J.P. Morgan Health Care Conference Kickoff

The 40th annual J.P. Morgan Health Care Conference kicks off today, and because of COVID concerns, this year’s event will be held virtually. One of the largest conferences for the Health Care sector, especially in regards to health care investment, this conference brings together investors and hundreds of companies to stay up to date on the pulse of the Health Care sector. Looking back since 2001, the conference has coincided with solid performance for the S&P 500 Health Care sector with positive performance 62% of the time and an average gain of 0.56% during the four-day event. During last year’s conference, which was also held virtually, the Health Care sector declined 0.7% which was the worst performance since 2009. As for the biotech industry, which the conference’s focus is rooted in since it began in the early 1980s, it heads into this year with three consecutive years of positive performance. Compared to the broader sector, the S&P 500 Biotech industry has averaged an even better 1.15% gain during the annual conference since 2001 and has seen a move higher a little better than three-quarters of the time. Click here to view Bespoke’s premium membership options.

Differentiation Within Growth

So far in 2022, growth stocks have broadly sold-off and the Russell 1000 Growth Index has declined by 6.9%. However, not all growth stocks are the same, and it may be inaccurate to say that “growth stocks” in general are getting hit with this market downturn. Within the Russell 1,000 Growth index, names with the most aggressive valuations and higher multiples have performed far worse than those will lower multiples. Certain groups of the Russell 1000 Growth Index members have outperformed the S&P 500 on a year-to-date basis. The 20% of members with the lowest price to earnings ratios have averaged a YTD decline of just 1.7% while the S&P 500 has lost 3.3% of its value. The 10% of stocks with the lowest price to book ratio have outperformed the market as well, declining just 1.8% this year. As you can see from the charts below, the higher the multiple, the worse the 2022 performance. The 20% of members with the highest P/B ratios have averaged a loss that is over three times that of the S&P 500 (10.5%). The 20% of stocks with the highest PE ratios in the index have averaged a reduction of 12.6%, almost four times the loss of the S&P 500.

A similar trend is seen when comparing YTD performance against price to sales deciles. The 10% of members with the highest P/S ratios have averaged a 15.9% turn down in 2022, while the 40% of names with lower P/S ratios have averaged a decline of 3.5%.

For investors looking for growth, there are two ways to look at this. The first line of thought is to believe that the most aggressive equities (think RIVN, PLUG, DOCU, CVNA, and UBER) have sold off at unreasonable rates, and there are presently buying opportunities. The other available option is to think that the outperformance from growth at a reasonable price stocks (i.e. OLN, RKT, OPEN, VRM, and GS) will continue moving forward as, among other factors, the fed hikes interest rates. Stay on top of market trends like growth versus value by becoming a Bespoke subscriber today. Click here to view Bespoke’s premium membership options.

Of the 25 stocks with the lowest P/E ratios in the Russell 1000 Growth Index, the average YTD performance is -1.5% (median: -1.4%), which is far better than the broader market. The average stock on this list is off of its 52 week high by 20.6% (median: 18.0%) and returned 33.3% from price appreciation alone in 2021 (median: 33.7%). 48% of these names are positive so far in 2022, which is impressive given that the Russell 1,000 Growth index has already fallen by 6.9% this year.

Bespoke Brunch Reads: 1/9/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

COVID Country

COVID-positive nurses say they’re being pressured to work while sick, and they’re petrified of infecting patients by Allan Akhtar and Aria Bendix (Insider)

Nurses that still have symptoms of confirmed positive COVID infections are being asked to return to work in hospitals in Kentucky and around the country. [Link]

White House, USPS finalizing plans to begin shipping coronavirus test kits to U.S. households by Jacob Bogage and Dan Diamond (WaPo)

The White House and USPS are finalizing plans to ship half a billion at-home COVID tests across the country with the first packages rolling out the door by mid-January if everything goes according to plan. [Link; soft paywall]

Belief in Having Had COVID-19 Linked With Long COVID Symptoms by Anita Slomski (JAMA)

