Stocks Down 2%+ Every Day This Week

This week was particularly volatile for the stock market with the S&P 500 seeing 1%+ moves every trading day from Monday through Thursday and then a decline of close to 1% on Friday. We came across Etsy (ETSY) on Friday when it was down 7% on the day, and then we noticed that the stock had been down 2% or more on every trading day this week. In wondering how many other stocks were down 2%+ every day this week, we found a total of 12, and they’re all listed below. Along with Etsy, the other notable losers include Affirm (AFRM), Oatly (OTLY), and Clear Secure (YOU). Affirm’s worst day was Wednesday when it fell 8%, but it fell another 5.7% on Friday to close the week down 21.7%. Oatly began the week down 3.7% on Monday and down 3.9% Tuesday before falling 6.1% on Wednesday. Smaller declines of 2% on Thursday and 2.8% on Friday left OTLY only down 17.3% for the week. That’s relatively good compared to Kirkland’s (KIRK), which fell 39.1% on the week after losing a quarter of its value on Thursday and then another 8.5% on Friday.

Small-Cap Corrections

At the close on Wednesday (12/1), the small-cap Russell 2,000 had fallen 12.1% from its recent high on November 8th, leaving the index in “correction” territory. A market “correction” is a drop of 10%+ that was preceded by a rally of at least 10% on a closing basis. This correction for the Russell 2,000 is its 58th since data for the index begins in 1978. Below is a table showing prior corrections for the Russell. The average correction sees the index fall 18.35%, which is just shy of the 20% threshold for a “bear market.” The median correction is a little smaller at -15.4%. In terms of length, the average Russell correction has lasted 73 days, while the median is 62 days. For the current Russell 2,000 correction to reach average levels, it would need to fall another 7% from here, and it would come to an end on January 20th, 2022.

In terms of extremes, the biggest correction that the Russell 2,000 has ever experienced was the 41.9% decline seen during the initial COVID Crash from 1/16/20 to 3/18/20. The longest correction lasted 397 days from 6/24/83 to 7/25/84. In terms of the shortest correction, there were two that lasted 3 days. One of those came during the Financial Crisis while the other happened last June. Like this type of analysis? See more of it with a Bespoke Premium membership. Click here to learn more and start a two-week trial.

Bespoke’s Morning Lineup – 12/3/21 – A Day of Rest?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Never confuse genius with a bull market.” – Unknown

After five days where the S&P 500 has moved up or down 1%, futures are practically flat this morning as the market tries to catch its breath from all the volatility. The quiet tone may not last long, though, as Non-Farm Payrolls was just released and came in much weaker than expected at just 210K compared to estimates for a gain well in excess of 500K. Despite the weak print, the unemployment rate was much less than expected (4.2% vs 4.5%). In terms of average hourly earnings, month/month growth was 0.3% vs 0.4%. In addition to the jobs data, we’ll be getting ISM Services, Factory Orders, and Durable Goods all at 10 AM. The initial reaction to the jobs number has been slightly positive with Nasdaq futures leading the way.

Last night, the state of New York announced five additional COVID cases related to the omicron variant, and Hawaii announced one case. At this point, all the cases appear to be mild which is encouraging. In South Africa, where the variant was first detected, the number of cases has tripled within the last three days, but thankfully, hospitalizations are not rising nearly as fast. Barely a week after the omicron variant first made headlines, there’s still a lot we don’t know about this variant, but based on data so far, it doesn’t appear to be any worse than other strains.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

It’s been quite a week in the markets, so investors probably deserve a quiet day for a change. Check out the carnage that we’ve seen in US stocks since Thanksgiving when news of the Omicron variant first surfaced and then Powell’s hawkish pivot this week. Every major US index ET we track in our Trend Analyzer is down more than 2%, while small caps are down more than twice that. Market cap has really been a factor in market performance this week as the Micro-Cap ETF (IWC) is down close to 6% while mega-cap indices like the Nasdaq 100 (QQQ) and S&P 100 (OEF) are both down less than 2.5%.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Consumer Pulse Report – December 2021

