Speculators Head for the Hills

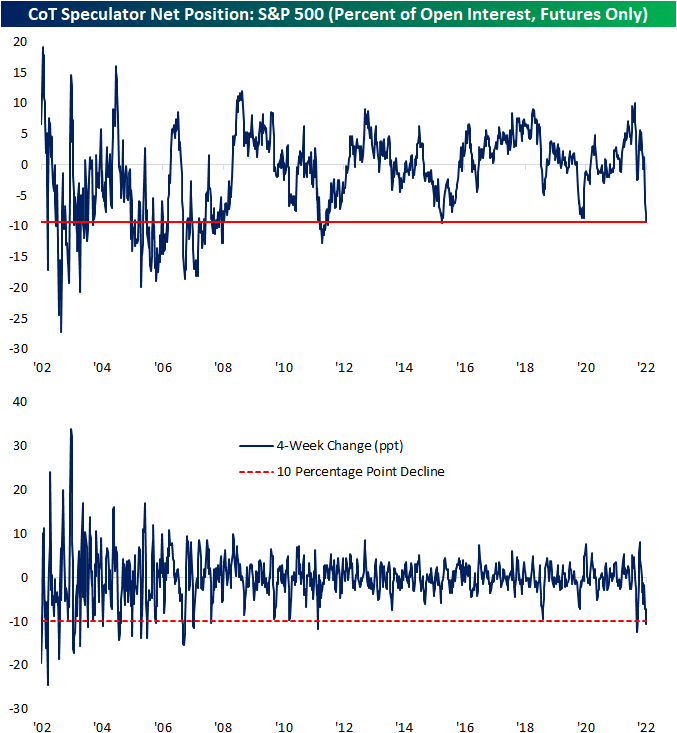

As we do each Monday in our Closer report, we reviewed the latest data from Friday’s release of the CFTC’s Commitments of Traders (CoT) Report. This data shows how speculators are positioned in various assets based on positions in the various futures contracts. One asset that has seen some of the most notable changes of the report in recent weeks has been the S&P 500. As recently as one month ago, that data showed a net 1.29% of open interest was positioned long. Even though the S&P 500 has managed to come off the lows in the past month, positioning has collapsed with a massive move lower meaning there are far more speculators positioned short than long.

Whereas one month ago the reading was net long, in the latest data as of last Tuesday a net 9.3% of open interest was short. That made for the lowest reading since October 2015. In other words, speculators are positioned more pessimistically now than they were during the COVID crash, during the late 2018 near bear market, or any other time over the past several years. The change in positioning has also been rapid. As shown in the second chart below, that net positioning reading has fallen over 10 percentage points in just 4 weeks. Earlier this year in March there was an even larger 12.5 percentage point decline but prior to that, looking back through the history of this data, such large moves have been much rarer over the past decade than was the case in the 2000s and before. In fact, prior to this year the last time positioning in S&P 500 futures fell double digits in four weeks was all the way back in August 2011. On the other hand, the early 2000s frequently saw moves of this size if not larger.

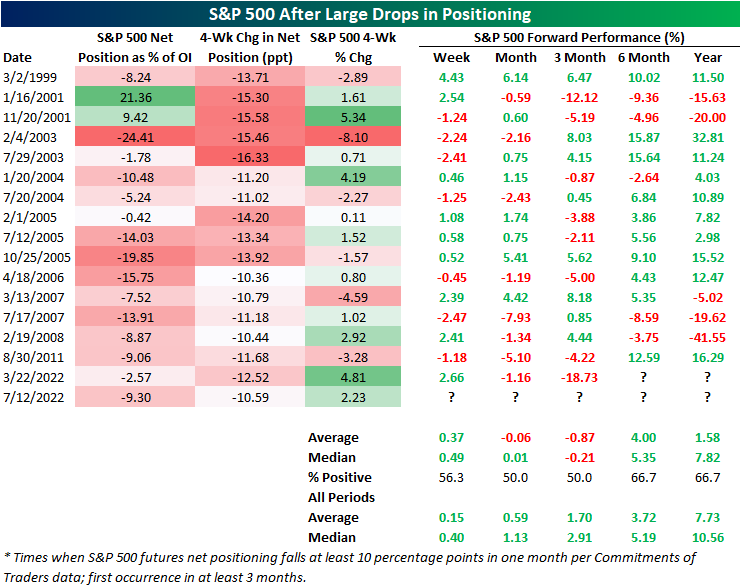

Typically, sentiment data is considered contrarian in nature. In other words, pessimistic sentiment readings are followed by stronger forward performance of equities and vice versa. That has not exactly been the case for this CoT positioning data. Following past declines of at least 10 percentage points, returns have been mixed.

