Largest 25 Stocks in the S&P 500, Now vs 10 Years Ago

In the last 10 years, the composition of the largest 25 companies by market cap in the S&P 500 has changed dramatically. Only 40% of the companies that were in the top 25 in 2011 remain there today. Additionally, the sector breakdown has shifted considerably. Sectors like Technology, Communication Services, and Consumer Discretionary have seen increases in their representation in the top 25 while the Energy, Consumer Staples, and Industrial sectors have seen declines.

Of the companies listed on both the 2011 and 2021 lists, the median total return excluding dividends over the last 10 years has been 312.33%, while the mean total return excluding dividends has been 606.65%. Apple ($AAPL), Microsoft ($MSFT), Alphabet ($GOOGL), and Amazon ($AMZN) have seen the largest appreciation of this group and are currently the four largest companies in the index.

As noted above, just 40% (10) of the companies on the list in 2011 made the cut in 2021, and as shown in the table below, while Apple (AAPL) and Microsoft (MSFT) remain in the top four, Exxon Mobil (XOM) and IBM not only fell out of the top four but also the top 25 altogether. Which top companies on the list now won’t be there in 2031? We wish we had a crystal ball!

Whereas the market cap of the S&P 500 has increased by 270% since 2011, the total value of the four largest companies has increased by 673%. In terms of market cap, the four largest companies account for just over 20% of the entire S&P 500’s market cap, and the 25 largest companies make up 49% of the total. In 2011, by contrast, the four largest companies had a weighting of 10% and the 25 largest accounted for about 36% of the total market cap. Click here to view Bespoke’s premium membership options.

Neutral Sentiment Surge

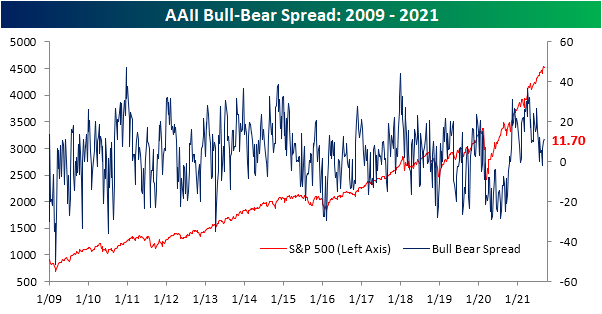

As we noted in today’s Morning Lineup, the S&P 500 has been pulling back over the past week but it has not been a particularly sharp pullback as the index remains within 1% of its all-time high. Bullish sentiment on the other hand has seen a more significant turn lower. The percentage of respondents reporting as bullish to the AAII survey this week fell 4.5 percentage points versus last week. At 38.9%, bullish sentiment is about in line with its historical average of 38%.

That pullback in bullish sentiment was not met with any pickup in bearish sentiment. In fact, bearish sentiment saw an even larger decline, falling 6.1 percentage points to 27.2%. That is the lowest level of bearish sentiment since the end of July.

Given those moves in bullish and bearish sentiment, the bull-bear spread was actually higher this week. The spread rose to 11.7 which is just below the recent high of 12.1 from the final week of July.

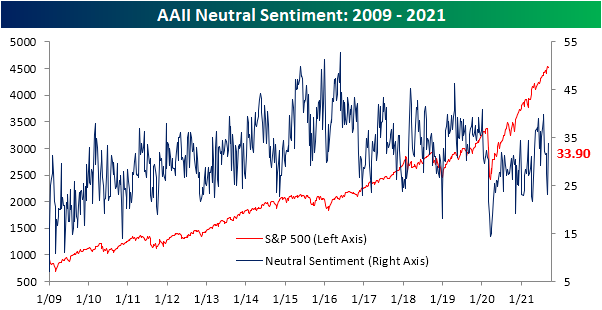

Given both bullish and bearish sentiments were lower this week by several percentage points, a large share of respondents shifted to neutral sentiment this week. That reading rose double digits to 33.9%. That is the first time since July 2018 that neutral sentiment has risen at least 10 percentage points in just one week.

