The Bespoke Report — Narratives In Price & Policy

This week’s Bespoke Report newsletter is now available for members.

The US equity market closed out this week right at the line in the sand that has snuffed out two prior attempts at sustaining the post-March rally. That sets up a huge next week as earnings reports start to really flow while the Federal Reserve debates yield curve control and Congress has to reckon with the expiry of large unemployment benefits which may threaten consumer spending. Meanwhile COVID continues to spread in the background, forcing a narrative reckoning across price and policy. We discuss in detail along with reviews of recent sentiment indicators, economic data, political polling, and the start of earnings season in this week’s Bespoke Report.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Daily Sector Snapshot — 7/17/20

The Good and the Bad from Earnings This Week

Earnings season began at the start of this week with Pepsi (PEP) and the first of the major US banks and brokers reporting Q2 numbers. It was a light week with only 32 companies reporting through Thursday, but in the coming weeks, we’ll see 100+ reports on multiple trading days.

From our Earnings Explorer tool, below is a recap of the results from this week’s earnings reports. 78% of companies that reported this week beat consensus analyst EPS estimates, while 72% topped consensus sales estimates. Those are both strong numbers. In terms of future projections, 16% of companies raised guidance, and not one company lowered guidance. That’s rare even with the very low number of reports so far.

While guidance and beat rates were strong, investors still used earnings reports as an opportunity to sell. The average one-day share price change this week for companies in reaction to their earnings reports was a decline of 0.57%. All of those declines came on the initial gap down at the open, however. After averaging a gap down of 0.76% at the open of trading following the earnings release, the average stock that reported gained 0.21% from the open to the close. (The gap down of 0.76% and the open to close gain of 0.21% adds up to the full-day decline of 0.57% mentioned earlier.)

Below is a table showing all 32 companies that reported Q2 numbers this week (through Thursday). The list is sorted by one-day share price reaction from best to worst. Alcoa (AA) had the best price reaction to earnings this week with a gain of 6.39% yesterday. WNS Global (WNS) put up the second-biggest gain at 6.36%. The next best-performing stocks in reaction to earnings this week only gained 3%+ — USB and HOMB. Other stocks that reported this week that gained in response to their earnings reports include Morgan Stanley (MS), Goldman Sachs (GS), Taiwan Semi (TSM), Johnson & Johnson (JNJ), and JP Morgan (JPM).

On the downside, AngioDynamics (ANGO) saw the worst share price reaction to earnings this week when it fell 11.51% on Thursday. Sleep Number (SNBR) was second-worst with a one-day drop of 9.19% yesterday as well.

While MS, GS, and JPM all posted gains in reaction to earnings this week, other banks like Citi (C), Wells Fargo (WFC), and Bank of America (BAC) reacted negatively with each falling 4% or more. Click here to view Bespoke’s premium membership options for our best research available. Our Earnings Explorer tool that gives you access to the information in this post is available fully at the Bespoke Institutional level.

Bespoke’s Morning Lineup – 7/17/20 – Role Reversals

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

After trading modestly lower most of the night, futures have been rebounding as we approach the close and are now in positive territory. The Nasdaq, which was down yesterday, is looking to avoid its first back to back declines in two months. On the economic front, Housing Starts and Building Permits were mixed with Starts modestly exceeding forecasts while Permits missed.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, the latest earnings reports, global economic data, trends related to the COVID-19 outbreak, and much more.

Market performance so far this week has been a complete reversal of roles from what we’ve been used to. At the top of the list, cyclical groups have uncharacteristically been leading the way higher as Autos & Auto Parts is up close to 10% while Capital Goods, Insurance, and Transportation have all seen gains of more than 5%. To the downside, groups that have normally topped lists like this are at the bottom with tech-related groups, Media, and Retail (mostly Amazon) all down so far on the week. Whether this trend has any durability remains to be seen, but these groups got a bit ahead of themselves, and their pullback serves as a reminder that their prices can go in more than one direction.

