Energy Stocks to Oil Ratio Below Average

Oil has had a strong start to the year thus far, and Energy has been the best performing equity-market sector on a year to date basis by a wide margin. This is due to the fact that the performance of the Energy sector (XLE) tends to be highly correlated to the price of oil, holding a correlation coefficient of 0.81. Currently, the ratio of the price of XLE versus oil is below historical averages. The current level is 0.77 and the average since XLE began trading is 0.99, suggesting there may be upside in the energy sector should oil hold its current levels. However, the ratio is still in a ‘normal’ range, as it is less than one standard deviation away from the historical average.

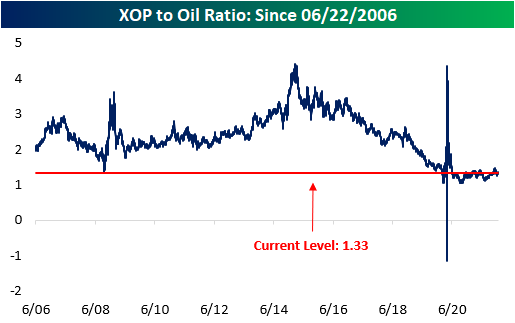

The Oil and Gas Exploration and Production industry (XOP) tends to be correlated with the price of oil as well (coefficient of 0.80). Historically, the ratio of XOP versus Oil has an average of 2.36, but the current level is far lower at 1.33. Additionally, the ratio is 1.7 standard deviations away from the average, which may imply that there is an opportunity to capitalize on a mispricing of XPO relative to the price of oil. However, since the start of 2020, the ratio has been suppressed and there is little evidence to suggest that this will change any time soon. Stay tuned as we will be releasing a deeper dive into oil tomorrow! Stay on top of market trends by becoming a Bespoke subscriber today. Click here to view Bespoke’s premium membership options.

As always, past performance is not a guarantee of future results. This is for informational purposes only and is not a recommendation to buy or sell a specific security.

Targeting Prices By Industry

Below we show how far the average stock is trading versus its consensus analyst price target by S&P 500 industry group. As shown, Media and Entertainment stocks are currently the most depressed versus price targets with the average stock in that industry over 20% below its target. That would indicate analysts either need to revise their targets far lower or those names need to rebound to catch up with expectations. On the other end of the spectrum, after a massive run for Consumer Staples stocks in the final months of 2021 and the first few days of this year, the average stock in that industry is actually above its price target. That is the only group in which that is the case, but Automobiles and Components, Food, Beverage, and Tobacco, and Bank stocks are all low single digit percentage points away from their price targets on average.

Given the sector’s massive weight, Tech is one area worth looking at, and under the surface, it is pretty split with regards to stocks’ current price and price targets. Technology Hardware and Equipment has rallied 23.64% since its recent October 4th low, retracing some of those gains this year. With such a rally over the past few months, the industry’s stocks have on average closed the gap on price targets. At the end of December, a little under half of the industry traded above its price target, and the average stock was only 2.3% away from its price target. Meanwhile, other areas of Tech like the Semiconductors and Software and Services have traded at more of a discount to where analysts believe they should be. Software and Services, in particular, has seen some of the weaker readings of the COVID era.

Consumer Staples and Financials have been two of the strongest performing sectors over the past couple of months. As could be expected given this, their stocks are relatively close to analyst price targets. For Consumer Staples, the Household & Personal Product industry is by far the strongest. While there are a small number of stocks in the industry (only six members), the average stock in this sector has actually traded above its target price the past two months and it ended December without a single stock below its target price.

Turning to the Financial sector, the Banks have put themselves ahead of the pack in a similar way. The average stock is only 3.25% below its price target compared to a 12.38% spread at the end of 2021. Additionally, in November and December there were no members of the industry above price targets, but today that number is nearly a third of the industry. Click here to view Bespoke’s premium membership options.

