at $1.5 billion, it would be a pretty big stunt. Also, while it’s easy to forget, TSLA is one of the largest companies in the world.

Prior to TSLA’s announcement, bitcoin was already up on the day, but once the news hit, the rally reached a whole different level. Bitcoin is currently trading up over 11% on the day making it the best one-day rally for the crypto-currency since last April.

With today’s rally, bitcoin is also breaking out above its highs from early January and trading at over $43K.

Not only is bitcoin at new highs for the year, but the late 2020 breakout after three years of consolidation is continuing to gain steam.

One of the primary arguments for bitcoin these days is it serves as a digital store of value- or gold 2.0. Based on the relative strength of bitcoin versus gold, gold 1.0 looks a lot less shiny these days. When bitcoin last peaked in late 2017, the ratio of bitcoin to gold peaked at just under 15. A year ago today, the ratio was under six ounces of gold for every bitcoin. Back in early January, the ratio surged to more than 21 ounces of gold for every bitcoin. After this morning’s rally, though, one bitcoin is worth more than 23 ounces of gold, and the ratio increases by one ounce for every 4% rally in bitcoin.

So where does interest with the general public currently stand towards bitcoin? One way to track interest is through Google Trends. The chart below shows search trends for the term ‘bitcoin’ over the last five years. As bitcoin ran up to record highs in late 2020 and early 2021, search interest also picked up but peaked out at levels nowhere even close to where search interest was at the prior peak. This could be read in one of two different ways. The bullish case would be that enthusiasm for bitcoin is nowhere near as high now as it was back then, so there’s still much more room to run. A less bullish take, however, would be that back in late 2017, no one had ever even heard of bitcoin, so they were looking it up just to figure out what it was. Three years later, though, most people are at least familiar with what bitcoin is, so there is less reason to search for it. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 2/8/21- How Much Bitcoin is on the Balance Sheet?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Everyone is digging deeper into their own trench and rarely standing up to look in the next trench over, even though the solution to their problem happens to reside there.” – David Epstein – Range

Equity markets are picking up this week right where they left off last week, and the major averages are all indicated to open the week higher. The big news of the morning has been Tesla’s (TSLA) announcement that it has purchased $1.5 billion in bitcoin with its cash on the balance sheet. TSLA is hardly considered a tradtional company, but when one of the largest companies in the world starts to hold bitcoin on its balance sheet as a substitute for cash, the market takes notice. Not surprisingly, bitcoin is trading up ~15% in the wake of TSLA’s announcement.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, crude oil prices, an update on the latest national and international COVID trends, and much more.

Weeks like the last one don’t come around all the time. With a 4%+ gain for the S&P 500, every one of the index’s major sectors finished in positive territory for the week. Leading the way higher, Energy surged over 8%, while Communication Services, Financials, and Consumer Discretionary all tacked on more than 6%. Following the rally, though, most sectors are overbought, including Communication Services and Real Estate which are both at ‘Extreme Overbought’ levels (more than two standard deviations above their 50-day moving average). Given the strength, we were a bit surprised to see that three sector ETFs still have timing scores that rank as ‘good’ in our Trend Analyzer.

Bespoke Brunch Reads: 2/7/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

GameStop Madness

GameStop Day Traders Are Moving Into SPACs by Amrith Ramkumar (WSJ)

With prices and volatility both subsiding in popular “meme” stocks, investors looking to get ahead of the next pump are turning to SPACs for their big gains. [Link; paywall]

A GameStop Evangelist’s Videos Draw a Regulator’s Attention by Matthew Goldstein (NYT)

Massachusetts securities regulators are looking in to a trader at the center of the GameStop stocks urge for potential violations of supervisory protocols at his former company. [Link; soft paywall]

YouTuber David Dobrik Said He’s Lost $85,000 From Investing In GameStop Stock During The Hype by Tanya Chen (BuzzFeed)

A popular social media influencer reported that he lost $85,000 buying GameStop stock near the peak of the parabolic move in the stock that subsided over the past week. [Link]

Barstool founder Dave Portnoy sells GameStop, AMC shares at $700K loss by Thornton McEnery (NYP)

After collecting a big payday selling his company to Penn National, Dave Portnoy has taken to the markets, and in the latest round of fun turned himself into a GameStop bagholder. [Link; auto-playing video]

What Robinhood Traders Need to Know About Taxes by Laura Saunders (WSJ)

