The Bespoke 50 Top Growth Stocks — 1/7/21

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” is up 438.5% excluding dividends, commissions, or fees. Over the same period, the S&P 500 is up in price by 175.3%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bespoke’s Weekly Sector Snapshot — 1/7/21

Optimism Pulling Back

Although the S&P 500 has returned to record highs today, the drawdown that had been in place for most of the week did manage to put a dent in sentiment. In the AAII’s weekly survey, just 42.13% of respondents reported as bullish. That is down from just over 46% last week and is the lowest level in bullish sentiment since the first week of November. Granted, that is still an elevated reading relative to the past several years. In fact, it is nearly 10 percentage points above the average reading of bullish sentiment of the past five years.

With the decline in bullish sentiment, bearish sentiment picked up. Bearish sentiment rose 6.7 percentage points up to 33.5%. That is the highest reading of bearish sentiment since the final week of October. Unlike bullish sentiment though, that is much more in line with the average sentiment reading of the past several years. Over the past five years, bearish sentiment has averaged 32.5%, roughly one percentage point away from the current reading.

Given the inverse moves of bullish and bearish sentiment, the bull-bear spread has come back down to more moderate levels. At 8.63, it is at the lowest level since the first week of November. Granted, those reporting as bullish continue to outnumber those reporting as bearish.

Not all of the gains to bearish sentiment came from the bullish camp. The percentage of investors reporting a neutral outlook on the market fell for a second week in a row dropping to 24.37%. Neutral sentiment has fallen just over 10 percentage points over the past two weeks, the biggest two-week decline since the two week period ending November 12th. Click here to view Bespoke’s premium membership options for our best research available.

No Price Declines Yet Again

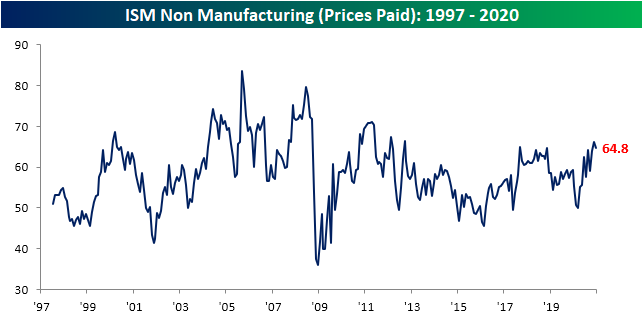

As we noted on Tuesday (see here and here), the ISM’s report on the manufacturing sector showed a significant acceleration in price increases in December. Today’s release of the non-manufacturing report similarly showed prices paid have continued to rise, albeit at a slower pace as the index fell to 64.8 from 66.1 in November. Granted, the rate of price increases remains at one of the highest levels of the past decade.

One other notable similarity between the two reports was the price changes for commodities. As we noted on Tuesday, prices for freight, steel products, and some PPE materials were all observed as moving higher. That was also the case for the service sector. Taking a closer look, though, a wider variety of PPE products are in short supply, and as a result, are moving higher in price than was shown in the manufacturing report. More specifically, only gloves were noted as moving higher in price in the manufacturing report, but the services report saw higher prices in not only gloves but also gowns and masks. Additionally, and perhaps one of the most interesting aspects of the report for the Services sector was that just like Tuesday’s release there was not a single commodity reported as falling in price. Click here to view Bespoke’s premium membership options for our best research available.

Service Sector Improves But Not Without Problems

Tuesday’s release of the ISM’s reading on the manufacturing sector showed a significant acceleration in activity in the month of December. The service sector counterpart released today similarly showed activity grew at a more rapid pace in December, though, the improvement was not as dramatic as in the manufacturing sector. The headline index rose to a three-month high of 57.2 from 55.9 in November. On a combined basis and accounting for each sector’s share in the overall economy, the composite ISM for December rose 1.5 points to 57.6- the highest reading since July.

Although the headline index was higher, breadth in the Non-Manufacturing report was mixed. Half of the indices for the various categories were lower month over month with two of them, Backlog Orders and Employment, falling into contraction. Overall, the report showed service sector demand continued to grow in December, but lead times were longer and employment cut back for the first time since August.

