Bespoke’s Morning Lineup – 3/26/21 – Rates Remain Temperamental

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“‘Experience’ is what you got when you didn’t get what you wanted.” – Howard Marks

Futures are indicated mostly higher this morning, although Nasdaq futures have been under pressure as yields on the 10-year rise. It’s been a busy morning of economic data, but so far there have been no major outliers relative to expectations.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events from the US and around the world, including a discussion of Chinese Current Account, Japanese Inflation, German sentiment, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

Within some of the major US indices, it’s a mixed picture with respect to their charts heading into the weekend.

The Russell 2000 broke below its 50-DMA moving average for the first time in over four months earlier this week, and while it bounced at support yesterday, it remains in a bit of limbo heading into today as it sits right between support below and its 50-DMA above.

The Nasdaq 100 has been having a much rougher go of it lately. With yields remaining temperamental, QQQ has been bouncing around in a range below its 50-DMA. Yesterday, it made a lower low relative to earlier in the week, so for now it remains in a tenuous position if you’re a bull on the index.

Lastly, while a number of other indices have been under pressure, the S&P 500 continues to chug along. Yesterday, SPY bounced right at support coinciding with its 50-DMA and uptrend. Bulls will want to see some follow-through after yesterday’s bounce, but if the weakness in the QQQ continues, it will be hard for SPY to maintain its immunity.

Bullish Sentiment Back Above 50% But Is That A Good Thing?

With the NASDAQ has put in a lower high and the Russell 2,000 touched the technical definition of a correction intraday today, sentiment has turned the other cheek. The AAII’s reading on bullish sentiment rose two percentage points moving back above 50% this week. Bullish sentiment is now at its highest level since the week of November 12th.

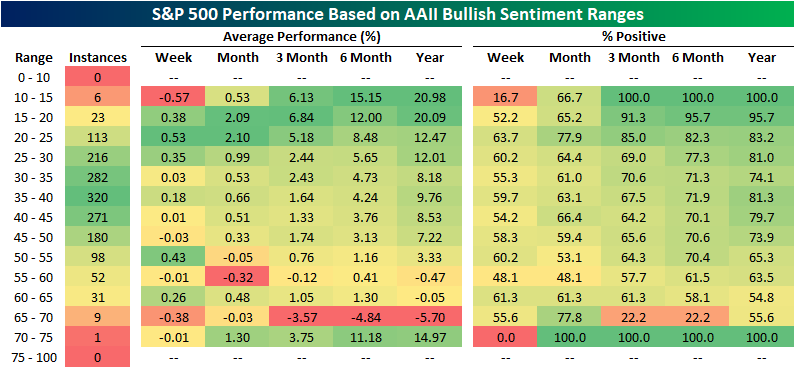

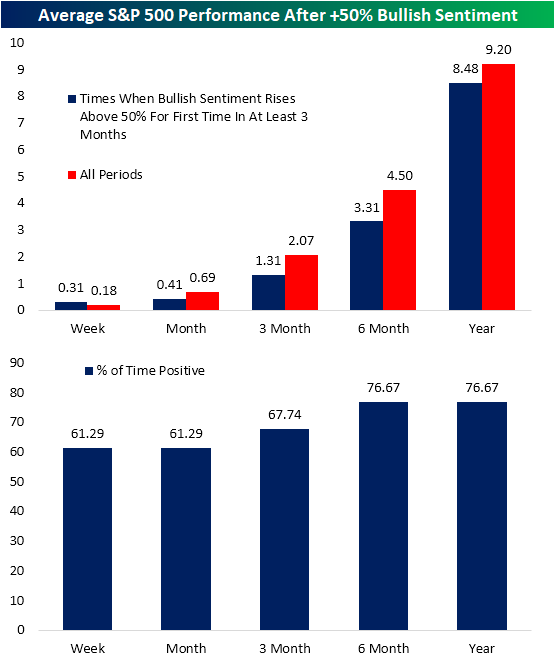

Since the AAII survey began in the late 1980s, there are plenty of instances (191 weeks) in which bullish sentiment has come in above 50%. As shown below, generally higher readings on bullish sentiment have resulted in weaker returns than when sentiment holds a more pessimistic outlook.

Given this, in the charts below we show the average performance of the S&P 500 in the weeks and months after bullish sentiment comes in above 50% for the first time in at least 3 months. Across those 31 past instances, while the index is frequently higher with positive returns better than three-quarters of the time six and twelve months later, the size of those gains are smaller than the norm. Only the one-week period has managed outperformance versus all periods with a 31 bps gain rather than the 18 bps gain for all other periods.

