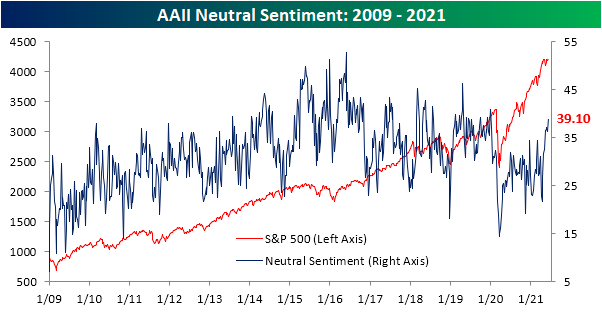

Neutral Sentiment Still On The Rise

After a sharp 7.7 percentage point rise last week, bullish sentiment as measured by the American Association of Individual Investors (AAII) weekly survey pulled back this week falling to 40.2%. While lower, that is still a few percentage points above the levels observed throughout most of May and is roughly 2 percentage points above the historical average of 38.03%. From a contrarian perspective, the more modest readings on sentiment recently are a welcome change from the elevated readings seen earlier this spring and in the winter.

Bearish sentiment tipped back above 20% this week, though, that is still a muted reading in the bottom 5% of the past decade’s range. In fact, the current level of bearish sentiment is around 10 percentage points lower than the historical average of 30.5%. Looking at another sentiment reading, the Investor’s Intelligence survey of newsletter writers saw bearish sentiment fall to 16.2% which is the lowest level since September.

That means sentiment continues to largely favor the bulls, but the drop in bullish sentiment was not matched by an equivalent rise in bearish sentiment. Instead, the bulk of those losses went into the neutral camp. The percentage of investors reporting as neutral has continued to climb reaching 39.1% this week. As has been the case consistently over the past month, that is the highest level in neutral sentiment since the first few weeks of January 2020 when over 40% of respondents reported as such. Click here to view all of Bespoke’s premium membership options.

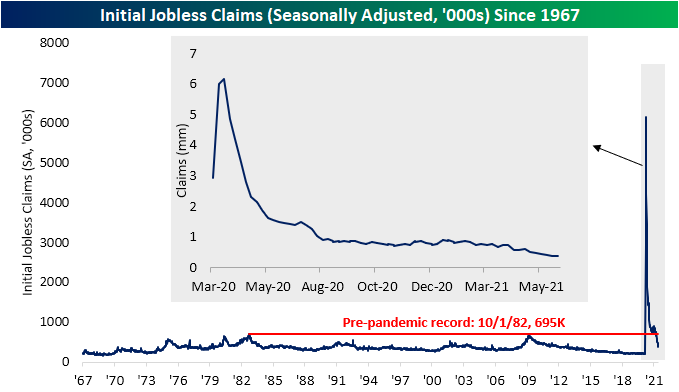

Continuing Claims Finally Improve

Initial jobless claims were expected to fall another 15K this week as forecasts were calling for a reading of 370K. While claims did not live up to those expectations, they did make another move lower falling 9K to 376K. That is now just 120K above the levels from last March, right before claims began to print in the millions.

WIth another sequential decline, seasonally adjusted claims have now fallen for six weeks in a row. That is about half of the record streak of 13 weeks long that ended in early July of last year. Outside of that streak, there have only been six other streaks as long as the current one and only two of those, one in 1980 and the other in 2013, went on for seven weeks.

Those improvements in initial claims were shared on a non-seasonally adjusted basis. Claims from regular state programs fell below 400K for the first time since last year reaching 367.1K. Pandemic Unemployment Assistance (PUA) also set a new low with claims totaling just 71.29K; down only about 2K from the prior week. Although that was a minuscule improvement, the PUA program has massively been unwound over the past few months as we close in on the end dates for the program in half of US states. In fact, this week will mark the exit of the program for Alaska, Iowa, Mississippi, and Missouri. In the most recent week’s data, these four states accounted for 1.7K initial PUA claims and 72.3K continuing PUA claims, or 2.5% and 1.14%, respectively, of PUA claims nationally.

