Bespoke’s Morning Lineup – 1/6/23 – And the Number is…

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The telegraph would bind man to his fellow-man in such bonds of amity as to put an end to war.” – Samuel Morse

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

In what has been an overall trend of weaker economic data, the monthly non-farm payrolls report has been an oasis. Heading into this morning’s report, the headline reading had come in better than expected for a record eight straight months, and this morning’s stronger-than-expected report extends the streak to nine. The only notable current streak we can think of that has gone longer is the 11 unsuccessful votes to elect a Speaker of the House.

While the headline reading has enjoyed a record streak of better-than-expected readings, the trend heading into this month and which still remains in place is one of weaker momentum. As shown in the chart below, while readings have been positive for the last two years, they have generally been trending lower. Combining the streak of better-than-expected readings with the actual readings in the total number of jobs created, economists were correct in forecasting a slowdown in job growth, but they overestimated the pace of it.

Not only that, but average hourly earnings and the length of the average workweek both came in weaker than expected.

Heading into this morning’s report, other indicators of employment that we saw earlier this week, including the ADP Private payrolls and jobless claims, investors were gearing up for a hot number this morning. The fact that the headline reading only came in 20K above expectations and that wage growth was weaker than expected are both modest positives.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

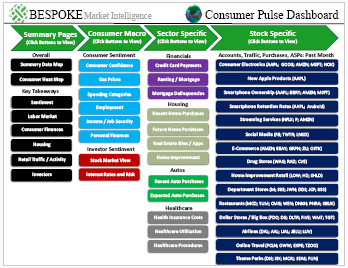

Bespoke’s Consumer Pulse Report — January 2023

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

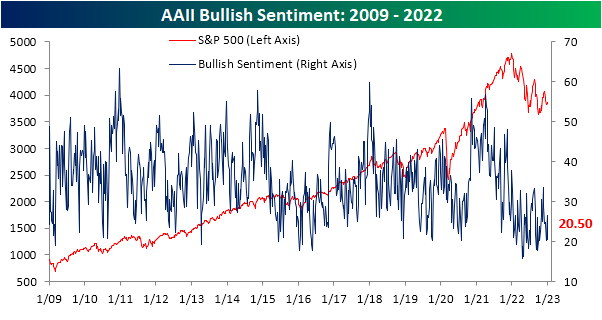

Bulls and Bears Back Off

The S&P 500 has seen some choppy price action heading out of 2022 and into 2023, and that has seemed to have sent shivers down the spines of investors. Only 20.5% of respondents to the weekly sentiment survey run by AAII reported as bullish this week. That is down from 26.5% last week and is just shy of the recent low of 20.3% from two weeks ago.

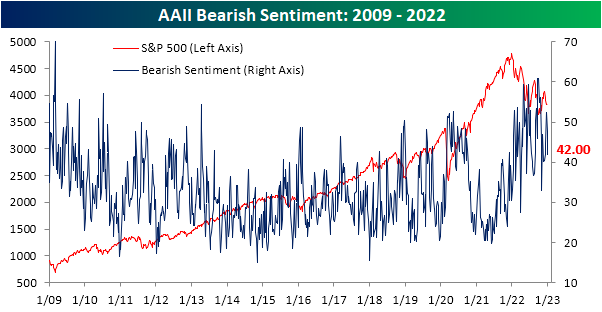

Although bullish sentiment dropped six percentage points week over week, there was not a shift to bearish sentiment as it also fell from 47.6% down to 42.0%. That is the lowest reading since December 8th.

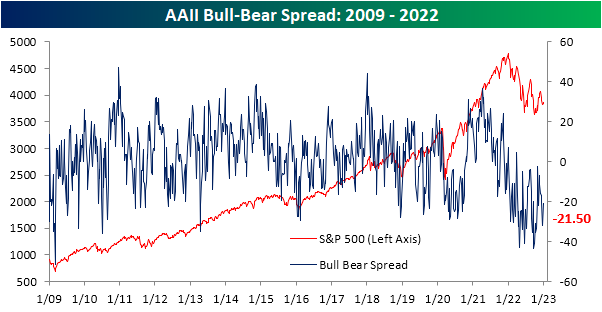

Given both bullish and bearish sentiment fell by similar amounts, the bull-bear spread moved down to -21.5, slightly below the previous week’s reading of -21.1 and extending the record streak of negative bull-bear spread readings to 40 weeks.

With both bullish and bearish sentiment falling, neutral sentiment surged to 37.5% which was the most elevated reading since the last week of March. Additionally, the 11.6 percentage point week-over-week increase was the largest since a 12.6 percentage point surge in July 2018.

