Chart of the Day: Breakout Emerging

Initial Jobless Claims Slightly Higher

After falling to 210,000 last week, initial jobless claims were forecast to see an increase to 215K. Instead, claims rose less than expected only rising to 214K. Jobless claims also remain flat over the past year as this week’s reading was only 1K lower than the same week last year. Regardless of the sideways range, jobless claims remain at very healthy levels having been at or below 300K for a record 241 weeks and at or below 250K for a record 106 weeks.

With this week’s increase in the seasonally adjusted data, the four-week moving average has ticked slightly higher. This was a result of a lower reading of 210K from mid-September rolling off of the average to be replaced by this week’s 214K. This was the third consecutive week with an increase in the average, albeit those increases have been small at 1K or less each week. While the moving average has been moving higher over the past month, it has by no means been by a concerning degree.

Turning to the non-seasonally adjusted data (NSA), claims rose to 197.8K. Through the end of the year, we are likely to see many more weeks with an uptick in the NSA number due to seasonal factors. Year-over-year on the other hand, which provides a better look at NSA data, claims rose by 7.3K. That is the largest YoY increase since July and the first time for the current week of the year that there has been a YoY increase since 2012. But, as with the other data, the level claims sit at are still very healthy. This week’s reading was far below the average of 323.25K for the current week of the year since 2000. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Housing Starts Retreat, But Still Healthy

Both Housing Starts and Building Permits pulled back in September from their extremely strong August levels. In both cases, the pullback was expected, although in the case of Housing Starts, the decline was larger than expected (1.256 mln vs 1.320 mln estimate). Looking at the charts of both series below, September’s levels remain near their highs of the cycle.

The table below breaks down this month’s report by single and multi-family units as well as regions. While both starts and permits were down this month, all of the declines were in multi-family units (which was a driver of last month’s gains). In fact, in the case of both starts and permits, single-family units were up both on a m/m and y/y basis.

In a post on homebuilder sentiment yesterday, we noted that it would be hard to imagine that the economy is on the cusp of a recession with homebuilder sentiment being so high. Similarly, when we look at the 12-month average of Housing Starts and Building Permits over time, current trends are not suggestive of a broader economic downturn. As shown in the top chart below, every prior US economic recession has historically been preceded by a downturn in the 12-month average of Housing Starts. In some cases, the peak in starts came well before the recession started and in others, it was within a year. Looking closely at the chart, while the 12-month average most recently peaked back in September 2018, it hasn’t yet shown signs of rolling over as it did leading up to prior recessions.

In fact, if we take a closer look at both Housing Starts and Building Permits, the 12-month average has actually started to tick higher again. That’s an important trend because going back to the mid-1960s, there has never been a period where we saw rising levels of starts heading into a recession. Start a two-week free trial to Bespoke Institutional to access our actionable research and interactive tools.

The Bespoke 50 Top Growth Stocks — 10/17/19

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 108.3 percentage points. Through today, the “Bespoke 50” is up 221.5% since inception versus the S&P 500’s gain of 113.2%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bespoke Morning Lineup – 10/17/19

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Chart of the Day: Weak Dollar and Stocks

The Closer – Weekly Fund Flows Update, Nordic Nosedive, Beige Book – 10/16/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we show the record level in EURNOK and reversal in the past couple of years build up in UST long positioning. We also show what precedent the largest banks have set for earnings given their results so far. We also take a more quantitative look at the Fed’s Beige Book with our Beige Book Index. We finish with our weekly recap of fund flows.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Netflix (NFLX) Earnings On Deck

The charts of the FAANG stocks have left something to be desired over the past several months. Streaming giant Netflix (NFLX) is a prime example. The stock managed to recover nearly all of its late 2018 losses in the first half of 2019, but it gave up the ghost in the wake of July’s earnings report when the company missed subscriber estimates. NFLX has remained in a downtrend in the months since with a recent lower low around support near last November’s lows. Granted, this recent low was still 8.9% above the 52-week low from Christmas Eve of last year. Now at the top of this downtrend, NFLX reports earnings once again tonight after the close and given its historical volatility around earnings, the stock has an opportunity to either break out or break down.