Communication Services Regaining Its Footing

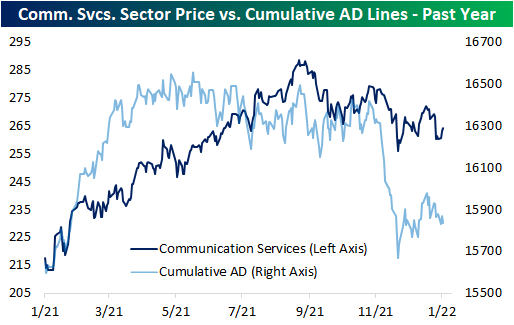

In the past year, one interesting internal disconnect for the S&P 500’s Communication Services sector has been between price and breadth. By the time price peaked in the late summer, breadth, as measured by the cumulative advance-decline (A/D) line, had been trending lower for several months. In other words, in the middle of last year, an increasingly smaller number of stocks were pulling the sector higher. This past fall, bad breadth hit a climax as the cumulative (A/D) line started to collapse just after the sector’s price set a lower high. Since the recent low for both price and breadth in the first days of December, the two lines have been moving more in tandem with each other.

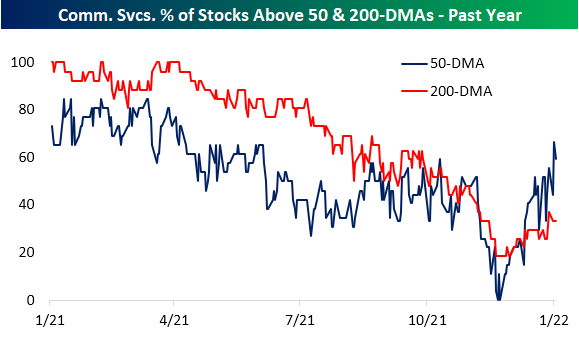

While the cumulative A/D line and price still have plenty of room for further improvement, there has been a significant pickup in the percentage of the sector’s stocks that are trading above their 50 and 200-DMAs. While the reading pulled back slightly to 59.26% yesterday, two-thirds of the sector finished last week above their 50-DMAs which was the strongest reading since April of last year. That reading comes just a little over a month after there was not even a single stock in the sector above its 50-day. The percentage of stocks above their longer-term 200-DMAs has been less impressive with only a third of stocks in the sector currently above that level, but that too has improved in recent weeks. The start of December saw readings in the high teens which marked the worst readings since the COVID Crash. Click here to view Bespoke’s premium membership options.

Another CPI Spike… Now What?

As mentioned in today’s Morning Lineup, the consumer price index (CPI) rose 7.0% year over year in December, the highest rate of increase since 1982. Consumers across America are paying higher prices for everything from bread to gas due to supply chain constraints, labor shortages, easy fiscal and monetary policy, and robust demand. Although this number was in line with estimates, the y/y increase is certainly notable.

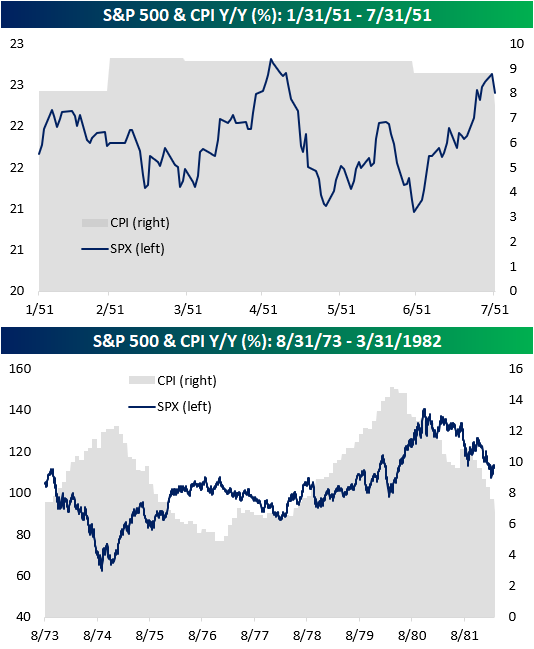

As shown in the chart above, there have only been four other periods since 1950 that y/y CPI reached 7.0% or more (1951, 1973, 1977, 1978), and in the table below we have summarized the performance of the S&P 500 during and after each of those prior periods. Overall, returns were mixed. In January 1951, the S&P 500 was just 0.4% off of its 52-week high when CPI first eclipsed 7%. During the seven months in which CPI remained above 7% on a y/y basis, stocks rallied 3.4%, and one year later, the S&P 500 was up 11.4%.

