Bespoke’s Morning Lineup – 4/14/20 – Earnings Season Kicks Off With a Thud

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Earnings season kicked off this morning with JP Morgan (JPM) reporting Q1 results. If first impressions are to be trusted, it could be messy. Of the six companies reporting this morning, three missed EPS forecasts (JP Morgan, Wells Fargo, and Conn’s), two beat EPS forecasts (First Republic and Johnson & Johnson), and one reported inline bottom-line results (Fastenal). This is just the tip of the iceberg, though, as the pace of reports will only pick up going forward. Despite the weakness in results, the one silver lining is that expectations couldn’t be much lower, so that should help to set the bar incredibly low.

Read today’s Bespoke Morning Lineup for a discussion of overnight market events in Asia and Europe, the first batch of US earnings reports, the latest trends and statistics of the COVID-19 outbreak, and other stock-specific news of note.

We’ve talked in the past about how the US and every sector has finally moved out of oversold territory. On a more global scale, we have seen the exact same trend. The image below is from our Trend Analyzer and shows the performance of various international regional ETFs. What’s striking about this chart is how every ETF has not only moved out of oversold territory, but they are also all at nearly the same spot with regards to its trading range. Talk about uniformity!

The Closer – Statecrafting, Retracing Prices, Credit Premiums – 4/13/20

Log-in here if you’re a member with access to the Closer.

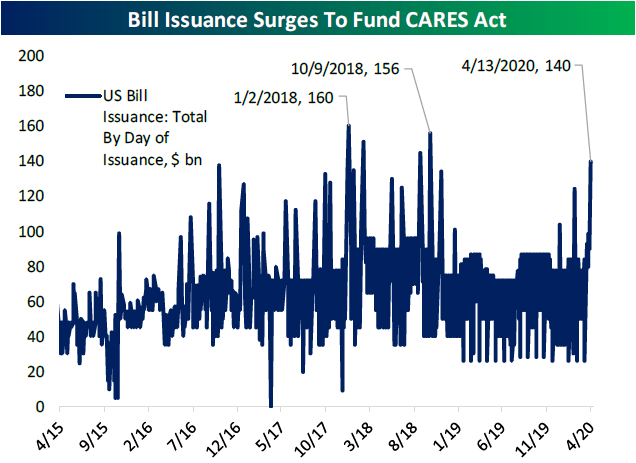

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with the news that several states are beginning to strategize on how to reopen their economies. Next, we turn to several technical developments across the equities space before taking a look at today’s $140 billion of bill issuance. We finish with a look at the massive premiums in the high yield ETF space.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Daily Sector Snapshot — 4/13/20

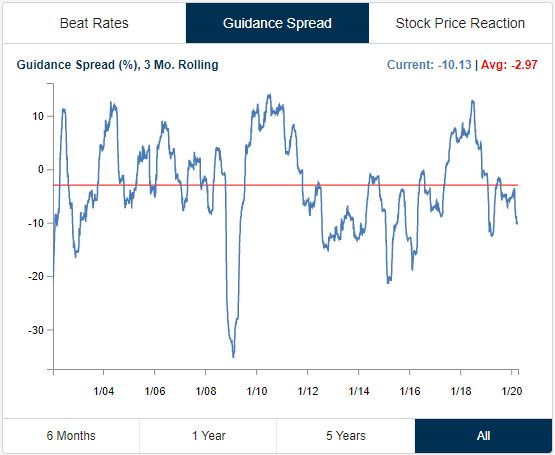

Earnings on Deck

Although there is only one company reporting earnings today, the earnings calendar ramps up this week with a total of 75 other reports through Friday. This upcoming earnings season will be closely watched for how individual companies have been impacted by the COVID-19 pandemic. As shown in the charts from our Earnings Explorer below, although some of the period pre-dates the outbreak and recently the number of companies reporting have been low, 3-month rolling beat rates over the past few months have generally remained positive and above their historical averages. On the other hand, more companies have been lowering than raising guidance. In fact, the guidance spread has been gradually approaching its lowest levels since early 2019.

In terms of stock price reactions, companies have been getting crushed on their earnings reaction days (first trading session after their report). In March, the rolling 3 month 1 day median percent change hit its lowest level since 2012. Granted, part of the reason for that is the sharp declines in February and March regardless of whether or not a company had reported.

