Bespoke CNBC Appearance (5/10/21)

Bespoke co-founder Paul Hickey appeared on CNBC’s Squawk Box to discuss the Friday jobs report and what it means for the market going forward. To view the segment, click on the image below. Click here to view Bespoke’s premium membership options for our best research available.

ARK Sinking?

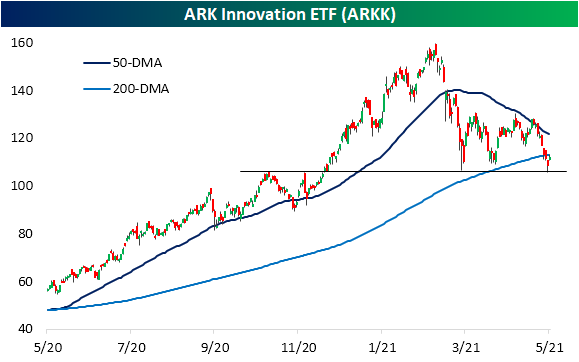

The recent struggles of the ARK Innovation ETF (ARKK) have been well-documented, so while there’s no reason to state the obvious, the last couple of days have been notable for a couple of reasons. ARKK broke and closed below its 200-day moving average (DMA) for the first time in over a year last week. It then attempted to bounce on Friday, but as shown in the zoomed-in inlay on the chart, the bounce ran out of steam just at the 200-DMA (two cents above) before reversing lower. Today, that reversal has continued to pick up steam, and ARKK is now in danger of closing below its breakout point from late 2020.

In looking at the rise and fall of ARKK over the last year, it’s interesting to note that Google Search trends for the ticker ‘ARKK’ peaked within a couple of days of the ETF’s peak.

Through Monday Morning, ARKK is already down 13% in May, which would rank as the 5th worst month since the ETF’s launch in late 2014. Remember that it’s only May 10th! The table below lists ARKK’s 25 largest holdings and their performance so far this month, this year, and over the last 12 months. Tesla (TSLA) is ARKK’s largest holding, and while it’s down sharply this month, it’s actually doing better than ARKK with a MTD decline of 9%. What really stands out on this table is the fact that all 25 of the ETF’s largest holdings are down MTD. It’s pretty bonkers that performance has been this overwhelmingly negative especially in a month where the S&P 500 is up over 1%. The fact that performance has been so weak relative to the rest of the market hints at the possibility that some investors are actively betting against the fund’s holdings as growth stocks fall out of favor.

With such large declines already in May, the YTD performance of ARKK’s holdings has only gotten worse. Even with the S&P 500 up over 10% YTD, all but three of the 25 largest holdings are in the red on the year with four stocks losing more than a third of their value. In spite of all the short-term weakness, though, the performance of ARKK’s largest holdings over the last 12 months remains strong and is one reason why investors have been willing to stick with the company’s funds up to this point. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 5/10/21 – Inflation Week

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Remember that stocks are never too high for you to begin buying or too low to begin selling.” – Jesse Livermore

It’s looking like a mixed start to the week and a bit of a reversal of Friday’s trade as the Nasdaq lags while the S&P 500 and Dow futures are both higher. Commodities are flying again this morning as copper is on pace for its third straight 2%+ daily gain and Energy commodities trade higher on the news of the Colonial Pipeline outage over the weekend.

The economic calendar is empty today, but with the moves we’ve already seen in commodities plus updates on CPI and PPI later in the week, inflation will be a major theme of the week.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of overnight earnings reports and economic data, updates on the major moves in commodities, as well as the latest US and international COVID trends including our vaccination trackers (which continue to show a significant deceleration in vaccine uptake), and much more.

Based on the first week’s performance, May started off with another run for cyclical stocks. In a week where seven of eleven sectors finished in the green, the biggest winners were Energy, Materials, Financials, and Industrials, which were all up over 3%. All four sectors are also leading on a YTD basis and the most extended relative to their 50-DMAs. With the rallies, though, also comes overbought levels, and in the case of Financials, Materials, and Energy, they all closed out last week at ‘extreme’ overbought levels.

So, who’s lagging? Utilities, Real Estate, Consumer Discretionary, and Technology were the only four sectors down last week, and besides Real Estate, they are also the only sectors that aren’t currently overbought.