While there is no doubt that some COVID sufferers have symptoms which last much longer than the acute infection, there’s a lot of uncertainty over how pervasive and severe long COVID is. This study showed that while belief that a person had actually been infected with COVID wasn’t correlated with the presence of antibodies for the disease, that same belief was positively correlated with “long COVID” presentations, suggesting a material psycho-somatic effect. [Link]

Indiana life insurance CEO says deaths are up 40% among people ages 18-64 by Margaret Menge (The Center Square)

Indiana insurance company OneAmerica reported that death rates for 18-64 year-olds had risen 40% versus pre-pandemic, a historic increase that illustrates just how heavy the burden of COVID has been on American society. [Link]

COVID & Children

Characteristics and Clinical Outcomes of Children and Adolescents Aged <18 Years Hospitalized with COVID-19 — Six Hospitals, United States, July–August 2021 by Alentine Wanga et al (CDC)

A survey of COVID cases in Southern hospitals identifies potential risk factors for children: over 80% had an identified underlying medical condition, two-thirds were obese, and virtually none were vaccinated. [Link]

Pandemic babies displaying developmental delays — even if their mothers didn’t have COVID (Study Finds)

Pandemic babies are showing slower cognitive and social development than pre-pandemic children, regardless of whether or not expecting mothers had COVID. [Link]

No Way to Grow Up by David Leonhardt (NYT)

Children are falling behind in school, suffering more mental health crises including suicide attempts, exposed to more gun violence, and are exhibiting more behavioral issues as the weight of the pandemic falls on the youngest members of society. [Link; soft paywall]

Embrace The Cold

Could Being Cold Actually Be Good for You? by Max G. Levy (Wired)

A range of studies of showed that being cold regularly is a good way to stimulate your body’s metabolism and force adaptations that can help reduce the effects of diabetes. [Link]

BTCS First-ever Nasdaq-listed Company to Offer a Dividend Payable in Bitcoin (Yahoo! Finance/Globe Newsire)

A NASDAQ-listed company which has delivered 69% losses per year since the end of 2010 announced it would start paying dividends denominated in bitcoin. Shares were up 40% in response but if history is any indication will return to their habitual declines soon. [Link]

Energy

Harold Hamm: ‘Republican, Democrat . . . I’m an oilocrat’ by Derek Brower (FT)

The Continental Resources founder wants coal plants closed so his natural gas empire can profit (and with a side of carbon reduction. Battery-electric vehicles, wind, and solar? Right out. [Link; paywall]

Is Nuclear Power Part of the Climate Solution? by Gernot Wagner (WSJ)

As most of the world’s nuclear reactors age and approach retirement (along with the 10% of global electricity they produce), the technology is at a turning point amidst demands for decarbonized power. [Link; paywall]

Labor Markets

‘Hottest it’s ever been’: why US labour market is stronger than it seems by Colby Smith, Andrew Edgecliffe-Johnson, and Christine Zhang (FT)

Official data points are finally catching up to anecdotes, as illustrated by this excellent round-up off labor market data. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Help Wanted: Predicting Monthly Employment

Predicting economic data has been difficult in the post-pandemic era, but economists have had a particularly difficult time trying to forecast the monthly number of jobs created in the US economy. This Friday’s Non-Farm Payrolls (NFP) report was a perfect example. While economists were expecting growth in payrolls of around half a million, the actual reading came in much weaker at 199K. December’s whiff wasn’t just a one-off either. Last month, economists were even further off the mark when actual payrolls in November came in 340K below forecasts. Since the pandemic really started to impact the economy in March 2020, the monthly NFP has been more than 100K off the mark in 17 out of 22 months, or 77% of the time. Prior to the pandemic, meanwhile, NFP forecasts were only off the mark by more than 100K less than 20% of the time.

Another way to highlight just how difficult it has been for economists to forecast the monthly number of jobs created in the US economy, in the chart below we compare the average spread between actual and estimated monthly payrolls from 1998 through 2019 versus the spread for each month in 2021. For this analysis, we left out 2020 as the magnitude of the disruption to the economy was. admittedly, impossible to predict. Even in 2021, though, the only month where economists were closer than average to predicting the actual number of jobs created was for the January 2021 report where the consensus forecast was less than 60K off the initially reported level of payrolls.

