The Ups and Downs of Sentiment

In today’s Morning Lineup, we discussed the sideways range the S&P 500 has found itself in over the past eight trading days. With indecisive price action, sentiment—as measured by the AAII’s weekly survey— has been equally undecisive. After picking up substantially last week from 19.8% to 32.0%, the percentage of respondents reporting as bullish has reversed most of its gains coming in at 21.0% this week%

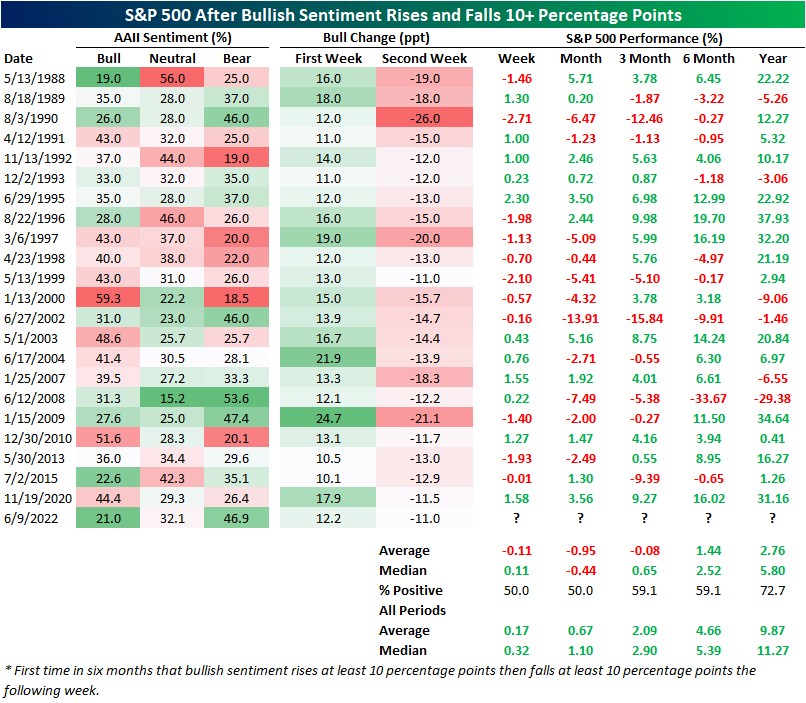

Back-to-back weeks of double-digit moves (either positive or negative for both weeks) in bullish sentiment are relatively rare with only about 4.6% of all weeks in the history of the survey dating back to 1987 seeing such a move. Of those, less than two dozen resemble this week with bulls rising by at least 10 percentage points in the first week followed by a 10 or more percentage point drop the next week for the first time in at least six months. The most recent occurrence (of any double-digit back-to-back moves) was over a year ago in November 2020 when bulls rose by an even larger 17.9 percentage points followed by an 11.5 point drop. We would also note that the current situation has the second-lowest reading in bullish sentiment of these past instances behind May 1988—roughly one year after the survey began—when it was two percentage points lower.

As we have frequently noted in the past, low bullish sentiment has actually tended to be a positive signal for forward performance of equities. Although that could pose an optimistic sign for the S&P 500 going forward, big swings up then down then have not tended to be the best sign for equities. As shown below, after similar moves in bullish sentiment, performance for the S&P 500 one week and month later has been positive only half the time with an average decline of 0.11% and 0.95%, respectively. While performance is more often than not positive three months later, the S&P 500 has averaged an 8 bps decline versus the norm of an average gain of 2.9%. Six and twelve-month performance is similarly more consistently positive but does not outperform the norm.

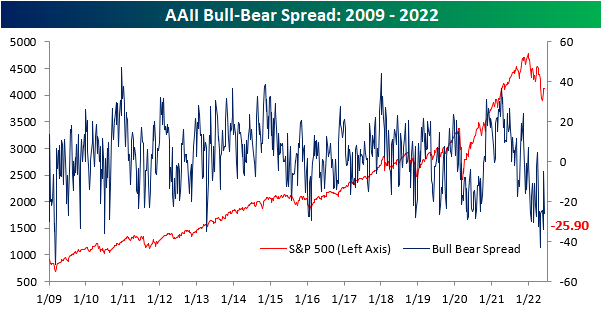

As bulls stepped back this week, bears recouped nearly 10 percentage points rising from 37.1% to 46.9%. While that is still below the readings above 50% observed throughout April and May, historically that is an elevated reading well above the historical average of 30.7%.