Although that may sound like an impressive and notable jump, historically double-digit increases in neutral sentiment in just one week have been followed by somewhat ‘meh’ returns. Both average and median performance are worse than the norm albeit the index has moved higher more than half the time one month to one year out.

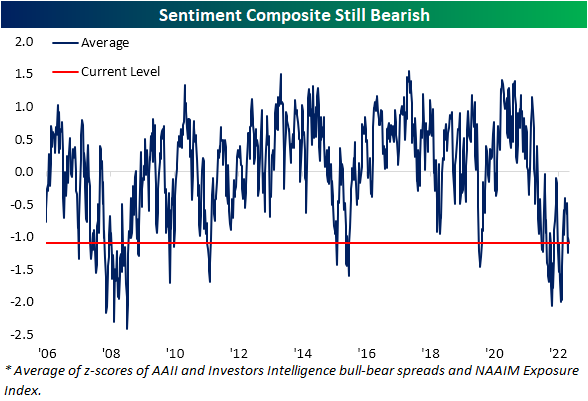

As the AAII survey continues to have an overarching negative tone, the same can be said for other surveys like the Investor’s Intelligence and NAAIM readings. Combining all three of these into a composite, this week’s reading was roughly 1 standard deviation below its historical average. While that implies sentiment is extremely bearish, that is only in the middle of the past year’s range. Additionally, we would note that this composite has been negative (meaning these indicators in aggregate are more bearish than historically normal) for a full year. The only other time period since at least 2006 when that was also the case was in the 54 weeks ending June 2009. Click here to learn more about Bespoke’s premium stock market research service.

Higher Claims on the Horizon?

Unfortunately for equities, between a stronger-than-expected ADP payrolls number and stronger-than-expected jobless claims data, today’s data showed some strength in the US labor market. Honing in on the weekly claims print, initial claims dropped all the way down to 204K this week. That marked a 19K decline from last week’s 2K downwardly revised level of 223K and brings claims to the lowest level since the last week of September when we last saw a sub-200K print. Expectations were calling for the reading to go unchanged from the unrevised level of 225K from last week.

Even continuing claims improved falling to 1.694 million instead of the forecasted increase to 1.728 million. Last week’s reading of 1.71 million had been the highest since February 2022 as continuing claims have steadily risen (at a pace consistent with past recessions) in the past several months.

Although both initial and continuing claims had strong showings, there is the caveat that the current period was smack dab in the middle of the holidays. For starters, that could have some impact on the weekly seasonal adjustment, but more importantly, we would note that those are some of the weeks of the year most prone to revisions.

In the chart below, we show the median revision (expressed as an absolute percent change from the first release) for each week of the year since 1997. The final week of the year has typically experienced a revision of +/-3.8%, tying the week of the July 4th holiday for the largest revision of the year. That means that while claims did show improvement this week, it might not be worth reading too deep into that single number. Further data will be beneficial to help confirm this print (via revisions or lack thereof) as well as provide a clearer picture of the trend, which had been one of deterioration leading into the end of the year.

One other slightly more anecdotal factor worth noting on the stronger-than-expected jobless claims data is that the strong reading this week has gone contrary to the number of layoffs that have made their way into headlines lately. Although the company initially announced the layoffs back in November, Amazon (AMZN) announced today that it plans to lay off a higher number of employees than previously stated (18K versus 10K originally). That also follows an announcement of a significant reduction of roughly 10% of the workforce of Salesforce (CRM) yesterday.

Over the past few months, news story mentions (in data aggregated from Bloomberg) of things like job cuts, firings, and layoffs have surged reaching a high of 16.5K on a four-week rolling average basis in November (around the time of Amazon’s initial announcement). Although that reading has pulled back in the several weeks since then, news counts on the topic remained elevated through the end of 2022 and are likely to get a further bump with this week’s headlines. Over the past decade, these story counts have generally followed the path of both initial and continuing claims. More recently, however, there has been somewhat of a divergence with story counts far outpacing actual claims figures.

That divergence could be for an array of reasons such as workers are quickly finding other roles and not needing to apply for unemployment insurance, but another thing to consider is the timing of the announcement of layoffs versus when they actually happen. For example, in the case of Amazon, while the initial announcement was all the way back in November, those cuts were not planned to go into effect until mid-January. In other words, while not in the data now, higher claims may very well be on the horizon. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 1/5/23 – ADP and Jobless Claims Stronger Than Expected

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Yesterday’s home runs don’t win today’s games.” – Babe Ruth

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures had reversed overnight lows and moved into positive territory earlier, but the stronger-than-expected ADP Private Payrolls report coupled with lower-than-expected jobless claims has pushed equities back in the red. Jobless claims were just released and also came in better than expected on both an initial and continuing basis, and that hasn’t helped the tone heading into the opening bell as the 10-year US Treasury yield has spiked up to 3.75%.