Throughout the history of the AAII survey, it has been rare for neutral sentiment to rise double digits in only one week. Since the survey began in 1987, there have been 85 other times that neutral sentiment has seen such a move. Looking across those instances, the S&P 500 has averaged a move higher over the following months, but returns are typically worse than the norm. Click here to view Bespoke’s premium membership options.

Maybe GameStop (GME) Should Stop Reporting Earnings Altogether

If there were a high scorer list in terms of stock performance since the start of 2020, the letters “GME” would be near the top. One hundred dollars worth of GameStop (GME) at the start of 2020 would currently be worth $2,925!

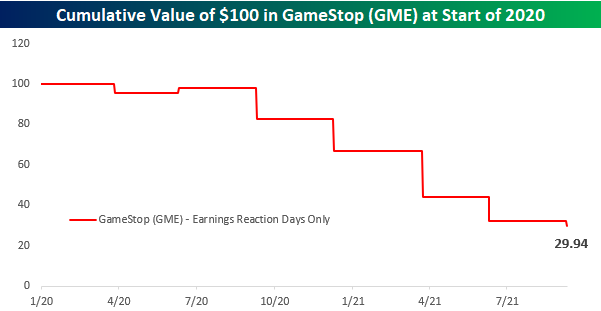

Today, though, shares of GME are trading down over 7% following a disappointing earnings report after the close yesterday. Given the performance of GME since the start of 2020, you would think that a day like today where the stock trades sharply lower in reaction to earnings would be an outlier. Hardly. Following its six prior earnings reports since the start of 2020 leading up to today, GME has traded lower on its earnings reaction day five times for an average decline of over 16%. The only positive reaction the stock has had in reaction to earnings during this period was a 2.2% gain in June 2020. In fact, going all the way back to September 2018, that June 2020 gain was the only positive earnings reaction day for the stock. How bad have earnings reports been for GME’s stock since the start of 2020? While $100 in GME stock since the start of 2020 is worth nearly $3,000 today, if you only had exposure to the stock on the day of each of its earnings reaction days during this period, that $100 would be worth less than $30 today!

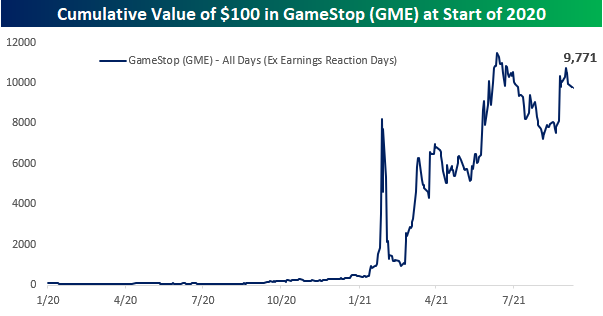

The cumulative effect of GME’s weak reaction to earnings also shows up if you look at its cumulative performance since 2020 and excluding the trading days following GME’s quarterly earnings reports. Not including those seven trading days, $100 worth of GME at the start of 2020 would be worth nearly $10,000 today! Following its earnings conference call after the close yesterday, GME management was criticized for not taking any questions and providing little insight into its strategy moving forward. Based on how the stock has historically reacted to earnings, though, management probably wishes they could just do away with the whole earnings process entirely. Click here to view Bespoke’s premium membership options.

