Chart of the Day – Sectors With Extreme Positive Earnings Revisions Spreads

Tesla Would Top a Number of S&P 500 Lists If It Was Added to the Index

We’ve tweeted a number of times in the last several days noting where Tesla (TSLA) would rank in terms of market capitalization if it were added to the S&P 500. As of Monday morning with the stock up over 10%, TSLA’s $325 billion market cap would rank it as the 10th largest company in the S&P 500. Besides market cap, though, there are also a number of other lists that TSLA would find itself near the top of. For starters, on lists of YTD performance and P/E ratios, you would find TSLA either at or near the top of the list. Another list TSLA would be near the top of is short interest.

The table below lists the 30 stocks in the S&P 500 with the highest levels of short interest as a percentage of float. At TSLA’s current level, it would rank as the 31st highest short interest as a percent of float. Looking through the list, there are a number of troubled companies or those whose businesses have been severely impacted by COVID. For starters, there are a number of cruise lines operators, including Carnival (CCL), Norwegian (NCLH), and Royal Caribbean (RCL). Concert promoter Live Nation (LYV) has also seen its short interest levels soar since COVID with just over 10% of its float sold short. While not quite as high as LYV, with 9.47% of its float sold short, TSLA would find itself just outside the list of S&P 500 stocks with the highest short interest as a percentage of float if it was in the index.

What makes TSLA’s high short interest as a percentage of float notable is that it is accompanied by such a large market cap. Normally stocks with such large market caps don’t have high levels of short interest. There are two reasons for this. First, high levels of short interest are typically due to a problem with the company in question, and therefore the market wouldn’t allow a troubled company’s market cap to get so high in the first place. Second, the amount of capital dedicated to short selling is relatively small, and therefore it’s hard to build up multi-billion dollar short positions in a single stock. Looking at the list above, though, TSLA has been a major exception as its market cap is more than 21 times the market cap of the largest stock listed above (Campbell Soup – CPB) and 38 times the average market cap of the 30 stocks listed.

Looking at this another way, the table below lists the 25 largest stocks in the S&P 500 along with where TSLA would rank if it was in the index. Of the 25 stocks listed, the average short interest as a percentage of float is 1.02% and the highest short interest is Netflix (NFLX) at 2.55%. TSLA’s short interest is nine times greater than the average of the largest 25 stocks and more than 3.7 times the level of Netflix! It’s not often that you see a situation where a company reaches the point where it has one of the largest market capitalizations of any company in the world and gets there with such high levels of skepticism. A lot of investors have made a ton of money on the back of TSLA in the last several weeks, but a lot have been taken to the cleaners too. Like what you see? Click here to view Bespoke’s premium membership options for our best research available.

Silver At New Highs

As we noted in an earlier post, one of the best-performing commodities in 2020 has been silver (SLV). Although it has lagged its yellow metal cousin on a year-to-date basis, SLV has seen strong performance over the past few months and has more recently even begun to break out to new highs. During the market turmoil of February and March, SLV had fallen over 35.5% from its February 24th high to its March 18th low compared to a 9.86% decline for gold (GLD) over that same period. Since that low on March 18th when SLV was at its lowest level since January of 2009, the ETF has rallied 59.23% through today compared to gold’s gain of 20.6%. As shown below, with that rally continuing over the past few sessions, SLV has risen above resistance between $17.40-$17.50 that traces back to the highs in February of this year and September of last year. That leaves the next area to watch around the early September high of $18.34. Click here to view Bespoke’s premium membership options for our best research available.

Commodity Performance in 2020

In the chart below, we show the year-to-date performance through last Friday of several different commodities. Fitting for a year with a pandemic ravaging the globe, vitamin C is in demand as orange juice is actually the top performing commodity year to date with a gain of 33.6%. Behind OJ, precious metals have been the next best performers. Gold is up the most of these with an 19.4% gain while silver is up about half that at +9.7%. The only other commodity shown that is in the green on the year is the industrial metal — copper.

On the down side, oil is the farthest in the red with a year-to-date decline of 34.2%. And conversely to OJ’s strong performance, another morning beverage that doesn’t provide a similar immune boost — coffee — is down 24%. Natural gas, corn, and platinum are all down more than 10% YTD, while wheat is down 6.7%. Click here to view Bespoke’s premium membership options for our best research available.