While a higher number of respondents reported as bullish, only 20.6% reported as bearish. That is the lowest level for bearish sentiment since December 2019 when it was only 0.1 percentage points lower than it is now. That is also the first time that less than a quarter of respondents have reported as bearish for three consecutive weeks since another three-week streak ending in the first week of 2020.

Given the high level in bullish sentiment and low level of bearish sentiment, the bull-bear spread rose back above 30 for the first time since the week of November 12th when it stood slightly higher at 30.97.

While both bullish and bearish sentiment are at notable levels, there was not a very large change in the percentage of respondents reporting as neutral. That reading rose only 1 percentage point to 28.5%. That leaves it right in the middle of its recent range. As recently as the first week of March this reading stood several percentage points higher at 34.4% whereas it is nearly equally as far away from its lows from early January.Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Claims Come In At A New Low for the Pandemic

It took almost a year, but seasonally adjusted initial jobless claims have finally moved back below their pre-pandemic record level of 695K set in October 1982. At the lowest level in a year, this week’s print came in below expectations of 730K at 684K. That was a 97K decrease from last week’s upwardly revised level of 781K and the largest week over week decline since the week of February 19th when claims fell by just 1K more. We would also note that in this week’s release the BLS announced this will be the last week before revisions to the seasonal factors are made meaning next week the series will likely look slightly different as a result of those revisions.

On a non-seasonally adjusted basis, claims likewise improved dramatically. Regular state initial claims fell by just over 100K to 656.8K this week. Not only is that the lowest level for regular state claims in a year, but it was also the third-lowest reading on record for the Pandemic Unemployment Assistance (PUA) Program. The only lower weekly readings in PUA claims occurred in the very first week that they were introduced (April 17th, 2020) and the first week of 2021 when there were some lapses due to the signing of the spending bill. On a combined basis, total initial jobless claims between the two programs fell back below 1 million for the first time of the pandemic. As for the individual states that drove those declines, California, Illinois, and Ohio (which is an unwind of some very elevated levels for the state recently) saw some of the largest declines across both regular state and PUA programs. In regards to just the PUA programs, Indiana and Oregon also were large contributors to that decline.

Continuing claims are lagged one week to initial claims so the most recent print for the week of March 12th would not reflect that big drop in the most recent initial claims data. Nonetheless, seasonally adjusted continuing claims have extended the declines that have consistently come over the past several months. In fact, of the past half-year (26 weeks), there have only been two times that the continuing jobless claims were not lower week over week. This week’s decline marked a tenth consecutive week that claims were lower. Falling to 3.87 million, the current reading is the lowest of the pandemic and is now “only” about 2 million above levels from prior to the start of the pandemic.

Including all auxiliary programs adds an additional week’s lag to the data meaning the most recent data as of the first week of March would again not reflect the big drop in initial claims this week. As of the most recent data for the first week of March, total claims across all programs rose slightly to 18.99 million from 18.253 million at the end of February. That continues to be a somewhat elevated reading relative to the past few months though the recent drops in initial claims could mean that there is certainly potential for improvement on the horizon.

Pandemic Emergency Unemployment Compensation (PEUC) claims were the biggest contributor to that uptick as claims from that program rose 734.69K. While this data predated it, the signing of the American Rescue Plan Act extended this federal program through September after it was supposed to end in mid-March. This program in particular extends benefits once they have expired. That means the increase in continuing claims comes from people who have been long-term unemployed. In fact, of all continuing claims, those from the PEUC program accounted for 29.2% which is a new high for the pandemic. Combined with other extension-type programs like Extended Benefits, that share is also at a new high of almost 35% of all claims. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 3/25/21 – Hideout in Defensives

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Experience is a good school. But the fees are high.” – Heinrich Heine

It’s not looking like a particularly positive day for risk assets extending what has already been a painful week. Equity futures were higher earlier but have given up all of their gains are now firmly in the red. Bitcoin prices have also been on the decline falling by more than 7%. Oil prices are lower and the 10-year yield is unchanged. There’s a lot of economic data and Fed-speak on the calendar today, so be on the lookout for headlines related to these events.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events from the US and around the world, including a discussion of recent confidence surveys from major global economies, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

It’s been a rough week in the equity market as all of the major US indices are down by a minimum of 1.5% over the last five trading days. Indices holding up the best have been the Dow and S&P 100, which is comprised of the 100 largest stocks in the market. At the other end of the spectrum, small-cap stocks have been hit hard. The Russell 2000 is down over 8%, and the Micro-Cap Index is down nearly 11%.