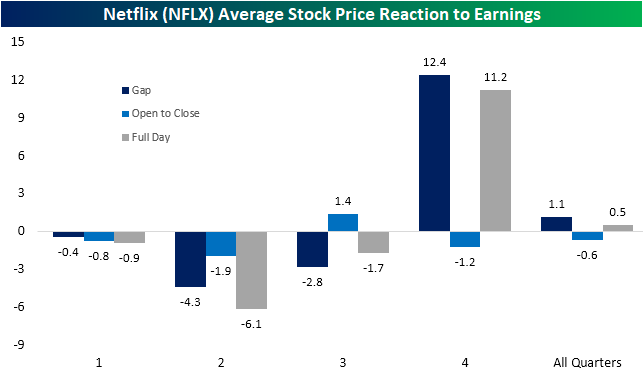

Although the 10.27% one-day decline in response to the last quarter’s report that preceded NFLX’s recent downtrend may sound bad, the move was basically par for the course. Netflix is one of the most volatile stocks on earnings with shares averaging an absolute move the day after earnings of 12.78% across all quarters since 2002. So last quarter’s decline was actually smaller than the average! As shown in the table from our Earnings Explorer tool below, that was the worst full-day decline in reaction to earnings since Q2 2016, but there was actually a larger gap down at the open just one year prior in July of 2018; although most of that decline was regained intraday. Headed into tomorrow, it should come as no surprise to investors if the stock swings wildly regardless of what the results of the quarter are. EPS is estimated to come in at $1.05 and sales are expected to grow to $5,247.5 million.

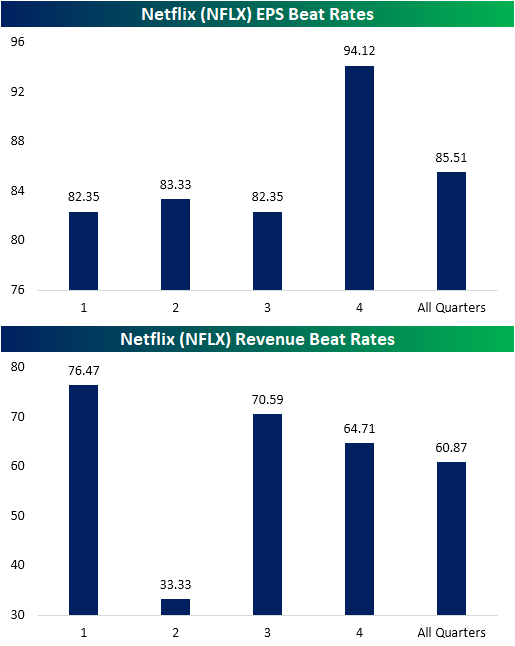

Looking at the historical trends of NFLX’s beat rates, last quarter’s revenue miss could have been expected. NFLX has only exceeded Q2 revenue estimates 33% of the time. The other three quarters have much stronger beat rates. As for today, the third quarter’s revenue beat rate is the second strongest at 70.59%, only behind the first quarter’s 76.47% beat rate. When Netflix has beaten revenue estimates in the third quarter, it has averaged a one-day share price gain of 2.74% with the stock positive two-thirds of the time. On the other hand, when there is a revenue miss in the third quarter, the stock has always declined, averaging -12.3%.

With regards to EPS beat rates, Netflix most consistently exceeds expectations in the fourth quarter having done so 94.12% of the time. Other quarters are a bit weaker in the low-80% range. For the third quarter, as with the first quarter, NFLX has beaten EPS 82.35% of the time.

Looking at the average stock price reaction to earnings, last quarter’s decline again could have been expected as the second quarter has averaged the largest gap down, decline from open to close, and full-day decline of any quarter. Third-quarter results have only been slightly better as NFLX averages a gap down of 2.8% and a full day decline of 1.17%. One silver lining, though, is that the third quarter is the only quarter that has seen the stock rise on average (1.4%) from the open to the close after its initial opening gap. Meanwhile, the fourth quarter has typically seen the strongest overall performance with an average gap up of 12.4% and full-day gain of 11.2%. Start a two-week free trial to Bespoke Institutional to access our interactive Earnings Explorer and much more.

Fixed Income Weekly – 10/16/19

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we review which parts of the Treasury curve did not invert this cycle.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Homebuilder Sentiment Surges

Homebuilder sentiment came in significantly better than expected in October rising from 68 up to 71 compared to expectations for the index to remain unchanged at 68. With October’s gain, overall sentiment is currently at its best level since February 2018. Also notable is the fact that over the last ten months, the NAHB Homebuilder Sentiment index is up 15 points. That’s the strongest ten-month rate of change in more than six years. With homebuilder sentiment so strong, it’s hard to imagine that the economy is on the cusp of a downturn.

Looking at the internals of the report, strength was broad-based at a national level as Present and Future Sales as well as Traffic all saw impressive gains. On a regional level, though, it was a bit of a mixed picture. While sentiment in the South and West increased, sentiment in the Northeast and Midwest declined. In the case of the South, though, sentiment hit its highest level since June 2005 (chart below)! Start a two-week free trial to Bespoke Premium to sample our actionable research. If you use this checkout link, you’ll receive a 10% discount on an annual membership if you stick with it past your trial period.