Communication Services and Consumer Staples Leading in 52-Week Highs

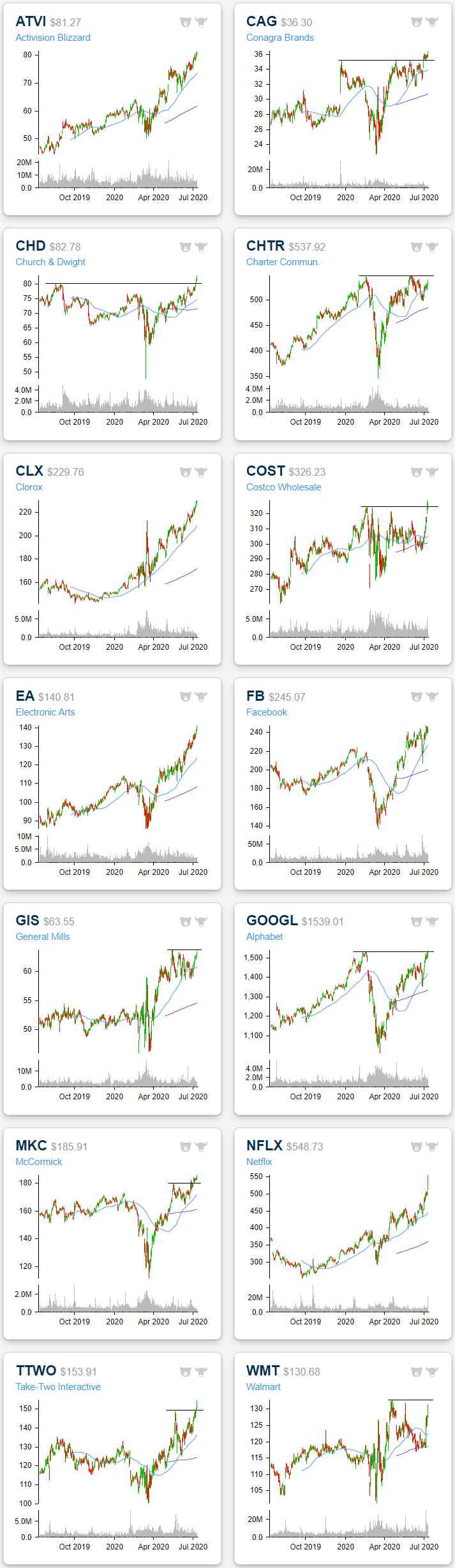

In Friday’s Bespoke Report, we broke down the rally off the bear market lows into three acts, noting a rotation out of “re-opening” stocks and back into the COVID economy stocks since early June. One metric where that is becoming evident is the sectors with the highest number of 52-week highs. As of Friday’s close, Communication Services had the highest net percentage of stocks at 52 week highs at just under a quarter of the sector’s stocks, 23.08%. While nearly 10 percentage points less, Consumer Staples has the second largest amount at new highs of the 11 sectors at 12.12%. For both sectors, these were the highest readings since the 2/19 high.

In the snapshot of our Chart Scanner below, we show the stocks in these sectors that reached new 52-week highs last Friday as well as a few others in sectors with interesting setups approaching or just off of 52 week highs. Of the Communication Services stocks, all of the major video game publishers—Activision-Blizzard (ATVI), Electronic Arts (EA), and Take-Two Interactive (TTWO)—made the list in addition to streaming giant Netflix (NFLX) and Google parent Alphabet (GOOGL). Each of the video game publishers has been in strong uptrends lately. Meanwhile, Netflix (NFLX) had an astounding end to the week, rallying 8.06% on Friday for its best single-day since March 23rd; the same day as the bear market low. Although all of these stocks have had strong uptrends, at the moment they are all extremely overbought meaning that now may not be the best entry point. Elsewhere in the sector, Charter Communications (CHTR) has been trending higher after a bounce off of its 50-DMA. If it continues to move higher it will be its second test (first one occurring in early June) of its February highs. Facebook (FB) is also right near a 52 week high after a sharp rally off of its 50-DMA in the past two weeks.

In the Consumer Staples sector, Conagra Brands (CAG), McCormick (MCK), Clorox (CLX), and Church & Dwight (CHD) also all reached new highs on Friday. For some like CAG and CHD, recent breakouts were above resistance from further back in 2019 while other highs for others like MKC were more recent. Other Consumer Staples stocks near 52-week highs include wholesale retailer Costco (COST) which broke out to a new high on Thursday but saw an inside day on Friday. General Mills (GIS) has broken its short term downtrend that has been in place since May over the past few weeks and has nearly returned to those prior highs. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 7/13/20 – Earnings Season Starts With a PEP

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

It’s a new week, but more of the same in the early going as the usual suspects are all trading higher. Leading the charge is Tesla (TSLA), which is trading up over 6% which in today’s share price works out to a gain of about $100. The pace of reports is slow today, but earnings season kicked off this morning with Pepsi (PEP) reporting better than expected EPS and rallying more than 2%. Outside of PEP, though, there are no other reports on the calendar for today.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, global and national trends related to the COVID-19 outbreak, and much more.