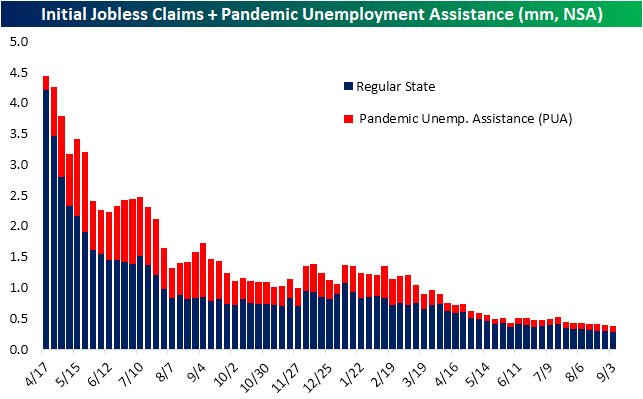

Ida Impacts Claims

Last week’s initial jobless claims number was revised higher by 5K to 345K. Partially thanks to that upwards revision and a big drop this week, claims fell by 35K for the biggest one-week decline since the last week of June. That sizeable decline brings initial claims to the lowest level of the pandemic at 310K on a seasonally adjusted basis.

On a non-seasonally adjusted basis, claims are actually below 300K as has been the case for the past three weeks now. This week marked the seventh in a row that unadjusted regular state claims have fallen week over week making for the longest stretch of consecutive declines in the number since a 13-week long run ending in the first week of July last year. Factoring in Pandemic Unemployment Assistance (PUA), claims totaled a pandemic low of 380.5K thanks to a drop back below 100K by the PUA program. With that said, the program is also nearing its end.

Lagged an additional week to the initial claims number, continuing claims also set a new low this week. Through the final week of August, continuing claims dropped for a second week in a row to 2.783 million (2.74 million expected) from 2.8 million the prior week. That reading is roughly 1 million above the pre-pandemic reading (1.784 million on March 13, 2020.

There is yet another week of lag to the data when all programs are included. Factoring in all auxiliary programs, the most recent data is through the week of August 20th. Total claims for that week were still above the low of 11.8 million from the last week of July, but they did cross back below 12 million. The biggest contributors to that decline were PUA claims which fell by 322.7K to 5.051 million and regular state claims which fell by 135K. Other programs, namely extended benefits, weighed on claim counts. The extended benefits program has been notably volatile over the past few months now, and that continued in the most recent week of data. The program rose from a near pandemic low of 114.4K to 311.3K which is at the upper end of the past several months’ range.

One other interesting point to note on this week’s claims data was the impact of Hurricane Ida. Regular state claims fell by 8K nationally on a non-seasonally adjusted basis this week, and that count would have been much better without the epicenter of recent hurricane news: Louisiana. With the state still recovering from the storm, claims more than quadrupled this week. In fact, the increase was even larger than that of the most populous state, California, which saw claims rise by 5.6K. Click here to view Bespoke’s premium membership options.

S&P 5%+ Rallies and Declines

We’ve heard a lot lately about the steadiness of the S&P 500’s rally over the last year. And steady it has been. As shown below, it has now been 307 calendar days since the S&P 500’s last 5%+ pullback. Over this time period, the index has rallied 38.75%.

While 307 days without a 5%+ drop may seem like a long time, we actually just experienced a streak that was nearly twice as long from mid-2016 through early 2018. As shown below, that streak from 6/27/16 through 1/26/18 lasted 578 calendar days and saw the S&P gain 43.6%.

There have been three other streaks of 500+ days without a 5%+ decline in the S&P’s history. The longest streak lasted 593 days from December 1957 through August 1959. During that time period, the S&P rallied 54.16%. The other two 500+ day streaks ran from November 1963 to May 1965 (538 days) and December 1994 to May 1996 (533 days).

The current streak of 307 days without a 5%+ pullback ranks as the 13th longest on record. It has been a good run, but it’s certainly not unprecedented either. Click here to view Bespoke’s premium membership options.

Bitcoin Seasonality – Following a Different Path

September has historically been a weak time of year for the stock market, but with the growing popularity of crypto-currencies, we wondered what the seasonal trends have historically been for bitcoin. The chart below shows a composite of bitcoin’s median YTD performance over the last ten years for every day of the year. Generally speaking, bitcoin has started off the year slowly. Based on the last ten years, its median performance during the first quarter of the year has basically been flat but then starts to accelerate to the upside in Q2. Strength has generally continued in the first half of Q3, but then the period from mid-August through mid-October has been the weakest time of the year when bitcoin’s median YTD change falls from over 120% to below 85%. While Q4 has historically tended to start off slow, the year has typically finished on a high note with steady gains from late October through year-end.