Since the start of the year, the improvements in continuing claims had been decelerating, coming to a head over the past couple of months with multiple upticks. This week offered a sigh of relief as claims fell 258K to 3.499 million. That was not only the biggest one-week drop since March 12th’s 282K decline, but it also brings claims to the lowest level since the week of March 20th last year.

On a non-seasonally adjusted basis and factoring in all other programs (which creates another week’s lag), the picture has been generally more positive. The most recent week’s data through May 21st showed total claims across all programs fell from 15.473 million to 15.376 million, the lowest level of the pandemic. A small uptick in claims from regular state programs was offset by sizable drops in PUA, PEUC, and Extended Benefit claims. Click here to view all of Bespoke’s premium membership options.

Chart of the Day: Wafer Wave Lifts AMAT

Energy Stocks Have a Long Way to Go

The S&P 500 Energy sector is by far the best performing sector year-to-date with a gain of 45.2% through yesterday. As shown below, Energy is outperforming the S&P 500 by roughly 33 percentage points so far in 2021.

Given its huge outperformance so far this year, it’s pretty remarkable that Energy is still lagging the S&P 500 over the last 12 months. As shown below, Energy is only up 22.8% year-over-year versus the S&P 500’s gain of 31.6%.

And longer-term, Energy’s performance on an absolute basis and relative to the S&P 500 remains horrible. Over the last 5 years, the Energy sector is down 18.7% versus the S&P 500’s gain of 99.5%.

Over the last 10 years, Energy is down 24.9% versus the S&P 500’s gain of 227.4%!

It’s not until we go back 20 years that Energy gets back into the green. Since June 2001, Energy is up 69.4% while the S&P 500 is up 233.6%.

Energy has finally experienced some outperformance versus the broad market in 2021, but its 45% gain year-to-date hardly makes up any ground when looking at the sector’s performance in the 2010s. The sector still has a LOT of catching up to do. Click here to view Bespoke’s premium membership options and sign up for a trial.

Bespoke’s Morning Lineup – 6/10/21 – Inflation Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Inflation hasn’t ruined everything. A dime can still be used as a screwdriver.” – H. Jackson Brown, Jr.

It’s inflation day in the US, as the May CPI is on tap for release or, depending on when you’re reading this, has already been released. The only other major report on the calendar is Jobless Claims at 8:30. Futures are mixed heading into the releases, treasury yields are modestly higher, and bitcoin is up over 4%.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of the ECB meeting, the latest economic news from around the world overnight, and the latest US and international COVID trends including our vaccination trackers, and much more.

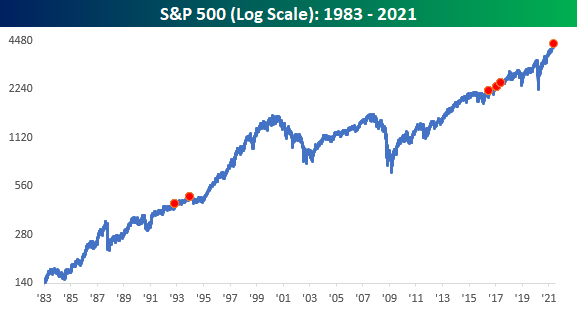

If you were up earlier this morning and in the Northeast US or parts of Eastern Canada, hopefully, you got a chance to view the eclipse. One ‘eclipse’ investors continue to impatiently wait for is the S&P 500 and its prior record high from early May. As we noted on the blog yesterday, the S&P 500 has made multiple attempts since the start of June to top the prior record, but after getting extremely close each time, either the buyers took a break or the sellers came in.

Wednesday marked the fourth straight day that the S&P 500 traded to within 0.15% of its record high but came up short each time. Since intraday data for the S&P 500 begins in the early 1980s, only five other periods have experienced either as long or longer of a stretch of days where the S&P 500 traded within 25 bps of a record high but never got there. The first of these periods occurred in the first half of the 1990s, while the last three all occurred in the year spanning the second half of 2016 and the first half of 2017.

