Government Problems Pulling Away From Labor Problems for Small Businesses

As we noted in today’s Morning Lineup and an earlier post, this morning’s release on small business optimism from the NFIB was a disappointment as the index missed expectations by a wide margin falling from 101.4 down to 95.9. While the headline number experienced a sharp drop, what businesses report as their most important problem largely went unchanged from November. As shown in the table and charts below, of the ten problems surveyed, half were unchanged MoM. Of those that were higher, “Other” saw the largest increase potentially as a result of rising COVID cases. Meanwhile, Cost/Availability of Insurance and Taxes were the others that saw an increase MoM. On the other hand, Competition From Big Business was less frequently reported as an issue while Quality of Labor saw an even larger decline. That three percentage point drop was the largest since April when that index fell nine points.

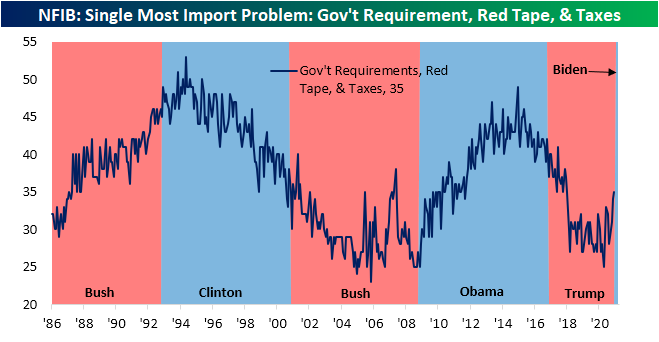

Where things currently stand means that government-related problems are back well above labor-related problems as the biggest issue reported by businesses. On a combined basis, last month saw 30% of respondents report either cost or quality of labor as their biggest issue. That was down to 27% in December while the percentage reporting either government requirements/red tape or taxes as their biggest issue rose from 34% in November to 35% in December.

As we have noted in general with this report, small business optimism has historically been impacted by changes in the political landscape. As shown below, during the past two Republican administrations—which are typically viewed as the more business-friendly party—fewer respondents to the NFIB survey reported either government red tape or taxes as their biggest issues while the opposite was true during the Obama years and early in the Clinton administration. With an incoming Democratic administration that is more likely to favor things like higher taxes and more regulation, this reading is starting to rise once again; erasing much of the move lower that occurred during the Trump presidency. Click here to view Bespoke’s premium membership options for our best research available.

Small Business Owners Didn’t Like the Election Results

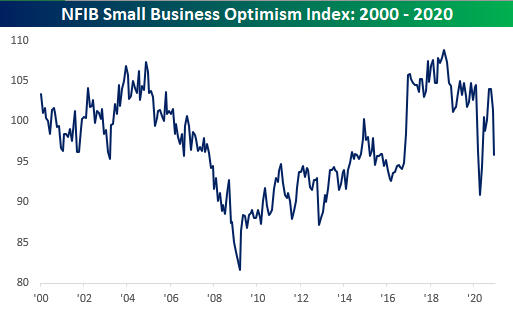

Today’s release of the December Small Business Optimism Index from the NFIB saw a large drop as the index dropped from 101.4 to 95.9. After a sharp drop in the wake of the COVID outbreak, the index bounced back nicely but now looks like it’s really rolling over.

Not only was this month’s headline index weak, but it caught economists completely off guard. While the index fell to 95.9, economists were expecting a drop to 100.2. That 4.3 spread between the actual and expected reading was the biggest miss relative to expectations in more than five years (July 2015) and was the third weakest reading relative to expectations since the December 2012 report.

Given the big drop in the headline index and the fact that it was so weak relative to expectations, should we be concerned about a double-dip? As an investor, we should always be worried about what could go wrong, but in the case of this report, you can probably wait for further confirmation from other data. The reason for the skepticism is that you could argue that politics plays a role in this report. To illustrate this, we would note that going back to 2010 (as far back as we have data) and right up through Election Day 2016, the NFIB only topped expectations 42% of the time. Following Trump’s election in 2016, though, this index surged and has since topped expectations 63% of the time. Since Election Day 2020, though, the headline index has now missed expectations three times.

