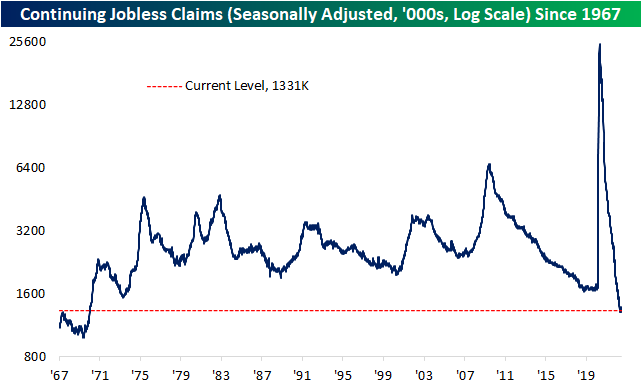

Seasonal High is Here for Claims

Jobless claims have continued to rise hitting the highest level since November this week. Claims rose from an unrevised 235K up to 244K this week. With consistent increases in claims over the past few months, the reading has gone from multi-decade lows to levels that would have been the highest since late 2017/early 2018 pre-pandemic.

As we have noted each week recently, the current week of the year has historically marked a seasonal peak in claims. As such, the current week of the year has also seen a sequential rise in claims 80% of the time including a rise this week. NSA claims now are at 241.3K which is inline with the comparable readings for the three years prior to the pandemic. Although part of the recent increase in claims is likely seasonal in nature, given evidence of a slowing economy including weakness in other labor market data like under the hood of Friday’s nonfarm payrolls report, how much that seasonal uptick unwinds in the weeks ahead will be something to watch.

As for continuing claims, there has not been as notable of an increase recently when compared to initial claims. Continuing claims have only risen marginally from the low of 1.306 million in the week of May 20th to 1.331 million in the most recent reading as of July 1st. That most recent reading also saw a sizable improvement from the prior week with claims falling from 1.372 million. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day: Bank Reports Kick Off

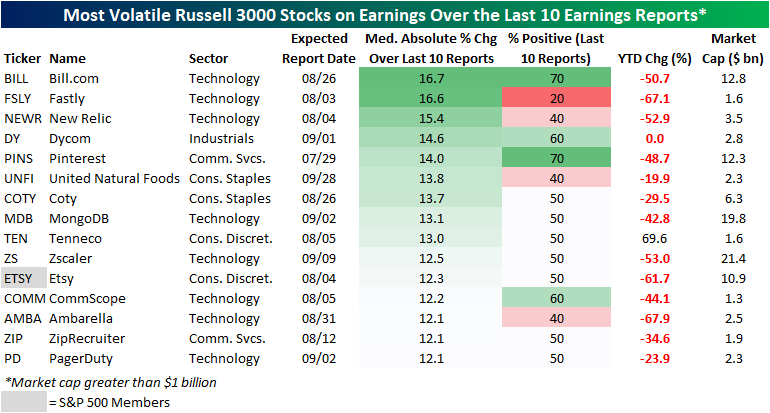

Volatile Stocks in Reaction to Earnings

With earnings season kicking off, we wanted to highlight Russell 3000 stocks that in recent history have been the most volatile in reaction to earnings (over the last ten quarters). In order to be included in this list, a stock must have reported at least ten quarters since going public and must also have a market cap over $1 billion. The list includes tech companies, e-commerce players, food producers, and more. On average, these stocks are down 35.1% on a YTD basis (median: -44.1%), which is notably worse than the overall market. We measured volatility by the median absolute percent change on earnings reaction days over the last ten quarters, and these names averaged a move of 13.6% in either direction on their earnings reaction days. The most volatile name has been Bill.com (BILL), followed by companies like Fastly (FSLY), New Relic (NEWR), Dycom (DY), and Pinterest (PINS). Only one of the stocks outlined below is in the S&P 500 (Etsy), and none have a market cap of more than $21.4 billion.

Of course, volatility does not imply direction. Of the 15 stocks outlined below, two – BILL and PINS – have seen seven of their last ten reports result in gains on their earnings reaction day. On the other end of the spectrum, four stocks have seen positivity rates of 40% or less over the last ten reports: Fastly (FSLY), New Relic (NEWR), United Natural Foods (UNFI), and Ambarella (AMBA). If you own any of these names, be prepared for a potentially sharp reaction to earnings (in either direction) when they report this earnings season. Click here to learn more about Bespoke’s premium stock market research service.