Bespoke Brunch Reads: 5/9/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Stock Drama

BlackRock Starts to Use Voting Power More Aggressively by Dawn Lim (WSJ)

The giant fund company is starting to put its proxy votes where its mouth, with a sharp increase in the number of environmental, social, and governance proposals in the first half of this proxy year versus the prior year when only a tiny fraction of those categories got support from the ubiquitous index fund provider. [Link; paywall]

Berkshire Hathaway’s Stock Price Is Too Much for Computers by Alexander Osipovich (WSJ)

The un-split A-shares of Berkshire have neared a maximum value that NASDAQ’s trading systems can handle, with shares knocking on a magic and unfortunate limit of $429,496.7295 per share. [Link; paywall]

Pandemic Culture

The Hot-Person Vaccine by Kaitlyn Tiffany (The Atlantic)

Tastemakers have landed on the Pfizer jab as the must-have injection of the vaccination season, for reasons that completely escape just about everyone. [Link; soft paywall]

New York City Is Roaring Back to Life, One Year After Its Nadir by Misyrlena Egkolfopoulou (Bloomberg)

With more than half of NYC vaccinated, the subway is going back to 24 hour service, and bars are opening up as the giant metropolis shakes off the past 13 months of cobwebs that made it a shadow of its former self. [Link; soft paywall]

Too Much Zoom

Even the CEO of Zoom Says He Has Zoom Fatigue by Chip Cutter (WSJ)

A never-ending slog of video calls is creating burnout and driving executives to push for a return to the office sooner rather than later, with even the CEO of remote work posterchild Zoom reporting fatigue over video calls. [Link; paywall]

‘I Used to Like School’: An 11-Year-Old’s Struggle With Pandemic Learning by Rukmini Callimachi (NYT)

For students that don’t have access to reliable internet, remote schooling has been an enormous burden, and one that has fallen overwhelmingly on non-white children. [Link; soft paywall]

Big Shifts

A Farmer Moved a 200-Year-Old Stone, and the French-Belgian Border by Anna Schaverian (NYT)

In Belgium, a treaty dating back to a post-Napoleonic years was violated by a farmer moving an inconvenient stone border marker to the edge of his field. [Link; soft paywall]

Microsoft is rolling out a new default font to 1.2 billion Office users after 14 years — and the designer of the old one is surprised by Jordan Novet (CNBC)

Vaunted workhorse of office documents Calibri is taking a back seat, with one of five potential replacements announced this week set to take the crown from the default font of Word, Excel, and other MS Office documents. [Link]

Demography

Births in U.S. Drop to Levels Not Seen Since 1979 by Janet Adamy (WSJ)

The number of American newborns dropped 4% in 2021 as birth rates fell to the lowest levels on record dating to at least the 1930s, with the lowest number of babies since 1979. [Link; paywall]

Renewables

Trends in electricity prices during the transition away from coal by William B. McClain (BLS)

Producer price indices for electricity in regions that use more renewable power have grown less over the long term than those in regions with less renewables generation. [Link]

Hollywood

‘A Quiet Place’ Stars Think Paramount Owes Them Money by Lucas Shaw (Bloomberg)

With studios shifting theatrical releases to streaming networks, actors are scrambling to protect their share of proceeds; contracts typically give huge names a share of box office receipts that are being skimmed off thanks to shorter theater runs. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

ARKK Stocks Breakdowns and Bounces

After struggling for most of the past couple months, momentum and Tech stocks are broadly outperforming today as the Nasdaq is up 1.25% compared to a 0.78% gain in the S&P 500. The ARK Innovation ETF (ARKK) has been a poster child of the momentum theme over the past year. After a 383.9% gain from the March 2020 low to its high in mid-February, ARKK has fallen around 30% in the months since then. For most of that time, the ETF consolidated between its 50 and 200-DMA. After a failed attempt to break above its 50-DMA at the end of April, it has taken a leg lower, falling below its 200-DMA for the first time in a year in the process. While ARKK has yet to move back above its 200-DMA, it has found support around $105 which traces back to the lows earlier this spring and the highs from the fall. In other words, from a technical perspective ARKK, as well as some of its holdings, still have plenty of technical hurdles including moving back above its moving averages and breaking the past few months’ downtrends. At least for the time being, the group has found some respite in the move higher today.

As for the individual holdings of the ARKK ETF, below we show the 25 largest which accounts for approximately three-quarters of net asset value. For the most part, these stocks continue to sit on huge gains from the past year (or since their market debut for those that have IPO’ed in the past year; bolded and bordered rows in the table below) with only a small handful in the red: Teladoc (TDOC), Coinbase (COIN), and Iovance Biotherapeutics (IOVA). Even though the 25 largest ARKK holdings are on average up 117% over the past year, they have certainly been a pain trade recently. Most of these names are deeply oversold at the moment, and relative to their 52-week highs, they are down 35% on average. In fact, of all 58 holdings, there are only four—Intercontinental Exchange (ICE), TuSimple (TSP), Trimble (TRMB), and PACCAR (PCAR)—that are less than 10% below their 52-week highs, and none of these break into the top 25 largest holdings (as such they are not pictured below).