The commentary section also painted a more mixed picture than the uptick in the headline number. A number of comments noted that recently implemented shutdowns and surges in COVID cases have had negative impacts on businesses ranging from weaker demand to labor shortages to supply and logistics issues.

Although many comments noted how COVID has recently impacted demand, December was all around a pretty good month. New Orders remain well off the highs from the late spring through the fall and are also below levels from prior to COVID, but December’s reading of 58.5 was nonetheless consistent with growth in order volumes. That marked a seventh consecutive month of growth (above 50) in New Orders and an acceleration versus November. Meanwhile, businesses have made progress in working off their backlog of orders. That index fell into contraction for the first time in six months, falling two points to 48.7. That is the lowest level in the Backlog Orders index since May

Given the further growth in demand, for only the third month in the history of the report—the other months being November and March of 2020—businesses reported inventory levels as being too low (readings below 50). In fact, at 47.7, the Inventory Sentiment index broke below the March reading of 47.8 for a new record low. Although businesses think inventories are too low, actual inventory levels rose at a historically high pace in December. After a contractionary reading in November, the Inventory index rose 8.9 points to 58.2 in December. That is the seventh-highest reading on record and the month over month increase stands in the top 1% of all monthly moves. While those two readings may seem counterintuitive, some comments highlighted by ISM give some color into inventories. A comment from one business noted that the business was “Building inventory when and where possible to mitigate supply chain risks like supplier plant disruptions, carrier-related delays, and the holidays” while another noted that “Inventories were previously too low.” In other words, rather than weakened demand, the build up of inventories was likely in order to get in front of foreseen supply issues down the road and to make up for previously weak inventory levels.

There is evidence of supply issues after all. As previously noted, comments from surveyed businesses made frequent mentions of issues with supply chains and lead times. The index for Supplier Deliveries backs this up. Higher readings in this index indicate longer lead times, and in December, the index jumped 5.8 points to the highest level since May. That increase was the sixth-largest MoM jump on record, and in terms of the level of the index, it was the fourth-highest reading on record. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: Polarization Right On Cue

PUA Plunge

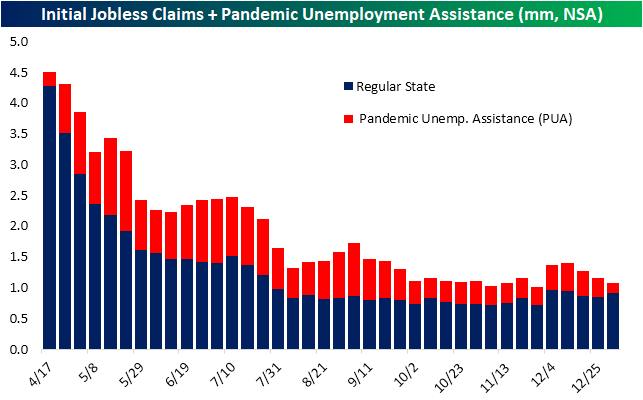

After falling back below 800K last week, initial jobless claims have taken a pause coming in at 787K for the week ending January 1st. That was unchanged from the previous week’s original reading, though, that number was revised up to 790K this week. While claims were little changed and remain off the low of 711K from early November, this week’s 3K decline was better than the forecasted uptick back up to 800K.

It is a bit less positive of a picture for unadjusted claims. After three weeks of declines, claims rose by 77.4K this week up to 922.1K. While at least part of that increase was a result of seasonality, that was the highest reading since the week of December 11th when claims came in at 941.9K.

Although regular state claims on an unadjusted basis were higher, total claims with the inclusion of the Pandemic Unemployment Assistance (PUA) program saw an improvement. Total claims between the two programs fell to 1.084 million from 1.155 million last week. That decline was driven by a big drop of about 48% WoW in PUA claims which came in at a new low of just 161.46K. The 149K decline in PUA claims was the largest since the first week of August when claims under this program dropped 166.36K. While that may sound like a positive, as detailed below, it should be taken with a grain of salt.

While that large drop in PUA claims is possible, there were irregularities on a state-by-state basis meaning the big drop was more likely due to a combination of the timing of when the recent spending bill was signed and the holidays. For instance, some states like Ohio, Florida, and Indiana reported zero PUA claims in the most recent week despite counts in the tens of thousands the prior week. Other states like Illinois and Kentucky may not have reported zero claims, but they reported single to double-digit numbers despite counts that were materially higher in the prior week.