It was a close call but Santa did come this year as the S&P 500 posted a positive return during the seven trading day window (the last five trading days of one year and the first two of the next) when the Santa Claus Rally is said to occur. With a gain of 0.80%, though, it was a smaller-than-normal rally. As shown in the chart, that continues a trend of recent subdued returns during this period. In fact, the last time the S&P 500 rallied more than 2% during the Santa Claus Rally was back in 2013, and that ten-year drought without a 2% rally is the longest since at least 1953 when the five-day trading week on the NYSE in its current form began. Hey Santa, stop being such a cheapskate!

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Homebuilders Shrugging Off Mixed Data

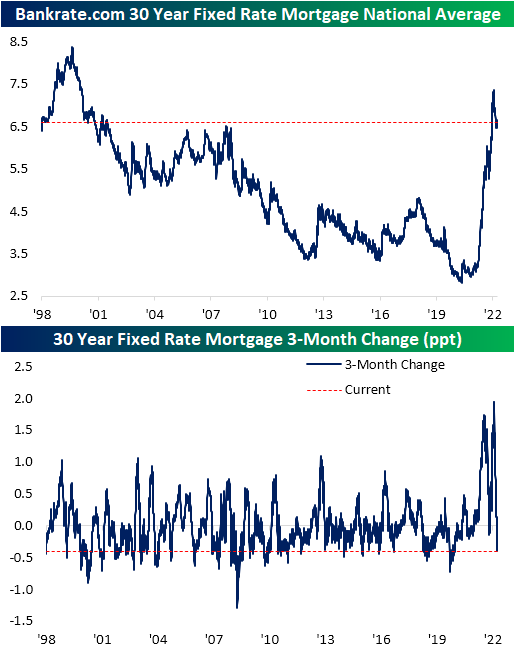

The national average for a 30-year fixed-rate mortgage has come well off its highs falling to 6.6% versus a high of 7.35% in early November. Despite the decline, mortgage rates remain at levels not seen since the early 2000s. We would also note that rates have gone on a series of wild swings in the past year. The second chart below shows the rolling 3-month change since 1998. Whereas most of the year saw rapid increases the likes of which have not been seen in the past quarter century, the current drop of 0.4 percentage points over the past few months has ranked as the largest since late 2020 and is just shy of a bottom decile reading of all periods.

With mortgage rates giving buyers some relief, purchase applications had generally been on the rebound throughout November and December. However, the final week of 2022 saw a large reversal in purchase apps with a 12% week-over-week decline (potentially as a result of residual holiday seasonality) in the largest single-week decline since the last week of September.

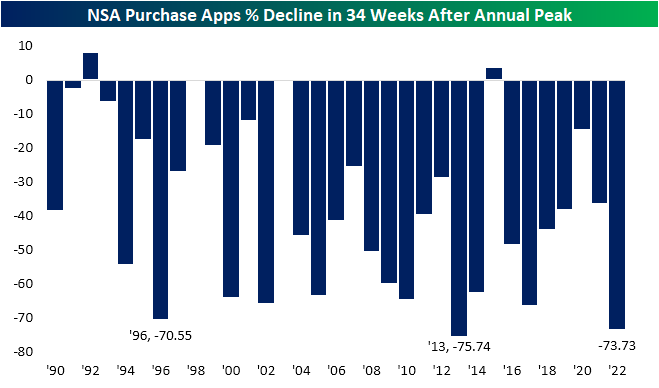

While it is hard to say if the final week of 2022’s large decline was seasonal or a return to purchase apps that are more consistent with readings from earlier in the fall, 2022 tended to follow seasonal patterns. The year began with applications around some of the strongest levels of the past decade and they continued to rise into peak housing season in the spring with applications hitting their pinnacle in the first week of May. The typical seasonal drift was then exacerbated by the added headwind of higher rates, and applications finished the year with the worst reading since 2014 for the comparable week of the year. Additionally, looking at the drop for each year from the annual high through 34 weeks later (second chart), 2022’s percentage drop was the second largest since 1990 behind only the 75.7% decline in 2013.

Refinance applications have continued to hit new lows as this week saw yet another decline down to the lowest level since May 2000.

