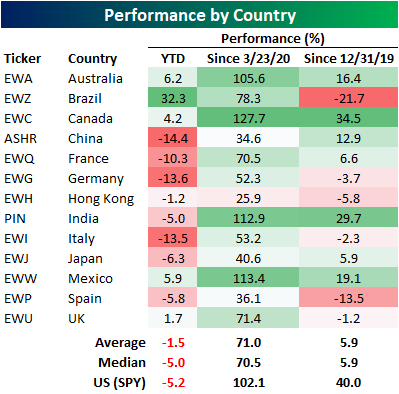

Country Performance Since COVID-Low

Earlier this week, we looked at US sector and individual stock performance since the COVID-low to give our readers a perspective on the huge moves seen since March 23, 2020. Today, we are looking into the performance of each major country ETF since the COVID-low to show you the differentiation across the globe for US investors. COVID impacted each country differently for a variety of factors. First, government responses differed greatly. Countries like China, Australia and Canada have been excessively restrictive, while most European countries were less stringent (with a few notable exceptions). Click here to view a “stringency” index generated by Our World in Data.

The second economically-impacting factor that has led to divergent equity performance has been buying power. With supply chain and inflation headwinds, poorer nations simply cannot compete for goods, as the order value ticked higher due to strong global demand and a constrained supply chain. These nations were essentially out-bid for everything they needed, be it food, gas, or durable goods.

A third factor is the mix of goods and services exported by each nation. Countries that are primarily commodity exporters (like Brazil and Australia) struggled initially, but have benefitted substantially as their average selling prices have soared. On the other hand, countries reliant on commodity imports have suffered, as the sky-rocketing of input costs dampens production and economic activity.

We could go on and on about all of the factors that impacted economic growth on a country-by-country basis. Needless to say, the performance in equity markets across the globe has varied greatly. Of the major country ETFs that we tracked, Canada has been the strongest performer since the COVID-low, largely due to their economic mix of commodity and services exports with very little manufacturing exposure (relative to comparable nations). Canada is close to self-sufficient in terms of inputs, as it is a commodity-rich nation. This holds true for Australia as well. Only Canada (EWC), Mexico (EWW), India (PIN) and Australia (EWA) have outperformed the US (SPY) since 3/23/20. Mexico benefitted from a shifting in the manufacturing environment, as port congestions and general supply chain woes pushed the US to ramp up Mexican imports. As labor became more and more expensive, an increasing number of corporations outsourced SG&A functions to India, which helped spur economic activity.

The worst performers have been Hong Kong (EWH), China (ASHR), Spain (EWP) and Japan (EWJ). China and Hong Kong have been negatively impacted by political fears, as China pushes for US-delisting and Hong Kong has seen its independency slowly fade. The table below summarizes the performance since the COVID-bottom (3/23/20) and on a YTD basis. As you can see, the top performer YTD by a substantial margin is Brazil, as their economy is highly concentrated into energy-related commodities.

Below is a set of graphs that shows the performance of each country listed above since the end of 2019 just before COVID hit. While the US (SPY) is well above where it ended in 2019, many country ETFs are actually down since then. These include Brazil (EWZ), Germany (EWG), Hong Kong (EWH), Italy (EWI), Spain (EWP), and the UK (EWU).

If you have an interest in learning more about Emerging Markets, we recently released the Bespoke Emerging Market 50, which tracks 50 ADRs domiciled in emerging economies that have either experienced strong earnings growth over the last several years, are positioned to recover substantially, or have unique upside due to the geopolitical environment. Click here to try out Bespoke’s premium research service, which will grant you access to the Bespoke Emerging Market 50.

Slight Disconnect Between the VIX and Volatility

The CBOE Volatility Index (VIX) was invented to allow investors to speculate about volatility over the next 30 days. The VIX is commonly referred to as the fear index, and readings above 20 tend to occur in uncertain times filled with concern, while readings below 20 indicate a perceived relatively low-risk environment. As of late, the average intraday range of the S&P 500 has been quite high, with the last 30 trading days averaging a trading range of 2%, which is on the high side relative to history. In fact, the 30-day rolling average percentage spread between intraday highs and lows did not cross 2% throughout the entirety of 2021, but on the first day of February 2022, we broke a 440 trading day streak in which the reading was below 2% that had bene in place since the days coming out of the COVID crash.