Within individual sectors, there hasn’t been much shelter either. Energy has been the leading sector YTD with a gain of over 30%, but it has also declined more than 4% in the last 5-trading days. Along with Energy, Consumer Discretionary and Communication Services haven’t been nearly as strong YTD, but that hasn’t made them immune to weakness as both sectors are down over 3%. The only areas of strength in the last five trading days have been the defensive sectors like Utilities and Consumer Staples which have both managed to rally more than 1%.

Bespoke’s Morning Lineup – 3/24/21 – Nasdaq Leads Again as Yields Remain Stable

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“It’s not whether you’re right or wrong that’s important, it’s how much money you make when you’re right and how much you lose when you’re wrong.” – George Soros

Nasdaq futures are leading the way higher this morning as yields stabilize. Crude oil is also rebounding and bitcoin is on the rise as we head into the final week of the quarter.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events from the US and around the world, including a discussion of Intel’s announcement last night, an update on the latest Markit flash PMI readings for the month of March, equity performance in Asian benchmark indices, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

Tuesday was a brutal day for the Russell 2000 as it fell more than 3.5% for its worst day in nearly a month. With that decline, the small-cap benchmark also closed below its 50-day moving average for the first time since the end of October.

At 96 trading days, the Russell 2000’s streak of closes above its 50-day moving average was the second streak of more than 90 trading days in the last year and also the longest streak in a decade (March 2011). As shown in the chart below, while streaks of 90 or more trading days have been relatively uncommon in the last decade, prior to that there were numerous streaks lasting much longer than 100 trading days.

Shipments Drive the Richmond Fed Higher

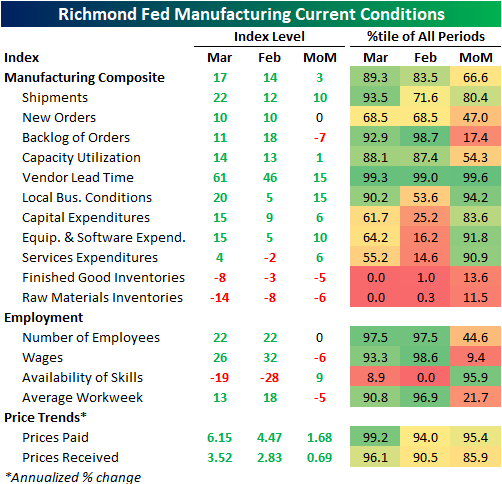

The Richmond Fed’s Manufacturing Activity Index rose to 17 in March after readings of 14 over the prior two months which had been the weakest readings since last July. At 17, this month’s reading was the strongest since December pointing not only to further growth but also an acceleration in the region’s manufacturing activity.

Across sub-indices, almost everything continues to show expansionary readings although there are a few exceptions for things like inventories and availability of skills; neither of which are necessarily bad signs for activity. As for the month-over-month changes, things were perhaps a bit more mixed with five of the eighteen categories lower and another two unchanged. Expectations also generally improved across categories though the actual levels of most of these indices are generally at the lower end of their historic range. In all, the report showed orders continue to grow with inventories being drawn upon at a record pace. Prices (including wages given labor market tightness) are also increasing at a historic rate.

