Bespoke’s Morning Lineup – 3/30/21 – Gloomy Gold

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The window to the world can be covered by a newspaper.” – Stanislaw Jerzy Lec

It’s more of the same this morning as futures are modestly negative, but higher interest rates are acting as a weight on the Nasdaq and growth stocks in general. The economic calendar is relatively light, with a report on home prices coming out at 9 AM eastern and Consumer Confidence at 10 AM. Crude oil and gold are both down sharply, but bitcoin is higher. In political news, President Biden will speak on Infrastructure this afternoon. In terms of the latest COVID trends, national declines have been inching higher, but the key as we discuss in the Morning Lineup is that among populations that have been widely vaccinated, case counts have remained contained.

Read today’s Morning Lineup for a recap of all the major market news and events including a discussion of the move higher in rates, a recap of international markets, some strong survey related economic data out of Europe, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

Gold just hasn’t been able to get out of its way this quarter. Despite concerns over inflation, the yellow metal has been weak as interest rates rise. This morning alone, gold is trading down over 1.5% after trading down over 1% yesterday and on the verge of testing its recent lows.

With the quarter coming to a close tomorrow, gold is on pace for a double-digit percentage decline this quarter, making it the worst quarter in nearly five years and just the tenth quarterly decline of more than 10% in the last 45 years.

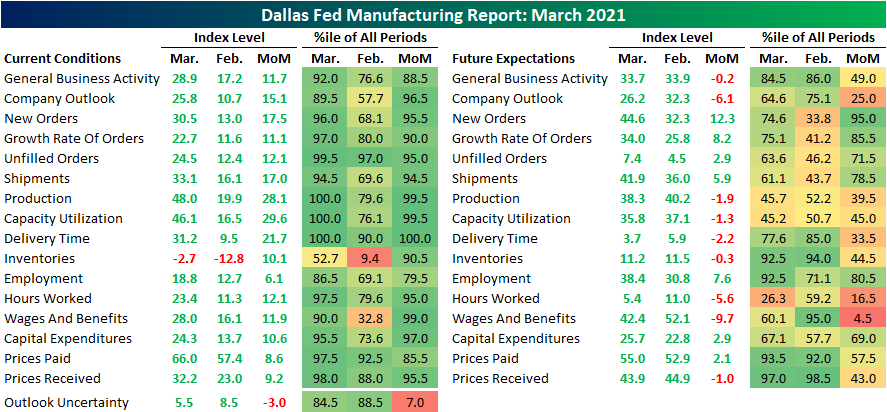

Dallas Manufacturing Bounces Back After the Storm

The reporting period for the Dallas Fed’s Manufacturing Outlook Survey for the month of February had some overlap with the region’s winter storms, but the extent of the damages were likely not fully captured. Fast forward a month to the March report and the region appears to have seen a strong bounce back. This morning’s release saw a huge beat relative to expectations just like other regions’ manufacturing surveys for the month of March. The Dallas Fed’s reading on the region’s manufacturing sector was actually expected to decline to 16.5 from last month’s reading of 17.2; the second-highest level of the index since the start of the pandemic. Instead of falling, the index surged to a new high post-pandemic high of 28.9. That is the best level since August 2018. Prior to 2018, the only other times that there has been as strong of readings was in the first few years of the index’s history.

The General Business Activity index was far from the only one to come in with an impressive reading. Across the 16 indices, 13 are in the top decile of readings with three of those at record highs. Expectations came in more mixed with most indices still positive but at less impressive levels historically while just over half fell month over month in March. Overall, the report showed that general conditions continue to improve with higher growth in orders, ramping up of production and employment, and higher prices. Granted, given the survey asks respondents to report on the change in activity from the prior month (i.e. when the winter storms had dampened activity), some of these strong readings could be a result of base effects.

New orders have consistently grown over the past several months, but since the fall, that pace of improvement had generally plateaued. But with activity bouncing back after the storms, the indices for New Orders and Order Growth Rate both ripped higher in March. New Orders topped a reading of 30 for the first time since June 2018 this month while Order Growth Rate reached the highest level since May of that same year. Thanks to that growth in new orders plus an inability to fulfill existing orders last month, the index for Unfilled Orders has experienced a more unprecedented spike higher. The 12.1 point rise month over month was in the top 5% of all monthly moves leaving the index at the second-highest level on record behind September 2005 when it was 10 points higher. Given that massive backlog, Shipments also have ramped up as the index rose 17 points to 33.1.