The longest streak of 7%+ y/y readings occurred between 1978 and 1982 and spanned 46 months. During this streak, the S&P 500 gained just 15.1% over the course of almost four years and just 1.8% in the year following the first reading over 7.0% in May 1978.

In between the 1951 and 1978 periods, there were two other occurrences where CPI eclipsed 7% on a y/y basis in 1973 (28 months) and 1977 (one month), and during both of these periods, equities traded lower.

As you can see from the charts below, the S&P 500 has acted differently each time CPI topped 7.0% on a Y/Y basis. In the first half of 1951, it appeared to trade independently of the elevated inflation readings, moving sideways as CPI readings remained elevated. For much of the 1970’s, however, CPI and the S&P 500 tended to move in opposite directions. Nonetheless, much of the gains experienced in the 70’s were in periods when the rate at which prices were increasing was on the decline. Inflation has typically been considered a negative backdrop of equity prices but a key factor behind that performance is how long-lasting the inflation is. In the early 1950s, when the elevated level of inflation was short-lived, equities, which were already near 52-week highs, performed fine. In the 1970s, though, when inflation was more entrenched, the backdrop for equities was negative. Stay on top of market trends by becoming a Bespoke subscriber today. Click here to view Bespoke’s premium membership options.

The Best and Worst of Q4 Earnings

Earnings season begins this week as corporations report their Q4 results and wrap up fiscal year 2021. Earnings season unofficially begins when the large banks begin reporting their earnings and concludes when Walmart (WMT) releases its results.

We do a lot of earnings season analysis using our Earnings Explorer tool, which is available to Bespoke Institutional subscribers. One type of analysis is tracking how share prices typically react to earnings reports. Since the start of 2011, there have been certain companies that have excelled after reporting Q4 results specifically, while others have historically struggled. Of the companies that have at least five years worth of Q4 reports, Netflix (NFLX), Etsy (ETSY), and SolarEdge (SEDG) have been the S&P 500’s three top performers, averaging 12.4%, 9.6%, and 8.3% gains on their Q4 earnings reaction days, respectively. Charles River Laboratories (CRL), Darden Restaurants (DRI), Signature Bank (SBNY), and Lamb Weston (LW) have beaten Q4 sales estimates every time, while ETSY, Fortinet (FTNT), EPAM Systems (EPAM), Meta Platforms (FB), and LW have beaten Q4 EPS estimates 100% of the time.

Using our Earnings Explorer, below is a look at how Netflix (NFLX) has historically performed on its earnings reaction days broken out by quarter. (For a stock that reports in the morning before the open, that day is its “earnings reaction day.” For a stock that reports after the close, the next trading day is its “earnings reaction day.”) Remarkably, NFLX has historically averaged declines on its earnings reaction days for Q1, Q2, and Q3 earnings releases, but it has absolutely soared on its Q4 earnings reaction days. As shown, the stock has historically averaged a one-day gain of 10.72% on its Q4 earnings reaction day with positive returns 74% of the time. (Conversely, the stock has historically averaged a decline of 6% on its Q2 earnings reaction day (typically in July) with positive returns just 20% of the time.)

As shown, post-COVID, Netflix (NFLX) has had seven quarterly earnings releases, and the only one that the stock reacted positively to was its Q4 2020 report last January when it gained 16.85%. The stock fell 2% or more on each of its six other earnings reaction days post-COVID.

SolarEdge (SEDG) is a stock from the table above that has traded positively on every single one of its Q4 earnings reaction days. Below is a snapshot of SEDG’s historical Q4 reports from our Earnings Explorer tool. As shown, SEDG has historically averaged a one-day gain of 8.3% on its Q4 earnings reaction day with positive returns six out of six times.