Bespoke’s Weekly Sector Snapshot — 7/16/20

The Bespoke 50 Top Growth Stocks — 7/16/20

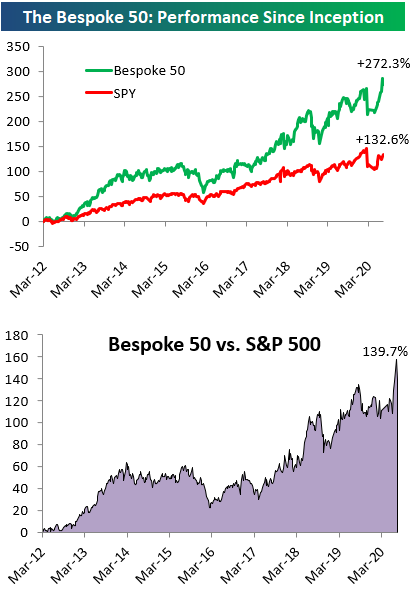

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 139.7 percentage points. Through today, the “Bespoke 50” is up 272.3% since inception versus the S&P 500’s gain of 132.6%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Stable Sentiment

Sentiment changes were relatively uneventful this week. Bullish sentiment rose 3.68 percentage points to 30.84%. That is a second straight weekly increase for bullish sentiment and the first time that it has risen above 30% since June 11th. That is still below the historical average of ~38%, but for the first time in four weeks, bullish sentiment came within one standard deviation of its long-term average.

The gains in bullish sentiment were met with a smaller gain in bearish sentiment which rose from 42.67% to 45.37%. Although higher, that is right in the middle of the past month’s range and not any sort of significant uptick week over week. But unlike bullish sentiment which is finally back within a standard deviation of its historical average, bearish sentiment remains elevated above its historical average of 30.5% by one standard deviation for a fifth consecutive week. That has now been the case for 17 of the past 20 weeks.

The gains to bulls and bears borrowed from those formerly reporting as neutral. Neutral sentiment fell 6.38 percentage points this week. That was the largest week over week decline since the first week of March. Now at 23.79%, neutral sentiment has reversed all of its gains of the past month and a half as it sits at its lowest level since May 7th. Click here to view Bespoke’s premium membership options for our best research available.

Philly Fed Continues to Rebound

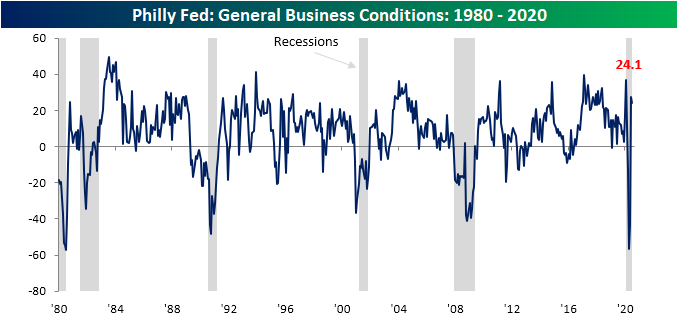

Following up on yesterday’s New York Fed reading on the manufacturing sector, this morning we got the manufacturing numbers from the neighboring Philadelphia Federal Reserve bank region. Similar to the Empire Fed’s reading for six months out, the Philly Fed’s index for General Business Conditions pulled back a bit in July falling to 24.1 from 27.5 in June. In absolute terms, that was the least volatile one month swing in the index since November of last year. Additionally, although it indicates a slower rate of improvement in July than June, it still indicates that the region’s manufacturing sector expanded for a second consecutive month after three months of contractionary activity.

Although the headline number fell in July, the internals paint a much more positive picture. Almost every category is now showing an expansionary reading with the exception of Inventories and Delivery Times, though both of those in contraction is not necessarily negative. Granted negative readings of these two, as well as a sizeable drop in Shipments, did contribute to the weakness in the July headline number.