An even more impressive increase to gauge the effort being put in to meet that demand came from the indices for Production and Capacity Utilization. Both indices surged to new all-time highs.

Even though the region’s manufacturers have increased production significantly, supply chains are showing signs of stress. The index for Delivery Times soared by the highest amount in a single month on record to a new all-time high of 31.2, surpassing the previous record from September 2005 by almost 10 points.

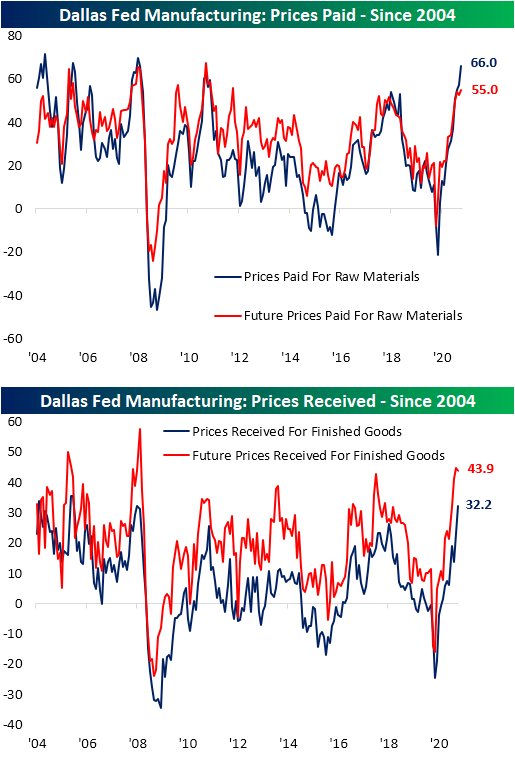

In addition to longer lead times, price growth is accelerating for both Prices Paid and Received. Prices Paid rose to 66 this month which is the sixth-highest level on record and a level that has not been seen since July 2008. The index for Prices Received is actually at a slightly higher end of its range (98th percentile versus 97.5th percentile for Prices Paid), but it too is at the highest level since 2008.

Finishing with a look at employment, although there was not a big pickup in the reading on firms increasing hiring, they appear to be making do with existing workers and are increasing incentives. The indices for Hours Worked and Wages & Benefits both saw increases in the top 5% of all months. In addition, Capital Expenditures also saw a big uptick in March. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 3/29/21 – Media Stocks in Focus

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“When you combine ignorance and leverage, you get some pretty interesting results.” – Warren Buffett

Media stocks are in focus this morning as the unwind of the Archegos hedge fund that began last week continues today. In today’s Morning Lineup, we provided a rundown of the situation and the key factors that will shape how things play out, so make sure to check that out (pg 4).

Futures are lower as financials that have been caught up in the liquidation look to open lower. Keep in mind also, that despite the weakness at the open, US equities saw major surges into the close on Friday.

Also in today’s report, check out updates on the latest market news and events from the US and around the world, including a summary of the Archegos hedge fund blow-up and its potential impact, profits in China, the rates market, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

One bank being hit especially hard from the blow-up in the media stocks over the last week has been Nomura. Nomura has seen a lot in the last forty years. From the bursting of the Japanese stock bubble in 1989, the 1987 stock market crash, the failure of Long-Term Capital in the 1990s, and then the credit crisis just over 10 years ago, the bank has faced a number of crises. This morning, the Japanese bank disclosed that it faces $2 billion in losses tied to margin calls, and compared to those prior periods, $2 bln doesn’t have quite the shock value that it used to.

Don’t tell that to the stock though. Overnight, shares of Nomura fell more than 16%, which is the largest one-day decline the stock has experienced in at least 40 years.

Bespoke Brunch Reads: 3/28/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Policymaker Profiles

The Years of Work Behind Washington’s Best-Liked Man by Claudia Sahm (NYT)

An oral history of how a strait-laced Republican and former Wall Street executive has helped push the world’s most important central bank in a genuinely populist direction. [Link; soft paywall]

The Born Prophecy by Richard B. Schmitt (ABA Journal)

In the late-1990s, the nascent derivatives markets were starting to boom, and CFTC Chair Brooksley Born tried to set up prudential regulation. Her efforts were quashed by Clinton administration Treasury Secretary Bob Rubin, his top deputy Larry Summers, and Fed Chair Allan Greenspan. [Link]

Odd Marketing

Post Consumer Brands to repay shoppers for black-market Grape-Nuts purchases by Noah Manskar (NYP)