As the start of the pandemic moves further back in the rearview mirror, it should become easier for economists to gauge the performance of the economy, but as 2021 has shown us, there’s still plenty of room for improvement. Click here to view Bespoke’s premium membership options.

Corporate America Quotes From Early Earnings Reports

With earnings season on the horizon, we wanted to provide you with insights into some of the issues (both positive and negative) experienced by companies that have already reported. Although every company handles challenges differently, these commentaries can prepare investors for what to expect throughout the upcoming earnings season. We selected some of the largest companies that reported this week and went through their conference calls and pulled some quotes concerning key macro issues each one has experienced. For a deeper dive into earnings calls that we find vital, click here to see our Q4 Conference Call Recaps. Throughout earnings season we will continue to update this analysis with key insights into both macroeconomic and company-specific trends.

Constellation Brands (STZ)

- Consumer-facing prices appear to be rising as CEO Bill Newlands stated, “We expect price increases within our beer portfolio to last, slightly above our typical 1% to 2% range.”

- Newlands continued, “we continue to expect our gross margin to be negatively impacted for the fiscal year as benefits from price and cost savings agenda are expected to be more than offset by cost headwinds… as the inflationary environment resulting from economic supply chain and other by-products of the pandemic continues to be dynamic and vertical.”

- Diving even deeper into the inflationary pressures, Newlands added, “We expect significant cost increases for the business including supply chain disruption inflationary cost pressures on product freight and warehousing costs… and we are diligently working to address the brown glass shortage that is acting as a headwind.”

Bed Bath & Beyond (BBBY)

- Supply chain concerns appear to be persistent as CEO Mark Tritton commented, “While we effectively offset higher freight costs that have been at the core of global supply chain pressures, increasing inventory disruptions impacted our ability to meet demand during the holiday season… we experienced a slower start to sales in September and October.”

- Tritton proceeded, “The customer experience was compromised as strong demand wasn’t met with strong product availability.”

- On a positive note for retailers, in-person shopping appears to be picking up. “We’re also pleased to see customers return to brick-and-mortar shopping this year as our U.S. stores delivered mid-single-digit sales comps over this five-day holiday [Thanksgiving weekend] period,” according to Tritton.

Conagra Brands (CAG)

- Although CAG experienced the same inflationary headwinds, it was more optimistic about the future. According to CEO Sean Connolly, “We expect margins to improve in the second half of the fiscal year as a result of the levers we pulled and continue to pull to manage the impact of inflation… Given the magnitude of the cost increases, our actions also include additional inflation-driven pricing.”

- Connolly explained, “We’re increasing our organic net sales guidance based on stronger than expected consumer demand and lower than anticipated elasticities,” which implies that price hikes are having little impact on demand, meaning companies are likely to continue increasing consumer-facing prices.

Helen of Troy (HELE)

- Although sales grew year over year, “online sales declined approximately 7% in the quarter, reflecting similar channel trends to those we saw in the second quarter.” As per CEO Julien Mininberg, consumers appear to be decreasing the rate at which they engage in commerce online, which may be a headwind for companies like SHOP, EBAY, and AMZN.

- Methods used to combat rising cost pressures “include a strategic increase in inventory, leveraging of pre-negotiated sea freight container rates, several efficiency and cost control initiatives, and price increases,” according to Mininberg.

Lamb Weston (LW)

- CEO Tom Werner stated, “We generated strong sales and solid demand across our food-away from home channels, drove volume growth, and the initial benefits of our recent pricing actions began to offset inflationary pressures.”

- The labor market seems to be improving for LW, and Werner commented, “Our efforts to stabilize our manufacturing operations are on track, including increasing staffing at our processing plants to improve production run rates and throughput.”

- Giving insight to consumer eating habits, Werner added, “In the US, overall fry demand and restaurant traffic in the quarter remained solid, especially at quick-service restaurants where demand has continued to be strong and above pre-pandemic levels. Traffic at full-service restaurants during the quarter was also solid but remained below pre-pandemic levels… Demand at non-commercial outlets also improved during the quarter but continued to be below pre-pandemic levels.”