So, does running out of steam just below record highs imply a market running out of gas or recharging ahead of a new leg higher. As shown in the chart below, the results were mixed, but more often than not, investors looked back at these occurrences from higher levels.

Daily Sector Snapshot — 6/9/21

Chart of the Day: Surging Stocks Not Just A US Phenomenon

Close, But No Cigar

It’s been quite a rangebound period for the S&P 500 over the last few days. Over the last 12 trading days, the spread between the S&P 500’s intraday high and low has been just 1.65% which ranks as narrower than any other period since July 2019. More recently, the upside has been especially capped. Ever since the start of June, the S&P 500 has made multiple attempts to take out its 5/7 record high, but each time it has failed. In just the last four trading days, if the S&P 500 doesn’t take out its record high today, the S&P 500 will have traded within 0.15% (0.11%, 0.14%, 0.03%, and 0.02%) of its all-time high from early May, but each time failed to take it out.

Coming up so close so often but falling short each time has to be disheartening for bulls, and it doesn’t happen particularly often either. The chart below shows streaks where the S&P 500’s intraday high came within 0.25% of an all-time but didn’t quite make it. Since intraday data for the S&P 500 begins in 1983, there have only been four other streaks of similar or longer duration. The first two were in the early 1990s, and then it wasn’t until 2016 that we saw a streak of six days. After that 2016 occurrence, there were two occurrences in the first half of 2017. Click here to view Bespoke’s premium membership options and sign up for a trial.

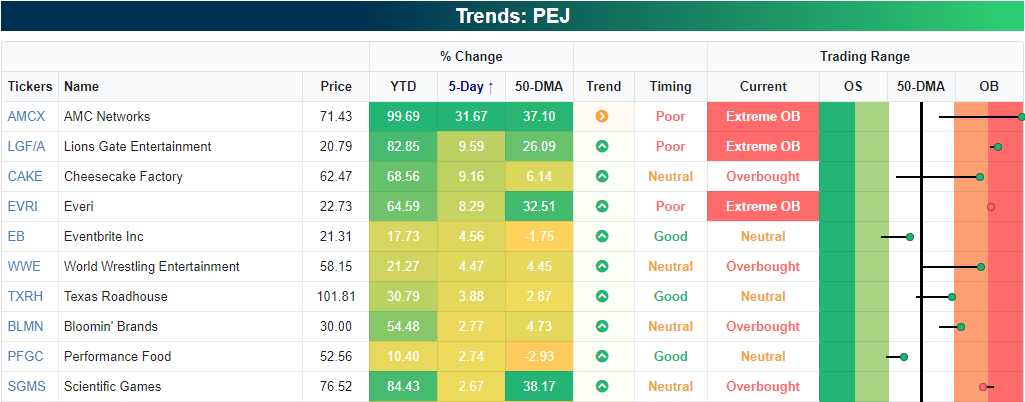

Leisure & Entertainment ETF (PEJ) and AMC Networks (AMCX) Caught In Meme Madness

Glancing through the US Groups ETF screen of our Trend Analyzer, by far the best performer over the past week has been the Dynamic Leisure and Entertainment ETF (PEJ). The portfolio is largely comprised of reopening stocks like restaurants, travel companies, and various forms of entertainment both live and otherwise. PEJ has rallied 11.77% in the five trading days ending yesterday in a move that has moved it deeply into overbought levels as it sits 16.71% above its 50-DMA. As the next best-performing ETFs in this screen, oil-related names like the S&P Oil and Gas Equipment and Services ETF (XES) and Oil Services ETF (OIH) have both risen well over 7% and are even more extended above their moving averages in percentage terms. As for the other ETFs, the S&P Biotech ETF (XBI) is another top performer and is the only one that is not overbought at the moment. Granted, it has retaken its 50-DMA in the past week, and its longer-term trend is worse than the rest of the screen.