While ARKK holdings have generally been weak over the past few months, in recent days there have been some notable developments in the charts of these names. Some of these like CRISPR Therapeutics (CRSP) and EXACT Sciences (EXAS) have fallen below the long-term 200-DMA. Other names in the ETF broke below their 200-DMA a while ago now, and their charts do not look much better. Stocks like Invitae (NVTA), Materialise (MTLS), and Teladoc (TDOC) collapsed below their long-term moving averages earlier this spring and this week’s moves lower have resulted in breaks of critical support levels. For TDOC and MTLS, those levels have previously marked support at multiple points in the past year. One other interesting name in terms of performance today is Regeneron (REGN). Unlike many other ARKK stocks, REGN has actually been trending higher since March, albeit that is in the context of a much longer-term downtrend than many other ARKK holdings. Regardless, that recent rally has resulted in the stock to run right up to its long-term downtrend. In another move that is out of sync with its peers, today it has reversed lower, failing to break out from that downtrend.

While most names have pulled back sharply and continue to trend lower to sideways at best, that is not to say all ARKK stocks have entirely negative charts. Similar to the ETF’s chart, there are several names that have found support in the past couple of days. For example, DocuSign (DOCU), Iovance Biotherapeutics (IOVA), Palantir (PLTR), and Spotify (SPOT) are all bouncing off critical support levels of the past year. For others like Fate Therapeutics (FATE), Iridium (IRDM), PagerDuty (PD), PACCAR (PCAR), and Synopsis (SNPS), those support levels have also coincided with their moving averages. PACCAR is also notable in that it is even breaking back above its 50-DMA today. Similarly, Novartis (NVS) is attempting to move back above its 200-DMA. Perhaps one of the most technically strong stocks of these has been Sea Ltd (SEE). Over the past year, the 50-DMA has consistently provided reliable support. After a brief dip back below in March, in April it moved back above its 50-DMA and has once again successfully retested in the past week.

In order to keep track of the ARK Innovation ETF’s (ARKK) holdings, we created a custom portfolio that members can add here. Please note that this does not update real time and is only based on ARKK’s holdings as of 5/6/21.

As always, investors should do their own research before buying or selling any securities, and this chart analysis is in no way meant to be a buy or sell recommendation. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 5/7/21 – That Was Ugly

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Fear incites human action far more urgently than does the impressive weight of historical evidence.” – Jeremy Siegel

So much for the ‘million job print’. While economists were expecting to see a print of one million jobs, the actual print was barely even a quarter-million at 266K. Not only that but last month’s print was revised lower by nearly 150K. In reaction, the 10-year yield has plummeted below 1.5% and Nasdaq futures are surging up nearly 200. These reactions may be a little bit too much of a knee-jerk, so we’ll see how things play out as the day goes on.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of overnight earnings reports and economic data as well as the latest US and international COVID trends including our vaccination trackers (which continue to show a significant deceleration in vaccine uptake), and much more.

Just when it looked like things were going to start getting ugly for the Nasdaq yesterday morning, it not only stabilized but reversed higher to finish the day in positive territory. It was the first time since late March that the Nasdaq was down over 1% intraday but finished the day higher. It’s always tempting to try and read into these types of moves and see them as a significant event. The reality, though, is that they are too common to be considered all that significant. In the last year alone, there have been 16 other times where the Nasdaq was down over 1% intraday but finished the day higher, and in the last ten years, it’s happened more than 60 times.

Looking back at prior occurrences over the last year and ten years, the frequency of positive returns over the next week (~62%) for the Nasdaq is just as common following these occurrences as it is for all one-week periods over the same time period. That being said, while the frequency of positive returns is similar, the magnitude of the Nasdaq’s median move following these reversals is moderately higher (1.1% vs 0.55%).