After declines of similar magnitude, the S&P 500 has experienced modest outperformance over the next week. One and three months out, however, have tended to be weaker with postive returns only half the time with negative returns on an average basis. Over the next month, each of the past four instances have been followed by declines.

Six and twelve months out have seen the S&P 500 higher two-thirds of the time, but average and median returns are not significantly better relative to all periods. Click here to learn more about Bespoke’s premium stock market research service.

Goldman and Citi Rip

Following earnings in recent days, both Goldman Sachs (GS) and Citigroup (C) have seen their stocks rip higher, resulting in rarely seen price moves for the stocks. Goldman’s trading segment benefited from increased trading volumes in FX, rate, and commodity markets, helping to fuel a beat on the top and bottom line. C also reported a top and bottom line beat, and every segment saw revenue rise y/y. Click here to view an in-depth analysis of these two earnings reports. Click here to learn more about Bespoke’s premium stock market research service.

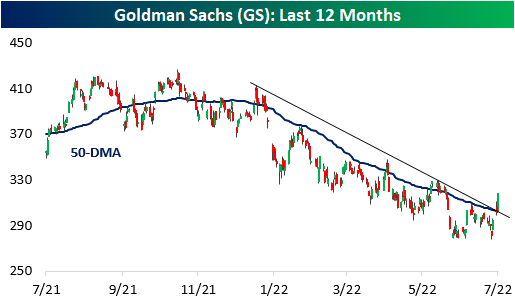

Since the close on July 14th (three trading days ago), GS has ripped 12.5% higher which is the largest three-day rally since May 2020. On its earnings reaction day (7/18), the stock gapped up over four percent but finished the day with a gain of 2.6%. Today, GS jumped an additional 5.5% higher. Notably, the stock has now broken its downtrend and its 50-day moving average, a bullish technical sign for the stock. However, the stock is still down close to 20% on the year, which is worse than the performance of the broader financial sector ETF (XLF).

Following three-day gains of over 12% for GS (for the first time in at least a month), the stock has underperformed its all-period performance on a median basis across each time period we looked at (one day, one week, one month, and three months). Positivity rates are lower as well, so it’s hard to view this occurrence as an overly optimistic signal. One data point to take note of is that the average absolute three-month change is significantly elevated at 20.5% (median: 21.6%). For all periods since its IPO, the average absolute three month price change has been 12.9% (median: 10.1%). If the historical pattern holds, this would suggest that the next three months for the stock will be more volatile than normal. Click here to learn more about Bespoke’s premium stock market research service.

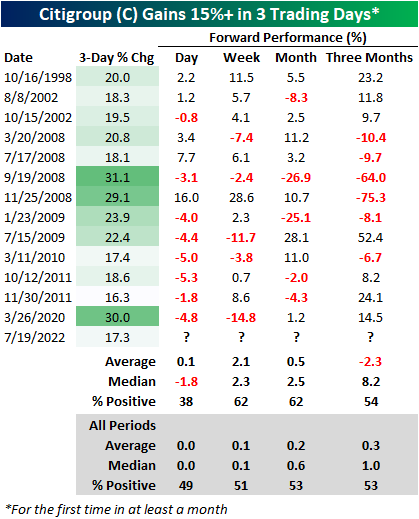

Citi’s chart looks quite similar, and its rally has been even more impressive than the rally in GS as the stock also broke above both the 50-DMA and the downtrend that has been in place since early January. With a gain of 17%, the stock has seen its largest three-day rally since the days coming off the COVID lows in March 2020. Both stocks have also struggled to definitively break through the 50-DMA, so investors should watch these levels carefully over the next few trading sessions. For both stocks, the 50-DMA is still moving lower, but the performance over the last few trading sessions certainly helps the technical picture.

In terms of forward returns, C has had mixed performance following prior three-day gains of at least 17.0%. The table below shows all prior occurrences since the October 1998 merger between Travelers and Citigroup. Of the thirteen prior occurrences, C’s median next-day performance has been a loss of 1.8%, but the stock has booked a median gain of 2.3% over the following week. Over the next three months, C underperforms all periods on an average basis but significantly outperformed on a median basis, and positivity rates have been narrowly above that of all periods. Three months out, C has averaged an absolute move of 24.5% (median: 11.8%), which like GS, is much higher than the 13.2% (median: 9.1%) average absolute three-month change for all periods. Long story short, although the technical picture has improved for both GS and C, investors should continue to expect volatility ahead.

