Bespoke’s Morning Lineup – 10/20/22 – Opposite Week

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It is clearly now the will of the parliamentary Conservative Party that there should be… a new prime minister.” – Boris Johnson 7/7/22

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Just over three months ago, Boris Johnson resigned as UK PM, and now this morning, his successor, Liz Truss, just announced she will be stepping down as PM. Do you think she had enough time even to unpack her bags? After trading lower throughout most of the night, S&P 500 futures had flipped modestly into positive territory this morning, but in the immediate aftermath of the resignation announcement, they pulled back closer to unchanged while Nasdaq futures are lower. Treasury yields have been behaving with nothing more than modest moves higher in yields across the curve. Crude, however, is rallying an additional 2%+ and back above $87 per barrel while copper is also up over 2%. Over in China, there was some positive news that the country is considering a reduction of the required quarantine time required for travelers in the country.

Here in the US, the general trend in earnings remains primarily positive, but there have been some duds. Tesla (TSLA) is trading lower after reporting weaker-than-expected sales raising concerns over demand, and Allstate (ALL) dropped over 10% after announcing Q3 catastrophe losses of $673 million. Lastly, Alcoa also reported weaker-than-expected EPS and sales and lowered forecasts for shipments, but anyone following the company over the years knows that it is hardly a bellwether.

In economic data this morning, Initial Jobless Claims came in lower than expected (214K vs 233K) while Continuing Claims were only slightly higher than forecasts (1.385 million vs 1.378 million). Also, the Philly Fed Manufacturing report for October improved less than expected rising from -9.9 to -8.7 versus forecasts for a reading of negative five.

This week’s equity market performance has been the opposite of the pattern we have seen this year. Heading into the week, the S&P 500 has averaged negative returns on every weekday this year except Wednesday when the average gain has been 0.20%. This week, the only down day (so far) was Wednesday, and on Monday and Tuesday, the S&P 500 was up well over 1%. While it’s still early, equity futures are once again modestly positive heading into Thursday’s trading. There’s still plenty of time left in the week but wouldn’t that be a welcome trend?

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Housing Continues to Roll…Over

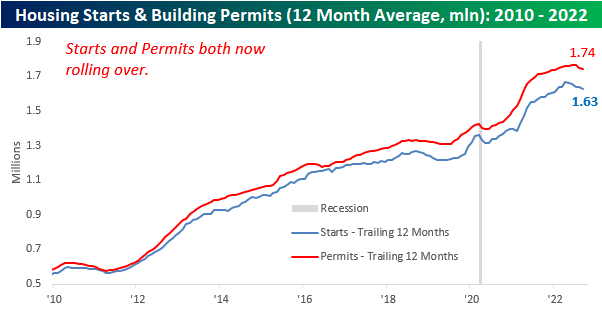

The latest update on Housing Starts and Building Permits from the Census Bureau was released this morning, and the results continue to reflect a significant slowdown in the sector. On a y/y basis, both starts and permits saw declines of 7.7% and 3.2%. respectively. The real weakness, however, has been in single-family units where starts are down 18.5% and permits fell 17.3% even as multi-family units were both up by double-digit percentages y/y. On a regional basis, the west was the only region to register a m/m uptick (4.5%) while the northeast was the only region registering an increase relative to last year. For permits, every region except the northeast was up m/m while it was the only region to register an increase on a y/y basis.

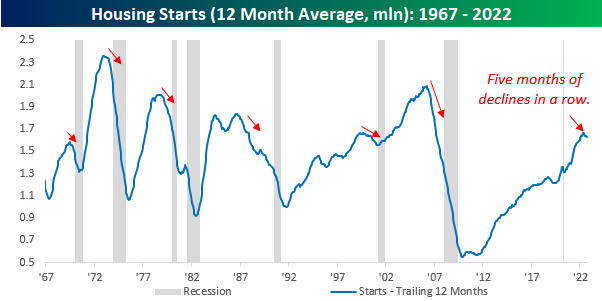

Housing Starts have historically done a good job predicting turns in the business cycle, so the fact that we have now seen five straight months of declines in this reading is just another indication of the risk of a recession on the horizon. We would note, however, that while recessions usually follow peaks in the 12-month average, they weren’t always imminent.