In terms of consistency, the chart below shows the percentage of time from every calendar day of the year that bitcoin has experienced positive returns over the following month (four weeks). Historically speaking, from 2011 through 2020, bitcoin experienced positive one-month forward returns the most frequently right around tax day as it traded higher from 4/14 over the following four weeks in all ten years. As for the current period of the year (second red dot in the chart), in the four-week period following 9/8, bitcoin has had positive returns 60% of the time.

Whenever we discuss market seasonality, we always stress that historical patterns should only be used as a guide. Just because something happened one way in the past doesn’t mean it will follow the same pattern in the future. Along these lines, bitcoin’s performance in 2021 is a perfect example of not following the historical pattern. The chart below is the same as the one above, but it also includes bitcoin’s performance so far in 2021. Compared to the historical pattern, bitcoin’s performance in much of 2021 has been nearly the exact opposite. Rather than starting off the year flat, bitcoin came out of the gate strong in 2021 and more than doubled before the end of Q1. Beginning in mid-April, when bitcoin has historically seen the highest consistency of positive returns over the next month, its price peaked and quickly gave up most of its YTD gains. In mid-July, bitcoin’s price finally bottomed out and started to rally right up through Labor Day weekend when it briefly traded above 50K before falling over 10%. If there’s ever a time of year when bitcoin bulls don’t want bitcoin to follow the seasonal script, it’s the next few weeks. Click here to view Bespoke’s premium membership options.

US Economic Data Turning Negative

With a federal holiday yesterday and nothing on the docket today, our Economic Monitors are unusually light the first half of this week. While there is nothing that would have an impact so far this week, the Citi Economic Surprise Index for the US is reaching the lowest levels since May of last year, shortly after the index hit record lows as economic data saw drastic impacts from the onset of COVID. These surprise indices represent how economic data is coming in relative to expectations. Lower/negative readings indicate economic data is coming in worse than expected and vice versa for higher readings.

Last year saw record lows in the index which were followed by record highs that far surpassed any level with historical precedence. Since the peak in July 2020, the Surprise index has not only moderated but turned negative. The US is now at the lowest level in over a year and in the eighth percentile of its historical range. While it has yet to find a bottom, this negative of a reading won’t last forever. The economists providing estimates will eventually catch up to the downside, and they usually overshoot, which will allow for the surprise index to bottom and start heading higher again. Click here to view Bespoke’s premium membership options.

Bespoke Brunch Reads: 9/3/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Technology

What the Metaverse is and why it matters to you by Andy Serwer with Max Zahn (Yahoo! Finance)

The hottest trend in Silicon Valley is an immersive series of platforms, experiences, and spaces that deepen the human experience beyond the physical world into untold layers of code. [Link]

The Silent Partner Cleaning Up Facebook for $500 Million a Year by Adam Satariano and Mike Isaac (NYT)

Accenture is widely known as a stodgy and quotidian consulting firm. It also sits at the center of a massive effort to make Facebook a tolerable place to spend time, at an equally massive human cost. [Link; paywall]

Leveraging Brands against Disinformation by Steph Hill (SSRC)

Social media and intensification of brands into value statements have created a two-way dialogue and placed non-political actors right into the middle of major efforts to shift society. [Link]

Afghanistan

Taliban Move to Ban Opium Production in Afghanistan by Sune Engel Rasmussen, Zamir Saar and James Marson (WSJ)

The lynchpin of the Afghan economy is being removed by its new rulers, which given the massive balance of payments crisis the company is going through may prove totally unsustainable. [Link; paywall]

Studies

J&J’s HIV Vaccine fails phase 2b, extending long wait for an effective jab by Nick Paul Taylor (Fierce Biotech)

