Sentiment Slide

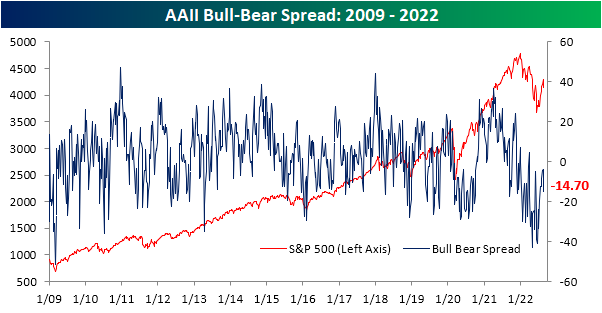

With the S&P 500 pivoting lower in the past week, sentiment has reflected the move as the AAII sentiment survey showed bullish sentiment drop from 33.3% last week down to 27.7%. That marked the first time bullish sentiment fell in three weeks, and it was the largest single-week decline since an eleven percentage point drop the week of June 9th.

Bearish sentiment picked up the bulk of that decline as the reading topped 40% for the first time since the last week of July. At 42.4%, it is at the highest level since July 14th. Although that marks a shift toward more pessimistic sentiment, reversing a trend of improvement from the past few weeks, the current reading on bearish sentiment is well below the highs from throughout the spring and early summer.

Nonetheless, after coming within only a few points of a positive reading in the past month, the bull-bear spread took a sharp turn lower as a result of this week’s results. The spread fell to -14.7 which is the lowest reading since July 14th. That was also the first double-digit week-over-week drop in the reading since June. Additionally, with a move deeper into negative territory, the spread is a week away from becoming tied for the second-longest streak of negative readings on record. Click here to learn more about Bespoke’s premium stock market research service.

Claims’ Seasonal Low Draws Near

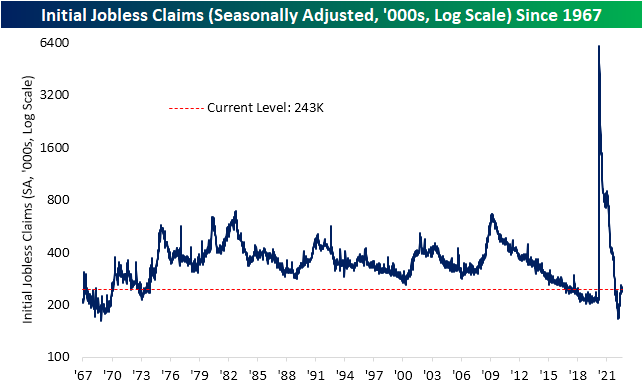

Initial jobless claims have come well off of the historic lows from earlier this year, but the past couple of weeks have also seen modest improvements. We’ve now seen back-to-back weeks of declines in claims for a total drop of 9K, leaving seasonally adjusted initial claims at 243K. That is the lowest reading since the week of July 22nd. However, that is still above the range from the two years prior to the pandemic.

