200-DMA Breakdown for FANG+

Mega cap tech tracked by the NYSE FANG+ index is getting crushed today and is down 3.2% for its worst single-session since May 10th when it fell 3.6%. One key difference between today and then is the technical damage done from a charting perspective. Today’s drop brings the FANG group below its August 19th low and more importantly below its 200-DMA. That marks the first close below its 200-DMA in 378 trading days. While the index does not have the most extensive history dating back to only to 2014, that makes for the second-longest such streak on record behind one that lasted 573 days ending almost exactly three years ago to the day.

Panning over the largest of the FANG stocks by market cap, most are still above their own 200-DMAs with the exception of Amazon (AMZN). Like the index, each of these names have been breaking down a bit from a technicals standpoint. In the case of Facebook (FB) and Alphabet (GOOGL), long-term uptrends are now broken. In tonight’s Closer, we illustrate the impact that the decline of these stocks have had on the S&P 500. You can read more about the FANG breakdown and more in tonight’s Closer with a two-week Bespoke Institutional trial.

First and Second Day of The Quarter Volatility

It’s only been two trading days, but Q4 has already started off on a volatile note. On the first day of the quarter last Friday (10/1), the S&P 500 rallied 1.15%. Today, though, last Friday’s gains have been more than erased as the S&P 500 is down 1.2%. A rally of more than 1% on the first trading day of a quarter is not that uncommon as it has happened just over 20% of the time since 1990. Since 1990, though, this quarter is on pace to be just the third time that a quarter has started with a 1%+ gain only to be followed by a 1%+ decline. The first occurrence was at the start of Q3 in 2000 just after the dot-com bubble burst. The only other occurrence was just over two years later at the start of Q4 2002 just as the 2000 – 2002 bear market was ending. Given the small sample size and the completely disparate paths of the S&P 500 following both periods, there’s really not much you can read from these two occurrences except perhaps that they were both periods of extreme volatility for the equity market.

As far as the inverse situation is concerned, there are more occurrences when the S&P 500 dropped 1% on the first day of a quarter only to rally 1%+ the following trading day. Since 1990, this has occurred seven times. Occasionally, this signifies the bottom of a market pullback, such as April of 2020, April of 2018, October of 2011, and October of 1998. Click here to view Bespoke’s premium membership options.

Global Auto Stocks Strong Despite Weak Sales

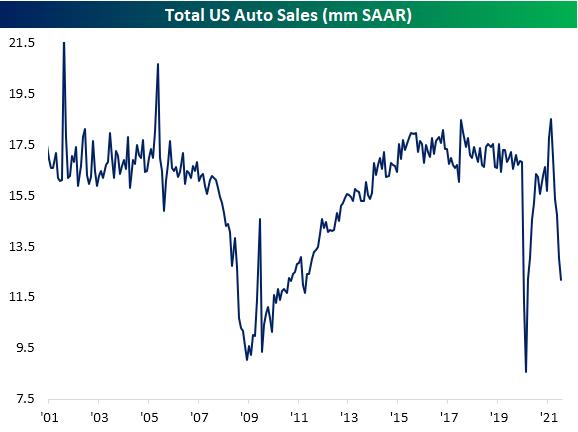

Throughout the day on Friday, quarterly US vehicle sales figures from WARD’s Automotive Group were released. In aggregate, US sales continue to plummet likely more as a result of supply constraints and low inventories. Total sales came in at 12.18 million SAAR versus expectations and a previous reading of at least 13 million.

Delving into which brands are the most prominent, below we show the percentage share of Q3 sales that can be attributed to each brand. As shown, Toyota (TM) topped the list in the third quarter by a wide margin accounting for 16.63% of total sales versus 13.02% for the next highest brand: GM (GM). Stellantis (STLA), Ford (F), and Honda (HMC) are the only other brands that accounted for a double-digit share of total sales. Of those, only Honda and Toyota saw their share grow versus before the pandemic with the latter seeing much larger growth. While those brands make up a larger share of total sales than they did at the end of 2019, they are not the ones to have seen the largest growth year over year. Tesla (TSLA) holds that title with sales up 30% YoY. Mazda, Hyundai, Volvo, Kia, BMW/Mini Cooper, and Toyota are the only other brands to have grown year over year.