Looking more closely at the last few years, in addition to the decline in Housing Starts, the 12-month average of Building Permits has also started to roll over.

Single-family starts and permits have been even weaker. and both have now declined for five straight months. Also, the magnitude of the recent decline has been steeper than anything seen since the period from 2010 through 2012. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 10/19/22 – Worse Than 1987

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s the nearest thing to a meltdown that I ever want to see.” – John Phelan, NYSE Chairman (1987)

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

35 years ago today, US stocks experienced their largest single-day decline in history as the Dow dropped 22.6%. Back then, before most Americans had 401Ks, the stock market wasn’t nearly as enmeshed in the lives of Americans as it is today, but the plunge still was THE story of the day prompting questions over whether it was a repeat of 1929 and the depression that followed. With the benefit of time and hindsight, the market and economy quickly moved on from the 1987 crash, and it barely even registers as a blip on long-term stock charts. Since the close on 10/19/87, the S&P 500 has had an annualized total return of 10.71%. Even more notable, though, is that had you invested in the S&P 500 on the Friday before the crash, you’re annualized total return over that span would have still been just short of 10% (9.99%). Not bad for the worst-timed trade of all time.

Moving to the present day, 2022 has actually been worse than 1987. After the crash in 1987, the S&P 500 was down less than 8% YTD. Today, even after a gain of nearly 4% over the last week, the S&P 500 is down more than 20% YTD or twice the decline of the S&P 500 at this point in 1987.

This morning, futures are in the red after trading higher overnight as yields surge with the 10-year nearing 4.10%. Building Permits and Housing Starts were just released and came in mixed relative to expectations with starts missing forecasts while starts came in a bit higher than forecast. Mortgage applications continue to decline, though, suggesting that the sector will continue to face pressure.

It’s now been a week since the S&P 500’s closing low on 10/12 (the intraday low was on 10/13), so we wanted to take a bird’s eye look at where things stand at the index and sector level. Of the Russell 2000 (IWM), Nasdaq 100 (QQQ), and S&P 500 (SPY), IWM probably looks best from a technical perspective. Of the three indices shown, it is the only one that didn’t violate the June lows on a closing basis and is also the only one that made a higher high even if it was just on an intraday basis. For both QQQ and SPY, the charts look very similar as last week’s lows represented lower lows, and the rally over the last few days has yet to make a higher high.

At the sector level, Financials have been leading the charge, rallying more than 6% over the last week. Of the remaining ten sectors, the only one not up more than 2.5% is Utilities. Despite the gains from the last week, though, the only sector that has managed to retake its 50-day moving average is Energy, and four sectors (Technology, Real Estate, Consumer Discretionary, and Utilities) still remain at oversold levels.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Not All New Lows for Homebuilders