Sentiment Collapse

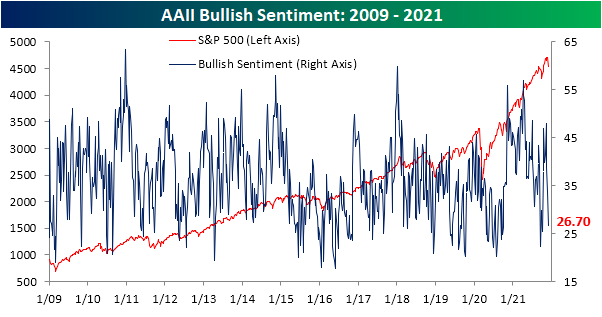

In the past three weeks, sentiment has taken a big hit with the percentage of respondents to the AAII survey reporting as bullish falling 21.3 percentage points. That is the biggest three-week decline since March 2018 when bullish sentiment fell a slightly larger 22.12 percentage points. With 26.7% of respondents bullish, market optimism is at the lowest level since the first week of October when 25.5% of respondents reported as bullish.

That big drop in bullish sentiment also means bearish sentiment has rocketed higher to 42.4%. That is the highest reading in bearish sentiment since the first week of October of last year. Similar to bullish sentiment, since the recent low of 24% three weeks ago, the 18.4 percentage point increase was the largest three-week uptick since March 2020.

Due to the big inverse moves in bullish and bearish sentiment, the bull-bear spread has also collapsed from double-digit positive readings only two weeks ago down to the bottom decile of its historical range. At -15.7, the bull-bear spread is now at the lowest level since September 16th.

Even though bullish and bearish sentiments have seen big shifts, the percentage of respondents reporting as neutral has gone little changed. There was only a half percentage point increase this week up to 31% which leaves neutral sentiment roughly in line with its historical average (31.43%).

The AAII readings were not the only sentiment indicators that have collapsed. The NAAIM Exposure index has fallen to 87.87 this week; the first sub-100 reading in five weeks. Meanwhile, the Investors Intelligence (II) survey saw the highest reading in bearish sentiment since May 2020. Combined with a decline in bullish sentiment, the bull-bear spread has hit the lowest level since October 20th. In the chart below, we have created a sentiment composite taking the z-scores of the current readings across each of these three surveys (AAII and II bull-bear spreads and the NAAIM index). This shows that sentiment readings have gone from a historically elevated reading that is a full standard deviation above the historical norm all the way back to zero in three weeks’ time. In other words, sentiment has made a sharp pessimistic turn in the past few weeks, but current readings are overall not exactly bearish to any extreme degree. Click here to view Bespoke’s premium membership options.

Claims Remain Low

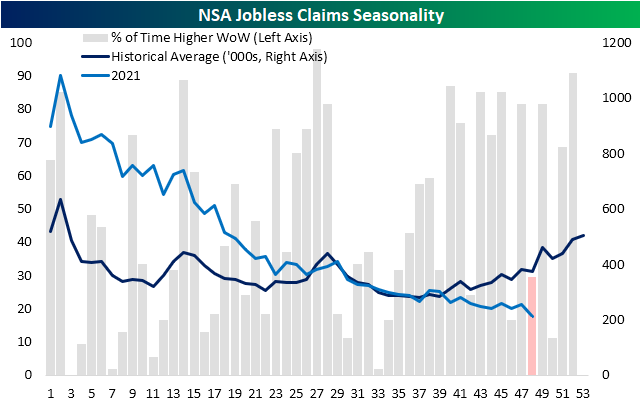

Last week saw the first sub-200K seasonally adjusted initial jobless claims print in over 50 years. This week, that number was revised even lower to 194K. While that reading sets a historic low, the most recent data for the week ending November 27th, however, saw claims rise by 28K to 222K. Although that marks the biggest one-week uptick in claims since July, the level of claims remains handily below pandemic levels and below the level of 256K from right before the COVID surge that took claims into the millions.

Last week, seasonal adjustments gave a significant boost to jobless claims as NSA claims actually came in at 253.5K versus the 194K adjusted reading. This week, NSA claims were the lower of the two coming in at 211.9K which is the lowest level since the first week of March 2020. With claims declining further, they continue to buck the seasonal trend. As shown below, the current week of the year has consistently seen a lower reading in NSA claims than the prior week as was the case in the most recent print. Currently, claims are at a new low for the year whereas historically they have been on the rise for several weeks now.