Consumers desperate for their fibrous favorite were willing to pay as much as $100 per box earlier this year, prompting parent company Post to offer to reimburse the biggest fans for their overpriced purchases. [Link; auto-playing video]

Read the Pentagon’s 20-Page Report on Its Own Meme by Matthew Gault (Vice)

An unimpressive effort to skewer Russian hackers spent three weeks filtering through an approval process at the Pentagon before winding up on the US Cyber Command’s Twitter feed. [Link]

Capex

A Van Fight Is Brewing by David Welch (Bloomberg)

Commercial vans typically travel less than 100 miles per day, so electric conversion of fleets that reduce operating costs thanks to fewer moving parts and fuel costs are compelling for operators…and that’s before considering big tax incentives. [Link; soft paywall]

Intel is spending $20 billion to build two new chip plants in Arizona by Kif Leswing (CNBC)

After losing huge ground to foreign competitors, Intel has decided to shift its strategy towards a more US-centric approach. The result is billions of capex on two Arizona factories. [Link]

Weird News

How Many Slaps Does it Take to Cook a Chicken? This YouTuber Built a Slapping Rig to Find Out by Alyse Stanley (Gizmodo)

Energy is fungible, so imparting kinetic force on a chicken should at least hypothetically be enough to raise its temperature to the point it is “cooked”. As it turns out, it’s not just a hypothetical possibility. [Link]

How to Kill a Zombie Fire by Matt Simon (Wired)

Peat fires can continue to burn long after they appear to be put out, and warming temperatures are making them more common. Luckily, new techniques are proving more effective in fighting these fires. [Link; soft paywall]

Gaming

RollerCoaster Tycoon: the best-optimised game of all time? by Matt Hrodey (PCGames)

Thanks to an expertise in a more fundamental language than the ones typically used to code graphics packages, RollerCoaster Tycoon’s original developer was able to pull off miraculous performance. [Link]

Infrastructure Week

Biden Team Prepares $3 Trillion in New Spending for the Economy by Jim Tankersley (NYT)

A two-part effort to revitalize physical infrastructure via investments in roads, bridges, telecommunications, housing, rail lines, ports, and green energy and human lives via job training, free community college, universal pre-kindergarten, subsidized childcare, and national paid leave is being floated by the Biden Administration. [Link; soft paywall]

Pandemic Spending

Pets and Pet Spending During the Pandemic: A Money Report by Paul Reynolds (Money)

Spending more time at home means spending more time with furry friends, leading to increases in value and affection of pets. Pandemic-enforced changes in behavior and increasing loneliness led to more purchases of pets, which were more commonly picked up from shelters or rescues than other sources. [Link]

Recast as ‘Stimmies,’ Federal Relief Checks Drive a Stock Buying Spree by Matt Phillips (NYT)

With $1400 economic impact payments rolling out the door, a legion of individual investors is looking to put their money to work in the stock market. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

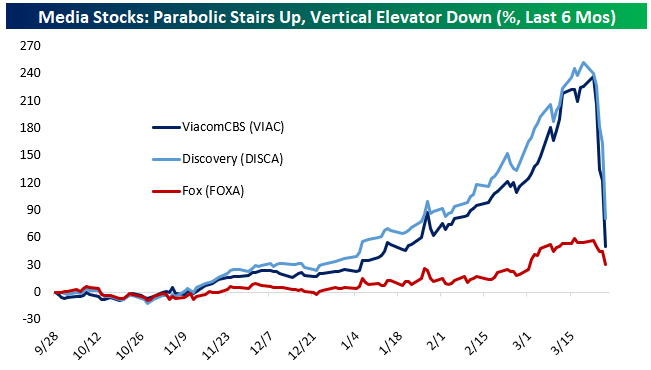

Media & Chinese Education Tech Carried Out On A Stretcher

This week we’ve seen a popular long blow up in a way that recalls the mess in GameStop (GME) earlier this year. As shown below, legacy media stocks like ViacomCBS (VIAC) and Discovery (DISCA) went parabolic since November. Fox (FOXA) also benefited, though to a much smaller degree. VIAC and DISCA both tripled in just a few months as hopes of a robust economic recovery boosting ad revenue and, more importantly, the potential for streaming riches similar to Disney (DIS) and its Disney+ platform helped fuel gains. But over the last four days, most of those gains have been incinerated. The catalyst appears to have been a secondary offering from VIAC a few days ago, with $1.7bn of shares sold into the $50bn market cap that existed at the time.