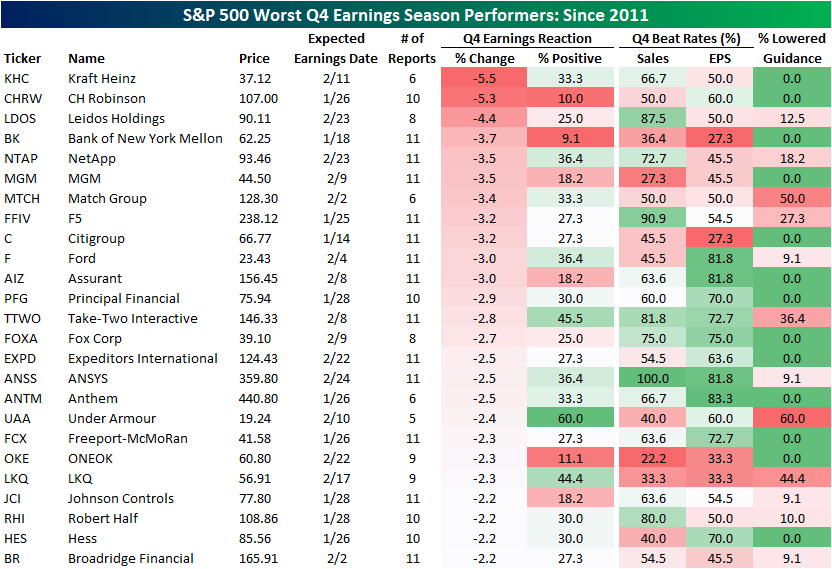

On the other side of the equation, Kraft Heinz (KHC), CH Robinson (CHRW), and Leidos Holdings (LDOS) have historically been the S&P 500’s worst performers after reporting Q4 earnings, averaging a decline of 5.5%, 5.3%, and 4.4% on earnings reaction days since 2011, respectively. None of these names have declined 100% of the time since, but Bank of New York Mellon (BK), CHRW, and ONEOK (OKE) have performed positively less than 15% of the time on Q4 earnings reaction days. Match Group (MTCH) and Under Armour (UAA) have lowered guidance at least 50% of the time on Q4 earnings, and BK, MGM (MGM), Citigroup (C), Ford (F), Under Armour (UAA), OKE, LNQ (LNQ), and Hess (HES) have missed Q4 sales estimates over half of the time.

Turning back to our Earnings Explorer, since the start of the 2020, NetApp (NTAP) has traded lower following an earnings report three times, two of which occurred in Q4. Interestingly, in the Q4 of fiscal year 2020 release, revenues and EPS beat estimates, but the equity still traded lower by nearly 14.5%. NTAP has not experienced gains on a Q4 earnings reaction day in four consecutive years.

As always, past performance is no guarantee of future results, and this is not a recommendation to buy or sell any specific securities.

If you want to stay up to date on earnings reports, we recommend that you start a 14-day trial to our Bespoke Institutional package. With this subscription, you will receive earnings coverage for the most crucial companies through our Conference Call Recaps section.

Small Pickup in Small Business Sentiment

The NFIB’s reading on small business sentiment has generally been on the decline over the past few years, although it’s also well off the lows set during the depths of the pandemic. In October, the index hit the lowest level since last March, and the past two months have seen a modest bounce off that October low, leaving small business sentiment middling versus its historical range.

While the headline number is far from any significant high or low, the individual components of the report are showing another story. Employment-related indicators are around some of the highest readings on record while a handful of other categories like Expectations for the Economy to Improve are near some of the lowest.

Rising slightly off the November reading, which was tied with November 2012 for the lowest on record, firms continue to have a historically sour outlook for the economy. While there are some other areas that are at the low end of their range of historical readings, this index is by far the most depressed area of the report.

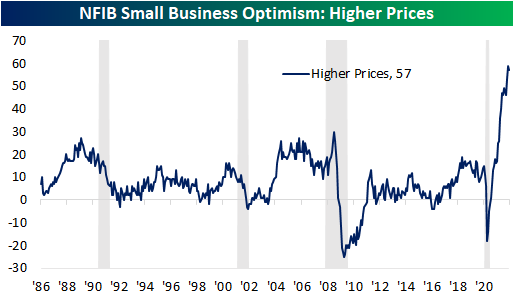

One potential reason for the pessimistic outlook could of course be the resurgence of COVID cases, but another likely reason, as we noted in today’s Morning Lineup, is inflation. The index tracking the rate at which firms report higher prices peaked in November but remains extremely elevated at 57. Meanwhile, a record high 22% of responding businesses reported inflation as their biggest concern.