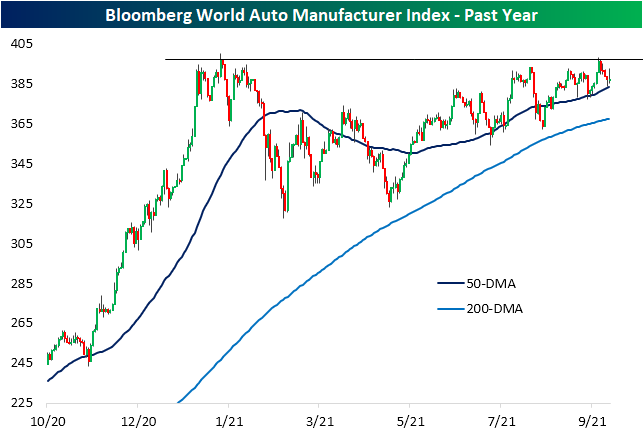

In spite of the massive drop in aggregate sales, the stocks of these global auto manufacturers have held up well, especially relative to the broader market as the S&P 500 is now down 5.4% from its 52-week high. As shown below, at the end of September, Bloomberg’s World Auto Manufacturer Index stopped short of its 52-week high set on January 25th. Currently, the index is down roughly 2.16% from those levels, but it also appears to be finding support at its 50-DMA as it has a handful of other times over the past several months. The strength in the auto stocks in the face of weak sales suggests that investors know the drop in sales is due to supply issues instead of demand issues, and they expect those supply issues to be resolved at some point. Click here to view Bespoke’s premium membership options.

Chart of the Day – Extreme Oversold Readings For a Change

Bespoke Market Calendar — October 2021

Please click the image below to view our October 2021 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.

Silver Gets Back in the Backseat

Gold and silver are two precious metals typically used as investment vehicles for diversification and as a hedge against the dollar. Because gold and, to a lesser extent, silver don’t have a lot of industrial utility, prices are often defined by the value the consumer is willing to pay. In times when the dollar is weakening, investors have typically rushed to ‘safe havens’, a category that precious metals tend to fall in.

While it would be reasonable to expect gold and silver to trade similarly, that hasn’t necessarily been the case over the last decade. Using the two ETFs that track the metals (gold- GLD and silver- SLV) as proxies, while they have been positively correlated, gold consistently outperformed silver from the beginning of 2013 right up through the start of 2020. The lower chart shows the relative strength of GLD versus SLV over the last 10 years. In it, a rising line indicates outperformance on the part of GLD while a falling line indicates SLV outperforming GLD.

With the outbreak of COVID, gold’s relative strength versus silver went parabolic in March 2020 but quickly pulled back thereafter. As optimism over economic growth surged in the months after the economic lockdowns, silver continued to outperform gold through the first quarter of this year. However, as economic expectations have started to reset as the re-opening hasn’t been as smooth as originally hoped, silver has once again taken a back seat to gold. Even as both have declined over the last few months, as shown in the top chart, the drop in silver has been larger than gold. Given that it has at least some industrial utility, silver’s relative strength versus gold tends to be impacted more by sentiment regarding economic growth. Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

September 2021 Headlines

Gun Background Checks Down Again

While background checks for the purchase of firearms may not be the most obvious example of an economic indicator, we find that they are worth watching as a gauge of sentiment. For example, if you see a sudden sharp increase in the number of background checks, it could be a signal of increased uncertainty on the part of Americans. After all, when things are going smoothly in the economy and society, people probably don’t feel the need to go out and buy a gun. A perfect case in point is last year during the early days of the pandemic in the Spring. In January 2020, right before COVID, there were 2.7 million background checks for the purchase of firearms. By March, even with most of the economy locked down, background checks surged 37% to 3.7 million. After that initial COVID surge, background checks dropped off a bit but then rebounded throughout the summer as protests flared up across the country. Then, after President Biden was elected and Democrats gained control of the House and the Senate, there was one last surge to a peak of 4.69 million in March 2021.