Lindsay (LNN)

- CEO Randy Wood commented, “Turning to the current operating environment. Material cost increases and supply chain constraints continue to impact our business and we expect that to persist through the spring and summer seasons… we continue to pass through cost increases and see a rational pricing environment in the market.” The inflationary pressures do not seem to be going anywhere, as companies across the board have reported continued cost increases on the supply side.

- As labor issues persist, companies are increasingly finding ways to replace humans with automation. According to Wood, “we continue to enhance both the FieldNET and RoadConnect platforms. We see growth in adoption of these technologies that reduce labor and improved efficiency for our customers”

- International farmings markets appear to be strong. Wood explained, “In international irrigation, we see some of the same positive market drivers linked to strong commodity prices and farm income in the developed markets including Brazil, where we continue to set shipping records, Australia, New Zealand and Western Europe.”

Schnitzer Steel (SCHN)

- Although steel demand remained strong, supply chain issues caused slippage. CEO Tamara Lundgren stated, “Our record results this quarter would have been even stronger had several contracted shipments for November not slipped into December, due to COVID-19 related supply chain disruptions… the supply chain impact on shipments is currently difficult to predict.”

- However, the operating environment was still favorable for SCHN. Lundgren explained, “Demand for finished steel continued to increase with prices reaching their highest levels on record. Supply flows remain robust in Q1, despite trucking and COVID related labor shortages in certain markets.”

Walgreens Boots Alliance (WBA)

- WBA offers unique insight into the realm of COVID, as they conduct a solid share of testing and vaccinations. CEO Rosalind Brewer expressed, “Our testing and vaccinations are tailwinds for our business. I’m very proud of the continued success of our core businesses, the strong growth in US retail, and robust recovery in our international market.”

- Brewer added, “In the US, we administered 15.6 million COVID-19 vaccinations within the quarter.”

- CFO James Kehoe disclosed that “Inflation is also on the rise and finally we expect to pass through the majority of these higher costs, but there may be some short-term impacts.”

Acuity Brands (AYI)

- Building management demand appears to be strong, which provides investors with insight into a variety of industries. CEO Neil Ash delineated, “Demand across our end markets remain strong. At the same time, the availability and cost of key inputs remain challenging. In short, it’s the best of times and the most challenging of times.”

- Ash proceeded, “In this dynamic pricing environment, we have been prudent and successful passing on price increases.”

- Consistent with the rest of the companies on this list, AYI faced production restraints. Ash disclosed, “There is a gap in time between when we receive orders and when we fulfill them in normal times, and that is even greater now… While we don’t disclose backlog, what I will say is that it is meaningfully higher than during normal periods.”

Summary

Inflation pressures were at the center of almost every conference call thus far and with supply chain disruptions and labor shortages leading the way as causal factors, are not likely to dissipate any time soon, Due to strong demand, companies appear able to pass these costs directly on to consumers, so do not expect reduced prices at the grocery/department store any time soon. On the bright side for retailers and small businesses, consumers have increased the rate at which they shop in person. Click here to view Bespoke’s premium membership options.

Bespoke Consumer Pulse Report – January 2022

Sentiment Surveys Miss Meeting Minutes

The news of the FOMC’s hawkish meeting minutes and the subsequent declines in markets in reaction to the release likely was not fully captured in sentiment indicators this week due to the timing of collection periods. Nonetheless, respondents to the AAII survey did show a drop in optimism with only 32.8% of respondents reporting as bullish versus 37.7% last week. While back below the historical average, bullish sentiment is not extremely extended below or outside of the recent range of readings.

Bearish sentiment picked up the larger portion of those losses rising from 30.5% last week to 33.3% which is only a few percentage points above the historical average (30.6%).

As a result of these moves, the bull-bear spread dipped back into negative territory, albeit not by much, after last week saw the first positive reading in five weeks.