As mentioned above, earnings season started off slowly today with Pepsi (PEP). Tuesday, though, we’ll get reports from Citigroup (C), Delta (DAL), Fastenal (FAST), JP Morgan Chase (JPM) and Wells Fargo (WFC), all of whom are scheduled to report in the morning. Wednesday’s major reports include Goldman (GS), Progressive (PGR), and UnitedHealth (UNH) in the morning, while Alcoa (AA) will report in the afternoon. Thursday will be the busiest day of the week with too many stocks to list here, but Netflix (NFLX) will highlight the schedule of afternoon reports. Finally, Friday’s key reports include Blackrock (BLK) and State Street (STT).

For a more detailed rundown of the earnings schedule for the upcoming season, please see our Earnings Explorer Tool (available to all Institutional clients) on the Tools section of our website. The chart below is from that tool and shows the daily number of companies reporting. While large caps dominate the list of companies reporting next week, the volume of reports will not pick up until later July when the pace of reports from smaller and mid-cap companies picks up and more than 400 companies will report in a single day.

Bespoke Brunch Reads: 7/12/20

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2020 Annual Outlook special offer.

COVID

US bets on untested company to deliver COVID-19 vaccine by Martha Mendoza and Juliet Linderman (AP)

In an effort to secure the material for rapid distribution of COVID vaccine doses, the government has invested more than half a billion dollars in a company that doesn’t have an approved device, doesn’t have a manufacturing facility, and is largely unproven. [Link]

Cause of Wuhan’s mysterious pneumonia cases still unknown, Chinese officials say by Helen Branswell (Stat News)

This article is a throwback to the very start of the COVID-19 outbreak Hubei, when a mysterious outbreak of pneumonia led to almost 60 hospitalizations by the first week of January. [Link]

Costs of COVID

The Toll That Isolation Takes on Kids During the Coronavirus Era by Andrea Patterson (WSJ)

While everyone feels the effects of isolation, they can have an especially extreme effect on children, adding concerns about childhood development to the public health calculation COVID is forcing governments to make. [Link; paywall]

Fearful and Frugal: Coronavirus Wreaks Havoc on America’s Psyche by Tiffany Kary (Bloomberg)

Survey data is suggesting a huge psychic toll on Americans as a result of the virus and the resulting economic impact. Austerity in the form of stockpiling, delayed purchases of durable goods, and less interest in public spaces are all warning signs for the viability of the economic recovery more generally. [Link; soft paywall]

Covid-19 Is Turning San Francisco’s Inequality Gap Into a Chasm by Olivia Rockeman and Gerrit De Vynck (Bloomberg)

COVID is hitting the more vulnerable workers in the service economy in a way that hasn’t had any salience for office workers in tech and other industries. [Link; soft paywall]

Carsyn Leigh Davis (Florida COVID Victims)

The horrifying story of an immunocomprised Florida teen who was exposed to COVID at a large youth event at her church. Her mother tried to treat her for the disease with totally ineffective anti-bacterials and hydroxychloroquine. Carsyn succumbed to the disease 12 days after the event at which she was exposed. [Link]

New York City

I’ve Seen a Future Without Cars, and It’s Amazing by Farhad Manjoo (NYT)

An argument and imagination of what a major city without cars looks like: less crowded, more vibrant, and faster-moving. [Link; soft paywall]

NYC Rental Market Pushed to Breaking Point by Tenant Debts by Prashant Gopal (Bloomberg)

With mass job loss in the hospitality industry, New York renters are completely incapable of covering their rent, and the result is a total inability for landlords to cover the cost of their debts, let alone property taxes and similar costs. [Link; soft paywall]

Heavier Reading

How to Fight Without Rules: On Civilized Violence in “De-Civilized” Spaces by Neil Gong (Social Problems)

This sociology paper is a bit off the wall, but is absolutely fascinating. The author sought to understand how “de-civilized” spaces without rules established new ways of ordering themselves. To do so, he participated in a no-holds-barred underground fight club that included weapons like sticks, chains, and dull knives as well as group battles. [Link; 18 page PDF]

The Dēmos In Dēmokratia by Daniela Cammack (The Classical Quarterly)

A novel reading of classical Greek sources which challenges our notion of democracy: not rule by all the people, but rule by the mass of people outside of the elite. The implications of that early political arrangement and our modern systems of representative government mediated by technocrats are profound: democracy in its original Greek forms was not a process of empowering elites (as it is today, via election of representatives) but was in fact a process of empowering everyone else over elites. [Link; 20 page PDF]