From that peak in March 2021, background checks have plunged over the last six months to a pre-COVID level of 2.63 million. Not only that, but with six straight months of declines, there has only been one other period in the last 20 years where background checks declined for as many consecutive months. That was back in June 2013 just after President Obama was re-elected. Since Democrats are traditionally more anti-gun than Republicans, any time they do well in elections, it creates a short-term surge in people looking to buy firearms in order to get ahead of any potential anti-gun legislation.

While a drop in firearm purchases suggests an easing level of uncertainty on the part of Americans, it’s obviously not good for the manufacturers of firearms. As shown in the charts below, both stocks are well off their recent highs and are currently testing support levels. Smith and Wesson (SWBI) has actually nearly been cut in half from its highs in the Summer, and while Sturm Ruger (RGR) has held up much better, it is still down 20% from its high. Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Bespoke’s Morning Lineup – 10/4/21 – Hostage to Interest Rates

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If a window of opportunity appears, don’t pull down the shade.” – Tom Peters

Equities are looking lower to start to the week, but the magnitude of the losses has narrowed over the last hour or so. There’s very little in the way of economic or earnings-related news to deal with today. For the week, the major economic news will be Tuesday’s ISM Services report and Friday’s Non-Farm Payrolls. That will give investors plenty of time to focus on negotiations in Washington over reconciliation and the debt ceiling.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

With equity futures lower, one thing you can count on is that interest rates are moving higher to start the week. As shown in the chart below, the performance of the equity market has recently been closely tied to the direction of the 10-year US Treasury yield on an inverted basis. For much of the last six months, SPY has moved step for step with the yield on the 10-year. The only period of divergence was back in August when yields first started to move higher (shown in the chart below as a falling red line). Initially, the S&P 500 kept moving higher, but by early September, the tug of interest rates began to pull the equity market lower.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.

Bespoke Brunch Reads: 10/3/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Conflicts of Interest

131 Federal Judges Broke the Law by Hearing Cases Where They Had a Financial Interest by James V. Grimaldi, Coulter Jones and Joe Palazzolo (WSJ)

More than 685 lawsuits heard between 2010 and 2018 involved judges that had an explicit financial conflict due to ownership of stocks impacted by the suits. [Link; paywall]

Kaplan Steps Down as Dallas Fed Chief, Hours After Rosengren by Catarina Saraiva and Craig Torres (Bloomberg)

After revelations that two different regional Fed Presidents traded individual stocks during 2020 and called their objectivity into question, both have stepped down within hours of each other. [Link; soft paywall]

Investing Business

Fidelity Brings Fractional Share Trading to Advisors by Diana Briton (Wealth Management)

RIA custody clients of Fidelity will get the ability to trade fractional shares for their clients across both single stocks and ETFs. Custody clients will get the benefit slightly later. [Link]

Franklin to Buy Custom Indexing Firm O’Shaughnessy to Help Personalize Portfolios by Justin Baer (WSJ)

Asset management giant Franklin Resources is betting on custom indexing, buying a modest asset manager whose core strength is a technology platform that allows investors to create and get exposure to custom indices. [Link; paywall]

University Endowments Mint Billions in Golden Era of Venture Capital by Juliet Chung and Eliot Brown (WSJ)

Numerous colleges saw their endowments gain more than 50% in the year ended June as favorable base effects and huge returns from venture investing sent the value supporting private colleges to their best years on record. [Link; paywall]

Downfall

Graveyard of the bikes: Aerial photos of China’s failed share-cycle scheme show mountains of damaged bikes (Straits Times)

The explosive growth of bike sharing programs in China didn’t lead to the sort of permanent demand that had been expected and the result is massive “graveyards” for scrapped bikes which are discarded when riders don’t turn up. [Link]

The Ancient People Who Burned Their Culture to the Ground by Blair Mastbaum (Atlas Obscura)

A pre-Roman society in Spain that was one of the most developed and powerful in the region is being unveiled by a site in Extremadura that suggests a self-destructive end. [Link]

TV

Why Is Every Young Person in America Watching ‘The Sopranos’? by Willy Staley (NYT)