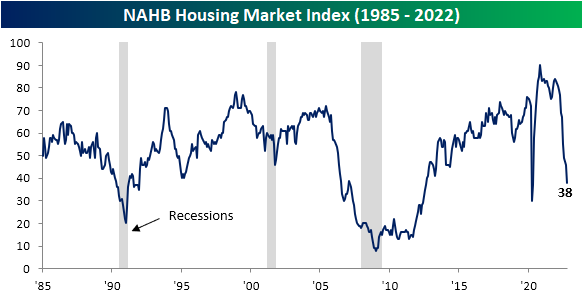

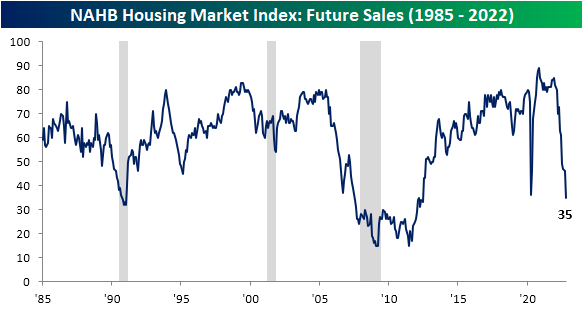

With mortgage rates running higher unabated and mortgage demand decimated, homebuilder sentiment has continued to tank. The latest reading on homebuilder sentiment from the NAHB hit a new post-pandemic low in October dropping from 46 down to 38. Outside of the weaker readings in May and April of 2020, August 2012 was the last time the index was as low as it is now.

Not only is the index at a new cycle low, but the 8-point month-over-month drop also ranks in the bottom 1% of all monthly moves. The declines in the present and future sales indices rank by similar magnitudes.

Although the headline index as well as sub-indices like present sales and traffic have not yet taken out 2020 lows, the index for future sales dropped to its lowest level since June 2012. As shown above, it has the lowest reading within its respective range historically of each of the sub-indices.

The only other index in the report that is below 2020 levels is the sentiment in the West region. While the Midwest and South have also fallen precipitously, the Northeast actually experienced a modest rebound in sentiment. Relative to other indices in the report, homebuilder sentiment in the Northeast is remarkably stronger with the index in the 62nd percentile relative to historical readings.

As for the technical picture of homebuilder stocks, recent declines have been a bit healthier than the broader market. Whereas major indices set new 52-week lows as recently as last week, the lows for the S&P 1500 Homebuilders Group at the end of September and the end of last week were between 7% and 8% above the June lows. While the line is somewhat choppy, relative strength versus the broader market has also been generally trending upward since the spring. In last Monday’s Closer, we further highlighted the disconnect between housing stocks and macro data.

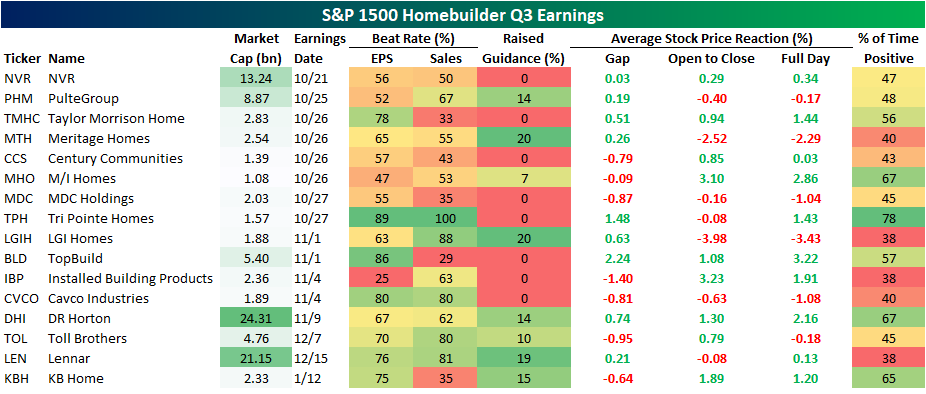

While homebuilder stocks have been holding up surprisingly well, earnings season is on the horizon which has the potential to change that picture; especially if said earnings start to mirror macro housing data. Using data from our Earnings Explorer database, below we show each of the S&P 1500 Homebuilder stocks as well as when they are expected to report earnings and what their historical Q3 earnings beat rates and stock price reactions have been.