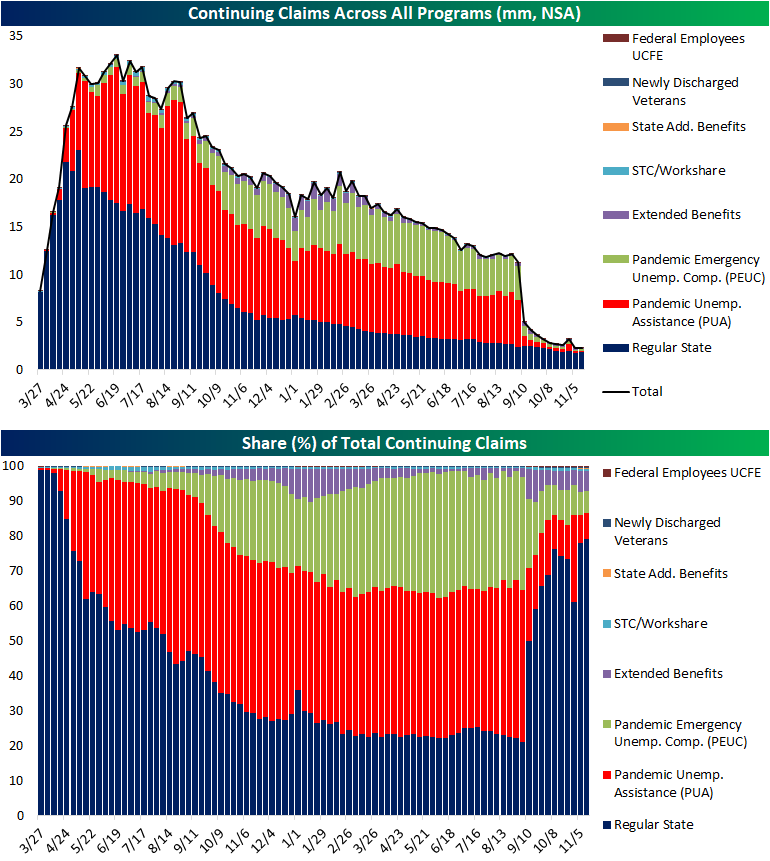

Lagged one week to initial claims, continuing claims also hit a pandemic low for the first sub-2 million print since March 2020. The 107K decline from last week’s revised number was the biggest one-week decline since October 22nd.

Including all programs delays the data by another week making the most recent reading through the week of November 12th. That week saw a slight uptick in claims led by gains in regular state programs. Pandemic era programs are largely unwound by now, but there is still a significant presence with over 300K claims coming from the PUA and PEUC programs. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 12/2/21 – Apple (AAPL) Falls

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Our liquidity is fine. As a matter of fact, it’s better than fine. It’s strong.” – Kenneth Lay

Good Morning Subscriber,

Today marks the 20-year anniversary of the Enron bankruptcy, and if you think the last few days in the market have been lousy, it was nothing compared to late 2001 when we were in the middle of the dot-com bust, coming out of 9/11, and heading into another rough year in 2002 when Worldcom eventually collapsed as well.

Futures are higher this morning, but traders aren’t even waiting until the opening bell to raise cash as Nasdaq futures have reversed into the red and the Dow and S&P 500 have also given up much of their earlier gains. One of the main culprits behind the weakness this morning is a report from Bloomberg that Apple (AAPL) has told suppliers that demand for the iPhone 13 after the holidays may not be as strong as previously estimated. AAPL had been a bright spot in the Nasdaq over the last few trading days but is trading down over 3% in the pre-market.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Yesterday was an extremely disappointing day for small caps as the Russell 2000 rallied more than 2% intraday only to give it all back and a lot more throughout the trading day. By the time the closing bell rang, the Russell 2000 was down over 2% on the day. Since the Russell 2000 tracking ETF (IWM) launched in early 2000, yesterday was just the 9th time that the ETF saw a similar intraday rally (+2%) only to finish the day down more than 2%. Each of those days is shown as a red dot in the chart below. Despite over 20 years of trading history for IWM, all eight prior occurrences were confined to a two-month period in 2008 (six occurrences) and a three-week period in 2020 (two occurrences).