Although costs are soaring, on the bright side, the employment situation is very strong. Firms reported an increase in hiring plans with the index rising to 28, the highest level since August while the net change in employment was positive for the first time since April. That is also only the second positive reading since the pandemic began. As with other costs, compensation is at an unprecedented level with the index setting a new record high in December. Compensation plans have now gone unchanged at 32 in back-to-back months. Responding firms also are reporting continued difficulties hiring with the Job Openings Hard to Fill index maintaining its lofty readings after gaining one point in December. Click here to view Bespoke’s premium membership options.

Dividends Outperform With Discrepancy

In last week’s Bespoke Report, we performed a decile breakdown of year to date performance of Russell 1,000 members based on a variety of factors ranging from valuations to performance in 2021. One standout attribute of stocks that has been driving performance this year has been dividend yields. Expanding to the broader Russell 3,000, as shown below, the decile of stocks that pay no dividend is down a dramatic 5.69% on average this year. Meanwhile, deciles 7 through 10 with the highest dividend yields are all firmly in the green with average gains ranging from 1.93% to 2.38%.

With dividend payers significantly outperforming, it is worth mentioning which stocks tend to have the highest dividend yields. In the chart below, we show the average dividend yield for stocks of each sector of the Russell 3,000. Utilities, Real Estate, and Financials all top the list with average yields above 2% while Health Care and Technology stocks, on an average basis, offer hardly any yield at all.

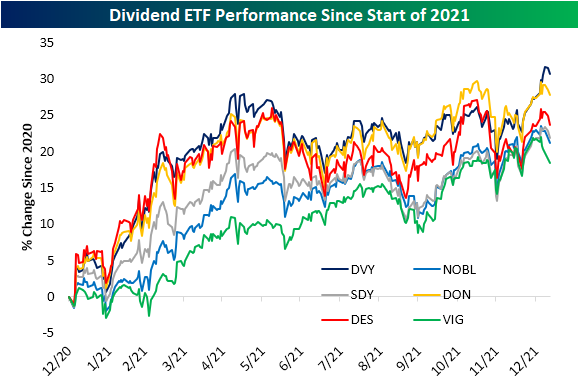

Given the outperformance of high-yielding stocks this year, some dividend-focused ETFs are up the most versus other investment styles highlighted in the styles screen of our Trend Analyzer, but there is a decent bit of dispersion for various ETFs tracking this theme as they have slightly different methodologies/more granular focuses.

The iShares Select Dividend ETF (DVY) is currently up the most year to date ( 2.5%) as it has also outperformed for most of the time since the start of last year (dark blue line). Additionally, the recent move higher resulted in a significant breakout to the upside. The next best performing dividend ETFs this year have been market cap focused with the WisdomTree SmallCap Dividend ETF (DES) gaining 0.09% and its mid-cap centered peer (DON) which has risen 0.29% YTD. Like DVY, these two ETFs have also tended to outperform over the past year, though neither has broken out in the same way as DVY, stopping short of prior highs even with solid gains late last year and to start this year.

On the other hand, dividend growers proxied by ETFs like the S&P 500 Dividend Aristocrats (NOBL), Dividend Appreciation ETF (VIG), and S&P Dividend ETF (SDY) have underperformed some of their peers since the end of 2020, but recently hit new highs and have generally trended higher since last year. More recently in 2022, though, they have actually sold off and are each in the red YTD.