Just to show you what we mean, the graphic below shows BILL’s (the most volatile name on the above list) earnings reactions over the last 10 quarters. As you can see, eight of its last ten reports have been followed by a one-day reaction of 10%+, including four moves of more than 20%! Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 7/14/22 – Streaky

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I am struck that so many of our leaders in the U.S. forget how strong our country can be.” – Jamie Dimon

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The market has taken on a bit of a streaky vibe in the last few weeks. After four straight down days to close out June where the S&P 500 fell 3.2%, the month of July started out with a four-day win streak where the S&P 500 rallied 3.1%. Since those four days ending last Thursday, the S&P 500 has been down four straight days falling 2.6%. The current four-day losing streak looks like it’s going to extend to five days as futures are indicated another 1.35% lower.

Besides the litany of issues facing the market all year, the catalyst for this morning’s weakness is weak results from Conagra (CAG), JP Morgan (JPM), and Morgan Stanley (MS). CAG is down 2.5% after reporting weaker than expected EPS and lowered guidance, MS is only down fractionally, and JPM is poised to open more than 3% lower putting it on pace to fall in reaction to earnings for the eighth straight quarter.

The commentary from the earnings release for JPM wasn’t particularly uplifting:

“The U.S. economy continues to grow and both the job market and consumer spending, and their ability to spend, remain healthy. But geopolitical tension, high inflation, waning consumer confidence, the uncertainty about how high rates have to go and the never-before-seen quantitative tightening and their effects on global liquidity, combined with the war in Ukraine and its harmful effect on global energy and food prices are very likely to have negative consequences on the global economy sometime down the road. We are prepared for whatever happens and will continue to serve clients even in the toughest of times.”

In economic news, PPI came in higher than expected on both a headline and core basis, while initial jobless claims ticked up to 244K which was the highest level since last November. The rise in jobless claims hasn’t been particularly steep, but it has been consistent ever since, bottoming out in Mid-March.

Today’s Morning Lineup discusses earnings from JPMorgan (JPM) and Morgan Stanley (MS), moves in Asian and European markets, and economic data from around the world.

It’s not just stock prices that have been on the decline this week. Crude oil prices have fallen sharply and WTI briefly traded below its 200-DMA this morning as it trades down near $93. As shown in the chart, while prices did run up in anticipation of the event, all of the increases in crude oil prices since Russia invaded Ukraine have now been erased.

The fact that oil prices are back to levels they were trading at right before Russia invaded Ukraine has been taken as a win by investors, and we wish we could say the same thing about the S&P 500. Unlike crude oil, which has managed to return back to pre-invasion levels, stock prices have kept falling.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 7/13/22

Short Interest Keeps Rising

Over the past few days, equities, including the most heavily shorted stocks, have reversed a good amount of the gains seen since the mid-June lows. A basket of the 100 most heavily shorted stocks in the Russell 3,000 is currently little changed versus its levels at the start of 2020 compared to a roughly 16% gain for the Russell 3000. Whereas heavily shorted stocks saw massive outperformance versus the broader market in the second half of 2020 and early 2021, that outperformance has unwound since last fall. More recently over the past two months, though, highly shorted stocks and the Russell 3000 have been performing more or less in line with each other as the relative strength line has trended sideways and is near similar levels to the COVID Crash.

The most recent short interest data as of the end of June was also updated in the past 24 hours. For the whole of the Russell 3000, the average reading on short interest as a percentage of float currently stands at 6.24%. That is up 20 basis points since the prior update for mid-June and a full percentage point higher versus the start of the year.

Across nearly all industry groups, there have been major shifts in short interest levels since the start of the year. While most have made considerable moves higher, there are others that have actually fallen significantly like Food & Staples Retail and Telecommunication Services. Given the big increases this year, Retail continues to have the highest average reading on short interest followed by the Pharmaceuticals, Biotech &Life Sciences, and the automobile industries. Although their levels of short interest are not as elevated, Software & Services and Energy stocks saw the largest increases from the last report while only the Media & Entertainment industry and Food & Staples Retailing stocks saw declines in average short interest between the two most recent reports. That being said, none of those sequential moves were particularly large with the biggest absolute move being the 0.45 percentage point increase in Software & Services.