In the table below, we show the 30 largest (by market cap) companies scheduled to report earnings through the end of the month. For each stock, we also show their EPS and revenue beat rates, the percentage of time they raise guidance, and then their average one-day performance in reaction to earnings and historical volatility. For volatility, we are simply measuring the average percentage move (up or down) on the day of each earnings report. Johnson and Johnson (JNJ) and Lockheed Martin (LMT) have the strongest EPS beat rates of these companies and Facebook (FB) has topped sales estimates the most consistently. Conversely, Wells Fargo (WFC) has missed EPS the most and NextEra Energy (NEE) has missed sales estimates the most. In terms of stock price reaction, the FANG names—Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google (GOOG)—have tended to be the most volatile on earnings with NFLX being the most volatile of these averaging a full-day move of 12.5%. While it has been the most volatile, NFLX has not averaged the best performance on earnings. FB holds that title with an average earnings reaction day gain of 2.7%. Bank of America (BAC) on the other hand has averaged the worst performance with a decline of -0.93%. Start a two-week free trial to Bespoke Institutional to access our interactive Earnings Explorer and much more.

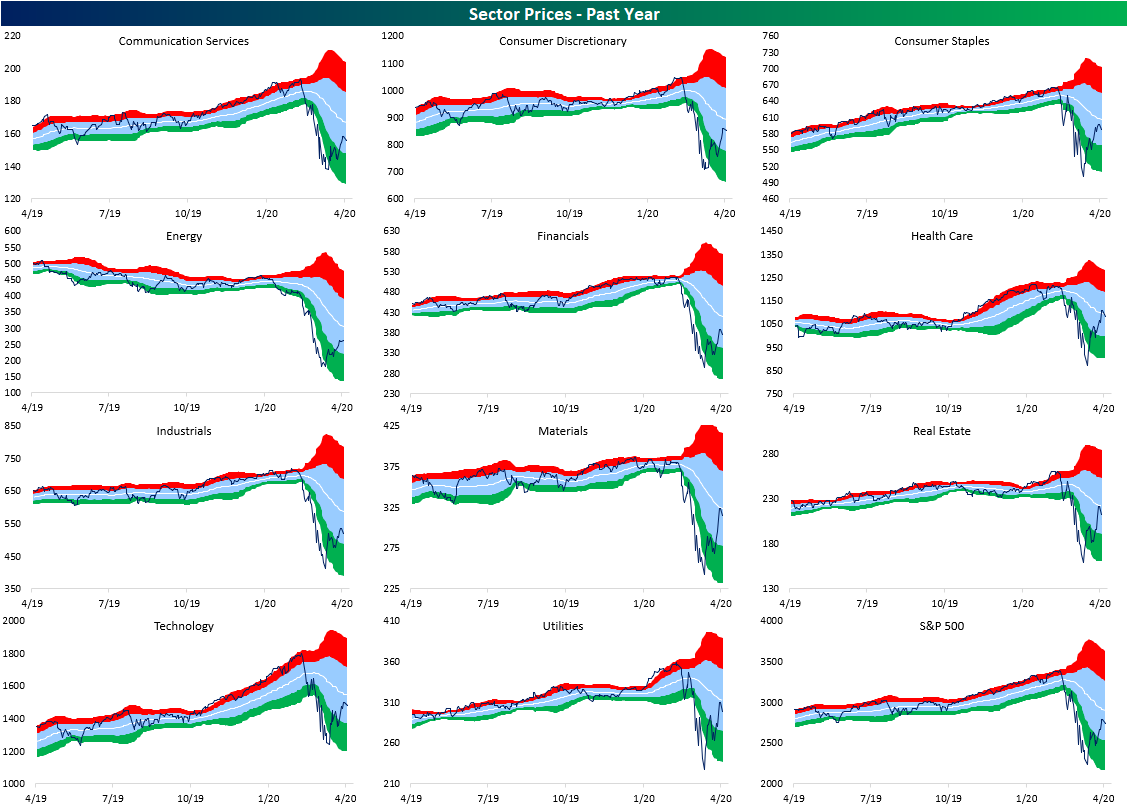

Sectors Failing at their 50-Day

In last week’s Sector Snapshot, we noted that each of the eleven sectors as well as the S&P 500 had finally exited oversold territory as shown in the charts below. Even with the major indices down around 2% today, they have held up in neutral territory so far. One interesting thing to note of today’s decline is some sectors are turning lower right as they come within reach of their 50-DMAs.