Given this, the bull-bear spread moved deeper into negative territory meaning bears continue to heavily outweigh bulls. Bears currently outnumber bulls by 25.9 percentage points. Again, that is a very low level albeit not as extreme as only a couple of weeks ago. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day: Intraday Performance Leads Market Move Higher

Claims Better Behind Seasonality

Seasonally adjusted initial jobless claims came in well above expectations today rising from 202K to 229K. Only an increase of 4K had been penciled in by economist forecasts. Although that increase brings claims up to the highest level in about six months, looking back historically it is still within the range of readings in the few years prior to the pandemic and that is also well below the typical readings for much of the history of the data.

Turning over to non-seasonally adjusted claims, recent readings have been much less volatile. In fact, compared to the seasonally adjusted number whose 27K increase was the largest since July of last year, unadjusted claims experienced a meager 1K uptick relative to last week. While the 1K increase during the current week of the year is very much normal (since 1967 72% of the time the 23rd week of the year has seen NSA claims rise WoW), it wasn’t a particularly large increase. On average, the same week of the year has seen unadjusted claims rise 31K. With the caveat that it covered a holiday week and revisions are still possible, that basically means the bulk of the move this week in the adjusted number was due to that seasonal adjustment rather than a material increase in claims. Taking another look at the unadjusted number, the current week of the year is well below the readings for comparable weeks in the years before the pandemic. In other words, the non-seasonally adjusted number points to a bit more strength than the adjusted number leads on.

Taking another look at the effects of seasonal adjustment, below we show the current series for seasonally adjusted and unadjusted claims as well as the adjusted numbers but using 2019 seasonal factoring (essentially removing any impacts on seasonal adjustment of the outlier-like high readings of the pandemic). While there are some minor discrepancies like how the current series had been understating claims relative to 2019 factoring earlier this year and the 2019 factoring was much more volatile around the holidays last year, overall the adjusted series have tracked one another well indicating that the extremely elevated readings of 2020 and 2021 have not had a major impact in undermining the effectiveness of seasonal factoring.

As the unadjusted initial claims number saw little change, continuing claims—lagged an additional week to the initial claims number— were unchanged week over week. Remaining at 1.306 million, it continues to be the strongest reading in several decades. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 6/9/22 – Stuck in a Range

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Everything must be taken into account. If the fact will not fit the theory—let the theory go.” – Agatha Christie

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Well. it was looking like a positive day. Futures were comfortably higher earlier but have pulled back as we approach the opening bell following the ECB’s monetary policy announcement. The European central bank will be ending asset purchases on July 1st, and hiking rates by 25 bps in July and at least another 25 bps at the September meeting.

The only economic data on the calendar today are initial and continuing jobless claims. Initial jobless claims came in at 229K which was more than 20K above forecasts and the highest level since January. Continuing claims, meanwhile, were unchanged at 1.306 million. While initial claims are still at the low end of their historical range, they have also been trending steadily higher now for 12 weeks.

In today’s Morning Lineup, we discuss market and economic developments in China (pgs 4 & 5), the latest ECB rate decision (pg 5), and economic data out of Asia, Europe, and Mexico (pg 6).

With all the volatility that has emblematized 2022, the Memorial Day weekend seems to have really flipped a switch to the Summer doldrums. Over the last eight trading days, the S&P 500 has traded in what has been a relatively tight trading range. During this period, the S&P 500 has traded on either side of 4,125 each day, and the total spread between the intraday high and low has been 2.5% which represents the narrowest eight-day trading range of the year. Investors have been longing for a period of calm in the markets, and for now, at least they’re getting it.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 6/8/22

B.I.G. Tips – Economic Malaise

Mortgage Activity Falling Off A Cliff

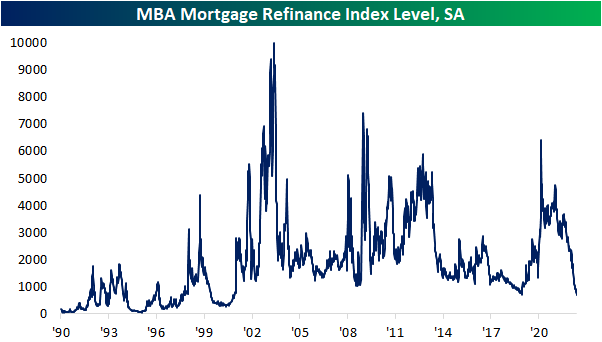

The economic calendar was light today with the only US releases of note being wholesale trade sales and inventories on top of the regularly scheduled weekly releases for Wednesday. Perhaps the most notable data point was the weekly reading on mortgage applications from the Mortgage Bankers Association. As the national average for a 30 year fixed rate mortgage has resumed its move higher and is once again above 5.5%, mortgage refinance applications continue to fall as fewer homeowners are balking at the highest rates in over a decade. The MBA’s index tracking refinance applications fell for a fifth week in a row. On top of all the other declines over the past year and a half, the index currently sits at the lowest level since December 2000.