Overall, Tri Pointe Homes (TPH) has been one of the strongest performers for Q3 with a positive reaction by the stock 78% of the time as it possesses the strongest beat rates as well. In fact, for TPH Q3 ranks as the best quarter of the year for stock price reactions. That is also the case for TopBuild (BLD) and KB Homes (KBH). Conversely, Q3 marks the weakest response to earnings for LGI Homes (LGIH), Cavco Industries (CVCO), Toll Brothers (TOL), and Lennar (LEN). Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 10/18/22 – Back to Back 500s

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Though I am often in the depths of misery, there is still calmness, pure harmony and music inside me.” – Vincent Van Gogh

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Stock futures are pointing sharply higher for the second day in a row this morning. While there are no specific catalysts, better-than-expected earnings against a backdrop of extremely oversold markets provide fuel for at least a short-term rally. Sentiment towards the market has been very negative as well. The latest example is the BofA Fund Manager Survey which showed the highest allocations to cash since 2001. Despite the rally in stocks, bonds are behaving as Treasury yields are modestly lower. In the commodities space, crude oil is little changed while gold is down modestly.

In the stock market lately, it’s either the end of the world or the beginning of a new bull market. In yesterday’s rally, the S&P 500’s net advance/decline (A/D) reading came in at +455 which followed a reading of negative -442 on Friday and +438 Thursday. With futures up nearly 2% this morning, it’s looking like another positive day of everything coming up roses (for now). We classify any day where the S&P 500’s net A/D reading is above positive 400 or below minus 400 as an all-or-nothing day. In the 1990s, all-or-nothing days were generally uncommon. There were seven years in the decade where there wasn’t more than one occurrence in an entire calendar year, and there were three with none.

As ETFs became more popular at the turn of the century allowing investors to buy or sell every stock in the index with one trade, the frequency of all-or-nothing days really picked up and peaked during the Financial Crisis when there were four straight years with more than 45. With all-or-nothing days occurring at a much more regular frequency in the last several weeks (and especially days), 2022 is giving some of those years from the Financial Crisis a run for their money. After three straight occurrences in a row (matching the total for all of 2017), the S&P 500 has now had 38 all-or-nothing days this year, putting 2022 on pace for 48. At that rate, this year would rank tied for third with 2010 trailing only 2011’s total of 70 and 2008’s total of 52.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Flip Flopping Like a Politician

With Thursday’s 2%+ rally, followed by Friday’s 2%+ decline, and now today’s 2%+ rally, the S&P 500 tracking ETF (SPY) has now rallied or declined 2%+ for the third straight day. Since SPY’s inception in the early 1990s, the current streak is the 26th time that the ETF has been up or down 2%+ for three straight days (and the second this year). Of those 25 prior streaks, eleven extended to a fourth day, so while 2% moves aren’t especially common (less than 8% of all trading days), when SPY has 2%+ daily moves for three straight days, there has been a 2%+ move the following day 44% of the time. There’s a saying in markets that strength begets strength; a corollary to that phrase would be volatility breeds more volatility. Of the five streaks that lasted at least five trading days, one was in July 2002, three were in 2008 (September, October, and December), and the most recent, which ended up being the longest on record was in March 2020.

While we’ve experienced a short burst of volatility in the last few days, SPY’s average daily move recently hasn’t been particularly extreme. Over the last 50 trading days, SPY has averaged a daily move of +/-1.25%, which while well off its lows from early September, is still well below the levels seen back in June. For all the talk about why the VIX hasn’t seen a major spike, one big reason is that we have yet to see a meaningful uptick in day-to-day volatility. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 10/17/22 – Maximum Indecision

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There is no more miserable human being than one in whom nothing is habitual but indecision.” – William James

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

A move by UK finance minister Jeremy Hunt to reverse most of the provisions of his predecessor’s ‘mini-budget’ have global equities and bond prices rallying this morning after Friday’s disappointing negative reversal. No major headlines out of China (good or bad) coming out of the country’s national party congress has also helped to contribute to the positive tone. So far, there hasn’t been much in the way of earnings flow, but earnings from Bank of America (BAC) were better than expected and the stock is trading up a bit more than the broader market. The only economic report of the day was Empire Manufacturing, and that report was weaker than expected coming in at -9.3 versus forecasts for a reading of -1.0. Given the massive swings of the last several days, what do you think an average investor’s confidence level is that the gains hold throughout the day?