From a longer-term perspective, dating back to 1974, the average reading of the NFIB Small Business Index during Republican administrations has been 100.1 while the average level under Democratic Presidents has been 96.2. Now, that would make sense if the economy was also in a recession more often in those periods, but over that same span, even though the percentages are low for both political parties (<20%), the economy has actually been in a recession a higher percentage of the time during Republican administrations than it has in Democratic administrations.

The lesson to take from all this is that even if it’s often hard to separate when it comes to business or investing (or a lot of other aspects of our lives for that matter), it’s usually best to leave politics outside. Click here to view Bespoke’s premium membership options for our best analysis available.

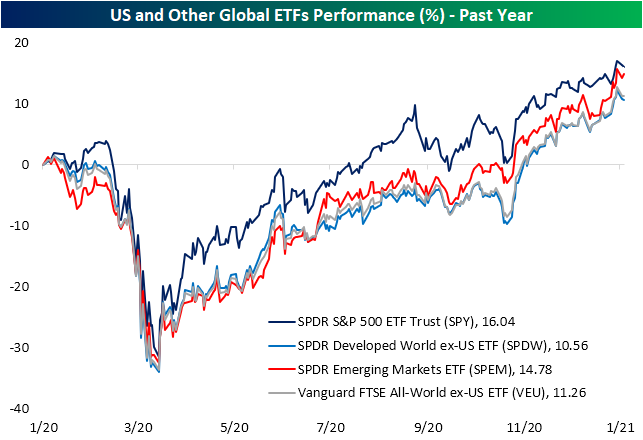

Rest of the World Catching Up

Over the past year, US equities—proxied by the S&P 500 (SPY)—have consistently outperformed global equities more broadly. As shown below, over the past year the S&P 500 (SPY) has risen just over 16%. That compares to 11.26% for the rest of the world as proxied by the Vanguard FTSE All-World ex US ETF (VEU). Breaking that down a bit further by developed and emerging markets, US equities have outpaced both emerging and other developed markets. While emerging markets (SPEM) are right on the heels of the US with just under a 14.78% gain, developed markets (SPDW) have lagged with just a 10.56% gain. So far in 2021, though, the rest of the world has been outperforming the US. Whereas SPY has risen around 1% YTD, VEU is up almost 3 times that. Emerging markets in particular have shown the greatest degree of strength currently having risen 3.87%. Meanwhile, SPDW has gained less (2.7%), though, it is still outperforming the US.

In the charts below, we show the ratio of SPY to these other ETFs. A rising line would indicate that the US is outperforming these other measures of global equities while a downward trending line indicates underperformance of SPY. As shown, the longer-term trend has pretty consistently been US outperformance over the past decade but that has faltered at the tail end of 2020 and into 2021. In the case of emerging markets, the line has been on the decline throughout the second half of 2020 as the ratio has hit its lowest level in a year in the past week. The S&P 500’s underperformance relative to other developed markets (SPDW) has been more recent as that line peaked in early September but the trend remains the same over the past few months with SPY weaker than global equities more broadly. That is further exemplified by the recent downtrend of SPY versus the All World ex US ETF (VEU). Click here to view Bespoke’s premium membership options for our best research available.

B.I.G Tips – Charts We’re Watching

Bespoke’s Morning Lineup – 1/12/21 – Small Businesses Lose Confidence

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“In the midst of chaos, there is also opportunity” – Sun-Tzu

Futures are higher this morning and attempting to regain some of the losses from Monday’s weak start to the week. Both the DJIA and the S&P 500 are on pace to erase more than half of yesterday’s losses, but the Nasdaq is a bit further behind.