Bitcoin to Ethereum Ratio in Freefall

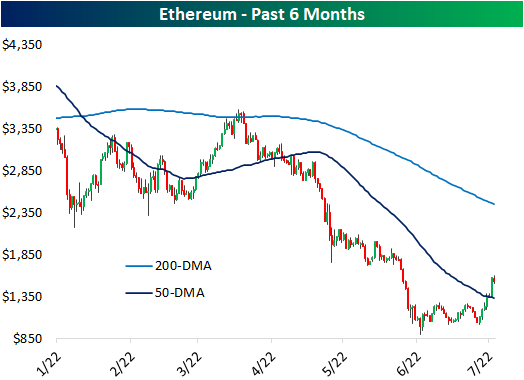

Risk assets have found some stability in the past month, but one asset that has been absolutely flying higher in Ethereum. The past week’s rally has risen to a remarkable 51% for the world’s second largest crypto bringing its market cap up from $126 billion to $187 billion. In that same span, Bitcoin has only gained 15.5%. After those moves, Bitcoin has returned to its 50-DMA while Ethereum has surged through the line.

Given that massive outperformance of Ethereum, the ratio of Bitcoin to Ethereum has collapsed. In fact, the ratio has now fallen for seven days in a row, tying three other streaks (September 2019, February 2020, and April of this year) for the longest streaks of consecutive days of declines.

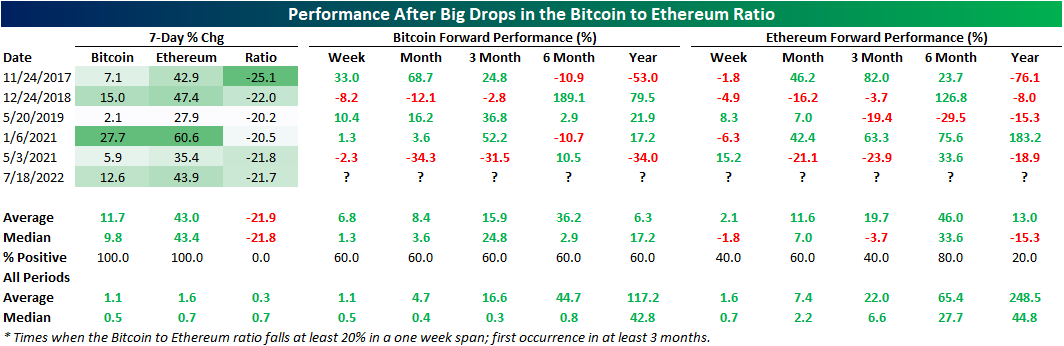

The ratio has fallen considerably as well as consistently in the past week. Exactly one week ago, the ratio hit a near term high and has dropped 23.5% since then. As shown above, that brings the ratio down to the rough uptrend line that has been in place since late last year. Since the start of our price data for Ethereum in November 2017, there have only been a handful of other periods in which this ratio has fallen as sharply; meaning times when there has been similar underperformance of Bitcoin relative to Ethereum. The most recent of these was a little over a year ago in May 2021.

Below we show the performance of Bitcoin and Ethereum during each one of those one week declines of at least 20% in the ratio without another occurrence in the prior three months. This most recent drop in the ratio is only the sixth time such a move has occurred. Performance this time around has been middling relative to these other instances with Ethereum’s 43.9% rally through yesterday when the ratio crossed the 20% decline threshold roughly inline with the median performance of other instances (43.4%). Bitcoin on the other hand has actually been doing a little better with its 12.6% rally larger than the median of 9.8%.

As for where the two largest cryptos head from here, historical performance has been mixed. Overall Bitcoin has more consistently moved higher across the following year. One year out has perhaps been the period with the most dramatic outperformance of Bitcoin. Although it was only higher 60% of the time, Ethereum was only higher one year later once following the January 2021 instance. Click here to learn about Bespoke’s Weekly Crypto Report.

Homebuilder Sentiment Plummets

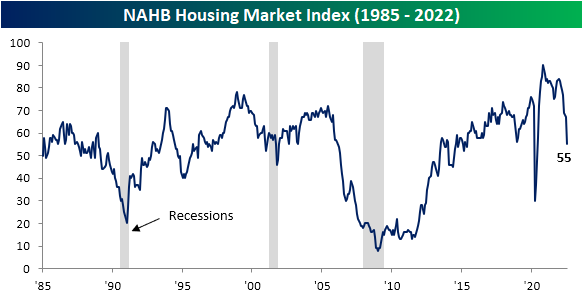

Another bad reading for housing hit the tape today as the NAHB’s Housing Market Index measuring the confidence of US homebuilders experienced its second largest decline on record behind the drop in April 2020. Homebuilder sentiment cratered 12 points month over month sending the index to the lowest level since May 2020 which is also one point below the late 2018 low.