Since that secondary, the stock has been more than cut in half. There have also been rumors of a big, leveraged position by an unnamed fund having its portfolio seized and liquidated by its prime brokers. There have also been huge blocks of stock reported at dealers, with Goldman Sachs (GS) reportedly getting tapped to sell a block equivalent to more than 6% of VIAC’s free float and a second block equivalent to more than 12% of DISCA’s free float. In a reversal of the GME mess, VIAC has 18.5% of its float sold short, while DISCA’s short base is 29.7% of float. This particular blow-up is a win for shorts. Start a two-week free trial to Bespoke Institutional to access all of our analysis and market commentary.

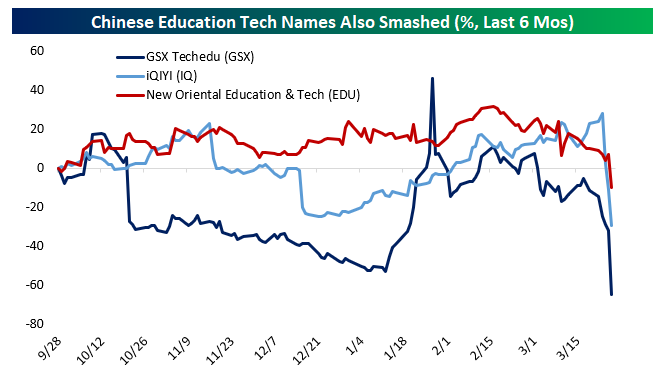

Another similar collapse has been playing out in Chinese education technology stocks listed in the US as ADRs. GSX Techedu (GSX) is down over 50% today, with a block offered by a dealer equivalent to almost 9% of the float. A similarly-sized block relative to float is also reportedly on offer in IQ. These names haven’t seen the same sort of parabolic gains as the media stocks above, but they’re a similar clustered theme that’s getting carried out to end the week.

ETFs Become Increasingly Active

In addition to providing a more liquid alternative to mutual funds, one of the big selling points of ETFs over the years has been the fact that since active management has been so bad on a collective basis, investors are better off settling for ‘market’ returns. This chart using data from Standard and Poors illustrates the point. Going back to 2001, there have only been six years where more than half of all domestic equity mutual funds outperformed the S&P 1500, and there has never been a year where even 60% of them outperformed. At the other extreme, you have years like 2011 and 2014 where less than 20% of funds outperformed.

Given the underperformance of active management over the years, it only makes sense that the vast majority of ETFs on the market have been passive in nature. There are also other factors like there being less of an ability to arbitrage that makes actively managed ETFs less feasible, but in any event, investor demand for passive index-tracking vehicles has been the main driver behind the explosive growth of ETFs.

In more recent years, though, actively managed ETFs have seen a surge in popularity. The chart below summarizes the year that each of the current ~400 actively managed ETFs that trade on US exchanges were launched. What clearly stands out is the fact that more than 30% of all actively managed ETFs were launched in 2020. Using data from ETF.com, we calculated that those 120 ETFs represent more than a third of all ETFs launched in the year.

For an investment vehicle that gained popularity because of its passive nature, the fact that actively managed ETFs have become so popular is noteworthy. Two factors behind their increased popularity stem from the success of the ARK funds, which have seen their assets under management swell to around $50 billion, and fees. Wall Street loves fees and because they offer more analysis behind security selection, actively managed ETFs can justify charging higher fees. For example, weighted based on Assets Under Management, ETFs have an average expense ratio of 0.19% per year. Within the actively managed ETF space, though, the weighted average expense ratio is nearly triple that at 0.54%. This new wave of actively managed ETFs can charge whatever fees they want, but ultimately, performance matters, and depending on how they perform over time will likely play a large role in how popular this area of the ETF space becomes. Start a two-week free trial to Bespoke Institutional to access all of our analysis and market commentary.

Bespoke’s Morning Lineup – 3/26/21 – Rates Remain Temperamental

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“‘Experience’ is what you got when you didn’t get what you wanted.” – Howard Marks

Futures are indicated mostly higher this morning, although Nasdaq futures have been under pressure as yields on the 10-year rise. It’s been a busy morning of economic data, but so far there have been no major outliers relative to expectations.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events from the US and around the world, including a discussion of Chinese Current Account, Japanese Inflation, German sentiment, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

Within some of the major US indices, it’s a mixed picture with respect to their charts heading into the weekend.