Individuals, Writers, and Managers All Still Bullish

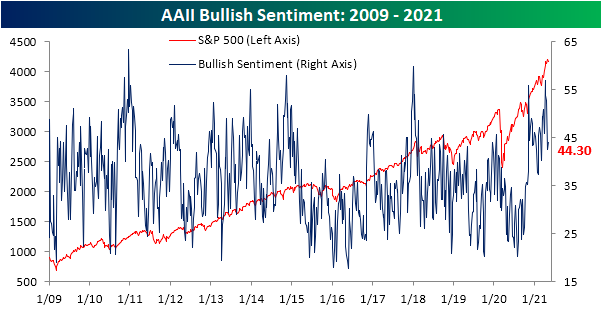

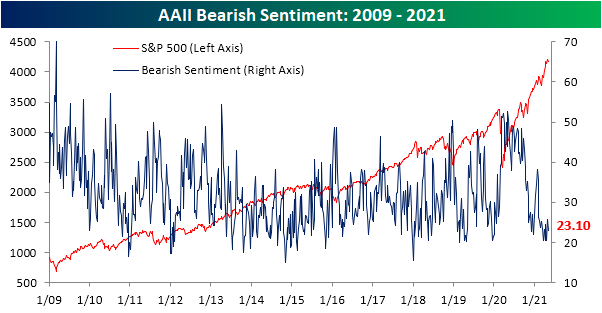

The major indices are broadly lower in the past week with the exception of the Dow which has risen just over 1%. The Nasdaq on the other hand has been the worst performer falling almost 3%. Even though the major indices are split in terms of performance, sentiment has gone the way of the Dow as bullish sentiment as measured through the AAII weekly survey rose 1.7 percentage points to 44.3%. While not a particularly large increase, this week did mark the first time bullish sentiment has risen in a month.

With bullish sentiment higher, fewer respondents reported as bearish. Only 23.1% of investors reported pessimistic sentiment; down 2.6 percentage points versus last week’s reading. Just like bullish sentiment, that was not a particularly large change, and it leaves the reading in the middle of the past several weeks’ range.

The inverse moves in bullish and bearish sentiment resulted in the bull-bear spread climbing 4.3 points to 21.2. While that is still at the high end of the past few years’ range, it is 11 points below where it stood only two weeks ago. Looking at another sentiment survey from Investors Intelligence which targets equity newsletter writers, the bull-bear spread also rose slightly week over week leaving the spread well below levels from only a couple of weeks ago. In other words, sentiment has moderated recently, but it has not dramatically shaken a historically bullish tone.

Perhaps the most notable reading in this week’s AAII survey was the reading on neutral sentiment. Up 0.7 percentage points from the prior week, it was not a particularly large gain especially compared to the 5 and 5.2 percentage point gains the previous two weeks. Regardless, moving higher once again neutral sentiment hit the highest level since the first week of March. Other than that week and the current one, there has only been one other week in the past year (second to last week of 2020) in which neutral sentiment was as high as it is now. Even though this week’s reading is elevated relative to the past year, compared to the rest of the history of the survey, it is pretty unremarkable. On average over the life of the survey, neutral sentiment has averaged a reading just 0.9 percentage points lower than this week’s reading.

The NAAIM Exposure Index is yet one more sentiment reading that also has shown some moderation but remains at a generally bullish level. This index reflects the average exposure to US equities of members of the National Association of Active Investment Managers. Readings of 200 would indicate they are leveraged long on average, 100 would be fully invested, 0 would be market neutral, -100 would be fully short, and -200 would be leveraged short. Last week saw this index tip above 100 for the first time since mid-February which also ranked in the top 2% of all readings going back to 2006. This week it fell 15.93 points. That stands in the bottom decile of weekly moves and was the largest drop since late March, but at 87.79, the index still points to historically bullish positioning among active managers. Click here to view Bespoke’s premium membership options for our best research available.

Claims Finally Break Below 500K

Last week’s number for seasonally adjusted initial jobless claims was revised higher by 37K. That means that while the original print of 553K was the lowest level of not only April but also of the entire pandemic, the revised reading actually changed that to make for the highest level of claims in three weeks. In spite of this, in the most recent week’s data, jobless claims dropped by 92K to 498K. That is the first reading below 500K of the pandemic era and is now down over 90% from the high in claims just over a year ago. This week’s reading is also for the first time less than double the reading from just before the massive upswing in claims in March of last year.

While there is the added factor of seasonal tailwinds—every week from the second week of April through the end of May has historically averaged a week over week decline in SA claims—on a non-seasonally adjusted basis, the data was just as positive. Although claims did not take out the 500K level by this measure, they did fall over 100K to 504.7K which also marked a pandemic low. PUA claims dropped around 20K to just above 100K. Again, that makes for the lowest level of claims both for this program and on a combined basis since the start of the pandemic.