Given the drop in the headline number, each of the individual components (present and future sales and sales traffic) similarly experienced historic declines month over month. Like the headline index, Present Sales and Traffic only experienced larger declines at the start of the pandemic. The same goes for Future Sales, although there was also a slightly larger drop in December 1987 making this month’s drop the third largest on record.

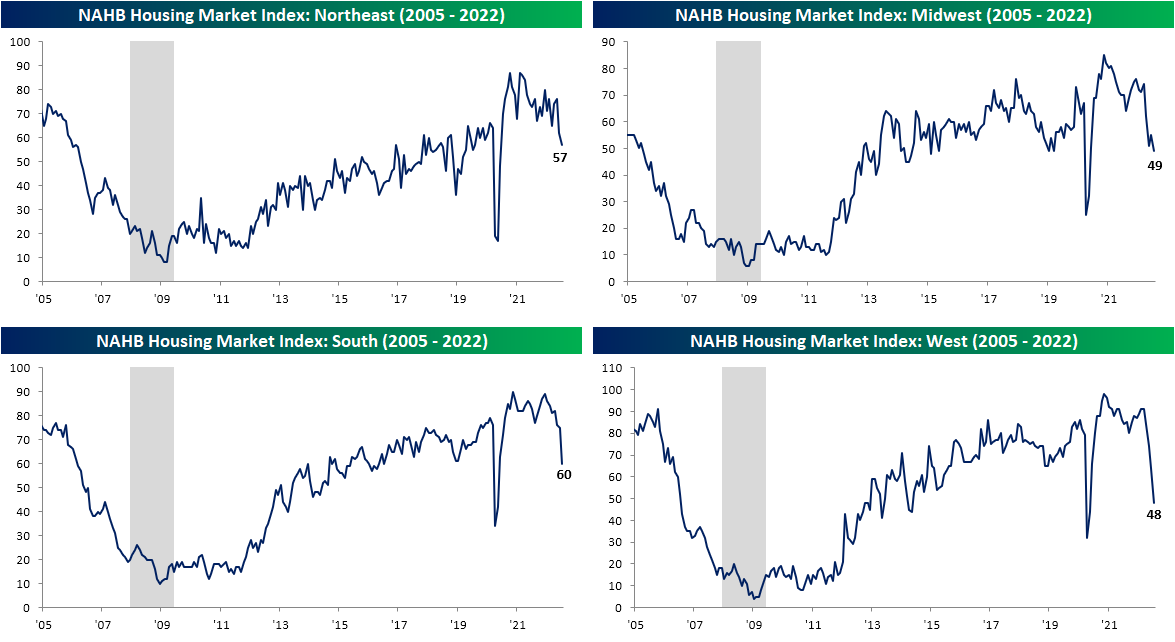

Geographically, no area of the country has been safe from plummeting sentiment, but the Northeast has held up remarkably well. Whereas the South and West saw double digit monthly declines that both were the second largest on record, the Northeast only fell five points to 57. That is a reading just shy of the top quartile of readings unlike the other regions that are in the 52rd percentile at best (South).