We got our first economic indicator of the week today with the NFIB Small Business Optimism Index which dropped to 95.9 versus estimates for a reading of 100.2. That wide gap actually represents the biggest miss relative to expectations since July 2015, but before reading too much into it we would note that over time, this index has tended to have some political undertones to it.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, a discussion of stock performance in Hong Kong, Chinese economic data, an update on the latest national and international COVID trends, and much more.

Yesterday was an interesting day as even though the VIX jumped more than two points, the yield on the 10-year US Treasury was also up by 2 basis points (bps). Normally, on days when the VIX has a big gain, investors are rotating into treasuries and pushing yields lower. The chart below shows the S&P 500 over the last ten years, and each dot represents days where the VIX was up at least two points and the yield on the 10-year also jumped more than two bps. In the last decade, there have only been 14 other days where we saw similar moves with the most recent occurring back in March 2020, but looking through the chart they have occurred at all different points of the market cycle.

Daily Sector Snapshot — 1/11/21

Home Construction Consolidating

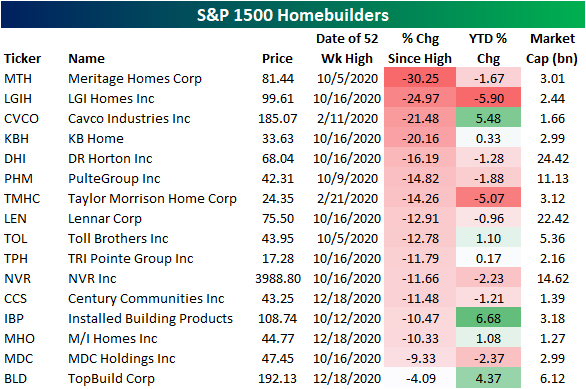

On a day when major US equity indices were lower across the board, the homebuilder group staged a nice rally. Below we provide a check-up on the group.

From the March lows until the October high, the iShares Home Construction ETF (ITB) rallied over 170%, but since that high, the ETF has been in consolidation. As shown below, ITB has been fluctuating around its 50-DMA for the past few months making some higher lows and lower highs in the process. The past few sessions have seen some more moves above and below the 50-day with today’s 1.8% gain currently bringing it back above and positive on a year to date basis. Currently, ITB is now 6.23% below its October 15th closing high.

As for the individual homebuilder stocks, below we show the constituents of the S&P 1500 Homebuilders index and the story is mostly the same. After surging from the March lows through October, most of these stocks are down double digits from their respective 52-week highs. Similar to the FAANG names that have mostly traded sideways for the past few months, the homebuilders have quietly been experiencing consolidation as well. Click here to view Bespoke’s premium membership options for our best research available.

B.I.G. Tips – Extreme Oversold Readings for 20+ Year Treasury ETF

Do Strong Starts Mean Strong Finishes?

As we noted in Friday’s Bespoke Report, through the first week of the year the best performing sectors were not what would have been expected. While the S&P 500 rose 1.83% through the first five trading days of the year, the Energy sector rose 9.31%. That is the sector’s best five-day start to a year since at least 1990. Materials was the next best sector notching a 5.68% gain. That is the sector’s second-best start to a year since 1999 when it rose 7.18%. Financials, Consumer Discretionary, and Health Care were also some of the better-performing sectors last week. Of these, there have been even better starts in recent years, although for Financials this year’s start was the best in a decade. While these sectors all led last week, sectors that had been leaders in the past year like Tech and Communication Services underperformed the S&P 500. That begs the question of how these sectors hold up throughout the rest of the year.

As shown in the table above, the best performers at the start of the year have typically traded higher through year’s end, though, they do not tend to remain the best performing sectors YTD come December as shown in the table below. Over the past three decades, there have only been five years in which the best performing sector in the first week of trading ended up being the best performing sector from the end of the first week through the end of the year: 1993, 1994, 1998, 1999, and 2003. Each of those years, that sector was also the same: Tech. In other words, outperformance at the start of a year does not necessarily predicate outperformance for the full year. Click here to view Bespoke’s premium membership options for our best research available.