The Russell 2000 broke below its 50-DMA moving average for the first time in over four months earlier this week, and while it bounced at support yesterday, it remains in a bit of limbo heading into today as it sits right between support below and its 50-DMA above.

The Nasdaq 100 has been having a much rougher go of it lately. With yields remaining temperamental, QQQ has been bouncing around in a range below its 50-DMA. Yesterday, it made a lower low relative to earlier in the week, so for now it remains in a tenuous position if you’re a bull on the index.

Lastly, while a number of other indices have been under pressure, the S&P 500 continues to chug along. Yesterday, SPY bounced right at support coinciding with its 50-DMA and uptrend. Bulls will want to see some follow-through after yesterday’s bounce, but if the weakness in the QQQ continues, it will be hard for SPY to maintain its immunity.

Bullish Sentiment Back Above 50% But Is That A Good Thing?

With the NASDAQ has put in a lower high and the Russell 2,000 touched the technical definition of a correction intraday today, sentiment has turned the other cheek. The AAII’s reading on bullish sentiment rose two percentage points moving back above 50% this week. Bullish sentiment is now at its highest level since the week of November 12th.

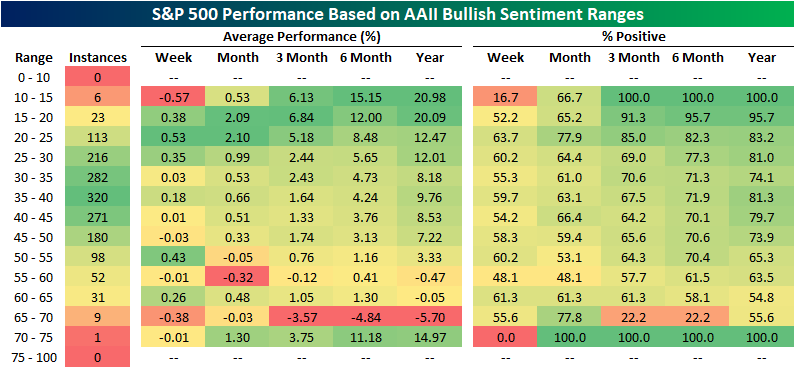

Since the AAII survey began in the late 1980s, there are plenty of instances (191 weeks) in which bullish sentiment has come in above 50%. As shown below, generally higher readings on bullish sentiment have resulted in weaker returns than when sentiment holds a more pessimistic outlook.

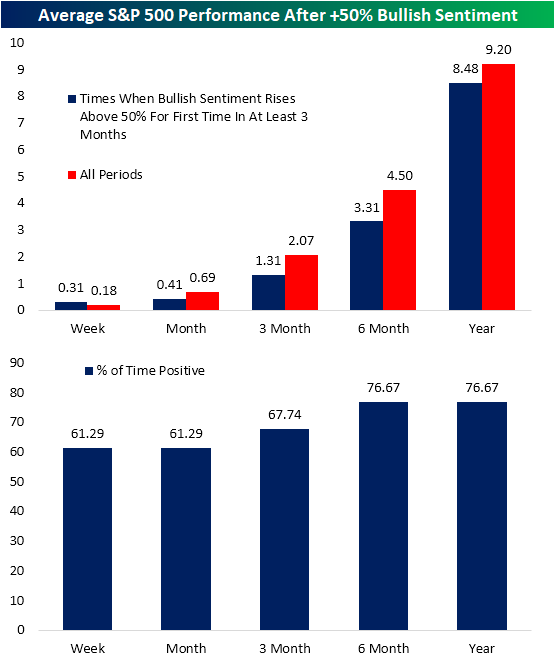

Given this, in the charts below we show the average performance of the S&P 500 in the weeks and months after bullish sentiment comes in above 50% for the first time in at least 3 months. Across those 31 past instances, while the index is frequently higher with positive returns better than three-quarters of the time six and twelve months later, the size of those gains are smaller than the norm. Only the one-week period has managed outperformance versus all periods with a 31 bps gain rather than the 18 bps gain for all other periods.

While a higher number of respondents reported as bullish, only 20.6% reported as bearish. That is the lowest level for bearish sentiment since December 2019 when it was only 0.1 percentage points lower than it is now. That is also the first time that less than a quarter of respondents have reported as bearish for three consecutive weeks since another three-week streak ending in the first week of 2020.

Given the high level in bullish sentiment and low level of bearish sentiment, the bull-bear spread rose back above 30 for the first time since the week of November 12th when it stood slightly higher at 30.97.

