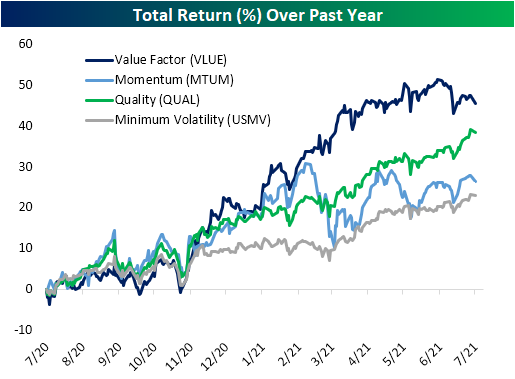

Value (VLUE) Giving Way To Quality (QUAL)

In last night’s Closer, we noted how until February the Momentum factor (MTUM) was keeping up with Value (VLUE), but it has since given up ground as VLUE, even after stumbling of late, remains the clear top performer of the four factor-based ETFs from MSCI. On a total return basis, VLUE has gained 45.42% over the past year which is roughly 7 percentage points more than the next best performer: the Quality ETF (QUAL). Granted, that return was even stronger at 51.49% at the high on June 4th. With VLUE’s outperformance having wavered over the past month, QUAL has been gaining ground. Additionally, although QUAL has underperformed, alongside Minimum Volatility (USVM) there has been a much less ‘exciting’ and steady grind higher than VLUE or Momentum (MTUM). Click here to view Bespoke’s all of Bespoke’s premium membership options and to sign up for a trial.

Big Banks

Below is a quick look at six-month price charts for the six big US banks and brokers. Notably, Goldman Sachs (GS) and Morgan Stanley (MS) are the two that have thus far managed to hold above their 50-day moving averages, while Bank of America (BAC), Citigroup (C), JP Morgan (JPM) and Wells Fargo (WFC) have all moved below their 50-DMAs. These stocks have generally tracked the direction of longer duration interest rates in 2021. When Treasury yields were rising earlier in the year, the banks were flying high. As Treasury yields have fallen, so have the stock prices of banks. In the next couple of weeks, we’ll get Q2 2021 earnings results from all of these firms, which (for better or worse) could at least briefly take attention away from the interest rate story. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 7/7/21 – Yield Plunge Continues

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Truly brilliant marketing happens when you take something most people think of as a weakness and reposition it so people think of it as a strength.” – Reed Hastings

While still higher versus yesterday’s close, US futures have given up some of those gains as the continued decline in long-term treasury yields picks up the pace. The yield on the 10-year US Treasury currently trades below 1.31% which is now lower than at any other point since 2/19. Lower interest rates are good for equity prices, but when the pace of the downside move picks up steam, equity investors take pause.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, a discussion of growth in the Delta variant, economic data from around the world, the latest US and international COVID trends including our vaccination trackers, and much more.

With the Russell 2000 down more than 1% over each of the last two trading days, small caps have really been lagging their large-cap peers. That underperformance continues a trend we have seen over the last several weeks where the S&P 500 has been increasingly outperforming the Russell 2000 on a daily basis. Over the last 50 trading days, the S&P 500 has outperformed the Russell 2000 56% of the time. That matches a number of other periods as the highest frequency of outperformance over a 50-trading day period since late March 2020. What makes the current period different, though, is that if the S&P 500 outperforms the Russell 2000 on any of the next three trading days, the current period will move into the lead as the highest consistency of large-cap outperformance since the end of March 2020. Just as large-cap tech was in the penalty box from early March through the end of Q1, now it appears as though small caps have found themselves in their own timeout.