Active traders are going to face an absolute deluge of tax forms and actual levies, with the ten million other new retail traders who entered the market last year destined to learn hard lessons about both how much tax they owe and how big of a pain it is to file those taxes. [Link; paywall]

Back End & Brokering

GameStop Frenzy Puts Spotlight on Trading Giant Citadel Securities by Alexander Osipovich (WSJ)

Market maker and hedge fund Citadel has gotten lots of attention this week for their role in facilitating order flow from retail traders, and not all of it is positive. [Link; paywall]

Jane Street: the top Wall Street firm ‘no one’s heard of’ by Robin Wigglesworth (FT)

Another high frequency firm that makes markets specifically focused on ETFs has bene having a very good year and is also attracting an unusual amount of scrutiny. [Link; paywall]

Aligning with our community by Public (Medium)

In an effort to improve trust in their product, one of the free-to-trade brokerages has decided to stop accepting payment for order flow, and instead operate on a “tip” model. Good luck, we guess. [Link]

Cake

Why Do King Cakes Have Plastic Babies Hidden Inside? by Lindsey Liles (Garden & Gun)

If you’ve ever had a King Cake, you might have bitten in to a plastic baby. Here’s where that odd ingredient comes from. [Link]

Props

It’s flipping madness: ‘Startling’ amount bet on Super Bowl coin toss by David Purdom (ESPN)

Every year, millions of dollars are bet on a negative expected-value outcome that puzzles even the least rational among us; why are people paying as much as 5% of their bet on the outcome of a coin toss? [Link]

Crypto

Visa Signals Further Crypto Ambitions With API Pilot for Bank Customers to Buy Bitcoin by Nathan DiCamillo (Coindesk)

The mainstream payments giant is creating a new suite of APIs that allows banks to offer crypto products side-by-side with traditional financial services. [Link]

India plans to introduce law to ban Bitcoin, other private cryptocurrencies by Manish Singh (TechCrunch)

India is taking steps to ban crypto in the country, instead offering an official digital currency that it will roll out via new legislation later this year. [Link]

Tech Dystopia

There Are Spying Eyes Everywhere—and Now They Share a Brain by Arthur Holland Michel (Wired)

A Montreal company is attempting to put all surveillance techniques available to law enforcement into a single platform, offering a panopticon-like vision of the future. [Link; soft paywall]

Elon Musk Makes Characteristically Wild Debut on a Buzzy Social App Clubhouse by Reed Stevenson (Bloomberg)

The new conversation-sharing app Clubhouse featured a conversation with Tesla CEO Elon Musk this week, and it proved predictably wild with topics including bitcoin, Mars, Robinhood, aliens, monkey brains, and the COVID-19 vaccine. [Link; soft paywall]

A 25-Year-Old Bet Comes Due: Has Tech Destroyed Society? by Steven Levy (Wired)

A quarter century ago, an author and a journalist entered into a bet about the fate of society. While a winner has been declared, the victory was much narrower than might be expected. [Link]

Tech Utopia

The Environmental Upside of Modern Farming by Robert Paarlberg (WSJ)

If the world is going to feed its teeming billions into the 22nd century, it’s going to need a lot of productivity from farms. The good news is that productivity is booming, with use of pesticides dropping 80% since their 1972 peak while water and energy use are both down over 40% on a per-bushel basis. [Link; soft paywall]

Hard Currency

Gold, silver coin demand surging, straining U.S. Mint’s capacity by Devika Krishna Kumar (Reuters)

Sales of gold coins rose 258% last year, with silver coin sales up 28% per data released by the US Mint this week, and heavy buying has continued since. [Link]

Essential Workers

Covid Wears On, Essential Workers Carry On: ‘Everybody Forgets That You’re Still on the Front Line’ by Jennifer Levitz, Valerie Bauerlein and Alejandro Lazo (WSJ)

The front lines and greatest sacrifices of the COVID pandemic aren’t always in ICUs but very often in jobs that simply have to be done to keep the wheels turning. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 2/5/21 – Global Momentum Keeps Rolling

The US equity market closed the week at record highs and stock markets around the world have roared back from last week’s lows amidst lower bond prices and an onslaught of earnings. We dive deep into the results and performance for US companies reporting this season, as well as diving into markets across Europe and Asia to take a look at results from names reporting since last Friday.

In addition to earnings and equity prices, we review economic data in the US and around the world, the outlook for the world’s most important currency market, rotation within the commodities space, and more in this week’s Bespoke Report.

This week’s Bespoke Report newsletter is now available for members.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!