While both bullish and bearish sentiment are at notable levels, there was not a very large change in the percentage of respondents reporting as neutral. That reading rose only 1 percentage point to 28.5%. That leaves it right in the middle of its recent range. As recently as the first week of March this reading stood several percentage points higher at 34.4% whereas it is nearly equally as far away from its lows from early January.Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Claims Come In At A New Low for the Pandemic

It took almost a year, but seasonally adjusted initial jobless claims have finally moved back below their pre-pandemic record level of 695K set in October 1982. At the lowest level in a year, this week’s print came in below expectations of 730K at 684K. That was a 97K decrease from last week’s upwardly revised level of 781K and the largest week over week decline since the week of February 19th when claims fell by just 1K more. We would also note that in this week’s release the BLS announced this will be the last week before revisions to the seasonal factors are made meaning next week the series will likely look slightly different as a result of those revisions.

On a non-seasonally adjusted basis, claims likewise improved dramatically. Regular state initial claims fell by just over 100K to 656.8K this week. Not only is that the lowest level for regular state claims in a year, but it was also the third-lowest reading on record for the Pandemic Unemployment Assistance (PUA) Program. The only lower weekly readings in PUA claims occurred in the very first week that they were introduced (April 17th, 2020) and the first week of 2021 when there were some lapses due to the signing of the spending bill. On a combined basis, total initial jobless claims between the two programs fell back below 1 million for the first time of the pandemic. As for the individual states that drove those declines, California, Illinois, and Ohio (which is an unwind of some very elevated levels for the state recently) saw some of the largest declines across both regular state and PUA programs. In regards to just the PUA programs, Indiana and Oregon also were large contributors to that decline.

Continuing claims are lagged one week to initial claims so the most recent print for the week of March 12th would not reflect that big drop in the most recent initial claims data. Nonetheless, seasonally adjusted continuing claims have extended the declines that have consistently come over the past several months. In fact, of the past half-year (26 weeks), there have only been two times that the continuing jobless claims were not lower week over week. This week’s decline marked a tenth consecutive week that claims were lower. Falling to 3.87 million, the current reading is the lowest of the pandemic and is now “only” about 2 million above levels from prior to the start of the pandemic.

Including all auxiliary programs adds an additional week’s lag to the data meaning the most recent data as of the first week of March would again not reflect the big drop in initial claims this week. As of the most recent data for the first week of March, total claims across all programs rose slightly to 18.99 million from 18.253 million at the end of February. That continues to be a somewhat elevated reading relative to the past few months though the recent drops in initial claims could mean that there is certainly potential for improvement on the horizon.

Pandemic Emergency Unemployment Compensation (PEUC) claims were the biggest contributor to that uptick as claims from that program rose 734.69K. While this data predated it, the signing of the American Rescue Plan Act extended this federal program through September after it was supposed to end in mid-March. This program in particular extends benefits once they have expired. That means the increase in continuing claims comes from people who have been long-term unemployed. In fact, of all continuing claims, those from the PEUC program accounted for 29.2% which is a new high for the pandemic. Combined with other extension-type programs like Extended Benefits, that share is also at a new high of almost 35% of all claims. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 3/25/21 – Hideout in Defensives

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Experience is a good school. But the fees are high.” – Heinrich Heine

It’s not looking like a particularly positive day for risk assets extending what has already been a painful week. Equity futures were higher earlier but have given up all of their gains are now firmly in the red. Bitcoin prices have also been on the decline falling by more than 7%. Oil prices are lower and the 10-year yield is unchanged. There’s a lot of economic data and Fed-speak on the calendar today, so be on the lookout for headlines related to these events.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events from the US and around the world, including a discussion of recent confidence surveys from major global economies, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

It’s been a rough week in the equity market as all of the major US indices are down by a minimum of 1.5% over the last five trading days. Indices holding up the best have been the Dow and S&P 100, which is comprised of the 100 largest stocks in the market. At the other end of the spectrum, small-cap stocks have been hit hard. The Russell 2000 is down over 8%, and the Micro-Cap Index is down nearly 11%.

Within individual sectors, there hasn’t been much shelter either. Energy has been the leading sector YTD with a gain of over 30%, but it has also declined more than 4% in the last 5-trading days. Along with Energy, Consumer Discretionary and Communication Services haven’t been nearly as strong YTD, but that hasn’t made them immune to weakness as both sectors are down over 3%. The only areas of strength in the last five trading days have been the defensive sectors like Utilities and Consumer Staples which have both managed to rally more than 1%.