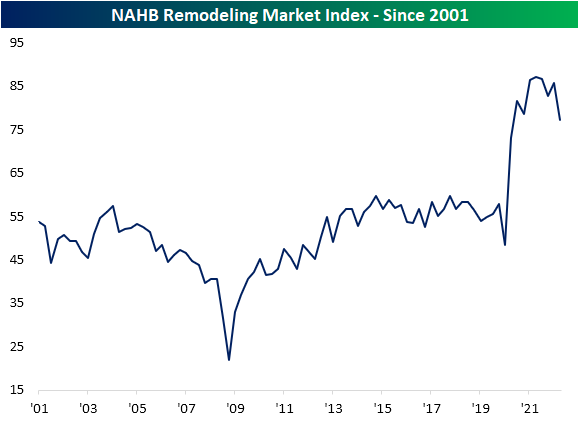

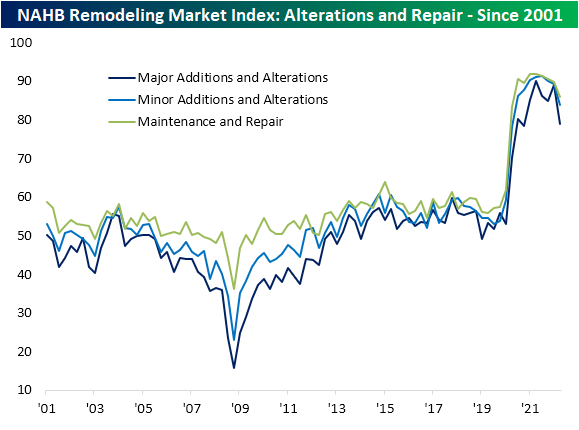

The lower sentiment for homebuilders is of course a function of rising mortgage rates and the subsequent dampening demand as a result. As for builder’s roles in existing homes, sentiment is also rolling over. In addition to today’s release, last week saw the quarterly release of the NAHB’s Remodeling Market Index measuring builder’s sentiment regarding remodeling projects. Unlike the Housing Market Index, this index remains historically elevated and down just a bit. In other words, remodeling demand has taken a hit but not to the same extent as projects to build a new home.

The most pronounced decline in remodeler sentiment has come from the projects carrying the highest costs ($50K or more) even though smaller project outlooks have also been falling for a few quarters now.

Backlogs have been unwinding as well even if they are historically elevated. A likely big reason for that has been a deceleration in new projects. The index for Appointments for Proposals is much less elevated in the 48th percentile compared to 56th for the headline reading or 68th for Backlog of Remodeling Jobs.

Homebuilder Earnings on Deck

While homebuilder sentiment experienced a historic plunge in the latest reading, homebuilder stocks have actually been on the move higher in today’s session. That brings the total rally off of the June low above 20%, although that is only a dent in the larger decline since late last year. The S&P 1500 Homebuilders group is currently down 31.4% since the December 10th high. Without a coincident drop alongside sentiment, homebuilders continue to hold above their 50-DMA.

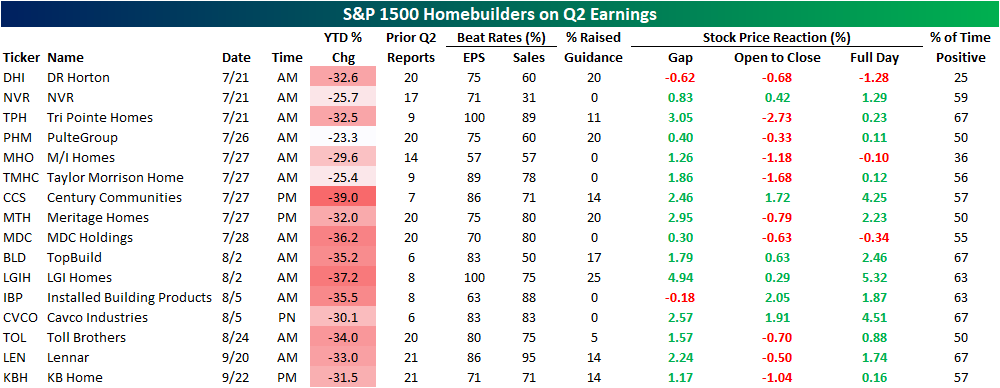

Homebuilders are at a bit of a crossroads at the moment as a further move higher would definitively break the past several months downtrend whereas a break back below its 50-DMA would mark a failed breakout similar to what happened earlier this spring. If today is any indication, macro data hasn’t been a particularly strong catalyst for the industry, however, there is a huge slate of earnings in the month ahead. Later this week on Thursday, DR Horton (DHI), NVR (NVR), and Tri Pointe Homes (TPH) are all scheduled to release quarterly results. Of these, DHI has actually averaged some of the worst performance on Q2 earnings of any homebuilder. The stock has averaged a 1.28% decline on its historical Q2 earnings reaction days and positive returns only a quarter of the time. As for other notables, Q2 has tended to be the best quarter of the year for stock price performance of Century Communities (CCS), Installed Building Products (IBP), LGI Homes (LGIH), and NVR (NVR). Click here to learn more about Bespoke’s premium stock market research service.

Pumped For Some Relief

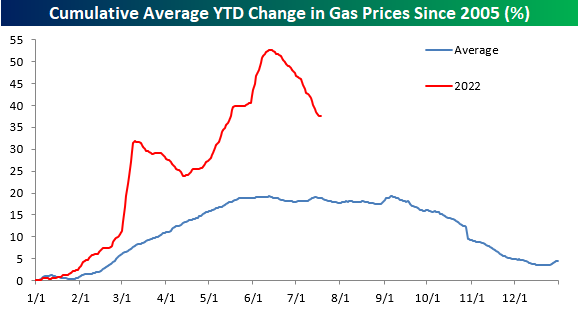

After one of the sharpest YTD surges on record, US consumers have seen a bit of relief at the pump over the last month as gasoline prices, as tracked by AAA, have seen a sharp pullback. The national average price of a gallon of gas currently stands at $4.52, which at any other point in history would have been astronomical, but compared to mid-June when the national average briefly topped $5, current prices seem downright cheap – at least on a relative basis!

