The Bespoke 50 Growth Stocks – 6/9/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were 14 changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Run For Cover: CPI On Deck

Tomorrow is the day everybody has been waiting for as CPI for the month of May will hit the tape at 8:30 AM eastern. The fact that people have literally been talking about this report for the last several days illustrates how much of an issue inflation has become for the market over the last six months since Fed Chair Powell first started to take a more hawkish approach to inflation. For a market concerned about inflation, recent reports certainly haven’t been soothing for investors. Over the last 24 months, there have been just three months where headline CPI has come in weaker than expected (6/10/20, 11/12/20, and 9/14/21). Ironically enough, on each of those three days, the S&P 500 actually traded lower, although to be fair, all three of these reports were before Powell ditched the term transitory.

Although CPI reports over the last two years have been coming in either higher or in line with expectations, market performance on these days has been right around the flatline with a median decline of 0.08% for the S&P 500 with positive returns 11 out of 24 times.

While median returns for the S&P 500 have been right around the flatline over the last two years on CPI days, more recent returns have been much weaker. Since Powell ditched ‘transitory’ in late November, the S&P 500 has declined on the day of the CPI report four times (the last four reports). Over the last six months, the S&P 500’s median performance on CPI days has been a decline of 0.18%. On an individual sector basis, Energy (surprise!) has been the best performing sector with a median gain of 1.1%, while Technology’s median performance has been of the same magnitude but in the opposite direction. Along with Technology, Financials and Communication Services have both faced declines of 0.8%. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Weekly Sector Snapshot — 6/9/22

The Ups and Downs of Sentiment

In today’s Morning Lineup, we discussed the sideways range the S&P 500 has found itself in over the past eight trading days. With indecisive price action, sentiment—as measured by the AAII’s weekly survey— has been equally undecisive. After picking up substantially last week from 19.8% to 32.0%, the percentage of respondents reporting as bullish has reversed most of its gains coming in at 21.0% this week%

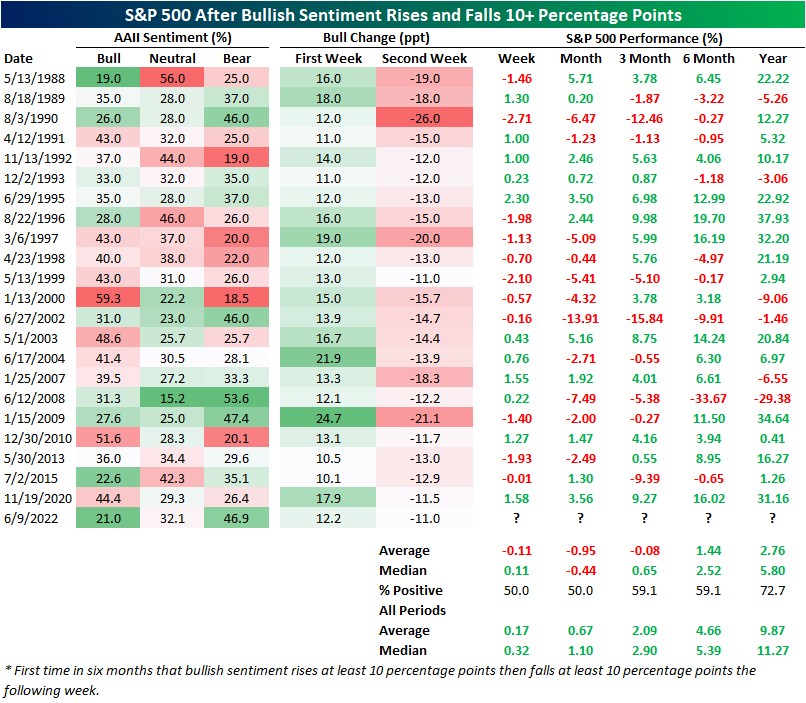

Back-to-back weeks of double-digit moves (either positive or negative for both weeks) in bullish sentiment are relatively rare with only about 4.6% of all weeks in the history of the survey dating back to 1987 seeing such a move. Of those, less than two dozen resemble this week with bulls rising by at least 10 percentage points in the first week followed by a 10 or more percentage point drop the next week for the first time in at least six months. The most recent occurrence (of any double-digit back-to-back moves) was over a year ago in November 2020 when bulls rose by an even larger 17.9 percentage points followed by an 11.5 point drop. We would also note that the current situation has the second-lowest reading in bullish sentiment of these past instances behind May 1988—roughly one year after the survey began—when it was two percentage points lower.