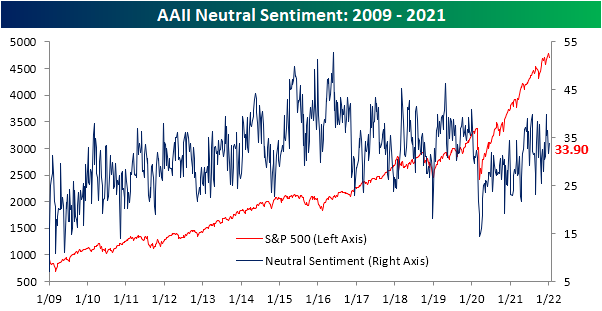

Neutral sentiment picked up the difference rising 2.1 percentage points to 33.9%. As with bearish sentiment, even with that increase, the reading remains below levels from just two weeks ago.

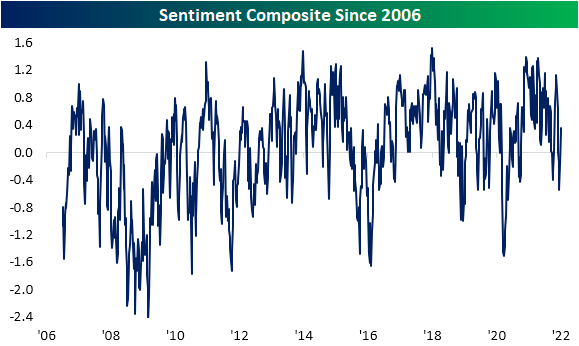

Out of three sentiment surveys—AAII, Investors Intelligence, and the NAAIM Exposure Index—the AAII reading is released the latest of the three, and as such was most likely to pick up any reaction to Wednesday’s declines. As such, both the Investors Intelligence and NAAIM Index saw more bullish readings this week. In fact, the Investors Intelligence survey—which had its first release since before the holidays—saw the largest increase in bullish sentiment since June 2016. That meant for our sentiment composite (which is an average of how many standard deviations from the historical norm the NAAIM index and bull-bear spread for the AAII and Investors Intelligence surveys are), this week saw a continued recovery in bullish sentiment. Click here to view Bespoke’s premium membership options.

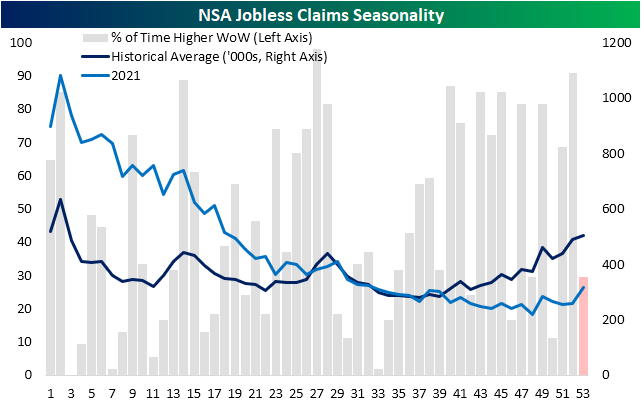

Year End Claims Uptick

Initial jobless claims data through the final week of 2021 was released this morning remaining above 200K versus expectations of a drop down to 195K. At 207K, seasonally adjusted claims were at their highest level since the last week of November when they were 20K higher. Although claims have not been improving in recent weeks, the current levels are in line with the low end of the range from prior to the pandemic which is also around the strongest levels in several decades.

Looking back on 2021, it was an interesting year for the dataset. The first half of the year saw a steady and rapid decline in claims as they were continuing to come off of historic levels set earlier in the pandemic. By mid-year and continuing into the final quarter, they had essentially returned to levels consistent with the historical average. Then, whereas the final few months of the year have historically marked a time that claims rise into year-end, claims generally fell throughout the fall and only noticeably began to experience that seasonal uptick in November and December. That resulted in claims to finish the year well below the historical average for the current week of the year.