The table below shows prices as of 7/18 each year going back to 2005 and where they stood on both a MTD and YTD basis. At $4.52, the national average has never been higher at this time of year, and the only year it was above $4 per gallon on 7/18 was in 2008. On a YTD basis, the average price is still up 37.6%, which is roughly double the average and median YTD gain at this point in the year, but 2021 (40.6%) and 2009 (52.6%) both saw larger YTD increases. One notable aspect of this year so far is that despite the big increases on a YTD basis, this month’s 6.6% MTD decline actually ranks as the largest MTD decline in prices through 7/18.

While the moves this year have been much more extreme than normal, average gasoline prices are following their typical seasonal pattern. Historically, prices tend to peak right around Memorial Day or into early June, and this year’s peak in prices was on June 13th. Granted, this year’s peak (50%+) was much larger than the typical YTD increase leading up to the peak, but the magnitude of the decline in percentage terms has also been steeper than normal. In order to get back down to a more normal YTD pattern, we’re going to need to see continued weakness in prices going forward. But from a seasonal perspective (and barring any hurricanes), there is a tailwind for lower prices. Click here to learn more about Bespoke’s premium stock market research service.

Besides the fact that gas prices hit record levels this year, what has made the period especially painful for consumers is how consistent the increase in prices has been. The chart below shows the y/y change in prices going back to 2005. The current level of 42.71% isn’t necessarily extreme in terms of its magnitude, but what stands out in the chart below is how long the y/y increase has stayed at elevated levels. Back in March 2021, the year-over-year change for gas prices first crossed 30%, and it hasn’t looked back since. When you start lapping 30% y/y increases, it really starts to add up! Let’s hope that this recent dip really starts to have some legs.

Bespoke Brunch Reads: 7/17/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Labor Markets

Here’s where Tesla’s recently laid-off talent is going by Fred Lambert (electrek)

Workers who have been laid off or otherwise departed Tesla recently has headed to other tech firms, with Rivian, Apple, and Lucid Motors among the biggest recruiters. [Link]

Netherlands Poised to Make Work-From-Home a Legal Right by Lucy Papachristou (WSJ)

Dutch legislation will force employers to consider remote work requests and provide a covered reason denying their request. [Link; paywall]

Food

Learning to Love an Induction Stove by Hannah Goldfield (NYer)

While gas remains a favored cooktop for chefs, home cooks are likely to reduce greenhouse gas emissions, protect their family’s air quality, and reduce cook time. [Link; soft paywall]

Rising prices curb consumers’ taste for chocolate by Maytaal Angel and Jessica DiNapoli (Reuters)

Sweet treats are an easy item to give up for many consumers, especially when high prices for chocolate mean choco-holics are paying out the nose for their fix. [Link]

In Portugal, Taking a Dive Into Sardines by Lily Puckett (NYT)

A look into the very old and very big business of fish canning, an industry dominated by women that is having a moment thanks to foodies’ search for intense and widely available flavors. [Link; soft paywall]

China

Chinese Homebuyers Across 22 Cities Refuse to Pay Mortgages (Bloomberg)

With apartment development timelines dragging out in part due to builders’ financial challenges, owners already on the hook for payments are starting to boycott their loans in protest. [Link; soft paywall]

China Is Stealing Taiwan’s Sand by Elisabeth Braw (FP)

Taiwanese islands close to the mainland regularly see thousands of dredgers and support vehicles trespass with the goal of removing sand for use in a huge range of applications from land reclamation to concrete or glass manufacturing. [Link]

Subscriptions

Instagram now lets creators publish feed posts just for their subscribers by Chris Welch (The Verge)

Content on Instagram can now be pushed exclusively to paid subscribers, following in the steps of Twitter and adding to a similar feature for Stories. [Link]

Netflix Changes Tack With Marketing Spree for $200 Million Film by Lucas Shaw (BNN Bloomberg)

Instead of just letting users discover a new movie, Netflix is actively marketing its new blockbuster (featuring Ryan Gosling) in a bid to re-start subscriber growth and maintain its position within the streaming wars. [Link]

