Bespoke’s Morning Lineup — 4/23/20

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

This morning’s update of investor sentiment from AAII showed a big drop in bullish sentiment and nearly as large an increase in bearish sentiment. We’ll have more on the details later, but below we wanted to provide a quick update on the sentiment of newsletter writers with the Investors Intelligence survey. In the latest report, the spread between bulls and bears was +12.5 percentage points, which is an improvement off the extremely negative reading of -11.6 percentage points right around the recent lows. Over the last 20 years, readings like the late March one of below -10 have been a pretty good medium to long-term buy signal. With the reading back above zero, it’s obviously nowhere nearly as extreme, but it’s still well below the 20-year average of 23.3 percentage points.

Daily Sector Snapshot — 4/22/20

Gauging the Global Bounce

The US (S&P 500) has managed to quickly re-enter a bull market after the 33.92% decline from 2/19 to 3/23 that brought the post-Financial Crisis bull market to an end. Today, the S&P is now 17.45% below the 2/19 high after rallying nearly 25% since 3/23. As shown in the table below, of the 23 countries in our Global Macro Dashboard, that is the third best rally off of its respective low. Only South Africa and South Korea have rallied more off of their 2020 low on 3/19; a few days before the US bottom. Around half of these countries found a bottom on the same day as the US, 3/23, while the rest were a few days earlier. Italy was the first to bottom on March 12th. But as for the 2020 equity market highs, the US peaked alongside Canada and multiple European countries later than other global economies. For example, South Korea, South Africa, Taiwan, Korea, Russia, Japan, the UK, and Hong Kong all peaked back in January.

As for longer term trends, below we provide 10-year price charts (in local currency) of the major stock market indices for the countries listed in the table above. The Covid market crash in the first quarter broke significant long term uptrend channels that were in place for the majority of countries. The only countries that have managed to somewhat hold onto long-term uptrends are China, Hong Kong, Norway, and Switzerland. For a handful of countries like Malaysia, Singapore, South Korea, and Spain, their equity markets fell to around the lowest levels of the past decade.

In terms of bounce backs, every country has rallied off of its lows, but Mexico is up the least at just 2.8%. So far the bounce backs hardly register on the long-term price charts for most countries, but there are some where the bounce has moved price back inside the long-term uptrend channel that had been in place prior to the crash. Norway, Russia, Sweden, Switzerland, and Taiwan are examples of countries where this is the case. Start a two-week free trial to Bespoke Institutional to access our Global Macro Dashboard and much more.

Investors Beware As USO Contango Collapse Fuels PnL Pain

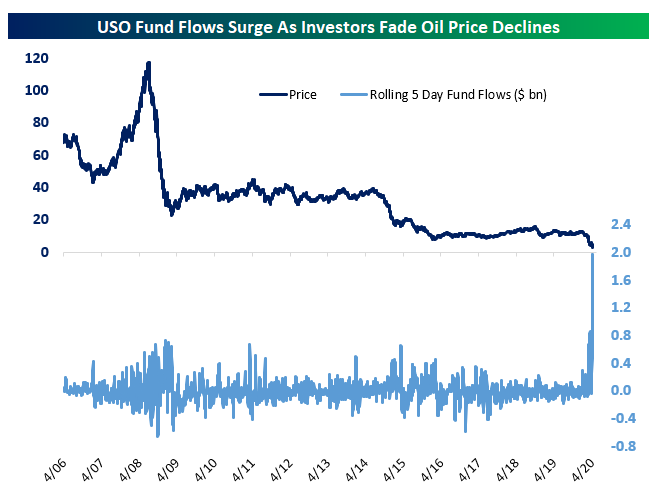

The United States Oil Fund (USO) has had a rough few weeks. With oil at the front of the WTI curve collapsing as far as massively negative prices on Wednesday, the ETF’s asset values decline as it sells near-term crude to purchase out-month crude. This “contango” in the crude curve is one reason that USO has so persistently returned less than the actual spot price of oil; when the curve is in contango as it has been for the last few years, it has persistently cost money to own oil exposure via USO. In order to avoid negative prices, the ETF’s issuer has spread out purchases across the front few months of the crude curve, which should help if June contracts trade negative at some point like May’s did this week. But investors are still paying a cost for direct crude exposure because the whole crude curve is in contango. That hasn’t stopped individual investors from trying, though: as shown below the last week has seen by far and away the biggest inflows into USO on record!