A tale of two wage subsidies: The American and Australian fiscal responses to COVID-19 by Steven Hamilton (National Tax Journal)

A comparative analysis of the different approaches to subsidizing wages taken by the US and Australia, arguing that a lack of infrastructure in the US led to a far less effective Paycheck Protection Program) that underperformed the Australian solution which relied on its tax payment systems instead of private lenders. [Link; 20 page PDF]

Eras Ending

Brooks Brothers files for bankruptcy by Jordan Valinsky (CNN)

The venerable American menswear brand survived the Civil War, two World Wars, and everything else since 1818, but COVID has ended its run. [Link]

Grim Day for Pipelines Shows They’re Almost Impossible to Build by Rachel Adams-Heard and Ellen M. Gilmer (Bloomberg)

Earlier this week a federal judge ordered the shutdown of the Dakota Access pipeline, followed by the cancellation of a planned pipeline by Dominion and Duke Energy. Well-funded and litigious environmental groups have proven incredibly effective at raising the costs of new pipeline projects beyond the point of viability. [Link; soft paywall]

Long Reads

The Hero of Goodall Park: Inside a true-crime drama 50 years in the making by Tom Junod (ESPN)

An incredible yarn focused on cars, baseball, the ephemerality of life, and history in a giant interconnected narrative. [Link; auto-playing video]

Markets

75 Years of American Finance: A Graphic Presentation 1861-1935 (St. Louis Fed FRASER)

A hand-drawn and annotated history of American financial markets and economic activity stretching from the start of the Civil War to the depths of the Great Depression. [Link]

Are Stock Investors ‘Irrationally Exuberant’ Again? by Mark Hulbert (WSJ)

An argument that basically unremarkable performance for IPOs, normal equity issuance, valuations of dividend-paying stocks versus those without a dividend, and closed-end fund discounts are all pointing to an unremarkable market relative to the late-1990s tech bubble. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — A Rally with Three Acts

This week’s Bespoke Report newsletter is now available for members.

The S&P 500 was up 3% on the week, while the Nasdaq 100 was up 6.6% (leaving it up 24.6% YTD). Chinese stocks also had a big week with a gain of 15.9%. Within the US, we continue to see huge performance divergence between the largest and smallest stocks. Within the large-cap S&P 500, the cap-weighted index was up 3% on the week, but the equal-weight index was up just 0.3%. YTD, the cap-weighted S&P is down just 0.28%, but the equal-weight index is still down more than 10%.

Here is a stat for you that highlights strength at the top: the five largest stocks in the S&P added $352 billion in market cap this week alone. That would rank as the 10th largest stock in the index. At the bottom of the index, if the 100 smallest stocks in the S&P 500 each doubled from here, it would only add 2.5% to the index. If only Apple (AAPL) were to double from here, it would add 6% to the index.

To read our full Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Daily Sector Snapshot — 7/10/20

Earnings Season Lurks

After a relatively quiet week for economic data and practically no earnings reports to speak of, the Q2 earnings season will kick off next week. Normally, earnings season starts quietly with just a handful of reports outside of the major banks, but next week will be relatively busy with some major players on the calendar. Things start off slowly with Pepsi (PEP) on Monday. Tuesday, we’ll get reports from Citigroup (C), Delta (DAL), Fastenal (FAST), JP Morgan Chase (JPM) and Wells Fargo (WFC), all of whom are scheduled to report in the morning. Wednesday’s major reports include Goldman (GS), Progressive (PGR), and UnitedHealth (UNH) in the morning, while Alcoa (AA) will report in the afternoon. Thursday will be the busiest day of the week with too many stocks to list here, but Netflix (NFLX) will highlight the schedule of afternoon reports. Finally, Friday’s key reports include Blackrock (BLK) and State Street (STT).

As far as analyst sentiment stands heading into the current earnings season, while we wouldn’t go so far as to say that it has made a full 180-degree turn from last quarter’s negative extremes, it has been close. Over the last four weeks, analysts have raised forecasts for 580 companies in the S&P 1500 and lowered forecasts for 419. That works out to a net of 161 or just under 11% of the index. Besides the S&P 1500, six sectors have positive revisions spreads, while just two are negative. Sectors with the most positive revisions spreads include Consumer Staples, Energy, and Technology, while the two sectors with negative spreads are Financials and Real Estate. Financials just can’t find any love these days.

What does this mean for the equity market’s prospects as earnings season begins? Make sure to check our quarterly preview of the upcoming earnings season for a read on what to expect.

Our quarterly preview of earnings season is extremely useful and a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!