Switching over to the individual stocks with the highest levels of short interest, Dillard’s (DDS) currently tops the list with a little more than half of its shares sold short. That reading is only half of a percentage point higher versus mid-June but has nearly doubled since the start of the year. Although it continues to sit near the top of the list, Redbox Entertainment (RDBX), has perhaps seen the most notable shift in levels of short interest versus the last bi-weekly report. Throughout the year, the recent SPAC has seen large swings in its reported short interest levels. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day – Notable Streaks of Gains and Losses in Reaction to Earnings

More Burning on Hot Inflation

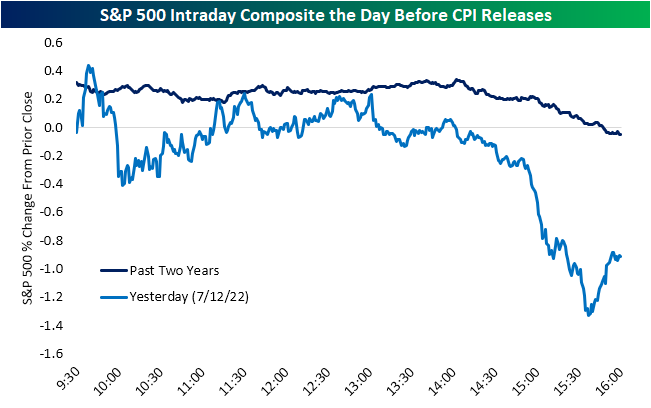

For most of the session yesterday, the S&P 500 was having trouble choosing a direction, but come the final hours of trading with a CPI release looming, the index took a decisive turn lower. Given rampant hot inflation over the past couple of years and its implications for changes to monetary policy, that sort of late day selling ahead of CPI prints has been the norm as shown below. On average for the past two years, the day before CPI releases has typically seen the S&P 500 trade higher for most of the session before turning lower and erasing its gains in the afternoon; just as we saw yesterday.

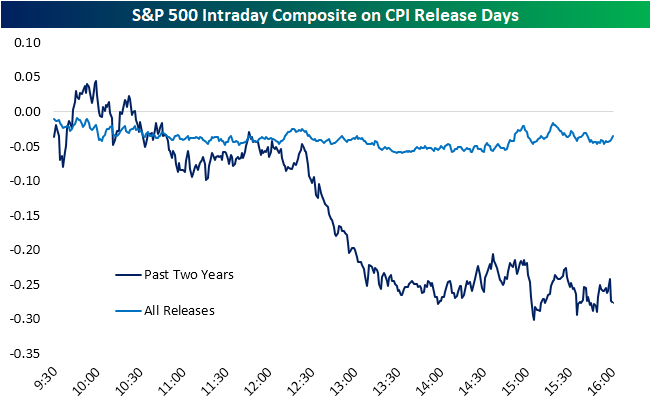

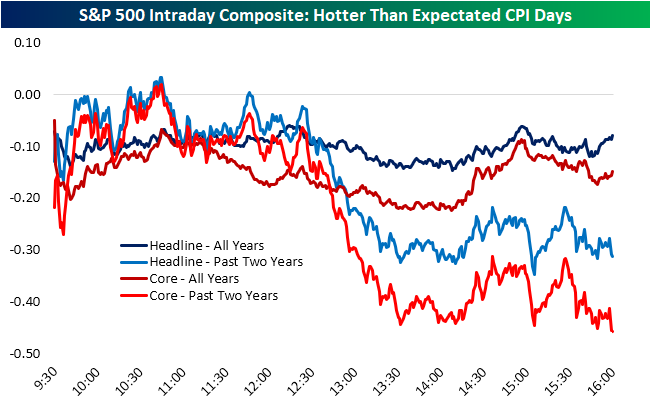

With another hotter than expected print this morning for both headline and core measures of inflation, yesterday’s late day sellers seem to have been on the right side of the trade as the S&P 500 has fallen further and is on pace for the sixth drop on a CPI print in a row. Taking a look at intraday price action of the S&P 500 on CPI release days, historically there has been a downward bias with all releases since 2000 averaging a drop of a few basis points by the close. Over the past two years it has been far worse with an average decline of 28 bps. Most of that drop has actually occurred after a bout of midday selling.

Using data from our Economic Indicator Database, filtering out for only times in which CPI has come in above expectations (on a month over month basis), that same pattern is apparent. The S&P 500 tends to trade in the red for most of the morning but the worst declines occur in the early afternoon before some stabilizing into the close.

In response to today’s hotter than anticipated release, the S&P 500 gapped down 1.2% which ranks as the fourth worst gap down for the index on a CPI day since at least 2000. Going back over the past two decades, there have only been a total of seven gaps down of 1% or more on a CPI day. Including today, four of those releases have occurred this year: February (-1.2%), March (-1%), June (-1.64%), and today (-1.23%). Taking a look at the intraday pattern of the S&P 500 across those 1% or larger gaps, the index has tended to continue to fall throughout the session with the lows of the day tending to occur around 2:30 EST with modest sideways action into the close from there. Click here to learn more about Bespoke’s premium stock market research service.