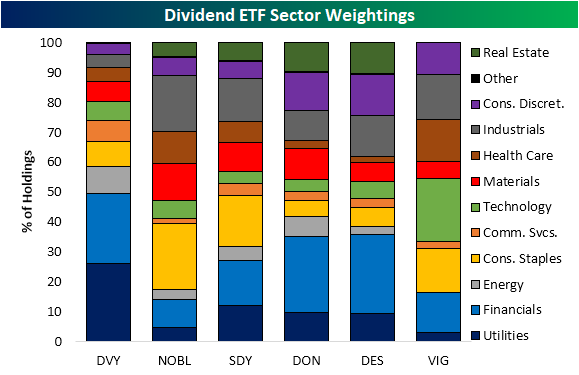

Again, each of the ETFs shown above have different methodologies for selecting their holdings, ranging from a history of dividend growth or market cap size which factors into performance. One other factor, however, for the difference in performance also has to do with sector exposure. This year, Financials have been one of the top-performing sectors and as mentioned earlier, is one of the highest yielding sectors. The top-performing dividend ETFs have the highest weight in Financials. DVY, DON, and DES each have around a quarter of their holdings in this sector. The other best performing sector this year, Energy, also accounts for a significantly larger portion of DVY and DON versus other dividend ETFs. Conversely, VIG has a much larger weight in Tech and Health Care, which have been the second and third-worst performing sectors this year, and that exposure helps to explain much of its YTD underperformance. Click here to view Bespoke’s premium membership options.

J.P. Morgan Health Care Conference Kickoff

The 40th annual J.P. Morgan Health Care Conference kicks off today, and because of COVID concerns, this year’s event will be held virtually. One of the largest conferences for the Health Care sector, especially in regards to health care investment, this conference brings together investors and hundreds of companies to stay up to date on the pulse of the Health Care sector. Looking back since 2001, the conference has coincided with solid performance for the S&P 500 Health Care sector with positive performance 62% of the time and an average gain of 0.56% during the four-day event. During last year’s conference, which was also held virtually, the Health Care sector declined 0.7% which was the worst performance since 2009. As for the biotech industry, which the conference’s focus is rooted in since it began in the early 1980s, it heads into this year with three consecutive years of positive performance. Compared to the broader sector, the S&P 500 Biotech industry has averaged an even better 1.15% gain during the annual conference since 2001 and has seen a move higher a little better than three-quarters of the time. Click here to view Bespoke’s premium membership options.

Differentiation Within Growth

So far in 2022, growth stocks have broadly sold-off and the Russell 1000 Growth Index has declined by 6.9%. However, not all growth stocks are the same, and it may be inaccurate to say that “growth stocks” in general are getting hit with this market downturn. Within the Russell 1,000 Growth index, names with the most aggressive valuations and higher multiples have performed far worse than those will lower multiples. Certain groups of the Russell 1000 Growth Index members have outperformed the S&P 500 on a year-to-date basis. The 20% of members with the lowest price to earnings ratios have averaged a YTD decline of just 1.7% while the S&P 500 has lost 3.3% of its value. The 10% of stocks with the lowest price to book ratio have outperformed the market as well, declining just 1.8% this year. As you can see from the charts below, the higher the multiple, the worse the 2022 performance. The 20% of members with the highest P/B ratios have averaged a loss that is over three times that of the S&P 500 (10.5%). The 20% of stocks with the highest PE ratios in the index have averaged a reduction of 12.6%, almost four times the loss of the S&P 500.

A similar trend is seen when comparing YTD performance against price to sales deciles. The 10% of members with the highest P/S ratios have averaged a 15.9% turn down in 2022, while the 40% of names with lower P/S ratios have averaged a decline of 3.5%.

For investors looking for growth, there are two ways to look at this. The first line of thought is to believe that the most aggressive equities (think RIVN, PLUG, DOCU, CVNA, and UBER) have sold off at unreasonable rates, and there are presently buying opportunities. The other available option is to think that the outperformance from growth at a reasonable price stocks (i.e. OLN, RKT, OPEN, VRM, and GS) will continue moving forward as, among other factors, the fed hikes interest rates. Stay on top of market trends like growth versus value by becoming a Bespoke subscriber today. Click here to view Bespoke’s premium membership options.