As depicted below, the VIX tends to spike during times in which market volatility increases. However, the current elevated level of intraday volatility has not been matched with a proportional rise in the VIX. Based on historical data, the VIX should currently be closer to 26.5, but the current reading of 21.8 is 17.6% below the implied value we would derive from the last 30 days of intraday volatility alone. This suggests that although the market has been shaky as of late, investors expect an easing of that volatility in the near future. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 3/25/22 – Semis Roll

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Your information sources should complement one another, and also be redundant because that gives you a way to verify what you’ve learned.” – Andrew S Grove

It almost took an entire quarter but the S&P 500 is on the cusp of its first back-to-back weekly gains in all of 2022. For the Nasdaq, a positive finish to this week would be the first back-to-back weekly gain since November. Futures are currently indicated higher, and the only economic reports on the calendar are Pending Home Sales and Michigan Confidence. Pending Home Sales are expected to bounce back modestly following January’s surprise decline of 5.7%. Michigan Confidence, meanwhile, has been one of the most disappointing economic series of the last several months as it’s well below its COVID lows and at levels last seen in late 2011 and before that the Financial Crisis.

Markets in Europe are modestly positive with the major benchmark indices up between 0.5% to 1.0%. despite weaker than expected sentiment readings in Germany and Italy, while UK Retail Sales unexpectedly declined. Treasury yields in the US are higher again today with the 10-year up to 2.36% while the 5-year is even higher at 2.40%. Crude oil is down another 2% sending WTI down to $110 per barrel, gold is modestly lower, and bitcoin is trading above $44,500.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Yesterday was a good day for the equity market, but it was especially strong for semiconductors as the Philadelphia Semiconductor Index (SOX) rallied close to 5%, and every stock in the index was up at least 2%!. In the process of Thursday’s rally, the SOX finished the day above its 50 and 200-day moving average for the first time since January and also managed to close back above its highs from last Summer (red line).

We watch the relative strength of the SOX versus the S&P 500 as it has historically been a good leading indicator of the broader market. On the positive side, yesterday’s rally broke the most recent downtrend that has been in place since mid-January, but it came up just short of taking out the high end of last summer’s range.

One thing the SOX has been this year is volatile. Over the last 50 trading days, the index has seen an average daily move of more than 2.5%. That ranks as the highest average daily change since the COVID crash (when it went much higher), and before that, you’d have to go all the way back to the financial crisis to find the last time daily volatility in the SOX was as high as it is now. In the post-dot-com era, this kind of volatility for semiconductors has been extremely uncommon.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Peso Push, Distributional Discussion, Roaring Capex – 3/24/22

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin tonight with a look at EMFX performance followed by a rundown of the Federal Reserve’s quarterly update of Distributional Financial Accounts data. We also show the differing performance of investors by generation. We then take a look at quarterly equity market issuance and retirement data, preliminary durable goods figures, and the 10 year TIPS reopening.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