BMW starts selling heated seat subscriptions for $18 a month by James Vincent (The Verge)

The German auto manufacturer is testing a feature that would allow users to pay full freight for heated seats up front or pay less in monthly installments…all to access a feature that comes built into the car but can be turned on or off with software. [Link]

Market Innovation

‘The market is just dead’: Investors steer clear of 20-year Treasuries by Kate Duguid and Colby Smith (FT)

Since being reintroduced in 2020, the 20y Treasury bond has found very little interest from investors as low liquidity and weak real money interest have made it attractive to nobody. [Link; paywall]

Lumber Futures Are Getting a Makeover by Ryan Dezember (WSJ)

In a bid to expand volumes, the CME is reducing the size of its lumber future by 75%, changed the delivery point, and broadened eligible species to allow for more participation on both sides of the contract. [Link; paywall]

Approval

Most Democrats Don’t Want Biden in 2024, New Poll Shows by Shane Goldmacher (NYT)

With President Biden deep underwater in broad polling, a majority of Democrats would prefer someone else in a primary challenge; that said, a failure to renominate a sitting President would be a major shocker in the longer-term history of the US two-party system. [Link; soft paywall]

Too Much of A Good Thing

A new ‘miracle’ weight-loss drug really works — raising huge questions by Hannah Kuchler (FT)

Last year the FDA approved a weight loss drug that led to patients losing 15% of their body weight on average. Its history and approval are controversial: patients will likely need to take it long term at a monthly list price of $1,350. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

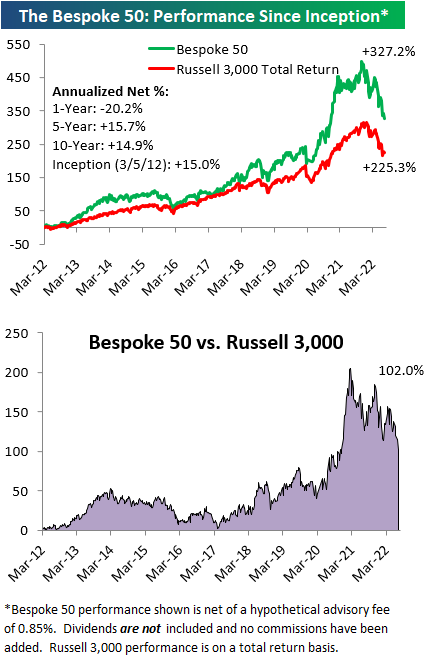

The Bespoke 50 Growth Stocks — 7/14/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

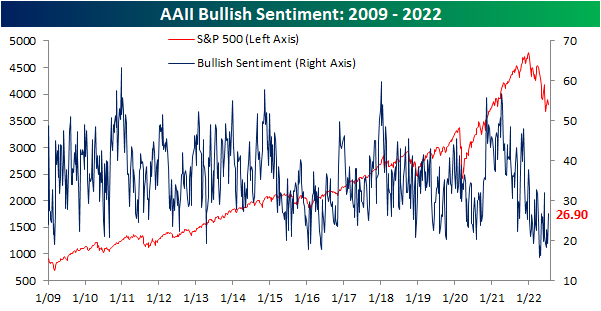

Bulls Back Above 25%

In spite of the S&P 500’s consistent declines in the past week as it failed to take out its late June highs, investor sentiment has turned around (relatively speaking) with this week’s reading from the AAII showing 26.9% of respondents reporting as bullish for the first time since early June. The 7.5 percentage point increase in the percentage of bullish responses this week was a large week-over-week increase by historical standards, although there have been multiple even bigger larger weekly increases over the past few months.

With the increase in bullish sentiment, over a quarter of respondents reported as bullish for the first time in five weeks. Such extended streaks with as depressed readings have been few and far between with the last five-week streak occurring all the way back in the summer of 1993. Overall, there have now only been six streaks in which bullish sentiment remained below 25% for at least 5 consecutive weeks. The longest of these was in December 1990 when it went on for 9 weeks in a row. Albeit a small sample size, historically the end of these streaks have not been raging buy signals for the S&P 500 in the short term with inline performance versus all periods and somewhat weak returns one month out. However, three, six, and twelve months later the S&P 500 has been higher almost every time with slightly stronger than normal performance (six months out from the March 1990 occurrence was the only decline).

The increase in bullish sentiment was met by bears falling back below 50% to 46.5%. Mirroring bullish sentiment, that made for the lowest reading since the first week of June.