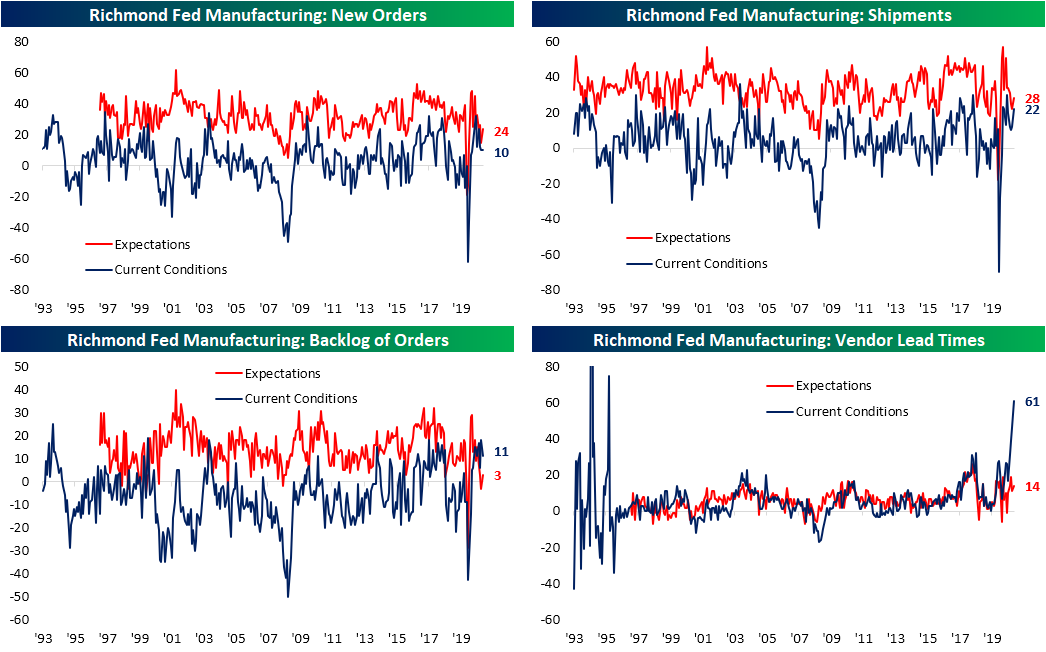

The main driver of the uptick in the headline number (which is a composite of Shipments, New Orders, and Employment) was the increase in Shipments which offset the unchanged readings in the other two components. That index gained 10 points to 22 in March. That was both the biggest one-month gain and the highest level for this index since October and leaves it in the top decile of readings throughout the index’s history. Although Shipments were higher, New Orders remain off their highs from a few months ago going unchanged in March. With Shipments on the rise and new demand steady, the Backlog of Orders decelerated as the index fell 7 points. But even with that decline, the current reading still stands in the top 10% of readings. One surprising point about the uptick in Shipments was that it also coincided with a historically high reading in Vendor Lead Times. Higher readings in this index indicate that it takes longer for products from suppliers to reach their destination. In other words, supplier delays have not yet appeared to slow down manufacturers getting products out the door.

While supplier delays aren’t slowing things down yet, inventories are being drawn upon at a record rate. Both indices for final good and input inventories fell to record lows in March.

Meanwhile, prices for both inputs and receivables continue to accelerate. Prices Paid rose at a 6.15% annualized pace. That is the third-highest reading on record behind October 2018 and June 2008. Expectations for Prices Paid are at the highest point in over a decade and the seventh-highest level on record. Prices Received are rising at a slower clip, 3.52% annualized, but this too is around one of the highest levels in recent years.

As for another input, Wages, there was a six-point decline in the current conditions index in March. Even though that is in the bottom 10% of monthly moves, the index is still at a historically strong level. As the report also continues to show a lack of skilled workers, expectations for Wages were much higher. That index rose to 57 which is the highest level since May 2019. Prior to that, you would need to go back to March and February of 2000 to find as high of a reading. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 3/23/21 – Nasdaq Outperforming Again

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“In a wicked world, relying upon experience from a single domain is not only limiting, it can be disastrous.” – David Epstein – Range

US equity futures are shaping up a lot like Monday where the Nasdaq is leading the way, although unlike yesterday where all three major averages were higher on the day, so far it’s just the Nasdaq. Treasury yields and crude oil are both trading lower to start the day as rising COVID cases in Europe have dampened risk appetite.

In Fed news, Dallas Fed President Robert Kaplan was on CNBC earlier and said he sees inflation for 2021 coming in at a rate of 2.25% to 2.50% but sees the rate of price increases declining again in 2022. Kaplan is only the first of many Fed officials, including Powell, scheduled to speak today, so expect a lot of headlines on that front.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events from the US and around the world, including a discussion of the recent moves in rates, equity performance in Asian benchmark indices, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

The Philadelphia Semiconductor Index (SOX) has been in a relatively steady downtrend since its high in early February. Last week the SOX briefly traded and closed above that downtrend but quickly reversed back below. Yesterday, the SOX’s rally to kick off the week not only brought the index back above its 50-DMA and downtrend line, but it was also the first time that the index opened and traded above that downtrend line for the entire trading session. The SOX has still underperformed the broader market by a relatively wide margin over the last month, but if it’s going to get back on track, it has to start somewhere.

February: Short But Weak

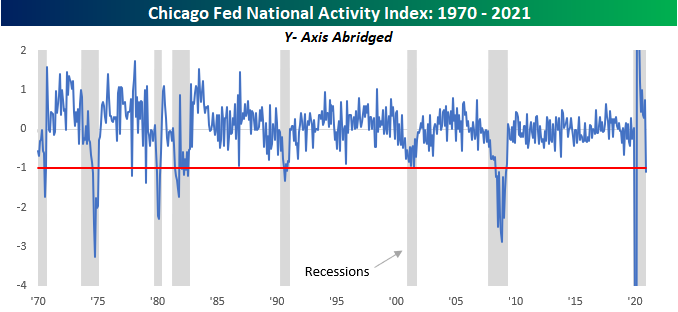

With elevated COVID cases and a major winter storm that paralyzed much of the south, February was a speed bump for the US economy. The latest example comes from this morning’s release of the Chicago Fed National Activity Index (CFNAI). From the website of the Chicago Fed, “The CFNAI is a weighted average of 85 existing monthly indicators of national economic activity. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend and a negative index reading corresponds to growth below trend.”