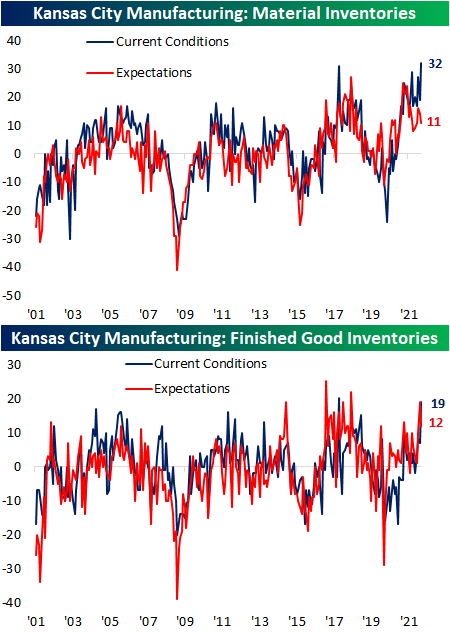

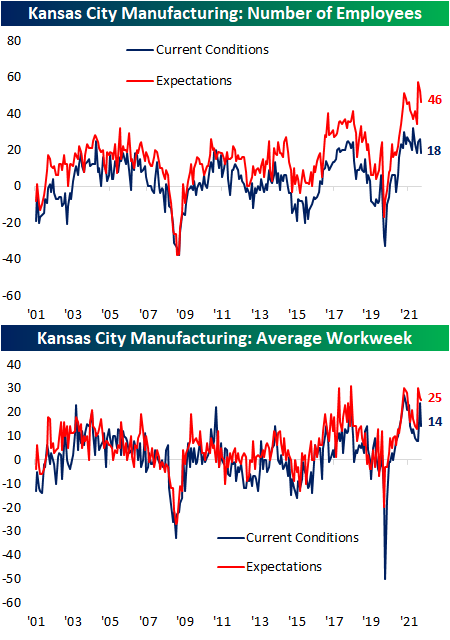

Record Readings From The KC Fed

The fourth of five regional Fed manufacturing indices was released this morning from the Kansas City Fed. The 10th district’s Manufacturing Composite hit a new record high in March rising 8 points to 37. Expectations also set a new record climbing 3 points to 41. Those readings indicate the region’s manufacturers have seen a historic rate of growth and expect that to continue over the next six months.

Given the record reading in the headline index, most categories of this month’s report came in at historically elevated readings. Breadth was also impressive with only three categories declining month over month: Number of Employees, Average Workweek, and New Orders for Exports. In spite of those declines, the levels are consistent with healthy growth. Breadth for expectations was more mixed with an equal number of categories rising and falling versus the February report.

Growth in demand only accelerated modestly as the new orders index rose a single point to 33, and order backlogs rose by a more significant 7 points. The ability of the region’s manufacturers to fulfill those orders, meanwhile, was much stronger in March as both shipments and production set new record highs rising 22 and 15 points, respectively. Production expectations also set a new record high.

That higher production also came in spite of supply chain slowdowns. The delivery times index rose back up to the November record high of 55, erasing any of the past few months’ improvements. The expectations index saw the same results in which any recent reversal lower has now been erased as it set another record high.

Similar to delivery times, a huge month-over-month increase in prices paid this month led the index to reverse much of the past year’s decline, though, that was preceded by a large increase in expectations last month. The prices received index has been more rangebound recently but it too ticked higher in March. That is while expectations are rising at a much more rapid rate, setting more all-time highs.

In spite of higher prices paid and supply chain delays, material inventories experienced record builds in March as that index took out the former record from October 2017. Finished good inventories, meanwhile, came up one point shy of its October 2017 record.

The only notably weak area of the report was employment metrics. Both number of employees and average workweek remain in expansionary territory but pulled back in March for both current conditions and expectations. Click here to view Bespoke’s premium membership options.

Bulls and Bears Swing Double Digits

There’s nothing like higher prices to cure investor blues, and the last week has been a perfect example of that. AAII’s weekly sentiment survey saw a double-digit increase in the percentage of respondents reporting as bullish this week with that reading rising from 22.5% up to 32.8% and matching the highest level of optimism in 2022.

Those gains to bullish sentiment borrowed entirely from bears as the percentage of respondents reporting as pessimistic fell from nearly 50% of respondents down to 35.4%. The 14.4 percentage point decline marked the largest weekly decline in bearish sentiment since July 2010 when the reading had fallen by 19.27 percentage points. More recently, however, there have been a couple of other double-digit drops in bearish sentiment including a 12.3 percentage point decline in the first week of March and an 11.9 percentage point drop in December.

Bears continue to outnumber bulls, but the margin has narrowed to the smallest degree since the first week of the year. The bull-bear spread has risen to -2.6 after leaping higher by 24.7 points week over week; the largest one-week increase in the number since October 2019.

Looking at it another way, this week marked the first time since October 2019 that bullish sentiment rose by at least 10 percentage points while bearish sentiment fell by at least 10 percentage points in the same week. In the table below, we show each prior instance of simultaneous double-digit swings in bullish and bearish sentiment without another occurrence in the previous six months. As for how price action has responded to such swings in sentiment, the S&P 500 has generally seen consistently positive performance in the months ahead, but only one week and one-month performance has been significantly stronger on an average or median basis than what has been the norm. Click here to view Bespoke’s premium membership options.