We should also note that the closing price of the ETF yesterday was more than 30% above the value of the futures it holds. Because price has dropped while flows surge, the fund’s assets have surged and share count has exploded, requiring an expanded authorization for new shares. That takes time to register, and as a result yesterday USO had to suspend creation of new shares. As a result, shares closed more than 35% above the value of the assets in the fund!

That’s bad news for the billions of new dollars of capital investors have thrown at USO in recent days. As shown below, as-of the flows yesterday, the prior five days of flows (assuming net purchases paid roughly the volume-weighted average price for the day) are now sitting on losses of more than $600mm. When combined with the huge net asset value premium which can be expected to eventually compress, we cannot strongly enough urge investors take caution when investing in this particular oil market vehicle. Start a two-week free trial to Bespoke Institutional to access our Chart Scanner, custom screens, and much more.

Inverse Oil ETFs Soaring

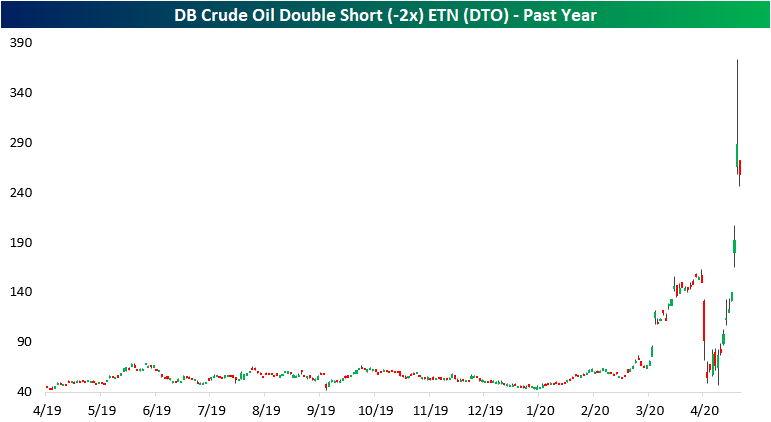

The collapse in oil prices has sent ETFs like the United States Oil Fund (USO) scrambling to quickly adapt as the ETF plummets to record lows. While these ETFs have plummetted, inverse ETFs in the space have been doing great. Products like the DB Crude Oil Double Short ETN (DTO) and ProShares UltraShort Crude Oil ETF (SCO)—which are more short term focused and track the inverse performance of crude oil (when crude is down, these products move higher and vice versa)—have soared this year. As shown in the charts below, the past month’s volatility has made the charts of DTO and SCO fairly messy, but both had their best days ever on Tuesday gaining 50.1% and 52.2%, respectively. Volumes were also huge at well over 300% of their 50-day averages for both. For DTO, which is the more thinly traded of the two, yesterday and Monday’s rise were a clear and massive break above the prior highs from mid to late March. Meanwhile, even though yesterday’s close was a new high, SCO actually saw higher intraday highs back on March 18th.

Obviously, given their nature of seeking to double the volatility of crude oil moves, these inverse ETFs will see much larger performance numbers, whether those be positive or negative than the more vanilla USO. Regardless, given the novelty of the current situation around oil, performance numbers all around are huge. For example, in terms of YTD performance in 2020, DTO is up nearly 500% as of today. At yesterday’s close, it was up even more at 527%! As for the more popular SCO, the ETF is up over 300% YTD. Meanwhile, the main crude oil ETF (USO) has been cut by more than three quarters since the start of the year. Start a two-week free trial to Bespoke Institutional to access our interactive tools including a screen of inverse and leveraged ETFs.