Pivoting back to the Dynamic Leisure & Entertainment Portfolio ETF (PEJ), the double-digit move in the past week is actually part of a longer near-vertical move that began in mid-May. Since the May 12th low, PEJ has rallied 28.72% through today moving it to within 2% of its 52-week high from back on March 15th. Additionally, looking just at the nearly 12% rally of the past week, a massive portion of the move came last Wednesday when it rose over 10% in a single session. In fact, last Wednesday was so volatile that even after a few days of higher closes, it is still below last Wednesday’s intraday high.

It is hard to mention parabolic moves these days without some mention of a meme stock, and of course, the massive move for PEJ is meme-related. Below we show the ten best-performing holdings of PEJ over the past week. Topping the list is AMC Networks (AMCX) with a 31.67% gain in the past week alone. After that move, AMCX is just shy of doubling year to date. While sharing a similar name, AMCX is not to be confused (although the meme traders seem to be doing just that) for AMC Entertainment (AMC) which has taken center stage with regards to meme stocks lately. In other words, the AMCX has gotten caught up in the meme stock mania alongside AMC. While AMCX is up big, the chart is extremely extended above its 50-DMA, and at the moment is setting up in what appears to be a head and shoulders pattern. From a technical perspective, that is viewed as a bearish pattern, and for that pattern to be confirmed, it would have to fall below the past several months’ support at around $44 after failing to move above the January and more importantly mid-March highs.

While it has no doubt had an impact, the move in PEJ has not solely been due to the strength of AMCX. The stock only ranks as the tenth-largest holding accounting for 3.26% of the portfolio. There have also been a handful of other strong performers pulling weight like Lions Gate Entertainment (LFG/A) and Cheesecake Factory (CAKE) which both have risen over 9%. Everi (EVRI) has also risen considerably, notching an 8.29% five-day gain. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 6/9/21 – It’s Post Time!

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The reason that you can win at poker and horse racing is the same – you are not betting against the house; you are betting against the other players.” – Steven Crist

Forty-eight years ago today, spectators in the hot, humid long island sun witnessed one of the greatest performances in the history of horse racing, and in the winner’s circle, there was Secretariat, winner of the coveted Triple Crown for the first time in a quarter-century after completing one of the greatest runs in horse-racing history. The horse ran the fastest Kentucky Derby ever, a record that still stands today, easily won the Preakness (unofficially in record time), so it was only fitting that the win at Belmont came in at a record of 31 lengths and likely barely breaking a sweat.

Like poker and horse racing, when it comes to investing, rather than betting against the house, which always wins, you are betting against the crowd. That means that the more informed you are as an investor, the better your chances of success. Just as a bettor who wagers based on the name of the horse or the color of their silks usually leaves lighter in the wallet than when they arrived, an investor chasing the hottest stocks or most popular trends usually, even during one of the greatest runs in market history usually ends worse off than the person on the other side of the trade.

US equity futures are right around the flatline this morning, and the overnight session was a snoozer as futures have traded in a range of less than 0.25%. Crypto assets have seen a bounce after yesterday’s plunge, and commodities are mixed.

Read today’s Morning Lineup for a recap of all the major market news and events including an update on infrastructure talks, the latest economic data from Asia and Europe, and the latest US and international COVID trends including our vaccination trackers, and much more.

Yesterday, investors who still read a physical newspaper were greeted with some interesting headlines related to inflation. Right below the fold on the front page of the Wall Street Journal, they saw “Commodity Prices Skyrocket, Adding to Inflation Fears”. Then on the front page of the Markets section (B1) right at the top was the headline “Traders Bet on Return of $100 Oil”. With headlines like that and a CPI report coming up on Thursday, weakness in the Treasury market would be a safe assumption. Not so fast. While the yield on the 10-year US Treasury was an already low 1.57% when yesterday’s Journal came off the presses, ever since then, it has done nothing but go down. In fact, as of this morning, the yield dropped below 1.5% and on pace for the lowest closing yield in over three months.