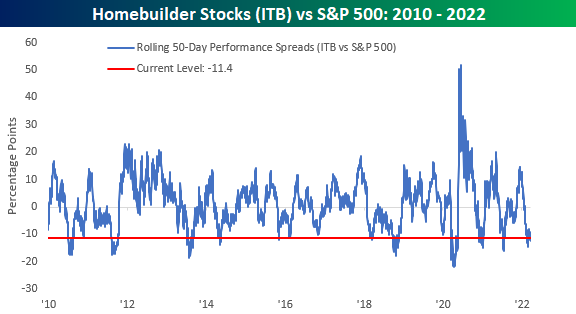

More 52-Week Lows for Homebuilders

Homebuilder stocks are under pressure again today following a weak earnings report from KB Home (KBH) which has the stock trading down over 3%. The weakness in KBH has also shown up in the iShares Home Construction ETF (ITB) which is down 1.6% and on pace for its lowest close in more than a year.

Rising rates have been cited as a major cause behind the weakness in homebuilder stocks, but they aren’t the only factor. As mentioned in the KBH call this morning, constraints in the supply of both labor and materials has also slowed down business for homebuilders. They literally can’t build houses fast enough to meet demand. The chart below compares the performance of ITB versus Bankrate.com’s 30-year mortgage rate (shown on an inverted basis in the chart). Over time, there has been a positive correlation between homebuilder stocks and rates, but there have also been periods where the two have diverged as well, and if you’re long homebuilder stocks, you should be happy that mortgage rates aren’t the only factor driving performance of homebuilder stocks. If that were the case, the recent surge in rates (shown by a falling red line in the chart) would have resulted in a crash in homebuilder stocks.

While homebuilder stocks trade near 52-week lows today and have underperformed the broader market, the current level of underperformance is hardly extreme relative to recent history. The chart below shows the rolling 50-trading day performance spread between ITB and the S&P 500 going back to the start of 2010. At the current level of 11.4 percentage points, the current level of underperformance by the homebuilders has been seen at three other periods since the start of the pandemic in 2020. Click here to view Bespoke’s premium membership options.

Chart of the Day: Bonds Wrecked Into Quarter End

Jobless Claims at Lowest Level in Over 50 Years

Since early December, initial jobless claims have risen and remained above multi-decade lows. That is until this week. Seasonally adjusted claims fell for a second week in a row down to 187K this week. That is the lowest reading since claims came in at 182K all the way back in September 1969.

While not to take away from the historically strong reading as NSA claims also hit a new low for the pandemic of 181.1K, before seasonal adjustment, jobless claims have not exactly fallen to as significant of a low as the adjusted number. Although that is the lowest level for the current week of the year since 1969, there have been recent periods like the fall of 2018 and 2019 in which claims were even lower. Declines in initial claims have historically been common for the current week of the year, but the next couple of weeks have typically seen claims experience a brief bump before resuming a seasonal downtrend roughly through mid-spring.

Continuing claims have fallen even more consistently with week-over-week improvements in 7 of the past 10 weeks. Now at 1.35 million, continuing claims are down to the lowest level since the first week of 1970. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 3/24/22 – Energy Back on Top

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I may have been born at night, but it wasn’t last night” – T. Boone Pickens

We’ve had a positive tone in equity futures for most of the night and into this morning, although the magnitude of the implied gains has been waning in the last several minutes. Initial and continuing jobless claims were just released and both came in lower than expected falling to levels not seen in more than 50 years! Durable Goods Orders, however, weren’t as strong with both the headline and ex Transportation readings coming in at negative levels.

On the geopolitical front, today’s NATO summit is likely to result in some headlines later today as more sanctions will be announced. On the ground in Ukraine, Russian troops still appear to be facing much more significant than expected resistance. For more on that, check out our commentary in today’s report. The strong resistance on the part of Ukraine has been impressive and welcome, but also raises the risk of Russia taking more drastic measures to win the war, something none of us hope to see.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

After a brief period mid-month where the sector took a back seat performance-wise, Energy finds itself back on top of the leaderboard with a gain of over 8% in the last week. For the year, Energy is up nearly 40% and once again remains the only sector in positive territory for the year. For much of the year, Energy’s gain meant pain for sectors like Consumer Discretionary and Technology, but both of these sectors are currently ranked in the top four of the eleven sectors with gains of 4.2% and 2.5%, respectively, over the last week. At the bottom of the list, no sectors are down in the last week, but defensive like Real Estate, Health Care, Utilities, and Consumer Staples have lagged with gains of less than 1%. So the market has been in a bit of a risk-on mode lately. Despite their underperformance over the last week, Utilities and Health Care are two of just four sectors that are in overbought territory.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.