Johnson & Johnson announced that its Stage 2 trial of an HIV vaccine did not demonstrate sufficient efficacy to continue trials in a setback for vaccines after a banner year. [Link]

The Impact of Mask Distribution and Promotion on Mask Uptake and COVID-19 in Bangladesh by Jason Abaluck et al (Innovations for Poverty Action)

A massive randomized control trial gives concrete and scientific evidence what had been strongly suggested by lower-level analysis: that masks, especially surgical masks, make a large difference in slowing transmission of COVID. [Link]

Regulation

McDonald’s McFlurry Machine Is Broken (Again). Now the FTC Is On It. By Heather Haddon (WSJ)

The Federal Trade Commission has reached out to McDonald’s franchisees in an inquiry related to the constant state of disrepair franchisees and the chain keep their machines in resulting in frequent breakdowns. [Link; paywall]

China Sets New Rules for Youth: No More Videogames During the School Week by Keith Zhai (WSJ)

After cracking down on for-profit education companies earlier this summer, Chinese authorities are now coming after students, setting rules for videogame time. [Link; paywall]

James Simons, Robert Mercer, Others at Renaissance to Pay Up to $7 Billion to Settle Tax Probe by Gregory Zuckerman and Richard Rubin (WSJ)

An inquiry into the treatment of investments as long-term capital gains as opposed to short-term capital gains (and therefore a massively reduced tax burden) has led to a massive $7bn settlement between investors in one of the . [Link; paywall]

Labor Markets

Need to Call and Airline? Your Hold Time Will Be Approximately One Zillion Hours by Allison Pohle and Krystal Hur (WSJ)

With massive demand and complex local regulations, airlines are struggling to accommodate high call volumes that are being further hindered by under-staffed call centers. [Link; paywall]

Amazon’s Answer to Delivery Driver Shortage: Recruit Pot Smokers by Spencer Soper (Yahoo! Finance)

With a complete lack of available labor for delivery trucks, Amazon is experimenting by featuring a lack of marijuana testing in its recruiting materials, part of an effort to reach into every crack of the workforce for potential candidates. [Link]

Ben Dugan Works for CVS. His Job Is Battling a $45 Billion Crime Spree by Rebecca Ballhaus and Shalini Ramachandran (WSJ)

Physical retail is facing a different kind of online competition: thieves are ripping off stores in order to sell goods online via platforms like Amazon or EBay. [Link; paywall]

Weird News

This company sold a copy of ‘Super Mario Bros.’ for $2 million. NFTs and a Triceratops skull could be next by Tom Huddleston Jr. (CNBC)

Video games are collectors items just like baseball cards: their rarity is the source of much of their value, and the values can get extraordinarily high when prestige buyers step up to the plate. [Link]

Coronal Ejections

A bad solar storm could cause an “Internet apocalypse” by Lily Hay Newman (ARS Technica)

A coronal mass ejection or solar storm could wreck havoc on electrical and electronic infrastructure that serves as the backbone of local and global commerce and industry, as well as badly damaging electrical grids. [Link]

Duration and extent of the great auroral storm of 1859 by James L. Green and Scott Boardsen (NCBI)

Just before the Civil War, a massive ejection of material from the sun drove an electromagnetic storm of epic proportions which knocked out massive swathes of telegraph infrastructure; a similar event today would have much further-reaching implications. [Link]

Indices

GameStop Stock’s Possible Return to S&P 500 in Hands of Anonymous Committee by Akane Otani (WSJ)

While the S&P 500 is widely used as a “passive” index, inclusion is largely dictated by human judgement rather than strict quantitative criteria that other indices tend to use. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – September Starting Soggy

This week’s Bespoke Report newsletter is now available for members.