For all the fireworks of the last two trading days, neither bulls nor bears really have much to show for it. On Wednesday, the S&P 500 closed at 3,577; by the week’s end, the S&P 500 was just six points higher at 3,583. In between those six points, though, there were some historic swings in equity prices. On Thursday, the S&P 500 gapped down over 2% but then quickly erased those losses before noon and kept rallying throughout the afternoon to finish up over 2.5%. On Friday, it looked as though bulls were going to get some follow-through as the S&P 500 rallied more than 1% in early trading. The positive momentum was fleeting, though, and within an hour of the highs, all the gains were erased, and by the end of the day, equities shed another 2.4% erasing nearly all of the prior day’s gains. In the span of two days, the S&P 500 had two extremely rare reversals in completely opposite directions.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 10/16/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

Billionaire Whimsy

Elon Musk Has the World’s Strangest Social Calendar by Joseph Bernstein (NYT)

A categorization of the strange and fragmented social life enjoyed – or perhaps, not enjoyed – by the Tesla CEO, who hops from one fragmentary encounter to the next across a sea of private jet flights, galas, and VIP lounges. [Link; soft paywall]

‘I Am Energy’: Inside the Bang Billionaire’s Reeling Empire by Anders Melin (Bloomberg)

A heartrate-popping profile of an energy drink company taking on the giants of the industry fueled by the mashup of hype, energy, and shady dealings that scream “Florida” from top to bottom. [Link; soft paywall]

China

World Bank Cuts China Growth Forecast as Covid-19, Real-Estate Crunch Take Toll by Jason Douglas (WSJ)

The combination of collapsing property activity and restrictions on activity related to COVID-19 are suppressing Chinese growth that is also hampered by Fed tightening. [Link; paywall]

Ocean plastics: How much do rich countries contribute by shipping their waste overseas? by Hannah Ritchie (Our World In Data)

A ban on imports of plastic waste to China has helped push down global plastics trade volumes dramatically, helping to reduce the volume of plastic being transported by sea and therefore plastic waste that makes it in to oceans. [Link]

Labor Relations

Exxon’s Exodus: Employees Have Finally Had Enough of Its Toxic Culture by Kevin Crowley (Bloomberg)

A revealing narrative that illustrates how pressure on companies to decarbonize or behave more ethically often comes internally, rather than externally from investors following the precepts of ESG investing. [Link; soft paywall]

Medical Marvels

Human hibernation is a real possibility – this is how it might work by Alex Wilkins (NewScientist)

Our ancient ancestors may have hibernated, a common survival strategy among mammals. Dormant brain paths may be the key to recovering that ability which has since been lost. [Link; paywall]

How a Diabetes Drug Became the Talk of Hollywood, Tech and the Hamptons by Sara Ashley O’Brien (WSJ)

A drug meant to help manage Type 2 diabetes is being used off-label for weight loss; another drug that uses a similar active ingredient is approved for weight loss among those with clinical weight management challenges. [Link; paywall]

Policy

Biden Proposal Could Lead to Employee Status for Gig Workers by Noam Scheiber (NYT)

A proposed rulemaking by the Labor Department would create a test to determine whether gig workers are employees or contractors, opening up a potential requirement to pay benefits and minimum wages at scale. [Link; soft paywall]

It’s Official: The Fed’s in the Red by Tracy Alloway (Bloomberg)

Rising payouts of interest amidst a stable yield on portfolio securities mean the Federal Reserve is now recording operating losses on a weekly basis. [Link; soft paywall]

How California’s Bullet Train Went Off the Rails by Ralph Vartabedian (NYT)

Good old fashioned corruption turned a laudable effort at building a high speed rail link into a boondoggle of historic proportions. [Link; soft paywall]

Astrophysics

Black Hole Pukes Up Star Years After Eating It by Isaac Schultz (Gizmodo)

After gobbling down a star three years ago, a black hole spit back up material at half the speed of light. Scientists are trying to understand why. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — Equity Risk Gauge

This week’s Bespoke Report newsletter is now available for members.