While refinancing activity has completely turned a corner from the historically impressive readings earlier in the pandemic, purchase applications are not as historically depressed, but the picture hasn’t been particularly promising. Falling another 7.1% week over week, today’s reading is one of the worst levels since the spring of 2020, and excluding those early days of the pandemic, it would be the worst reading since November 2016.

Taking a look at the non-seasonally adjusted number, claims have been running at a healthy level relative to the past decade, albeit below the pace of the past couple of years. Late spring is typically when applications set an annual peak as was the case this year (blue dots in first chart below). The high was now exactly one month ago which brings to question how the current decline from the seasonal high stacks up to prior years. As shown in the second chart below, the unadjusted number has fallen just short of 30% over the past four weeks which is one of the most rapid declines from a high of any year since at least 1990. The largest and last time with a comparable drop was in 2010 when it fell almost 40%. 1995, 1999, and 2001 are the only other years that have seen even larger declines from an annual peak than this year.

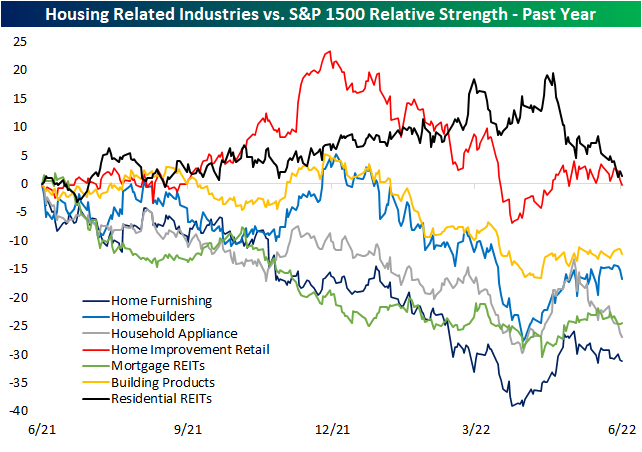

While the macro backdrop for housing continues to deteriorate, S&P 1500 stocks that are part of various housing-related industries have underperformed the broader market over the past year. Below we show the relative strength lines of a handful of these industries’ S&P 1500 indices versus the S&P 1500 since this time last year. Some groups like Mortgage REITs, Household Appliances, and Home Furnishing have been steady underperformers over the past year while there were others that had managed to hold out. For example, Residential REITs and home improvement stores were actually outperforming handily up until only a few months ago. Of course, the past few months have seen a complete unwind of that outperformance as they have now posted inline returns to the broader market. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day – Japanese Yen Weakness

Bespoke’s Morning Lineup – 6/8/22 – A Yen for the Dollar

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You must always examine what’s working, evolve your ideas, and change the way you do things.” – Marc Benioff

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Treasury yields and crude oil are moderately higher this morning and that has put pressure on equities which are just modestly lower. There’s not a lot of economic data to speak of, but weekly mortgage applications fell 6.5% to their lowest level, outside of the early COVID days, since 2016. There isn’t much in the way of a catalyst for this morning’s weakness on the equity side of things, but the fact that the OECD lowered economic growth forecasts for this year and next hasn’t helped.

In today’s Morning Lineup, we discuss the OECD’s downgrade of global growth forecasts (pg 4), central bank actions in emerging markets (pg 4), market activity in Asia and Europe (pg 4), and economic data out of Asia and Europe (pg 5).

The US Dollar is up over 1% versus the yen this morning as the one-way trade in that currency pair continues. Over the last year, the dollar has rallied more than 20% versus the yen, and since the start of the year, the gain has been more than 16%. From a longer-term perspective, the dollar’s rally puts it at the highest level versus the yen since February 2002, and if it rallies another half of one percent, it will be at the highest level since 1998. This rally spells trouble for Japanese consumers, but for manufacturers in the country, the weak yen is a welcome trend.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.