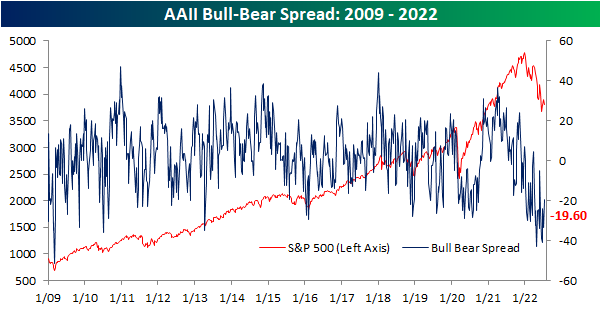

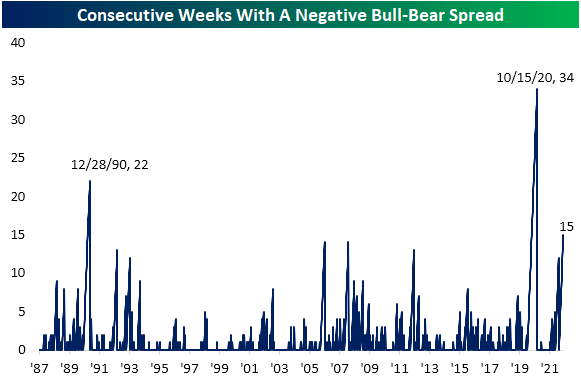

As a result of those moves, the bull-bear spread remains firmly in favor of bears. With the percentage of bearish responses outnumbering bulls by 19.6 points, for the 15th week in a row the bull-bear spread remains negative. That steak has grown to be the third largest on record behind a 22-week streak ending in late 1990 and a 34-week streak ending in October 2020.

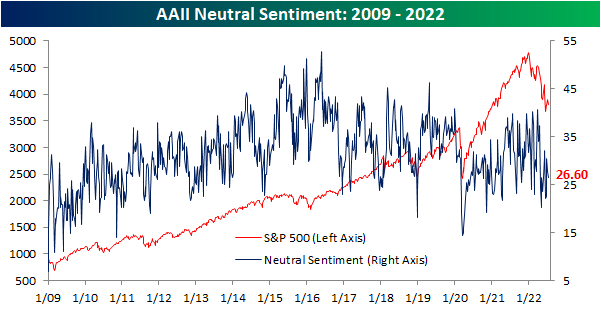

Neutral sentiment has managed to avoid major shifts in sentiment in recent weeks and this week was no exception. This reading fell modestly from 27.8% to 26.6%. That is well within the range of the past couple of years’ readings and is only the lowest since three weeks ago. Click here to learn more about Bespoke’s premium stock market research service.

Seasonal High is Here for Claims

Jobless claims have continued to rise hitting the highest level since November this week. Claims rose from an unrevised 235K up to 244K this week. With consistent increases in claims over the past few months, the reading has gone from multi-decade lows to levels that would have been the highest since late 2017/early 2018 pre-pandemic.

As we have noted each week recently, the current week of the year has historically marked a seasonal peak in claims. As such, the current week of the year has also seen a sequential rise in claims 80% of the time including a rise this week. NSA claims now are at 241.3K which is inline with the comparable readings for the three years prior to the pandemic. Although part of the recent increase in claims is likely seasonal in nature, given evidence of a slowing economy including weakness in other labor market data like under the hood of Friday’s nonfarm payrolls report, how much that seasonal uptick unwinds in the weeks ahead will be something to watch.

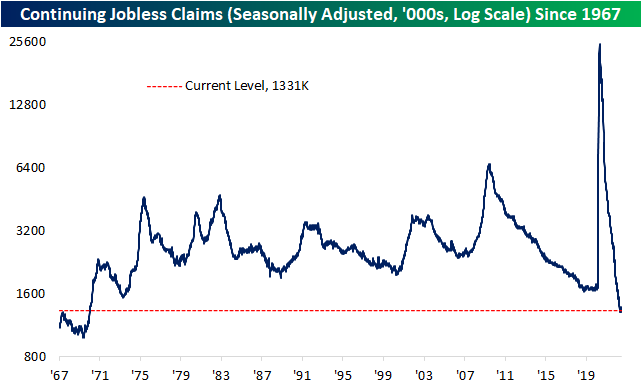

As for continuing claims, there has not been as notable of an increase recently when compared to initial claims. Continuing claims have only risen marginally from the low of 1.306 million in the week of May 20th to 1.331 million in the most recent reading as of July 1st. That most recent reading also saw a sizable improvement from the prior week with claims falling from 1.372 million. Click here to learn more about Bespoke’s premium stock market research service.