As for continuing claims which are lagged one week to initial jobless claims, claims fell 126K for their fourth consecutive weekly decline. That leaves claims just above 5 million which is the lowest level since the week of March 20th.

Including the most recent data for all other programs in addition to regular state claims adds another week’s lag. That means the most recent print is for the week of December 18th. Total claims across all programs came in at 19.2 million, down from 19.6 million the week before. That is still above the pandemic low of 19.077 million from November 20th but marks a third consecutive improvement. The declines were broad across programs with the only uptick coming from the Extended Benefits program. Given this, the trend of a growing number of those on some sort of extension has continued with the Extended Benefits program accounting for a new high of 5% of all claims. Claims for all extension type programs accounted for roughly 29% of all continuing claims in the most recent week’s data. Click here to view Bespoke’s premium membership options for our best research available.

Asset Class Performance to Start 2021

Large-cap Tech led the US equity market in 2020, but it has gotten off to a rough start to 2021. As shown in our asset class performance matrix below, the Nasdaq 100 (QQQ) is down 1.98% YTD after gaining 48.62% in 2020. The S&P 500 (SPY) is down 0.09%, while the Dow 30 (DIA) is up 0.79%.

While large-cap index ETFs are flat to down so far this year, the small-cap ETFs like IJR and IWM are up 6% and 4.3%, respectively. The S&P 500 Growth ETF (IVW) is down 1.77% to start the year, while the S&P 500 Value ETF (IVE) is up 1.6%. Small-cap value (IJS) is already up 6.8% on the year. The DJ Dividend ETF (DVY) is up 3.6% so far in 2021 after falling 4.9% in 2020. 2021 has so far been the opposite of 2020 in terms of what’s outperforming.

Looking at S&P 500 sectors, the Energy sector (XLE) is up 7.8% YTD after falling 32.5% in 2020. Materials (XLB) and Financials (XLF) have gotten off to a hot start to the year as well. On the flip side, we’ve seen Technology (XLK), Consumer Staples (XLP), and Communication Services (XLC) fall more than 1%.

Outside of the US, international equity markets have staged nice rallies over the first three trading days of the year. The UK (EWU) is already up 6% while China (ASHR) is up 5%. The only country ETF in the matrix that is down is Brazil (EWZ) with a decline of 1.2%.

Commodity ETFs are up across the board, with DBC up 2.4%, oil (USO) up 3.3%, natural gas (UNG) up 6.9%, silver (SLV) up 3.1%, and gold (GLD) up 0.9%. Treasury ETFs have seen some of the weakest performance numbers to start 2021 with the 20+ Year Treasury ETF (TLT) already down 2.9%. Click here to view Bespoke’s premium membership options for our best analysis available.

Bespoke’s Morning Lineup – 1/7/21- Regrouping

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The truth does not change according to our ability to stomach it.” – Flannery O’Connor

They’re trying to pick up the pieces in Washington DC today after Congress certified the results of the November election very early this morning. Futures are up and indicated to open at more record highs. In economic news, both initial and continuing jobless claims came in lower than expected. Regarding the Fed, there are a number of speakers on the calendar today, so those comments will be watched closely.

As we often say, markets are usually better off when Washington isn’t the story, so hopefully, there is no breaking news on that front going forward in the days ahead.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, the results of the electoral college certification, economic data out of Europe, an update on the latest national and international COVID trends, and much more.

The rally in bitcoin just won’t stop. While a normal price chart of the crypto-currency looks crazy enough, looking at bitcoin’s ascent in terms of its price relative to gold is even crazier. After today’s 8% rally, one bitcoin is now worth a pound and a quarter of gold. On Election Day, one bitcoin was worth a half-pound of gold, which at the time we thought was a lot. At the end of the year, though, the ratio moved to a pound, and year to date, bitcoin’s price has rallied more than 30%- in less than a week!

While the move in bitcoin has been extreme on a percentage basis, it may sound hard to believe, but the current move is not even as large as other similar moves in recent years. Over the last 50-days, bitcoin’s price has rallied more than 115%, but back in June 2019, its price rallied more than 138% over 50-days, and back in late 2017, the price rallied more than 300%!