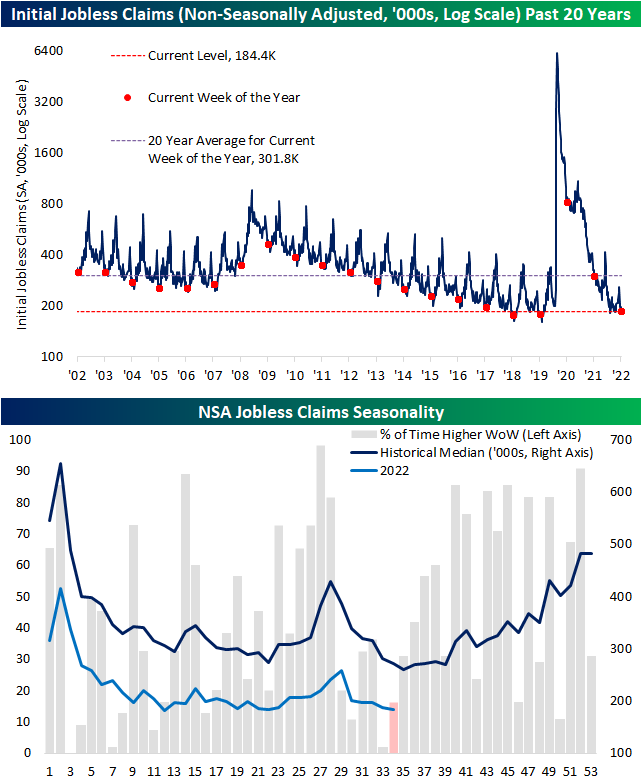

Non-seasonally adjusted claims are nearing what is typically an annual low. The past couple of weeks have historically been two that have seen the most consistent declines on a week-over-week basis throughout the year. That has dropped NSA claims to 184.4K which is only slightly above the post-pandemic low of 183.6K from the final week of May.

Continuing claims came in lower than expectations this week dropping to 1.415 million versus forecasts for an increase to 1.441 million. Overall, continuing claims remain much stronger and less elevated off the lows than initial claims. Whereas initial claims are above their pre-pandemic range, current levels of continuing claims continue to come in at some of the lowest levels since the first few years of the data.

Given this, the ratio of initial to continuing claims continues to hover at levels that are well above the norm of the past few decades even after peaking last month. That would imply healthy turnover as those who are filing for unemployment are not remaining unemployed for long given the small amount of follow-through of initial claims into continuing claims. Click here to learn more about Bespoke’s premium stock market research service.

LIKS Report: 8/25/22

Bespoke’s Little Known Stocks (LIKS) report highlights a company that may not be on the traditional radar of most investors. In this report, we provide an in-depth analysis of the little known stock, including industry insights, growth lever analysis, insights to the competitive landscape, equity performance, relative valuation, operational efficiency, pros & cons, and more. Today’s report is about a company that helps governments and enterprises defend their cyber assets.

As always, this report is for informational purposes only and is not a recommendation to buy or sell any specific securities. Investors should do their own research and/or work with a professional when making investment decisions. Highlighting a stock doesn’t mean we are bullish or bearish on it. Our goal is simply to provide readers with facts to help them make informed decisions rather than just opinions.

Bespoke’s LIKS reports are available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our LIKS reports. To sign up, choose either the monthly or annual checkout link below:

Chart of the Day: Jackson Hole Trends

Bespoke’s Morning Lineup – 8/25/22 – Mountain Jam

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s hard to live your life in color, and tell the truth in black and white.” – Gregg Allman

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

We’re still a full day from Powell’s Jackson Hole speech, but futures have shown some resilience this morning indicating a positive start to the trading day. Interest rates are little changed but slightly biased to the upside. It’s a busy day for economic data for jobless claims, GDP, Personal Consumption, and Core PCE all at 8:30 with the KC Fed Manufacturing report coming out at 11 AM. The 8:30 data was just released and Jobless Claims came in lower than expected on both an initial and continuing basis. The revision to Q2 GDP came in at a decline of 0.6% which was slightly less worse than forecasts for a decline of 0.7%. Personal Consumption came in right in line with forecasts at 1.5% while Core PCE was 4.4% which was in line with consensus forecasts. All in all not much in the way of big surprises.

As investors gnaw on their fingernails in anticipation of Friday’s Powell speech in Jackson Hole, they remain anxious about the direction of interest rates. The yield on the 10-year US Treasury has gone from a multi-year high of just under 3.5% in late June down to 2.57% in early August. Since that low, yields have rocketed higher and closed yesterday at 3.10% which is right around the same levels they temporarily peaked at in the Spring. If yields continue higher in the coming days, a run to new highs will seem like a foregone conclusion which would act as a headwind for risk assets, but if yields start to stall out here, the chart of the 10-year yield will look more like a head and shoulders and provide a sigh of relief.

The two-year yield is another story. Just yesterday, the yield finished the day right at 3.39% which was just four basis points (bps) below its June 14th high. Like the 10-year, the direction of the 2-year yield in the coming days will likely play a big role in the stock market narrative for weeks to come.