This Isn’t Normal

With inflation running out of control and markets furiously attempting to re-price Federal Reserve interest rate policy, we’re seeing some truly wild moves in the fixed income markets. This week, the big moves have come at the short-end of the Treasury yield curve as three-month Treasury yields have surged by 35 basis points this week alone. While the 2y10y US Treasury yield curve has been inverted for seven trading days now, the 3m10y curve, which is the FOMC’s preferred measure of the yield curve, has remained positively sloped, but the rate of flattening has really picked up in recent days and since early May has gone from around 225 bps to under 75 bps today. Click here to learn more about Bespoke’s premium stock market research service.

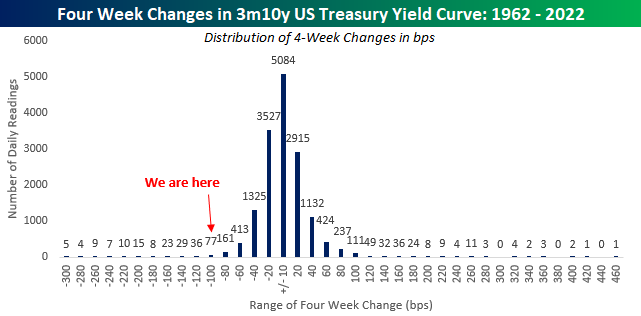

As mentioned above, the bulk of the flattening in the 3m10y curve has occurred more recently. The chart below shows the 20-day rate of change in the 3m10y US Treasury yield curve since 1962. The red line indicates the threshold for 100 bps of flattening in a four-week span which is where we are at now. Prior to the current period, there wasn’t a similar flattening of the 3m10y curve in a four-week span since the Financial Crisis. In August 2011, the rate of flattening got close to 100 bps in a four-week span but came up just shy. In other words, these types of moves in the yield curve don’t happen very often.

How often are they? The chart below shows the distribution of four-week changes in the 3m10y yield curve over time grouped into 20 bps increments. Including the last few days, where we are at in the current period (-100 to -120 bps of flattening in a four-week span) has only occurred on 77 trading days, and there have only been a total of 223 trading days where the yield curve flattened by 100 bps or more in a four-week period. On a percentage basis, that works out to less than 1.5% of all trading days. When it comes to markets, it seems as though there’s always something unique happening out there, and these days, you don’t see what’s happening at the short end of the Treasury curve very often.

Bespoke’s Morning Lineup – 7/13/22 Buckle Up

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Inflation is like toothpaste. Once it’s out, you can hardly get it back in again.” – Karl Otto Pöhl

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The big CPI report that everyone is waiting for is finally here, and most investors appear to be leaning on the side of a stronger-than-expected report. However, after two weak days for equities futures are indicated higher in early trading.

Update – The report was just released and headline CPI came in at 1.3% compared to the forecast for 1.1%. On a core basis, CPI rose by 0.7% compared to forecasts for growth of 0.5%.

Earlier this morning, the IMF cut its forecast for US GDP growth down to 2.3% from 2.9%. This news is notable for two reasons. First, it comes less than a month after the IMF downgraded its growth forecast down to 2.9% in late June. Second, given the indication from the Atlanta Fed’s GDPNow model, which is calling for a Q2 contraction of 1.2% following Q1’s decline of 1.6%, the US economy would need to grow by 3.2% in the second half in order to reach that goal. Based on the trend in recent data and the Fed’s tightening bias, that level of growth seems optimistic.

In today’s Morning Lineup, we discuss moves in Asian and European markets, Chinese trade data, and economic data from around the world.

The days of the monthly employment report being ‘the most important indicator’ are long gone, and the new flavor of the month is CPI. Unfortunately for bulls, the trend of recent reports hasn’t been particularly market-friendly. As we have highlighted repeatedly in recent months, the headline CPI report has rarely come in weaker than expected. In the two years through May’s report, there have only been two weaker-than-expected headline CPI reports, which is easily the lowest number over a two-year span in at least twenty years.

When times are tough, there’s a stage in the process where people think that if they only wish hard enough, things will go their way. Unfortunately, elevated levels of inflation are a reality economists can’t simply hope away by consistently low-balling estimates.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.