The release for February showed considerable weakness falling from a strong reading of 0.75 in January to -1.09 in February. The chart below shows historical readings of the CFNAI index dating back to 1970 with recessions highlighted in gray and a red line indicating the current reading for February. Because of the major swings we saw in this index around the COVID outbreak last year, this chart is pretty useless in terms of looking at the current data to see how it compares to prior periods.

In order to get a better view, in the chart below we have cut off the y-axis to leave out the extreme readings from 2020. Looking at it this way shows just how weak February was. Looking back, just about every prior occurrence where the CFNAI was below -1 the US economy was in a recession. Besides the period in 2020, the last times this index was at similar levels was during the Financial Crisis, during the dot-com recession, the 1990 recession, and then the double-dip recession of the 1980s. Noticing a trend?

The table below shows every month where the CFNAI was less than negative one (-1). Since 1970, out of 612 monthly readings, there have only been 37 months that the index was below -1. Of those 37 months, there have only been two (Jan 1978 and April 1979) that occurred when the US economy wasn’t in a recession. Technically, since the NBER has yet to confirm an end date, the US economy remains in the COVID recession, but most would agree that when the time comes, the recession will likely have ended in the second or third quarter of 2020 which would make February just the third month since 1970 that the CFNAI was below -1 outside of a recession. In other words, in just about any other time but now, an overheating economy would be the last thing people would be worried about right now given a negative reading of this magnitude in the CFNAI. Click here to view Bespoke’s premium membership options for our best research available.

Canada on Top

As shown below, there is not a single BRIC or G7 country that has a total return of less than 50% since the March 23rd, 2020 COVID low through today. Of all of these, India (PIN) boasts the best return having more than doubled and leading the pack throughout basically all parts of the past year. There were only a couple of points in time early on in the recovery that PIN was not the leader. That was when Brazil (EWZ) was up the most, but since the end of 2020, the country’s equities have significantly underperformed. The same applies to China (ASHR). Meanwhile, Russia (RSX) and the US (SPY) have more steadily continued higher alongside PIN.

As for the developed world, things have been more stable. There has not been a G7 country that has fallen sharply recently in the same way as Brazil or China. As a result, China (ASHR) actually has the worst return over the past year out of all G7 and BRIC countries and Brazil would rank as the second-worst. Earlier in the pandemic, Canada (EWC) and Germany (EWG) had been vying for the best-performing G7 country, but since the fall, EWC has put some distance between itself and the rest. The US has the next best returns with a 78.46% total return over the past year.

Click here to view Bespoke’s premium membership options for our best research available.

Historic Year for the S&P 500

Tomorrow will mark the one-year anniversary of the S&P 500’s closing low from the COVID crash, and for most stocks in the index, it has been a historic year. Within the S&P 500, stocks in the index are up an average of 104.22% through Friday’s close, and just three stocks – all from the Health Care sector – are actually lower. Leading the losers, Gilead (GILD) has declined over 10%. Recall that GILD performed well during the initial stages of the pandemic on the promising results of its drug Remdesivir in treating COVID patients, but once the market started to rally, it was left behind.

The table below lists the top 25 performing stocks in the S&P 500 since the closing low on 3/23/20. Topping the list with a gargantuan gain of 763% is ViacomCBS (VIAC). After trading below $12 per share last March, the stock is close to triple-digits today. Behind VIAC, Tesla (TSLA), L Brands (LB), Etsy (ETSY), and Freeport-McMoRan (FCX) round out the top five, and all have gained in excess of 500%. Interestingly enough, despite the strength of the sector for what seems like years now, the only stock on the list from the Technology sector is Enphase Energy (ENPH). In fact, after ENPH, you have to go all the way down to the 53rd spot to find the next stock from the Technology sector (Applied Materials – AMAT, +186%).

Leading the way higher, stocks in the Consumer Discretionary and Energy sectors are both up an average of over 150%, while Consumer Staples and Utilities are the only two sectors where each one’s components are up an average of less than 50%. Just to the right of the S&P 500 in the chart below is the Technology sector which is one of five sectors where the average performance of its components is less than 100%. A gain of 96.1% in a year is nothing to sneeze at in any market environment, but just the fact that the average performance of stocks in the Technology sector since the March lows is now lower than the average of the S&P 500 illustrates the shift we have seen since the sector’s peak relative strength last fall. Click here to view Bespoke’s premium membership options for our best research available.