Daily Sector Snapshot — 7/6/21

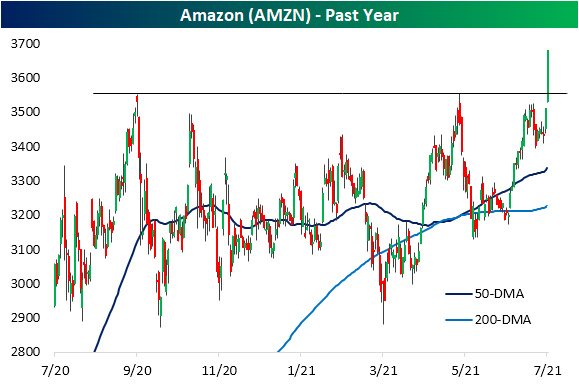

Amazon (AMZN) Primed and Popped

One returning trend that we have made note of recently has been the outperformance of mega-cap stocks on what has generally been moderate broader market breadth. Online retail giant Amazon.com (AMZN) is a good example of this today. Even though the S&P 500 is down 0.35% on 3:1 negative breadth as of this writing, AMZN is providing a boost as the index’s top performer up 4.55%. That puts the stock on pace for its best day since November 4th when it gained 6.32%. While today’s move is notable in its own right as that stands in the 93rd percentile of all daily moves since the stock began trading in 1997, even more impressive is that it marks a breakout to the upside of the past year’s range. As shown below, since last summer the stock has been rangebound between its lows around $2,870 set in late July—which were then retested in September and March—and the highs around $3,550 first reached in September which was then unsuccessfully tested earlier this spring.

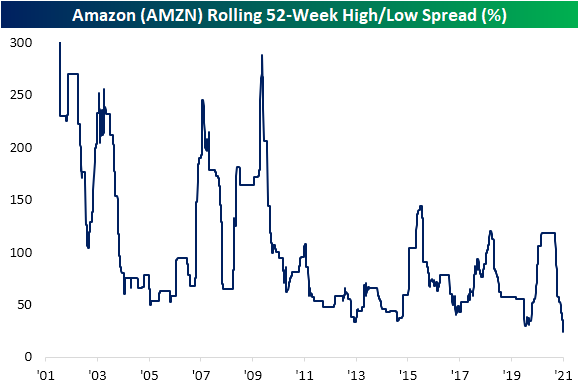

While that range is finally broken, we would note just how tight it had gotten. With the lower readings from last spring having rolled off, the 52-week intraday high/low spread as of last Friday hit a record low of 23.79%. The breakout to new highs today has lifted that reading up to 28.14% which still does not have another period that can be compared to. While not as low as today, the only other times that the spread has come close to current levels was early 2020 right before the COVID crash, February 2015, and June 2013. Click here to view Bespoke’s premium membership options.

Chart of the Day – Netflix (NFLX) Chills

Chinese Equities Falling Behind

2021 saw Chinese equities get off to a strong start with the CSI 300 leading the way higher versus the US (S&P 500) and Europe (STOXX 600). By the time of the Chinese New Year on February 12th, the CSI 300 had already rallied 11.44% YTD, but the new (Chinese) year has seen a plague of regulatory risk resulting in a complete reversal in that earlier strength. From mid-February to March the index fell sharply and it has not done much since then. Chinese equities have now erased the entirety of the double-digit move from the first several weeks of the year as the CSI 300 is currently down 2.5% YTD. Meanwhile, the S&P 500 and STOXX 600 have both trended higher and are currently up 15.58% and 14.58% YTD, respectively. Given the weakness of the CSI 300, the relative strength lines of the S&P 500 and STOXX 600 versus the CSI 300 have taken off in recent months.

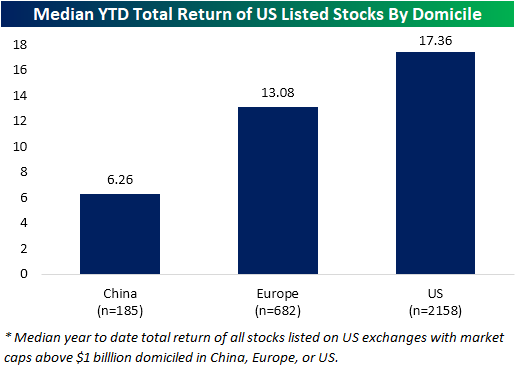

Taking another look at the underperformance of Chinese equities, in the chart below we show the median year-to-date total return of stocks listed on US exchanges with market caps greater than $1 billion grouped by the country, or region in the case of Europe, that they are domiciled in. As shown, US-domiciled stocks have the largest median return this year at 17.36%. European companies whose shares are traded in the US are not far behind in performance having posted 13% gains this year. While still having posted a positive total return, Chinese names are up by far less at only 6.26%. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke Stock Scores — 7/6/21