As we have frequently noted in the past, low bullish sentiment has actually tended to be a positive signal for forward performance of equities. Although that could pose an optimistic sign for the S&P 500 going forward, big swings up then down then have not tended to be the best sign for equities. As shown below, after similar moves in bullish sentiment, performance for the S&P 500 one week and month later has been positive only half the time with an average decline of 0.11% and 0.95%, respectively. While performance is more often than not positive three months later, the S&P 500 has averaged an 8 bps decline versus the norm of an average gain of 2.9%. Six and twelve-month performance is similarly more consistently positive but does not outperform the norm.

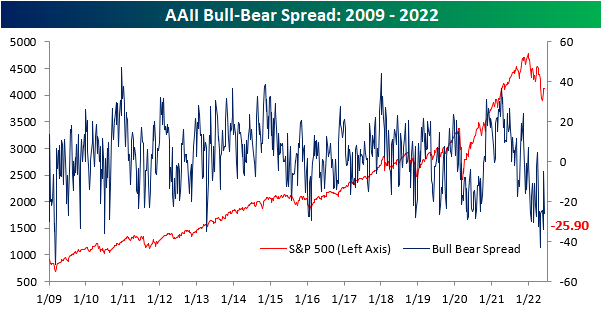

As bulls stepped back this week, bears recouped nearly 10 percentage points rising from 37.1% to 46.9%. While that is still below the readings above 50% observed throughout April and May, historically that is an elevated reading well above the historical average of 30.7%.

Given this, the bull-bear spread moved deeper into negative territory meaning bears continue to heavily outweigh bulls. Bears currently outnumber bulls by 25.9 percentage points. Again, that is a very low level albeit not as extreme as only a couple of weeks ago. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day: Intraday Performance Leads Market Move Higher

Claims Better Behind Seasonality

Seasonally adjusted initial jobless claims came in well above expectations today rising from 202K to 229K. Only an increase of 4K had been penciled in by economist forecasts. Although that increase brings claims up to the highest level in about six months, looking back historically it is still within the range of readings in the few years prior to the pandemic and that is also well below the typical readings for much of the history of the data.

Turning over to non-seasonally adjusted claims, recent readings have been much less volatile. In fact, compared to the seasonally adjusted number whose 27K increase was the largest since July of last year, unadjusted claims experienced a meager 1K uptick relative to last week. While the 1K increase during the current week of the year is very much normal (since 1967 72% of the time the 23rd week of the year has seen NSA claims rise WoW), it wasn’t a particularly large increase. On average, the same week of the year has seen unadjusted claims rise 31K. With the caveat that it covered a holiday week and revisions are still possible, that basically means the bulk of the move this week in the adjusted number was due to that seasonal adjustment rather than a material increase in claims. Taking another look at the unadjusted number, the current week of the year is well below the readings for comparable weeks in the years before the pandemic. In other words, the non-seasonally adjusted number points to a bit more strength than the adjusted number leads on.

Taking another look at the effects of seasonal adjustment, below we show the current series for seasonally adjusted and unadjusted claims as well as the adjusted numbers but using 2019 seasonal factoring (essentially removing any impacts on seasonal adjustment of the outlier-like high readings of the pandemic). While there are some minor discrepancies like how the current series had been understating claims relative to 2019 factoring earlier this year and the 2019 factoring was much more volatile around the holidays last year, overall the adjusted series have tracked one another well indicating that the extremely elevated readings of 2020 and 2021 have not had a major impact in undermining the effectiveness of seasonal factoring.

As the unadjusted initial claims number saw little change, continuing claims—lagged an additional week to the initial claims number— were unchanged week over week. Remaining at 1.306 million, it continues to be the strongest reading in several decades. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 6/9/22 – Stuck in a Range

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Everything must be taken into account. If the fact will not fit the theory—let the theory go.” – Agatha Christie

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Well. it was looking like a positive day. Futures were comfortably higher earlier but have pulled back as we approach the opening bell following the ECB’s monetary policy announcement. The European central bank will be ending asset purchases on July 1st, and hiking rates by 25 bps in July and at least another 25 bps at the September meeting.

The only economic data on the calendar today are initial and continuing jobless claims. Initial jobless claims came in at 229K which was more than 20K above forecasts and the highest level since January. Continuing claims, meanwhile, were unchanged at 1.306 million. While initial claims are still at the low end of their historical range, they have also been trending steadily higher now for 12 weeks.

In today’s Morning Lineup, we discuss market and economic developments in China (pgs 4 & 5), the latest ECB rate decision (pg 5), and economic data out of Asia, Europe, and Mexico (pg 6).