Whichever way yields move, the 10-year/2-year Treasury yield curve remains firmly entrenched at inverted levels and is one of an increasingly growing number of indicators out there suggesting that the economy is either on the verge of or already in a recession.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Bespoke 50 Growth Stocks — 8/25/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

High Yield Finds Support

The S&P 500 is cutting back on some of its losses today as the index is up around 0.4% as of this writing. From a technical perspective, the S&P 500 is currently around similar levels to the June highs, but other than that there is no clear technical support. High yield bonds are another story. Investors often turn to credit markets for confirmation of moves the equities, and while earlier this week credit spreads were ripping higher to confirm the drop in equities, the high-yield bond ETF (HYG) is showing a more promising sign for bulls today. As shown below, HYG has pulled back 3.33% from its high less than two weeks ago, but over the past three sessions, that decline has been paused as the ETF has found support at its 50-DMA (which has also begun to trend sideways). That is the reverse of what has frequently been observed in the past year as the 50-DMA has gone from resistance to support. At multiple points throughout the past year, the 50-DMA frequently marked a stopping point in short-term rallies. This week, the opposite has appeared to be the case. Click here to learn more about Bespoke’s premium stock market research service.

2022 Slams Stocks and Bonds

It is no secret that 2022 has not exactly been the year of the 60/40 portfolio. This year has left nothing safe with both stocks and bonds hit hard. Both are in the red by 10%+ on a year to date basis headed into the final week of August. In the charts below, we show the year to date total returns of the S&P 500 (y-axis) and the year to date total returns of various ICE Bank of America bond indices (x-axis) through August for each year going back to their respective inceptions (each index began in 1973 except for high yield which began in 1987). No matter which way you cut it, 2022 has been the worst year of the past half century for stocks and bonds combined.

With the S&P 500 down a little over 12% YTD, aggregate bonds (government and corporate bonds combined) are only around one percentage point better. For the comparable time of the year, the only years that also have seen both bonds and stocks sitting on a loss through August were 1973, 1974, and 1981. The same applies for government bonds. The corporate investment grade bond index has a bit more variety of years with stocks and bonds falling in 1974, 1981, 2008, and 2015. Again though, none of those other years have seen as sharp of a decline as 2022, and the S&P 500’s drop in the same time also ranks as one of the worst. 2022 is the only year that the high yield bond index has fallen simultaneously with stocks, however as we noted earlier, it does not have as long of a history as those other categories. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day: Breadth Surge Recedes

Bespoke’s Morning Lineup – 8/24/22 – Flat as the Yield Curve

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you want to succeed you should strike out on new paths, rather than travel the worn paths of accepted success.” – John D. Rockefeller

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Trading this morning has been directionless, but it’s better than the alternative of weakness which has been the prevailing tone. Fed Chair Powell’s Jackson Hole Speech on Friday continues to be the main focus of investors, and expectations for the tone of the speech are low. Have you spoken to anyone in the last seven days who thinks Powell’s message will be a positive for the market?

In economic news this morning, Durable Goods for July were unchanged, which was weaker than expected, but ex Transportation, the reading came in better than expected (+0.3% vs +0.1%). The only other report on the calendar is Pending Home Sales at 10 AM.

Treasury yields are mostly lower across the curve except for the two-year which is 2 bps higher and further flattening or inverting various portions of the yield curve. In commodities, crude oil continues to run higher following reports yesterday that OPEC would consider cutting production and that has pushed WTI up to just under $95 per barrel.

As oil prices have moved back into the mid-90s per barrel and natural gas surges to multi-year highs, the Energy sector has gotten a jump. Since its July 14th low, the Energy sector has rallied more than 20% taking it from extreme oversold to extreme overbought levels in the span of six weeks, and as of yesterday’s close, the sector is less than 11% from its 52-week high in June.

Perhaps even more impressive than the rebound in price has been the about-face in the percentage of stocks in the sector trading above their 50-day moving average (DMA). While not a single stock in the sector was above its 50-DMA less than three weeks ago, as of yesterday’s close all but one name was above that level (bottom chart). The lone hold-out has been Baker Hughes (BKR), but even it is now just barely 2% below its 50-DMA. Falling oil prices and the prospects of lower inflation have played an important role in the broader market’s summer rally, but the recent trends for oil and natural gas and stocks in the Energy sector may be starting to shift.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.