Memory Lane: Some of The Best and Worst Days of This Week Through History

“Aggressive accounting does not mean illegal accounting” – Kenneth Lay, Enron CEO

“It was greed, pure and simple.” – Dennis Kozlowski, Tyco CEO

“I don’t know accounting.” – Bernard Ebbers, WorldCom CEO

With the July 4th holiday, the first week of July has historically been a rather quiet one for the US equity market, but the equity market don’t always follow the seasonal playbook, and a perfect case in point was the first week of July 2002 when the S&P 500 saw one of its best and worst days in history for that particular week of the year.

Friday, July 5th, 2002 (+3.67%)

With Americans still on edge following the September 11th attacks, the S&P 500 surged on the first trading day after the peaceful and uneventful July 4th holiday. Even a weaker-than-expected jobs report couldn’t dampen the sense of relief. The peaceful weekend coupled with two solid days of gains in European bourses and panic short-covering on a light volume holiday-shortened Summer Friday helped to exaggerate the upside. Relative to prior weeks, it was a rare positive day for the S&P 500. Breadth was positive as gainers outnumbered losers by a margin of more than 4 to 1, and semis surged more than 9%! With terrorism fears momentarily allayed, bulls pushed the S&P 500 to its largest one-day gain since May 8th. Would the post-July 4th rally serve as the catalyst to break the downtrend in US stocks?

Stock market declines in the first half of 2002 were driven by economic weakness as a result of 9/11 and numerous accounting scandals that surfaced in companies like Enron, Tyco, and WorldCom. July 5th provided some irony on that front, though, as The Great Atlantic and Pacific Tea Company (aka A&P grocery chain) disclosed its own accounting error. Only this one was in its favor as an audit showed that the grocer had improperly booked manufacturer discounts and promotions, and the restatement turned what was originally a loss to a gain.

The rally on July 5th also came just two trading days after the S&P 500 first closed below its 9/11 lows, and the bounce instilled some hope that perhaps this would mark the beginning of the elusive bottoming process. Unfortunately, there was no such luck. The following Monday, the S&P 500 dropped 1.22%, and that was followed the next Tuesday by a decline of 2.47%, erasing all of the prior Friday’s gain. The sellers still weren’t done yet, though. Over the next two weeks, the S&P 500 dropped an additional 16%+.

Wednesday, July 10th, 2002 (-3.40%)

After a strong rally on a holiday-shortened Friday (discussed above), stocks opened the following week with declines that reached a crescendo on Wednesday, July 10th when the S&P 500 fell 3.40% to levels not seen in nearly five years (November 1997). As mentioned above, accounting scandals, fears of terrorism, and the weak economy all merged to create one of the worst bear markets in decades, with stocks having their worst half-year performance since 1970.

The first two trading days of this week in July 2002 completely erased the big gains from the prior Friday, and then on Wednesday (7/10/02) equities immediately opened down and ground lower throughout the entire day, closing near the lows of the day. While the news items of the day certainly did not generate any positive sentiment (Qwest under federal investigation, President Bush delivering a speech on corporate responsibility that did not have any concrete steps to prevent future scandals), the market action seemed driven more by despondency than any specific catalyst. A report that investors pulled $11.8 billion out of stock mutual funds in June, the largest move since the prior September after the 9/11 attacks, provided concrete evidence of that sentiment. With so much pessimism and large outflows from mutual funds, a contrarian bet might be to take the other side, but it would be a few more weeks before stocks were able to show any signs of stabilization. Over the nine trading days to the eventual bottom of the July swoon, the S&P 500 fell seven times for an additional decline of 13.3%. Click here to view Bespoke’s premium membership options.

Bespoke Market Calendar — July 2021

Please click the image below to view our July 2021 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.