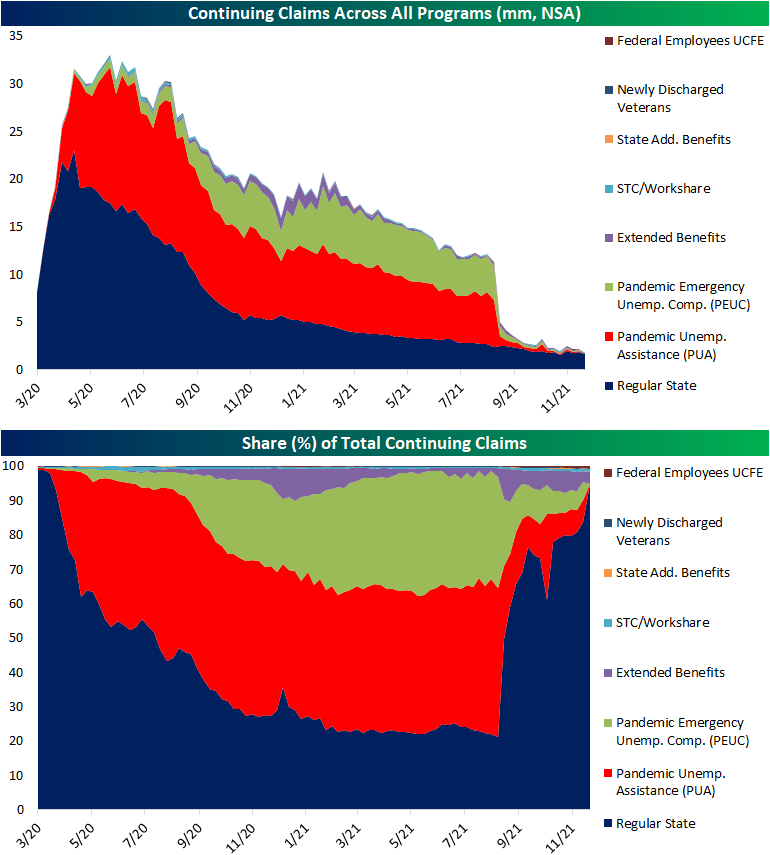

Turning to continuing claims, which are delayed an additional week to the initial claims data, the week of December 24th saw a 36K increase to 1.754 million. While higher, the current level remains over 100K below the one from only two weeks ago.

Pandemic era programs faced official expiration in September, but there were some residual claims reported in the following months. With that said, those levels declined, and by the final week reported (December 10th) total claims across PUA and PEUC programs only accounted for a combined 255.1K. With the new year, the Department of Labor is no longer reporting total national counts for these programs. With those changes over the past several months, that means the composition for continuing claims is comprised massively by regular state programs once again and the other major contributor, though to a much less impactful degree, is extended benefits programs. Total claims across all reported programs are now a fraction of their pandemic highs at only 1.73 million. Click here to view Bespoke’s premium membership options.

Nasdaq Down 3%+ In First Three Trading Days

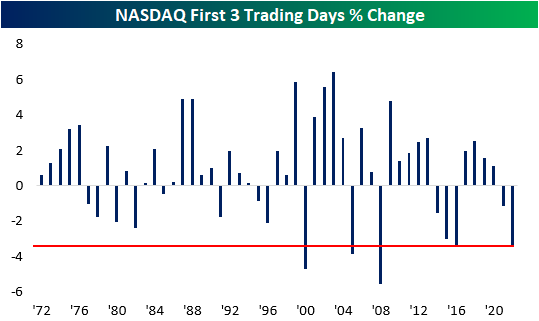

Historically, the first three trading days of the year have been positive for the NASDAQ with gains more than two-thirds of the time (68.6%). This year has been a different story, though, as the Nasdaq fell 3.4% in the first three days; the fifth-worst 3-day start to a year in the NASDAQ’s history. The only years with a weaker 3-day start were 2000, 2005, 2008, and 2016.

The table below lists the five prior years where the NASDAQ started the year with a decline of 3% or more in the first three trading days. For each year, we also show the index’s performance for the remainder of January as well as the remainder of the year. In the case of these five years, first impressions have been a pretty good indicator of future performance as the NASDAQ’s performance for the remainder of January and the rest of the year was weaker than average. While the range of returns is extremely wide, the average return for the rest of January was a decline of 1.6% (median -1.4%), and the rest of the year averaged a decline of 9.5% (median +5.5%). We’d also note that the two worst three-day starts to a year for the NASDAQ (2000 and 2008) also experienced the two worst rest of year returns for the Nasdaq in its history.