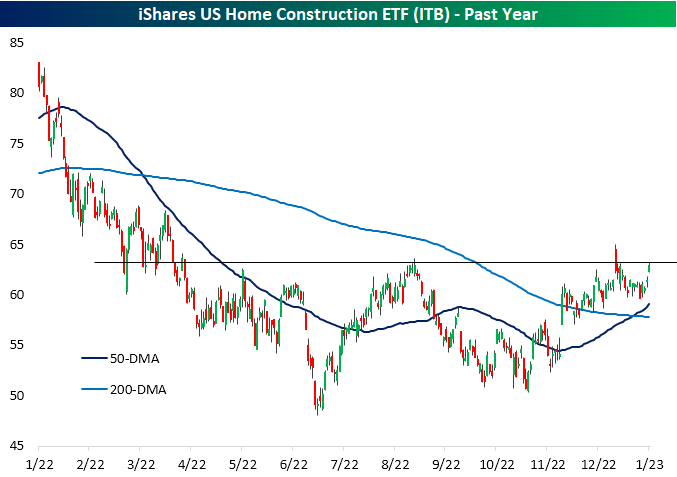

Even though there are some silver linings in recent data, housing activity remains weak. Homebuilder stocks continue to look past that though and continue to shrug off much of the broader market choppiness. The past week has seen the homebuilders, proxied by the iShares US Home Construction ETF (ITB), rally 3.25%. That has largely erased the mean reversion from the second half of December and brings the ETF right up to resistance at the mid-August highs. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 1/4/23 – Energy and Rates Down, Stocks Up

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Yet we still live in a troubled and perilous world. There is no longer a single threat. There are many. They differ in intensity and in danger. They require different attitudes and different answers.”– Lyndon B Johnson

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Investors are waking up to a bit of – dare we say it – goldilocks this morning as commodity prices and treasury yields are both lower and economic data out of Europe has been positive. Service sector PMIs for the Eurozone and each of the largest economies in the region have come in better than expected while some inflation-related reports have come in lower than estimates. Import Prices in Germany for the month of November dropped more than expected (-4.5% vs -1.6%) and French CPI for December unexpectedly declined. In response, futures are modestly higher heading into what is likely to be an eventful day with ISM Manufacturing and JOLTS at 10 AM, and the FOMC Minutes at 2 PM.

It wasn’t a particularly great year for financial assets anywhere across the spectrum in 2022. The only area to buck the trend was Energy. To start off 2023, though, Energy has been among the weakest areas as WTI opened the year with a decline of 3.9% on Tuesday (and is down an additional 3%+ this morning). With that decline, the Energy sector tumbled 3.5% (and is down another 1.5% in the pre-market).

The chart for WTI doesn’t look particularly encouraging. After making a lower high last June, the sector has been in a relatively consistent downtrend for more than six months, and a key trend since that peak has been multiple occurrences where the sector tried to rally back above its 50-DMA but failed. The last week has been the most recent example. After failing to take out its 50-DMA yesterday, WTI’s plunge yesterday was its largest decline to kick off a new year since 2007.

Even as oil prices have plunged from their 2022 highs, Energy stocks have held up impressively well. It was only back in mid-November that the Energy sector made a new high for the year while oil prices were well off their highs. Despite the outperformance, the sector’s technical picture has deteriorated. November’s peak was technically a higher high, but it’s starting to look more like a double-top. The fact that after trading below its 50-DMA in early December, the Energy sector has had multiple failed attempts to trade back above that level is a concern for longs. Like crude oil, Tuesday’s 3.6% decline was the weakest opening-day performance for the sector to start a year since 2007.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Market Calendar — January 2023

Please click the image below to view our January 2023 market calendar. This calendar includes the S&P 500’s historical average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 1/3/23 – Turning the Page

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The beginning is always today.” – Mary Shelley

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It’s a new year but it’s looking like the same old market as positive futures drift off their highs into the opening bell. With treasury yields sharply lower, crude oil and natural gas also lower, and foreign equity markets firmly higher to kick off the year, it’s a positive backdrop for equity bulls to start the year. After a quiet week data-wise to close out the year, things will pick up this week with Construction Spending, ISM, and an Employment report all headlining the calendar on this shortened week.

People tend to put a lot of emphasis on first impressions, so what looks like a positive start to the year for stocks should be a welcome sign. With the S&P 500 (as proxied by SPY) poised to gap up 0.45% at the open this morning, it would be the best start to a trading year since 2020 when SPY gapped up 0.52%. If stocks manage to take out that level at the open, it would be the strongest start to a year since 2017 (0.68%). The last time SPY gapped up 1%+ to start a year was in 2013 (1.9%), and that followed a nearly equally strong start to the year in 2012 when SPY gapped up 1.8%.