With all the volatility that has emblematized 2022, the Memorial Day weekend seems to have really flipped a switch to the Summer doldrums. Over the last eight trading days, the S&P 500 has traded in what has been a relatively tight trading range. During this period, the S&P 500 has traded on either side of 4,125 each day, and the total spread between the intraday high and low has been 2.5% which represents the narrowest eight-day trading range of the year. Investors have been longing for a period of calm in the markets, and for now, at least they’re getting it.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 6/8/22

B.I.G. Tips – Economic Malaise

Mortgage Activity Falling Off A Cliff

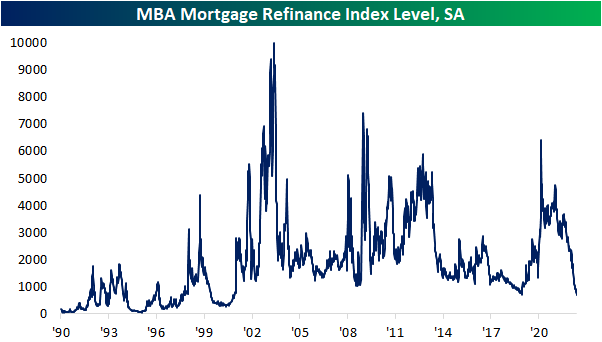

The economic calendar was light today with the only US releases of note being wholesale trade sales and inventories on top of the regularly scheduled weekly releases for Wednesday. Perhaps the most notable data point was the weekly reading on mortgage applications from the Mortgage Bankers Association. As the national average for a 30 year fixed rate mortgage has resumed its move higher and is once again above 5.5%, mortgage refinance applications continue to fall as fewer homeowners are balking at the highest rates in over a decade. The MBA’s index tracking refinance applications fell for a fifth week in a row. On top of all the other declines over the past year and a half, the index currently sits at the lowest level since December 2000.

While refinancing activity has completely turned a corner from the historically impressive readings earlier in the pandemic, purchase applications are not as historically depressed, but the picture hasn’t been particularly promising. Falling another 7.1% week over week, today’s reading is one of the worst levels since the spring of 2020, and excluding those early days of the pandemic, it would be the worst reading since November 2016.

Taking a look at the non-seasonally adjusted number, claims have been running at a healthy level relative to the past decade, albeit below the pace of the past couple of years. Late spring is typically when applications set an annual peak as was the case this year (blue dots in first chart below). The high was now exactly one month ago which brings to question how the current decline from the seasonal high stacks up to prior years. As shown in the second chart below, the unadjusted number has fallen just short of 30% over the past four weeks which is one of the most rapid declines from a high of any year since at least 1990. The largest and last time with a comparable drop was in 2010 when it fell almost 40%. 1995, 1999, and 2001 are the only other years that have seen even larger declines from an annual peak than this year.

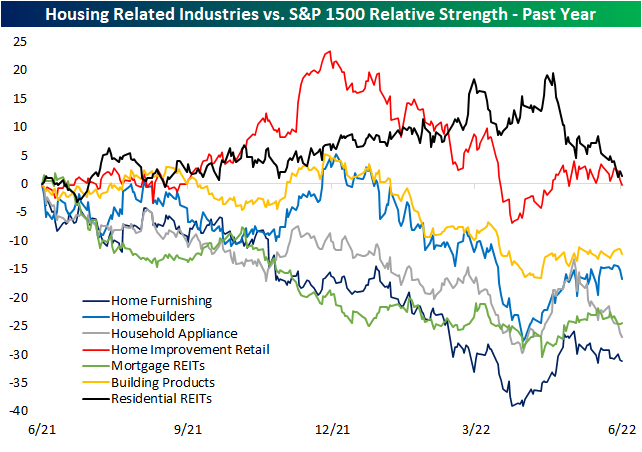

While the macro backdrop for housing continues to deteriorate, S&P 1500 stocks that are part of various housing-related industries have underperformed the broader market over the past year. Below we show the relative strength lines of a handful of these industries’ S&P 1500 indices versus the S&P 1500 since this time last year. Some groups like Mortgage REITs, Household Appliances, and Home Furnishing have been steady underperformers over the past year while there were others that had managed to hold out. For example, Residential REITs and home improvement stores were actually outperforming handily up until only a few months ago. Of course, the past few months have seen a complete unwind of that outperformance as they have now posted inline returns to the broader market. Click here to learn more about Bespoke’s premium stock market research service.