Although the fact that two of the worst years in the NASDAQ’s history were also years where the index dropped more than 3% in the first three trading days of the year, by itself, investors should not take this year’s occurrence as an overly bearish sign. Throughout the index’s history, there has been very little correlation between how it traded in the first three trading days and its rest of year return, and the r-squared between the two is just 0.0132.

While any association with 2000 and 2008 is always scary, in every other year that the NASDAQ traded lower in the first three trading days of the year, its rest of year performance was positive every time. In fact, during the 15 years when the first three days were negative, the average rest of year performance was a gain of 15.7% (median: 15.13%) with positive returns 87% of the time. Meanwhile, in the 35 years where it traded higher in the first three trading days of the year, the average rest of year return was a gain of 10.92% (median: 13.22%) with positive returns 69% of the time. Click here to view Bespoke’s premium membership options.

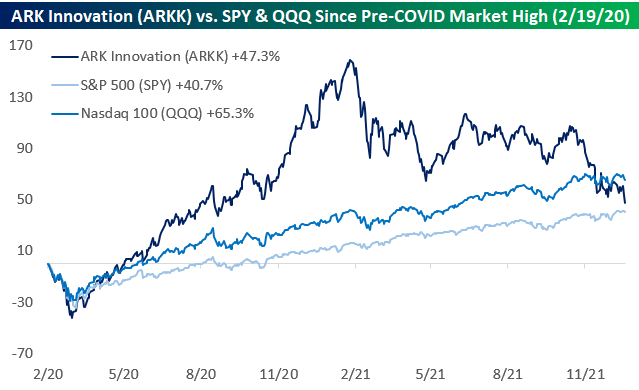

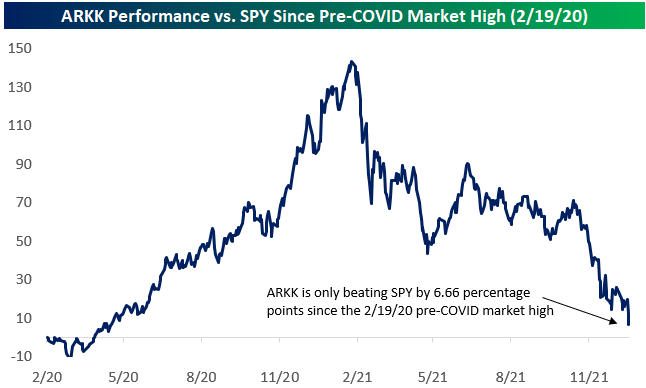

ARK Innovation (ARKK) Now Underperforming QQQ Since the Pre-COVID Peak

After further declines to start 2022, the ARK Innovation ETF (ARKK) is now up just 47.3% since the pre-COVID peak for the US equity market on 2/19/20 and is now only beating the S&P 500 by 6.66 percentage points since the pre-COVID high. Not only that, but it’s also underperforming the Nasdaq 100 (QQQ) by 17.9 percentage points.

ARKK was the envy of the industry in the year or so after the pandemic hit. Fund assets for the ARKK ETF went from $2.4 billion prior to COVID up to $28.5 billion at its peak last February. At its high, ARKK was absolutely crushing both SPY and QQQ. On 2/12/21, ARKK was outperforming SPY by 143 percentage points since the 2/19/20 pre-COVID peak for the stock market and beating the more tech-heavy Nasdaq 100 by 117 percentage points. Since its peak, ARKK has dropped more than 43%, allowing the more steady SPY and QQQ to catch up. Talk about a real-life “tortoise and the hare” scenario!

Interestingly, if we look at ARKK’s annualized price change from its launch in October 2014 through the pre-COVID peak for the stock market on 2/19/20, it’s roughly the same as ARKK’s annualized price change since the 2/19/20 pre-COVID peak: ~22.8%. Also, throughout its history, ARKK’s annualized total return still stands at ~24.3%, which is nearly 10 percentage points better than SPY’s annualized total return of 14.8% over the same time frame. Click here to view Bespoke’s premium membership options.