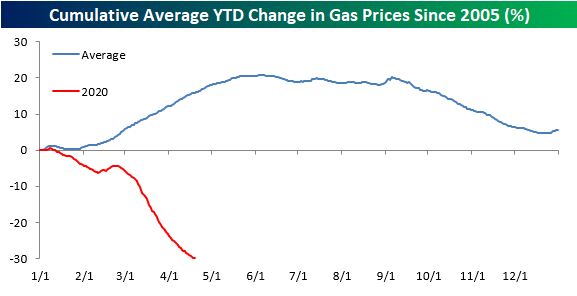

Two Months Without an Increase in Prices at the Pump

While consumers staying home have not had much of a chance to enjoy the decline in gas prices, the decline has been relentless. The last time the national average price of a gallon of gas increased was on February 22nd. That’s 59 days ago. The chart below shows historical streaks where the national average price of gasoline did not show a day/day increase. At 59 days, the current streak is the fourth-longest on record dating back to 2005. The longest streak ended at 123 days in January 2015, while the next two ended at just under 90 days.

With the current streak of days without an increase at just 59 days, it sure doesn’t seem extreme relative to those other periods. So what gives? Even though the current streak is much shorter than the three longest streaks, this one is perhaps even more extreme given the time of year when it is occurring. Looking at the chart above, each of the three longest streaks on record all ended in December and January. The blue line in the chart below shows the seasonality of gas prices throughout the year, and the weakest time of year is typically from the beginning of December through year-end. Therefore, it shouldn’t be too much of a surprise that the three longest streaks on record took place during that time of year. The current streak, however, has occurred during a time of year where prices at the pump are normally at their strongest. In fact, this is the first time since 2005 that gas prices have ever been down on a YTD basis at this time of year. In other words, this current streak of declines is rather extraordinary. Start a two-week free trial to Bespoke Premium to access our full range of research and interactive tools.

Chart of the Day: Stocks vs. COVID Symptom Search Trends

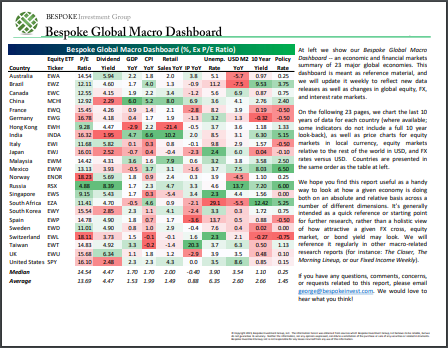

Bespoke’s Global Macro Dashboard — 4/22/20

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Bespoke’s Morning Lineup – 4/22/20 – Third Time the Charm?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

After two down days to start off the week, equity futures are indicated to recoup some of those losses at the open. Hopefully, the market can hold onto these early gains, but only time will tell. One positive for the bulls is that semis are trading up over 2% as a group following positive reports from Texas Instruments (TXN) and Teradyne (TER).

Read today’s Bespoke Morning Lineup for a discussion of the latest moves in the crude oil market, major earnings releases, the latest trends in the COVD-19 outbreak, and other stock-specific news of note.

After the May contract for WTI crude oil moved back above zero yesterday and the now front-month June contract is ‘only’ down 3% today, one might be tempted to think that a sense of normalcy is moving back into the crude oil market. Don’t be fooled.

First, let’s look at the historical one-day change for WTI going back to 1983. After Monday’s 306% record (in more ways than one) decline, yesterday’s rally of 126.6% rally out of negative territory was the strongest one-day gain in WTI’s history.

It’s not only the one-day daily changes that suggest the crude oil market is nowhere anywhere close to normal. In looking at the spread between the prices of the current (front month) contract and the price six months from now, the current spread is at levels rarely seen. Through yesterday’s close, the spread between the two contracts was -$14.89 per barrel indicating that crude for delivery six months from now is nearly $15 more expensive than crude oil for delivery in the current month. While that’s well off the record $68 spread seen at the close on Monday, going back to 2006, the only time the spread was at similar levels was during the depths of the financial crisis. One thing we know about the 2008/09 period is that there was nothing normal about then.