In this week’s newsletter, we highlight some absolutely crazy market stats from the last few trading days and then introduce a new “equity market risk gauge” that clients can use to quickly understand our overall market view using eight key components.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Bespoke’s Morning Lineup – 10/14/22 – Let the Games Begin

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Just before you break through the sound barrier, the cockpit shakes the most.” – Chuck Yeager

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Let the games begin. Today marks the unofficial start to earnings season as the major banks come out of the gate with what have generally been positive results. Of the seven banks reporting, five exceeded EPS forecasts, one (Morgan Stanley) missed and one was inline (US Bancorp). Besides the Financials, UnitedHealth (UNH) also reported and topped forecasts on both the top and bottom lines. It’s still early, but so far, no major disasters. JPMorgan Chase (JPM) is even poised to trade higher in reaction to earnings which, if it holds, would be something it hasn’t done in over two years!

Outside of earnings, it’s a busy day for economic data this morning with Retail Sales (mixed relative to expectations), Import Prices (lower than expected), Business Inventories, and Michigan Sentiment all on the docket between now and 10 AM. If that wasn’t enough, we’ll also hear from three different Fed officials (George, Cook, and Waller). So much for a quiet Friday.

In international news, the German economic ministry said that a recession likely started in Q3 and will last for three quarters. The political situation in the UK continues to be a mess as PM Truss will reportedly reverse her tax plans and allow the corporate tax rate to increase while at the same time sacking her finance minister. That news has pushed the yield on the 10-year gilt down 23 bps and below 4%.

US Futures are still in positive territory, but they are well off their highs, and if the last several weeks have told us anything, it’s that where the market starts the day and where it finishes usually varies widely.

75 years ago today, Chuck Yeager accomplished the ‘impossible’ becoming the first pilot to ever break the sound barrier. Up until that time, the thought among ‘experts’ was that once an aircraft approached the speed of sound it would break apart resulting in the death of the pilot. Not really the way anyone wants to go out. Yeager proved the experts wrong, but in the moments leading up to that point, he remarked that the cockpit of the aircraft starts to shake violently.

Based on Yeager’s description, the market looks like it’s trying to break its own sound barrier. After trading up over 1% in pre-market trading yesterday, the stronger-than-expected CPI erased all the gains and more. Shortly after the open, the S&P 500 had dropped nearly 4% from its pre-market highs before staging an epic rally of over 5%. Even in this ‘all or nothing’ type of market environment, reversals of that magnitude are rare.

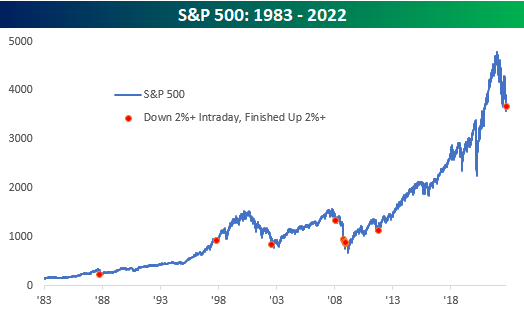

As shown below, prior to yesterday there were only nine other days since 1983 when the S&P 500 fell more than 2% intraday but finished the day up over 2%. The most recent occurrence was over eleven years ago on 10/4/11 and before that, there were five separate occurrences in 2008 alone! The three remaining reversals were in 2002, 1997, and 1987.

We’re not sure when or where the ultimate bottom in stocks will end up, but violent moves like yesterday tend to occur closer to lows than highs. It’s easy to remember the good parts of a bull market where stocks rally, but people usually forget that long-term rallies emerge out of chaos where investors become increasingly convinced that the only viable path if any exists at all, is lower. The early days of bull markets feel like anything but a sure thing.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.