Lagged an additional week to initial claims, continuing claims continue to look less positive. As we mentioned last week, though it doesn’t take away from the fact that there have been massive and consistent improvements in just a year’s time, continuing claims have experienced a significant deceleration in improvements over the past few months. The past couple of weeks have been the pinnacle of this. Last week’s reading was revised lower by 7K meaning the print only saw a 1K increase WoW, but that still snapped a 14 week-long streak of consecutive sequential declines. Pair that with the 37K increase to 3.69 million this week, and continuing claims have experienced the first back-to-back increases since last May when jobless claims were rising by well above 1 million per week.

Even though continuing claims via the regular state programs have plateaued, that gives an incomplete picture. Including all other programs helps to solve that, though it does create an additional week’s lag to the data meaning the most recent week is through April 16th. Including all programs, the tone is more optimistic. Total claims across all programs fell by 404K to 16.185 million. Barring the irregular drop in the first week of the year to 16.048 million when some plans had lapsed due to the timing of the signing of the spending bill, that makes for the lowest level of claims since the first week of last April. Considering the lack of improvements in regular state claims and the fact that the program accounts for a smaller share of total claims than earlier in the pandemic, the main drivers of the overall decline in total claims were significant drops in PUA claims and the Pandemic Emergency Unemployment Compensation (PEUC) program. Click here to view Bespoke’s premium membership options for our best research available.

Cruise Stocks Running Aground

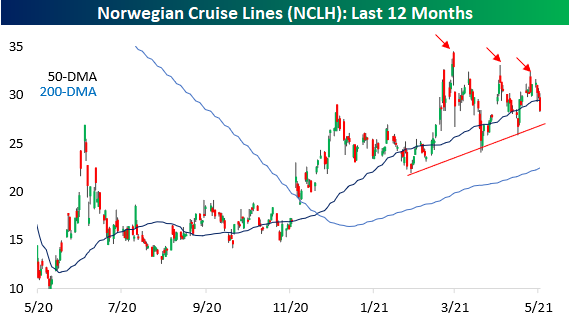

The CDC issued guidance this week on how cruise operators can run test cruises in order to move closer to returning to ‘normal’ cruising operations. At the surface, one would assume that anything that moves the industry closer to returning back to business would be a positive for the sector, but when the cruise stocks have already bounced so much off their lows, a lot of the good news appears to be priced in.

A key sign of good news being priced into a stock happens when you start to see selling into strength, and that’s exactly what we’ve seen over the last several weeks in the cruise operators. The charts below show the performance of Carnival (CCL), Norwegian Cruise Lines (NCLH), and Royal Caribbean (RCL). In each chart, we have included red arrows over days when the stocks saw strong intraday gains only to reverse lower from their highs into the close. Not only have we seen a number of these types of reversals in the last several weeks, but in most cases, each successive intraday high has been lower than the prior peak. The fact that investors are selling strength at progressively lower levels suggests a degree of eagerness to exit positions. If you’re willing to sell something for $38 today that you were selling for $40 last week, you’re what they call a motivated seller.

While the selling into strength in these cruise stocks may be disheartening if you are long, at this point the cruise operators haven’t yet shown any meaningful signs of breaking down. CCL still remains comfortably above its highs from last June and December, and each recent sell-off has been met with some buying at higher levels (motivated buyers) causing a series of higher lows. For NCLH, it’s a similar story. Of the three stocks, the only one that has been experiencing lower lows from each reversal has been RCL, but while it is currently modestly below its late 2020 high, it has yet to show a meaningful breakdown. Looking for full access to our research and market analysis? Sign up for a two-week trial today.

Bespoke’s Morning Lineup – 5/6/21 – Under 500K!

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Chronic indecision is not only inefficient and counterproductive, but it is deeply corrosive to morale.” – Robert Iger, The Ride of a Lifetime

US Equity futures are indicated higher but only modestly so as the Nasdaq looks to avoid a five-day losing streak. The big news of the morning, though, is Initial Jobless Claims which dropped below 500K for the first time since the pandemic began.

Read today’s Morning Lineup for a recap of all the major market news and events including a snapshot of major US and international index performance, as well as the latest US and international COVID trends including our vaccination trackers (which continue to show a significant deceleration in vaccine uptake), and much more.

Remember those days earlier in the year when you could look at the yield on the 10-year US Treasury and know exactly which way the Nasdaq was going. That’s still the case today, but it’s just the opposite relationship. Whereas yields and the Nasdaq were negatively correlated for much of the year, the opposite has been the case recently where the 10-year yield and the Nasdaq have been trading in the same direction over the last four trading days. That’s the way the market works, though; just when a pattern becomes so ingrained in the minds of investors, the script changes!