This month’s release indicated solid overall demand with New Orders surging to 23 from 16.7 last month. Unfilled Orders also rose; moving back into expansion territory after four months of contraction. Meanwhile, Shipments were down 10 points to 15.3, but that is still a firmly expansionary reading.

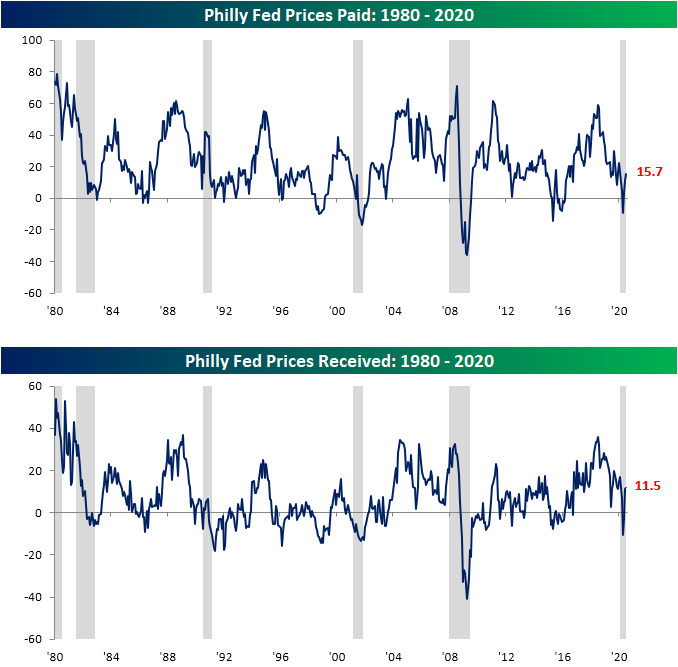

In addition to the strong levels of those indices, respondents reaffirmed the strength in demand by reporting higher prices for the second month in a row in terms of both prices received and paid.

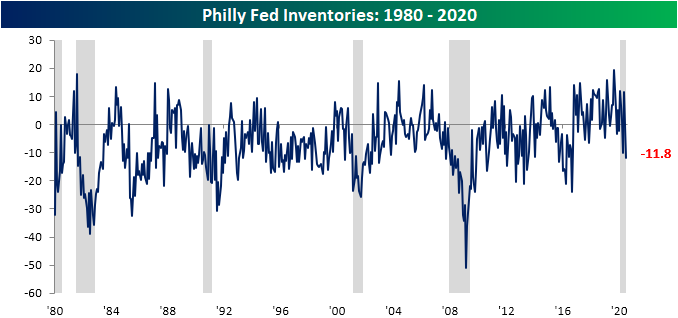

As previously mentioned, both Delivery Times and Inventories showed contractionary readings this month, but that again is not necessarily a bad thing. The Philly Fed’s index on delivery times has fluctuated between positive and negative readings in recent months while other Federal Reserve regions have seen their equivalent readings surge to extremely elevated readings (albeit lower more recently) pointing to supply chain disruptions and longer lead times. The tip into negative territory for the Philly Fed’s index of Delivery Times indicates shorter delivery times and potentially some further normalization in supply chains. Additionally, the index for Inventories fell to its lowest level since September of 2016. That indicates large inventory drawdowns which reasonably can be evaluated as a result of a pick up in demand given the increase in other areas of the survey.

As with yesterday’s Empire Fed report, one of the major highlights of this month’s Philly Fed report was the massive increase in readings on employment. The index for Number of Employees and Average Workweek were the categories to see the biggest increases in this month’s survey returning to positive territory. For these two respective indices, this month’s gains were also some of the largest of all reports since the beginning of the survey. In fact, for both indices, there have only been two months with higher monthly increases. For both indices, one of those months was this past May’s report. As for the other month, the other larger monthly gain for the index for Number of Employees was May of 1975 and for Average Workweek it was June of 1970. These huge jumps also bring both indices into the upper 90th percentiles of all readings. In other words, Philly area manufacturers seem to have not only brought people back to work but also are returning to longer workweeks. Click here to view Bespoke’s premium membership options for our best research available.