There were a lot of convulsive headlines this week, ranging from Hurricane Ida to the Supreme Court to China to the Delta variant, but markets broadly yawned at events thrown their way. Even a massive miss from payrolls on Friday morning couldn’t derail the slow and steady grind that the US equity markets have trended on for the past several months. That steady grind is also impressive given the huge wave of hawkish Fed speakers in August and the very high likelihood of a taper starting before the end of the year.

In this week’s Bespoke Report, we cover a lot of different topics. Among them:

- Q3 performance drivers.

- The state of COVID in the United States.

- Very low real rates compared to prior economic recoveries.

- The hawkish August in Fedspeak and outlook for tapering.

- Easy financial conditions.

- The US auto industry.

- Policy and political developments in China.

- EM’s breakout.

- German elections.

- Earnings Triple Plays.

- And so much more!

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

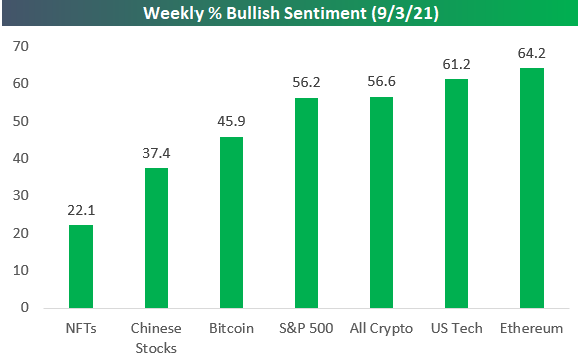

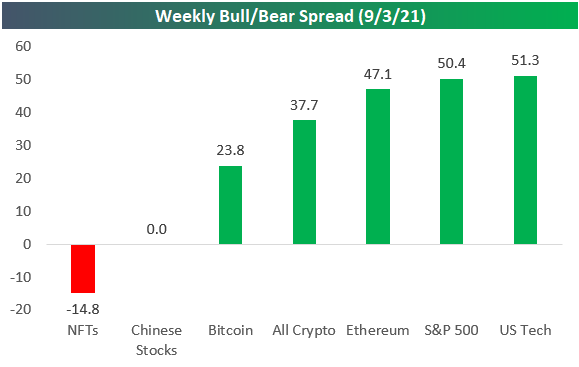

Bespoke’s Weekly Equity/Crypto Sentiment Survey

This week we launched a new weekly crypto sentiment survey to track sentiment towards the space. There are already plenty of stock market sentiment surveys, but sentiment survey data in the crypto space — bitcoin, ethereum, NFTs, etc. — is few and far between.

The new survey will be sent weekly to our Think BIG mailing list that has thousands of potential survey participants that have an interest in financial markets simply based on the fact that they joined our mailing list by visiting our website. We will collect responses from Tuesday through Thursday each week and publish the results on Fridays.

In the survey, we ask whether the participant is “bullish or bearish” on seven things over the next 12 months — 1) the entire crypto space, 2) bitcoin, 3) ethereum, 4) NFTs, 5) the S&P 500, 6), US Tech stocks, and 7) Chinese equities. While we are mainly focused on collecting sentiment towards the crypto space, we thought including sentiment on equities was beneficial so that we could easily compare the two over time.

Below are the results from the first run of our new weekly survey. Participants are actually most bullish on US Tech stocks out of this group with a bull/bear spread of +51.3%. The S&P 500 also leaned heavily bullish with only 5.8% of respondents saying they were bearish over the next 12 months.

Sentiment towards the entire crypto sector leans bullish with bulls coming in at 56.6% and bears coming in at 18.9%. The bull/bear spread for bitcoin was +23.8 ppts, while the bull/bear spread for ethereum was considerably higher at +47.1 ppts. Notably, participants are much less bullish on the NFT space with just 22.1% bulls and 36.9% bears. Chinese stocks also saw bulls and bears come in exactly equal at 37.4% each. If you’d like to help us measure crypto sentiment going forward, you can join our Think BIG mailing list and take the survey starting next week. Click here to view Bespoke’s premium membership options.