Unlike yesterday’s reversal, most of the other occurrences came well into market declines. The only exception was on 3/3/20. Interestingly enough, that occurrence also followed a period of sideways trading for the Russell where it broke out of a multi-month range (but didn’t reach a new high) only to reverse and sell-off sharply into the COVID crash. It’s unlikely the Omicron variant will cause the same sort of market turmoil that COVID initially created in early 2020, but the Fed is certainly not going to be nearly accommodative going forward as they have been since early 2020.

This morning, Russell 2000 futures are indicated higher by about 1%, but to put that in perspective, the gain isn’t even enough to bring the index back to where it was trading 15 minutes before the close yesterday.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Stocks with Aggressive Valuations Getting Crushed

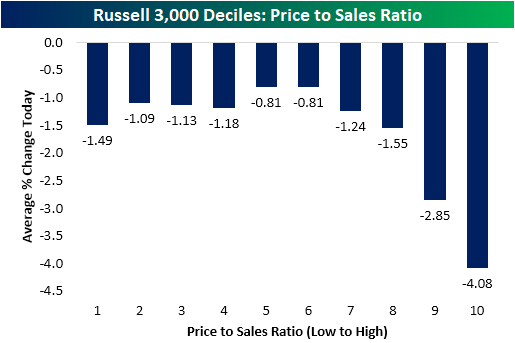

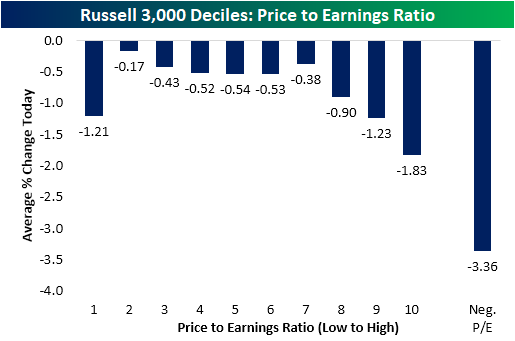

One theme popping in and out of recent price action has been the underperformance of stocks with higher valuations. That was once again apparent today. In the chart below, we break down the Russell 3,000 into equal-sized deciles (10 groups) based on their price to sales ratios (sorted from those with the lowest ratio to the highest). As shown, the stocks with the highest P/S ratios significantly underperformed today with the decile of the most elevated ratios falling over 4% on average. The ninth decile similarly experienced outsized declines of 2.85% compared to the average stock in the index which fell 1.6% today.

Turning to another common valuation metric, the P/E ratio, the dynamic is just as evident. In the chart below we again broke the Russell 3,000 into equal-sized deciles except we separated out all stocks with negative earnings as well. Nearly a third of the index has a negative P/E ratio at this point! As shown, the stocks with negative earnings (no P/E ratio) got absolutely crushed today with an average drop of 3.36%. Click here to view Bespoke’s premium membership options.

Semis Outperforming Software

Over the last year, the performance of semiconductor stocks has been highly correlated to that of software stocks. Over the last 12 months, the median 50-day rolling correlation coefficient between the iShares Expanded Tech-Software Sector ETF (IGV) and the iShares Semiconductor ETF (SOXX) was +0.77. Currently, the 50-day rolling correlation coefficient is 0.59 due to a recent divergence between the performance of the two ETFs, and since the start of November, the two ETFs have actually been inversely correlated (-0.31). As you can see in the chart below, SOXX has significantly outperformed IGV since the start of November. gaining 11.7% versus a 6.6% decline for IGV.

As implied by the chart above, the relative strength of SOXX vs IGV has moved upwards since the start of November. Although SOXX has mostly outperformed IGV over the last 12 months, the difference between the two is currently the largest of the last 12 months with a 24 percentage point spread between the performance of the two ETFs.

Looking back over time, when we have seen similar performance disparities where SOXX outperforms IGV by 15 percentage points or more in a month (with no prior occurrences in the prior three months), forward performance has been mixed. In terms of the next week’s performance, in two of the three prior periods, SOXX underperformed over the following week, but over the following month and three months, SOXX continued to outperform. A sample size of three is on the small side, and even with just three occurrences there is no clear trend in performance, so we wouldn’t read too much into the results. Click here to view Bespoke’s premium membership options.

Bespoke Market Calendar — December 2021

Please click the image below to view our December 2021 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.