So, how important are these first impressions in terms of the remainder of the year? For all years since 1994, when SPY had a larger than average opening gap to start the year, its median performance from the open on the first trading day of the year through year-end was a gain of 13.93% with positive returns 82% of the time. That’s nothing to sneeze at, but it’s actually right in line with the historical average for all years since 1994. On the other hand, in the four years when SPY gapped down to start the year (1996, 2014, 2016, and 2019), its median performance for the remainder of the year was 18.3% with positive returns all four times.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 1/1/23

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

The Year Coming & Going

Why everyone thinks a recession is coming in 2023 (CNBC)

Consensus from economists and forecasters is for a US recession in 2023 with Federal Reserve monetary policy tightening the key driver of the slowdown. [Link]

The Year the Long Stock Market Rally Ended by Joe Rennison (NYT)

Soaring interest rates in response to high inflation have crushed the stock market this year, delivering the sort of grinding bear market that was impossible during the previous decade. [Link; soft paywall]

SBF

POLITICO Playbook: Inside the scramble to trace SBF’s dirty money by Ryan Lizza, Rachael Bade, and Eugene Daniels (Politico)

Political donations by the FTX and Alameda Research chief have spiraled outwards and look likely to have driven a straw-donor scheme that has enveloped at least one progressive think tank. [Link]

Sam Bankman-Fried’s only way out is ratting on Binance and Tether by Steven Stradbrooke (Coingeek)

A speculative account that might explain why Sam Bankman-Fried isn’t still behind bars: cooperation on an even bigger fraud fish. [Link]

Consumer Spending

Economy Has Drinkers Choosing Prosecco Over Champagne by Jennifer Maloney (WSJ)

Consumers are less inclined to shell out for premium spirits brands and are more inclined to reach for cheaper swill when they shop for hooch. [Link; paywall]

The world just doesn’t have enough planes as travel roars back (The Straits Times)

Soaring demand for travel combined with supply chain disruptions and production slowdowns during the pandemic mean the global airliner order backlog numbers nearly 13,000 planes. [Link]

Consumers Change Food-Delivery Habits by Preetika Rana and Heather Haddon (WSJ)

After booming during the pandemic, food delivery is shifting thanks to smaller discretionary budgets and high inflation. [Link; paywall]

Auto Industry

Carmakers quietly cut ties with China in supply chain shake-up by Peter Campbell, Eri Sugiura, and Edward White (FT)

Global automakers are shifting away from parts purchases in China, joining other industries in questioning reliance on the country. [Link; paywall]

Electric Vehicle Charging Investment Approaches the $100 Billion Mark by Ryan Fisher (Bloomberg)

By the end of this year investment in electric vehicle charging hardware and installation will top more than $60bn with almost half that again due for next year alone. [Link; paywall]

Toyota Chief Says ‘Silent Majority’ Has Doubts About Pursuing Only EVs by River Davis and Sean McLain (WSJ)

Early skepticism about fully battery-electric vehicles have left Toyota far behind the curve in that segment, so it’s not a surprise that management is talking down an area they lag the market. [Link; paywall]

Food

Who created chicken tikka masala? The death of a curry king is reviving a debate by Emily Olson (NPR)

The ubiquitous tomato-cream chicken is most likely not a creation of the Indian subcontinent at all but a Scottish hybrid based on tomato soup. [Link]

How Changing Diets Leave Us Exposed to War, Extreme Weather and Market Turbulence (Bloomberg)

Global diets are shifting towards the same uniform diet across countries and continents as the world eats more grain, more meat, and less local food. [Link]

Google Employees Brace for a Cost-Cutting Drive as Anxiety Mounts by Nico Grant (NYT)

Gone are the days when massive search revenues and ever-expanding cloud investment fueled huge salaries and a monstrous workforce. The vibe, as they say, has shifted. [Link; soft paywall]

Money Management

Schwab’s Investment in Dynasty Could Be the First of Many by Diana Britton (Wealth Management)

With assets flocking to the registered investment advisor space, brokerage giant Schwab is buying up a services provider that caters to the space. [Link]

China

China Estimates Covid Surge Is Infecting 37 Million People a Day (Bloomberg)

As China’s government lets COVID infections rip, tens of millions of people are contracting the virus every day in one of the largest booms in COVID cases since the pandemic began. [Link; soft paywall, auto-playing video]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!