Over the course of this recent market downturn, Health Care has been the only sector to recently close above its 50-DMA which happened last Wednesday and Thursday. Before that, you would have to go all the way back to March 5th to find a sector above its 50-DMA (Utilities). While Health Care pressed above this average last week, it has failed to hold there with today’s declines bringing it 0.79% below its 50-DMA. Health Care is not alone in failing at its 50-DMA though. Despite having never taken out these levels, the Materials and Real Estate sectors both came within 1% of their averages as of Friday’s close before turning lower today. While they did not get as close, Consumer Staples and Utilities have also failed to press higher after closing within 2% of their 50-DMAs on Friday. That gives evidence that the 50-DMA could be the next technical roadblock for the other sectors as well as the broader S&P 500. Start a two-week free trial to Bespoke Institutional to access our Sector Snapshot and much more.

Chart of the Day: Bank Lending Surges

B.I.G. Tips – Weekly 10%+ Gains Bunched Together

Sport Stocks Still In A Slump

The outbreak of COVID-19 has put a wide array of sports on hold from the NHL, NBA, and MLB in the US to the Olympics on the global stage. With the operations of these businesses basically shut down for the foreseeable future, it makes sense that they underperformed the S&P 500 during the worst of the sell off. Whereas the S&P 500 fell 33.92% from 2/19 through 3/23, the average ‘sport stock’ was down 42.35%. The worst decliner of these was Churchill Downs (CHDN) which fell 55.34%. CHDN is the owner of several racetracks and casinos around the US including the track from which it derives its name, Churchill Downs in Kentucky where the Kentucky Derby takes place. On the bright side, CHDN has far outshined its peers since the market’s bottom on 3/23 rising 41.59%. Meanwhile, Liberty Media – Liberty Braves (BATRA), owner of the MLB’s Atlanta Braves and the Premier League soccer team Manchester United (MANU) have only risen 16.61% and 11.94%, respectively since the 3/23 low. Even after those rallies more recently, these stocks are still down 29.28% on average from their levels on 2/19 compared to the S&P 500 which has outperformed by more than 10 percentage points. As for YTD performance, ‘sport stocks’ are also underperforming the S&P 500 by over 13 percentage points.

We created a custom portfolio of these stocks, and below we show the charts of these stocks from our Chart Scanner. As shown, this group experienced just as sharp of a drop as many other stocks but have been grinding higher more recently. Every stock has put in a higher low in the past couple of weeks, but Churchill Downs (CHDN) and Madison Square Gardens (MSG) have also broken out above their late March highs which is another constructive technical sign. The next resistance to watch will be their moving averages. Start a two-week free trial to Bespoke Institutional to access our interactive tools and much more.

Bespoke’s Morning Lineup – 4/13/20 – Rejected

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

After the best week since 1974 and the second 10%+ rally for the S&P 500 in three weeks, US equities are understandably starting off the week on a down note. That being said, futures are off their lows. This is going to be a big week for the market as earnings season kicks off. With the economy shut down indefinitely, though, for a lot of companies, there aren’t going to be much in the way of earnings, revenues, or guidance to speak of.

Read today’s Bespoke Morning Lineup for a discussion of the oil production cut agreement over the weekend, the latest trends and statistics of the COVID-19 outbreak, and other stock-specific news of note.

The performance of semiconductors in recent days has been a bit concerning. We reference the group a lot, but that’s only because they have been such a reliable leading indicator for the broader market. While the Philadelphia Semiconductor Index (SOX) led the S&P 500 off its March lows, in the last few days it has been lagging.

On Thursday, as the S&P 500 rallied 1.5%, the SOX fell over 2% for its worst single-day underperformance versus the S&P 500 since March 16th. Even more disheartening than the bad day, though, was how it transpired. In early trading, the SOX was actually up with the market and even briefly traded above both its 50 and 200-day moving averages. Shortly after the open, though, the sellers stepped in and within the first hour of trading, it was down on the day. Had the early gains held, it would have been the first time since 2/21 that the SOX closed above both its 50 and 200-day moving averages, but instead of that milestone, the index saw its relative strength make a new short-term low. Watch the group today to see if last week’s weakness was temporary or not.