Of the 25 stocks with the lowest P/E ratios in the Russell 1000 Growth Index, the average YTD performance is -1.5% (median: -1.4%), which is far better than the broader market. The average stock on this list is off of its 52 week high by 20.6% (median: 18.0%) and returned 33.3% from price appreciation alone in 2021 (median: 33.7%). 48% of these names are positive so far in 2022, which is impressive given that the Russell 1,000 Growth index has already fallen by 6.9% this year.

Bespoke Brunch Reads: 1/9/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

COVID Country

COVID-positive nurses say they’re being pressured to work while sick, and they’re petrified of infecting patients by Allan Akhtar and Aria Bendix (Insider)

Nurses that still have symptoms of confirmed positive COVID infections are being asked to return to work in hospitals in Kentucky and around the country. [Link]

White House, USPS finalizing plans to begin shipping coronavirus test kits to U.S. households by Jacob Bogage and Dan Diamond (WaPo)

The White House and USPS are finalizing plans to ship half a billion at-home COVID tests across the country with the first packages rolling out the door by mid-January if everything goes according to plan. [Link; soft paywall]

Belief in Having Had COVID-19 Linked With Long COVID Symptoms by Anita Slomski (JAMA)

While there is no doubt that some COVID sufferers have symptoms which last much longer than the acute infection, there’s a lot of uncertainty over how pervasive and severe long COVID is. This study showed that while belief that a person had actually been infected with COVID wasn’t correlated with the presence of antibodies for the disease, that same belief was positively correlated with “long COVID” presentations, suggesting a material psycho-somatic effect. [Link]

Indiana life insurance CEO says deaths are up 40% among people ages 18-64 by Margaret Menge (The Center Square)

Indiana insurance company OneAmerica reported that death rates for 18-64 year-olds had risen 40% versus pre-pandemic, a historic increase that illustrates just how heavy the burden of COVID has been on American society. [Link]

COVID & Children

Characteristics and Clinical Outcomes of Children and Adolescents Aged <18 Years Hospitalized with COVID-19 — Six Hospitals, United States, July–August 2021 by Alentine Wanga et al (CDC)

A survey of COVID cases in Southern hospitals identifies potential risk factors for children: over 80% had an identified underlying medical condition, two-thirds were obese, and virtually none were vaccinated. [Link]

Pandemic babies displaying developmental delays — even if their mothers didn’t have COVID (Study Finds)

Pandemic babies are showing slower cognitive and social development than pre-pandemic children, regardless of whether or not expecting mothers had COVID. [Link]

No Way to Grow Up by David Leonhardt (NYT)

Children are falling behind in school, suffering more mental health crises including suicide attempts, exposed to more gun violence, and are exhibiting more behavioral issues as the weight of the pandemic falls on the youngest members of society. [Link; soft paywall]

Embrace The Cold

Could Being Cold Actually Be Good for You? by Max G. Levy (Wired)

A range of studies of showed that being cold regularly is a good way to stimulate your body’s metabolism and force adaptations that can help reduce the effects of diabetes. [Link]

BTCS First-ever Nasdaq-listed Company to Offer a Dividend Payable in Bitcoin (Yahoo! Finance/Globe Newsire)

A NASDAQ-listed company which has delivered 69% losses per year since the end of 2010 announced it would start paying dividends denominated in bitcoin. Shares were up 40% in response but if history is any indication will return to their habitual declines soon. [Link]

Energy

Harold Hamm: ‘Republican, Democrat . . . I’m an oilocrat’ by Derek Brower (FT)

The Continental Resources founder wants coal plants closed so his natural gas empire can profit (and with a side of carbon reduction. Battery-electric vehicles, wind, and solar? Right out. [Link; paywall]

Is Nuclear Power Part of the Climate Solution? by Gernot Wagner (WSJ)

As most of the world’s nuclear reactors age and approach retirement (along with the 10% of global electricity they produce), the technology is at a turning point amidst demands for decarbonized power. [Link; paywall]

Labor Markets

‘Hottest it’s ever been’: why US labour market is stronger than it seems by Colby Smith, Andrew Edgecliffe-Johnson, and Christine Zhang (FT)

Official data points are finally catching up to anecdotes, as illustrated by this excellent round-up off labor market data. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!