B.I.G. Tips – Retail Revival Remains

After months of being cooped up in their homes, Americans were once again out and spending in June. Retail Sales for the month of June were expected to rise by a strong 5%, but the actual reading came in much stronger at 7.5% on the headline reading and modestly less than that ex Autos and ex Autos and Gas. In addition to June’s strong headline number, May’s reading was also revised higher at the headline level but moved lower after taking out the impacts of Autos and Gas.

It’s no doubt been a whirlwind four months for retail sales. After the two worst monthly reports in March and April, May and June have followed up with record m/m increases. As shown in the chart, even though June’s reading of 7.5% seems like a pretty big step down from May’s record reading, it was still the second strongest m/m change in the history of the report.

For anyone with more than a passing interest in how the COVID outbreak is impacting the economy, our monthly update on retail sales is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

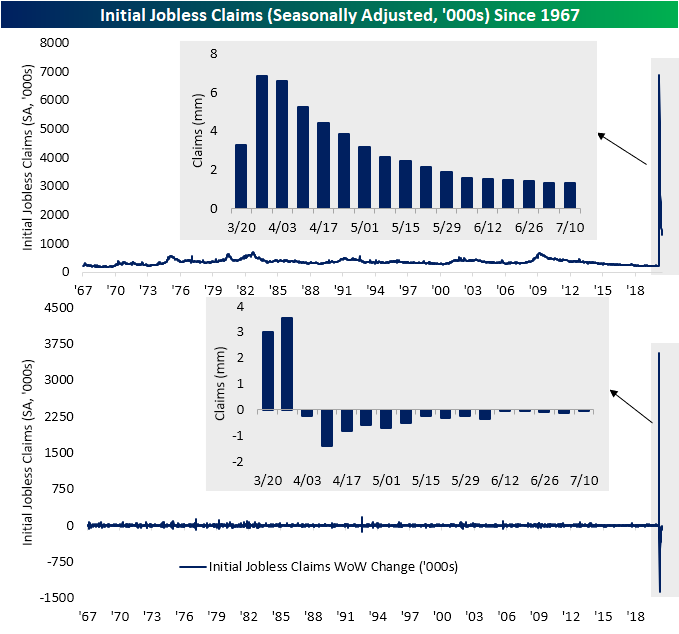

Muddled Jobless Claims

The Department of Labor released weekly jobless claims this morning and the results were mixed. For initial claims, they remain stubbornly above 1 million at 1.3 million. That was above expectations of 1.25 million but was still another decrease week over week, making it a record fifteenth streak week with lower jobless claims on a seasonally adjusted basis. This week was also yet another example of how even though claims are improving, the pace of improvement has slowed dramatically. In fact, claims only fell 10K this week. That is the smallest decline of these past 15 weeks.

Although the seasonally adjusted number showed a small improvement, actual reported claims on a non-seasonally adjusted basis actually rose from 1.395 million to 1.503 million. That was the highest reading since the first week of June. Additionally, that increase was the first time that jobless claims (NSA) rose since the last week of March, snapping a record streak of 13 consecutive weeks with lower claims.

Given continuing claims are lagged an additional week, they would not reflect that uptick as that reading continued to fall. Seasonally adjusted continuing jobless claims now total 17.34 million which is the lowest since the second week of April.

Looking at claims on a state by state basis, the main drivers of higher NSA claims this week have been some of the states with the largest increases in COVID cases like California, Georgia, and Florida. In the case of Florida, it saw a massive increase in first time jobless filings, nearly doubling from 66,941 last week to 129,408 this week. Meanwhile, Texas is bucking that trend with one of the largest improvements in claims despite higher case counts. As for continuing claims in the week ending July 4th, Florida, California, Georgia, Pennsylvania, and Texas, have all seen the largest increases in continuing claims. New York, North Carolina, and Texas on the other hand have seen the biggest declines. Click here to view Bespoke’s premium membership options for our best research available.