A wandering investigation of why so many younger Americans – many far on the political left – are jumping into The Sopranos. The show is less about the Mafia, and more about American decline, or so many new enthusiasts argue. [Link; soft paywall]

How Peyton and Eli Manning Are Changing Television by Jason Gay (WSJ)

Three weeks in to the NFL season, ESPN’s experimental Manning-only version of their Monday Night Football broadcast has achieved rave reviews for its Twitch-like approach to covering sports. [Link; paywall]

Inflation & Shortage

An Obscure Chinese Mining Law Is Hobbling Global Energy Security by Alfred Cang (Bloomberg)

Back in March, Chinese coal miners faced stepped-up requirements for miner safety, which has made it harder to expand production of the critical energy resource. Tighter climate enforcement has also played a role, but this key factor has flown further under the radar. [Link; soft paywall]

Dollar Tree to Sell More Items Above $1 as Costs Rise by Sarah Nassauer (WSJ)

Famous for selling nothing at more than a single dollar bill, Dollar Tree has decided to shift strategy amidst supply chain costs and high demand. Previously the chain had experimented with higher-dollar items, but this latest choice is a more widespread one. [Link; paywall]

The Return of Empty Shelves and Panic Buying by Andrea Felsted (Bloomberg)

Supply chain snarls have left some grocery shelves empty in a vibe reminiscent of pandemic panic buying back in March and April of 2020. COVID restrictions around the world are also playing a role. [Link; soft paywall]

COVID

Merck to seek emergency US approval of oral COVID treatment by Will Feuer (NYPost)

Clinical trials for a 5 day course of pills designed to fight COVID severity went so well that the trial was discontinued in order to give all participants the drug. It appears to prevent hospitalization entirely. [Link]

Newsom orders COVID vaccines for eligible students, the first K-12 school mandate in nation by Howard Blume, Rong-Gon Lin II, and Taryn Luna (LAT)

All eligible school children in the country’s largest state will be required to receive COVID vaccinations per a mandate from Governor Gavin Newsome on Friday. [Link]

Real Estate

Squamish Nation moves Vancouver forward with transformative Senakw project by Kenneth Chan (Daily Hive)

Frustrated by anti-development elements in Vancouver, the Squamish Nation is using its special legal status to opt out of approval by the city government, giving the stiff-arm to anti-housing advocates and introducing 50+ story residential towers to Kitsilano. [Link]

Fedcoin

Analysis: U.S. Fed navigates policy minefield with impending digital dollar report by Jonnelle Marte and Michelle Price (Reuters)

The Fed is due to release a report exploring adoption of a digital dollar not reliant on bank liabilities like deposits. Some helpful background explains how the central bank is likely to come down on the issue in this read. [Link]

Emissions

Electric Cars Have Hit an Inflection Point by Robinson Meyer (The Atlantic)

After years of slowly building momentum, EV adoption and production have reached a point of critical mass. Climate subsidies and charging network rollouts well help smooth the process, but even without more state support the shift towards zero emission driving is here to stay. [Link]

Hole in the ozone layer widens as recovery remains in the distance by Camilla Hodgson, Claire Buchan and Steven Bernard (FT)

While the end of CFC use means that the ozone layer will repair itself over time, this year has still seen a record large gap in UV protection over Antarctica. [Link; soft paywall]

Irrational Investors

Individuals Embrace Options Trading, Turbocharging Stock Markets by Gundan Banerji (WSJ)

Retail investors continue to sway markets, with options the latest space to get large flows of retail trading that was scarce or inconsistent only a few years ago. [Link; paywall]

MIT Study Finds Older Men Are More Likely to Panic Sell Stocks (Bloomberg/The Wealth Advisor)

Three critical factors made investors more likely to dump stocks during selloffs: being male, being over the age of 45, being married, or having a self-described “excellent” level of investment experience. [Link]

Texas

JPMorgan’s Texas Muni Work Becomes Latest Culture War Fallout by Amanda Albright and Danielle Moran (Bloomberg)

Texas laws designed to punish private companies for taking stances on certain political questions will shut JP Morgan out of the $58bn Texas muni underwriting market. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!